Abstract

Currently the national program for innovation and the federal and local authorities of the Russian Federation aim at increasing the innovative potential for growth in all industries of national economy. Development of construction, as an industry of national economy, requires solutions for the tasks set by the governmental strategy of economic growth. While stating the problem and developing solutions and methodology for assessing its outcomes within the declared national Strategy for Innovative Development 2030 (Proekt, 2030) administrative bodies often pay insufficient attention to evaluating the needs and constraints of the population, a major end-user of products in construction industry. The national program often lacks detailed methodologies for assessing the purchasing power (PP) of the population and the factors which are to render influence on the indicator. The paper elaborates on the indicators for assessing the PP based on innovative development of the construction industry to reorient the lines of development to the end-users while revealing their demands and constraints.

Keywords: Investmentsinnovative developmentnational economicconstruction industry

Introduction

Currently the program for innovation developed at the federal level and the federal and local authorities of the Russian Federation strive to increase potential for innovations and growth across the national economy. Innovative solutions in construction, one of the principal industries in the national economy, are aimed at achieving the goals set by the governmental strategy of economic growth (Golichenko, 2014; Golichenko, 2017; Silin et al., 2016).

According to the guidelines for innovation-based development of construction industry set by the national Strategy for Innovative Development 2030, one of the primary goals is ‘improvements and implementation of the housing policy at the federal and regional levels as the basis for socio-economic policy in the Russian Federation aimed at providing the citizens of the Russian Federation with the affordable and comfortable housing, increasing the number of housing commissioned and reducing its costs, establishing high-quality environment including construction of structures of various functionality, development of transport and utilities infrastructure’. Solutions, in this case, will require development of most efficient and effective methodologies for assessing the innovation-based growth in construction and for determining the factors which will promote its continuous growth. In addition, when developing the methodology, the main emphasis should be placed on the human being and the development of his well-being – as a priority of the government of the Russian Federation (Medvedev, 2015; Medvedev, 2016).

Problem Statement

The guiding document stating, among other, indicators and criteria for assessing the growth of construction industry in Russia is the Strategy for Innovative Development of Construction Industry 2030 by the Ministry of Construction, Housing and Utilities of the Russian Federation. The approach to determining and calculating the principal indicators described in it seems insufficient for determining those factors which affect the current conditions in housing and changes in the levels of housing prices, the rates of satisfaction with housing and the constraints influencing the PP of the population. The PP of the population is of immediate effect for the affordability of housing for them and is determined by combination of the buyer’s own money, mortgage loans and other sources. This entails posing certain problems requiring solutions in this study:

justification of the criteria-based indicator to determine the PP of the population as a major factor of influence in construction industry;

establishing a set of factors influencing changes in the criteria-based indicator;

elaborating the methodology of the factor analysis for criteria and indicator to assess the PP of the population in the developing construction industry.

Research Questions

The present study aims to answer the following questions:

What can be taken for an indicator to assess the PP of the population?

What factors affect the changes in the PP of the population in innovation-based construction industry?

How to evaluate the effect of these factors on the changes in the PP of the population in innovation-based construction

Purpose of the Study

The study aims at developing a methodology to assess the effect of factors on changes in PP of the population in conditions of innovative developments and transformation of construction industry.

Research Methods

As a theoretical and methodological foundation the present study uses the studies by Russian and foreign scholars, regulations and other legislation issued by the Ministry of Construction, Housing and Utilities of the Russian Federation. The data used as the basis for the study have been taken from the published statistics of the Russian Federal State Statistics Service, the Central Bank of Russia and other open sources.

The study relies on such methods of research analysis such as comparative economic system analysis, factor analysis and abstraction. This combination allowed achieving reliability in research findings.

Justification of the criteria-based indicator to determine the PP of the population as a major factor of influence in construction industry

Among the principal indicators of innovations in the construction industry of the Russian Federation set for long-term Strategy for Innovative Development of Construction Industry the factors of the current conditions in housing and changes in the levels of housing prices, the rates of satisfaction with housing and the constraints influencing the PP of the population can be identified and measured with the below indicators:

the sufficiency of housing available for the citizens of the Russian federation (calculated in square meters of housing per capita and as percentage of the average as taken per capita in the countries of the European Union);

new housing facilities commissioned (in square meters as for the total amount of new housing);

new housing facilities commissioned (in square meters as for the total amount of new housing calculated per capita);

the total of new housing facilities commissioned in a given year as calculated for the percentage of the comfort-class housing commissioned (calculated as percentage of the total of new housing commissioned);

the number of land parcels with utilities infrastructure granted at no charge to preferential categories of beneficiaries (number of parcels);

the ratio of the number of citizens whose housing conditions require improvement and who are listed for granting housing and the number of citizens whose housing conditions have already been improved during a given year to the total number of citizens whose housing conditions require improvement (calculated as percentage) (Litvinenko, 2016).

Such approach to determining the principal indicators makes it impossible to evaluate the factors which are to influence the amounts of housing already in use as compared to the required amounts and the dynamics of increases in the amounts and the quality of housing available for the citizens in the Russian Federation. The PP of the population is to determine the affordability of housing with the buyer’s own money, loans and other sources of funding.

When investigating the problem of assessing the innovative development of the housing construction it was estimated that among other financial indicators revealing the trends in this area one of most essential is the PP of the population. Experience of other countries supports the idea that for the country to be turned around the crisis conditions the main tool is the raise in the population’s PP (Isaev, 2016).

The country’s population and the PP they are characterized by are seen as a main driver for the national economy revival including the system of innovations in it and the sector of construction.

Solution to this problem and the task of creating incentives for increased demand in the housing construction market require assessing the population’s PP which will allow for evaluating the potential for innovation and the levels of innovative development in construction of housing. The criteria for assessing the PP are the term during which the housing becomes available as it gives the time-frame for population with certain level of incomes purchasing one of the construction industry end products – residential real estate (most often apartments, if speaking of Russia).

Establishing a set of factors influencing changes in the criteria-based indicator

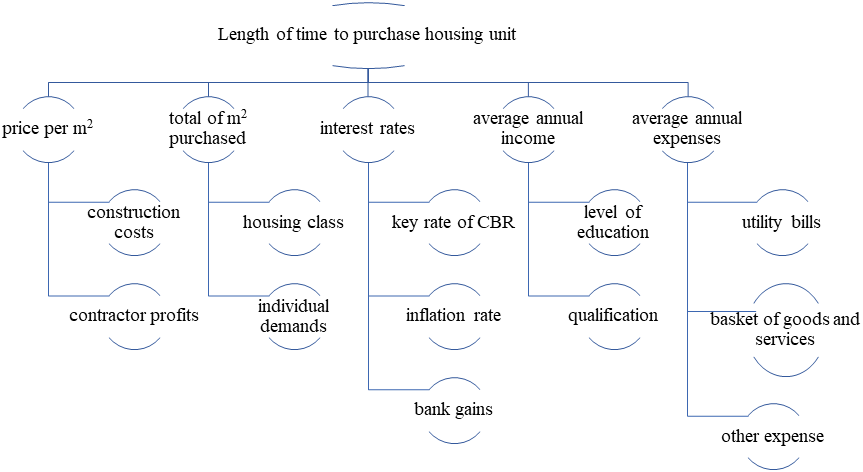

The length of period during which an individual housing unit becomes affordable for a household is affected by the following factors of the first order:

price per one square meter of housing premises ( );

the total of square meters of the housing being purchased ( );

interest rates on mortgage loans (Eн);

the average level of incomes of a household ( );

the average level of expenses of a household ( );

the number of earners and the number of dependants in a household;

the amount of taxes paid by the household (Н).

The length of period is also affected by a number of factors of the second order (Antokhina & Litvinenko, 2017), which are:

key interest rate established by the Central Bank of the Russian Federation;

the inflation rate;

the cost of construction (including materials and land);

the level of administrative barriers;

the rate of payments for utility bills;

the amount of taxes paid by all parties involved in construction, etc.

The above allows systematizing the set of factors affecting the changes in the lengths of time during which the unit of housing becomes affordable for a household (Figure

The formulas for calculating the indicator, depending on the method of purchasing the housing unit (with the household’s own money or/and with the mortgage loan from a bank), are given below (Litvinenko, 2016).

Calculation of the length of time ( ) during which a household becomes capable of purchasing a unit of household employs the below Formula (1):

(1)

Calculation of the length of time ( ) during which a household becomes capable of purchasing a unit of household partly funded with the mortgage loan requires variation as in Formula (2):

, (2)

The system of factors determining the length of time during which a housing unit becomes affordable for a household derived above demonstrates its wide-range applicability for assessing the PP of a household for deciding on the construction industry strategies and from the above this indicator can be defined as a criterion.

Elaborating the methodology of the factor analysis for criteria and indicator to assess the PP of the population in the developing construction industry

Application of the above indicator for evaluating the trends of innovative development in construction industry allows for a factor analysis to analyze changes in the indicator when affected by the above factors (Fig.1) using a traditional methodological approach. More informative and practical, however, seems analysis of the instruments applied in construction industry by the state to regulate the market of housing and housing construction and their effects for the changes in the lengths of time for purchasing a unit of housing by a household. Such levers include:

the difference between the normative price and the market price per one square meter of housing premises in the primary market ;

the difference between the normative price and the market price per one square meter of housing premises in the secondary market ;

the difference between price per one square meter of housing premises in the primary and in the secondary markets ;

increases in the normative price of new housing if funding sources include the mortgage loan ( );

increases in the price of new housing conditioned on the difference between the normative price and the market price in the primary market if funding sources include the mortgage loan (( );

increases in the price of new housing conditioned on the difference between the normative price and the market price in the secondary market if funding sources include the mortgage loan (( );

increases in the price of new housing in the primary market if funding sources include the mortgage loan ( );

increases in the price of new housing in the secondary market if funding sources include the mortgage loan ( );

increases in the price per one square meter of new housing conditioned on the difference between the market prices in the primary and in the secondary markets if funding sources include the mortgage loan ( ).

The first stage requires calculating the length of time for purchasing a unit of housing by a household if funded with a combination of the household’s own money and the mortgage loan.

1) when the purchase is funded with the household’s own money:

- the normative length of time for purchasing a unit of housing (for normative prices) ( ):

(3)

- the length of time for purchasing a unit of housing in the primary market ( ):

(4)

where stands for the price per one square meter of housing premises in the primary market, RUB.

- the length of time for purchasing a unit of housing in the secondary market ( ):

(5)

where stands for the price per one square meter of housing premises in the secondary market, RUB.

2) when the purchase is funded jointly with the household’s own money and the mortgage loan:

- the normative length of time for purchasing a unit of housing ( ):

(6)

- the length of time for purchasing a unit of housing in the primary market ( ):

(7)

- the length of time for purchasing a unit of housing in the secondary market ( ):

(8)

The second stage requires calculating deviations in the indicator given the application of instruments to regulate the market of residential real estate:

the difference between the normative price and the market price per one square meter of housing premises in the primary market :

(9)

2) the difference between the normative price and the market price per one square meter of housing premises in the secondary market :

(10)

3) the difference between price per one square meter of housing premises in the primary and in the secondary markets :

(11)

4) increases in the normative price of new housing if funding sources include the mortgage loan ( ):

(12)

(13)

(14)

(15)

where stands for the normative price of the housing unit purchased in the reporting period, RUB;

stands for the normative price of the housing unit purchased if funding sources include the mortgage loan, RUB;

stands for annuity rate given the loan period .

5) increases in the price of new housing conditioned on the difference between the normative price and the market price in the primary market if funding sources include the mortgage loan (( ):

(16)

(17)

(18)

where stands for the price of the housing unit purchased in the reporting period in the primary market, RUB;

stands for the price of the housing unit purchased in the primary market if funding sources include the mortgage loan, RUB;

6) increases in the price of new housing conditioned on the difference between the normative price and the market price in the secondary market if funding sources include the mortgage loan (( ):

(19)

(20)

(21)

where stands for the price of the housing unit purchased in the reporting period in the secondary market, RUB;

stands for the price of the housing unit purchased in the secondary market if funding sources include the mortgage loan, RUB;

7) increases in the price of new housing in the primary market if funding sources include the mortgage loan ( ):

(22)

8) increases in the price of new housing in the secondary market if funding sources include the mortgage loan ( ):

(23)

9) increases in the price per one square meter of new housing conditioned on the difference between the market prices in the primary and in the secondary markets if funding sources include the mortgage loan ( ):

(24)

Within the framework of the Strategy for Innovative Development of Construction Industry the methodology described can be used to evaluate the effects of the above set of factors on changes in the population’s PP as measured both at the national level and at the level of individual regions and territories. This will allow determining the distortions in the innovative development of the construction industry and identifying the leaders and those lagging behind.

Findings

Development of effective innovative strategy can be fraught with error in a nation with substantial distortions in socio-economic development, financial and economic constraints and potential for innovation across individual regions and territories (Golova & Suhovey, 2019). Application of the methodology proposed for assessing the PP of the population allows establishing effective applications of state regulation in the residential real estate market aimed at increasing the potential for innovation and innovative development of the public housing construction sector with favorable investment climate for the end users in the construction industry. Further study presumes assessment of the population’s PP performed for various regions and territories of the Russian Federation to evaluate the effects of the factors described and the distortions present.

Conclusion

Today, science plays a key role in national development, directly affects the speed and depth of necessary changes in the economy, industry and agriculture, and determines the quality of life and well-being of people (Putin, 2007, 2016, 2019). In Russia, the main factors hindering the development of the innovation system are the lack of a clearly formulated innovation strategy (Shevchenko et al., 2017). Russia has the capacity to implement major national projects, but achieving this goal is not important in itself, but only as a mechanism to ensure the growth of the well-being and quality of life of Russians (Medvedev, 2018). Development of a methodology for assessment of the PP of the population is deemed critical for modern economics as it allows more profound analysis of the factors influencing the innovative development of both the national economy, and its individual industries, aiming at effective innovative strategies.

References

- Antokhina, Yu. A., & Litvinenko, E. V. (2017). Analiz effektivnosti investicii v usloviyah sicialno-orientirovannoy economiki [Analysis of the effectiveness of investments in a socially oriented economy]. Vestnik Kavkazskogo Federal'nogo Universiteta, 6(57), 49-53. [In Rus]

- Golichenko, O. G. (2014). Nacionalnaya innovacionnayasistema: ot koncepcii k metodologii issledovaniya [National innovation systems: from conception toward the methodology of the study]. Voprosi economiki, 7, 35-50. https://doi.org/10.32609/0042-8736-2014-7-35-50

- Golichenko, O. G. (2017). Gosudarstvennaya politika I provali nacionalnoi innovacionnoi sistemi [Public policy and failures of the national innovation system]. Voprosi economiki, 2, 97-108. [In Russ.]

- Golova, I. M., & Suhovey, A. F. (2019). Differenciaciya strategii innovacionnogo razvitiya s uchetom specifiki rossiiskih regionov [Differenciaciya strategiy innovacionnogo razvitiya s uchetom specifiki rossiiskih regionov]. Economica regiona, 15(4), 1294-1308. https://doi.org/10.17059/2019-4-25

- Isaev, A. V. (2016). Increasing the PP of the population. Rossiiskaia gazeta, 9 (6877). [In Rus]

- Litvinenko, E. V. (2016). Razrabotka sistemi pokazateley effectivnosti kapitalnih vlozeniy v priobretenie zilya v sobstvennost [Development of a system of indicators of the effectiveness of capital investments in the acquisition of housing in property]. Rossiiskoe predprinimatel'stvo, 17(3), 423-440. [In Rus]

- Medvedev, D. A. (2015). Novaya realnost: Rossiya i globalnie vizovi [A new Reality: Russia and global Challenges]. Voprosi economiki, 10, 5-29. https://doi.org/10.32609/0042-8736-2015-10-5-29

- Medvedev, D. A. (2016). Socialno-ekonomicheskoe razvitie Rossii: obretenie novoi dinamiki [Social and economic development of Russia: finding new dynamics]. Voprosi economiki, 10, 5-30. [In Rus]

- Medvedev, D. A. (2018). Rossiya-2024: strategiya socialno-ekonomicheskogo razvitiya [Russia-2024: the strategy of social and economic development]. Voprosi economiki, 10, 5-28. https://doi.org/10.32609/0042-8736-2018-10-5-28

- Putin, V. V. (2007). Perekhod k innovatsionnoy ekonomike — prioritetnaya zadacha Rossii [Transition to the Innovative Economy — the Foreground Task of Russia]. Ekonomika i upravlenie, 6, 4. [In Rus]

- Putin, V. V. (2016). Privetstvie prezidenta Rossiiskoi Federacii V. V. Putina obchemu sobraniyu chlenov rossiiskoi academii nauk [From the Presidential Address to the Federal Assembly]. Gosudarstvennaya sluzba, 6(104), 6-9. https://doi.org/10.22394/2070-8378-2016-18-6-6-9

- Putin, V. V. (2019). Iz poslaniya Prezidenta Federalnomu sobraniyu [Greetings from the President of the Russian Federation V.V. Putin to general meeting of members of the Russian Academy of Sciences]. Vestnik Rossiiskoi Akademii nauk, 89(9), 891. https/doi.org/10.31857/S0869-5873899891-891

- Shevchenko I. K., Razvadovskaya Y. V., Marchenko, A. A., & Khanina, A.V. (2017). Garmonizaciya mehanizmov strategicheskogo razvitiya nacionalnoi innovacionnoi sistemi [The harmonization of mechanisms for the strategic development of the national innovation system]. Terra Economicus, 15(1), 103-129. 1https://doi.org/0.18522/2073-6606-2017-15-1-103-129

- Silin, Ya. P., Animica, E. G., & Novicova, N. A. (2016). “Novaya normalnost” v rossiiskoi ekonomike: regionalnaya specifika [New Normal in Russian Economy: Regional Specificity]. Economica regiona, 12(3), 714-725. https://doi.org/10.17059/2016-3-9

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

21 October 2020

Article Doi

eBook ISBN

978-1-80296-089-1

Publisher

European Publisher

Volume

90

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1677

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Litvinenko, E. V. (2020). Assessment Of Pp For Innovative Development Of Construction Industry. In I. V. Kovalev, A. A. Voroshilova, G. Herwig, U. Umbetov, A. S. Budagov, & Y. Y. Bocharova (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST 2020), vol 90. European Proceedings of Social and Behavioural Sciences (pp. 317-326). European Publisher. https://doi.org/10.15405/epsbs.2020.10.03.36