Abstract

Investments represent an essential element of economy. Technological progress and financial innovation become the key drivers of modern globalization. Therefore, information technologies as a basis of management and functioning of various spheres of modern economic life, including investment processes, play special role in the development of digital economy. Unstable geopolitical situation, fluctuations of the Russian economy, as well as political interests of other countries in the Russia's wealth confirm the relevance of the studied problem. In this connection, purpose of the study consists in analyzing possible ways of financing and crediting of Russia by third-party countries, as well as identifying trends and directions of financing in the context of globalization and digitalization of markets. Scientific relevance and novelty of the study consist in establishing the dependence of international financing and crediting of Russia on investment climate in the country and its sensitivity to various external and internal factors. At the same time, the investment climate in the country is influenced not only by administrative conditions, but also by economic factors. Fulfilling recommendations on ensuring direct foreign investments contributes to their attraction and provides additional opportunities for the country. Thus, investment activity and digital technologies are interconnected. Introduction of digital technologies in the future can radically change the nature of international investment by simplifying it and attracting larger capitals to the market. This will provoke a rapid increase in investment in the same digital technologies, accelerating the integration of these areas and bringing both to a qualitatively new level.

Keywords: Investmentsinvestment climatedirect investmentsforeign investmentsglobalizationdigital economy

Introduction

In the modern conditions of globalization, countries are increasingly interacting with each other in various fields, especially in the economy. Interaction is expressed in the form of exchange of goods, services, capital flows and information, resulting in international settlements. Globalization of the world economy increases the volumes of international currency, credit, financial and settlement operations. At the same time, globalization processes contribute to emergence of a number of specific problems and risks for both international and national economic systems ( Pakova et al., 2017). Technological progress and related products of financial innovation become the key drivers of modern globalization. Information technologies as a basis of management and functioning of various socio-economic spheres of life, including investment processes, play a special role in development of the new digital economy. However, it is necessary to take into account the fact that any operations, including international ones, develop in conditions of uncertainty and impossibility to give an absolute guarantee of achieving a predetermined result, which requires correct estimation and determination of insurance methods (Konopleva et al., 2017).

Development of any economy directly depends on the inflow of investment resources directed to production. At the same time, the volume and priority of realized investments determine the economic growth and the country's position in the world economy. Therefore, state authorities pay special attention to increasing the investment attractiveness of their territories. Russia is no exception in this sense. Unstable geopolitical situation, fluctuations of the Russian economy, as well as political interests of other countries in the Russia's wealth confirm the need for thorough investigation of this problem.

Problem Statement

Digitalization is a process that has qualitatively changed the principles of the financial market, contributing to an increase in the volume and speed of transactions, in the availability of financial services through creation of new ways of providing them, in expansion of product lines for potential consumers. Digital transformation of international production has serious implications for investment promotion and facilitation, as well as for regulating investor behaviour ( Parakhina et al., 2018). The use of new technologies in the financial industry makes it possible to reduce costs, to adapt services to customer needs, taking into account their requirements and expectations. Interrelation of investment activity and digital technologies has been substantiated in the study. It has been proved that the introduction of digital technologies in the future can radically change the nature of international investment by simplifying it and attracting larger capitals to the market. This will provoke a rapid increase in investment in the same digital technologies, accelerating the integration of these areas and bringing both to a qualitatively new level.

Research Questions

In the context of Russian economy's integration into the world economy, high expectations were put on the inflow of foreign resources until recently. Foreign resources were considered as a driver of investment process and economic growth of Russia's production, since the investment process acts as a cumulative movement of investments of various forms and levels ( Nikandrova, 2009). However, the actual situation dispelled these illusions. Due to the current geopolitical situation and the aggravation of international relations between Western countries and Russia, we are witnessing an outflow of investment resources and growing distrust in stability of the Russian economy.

At the same time, international financing and crediting of Russia directly depends on the investment climate in the country and its sensitivity to various external and internal factors. The investment climate in the country is influenced not only by administrative conditions, but also by economic factors.

The investment climate in Russia is often the subject of discussion ( Akimov, 2018). Let us consider the Russia's investment climate for foreign investors on the basis of economic data for the period of 2012–2018.

As can be seen from Table

As for financial flows to Russia, they can be divided into: direct and portfolio investments in equity securities, debt issuance, bank loans (provided by the IMF) (Figure

A. Direct investments: factors and trends of development

Development of innovation ( Akinin et al., 2016) and foreign direct investment is one of the most important tasks of any state due to additional opportunities that appear in a country's production sector. Therefore, each state supports foreign direct investment through various mechanisms. In Russia, the following mechanisms of supporting foreign direct investment are appropriate (Figure

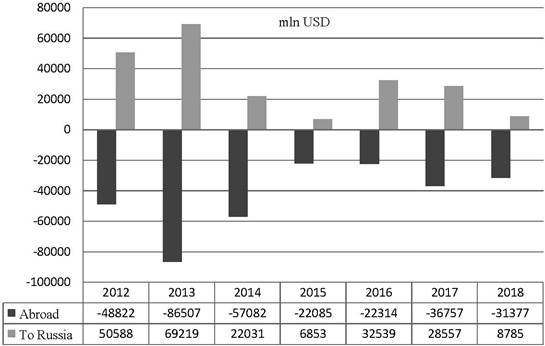

Over the past decade, the volume of investment directed to Russia has decreased significantly (by 47.089 mln USD). However, the volume of investments sent abroad has decreased, although on an incomparably smaller scale (13.424 mln USD). As of the end of 2018, the balance on direct investments made 22.592 mln USD. Taking into account that at the beginning of the period under review the balance went negative, this is an extremely favorable factor indicating the transformation of Russia from a recipient of investments to an investment donor. Most of the investments are directed to the capital of organizations, financing of debt instruments, as well as to the banking sector. Dynamics of direct foreign investments in 2012–2018 is shown in Figure

Thus, in 2012–2018, the volume of investments directed to Russia by foreign investors amounted to 218.572 mln USD. As a comparison, Russia directed to foreign countries 304.944mln USD (up 39.5 %) over the same period. It should be noted that the largest gap between received and directed funds is observed in 2014 – the crisis year for the Russian economy (35.051 mln USD). The positive point, however, is the excess of direct investment by 374.8 % in 2016 as compared to 2015. This indicates improvement in the investment climate of Russia.

At the same time, direct investment always implies participation in the management of companies. That is why our country has strict control over the volume and scope of direct investment. For example, Russia's regulatory and legal acts provide for certain restrictions on investment in the industries that involve participation in ensuring the country's defense and security.

B. Debt Issuance. External debt of the Russian Federation:

In the framework of international financing and crediting of Russia, debt issuance is understood as the management of external debt, namely, country's foreign-currency obligations (Figure

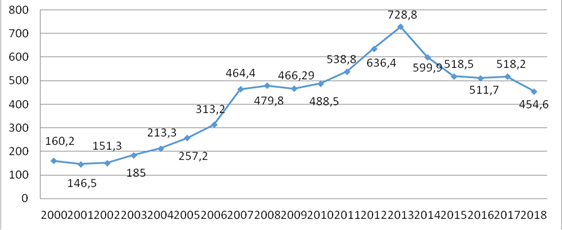

As can be seen from Figure

It is also worth noting that the growth of external debt is directly related to the growth of the country's budget gap, since the use of external sources of financing the budget gap increases the external debt of Russia. Let us consider the use and repayment of external sources of financing of the Federal budget gap in 2016–2018 (Table

The calculations allow drawing the following conclusions:

the period of 2016–2018 was marked by the Federal budget gap reduction, accompanied by repayment of sources of its external financing for previous years;

repayment of previously used external sources of financing of the Federal budget gap is fulfilled by reducing the debt on state securities. At the same time, the rate of debt repayment drops, and loans are attracted less often from year to year;

other sources of financing of the budget gap allow noting significant prevalence of the article "Repayment" over the article "Attraction" throughout the period under review.

The structure of Russia's external debt has changed slightly over recent years (Table

According to Table

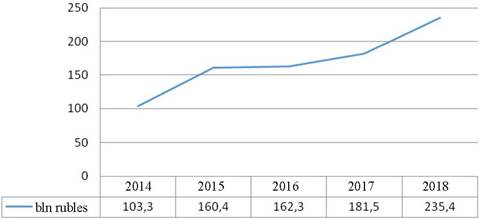

Let us also pay attention to the servicing of Russia's external debt in 2014–2018 (Figure

Thus, the period of 2014–2018 shows a tendency to increase the volume of financing of state obligations in foreign currency, which has a positive impact on the reduction of Russia's external debt.

Purpose of the Study

Purpose of the study consists in analyzing possible ways of financing and crediting of Russia by third-party countries, as well as identifying trends and directions of financing in the context of globalization and digitalization of markets.

The purpose-based tasks of the study include:

research into investment attractiveness of Russia in the international stage;

analysis of retrospective financing and crediting of the Russian Federation;

identification of the main trends of foreign investment in the Russian economy;

identification of financial flows;

working out the mechanisms of direct foreign investment support in Russia economy

Research Methods

Substantiation of theoretical provisions and practical results of the study requires observing a set of methodological principles: scientificity, consistency, complexity, reliability, objectivity, continuity, efficiency and effectiveness. The study is based on methodological principles of system analysis. Methodological basis of the study is represented with the categories and principles of dialectics (comprehensiveness, objectivity, connection of theory and practice, historicism). Achievement of the set purpose and the solution of the designated tasks are possible provided that the following general scientific methods are used in the process of research and evaluation of its results: deduction and induction; analysis and synthesis; analogy; observation as a universal way of organizing joint activities and assessing the effect of management decisions; description; generalization.

Findings

Today, gradual transition of the world economy to a digital format is the main vector of its development. The so-called digital economy represents a set of economic relations associated with the use of digital technologies on the basis of the world network for production and trade of goods and services. The importance of this paradigm is conditioned by the role currently played by network technologies in the modern life of our society (Figure

It should be noted that different sources of investment require different directions of digitalization development. For example, private small investors are most focused on the use of special cross-platforms for their activities, while large investors expect great results in improving the systems of evaluation and forecasting of various organizations' activities, as well as expanding the range of software that would allow carrying out activities with higher efficiency. States are primarily interested in the digitization of public services, improvement and automation of regulatory and control systems, as well as in increasing the level of financial literacy of population through up-to-date technologies in the field of education.

On the way to the digitalization of investment activity, state authorities should be prepared for serious reforms related to the legal regulation of this area. The regulations developed for the non-digital economy will most likely have to be revised in the light of the emergence of new business models, services, various kinds of software, etc. Many developed countries are already taking steps to modernize their policies, while those lagging behind risk being left with outdated rules and non-modernized digital technologies, which may incur serious financial consequences in the constantly changing world.

Conclusion

International financing and crediting of Russia directly depends on the investment climate in the country, which in recent years, due to the destabilization of the Russian economy, does not create positive prerequisites for attracting foreign investors. Nevertheless, foreign financial flows are still directed to Russia through direct and portfolio investments, debt issuance and bank loans.

Over the past decade, the volume of investments directed to Russia has decreased significantly (by 47.089 mln USD). However, the volume of investments sent abroad has decreased, although on an incomparably smaller scale (13.424 mln USD). It should be noted that the largest gap between received and directed funds is observed in 2014 – the crisis year for the Russian economy (35.051 mln USD).

As of 1 January, 2019, Russia's external debt has grown by 294.4 bln USD since 2000. The growth of external debt is directly related to the growth of the country's budget gap. At the same time, over the period of 2014–2019, the country's external debt reached a peak of 728.8 bln USD and then decreased by 274.2 bln USD. The largest decrease in the Russia's external debt during the period under review in absolute terms is observed on state securities of the Russian Federation, the nominal value of which is specified in foreign currency, and in relative terms – on loans of foreign governments, foreign commercial banks and firms, international financial organizations. The findings allow making conclusion on decrease in the Russia's external economic dependence on other countries and in the volume of foreign investments in the country's economy.

References

- Akimov, S. S. (2018). Interrelation of digital economy development and investment activity. Management of economic systems. http://uecs.ru/uecs-118-122018/item/5252-2018-12-12-10-10-40

- Akinin, P., Anikina, V., Viderker, N., & Ter-Akopov, A. (2016). Priorities of Socio-Economic and Financial Development of the North Caucasus Federal District in the Current Geopolitical Situation. Int. Rev. of Managem. and Market., 6(1), 130–134.

- Konopleva, Yu. A., Zenchenko, S. V., Pakova, O. N., & Sokolova, A. A. (2017). Monetary and financial risks in International relations. Advan. in Econ., Busin. and Managem. Res., 38, 331–336.

- Nikandrova, L. Yu. (2009). Investment process in the Russian Federation. Transp. Busin. of Russ., 6, 73–75.

- Pakova, O. N., Konopleva, Yu. A., & Berdanova, A. A. (2017). Risks in the Russian financial market in the context of globalization. Bull. of the North Caucasus Fed. Univer., 2(59), 92–95.

- Parakhina, L. V., Popovicheva, N. E., & Bazarnova, O. A. (2018). Digital transformation of economic systems stimulating international business investment activity. Central Russian. Bull. of Soc. Sci., 13(2), 142–160.

- Sergushina, E. S., Elaeva, A. V., Kabanov, O. V., & Loginov, V. V. (2019). Role of investments in the economy of the Russian Federation. Concept, 5. http://e-kon-cept.ru/2019/194034.htm

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 October 2020

Article Doi

eBook ISBN

978-1-80296-091-4

Publisher

European Publisher

Volume

92

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3929

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, translation, interpretation

Cite this article as:

Konopleva, Y. A., Pakova, O. N., Zenchenko, S. V., & Babenko, M. A. (2020). Investment Process In Russia In The Conditions Of Digitalization. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism» Dedicated to the 80th Anniversary of Turkayev Hassan Vakhitovich, vol 92. European Proceedings of Social and Behavioural Sciences (pp. 1997-2005). European Publisher. https://doi.org/10.15405/epsbs.2020.10.05.263