Abstract

The paper provides a detailed analysis of the risk groups encountered across the globe, i.e. the list of global risks threatening, among other nations, the Russian Federation. The list is supported by the data of surveys with both businessmen and population. All these risks appear to be linked with digitized economy and many result from negative effects of digitization. The paper emphasizes differences and variations in estimates of digitization effects changing with further developments in digital technologies and their omnipresence. The paper examines the instances of efficient risk management in operation of a number of companies. They are the so called innovator companies with highly flexible corporate policies. Analysis of measures taken by these allows determining the principles of risk management based on digitization and digital technologies. In conditions of instability risk management becomes integral to both corporate culture and government policy and intrinsic to rational behavior. Risk management itself undergoes transformation while staying an effective tool for solving global problems at all levels. The paper identifies principles to be followed in managing risks in conditions of digitized economy both at the level of an individual organization and at the level of a nation.

Keywords: Risksdigital economyinformation securityrisk managementcorporate cultureinnovator companies

Introduction

In modern world, crises (economic, political, social) increasingly arise as a result of incorrect forecasts of future developments and events in the society, state, or social system, and result from ineffective risk management.

The term ‘risk’ was introduced in 1700s by an Irish-French entrepreneur and economist Richard Cantillon. Hans von Mangoldt, a prominent German economist, in 1800s argued qualitative evaluation and efficient management of risks necessitating allowances for time-factor, i.e. the study is to be dynamic.

Nowadays risks are typically regarded in two perspectives: as a historical and as an economic category. Knight (2003), an American economist, in early 1900s was among the first to formulate the problem of uncertainty in economic theory and defined risk as ‘measurable uncertainty’.

Beck (2000), a German sociologist and political philosopher, in 1984 concluded the study of risks in sociological context. In his Risk Society: Towards a New Modernity, he extended the notion of risk beyond the social system and termed modern society a ’risk society’.

A milestone in the study of risks was the Global Risks Report for the World Economic Forum in Davos in 2017. The conclusions in the report were based on surveys of 750 experts who assessed the probability of 30 global risks and their consequences. All risks studied were subdivided into 5 categories of economic, technological, geopolitical, social and ecological risks (Zveryeva, 2017).

Problem Statement

The dynamics of changes and transformations in the modern society and hence, emergence of new types of risks, are in most immediate and direct relation to the phenomenon of digital economy. How should Russia react to new challenges?

Today informatization affects almost every aspect of economy, to different extents, however. Digitization is bound to affect, in certain ways, socio-economic systems, and the studies of the digitization effects are insufficiently extensive, to this point (Chernyakova, 2018).

Research Questions

What is a digital economy? Already a number of definitions have been offered. They are ‘a new economic order based on knowledge’; ‘market based on digital technologies’; ‘global socio-economic network comprising various forms of economic activities’. A most laconic definition is ‘economy relying on digital technologies’. This one is deemed most appropriate since it reflects most precisely the character of interrelations in the economy as a global system and digitization as a sum-total of digital technologies (Scwab, 2017). The effect rendered by digital innovations in the economy and transformations induced by them can no longer be regarded ‘factors’, they have already become the essence and the foundation of modern economy.

Let us define what kinds risks are caused by digitization, and the main question of the research is how to manage these risks.

Purpose of the Study

The aim of the analysis performed is to determine major risks to be encountered by both government and individual organizations and to identify the principles which are to be relied upon to minimize possible negative effects.

Research Methods

The study employs theoretical methods of abstraction, synthesis, analysis, and generalization, also survey results are used. The studies of Russian and foreign experts were taken and analysed.

The Russian Federation, as any other nation, is to forecast and timely react to new trends in economy, politics, society and culture, resulting from the phenomenon of global digital environment (Osipovich et al., 2018). The risk groups related to digitization and common for all nations across the globe are the following:

1. Socio-economic risks. Digitized economy induces the emergence of new types of threats and risks for all participants of economic processes and relations rendering influence on the whole system of managing global socio-economic processes (Chernyakov et al., 2016). In. Modern economic systems are based on global social, information and trade networks, crypto-currencies and Internet of Things. Financial operations become impersonalized and individuals become vulnerable to global platforms with access to private and personal data.

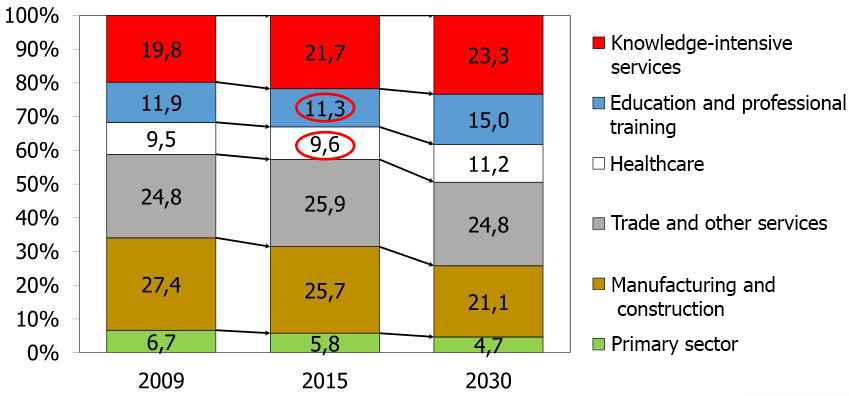

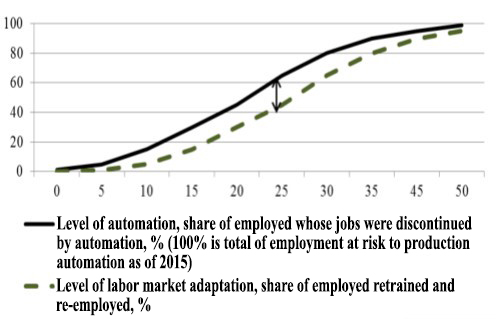

One of major socio-economic risks is structural unemployment resulting from insufficiency of retraining schemes and programs. Figure

Prevention of such condition requires a sustainable system of retraining aimed at continuous acquisition of new skills and qualifications and creation of a system for managing careers in industry and manufacturing. Another factor for efficient minimization of negative effects and consequences of digitization is increasing digital literacy of the population and creating incentives for self-education. The coronavirus pandemic of 2020 increased the importance of distant learning using digital technologies. The above mentioned factors are to promote development and acquisition of competences to be of high demand in the next decade.

2. Managerial risks. This group of risks is related to the factors already discussed above but has most immediate and important implications for heads of structural and organizational subdivisions, enterprises, regions and even nations. Digital economy necessitates development of new forms and methods of interaction and communication between both individuals and companies and organizations. It requires, hence, development of new approaches to acquisition and evaluation of new managerial competences at present and in future.

3. Technological risks. These are primarily related to provisions for cyber-security. In conditions of digitization business processes proceed real-time with information systems and undergo continuous transformation. Hackers search for and find vulnerabilities in security systems of banks and enforcement agencies (financial institutions being a primary target) and the scale and numbers of computer crimes are constantly increasing. Continuously increasing levels of threats require establishment of new foundations to provide operation in global digital environment (Rudskoy et al., 2017).

The technological change is accompanied by the process of innovation to radically transform living of both an individual and the nation. Digital economy transforms all aspects of human activities, once being an innovation and developing rapidly with information and communication technologies (Chernyakov & Chernyakova, 2018). The Internet global network is unique in being both a symbol and an integral component of digital economy; the basis is its global and universal character. Any person having a phone or a computer can access the World Wide Web becoming an element of this system (Kolodnyaya, 2018).

Hence a most acute necessity in the modern society is the one of information security required by both individuals and businessmen. This trend, mentioned by the Director for interaction with government bodies and agencies in the Russian Public Opinion Research Center VCIOM Kirill Rodin, is evidenced by the polls conducted by the Center: 56% of those polled consider increased information security crucial and necessitating updates in legislation and regulations (Titov, 2019).

The Director-general of the VCIOM Center Valery Fyodorov claims in the period of 2000-2018 population in the Russian Federation has become more skeptical in terms of the Internet proliferation and growth. He argues in the period of 2000-2013 the share of Russian citizens considering the number of threats on the Internet to be increasing constantly fell from 36% to 24%; the trend, however, changed in 2014. As for 2019 the share is 39% which indicates an increase if compared with the initial share. Such rise proves Russians’ expectations of positive experiences using the Internet are less optimistic and they foresee higher numbers of threats and risks related.

Concluding the above, in the past decade of 2010-2020 the attitudes of both population and businesses to information technologies in general and the World Wide Web in particular have changed to become less enthusiastic. The results of polls support the proposition of internet-users paying ever increasing attention to the information they upload or post onto nets, the caution more obvious with text sources (Kasperskaya, 2018). Most typical reasons vary from the threat of hacking and leakage of personal sensitive information to be used with fraudulent purposes to suspected surveillance by the company managers or security department and state espionage.

Returning to the above list of risks classified into three groups, a more detailed examination is required for those affecting business activities transformed by digitization. There have been an insufficient number of studies in the field of analyzing the existing and possible threats, potentially capable of rendering negative effects on digitization and innovative activities in a company, while businesses are least likely to stay intact and uninvolved into solving the urgent problems of digitization.

How do organizations assess the prospects of digital technologies? A universal solution is difficult to provide. On the one hand, digital technologies are perceived through a prism of operation optimization, and their integration is regarded an opportunity to use electronic digital signature (69% of businessmen polled), industrial internet (34%), cloud-based services (29%), CAD systems (27%).

On the other hand, businesses realize the risks associated with digitization such as:

disproportion of expense on integration of digital technologies and benefits gained (35%);

difficulties with personnel selection (34%);

issues in information security (33%);

possible losses (31%).

Technological risks themselves are not a novelty, rapid growth of digital technologies, however, increases the probability and the scope of risks and, which is more important, creates new threats. The following factors contribute to the growing number of risks:

increased amounts of the data used;

higher level of business processes automation;

more sophisticated cyber-attacks;

volatility of markets;

increased demands of customers.

Inefficient risk management is largely dependent on the level of risk management in big businesses. Risk management became a separate branch in the second half of the 20th century. First studies resulting in establishing the methodology for assessing risks of hazardous production facilities were performed after the disaster at a natural gas storage tank at the East Ohio Gas Co. plant in Cleveland, Ohio, USA, in 1944. New position of CRO, Chief Risk Officer, in many companies, recurring reports of methods and approaches in risk management included in company statements prove the trend. Risk, being intrinsic to any economic process, renders significant influence on operation of any business. To maximize efficiency of business operation it is necessary to identify and assess the risk and then to find a method for managing it.

The above proves experts in risk management to be in high demand: company management aims to account for all possible risks and their effects to control and manage them. High-quality interaction and cooperation of company management and risk managers become a necessary condition for effective use of information from both internal and external sources to prevent the negative effects of risk factors. Digital transformation is to be guaranteed management of new arising and foreseen risks. A study by PricewaterhouseCoopers demonstrates how risks can be managed effectively in conditions of digital technologies integration.

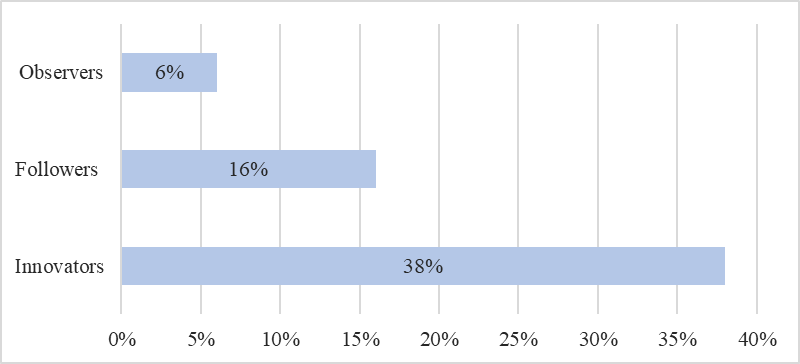

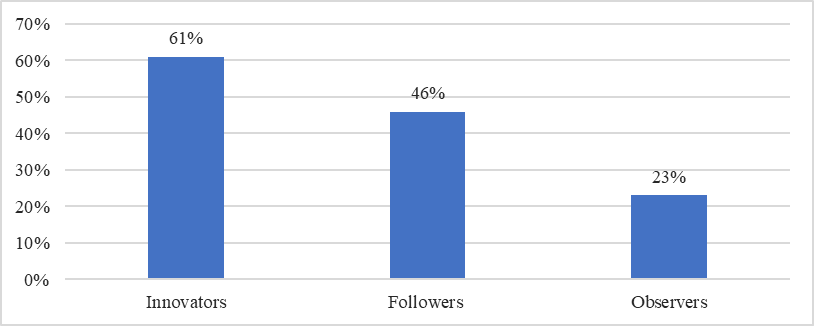

In terms of risk management three types of companies can be identified: innovators, followers and observers. Innovators receive maximum of benefits from investing in new technologies managing risks effectively. Followers, falling behind the pioneers in digitization, ultimately develop measures to oppose and minimize the negative effects of digitization. Observer companies either stay at the stage of planning for actions and measures to reduce negative impacts, or implement their plans of risk management, but only partially and refusing systemic approach.

Differences in strategies of the three types of companies can be visualized with diagrams. Figure

The generalized diagram below (Figure

Hence it can be stated that over a half of innovator companies possess a well-defined strategy of risk management and take preventive measures: study of risks, their assessment, making reports on risk factors and elaboration of plans to minimize the negative effects of risk factors.

Innovator companies are most noteworthy in terms of examining successful experiences, and their activities deserve a more detailed description. Time is a key factor: innovators, in relation to risk management, gain benefits in terms of time, outstripping the competition in terms of digital technologies integration. Consequently, such market participants closely follow the schedule set in their road maps of digitization in general and development of digital competences in particular, and are capable of even performing ahead of the schedule (Malikova, 2020).

Management of innovator companies recognizes the priorities of the company and its risk appetite, i.e. the levels of risk the company is ready to accept achieving business goals. It results in promoting and supporting promising initiatives within the organization starting with earliest stages, this allows businessmen to maintain and increase the company potential, without restraining it, and to effectively manage risks while complying with the plan of strategic development. In such case the process of risk management is secured with reliable data timely analyzed and results of analyses presented to the company management for weighed decision-making. Another typical feature is that innovator companies tend to change their risk appetite and most often these variations result from the process of digitization.

Among gravest risks of transformation related to digital initiatives the following ones can be identified:

threats to cyber-security;

risks of data management;

operational risks.

In terms of finance effective risk management innovators receive much higher returns on investments in digital technologies. Increased incomes are only one among the three major benefits of investments in new technologies. The other two are gaining valuable experience of interaction with customers and optimization of managerial decision-making.

Findings

In conclusion, we identify a set of features characterizing innovator companies in terms of risk management (Ritchie & Brindley, 2009):

high degrees of involvement into realization of digital transformation strategy;

improving qualifications of personnel and, if necessary, hiring of new employees to provide for human capital required for company development;

due attention paid to competences required for integration of new technologies;

ongoing feedback to provide for measures to eliminate or minimize negative effects of risk factors;

close cooperation and interaction with experts in risk management responsible for integration of digital technologies;

continuous sharing of information within the company, setting the system for communication to develop the general concept of risk management.

The most sophisticated component of innovative strategy of risk management is motivation of employees to become involved in the process. A message to be delivered to them is that risk management is the common goal and each employee holds personal responsibility for achieving it.

Dwelling on the human component in risk management we should note that due to rapidly changing composition of labor market and economy on the whole the crucial factor is development and implementation by companies of programs stimulating preventive retraining and qualification improvement. Establishing systems for career management companies can minimize risks of de-professionalization (Rudskoy et al., 2019).

Finally, still another factor essential for effective risk management is cyber-security. Innovator companies take the following steps in this direction:

minimizing obsolete technologies used for providing information security in the company and integration of novel and progressive technologies in the field (with either company’s inside resources, or in cooperation with outside developers and experts);

reliance on digital technologies capable of resisting various types of cyber-attacks;

prevention of infringements performed with information technologies (inclusion of a relevant provision into corporate policy).

Thus developed, the strategy of digital transformation in a given company becomes a basis for establishing risk management as an element of corporate culture. Innovator organizations with clear realization of corporate digitization strategy correct their activities to become high performers in the market.

Conclusion

Changes accompanying digitization of economy affect all aspects of living and society. Evidently, progress brings considerable benefits while sharpening already existing and possible risks. The paper identified main groups of threats encountered in the process of digitization; the solutions for minimizing those are provided – they are to reduce the probability of risks in further digitization of economy.

One of the most valued resources of digital age is knowledge. Knowledge becomes a demanding factor for human resources; the ability of an individual to acquire existing and create new knowledge becomes crucial, as abilities of self-development and autodidactisism. Russia striving to secure a leading role in the global economy of digitization is to proceed through a fundamental transformation of education, science and research, production organization. All these are provided for in the national ‘Program for Development of Digital Economy by 2025’.

The instruments developed to minimize risks are to be based on joint actions of state, business and society, accounting for interests of all economic agents and benefiting from the digital economy.

Acknowledgments

The authors gratefully acknowledge the support of Yulia A. Antokhina, Rector of St. Petersburg Sate University of Aerospace Instrumentation.

References

- Beck, U. (2000). Obschestvo riska. Na puti k novomu modernu [Risk Society: Towards a New Modernity]. Progress-Traditsiya [in Rus.].

- Chernyakov, M. K., & Chernyakova, M. M. (2018). Innovatsyonnye riski tsyfrovoy ekonomiki [Innovative risks in digital economy]. National priorities in Russia, 31. https://cyberleninka.ru/article/n/innovatsionnye-riski-tsifrovoy-ekonomiki [in Rus.].

- Chernyakov, M. K., Chernyakova, M. M., Razomasova, E. A., & Arutyunyan, N. V. (2016). Innodiversifikaciya [Innovative diversification]. Competitiveness in the global world: economics, science, technologies, 6, 283-287. [in Rus.]

- Chernyakova, M. M. (2018). Sotsialno-ekonomicheskiye faktory razvitiya tsyfrovoy ekonomiki [Socio-economic factors of digital economy development]. Krasnoyarye science, 3-2(7), 140. [in Rus.]

- Kasperskaya, N. I. (2018). Tsifrovaya ekonomika i riski tsifrovoy kolonizatsii. Razvernutyye tezisy vystupleniya na Parlamentskikh slushaniyakh v Gosdume [Digital Economy and the Risks of Digital Colonialism. Expanded Theses Statements at the Parliamentary Hearings in the State Duma]. http://narodosnova.ru/2018/04/tsifrovaya-ekonomika-i-riski-tsifrovoj-kolonizatsii.html [In Rus.]

- Knight, F. (2003). Risk, neopredelennost „i pribyl“ [Risk, Uncertainty and Profit]. Delo.

- Kolodnyaya, G. (2018). Tsyfrovaya eckonomika: osobennosti razvitiya v Rossii [Digital economy: specific development in Russia]. Economist, 4, 63-69. [in Rus.]

- Malikova, S. (2020). Razumnoye upravleniye riskami v khode tsyfovoy transformatsii [Reasonable risk management in digital transformation]. Economics and life, 6(9822). https://www.eg-online.ru/article/414912/ [in Rus.]

- Osipovich, T. A., Chernyakov, M. K., & Chernyakova, M. M. (2018). K voprosu ob ocenke stranovogo riska [On the issue of country risk assessment]. In V.I. Bakajtis (Ed.), International scientific and practical conference, 2 (pp. 143-149). Novosibirsk. [in Rus.]

- Ritchie, B., & Brindley, C. (2009). Risk Management in the Digital Economy. In Encyclopedia of Information Science and Technology (Second Edition) (pp. 3298-3305). https://doi.org/10.4018/978-1-60566-026-4.ch525

- Rudskoy, A. I., Borovkov, A. I., Romanov, P. I., & Kolosova, O. V. (2019). Puti snizheniya riskov pri postroyenii v Rossii tsyfrovoy ekonomiki. Obrazovatelny aspect [Ways of reducing risks in establishing Russian digital economy. Educational aspect]. Higher Education in Russia, 2. https://cyberleninka.ru/article/n/puti-snizheniya-riskov-pri-postroenii-v-rossii-tsifrovoy-ekonomiki-obrazovatelnyy-aspekt [in Rus.].

- Rudskoy, A. I., Borovkov, A. I., Romanov, P. I., & Kiseleva, K. N. (2017). Inzhenernoe obrazovanie: opyt i perspektivy razvitiya v Rossii [Engineering Education: Experience and Development Prospects in Russia]. Publishing House of Polytechnic Univ. [In Rus.]

- Scwab, K. (2017). The Fourth Industrial Revolution. Currency. Top Business Awards. Crown Publishing Group.

- Titov, D. (2019). Tsyfra: vozmozhnosti i riski [Digitization: opportunities and risks]. Economics and life, 17-18 (9783). https://www.eg-online.ru/article/398960/ [in Rus.].

- Zemtsov, S. P. (2019). Riski i vozmozhnosti tsyfrovoy eckonomiki: kak adaptirovatsya regionam [Risks and opportunities of digital economy: the ways for regions to adapt]. https://www.researchgate.net/publication/336902931_Riski_i_vozmoznosti_cifrovoj_ekonomiki_kak_adaptirovatsa_regionam [in Rus.]

- Zveryeva, T. V. (2017). Ekonomicheskiye riski tsyfovoy ekonomiki [Economic risks of digital economy]. Problems of risk analysis, 6(14), 22-29. [in Rus.]

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

21 October 2020

Article Doi

eBook ISBN

978-1-80296-089-1

Publisher

European Publisher

Volume

90

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1677

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Okrepilov, V., Peshkova, G., & Samarina, A. (2020). Approaches To Risk Management In Digital Economy: Corporate Risk Management. In I. V. Kovalev, A. A. Voroshilova, G. Herwig, U. Umbetov, A. S. Budagov, & Y. Y. Bocharova (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST 2020), vol 90. European Proceedings of Social and Behavioural Sciences (pp. 543-552). European Publisher. https://doi.org/10.15405/epsbs.2020.10.03.61