Abstract

The Russian economy with its spatial development, considered by Vladimir Putin as one of the main directions of state policy for the next five years, is unthinkable without stable investment activity in the regions. The experience of recent decades has shown that neither subsidies nor preferences are capable of giving the economic impetus to the regions, which both the recipient entities and the center helping them hoped for. The authors propose a comparative analysis of the existing approaches for attracting investment resources in the entities of the North Caucasian Federal District so as to identify the most promising leverages over the investment process. The paper provides a comparative analysis of the instruments to have been of particular interest to investors in 2018. The paper analyzes the indicators reflecting the degree of PPP development in the target regions of the North Caucasian Federal District in particular, and in Russia as a whole. It explores the regional forms of state support provided to potential investors. Particular attention is paid to a mechanism of state guarantees as an important form of state support for investment projects. The authors find out that over the past eight years, the largest volume of state guarantees for investment projects selected in the North Caucasian Federal District has been allocated to the Chechen Republic – about 30 % of the total volume. The paper also focuses on the unique for Russia territorial development institutions – the North Caucasian Development Corporation and the Northern Caucasian Resorts Company.

Keywords: InvestmentregionPublic Private Partnership

Introduction

Economic outcomes in Russia in 2018 can be regarded as disappointing: a continued stagnation of the national economy, an extremely low GDP growth rate and all this against the backdrop of Vladimir Putin’s goal towards one of the five largest economies in the world by 2024. According to the experts, the goal set can be achieved provided that stable economic growth makes up at least 4 % per year. Today, it is the accelerated development of regions and their ability to attract and develop investments that can become a keystone in a national strategy for transitioning the Russian economy from a resource-based to scientific and technological development path with a view to enhancing competitiveness and ensuring a new quality of life.

Problem Statement

The North Caucasian Federal District (NCFD), along with the regions of the Arctic zone, the Far East and Crimea, are entities that ensure Russia’s geopolitical and national strategic priorities. The heightened attention being accorded by the state to the development of the North Caucasian Federal District, as well as the need to develop mechanisms for attracting investment in the constituent entities of the Russian Federation determined the relevance of the study.

Research Questions

The subject of the study is a state mechanism designed to attract investment to NCFD entities.

Purpose of the Study

The paper aims to study the basis for the development and implementation of state instruments to promote the attraction of investment capital in the regions of the North Caucasian Federal District.

Research Methods

The study was based on both general theoretical methods, including grouping and classification, a systematic approach, peer review, statistical, comparative and analytical analysis, and empirical methods, including observation and comparison.

Findings

The regions of the North Caucasian Federal District have a unified system of state support for investment activity that articulates the governance of entrepreneurship and establishes forms and methods for support and protection of rights and interests of investment participants.

One of the most important factors affecting the investment climate of any region is the existing system of legislation. In recent years, the emphasis in the legal regulation of investment activities has shifted to the regional level, due to an increasing role of the constituent entities of the Russian Federation in the economic and legal spheres, as well as the acute need of the regions for investment resources.

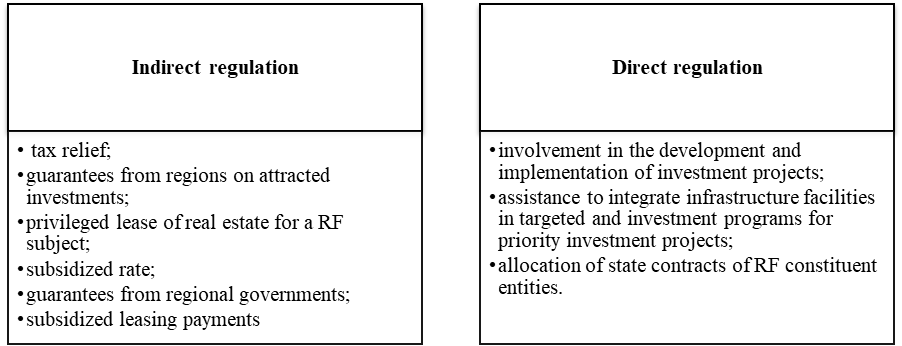

Based on the objectives and the role of state authorities in the investment process, methods of state impact fall into two main groups – indirect and direct regulation. Indirect regulation aimed at creating favorable conditions for investment activities in the regions is represented by tax, depreciation policies, legislative measures, and investment lending.

Direct participation is realized through organizational and financial measures of budgeted investment based on state programs; investment activities in the public sector. Both direct and indirect regulation of investments (Figure

The economic crisis threatened to reduce a significant number of regional investment programs. Nevertheless, the current challenges related to the completion of current investment projects, as well as the issues of improving existing infrastructure facilities, require timely decisions. On the one hand, the decline in budget revenues at various levels complicated the situation in the regions, which forced the government to seek some alternative solutions for attracting extra budgetary funding for certain public functions. On the other hand, in the face of unfavorable conditions, business interest in government support is increasing, which enables to minimize the risks of private investments, foster the efficiency of investment projects, and mobilize credit resources for their implementation. It is about a public-private partnership.

Public-private partnership (hereinafter PPP) is referred to as an institutional and organizational cooperation between business and the state, facilitating publicly significant projects. The range of areas to encompass this cooperation is quite wide, from the development of strategically important sectors of the economy to the provision of public services throughout the country (Gerasimenko & Avilova, 2017; Oreshin, 2016). Thus, PPP is one of the most effective mechanisms for enhancing the economy of the country, in general, and regions, in particular.

The experience of leading countries suggests that the use of PPP is characteristic both for the development of economic sectors and social infrastructure (Polyakova & Vasilyeva, 2016). As of 01/01/2019, Russia officially registered and made a decision on the implementation of 2,446 PPP projects, with a total investment of about 1.5 trillion rubles, of which:

30 projects are federal;

556 projects are regional;

over 3,356 projects are municipal.

For the Russian economy, this number of projects is insufficient, as evidenced by their contribution to national results. Thus, in 2017, the ratio of private investment in infrastructure in PPP projects to the nominal GDP of the Russian Federation was less than 1 %. (Russia – 0.89 %, Nigeria – 1.95 %, Indonesia – 3.7 %, Mexico – 5.33 %, Turkey – 7.43 %, Thailand – 7.83 %, Argentina – 8.16 %, India – 9.47 %, Brazil – 18.9 %). According to expert estimates, infrastructure investments and their role in the Russian economy will only be possible when this ratio is at the level of about 4-5 %. When it comes to the entire budget of PPP projects, it currently exceeds 2 trillion rubles.

The national rating of the entities of the Russian Federation in the field of PPP reflects an assessment of the level of PPP development in the region in accordance with the methodology developed by the Ministry of Economic Development of the Russian Federation (Table

Statistical data showed a significant gap between the leading regions and the lagging regions. Thus, the number of PPP / MPP projects in the Volga Federal District is 12 times more than in the North Caucasian Federal District. The PPP mechanism has significant advantages: firstly, it reduces the timing for a project to be developed for a state partner and competitive procedures to be conducted and saves budgetary funds, which is important in the context of the economic and financial crisis; it promotes the attraction of investments in such areas as housing and utility services, passenger transport, and social services. Secondly, the potential of PPPs has not been properly developed in a number of federal districts. Thirdly, the mechanism of private initiative, life cycle contracts is practically not involved. All in all, only four out of the ten factors necessary for PPP development are represented through the lens of the institutional environment and the regulatory framework in the subjects of the North Caucasian Federal District:

An authorized body in the field of PPP, including concession agreements.

Public availability of the list of facilities for which it is planned to conclude PPP agreements, concession agreements, etc.

Orderly interdepartmental interaction of executive authorities at the stage of development and consideration of PPP projects.

Legal framework in the field of PPP, including concession agreements, in compliance with federal laws.

Most regions of the North Caucasian Federal District provide a standard list comprising forms of state support for investment activities: income tax benefits, property tax benefits, and rental benefits. Least of all, as forms of support for the regions, the issue of targeted loans and the provision of budget investments are used (Table

The largest number, ten, of the proposed forms of state support was provided in the Stavropol Krai, nine – in the Republic of Dagestan, eight – in the Karachay-Cherkess Republic, and only six – in the North Ossetia-Alania. Income tax and property tax incentives started functioning in the country in early 2017.

The analysis indicated that subsidized rates are used as the main form of support for entrepreneurs in all subjects of the North Caucasian Federal District.

In 2016 a significant step was taken towards the development of SMEs, namely, the approval of a long-term strategic document – the Strategy for the Development of Small and Medium-Sized Enterprises in the Russian Federation for the period until 2030. A strategic guideline is to double the share of SMEs in GDP (from 20 to 40 %) (Kabanov et al., 2018). The developed passport of the priority project on Formation of a Service Model to Support Small and Medium-sized Enterprises in North Ossetia-Alania was included in the top ten passports in the country.

An important form of state support is the provision of state guarantees for loans attracted for the implementation of investment projects. In response to limited investment resources, the mechanism for providing state guarantees can be used as per capital-intensive investment projects and be aimed at reducing risks both in the investment and operational phase of their implementation. Since 2014, the selection of investment projects for state guarantees has been carried out by the Ministry of North Caucasus Affairs (Minkavkaz) of the Russian Federation. Earlier, these powers were exercised by the Ministry of Regional Development of the Russian Federation, where an Interdepartmental Investment Commission (IAC) was established to select projects. Since 2011, 35 investment projects implemented on the territory of the North Caucasian Federal District have received state guarantees totally amounted to 24.318 billion rubles (Table

The Advisory Division was set up at the North Caucasian Development Corporation to assist investors in the preparation of documentation for obtaining state guarantees of the Russian Federation. The volume of the state guarantee of the Russian Federation can be up to 70 % of the amount of a loan (not less than 300 million rubles).

Thus, from 2011 to 2018, the amount of state guarantees for the investment projects selected in the North Caucasus Federal District was distributed as follows: Chechen Republic – 29 %, Ingushetia – 22 %, Stavropol Krai – 14 %, Kabardino-Balkaria – 13 %, Dagestan – 12 %, North Ossetia-Alanya and Karachay-Cherkessia – 5 %.

The establishment of technology parks is globally recognized as one of the most effective PPP tools. However, in 2015, at the federal level, the effectiveness of technology parks in RF regions was analyzed and it was found that only a few of the existing technology parks worked efficiently. In this regard, at the federal level, a decision was made to reduce funding for this program (Silvestrov et al., 2018; Sushko & Talanova, 2017).

Currently, the functions of state regulation and coordination towards investment activities in the Russian Federation are scattered about among many institutions, each of which performs them within its substantive competence and dimensions. Regional development institutions act as a catalyst for private investment in priority sectors and sectors of the regional economy and create enabling conditions for the formation of infrastructure that provides enterprises with access to the necessary financial and information resources.

The most common and formalized structures among regional development institutions are SME support funds. These funds operate with varying degrees of effectiveness in all regions of Russia. According to the Ministry of Economic Development of the Russian Federation, in 2018, 5.017 billion rubles were allocated under the program for providing support to small and medium-sized businesses, with 4.6 billion rubles to be distributed between entities and 0.4 billion rubles to be recorded as an unallocated reserve, subsequently transferred to 5 regions: the Republic of Dagestan, Smolensk, Kaluga, Lipetsk and Yaroslavl regions. The base amount was distributed on a competitive basis in the form of subsidies to the budgets of the constituent entities of the Russian Federation, subject to co-financing from the respective budgets and in accordance with the program for support and development of SMEs approved. Until 2024, it is planned to increase subsidies to SMEs by almost ten times – 66.6 billion rubles in 2024. The total amount of six-year expenses for these purposes is planned at 190.9 billion rubles.

The most prominent development institutions at the federal level are the North Caucasian Development Corporation (NCDC) and regional development corporations. NCDC was established in 2010 as one of the tools to ensure the implementation of stage I of the Strategy for the Socio-Economic Development of the North Caucasian Federal District until 2025. The Corporation is a 100 % subsidiary of the State Corporation Bank for Foreign Economic Development (Vnesheconombank).

In 2011–2018, the Corporation analyzed over 220 investment projects with a total value of over 330 billion rubles. As of the beginning of 2018, NCDC financed 7 investment projects, of which 2 were infrastructure projects, 2 projects in the industrial sector, 2 projects in agriculture and 1 project in the field of tourism. The total volume of projects was 30 billion rubles, while the share of participation in NCDC amounted to 6,708 million rubles. Their implementation will result in 2.284 jobs directly in projects and 6.150 jobs in related industries. Annual tax revenues will amount to 10.005 million rubles (Table

A unique development institution at the federal level is JSC Resorts of the North Caucasus, launched in October 2010 to manage a tourism cluster project in the North Caucasian Federal District, the Krasnodar Territory and the Republic of Adygea.

As part of the tourism cluster project, it is planned to build a network of world-class ski resorts. The total area of the cluster is 269 thousand ha. There are two stages of project implementation. At the first stage, until 2020, Arkhyz, Veduchi, and Elbrus-Bezengi, being the most prepared sites for the construction of resort infrastructure, will become the priority areas. In 2014, JSC NCDC designed the project of the all-season tourist and recreational facility Mamison, the development of which was attributed to the second stage of the creation of the tourism cluster, after 2018. Despite the ability of North Ossetia-Alania to fulfill the conditions (infrastructure construction – about 2 billion rubles were spent), the project was frozen due to the termination of funding from the federal center, and later its implementation was postponed until 2023. There was an ambiguous situation in which a very significant territory of the republic was disengaged from economic circulation, because the region, for the period of the SEZ, did not have the right to dispose of the designated territories, and JSC NCDC did not intend to start implementing the project in the region before 2023 (Musaev & Urumova, 2019). Thus, one of the most attractive recreational territories of Russia was unclaimed. Given the potential of the Mamison Gorge, represented not only by the ski component with a season lasting up to 8-10 months, but also by unique mineral springs, significant historical and cultural assets with a competent approach, it is possible to create a demanded multi-profile resort.

Russian and world experience shows that a vast majority of infrastructure projects cannot be implemented without additional support from public authorities for the following reasons:

Hardly predictable political risks.

Social focus of the state, expressed in the fact that basic infrastructure services should be either free of charge or lower than the actual cost.

In some cases, the private business lacks the necessary support to obtain loans at the initial stage of the project.

Incomplete financial conditions of private entrepreneurship with the requirements of funding organizations for obtaining loans.

Due to the above reasons, the decision on the amount of state support should be based on an assessment made by the state as to whether a project is economically and socially significant, taking into account alternatives for its implementation (Kvint, 2019). Today it’s too early to talk about how successful the experience of using investment support mechanisms in Russian regions is. The search for optimal forms and methods of state impact on the promotion of investment activity in the regions of the country is still ongoing.

Conclusion

The study allowed the distribution of the North Caucasian Federal District by the degree of involvement in the investment development of the federal district. Two regions (Stavropol Krai and Dagestan) showed the largest number of forms of support in the federal district, and as a result, it was Stavropol Krai that became the leader in the number of projects approved and funded by the North Caucasian Development Corporation. The analysis of existing instruments to attract investment in the regions of the North Caucasian Federal District can be applied by regional authorities to streamline actions to attract and use investment resources, which will help improve the quality of regional management and foster the socio-economic situation in the regions.

References

- Gagarina, G. Yu., Dzyuba, E. I., Gubarev, R. V., & Fayzullin, F. S. (2017). Forecasting the Socio-Economic Development of Russian regions. Econ. of Region, 13(4), 1080–1094.

- Gerasimenko, O. A., & Avilova, Zh. N. (2017). Public-private Partnership: Problems and Development Prospects. BSTU Publ. House.

- Kabanov, V. N., Zhilnikov, A. Yu., & Zablotskaya, T. Yu. (2018). Financial Guarantees of Regional Budget – a potential for the growth of investment in fixed assets. Econ. of Reg., 14(1), 315–325.

- Kvint, V. L. (2019). Concept of Strategizing. NWIM RANEPA Publ. House.

- Musaev, R. A., & Urumova, I. O. (2019). Assessment of the Effectiveness of the Implementation of Investment Strategies in the Regions of the North Caucasian Federal District. Reg. Econ.: Theory and Pract., 9(468), 1657–1667.

- Oreshin, V. P. (2016). The potential of Economic Planning. Quest. of Political Econ., 1, 78–91.

- Polyakova, I., & Vasilyeva, E. (2016). Benefits of Public-and-private Partnership for the Creation of the Infrastructure of the Urbanized Territories in Russia. Procedia Engineer, 165, 1380–1387.

- Silvestrov, S. N., Bauer, V. P., & Eremin, V. V. (2018). Assessment of Dependence of Investment Multiplier on Changes in the Structure of the Regional Economy. Econ. of Reg., 14(4), 1463–1476.

- Sushko, T. I., & Talanova, I. M. (2017). Ensuring Effective Management of Investments in Long-term Non-financial Assets. Food Engineer., 47(4), 136–144.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

27 October 2020

Article Doi

eBook ISBN

978-1-80296-091-4

Publisher

European Publisher

Volume

92

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3929

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, translation, interpretation

Cite this article as:

Musaev, R. A., Urumova, I. O., & Pankratov, A. A. (2020). State Impact On Investment Promotion In The North Caucasian Federal District. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism» Dedicated to the 80th Anniversary of Turkayev Hassan Vakhitovich, vol 92. European Proceedings of Social and Behavioural Sciences (pp. 758-766). European Publisher. https://doi.org/10.15405/epsbs.2020.10.05.102