Abstract

In the article, in order to determine the degree of diversification of debt offered by the state to inverters, its impact on the level of their return on the market portfolio within the framework of operations by the Bank of Russia with government securities on exchange markets; as well as the conditions and volumes of circulation of federal loan bonds for individuals, considered by the state as a tool to increase investor activity in the secondary securities market, the state of the government securities market is analyzed in light of the debt policy and the monetary policy of the Bank of Russia by identifying the relationships between indicators of debt issuance, Bank of Russia own operations with securities, placement and additional placement of government short-term bonds federal loan bonds and bonds on an auction basis and the secondary market .It has been established that in the face of a reduction in the volume of government securities issued and the Bank of Russia operations on their sale on the exchange market. The presence of a noticeable correlation between the change in the level of yield of federal loan bonds on the market portfolio and the Bank of Russia key rate indicates that bank liquidity is used by banks not only for lending to the economy, but also for investments in government securities, and a decrease in federal loan bond yield on the market portfolio is the result of increased demand for them from credit organizations.

Keywords: Government bondssecondary marketanalysiscorrelationmarket portfolio returnkey rate

Introduction

The development of the economy of any country does not occur without the use of “... government securities (GS) as a tool for regulating the economy, a lever for influencing money circulation and money supply management, means of non-issue coverage of state and local budget deficits, a way to raise funds from enterprises and population to solve particular problems...” ( Demilkhanova, 2016, p. 86). They are “... the cornerstone of the modern financial system ...” ( Feder-Sempach & Stawasz-Grabowska, 2019, p. 66).

Modernization, innovative development, digitalization of the Russian economy are processes that directly depend on the effectiveness and unity of the monetary policy and the state debt policy pursued by the Bank of Russia, focused on adapting the national economy to new realities on the basis of, first of all, maintaining “flexibility in the implementation of internal borrowing”, as well as conducting a responsible debt policy in the constituent entities of the Russian Federation and municipalities.

Problem Statement

The modern sovereign debt market (state short-term zero-coupon bonds-federal loan bonds) operates in the context of the development of world securities trading on exchange markets in the following areas:

“... increased trade in derivatives on international stock assets;

consolidation of the securities market in space and time;

market concentration in leading financial centers of the world and in the ownership of legal entities;

the creation of new market tools...” ( Pryanishnikova, 2016, p. 57).

The domestic market for government debt instruments is directly influenced by the above trends in the development of global stock markets. The results of the study, reflected in the work ( Demilkhanova, 2019), showed that the level of development of the market for corporate bonds and broad market shares is also reflected in the change in the development indicators of the Russian government securities market; “... an increase in the tightness of the relationship between the main government bond index and additional indices (RUGBITR 1Y, RUGBITR 3Y, RUGBITR 5Y) occurs as the duration increases...”. In these conditions, the issue of the effect of the monetary policy pursued by the Bank of Russia on the functioning of the government debt instruments market, the relationship between the operations of credit institutions in the stock market, their profitability and the conditions for their implementation remains no less important.

Research Questions

Modern studies on the problems of state borrowing are aimed primarily at improving the state debt policy, overcoming crisis phenomena in the economy by identifying and using the potential of debt financing and achieving economic growth based on this ( Stolyarov & Transition, 2019).

Many researchers turn to the study of the relationship between profitability factors of long-term financial market instruments, such as inflation (Mikhailov, 2012, 2016), duration and frequency of coupon payment ( Alkina, 2019), foreign exchange reserves ( Tiunova, 2019), and exchange rates ( Megasari et al., 2019), the stock market ( Cheng & Yang, 2017), etc., improving the mechanism for using them as a tool to finance the budget deficit of a country or a specific region ( Levin & Polkin, 2018), as well as the formation of highly liquid assets of credit institutions anizatsy ( Ushanov, 2016).

The results of systematizing the approaches of Russian researchers of the financial market and its indicators ( Fedorova & Pankratov, 2010; Lakhno, 2017; Nikonorov, 2014; Vlasenko & Simanova, 2016 etc.) show that the researchers are especially interested in the dynamics of stock market indicators, cross-country comparisons, and also models describing the influence of certain macroeconomic factors on the state of the stock market of debt instruments.

Purpose of the Study

The scientific interest in the problems of the functioning of the market for government debt instruments is explained by its influence on the development of all areas of the economy, participation in economic processes that contribute to the development of both the public sector and the financial and credit sector through an increase in its credit potential. Based on this, it is considered necessary to determine:

the degree of diversification of debt instruments offered by the state to inverters, by type and its impact on their level of return on the market portfolio within the framework of operations by the Bank of Russia with government securities on exchange markets;

the conditions and volumes of circulation of federal loan bonds for individuals, which, in accordance with the “Main Areas of the Debt Policy of the Russian Federation for 2017-2019. should be "... an intermediate step on the way from the traditional savings instrument, which is a bank deposit, to marketable securities with secondary circulation and associated with increased risks...”.

Research Methods

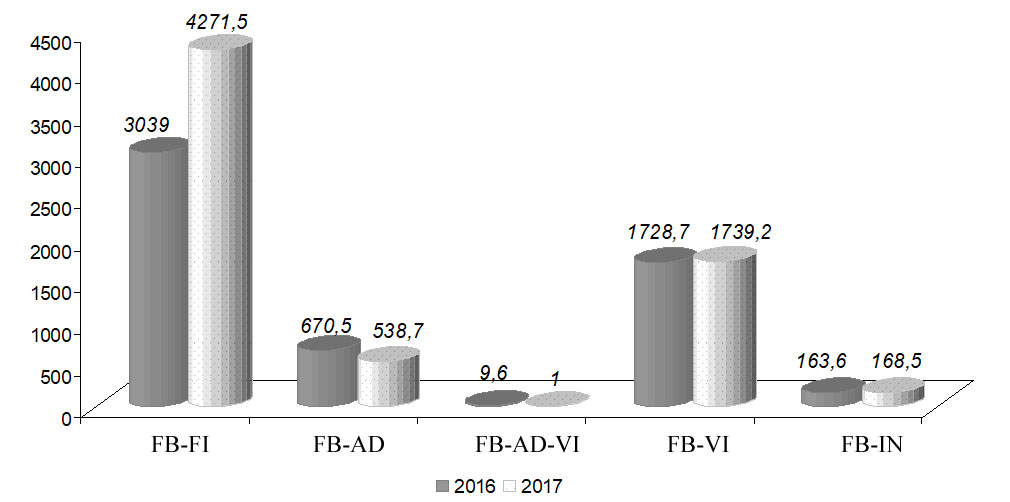

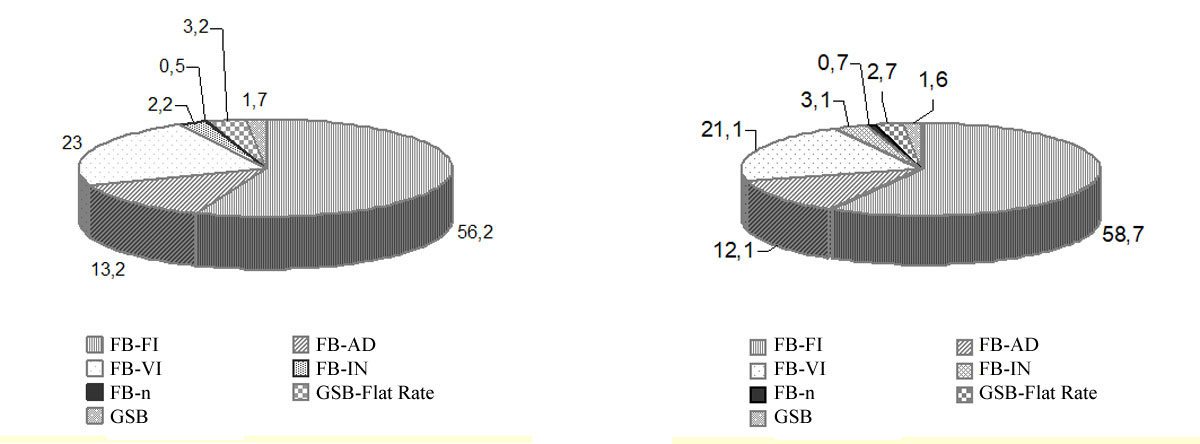

The initial stage of implementation of the state debt policy is characterized by the fact that the volume of placement and additional placement of state short-term zero-coupon bonds-federal loan bonds is growing, while in 2016–2017 there is a multiple increase in the nominal volume of placement and additional placement over the revenue of the Ministry of Finance of the Russian Federation obtained as a result of placement of securities by the Bank of Russia on an auction basis and the secondary market. The total volume of government securities in circulation in 2016 is 5611.3 billion rubles, in 2017 – 6719.0 billion rubles. Federal bonds with fixed coupon income (FB-FI) hold the bulk of government securities in circulation: 54.2 % in 2016 and 63.6 % in 2017 (an increase of 9.4 %). Their volume in circulation increased by 1232.5 billion rubles. or 40.6%. For the analyzed period, there is a decrease in the share of federal bonds with amortization of debt (FB-AD); federal bonds with amortization of debt and variable income (FB-AD-VI) and federal bonds with variable coupon income (FB-VI) in the total volume of government securities in circulation: by 3.6, 0.15 and 4.9 %, respectively (Table

In the structure of the Bank of Russia’s investments in securities, the debt obligations of the Government of the Russian Federation occupy only 1.1 % in 2018. The volume of these investments decreased by 39.9 billion rubles and in 2018 amounted to 179.0 billion rubles. Investments in debt obligations of foreign issuers in Euro, US dollars, British pounds and Chinese yuan and other currencies increased by 0.5 % and amounted to 15 504.6 billion rubles in 2018. So, a significant share of investments is held by investments in debt obligations of European countries (55.6 %), 8712.0 billion rubles (Fig.

![Structure of Bank of Russia investments in debt instruments in 2017 and 2018.

Note: author’s calculations are based on: Bank of Russia Annual Report for 2018 [Electronic resource]. URL: https://www.cbr.ru/Collection/Collection/File/19699/ar_2018.pdf. P. 310.](https://www.europeanproceedings.com/files/data/article/10040/11751/SCTCMG2020FA214.fig.002.jpg)

There is a sharp decrease in investments in debt securities of issuers in the USA and Canada (-32.9 %) and a significant increase in the share of investments in debt obligations of Chinese issuers (+ 25.1 %).

In 2018, there was a decrease in the Bank of Russia operations in the sale of securities on the open market compared to 2017:

the volume of Bank of Russia own operations (operations on placement of own bonds (Bank of Russia bonds)) decreased by 29 095.3 billion rubles or 78.6% and amounted to 7 902.6 billion rubles in 2018;

the volume of Bank of Russia operations on the sale of government securities of the Russian Federation, performed on behalf of the Ministry of Finance of the Russian Federation, decreased by 666.6 billion rubles (by 39.1%), and by the end of 2018 amounted to 1038.3 billion rubles (Table

As one of the factors for reducing the volume of Bank of Russia operations on the organized market, one can name a decrease in federal loan bond issue volumes. According to the report of the Ministry of Finance “On the results of the issuance of government securities in 2018”, a decrease in the total volume of issued federal loan bonds and external bond loans by 740.8 billion rubles (Table

In accordance with a decree of the Government of the Russian Federation, in 2018, government securities were to be issued “in volumes not exceeding 1,485.7 billion rubles (in the currency of the Russian Federation) and 7 billion US dollars (in foreign currency)” (in accordance with the order of the Government of the Russian Federation of December 16, 2017 No. 2850-r “On the issue of government securities in the currency of the Russian Federation” and the order of the Government of the Russian Federation of December 16, 2017 No. 2851-r “On the issue of government securities in foreign currency”).

The decrease in government securities issues also influenced the structure of the debt portfolio formed by credit institutions. In its composition, the debt obligations of the Russian Federation occupy the bulk of investments, both in 2017 and in 2018, but at the same time this indicator for the analyzed period decreased from 35.7 to 29.8 % (Table

A special place in the government borrowing market is held by federal loan bonds for individuals (FB-n), their share in the total volume of placed government securities increased in 2017–2018 from 0.5 to 0.7 % and continued to remain at this level in the first half of 2019 (Table

Equally preferable for credit institutions are debt instruments issued by non-residents, they occupy 16.8 % in the structure of investments in 2018, but the volume of investments over the period decreased by 3.1 % and amounted to 1824.3 billion rubles. A decrease in investment volumes is also observed in other areas, with the exception of investments in Bank of Russia bonds, there is a noticeable increase in their share in the structure of credit institutions' investments in debt instruments from 3.4 to 12.4 % in 2018. The volume of investments in Bank of Russia bonds for the analyzed period increased by 295.0 % and amounted to 1344.0 billion rubles.

According to the Ministry of the Russian Federation, “the total nominal “value of redeemed FB-n from the owners (issue No. 53003RMFS) in 2018–2019. amounted to 1865.6 million rubles. The buyback was carried out in different periods: 22.04.2018–30.05.2019, 09.09.2018–30.05.2019, and 10.03.2019–30.05.2019. The largest repurchase volume was in the first period and amounted to 1357.2 million rubles.”

Findings

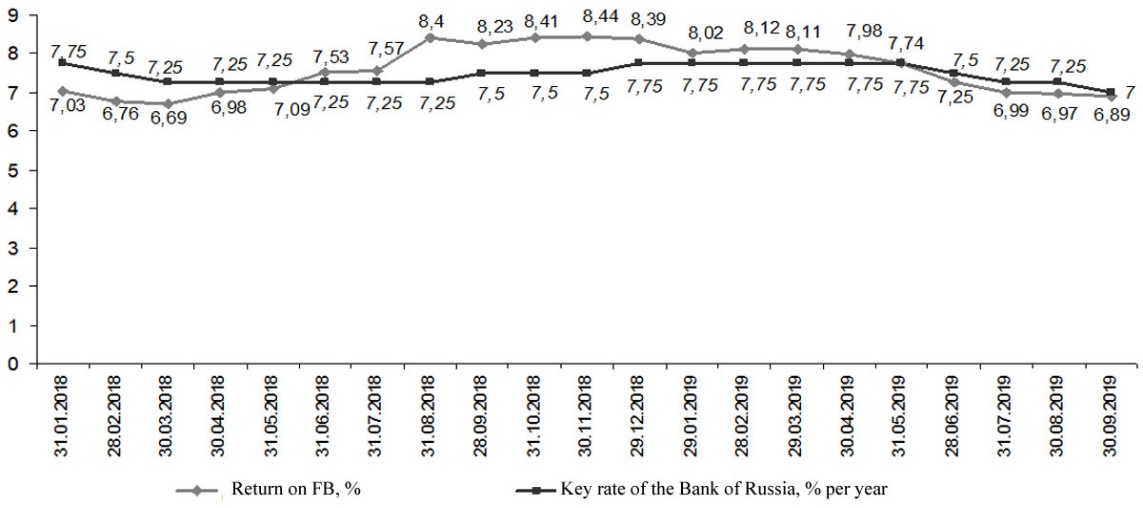

An assessment of the correlation between the change in the FB yield level for the market portfolio and the Bank of Russia key rate for the period 31.01.2018–30.09.2019 indicates that there is a noticeable relationship between the studied indicators: bond yield decreased from 7.03 % per annum to 6.89% per annum, the key rate decreased from 7.75 to 7.0 % (Fig.

Conclusion

Thus, the government borrowing market in the light of the debt policy and monetary policy of the Bank of Russia is characterized in 2017–2018 by the following:

FB-FI are the main instrument of the organized market used to implement state tasks;

in the context of a reduction in Bank of Russia operations on placing its own securities on the market, Bank of Russia bond, interest from credit organizations has increased and investments in these debt instruments have amounted to 3239.0 billion rubles in 2018;

in the face of a decrease in the volume of government securities and Bank of Russia operations on their sale on the exchange market, they still occupy a significant share in the structure of credit institutions' investments in debt instruments, but over the analyzed period their share decreased from 35.7 to 29.8 %. The presence of a noticeable correlation between the change in the FB yield on the market portfolio and the Bank of Russia key rate indicates that the bank liquidity increasing as a result of the reduction in the key rate is used by banks not only for lending to the economy, but also for investments in government securities, and a decrease FB yield on the market portfolio is the result of increased demand for them from credit organizations.

the demand for FB-n increases, their share in the total volume of placed government securities increased in 2017–2018 from 0.5 to 0.7 %;

Further research is aimed at identifying the degree of influence of such factors as changes in demand from various groups of investors, the structure of the market portfolio of corporate bonds, non-residents' investments in government securities of Russia and other factors on changes in the yield of government bonds.

References

- Alkina, I. I. (2019). Factors affecting the yield of federal loan bonds in Russia. National interests: priorit. and secur., 8, 1406–1423.

- Cheng, K., & Yang, X. (2017). Interdependence between the stock market and the bond market in one country: evidence from the subprime crisis and the European debt crisis. Finan. Innovat., 3(1), 1–22.

- Demilkhanova, B. A. (2016). Formation of profitability in the government borrowing market. Econ. and managem.: probl., solute., 1(12), 85–91.

- Demilkhanova, B. A. (2019). Comparative assessment of the relationship between stock and bond indices. In Proc. of the int. sci.-pract. Conf. “National economic systems in the context of the formation of the global economic space” (pp. 492–496). LLC Publ. House Print.; House Arial.

- Feder-Sempach, E., & Stawasz-Grabowska, E. (2019). Reserve Currency Status as a Safe Asset Determinant. Empirical Evidence from Main Public Issuers in the Period 2005–2017. Comparat. Econ. Res., 22(3), 65–81.

- Fedorova, E. A., & Pankratov, K. A. (2010). The influence of macroeconomic factors on the stock market of Russia. Forecast. Probl., 2, 78–83. https://ecfor.ru/wp-content/uploads/2010/fp/2/06.pdf

- Lakhno, Yu. V. (2017). Analysis of the adaptive development of the Russian securities market. Finance and credit, 23, 2243–2256.

- Levin, V. S., & Polkin, E. N. (2018). Bond loans in the Orenburg region in the public debt management system of the region. Finance, 9, 21–28.

- Megasari, D., Siregar, H., & Syarifuddin, F. (2019). Asymmetric volatility and macroeconomic factors on Indonesian government bond returns. J. Keuangan dan Perbankan, 23(3), 430–442.

- Mikhailov, A. Yu. (2012). Assessment of the effectiveness of the functioning of investment funds. Econo. and entrepreneurship, 4, 43–53.

- Mikhailov, A. Yu. (2016). Interrelation of macroeconomic parameters and profitability of Russian government bonds. Finance and credit, 22(48), 18–27.

- Nikonorov, A. E. (2014). The effectiveness of the use of the MICEX and RTS index in the correlation analysis with foreign indices according to the Pearson method. Finance and credit, 37, 60–65.

- Pryanishnikova, M. V. (2016). The main directions of development of world securities trading in organized stock markets. Finance, 2, 56–61.

- Stolyarov, A. I., & Transition, S. A. (2019). The potential of debt financing of state investment spending and Russia's economic growth. Finance, 3, 31–36.

- Tiunova, M. G. (2019). The impact of monetary policy on the dynamics of the Russian financial market. Finance and credit, 25(3), 618–635.

- Ushanov, A. E. (2016). Short-term banking liquidity: new requirements and management tools. Finance and credit, 22(34), 2–14.

- Vlasenko, R. D., & Simanova, I. A. (2016). Analysis of the dynamics of stock indices in Russia. Young scientist, 10, 645–648. https://moluch.ru/archive

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 October 2020

Article Doi

eBook ISBN

978-1-80296-091-4

Publisher

European Publisher

Volume

92

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3929

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, translation, interpretation

Cite this article as:

Demilkhanova, B. A. (2020). Factors Of Market Circulation And Government Debt Yields. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism» Dedicated to the 80th Anniversary of Turkayev Hassan Vakhitovich, vol 92. European Proceedings of Social and Behavioural Sciences (pp. 1621-1630). European Publisher. https://doi.org/10.15405/epsbs.2020.10.05.214