Abstract

The article is devoted to the formation of ideas about behavioral leverage in accordance with the established view of operational and financial leverage, which act as indicators of the risk level and the corresponding potential for profit as compensation for increased risk in the business activity. The reasoning point is based on the consideration of financial mentality of persons making management decisions. The scientific novelty of this paper is determined by the fact that financial mentality is presented as a factor of business management, which has an objective character from the standpoint of behavioral economics. Using analytical methods, as well as methods of systematization, the authors investigate financial mentality, its role in the modern management, and how it affects the business profitability. Financial mentality is usually presented as a subjective factor. This article is an attempt to analyze the impact of behavioral leverage on business management in the context of financial mentality as an objective factor. The main result of this research is the systematization of scientific views of the behavioral leverage, its effects and functions, relations with financial risks return on equity. Proposed perspective on the behavioral leverage opens up an assessment of its impact on the business profitability potential as a promising direction for further research.

Keywords: Operational leveragefinancial leverageleverage effectbehavioral leveragefinancial decisionsfinancial mentality

Introduction

The process of business operation involves risks, both business and financial. One of the main aspects of decision-making in the financial sphere is a risk compensation principle by which the compensation is possible due to the increased business profitability. Determined by the fact that a rational subject of any economic activity is an opponent of risks, he will choose a business option with a minimal risk level from the variety of options that assume the same benefit at different risk levels. For a greater risk, the economic subject can require larger compensation.

Management activities, related to the involvement of financial resources in the company's business turnover and their usage, form appropriate risk sources. Traditionally, the following internal risk sources are identified as those caused by management decisions in the field of financial management:

the company's cost structure (the higher the fixed costs level is, the more sensitive to fluctuations in sales the operating profit of the company will be);

financing sources (usage of debt financing reduces the financial stability of the organization and needs strict compliance with income generation timing for business activities financed from such sources).

An indicator of the level of risks associated with the company's cost structure is the operating leverage. Its action provides a faster growth of operating profit with an increase in sales volume due to the presence of conditionally constant components in the cost structure, the value of which does not depend on the sales volume (it is the sales volume that acts as a source of covering operating costs, both variable and constant). An indicator of the level of risks associated with the formation of financing sources is the financial leverage. Its action provides a faster growth of the net profit when increasing the borrowed capital due to the fact that financial costs of servicing the borrowed capital do not depend on the size of the company's profit ( Doshi et al., 2019; Ibhagui & Olokoyo, 2018; Vorobyov & Leontiev, 2017). Thus, the leverage action occurs due to the presence of constant elements in the cost structure. The leverage effect is expressed in a disproportionately significant increase in profit from operating activities (for the operating lever) and return on equity (for the financial lever) ( Helfert, 2002). In both cases, a potentially high growth rate of the company's profit indicators compensates the increased risk reflected in high values of financial or operational leverage.

Problem Statement

Both operating and financial leverages take into account objective factors that affect the potential for profit. But, in addition to objective factors, there are also subjective factors that also have a significant impact on the potential business profitability ( Bărbută-Misu et al., 2019). The key subjective factor in making strategic decisions is the financial mentality of the company's owners and / or managers.

The financial mentality of management decision makers is considered as a system of conservative, moderate or aggressive principles of asset formation and financing ( Kandrashina & Mantulenko, 2020). Searching for an acceptable level of risks in making business decisions, the financial mentality determines differences in the structure of sources and directions for using business financial resources, cash flows, and profitability levels. Financial mentality is a factor that links the choice of a particular financial decision with objective conditions in which these decisions are made ( Financial Dictionary, 2020), and from the standpoint of behavioral economics, it can be considered as an objective factor of business management ( Kandrashina, 2019). Accordingly, together with operational and financial levers, we should also consider the phenomenon as a behavioral leverage.

Research Questions

The main research questions considered in this article are:

financial mentality as a subjective and objective management factor;

differences in the cost structure and financing sources, profitability levels;

the impact of financial mentality and the behavioral leverage on the business profitability.

Financial mentality is considered as a factor that determines the attitude of decision-makers (business owners and/or company managers) to risks by making essential entrepreneurial decisions that significantly affect financial results of their organizations.

Purpose of the Study

The purpose of this study is to analyze how the phenomenon of behavioral leverage came to the economic science and why, as well as to understand how the behavioral leverage affects the business management of companies. The research work is focused on the fact that financial mentality is an objective factor of business management. The management mentality is defined as a specific system of principles, values, stable views, which act as a basis for management decision-making.

Research Methods

To achieve the research goal and solve the main research tasks, the authors applied analytical methods of cognition. Psychological, sociological and economic approaches to understanding ‘business mentality’ were systemized. Based on the analysis of various scientific views, the authors linked concepts of operational, financial and behavioral leverage, taking into account complicated relations between the level of risks and the expected profitability, different principles of assets formation.

Findings

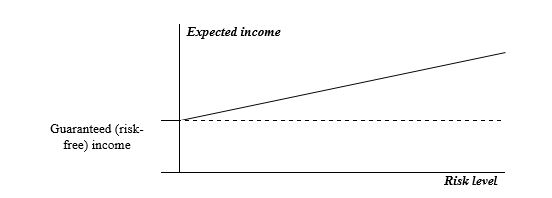

Behavioral leverage is interpreted as a phenomenon accessible to human cognition. It is a philosophical category that reflects external properties and relations of the research subject which reveal its essence. The phenomenon of behavioral leverage, following the logic of scientific views of the leverage action, is that the propensity of management decision-makers to increased risks creates prerequisites for an increased rate of profit growth for a company. The theoretical basis for the concept of relations between risk and profit was first formulated in 1921 by Knight ( 2014), founder of the Chicago school of economics, in the book “Risk, uncertainty, and profit”. The essence of this concept lies in the fact that the receipt of business income is associated with a more or less high risk. And even absolutely safe investments make the investor to expect a certain income level (Figure

From the perspective of the classical economic theory, the income that is expected by the investor even by the absence of any risk situations (under conditions when the minimum guaranteed income may be reached without any risk) is considered as a compensation for his refusal to use available financial funds immediately ( Mosselmans, 2020). In accordance with the concept of liquidity preference by Keynes, it is defined as price of abandoning liquidity, that is, the refusal to save accumulated funds in the monetary form ( as cited in Bibow, 1998). The operational demand for money has a minimum level that does not decrease when the interest rate increases. When making financial decisions in business management, this risk-free level of return is considered as imputed costs ( Aharon & Yagil, 2019).

Traditionally, the level of risk-free income was determined by reference investments such as bank deposits and government securities. However, in the context of the global financial and economic crisis of 2008, the concept of risk-free assets was destroyed. "The concept of risk-free assets no longer exists", the UBS chief executive Sergio Ermotti said ( Martinuzzi & Weber, 2017).

At the same time, a new scientific direction is being actively developed, based on the criticism of one of the key provisions of the neoclassical economic theory about the rationality of the economic behavior – behavioral economics. From the point of view of behavioral economics, there are three typical attitudes to risks: risk aversion, inclination to risk and risk-neutral attitude. In the mathematical context, the risk averse group is formed by people whose preferences are expressed by a declining marginal value of capital, the group of risk takers is made up of people whose preferences are expressed in the increasing marginal value of capital, the risk-neutral group consists of people whose preferences are expressed by a function with a constant marginal value of capital ( Drogobytsky, 2016).

The research by Kahneman and Tversky ( 1992) has shown that most people belong to the second category, but the perception of gains and losses is characterized by an asymmetry. This asymmetry is based on the fact that losses are usually perceived much more deeper and strongly than gains (approximately by 2 times), while different attitudes to risks in the context of losses and gains characterize these areas: it means risk aversion in the situation of getting benefits and inclination to risk in the case of losses. The point that separates these specified branches (the so called subjective zero point) depends on the "context" (a comparison base, expectations).

Conclusion

The concept of the essence of behavioral leverage should correspond to the established stable ideas about operational and financial leverages. Following the logic of the leverage effect described above, the behavioral leverage effect can be characterized as the potential for changes in economic profit when changing the financial mentality of financial decision makers, that is, when moving from a conservative to a moderate and then an aggressive approach to the asset formation and financing. If the operational and financial leverages represent risk characteristics of a chosen business model, then the behavioral leverage, in turn, acts as a characteristic that determines this choice.

Considering the behavioral leverage, it seems appropriate to link the conditionally constant component in the structure of costs taken into account when calculating the economic profit indicator, precisely with the "subjective zero point", which corresponds to the minimum imputed costs of using financial resources in business – compensation for the refusal of immediate consumption. The proposed representation of the behavioral leverage opens some promising directions for further research in this area, in particular in assessing its impact on the business profitability potential.

References

- Aharon, D. Y., & Yagil, Y. (2019). The impact of financial leverage on shareholders' systematic risk. Sustainability, 11(23), 6548. https://doi.org/10.3390/su11236548

- Bărbută-Misu, N., Madaleno, M., & Ilie, V. (2019). Analysis of risk factors affecting firms’ financial performance – support for managerial decision-making. Sustainability, 11, 4838. https://doi.org/10.3390/su11184838

- Bibow, J. (1998). On Keynesian theories of liquidity preference. The Manchester School, 66(2), 238-273.

- Doshi, H., Jacobs, K., Kumar, P., & Rabinovitch, R. (2019). Leverage and the cross-section of equity returns. Journal of Finance, 74(3), 1431-1471. https://doi.org/10.1111/jofi.12758

- Drogobytsky, I. N. (2016). Behavioral economics: Science or exoticism? The World of New Economics, 10(3), 94-105.

- Financial Dictionary (2020). Financial analysis: All about financial analysis. http://1fin.ru/?id=281&t=578&str=%D0%E8%F1%EA%EC%E5%ED%E5%E4%E6%EC%E5% ED%F2 [in Rus.]

- Helfert, E. A. (2002). Techniques of financial analysis: A guide to value creation. McGraw-Hill Education.

- Ibhagui, O. W., & Olokoyo, F. O. (2018). Leverage and firm performance: New evidence on the role of firm size. North American Journal of Economics and Finance, 45, 57-82. https://doi.org/10.1016/j.najef.2018.02.002

- Kandrashina, E. A. (2019). Financial mentality of managers as a factor of business management. Science of the XXI century: Actual directions of development. Materials of the VIII International scientific and practical conference, 2019, 1(1), 277-280. [in Rus.]

- Kandrashina, E. A., & Mantulenko, V. V. (2020). Financial mentality of entrepreneurs as a factor of business management. European Proceedings of Social and Behavioural Sciences EpSBS, LXXXII, 869-873. https://doi.org/10.15405/epsbs.2020.04.110

- Knight, F. H. (2014). Risk, uncertainty and profit. Martino Fine Books.

- Martinuzzi, E., & Weber, J. (2017). How UBS became home to the world’s billionaires. https://www.bloomberg.com/features/2017-ubs-sergio-ermotti-interview/

- Mosselmans, B. (2020). Measuring utility: From the marginal revolution to behavioural economics. Journal of the History of Economic Thought, 42(1), 138-141. https://doi.org/10.1017/S1053837219000385

- Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5, 297-323.

- Vorobyov, A. V., & Leontiev, V. E. (2017). Corporate finance (water transport). MCNIP. [in Rus.]

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

21 October 2020

Article Doi

eBook ISBN

978-1-80296-089-1

Publisher

European Publisher

Volume

90

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1677

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Kandrashina, E. A., & Mantulenko, V. V. (2020). The Essence Of Behavioral Leverage In Business Management. In I. V. Kovalev, A. A. Voroshilova, G. Herwig, U. Umbetov, A. S. Budagov, & Y. Y. Bocharova (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST 2020), vol 90. European Proceedings of Social and Behavioural Sciences (pp. 619-623). European Publisher. https://doi.org/10.15405/epsbs.2020.10.03.71