Abstract

The authors analyse technical changes as an object of innovation project activity in entrepreneurship. Accordingly, the article offers new tasks of project activity, involving the analysis of exogenous and endogenous factors affecting the results of innovative project development. It scientifically defines research of costs and results of core directions of innovation project activity as conditions for overcoming barriers on the way of businessmen entry into the market conditioned by innovative products competition. Empirical research resulted in recommendations to determine the directions of innovative project development, to form a life cycle model, phases of which are interrelated with innovative project development. The paper studies theoretical aspects of markets transformation under the influence of innovation dynamics, as well as policy of entrepreneurs in the socio-economic sphere, ensuring orientation of innovations and their outcome on social problems solution. It gives guidelines for differentiated approach to innovation project activity depending on capacity and other exogenous and endogenous factors influencing developments efficiency since some businessmen, due to their insufficient capacity, are unable to maintain innovative activity at all its stages. The authors present methodical recommendations to research efficiency of project activity, to identify the factors influencing general efficiency of an entrepreneur and efficiency of innovation project activity considered in context of this article as projects of researches and development as the most relevant under modern conditions for implementing national projects. They analysed socio-economic initiatives specified by state target programs regarded as the essential factor of business development as the driver of our economy.

Keywords: Empirical analysissocial transformationeconomic transformationmarketentrepreneurship

Introduction

Innovation project activity of entrepreneurship in the market economy is based on strategic decisions regarding research and development aimed at creating and using innovation of product and process. Project planning can be seen as a form of project abstraction. The project results are described by specific features and milestones (Jissink et al., 2019). The reputation for technological innovation and its consistency with innovation activity is detailed in the article (Höflinger et al., 2018).

Technical advances are a reaction, on the one hand, to profit-oriented entrepreneurship as a reaction to the market needs, on the other hand, as performance potential of entrepreneurship. They prescribe technical, market-oriented actions that are subject to the national economy needs for innovation. This includes the need for new knowledge production, their inseparability in the process of application (positive external effect). According to Neo-Schumpeter hypothesis or evolutionary economic theory, entrepreneurial innovation, as a result of uncertainty about technical and market results obtained in an incremental, routine way, is opposed to radical innovation, which can also be achieved in different ways in various sectors of the economy. Technical changes are manifested as a cumulative process within the boundaries, they are established and coordinated through technical set course with the entrepreneur's previous activity. In any case, technical development is based on breakthrough innovations that are concordant with their consistent application and dominate at the early market stages of the product. Innovative activity takes place in business and economic sectors not on a single model, for example, in relation to the source and mechanism of dissemination of new technical knowledge, dominants of product and process innovation, importance of scientific research for technical development. There is no optimal strategy for the entrepreneur to create and apply innovations.

In his later work "Capitalism, socialism and democracy" Schumpeter (1942), in contrast to his work "The theory of economic development" (Schumpeter, 1912), proceeds from the fact that technical innovations can function only in large entrepreneurs in concentrated markets. The Neo-Schumpeter hypothesis is based on the fact that there is a positive relationship between both absolute and relative size of entrepreneurship (concentration of entrepreneurship) and innovation. This is measured, for example, by the intensity of research and development (share of research and development costs in turnover) and patentability. They justify the conflict between static and dynamic efficiency of competition. With regard to enterprise size, it is reasonable to raise the question of various advantages and disadvantages of large, small and medium-sized enterprises. Large entrepreneurs can use significant amounts in accordance with their high financial capabilities for research and development projects in the innovation phase, as well as distribute their risks to many projects (in case of their technical independence). In addition, private income from innovation can be significant and be used for further investment. With growth of the size of entrepreneurship, the share of basic research costs increases. With a disproportionate share of costs, especially for risky research and development, they extend to creation of a completely new product and process. The advantages of large-scale business include savings, primarily in the phase of technological competition and product standardization. What matters here is price competition as opposed to technological competition. Thus, process innovation dominates as opposed to product innovation. Effectiveness of innovation activity is measured, for example, by the number of patents granted and the cost of research and development, which, with a view to one patent in a large enterprise, can be relatively low. The problem of communications, incentives and stimulation becomes a disadvantage of large business compared to small and medium-sized enterprises.

Problem Statement

Small and medium-sized entrepreneurs have the advantage of high flexibility in the initial phases of product cycle. There are no advantages in production, level of unreliability of the target and the result of research and development. Product innovation and creation of new markets dominate as opposed to process innovation. Technology-oriented small and medium-sized entrepreneurs have an above-average share of inventions when entering the market. Their "bottleneck" of innovation process is information insufficiency of new technical developments, their market potential, financial deficit, low level of risk management and barriers to entry into the market. Accordingly, only a small proportion of today's small and medium-sized entrepreneurs are engaged in continuous research results generation and development. Individual entrepreneurs, due to insufficient capacity are unable to maintain innovation activities at all its stages. Therefore, it is necessary to substantiate recommendations and apply a differentiated approach to innovation project activities depending on the capacity and other exogenous and endogenous factors affecting the effectiveness of development.

Research Questions

Social and economic initiatives, conditioned by state target programs, serve as an essential factor of business development as a driver of our economy. The implementation of these programs requires a project support and engagement in this work of small, medium and large business organizations. Despite the fact that accumulated domestic and foreign practice and scientific justification of project management provide ample opportunities for entrepreneurship in this area, market requirements put forward new challenges and pose new problems due to the current situation in the innovation markets, as well as due to clear socio-scientific and investment programs being developed within business structures. Moreover, when implementing such programs, entrepreneurs should have a clear attitude to the effectiveness of innovation project activities in order to reduce risks of decisions that they make. This study becomes more relevant due to the country's desire for a technological breakthrough and dominance in high-tech markets. Considering the constraints on resources, primarily financial, in the process of project activities for each entrepreneur the objective should involve the effectiveness of projects based on the evaluation of the cost-benefit ratio. This study is aimed at developing recommendations on solving this problem through empirical analysis in accordance with the chosen topic of this article. Project management approaches are becoming more flexible and adaptive to meet the challenges of an increasingly complex and dynamic environment (Nguyen et al., 2018).

Purpose of the Study

The aim of the study is to conduct an empirical analysis of innovation project activity as a condition of social and economic transformation and to propose ways to solve the problem of substantiation for models of efficiency of entrepreneurs project activity regarding transformational processes under the influence of research and development results.

Research Methods

Empirical analysis of innovation and project activities relies on such methods as system analysis, comparative analysis, modeling, observation. The analysis resulted in recommendations for research on correlation of the cost of innovation project activity and its results according to the designed original model of the project activity. Practical output of the study is that the proposed model of research and development as one of the forms of project activities, provides background for decision-making to improve its effectiveness. It is possible to increase the validity and relevance of project activities depending on the structured endogenous and exogenous factors for entrepreneurs in the field of small, medium and large enterprises. In addition, the recommendations on the analysis of market transformation nature will serve as a basis for focusing on projects, the innovative nature of which will improve their social component, as one of defining results of project activities of entrepreneurs.

Findings

Currently, socio-economic development is characterized by global transformation processes (Shirokova, 2015). Initial conditions of this study to justify social and economic transformation are as follows. Transformational processes development should focus on human's capabilities and needs. Ultimately, every civilized society is formed under the influence of favorable conditions for free realization of each person's potential, competencies, abilities and skills. In context of this article, these conditions are considered through the prism of innovation project activities for small, medium and large businesses. Comprehensive and constant reliance on scientific and practical developments, results of research and development, analysis and implementation of progressive experience, technical and technological re-equipment of economic sectors, shifting priorities in favor of high-tech industries are inextricably linked with transformation of professional structure of workforce, increasing the proportion of higher-skilled workers.

Social and economic transformation is the process of significant changes in society as a whole or its system-forming elements, with multi-vector, relatively high rate of changes and increased influence of subjective factors. The economic system is a part of socio-economic systems based on the interests of individuals and social groups (Saybel & Kosarev, 2017). The process of transformation of one system into another is characterized by special general laws, it covers all spheres of society life (Lapaeva & Maslennikova, 2014). The main reason for social transformation is a deep systemic crisis of society.

Social transformation is a special type of social changes, alternative to revolutionary and evolutionary types, which reflects the fundamental regularity of the shift of natural-historical processes towards social-historical, when determining role in the development of society is played by social factors, human potential. The factors of economic transformation involve the following: globalization as a complex result of the development of national markets and information and communication technologies, STP, organizational culture and others. Digital transformation involves the ability of an organization to adapt, respond, and position itself to succeed in a rapidly evolving technology environment (Guinan et al., 2019).

The activities of corporations determine business development direction. The presented empirical study leads to rapid rising to a certain value of the intensity of research and development in relation to the largest research and development of entrepreneurs activities (for example, Fortune-500 entrepreneurs, i.e. the list published annually by Fortune magazine, which presents the ranking of 500 largest global companies and the criterion for compiling which is revenue) with an increase in their capacity; for some industrial sectors there are strong differences. Small entrepreneurs who, with a few exceptions, conduct research and development, counting on the result with a minimum threshold of profitability implementing research and development. The costs are associated more often with the highest intensity of research than average, so that their distribution in relation to the size of enterprise can occur in a U-shaped form.

Regarding concentration of entrepreneurs, the theoretical model shows that the profit as a result of incentives, stimulating, reducing the costs of process innovation in monopoly case is lower than in case of competition. In contrast, the monopolist entrepreneur may, on the basis of market power and positive rapid effect of innovation, have a large right to assign the result as a monopoly privilege. The high level of private appropriation of the result is countered by a negligible maximum profit in the volume of production associated with technical knowledge. Further, it should be noted that dominant entrepreneurs in the market as a result of significant savings in large production can produce insignificant average costs as a seller, supplier, manufacturer in a competitive market. There is no unambiguous answer to the question whether a monopoly market or a competitive market shows a higher intensity of research and development due to a large number of factors-arguments envisaged and taken into account. Entrepreneurs in concentrated markets tend to have greater effort and the highest ability to innovate than in more competitive structured markets, while in terms of incentive, it is impossible to uniquely determine it.

Empirical studies cannot find a positive cross-cutting relationship between the magnitude of the market structure and market behavior (course of action). The results are representative; up to a certain value of market structure, there is a positive effect of concentration of entrepreneurs on innovation, after which there is a slower impact based on a declining number of market participants and increasing barriers to entry into the market. The importance of market dominance for innovation activity should be lower for industries with rich technical capabilities, correspondingly low research and development costs, and with barriers that should be negligible. Empirical results show that the relationship between the size of entrepreneurship or concentration of entrepreneurship and innovation should be determined through characteristic industry features, for example, technical capabilities, the level (degree) of technical knowledge availability, conditions of demand in the market, which mutually affect the results of innovation activity of entrepreneurs. The structure of the market and the level of innovation are overall result of these basic conditions.

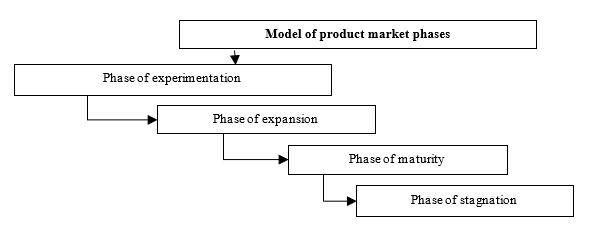

Model of market phases of the product (Figure

products with a relatively high market share in strongly growing markets ("stars»);

products with strongly growing markets, but with competition hindering the development (the «doubters»);

products with a relatively high market share in weakly growing markets ("cash cows»);

products with low market share in poorly growing or stagnant markets ("poor dogs").

Different combinations can also be considered in relation to life cycle concept. A complete set of development stages forms life cycle of project (Avdeeva, 2012). Life cycle goes from doubters through stars to poor dogs. There is a strategic requirement that it is "cash cows" that should fund research associated with high innovation risk. Responsibility also falls on the "stars".

The Harvard school focuses on theoretical and empirical studies of influence of correlation between elements of market structure, market actions and parameters of market results. The research proceeds from central hypothesis that the direction of impact follows a pattern: market structure – market actions – market result, moreover, in the reverse effect of the result on the market structure. Empirical research is studied as follows. Sectors of the economy that have a high level of concentration of entrepreneurship receive profit of average level. In addition, they affect the barriers to entry into the market, level of capital in relation to turnover, growth of the economy in the past, market result. The level of profit is usually defined as average value for the entire sector of the economy. Possible differences between entrepreneurs with different market shares are not taken into account. Entrepreneurs with a high market share dominate, however, there is no positive correlation between profitability and concentration. The part of study that does not affect the level of concentration of entrepreneurs is considered insignificant. Market entry barriers are important when it is very difficult to separate the impact of monopoly profits from the average level of profits. At the same time, they are seen as an essential element of the market structure. The influence of both elements of market structure in interpretation of empirical estimates leads to the idea that inverse effect between the amount of profit and market structure can be assumed that it is not exogenously specified, but long-term determined through market result and market actions endogenously.

The Chicago school belongs mainly to the theoretical direction in sectoral markets economy and is based on the methods of microeconomic analysis and game theory to study behavior of firms and organization of markets. The Chicago school research focuses on the analysis of economic choice problems based on price theory. This predetermines the main subject of the study, if at Harvard school there are various factors and correlation that determine the development of industry market, then at the Chicago school there are patterns of decision - making. One of the main issues considered by the representatives of this school is the study of impact of sectoral policies on market structure and market actors behavior. At the same time, both theoretical analysis and empirical verification of the results are carried out. The Chicago direction of sectoral markets economy has studied functioning of quasi-monopoly markets, which means markets characterized by monopoly power with a low level of sellers concentration (as a rule, such markets arise as a result of dominating of one of the sellers or the entry of sellers in the collusion). The study of such markets identifies causes and processes that contribute to the emergence of monopoly power. Research within the Chicago direction follows the results of transaction costs theory and quasi-competitive markets theory. Transaction costs limit the possibility of price competition between firms, thus affecting the market structure.

there is a benefit from preparation of project development decisions;

the entrepreneur must bear the costs of preparing solutions.

Information decisions in projects are placed next to decisions about actions (the main decision), they need to establish the optimum. However, the difficulty in establishing the project development optimality is that project designer is tasked with whether additional information should be created and accumulated or not. Answer: to reduce unreliability, such actions are necessary. The project optimum based on information accumulation requires consideration of the following dilemma:

to accumulate information, it would be better to abandon this information;

in the absence of information, it is necessary to create additional information.

At the same time, it is clear that information solutions within the project development relate to reliability solutions. The optimum design is determined by the optimal decisions of action. Theoretically, the design optimum lies where the design boundary costs are equal to the design results.

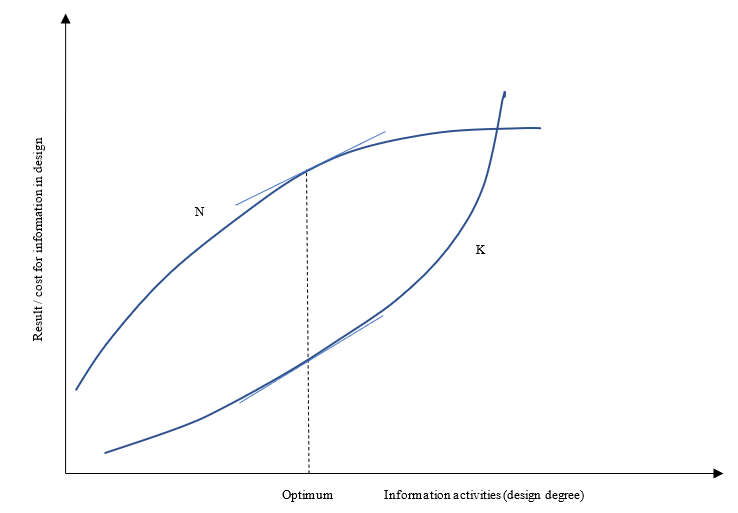

All project efforts serve the information preparation of solutions. Design (project development process, project system), should be called effective when it provides a solution (or can improve the solution). The result of the project development is determined through the project results (income, cost) and project costs. The project result (effect) is determined through improvement of decisions as a result of better information. Project costs (when personnel, material factors, communications are reflected in costs) are, in fact, negative economically. The consequences of project decisions should justify project efforts. This is reflected in Figure

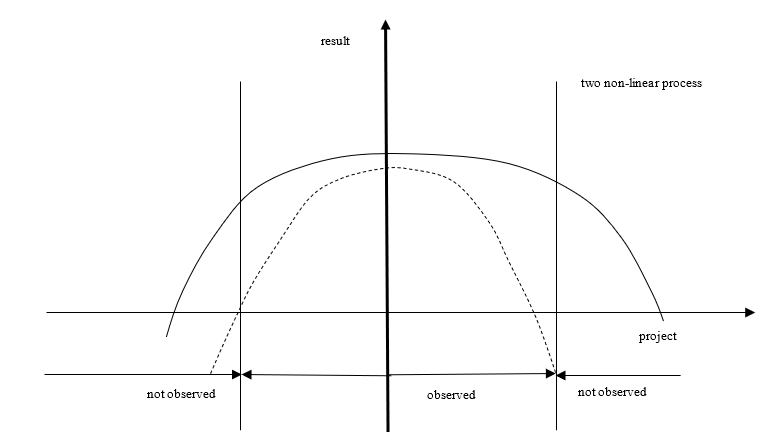

We observe the relationship of factors in the form of a single U-curve as a downward open parabola. The project developer of the entrepreneur does not take into account that there is no opinion regarding the coordination or optimization of the internal flow of project development process. This leads to inefficiency, that is, to a negative impact on the efficiency or success of the enterprise. The actual distribution should be near the optimum, so firms project on average in the correct volume, i.e. they do not make systematic mistakes. Therefore, we formulate the hypothesis of optimum: on average, firms project to the extent that for their result is optimal (we call this average "standard practice"). Standard practice ensures progressive success. Obviously, we do not expect that the optimum for all companies is the same, despite their size and other enterprise-specific brand variables. The optimum is thus conditioned by the situation.

Conclusion

All empirical studies of project activities effectiveness are also associated with situational conditions. This leads to different outcomes where different situational variables must be taken into account, such as industry, size of enterprise, market actions and market development, change or structure of enterprise, individual alternatives or combinations.

Instead of atomistic results, issues of efficiency of innovation and project activities should be summarized within the conceptual framework of empirical research. There are two levels of efficiency to be distinguished:

it is about institutional project development efficiency where the (positive) impact of a project system or project process needs to be studied on overall business efficiency;

it refers to functional efficiency of project development, when the contribution of project development to the degree of performance of functions (for example, functions of structuring, optimization, creativity, reliability and flexibility) in a particular project developing organization must be determined.

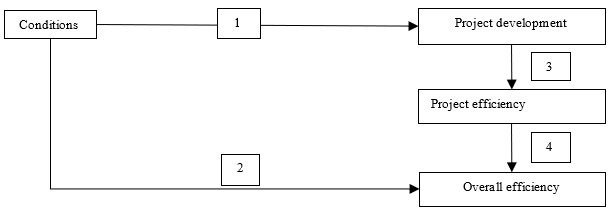

Relationship between institutional and functional project development efficiency in the framework conditions can be presented in Figure

External conditions (e.g. industry, market dynamics or legal regulations) and internal conditions (e.g. type and scope of technology, overall organization and sub-organization, management concept) affect both project development (1) and directly overall efficiency (2). Project impact is assessed through project development – oriented performance criteria, which derive from this as project effectiveness (3) as part of overall effectiveness (4). The key issue of empirical research of project efficiency is the following: How can project effectiveness be distinguished from overall effectiveness and measured? There is no unambiguous and exhaustive answer to this question. It is therefore so difficult because project efficiency and overall efficiency derive through a conglomerate of data, actions and tools.

Acknowledgments

The reported study was funded by RFBR, project number 19-310-90024.

References

- Avdeeva, I.A. (2012). Management of innovative projects implementation. Current probl. of econ. and managem., 1(035), 9–12.

- Guinan, J. G., Parise, S., Langowitz, N. (2019). Creating an innovative digital project team: Levers to enable digital transformation. Busin. Horizons, 62(6), 717–727.

- Höflinger, P. J., Nagel, C., & Sandner, P. (2018). Reputation for technological innovation: Does it actually cohere with innovative activity? J. of Innovat. & Knowledge, 3(1), 26–39.

- Jissink, T., Schweitzer, F., & Rohrbeck, R. (2019). Forward-looking search during innovation projects: Under which conditionsit impacts innovativeness. Technovat, 84-85, 71–85.

- Lapaeva, M. G., & Maslennikova, A. Yu. (2014). Transformation of economic systems: theory and regularities. Bull. of Orenburg State Univer., 8(169), 228–233.

- Nguyen, N. M., Killen, C. P., Kock, A., & Gemünden, H. G. (2018). The use of effectuation in projects: The influence of business case control, portfolio monitoring intensity and project innovativeness. Int. J. of Project Managem., 36(8), 1054–1067.

- Saybel, N. Yu., & Kosarev, A. S. (2017). Factors of transformat. of soc. and econ. syst., 12(66). https://research-journal.org/economical/faktory-transformacii-socialno-ekonomicheskoj-sistemy/

- Schumpeter, J. (1912). The theory of economic development. Science.

- Schumpeter, J. (1942). Capitalism, socialism and democracy. Science.

- Shirokova, E. S. (2015). Innovative factors of social and economic transformation. Electr. Sci. J. “Engineer. Bull. of the Don”, 2. https://cyberleninka.ru/article/v/innovatsionnye-faktory-sotsialno-ekonomicheskoy-transformatsii

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 October 2020

Article Doi

eBook ISBN

978-1-80296-091-4

Publisher

European Publisher

Volume

92

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3929

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, translation, interpretation

Cite this article as:

Bashirzade, I. V., Tavbulatova, Z. K., Khakhanaev, U. S., & Pakhomova, A. V. (2020). Empirical Analysis Of Innovation Projects As A Condition Of Socioeconomic Transformation. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism» Dedicated to the 80th Anniversary of Turkayev Hassan Vakhitovich, vol 92. European Proceedings of Social and Behavioural Sciences (pp. 128-139). European Publisher. https://doi.org/10.15405/epsbs.2020.10.05.18