Abstract

There are various academic assessments of the main growth forces of Russian gross domestic product, many of which show that the overall growth of production factors is of paramount importance. However, many studies analyze the relationship between foreign trade and economic growth, i.e., causes of expanding trade and economic growth. Moreover, the regional projection of economic growth, determined by exogenous factors, is an understudied research area. These issues are acute in the border regions of the North Caucasus macroregion of the Russian Federation. We reconstructed the growth dynamics of the economy of the North Caucasian macroregion of Russia for 1995–2017 and compared the results with two time series of foreign trade and the foreign trade index, using the R. Solow’s growth model. The terms of trade depend on exogenous shocks and are an important factor in the development of gross fixed capital and the GDP growth. The article consists of several blocks: theoretical and methodological, statistical and economic and mathematical. The study determines the relationship of the economic growth of the North Caucasus Federal District with exogenous factors, including an index of foreign trade conditions, presents a multifactorial growth model for the North Caucasus macroregion and short-term growth forecasts taking into exogenous factors. The results confirm the hypothesis about the determinism of economic growth by exogenous factors: the index of foreign trade conditions, the level of openness of the regional economy which should be taken into account when developing a growth strategy for the North Caucasus macroregion.

Keywords: Economic growthforeign tradeeconometric model

Introduction

In Russia, the structure of driving forces of economic growth is different from the determinants of development in Central and Eastern Europe or China. The raw material growth model of the Russian economy depends on world market conditions and trade terms, that is, the ratio of export prices to import prices increases domestic investment and consumer spending, and helps increase public finances.

It should be noted that the ratio of investment to gross domestic product (GDP) is low, economic institutions are poorly developed. The Organization for Economic Cooperation and Development emphasized the importance of improving the business climate in Russia to accelerate economic growth ( EBRD, 2013). It is necessary to neutralize the influence of negative factors that are not taken into account when analyzing the conditions affecting economic growth, such as slow or negative reformation progress, international sanctions and uncertainty about future changes in export prices.

It is important to understand that the commodity model of economic growth will continue to support the Russian economy as it did between 1998 and 2008: real oil prices and other commodity export positions will not recover to the level of 2013. Nevertheless, the raw material model of the Russian economy has not exhausted its potential and the importance of case studies of the relationship between the index of foreign trade conditions and the index of economic openness remains relevant.

This article studies trade and economic growth in the border North-Caucasian macro-region (SCM). The first section reviews literature on the theory and methodology of economic growth. The next part carries out a statistical analysis of the time series of indicators of the gross domestic product of SCM and its foreign trade, and calculates openness indices and indices of the foreign trade conditions. The third part discusses how foreign trade conditions and other indicators depend on external shocks, and evaluate SCM GDP, measured by the purchasing power parity. The multivariate regression equation is built and the medium-term forecast for the economic growth of the SCM economy taking into account the influence of exogenous factors is developed.

Problem Statement

The article suggests several research hypotheses: the foreign trade openness of the regional economy depends on global shocks; foreign trade is associated with the economic growth of the region; the improvement of foreign trade conditions is positively correlated with the economic growth of the macroregion.

The importance of this problem arises from the need to assess the impact of global shocks on the dynamics of economic growth of the border North Caucasian macroregion. Without taking into account exogenous conditions, it is difficult to verify the short-term forecast of the economic growth trajectory.

Research Questions

International economic integration is a multi-faceted process associated with globalization and economic (trade, capital flows, financial development); technological (technology export, research and development, information society); social (population migration, education and health systems, poverty, discrimination); cultural (freedom, acceptance, tolerance); and political (international and multilateral global cooperation, global stability and security) factors ( Bari, 2005; Huidumac-Petrescu et al., 2011; Murariu, 2011).

The article studies an ability of foreign trade to generate economic growth ( Irwin, 1996). Therefore, it is not surprising that achievements of econometrics ( Johansen, 1988; Johansen & Juselius, 1990; Toda & Yamamoto, 1995) caused great interest.

Most studies dealing with foreign trade and economic growth, as well as the effects of exogenous shocks, focus on short-term sampling periods. Therefore, they give an incomplete idea of how the multidimensional causal relationship changed over time in accordance with various historical or political stages. The recent works by Pistoresi and Rinaldi ( 2012), which consider cause-effect relationships in various historical subperiods, are of thematic interest. An analysis of regional aspects of the influence of exogenous factors, including foreign trade, on the economic growth of the North Caucasus Federal District, has been studied by many Russian economists ( Gichiyev, 2012; Gimbatov et al., 2019).

Purpose of the Study

The main purpose of the article is to study short-term and long-term consequences of an increase in the index of foreign trade conditions, the openness of trade to economic growth under the influence of exogenous shocks. The article examines whether the dynamics of the index of openness and the index of foreign trade conditions are associated with global crises of the world economy and international sanctions.

Section

Research Methods

Statistical data for 7 Russian regions that are part of the North Caucasian macroregion for the period from 1995 to 2017 were used. The econometric VAR model was used as the main approach to data analysis. Data on the trade openness index, the foreign trade conditions index and the economic growth index (measured in per capita GDP in US dollars by the purchasing power parity as the best indicator for economic growth) were collected from statistical indicators. All values of were taken in real time.

To calculate the dynamics of the gross regional product under the influence of independent variables, the following indicators were used: foreign trade, net exports, personal consumption, investment, government spending:

where GNP is gross national product, C is personal consumption, I is investment, G is government spending, NX – (X – M), X is exports, and M is imports.

Formula (

It should be noted that certain aspects of the regional projection of the impact of the oil prices and the exchange rate, the openness index, and the index of foreign trade conditions on economic growth are understudied.

Quantitative assessment of the dynamics of the level of integration of the North Caucasian macroregion is based on many indicators. The formula for calculating the openness index is as follows:

where X is exports of the macroregion ($ million), M is imports of the macroregion ($ million), GDP is the gross regional product ($ million).

The index has values in the range from 0 to 100 percent and shows the role of a particular trading partner in the foreign trade of a country (region). The share of intraregional trade of an integration association is a special case of this index. The growth of this indicator is considered an indicator of an increase in the degree of integration of a country or region.

Another important indicator characterizing the level of favorable conditions for expanding the external integration of the macroregion through foreign trade channels in order to ensure its economic growth is the indicator is the index of foreign trade conditions. We assessed the conditions using the method below:

where – the index of trade conditions, – the index of average export prices, – the index of average import prices

Findings

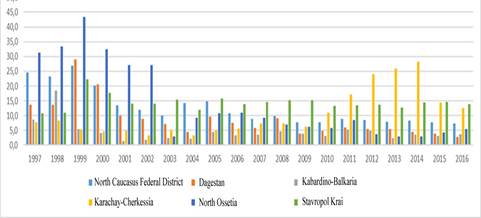

Based on the calculations, the following conclusion can be drawn: the level of economic integration of the North Caucasus macroregion into the system of world economic relations through foreign trade channels decreases during global shocks. The last period began in 2014 (Figure

Based on the data presented in Table

The comparative statistical analysis confirming the relationship between gross regional product and foreign trade is presented on the example of two macroregions of the South of Russia – the North Caucasus Federal District (NCFD) and the Southern Federal District (SFD). An integrated assessment of the close connection between economic growth and foreign trade is presented in Table

The level of correlation of exogenous conditions (the index of foreign trade conditions and oil prices) with the economic growth of the North Caucasus macroregion (2008-2015) can be represented as follows:

where X1 is the index of foreign trade conditions in the North Caucasian macroregion; X2 – the cost of Brent oil. R = 0.7; R2 = 0.49.

Equation (

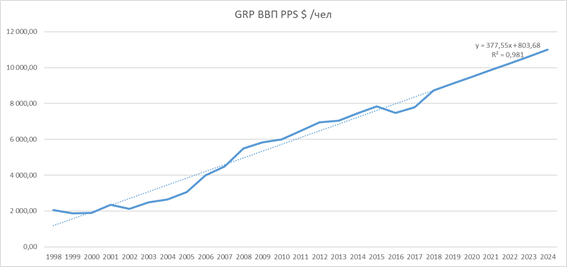

The analysis allowed us to build regression equations of economic growth for the North Caucasus macroregion for the period up to 2024 (Figure

The econometric growth model of the North Caucasus macroregion until 2020 has the following form:

where

Y – Gross regional product of the North Caucasian macroregion per capita by PPP;

X1 – Budget expenses per capita by PPP;

X2 – Investment per capita by PPP;

X3 – Consumer spending per capita by PPP;

X4 – NX (net exports) in $.

According to the forecast, based on the econometric growth model (4), GRP of the North Caucasus Federal District will increase by 20.7 % from 2017 to 2024, if there is an increase in budget spending by 20.4 %, investment by 22.5 %, and consumer spending by 23.9 %. This confirms the hypothesis that the growth rate of GRP in the North Caucasus Federal District lags behind the planned average Russian by 4 % per year.

Conclusion

The article addressed the issue of the dynamics of economic growth and the openness of foreign trade under the influence of global shocks in the North Caucasus macro-region. An analysis of data and analytical methods was carried out. The results obtained are relevant and of practical value for developing a socio-economic development strategy for the North Caucasian macroregion. We found that the foreign trade conditions index, the openness index and economic growth are subject to exogenous shocks.

The main results of econometric modeling and short-term forecasting indicate that the economic growth rate of the North Caucasus macroregion in the period up to 2024 will not be sufficient to reduce the 4 % growth rate lag. This is due to the insufficient rate of projected growth in government spending, final consumption, investment in fixed assets and net exports of the North Caucasus macroregion.

The following conclusions can be drawn: the economic development of the North Caucasus macroregion is determined by exogenous conditions; the economic growth of the North Caucasus macroregion and the terms of foreign trade are interconnected; an increase in the period of volatility of foreign trade decreases the real gross regional product per capita; an econometric analysis identified a strong correlation between foreign trade and economic growth in the regions of the North Caucasus Federal District and the Southern Federal District (Krasnodar Krai, Astrakhan, Volgograd, Rostov Oblasts, the Republic of Dagestan and Karachaevo-Circassian Republic). The results of econometric modeling and short-term forecasting can be used for developing a new Strategy for the socio-economic development of the North Caucasus macroregion, aimed at reducing its level of economic polarization.

References

- Bari, I. (2005). Globalizarea economiei. Editura Economica.

- EBRD (2013). Transition report 2013: Stuck in transition? Europ. Bank for Reconstruct. and Developm.

- Gichiyev, N. S. (2012). Caspian vector of integration of the Shanghai cooperation organization: Exogenous and endogenous factors of development of the North Caucasus. Econ. of Reg., 4, 249–253.

- Gimbatov, Sh. M., Kutayev, Sh. K., & Gichiyev, N.S. (2019). Social and demographic aspects of regional labormarket development. SE European Proceedings of Social and Behavioural Sciences. CT Conf. on Soc. and Cult. Transformat. in the Context of Modern Global. (SCTCGM) CY NOV 01-03, 2018. https://doi.org/10.15405/epsbs.2019.03.02.236

- Huidumac-Petrescu, C., Joja, R. M., Hurduzeu, Gh., & Vlad, L. B. (2011). Foreign Direct Investments Expansion – Essential Globalization Factor. Theoret. and Appl. Econ., XVIII(1). 163–172.

- Irwin, D. A. (1996). Against the tide: an intellectual history of free trade. Princeton Univer. Press.

- Johansen, S. (1988). Statistical analysis of cointegration vectors. J. of Econ. Dynamics and Control, 12(2), 231–254.

- Johansen, S., & Juselius, K. (1990). Maximum likelihood estimation and inference on cointegration with applications to the demand for money. Oxford Bull. of Econ. and Statist., 52(2), 169–210.

- Murariu, I. A. (2011). Cauzele si implicatiile procesului globalizarii economiei mondiale. Studia Uni-versitatis “Vasile Goldis” Economic Series.

- Pistoresi, B., & Rinaldi, A. (2012). Exports, imports and growth: new evidence on Italy: 1863–2004. Explorat. in Econ. History, 49(2), 241–254.

- Toda, H. Y., & Yamamoto, T. (1995). Statistical inference in vector autoregressions with possibly integrated processes. J. of Econ., 66(1), 225–250.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 October 2020

Article Doi

eBook ISBN

978-1-80296-091-4

Publisher

European Publisher

Volume

92

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3929

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, translation, interpretation

Cite this article as:

Gichiev, N. S., Kutaev, S. K., & Gimbatov, S. M. (2020). Influence Of Foreign Trade On The Economics Of The North Caucasian Macroregion. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism» Dedicated to the 80th Anniversary of Turkayev Hassan Vakhitovich, vol 92. European Proceedings of Social and Behavioural Sciences (pp. 1787-1793). European Publisher. https://doi.org/10.15405/epsbs.2020.10.05.236