Abstract

Digitization affects industries changing them and generating new ways and methods of business-customer interaction while transforming the whole economy as well. Digital transformation implies such changes which result in reform of every aspect – bank structure and services, bank-customer relations, understanding of bank and banking – conceiving future virtual digital banks. The study describes the structure of modern bank and bank services as transformed with cutting edge digital technologies. Bankers all over the world, in Russia also, are starting to recognize the implications of banking digitization while still vague as to its nature and effects. Today’s bank customers are not as loyal as before and many rate highly digital experiences in their interaction with the bank, ready to switch to those banks who can offer them going completely online. With speech and voice technologies banks can raise the levels of customer satisfaction, thus increasing customer loyalty and gaining competitive edge, they can also change the character and structure of spending on organizing bank operation and customer services transforming banking in general.

Keywords: Digitizationspeech technologiesconversational user interfacebankingmobile application

Introduction

Economy, being intrinsic to modern society, shaped and transformed by it and, in its turn, shaping and transforming it, undergoes similar changes and in its development follows similar lines to those of the society it underlies. Sky-rocketing technologies transform both the ways of society in general and the ways of living for every individual inducing changes into the whole global and national economies and individual industries. Banking, more immediately related to customer interaction and servicing, is growing ever more affected by new digital technologies and their applications.

When outlining basic transformations in methods and channels of bank-customer interaction model Dolgusheva and Poltoradneva (2016) identify a few stages based primarily on the technologies applied during a certain period. They argue the technology-based transformation in banking was launched as early as 1920s with servicing by telephone made available for bank customers. In fact, the history of banking transformation from 1900s to 2000s can be viewed as transition from the traditional model of banking which necessitated personal contact of bank customer with bank employee during visit to the bank office to the digital banking model which emerged in early 2000s based on new digital technologies (DTs) finding their way into this area. The characteristic which underlies the procedure of identifying those various models of banking and bank-customer interaction are ‘channels’ (Kearney, 2015) by which the customer can operate their bank account and make transactions, by which the customer’s identity is verified, and which transform and develop introducing novel options for remote interaction and operation.

The driver of modern technologies and their growth which is bound to radically transform both banking and other industries changing the very understanding and idea of those is systems and applications developed with innovative artificial intelligence (AI) and speech technologies (ST), in the first place.

Problem Statement

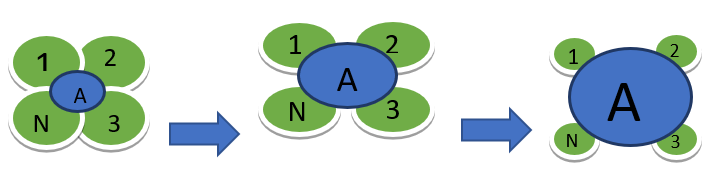

DTs and their application affected almost every aspect of bank operation – starting with switching from payments with coins and banknotes to cashless payments with bank transfers and to virtual currencies and transition from operations by the customer’s personal visit to the bank office to modern mobile applications allowing payments anytime and virtually anywhere. DTs cause transformation in structure of both individual bank and the whole banking sector. Ever increasing numbers of remote payments result in amassing payments data which, in its turn, generates fast growth and development of automation departments – these are constantly increasing their size and significance becoming the core of bank operation (Figure

DTs cause profound transformation at every level of bank operation – digitization of money and money supply, of security systems, of processing and operations with the customer and financial data. Cutting edge DTs – developments in AI and ST, machine learning, big data and block-chains – all will cause ever deeper changes in banking to affect primarily the aspect of bank-customer interaction while transforming the very idea of the bank (King, 2018).

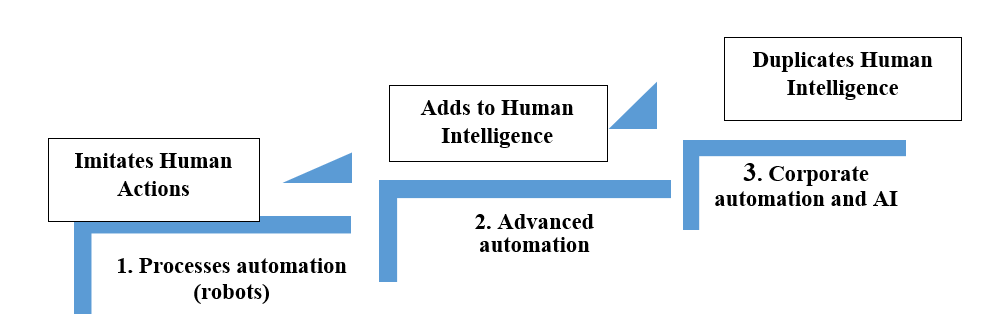

In 2019 a survey by KPMG with leading bankers and industrialists in the Russian Federation (Figure

In early 2019 63% of bankers polled said their banks have allocated an investment budget of 50 mln RUB for bank digitization specifically. It is essential that bankers emphasize the need for end-to-end transformation while at the same time admitting they lack maturity of both business processes and expertise for full-fledged digital transformation. Analysts in their evaluation of DTs application in the economy mention the lack of both vision and strategic assessment of further digital transformation.

The survey also revealed that the bankers polled consider among 8 DTs for banking digitization chat-bots, AI, Internet of Things (IOT) and Virtual Reality (VR) most promising while 72% state they believe ST-based solutions (speech recognition, video imaging, speech and voice analyses, neural networks and machine learning) to be top priority and 56% already have plans for developing chat-bots.

In North America, Europe and Eastern Asia (South Korea, China and Japan) digitization in banking is even more profound – leading banks are offering their customers AI and ST-based applications and systems in the form of user interfaces and online/mobile applications which allow most advanced digital experiences (Das, 2019).

World’s biggest banks started their application as early as 2014 with several banks offering conversational interfaces based on Alexa by Amazon and Google Assistant. Payment systems like PayPal and Venmo, banks like N26 and Royal Bank of Canada allow money transfers through user dialog with Siri by Apple.

Some banks offer mobile applications with even more features and options: tracking the history of transactions, getting information on the account details, learning exchange rates, etc. Australian Westpac Banking Corporation has launched an innovative Alexa-based Westpac Live – a joint development by the bank and Amazon.com. The bank’s spokesman says it has an option of finding the user’s account details from any Alexa-supporting device. Westpac Live also accesses the news and analytics on the bank’s official site and by analyzing them and applying the natural language processing (NLP) and ST-based procedures can consult the user on certain financial issues in course of a conversation with the interface (Westpac Live, n.d.). Also the bank in cooperation with Google has developed a mobile banking application based on Google Assistant so that users with Android devices can effect payments to other users with their voice. Apple’ Siri offers the same functionality.

The option of checking the account balance and recent account history is already added by an option allowing bank customers to make money transfers and payments with voice command. Garanti BBVA, a Turkish bank owned by Banco Bilbao Vizcaya Argentaria, has launched a Mobile Interactive Assistant (MIA) with which users can effect transfer by simply saying ‘I want to transfer money to…’ and saying the name of beneficiary. The Assistant can also answer user’s questions about the recent transactions, balance details, buy and sell foreign currencies – the Assistant analyzing currency exchange operations by the user can even notify of changes in exchange rates of the currencies the user deals in. The bank reports 63% of customers using mobile application use MIA and the rates of satisfaction are very high (MIA interface, 2020).

In Russia only PJSC Sberbank announced a joint development by Sberbank and the Center of Speech Technologies – digital assistant Helen (Yelena) in April 2019 (Sberbank launches Yelena, 2020).

AI and ST-based applications and systems are bound to contribute to radical digital transformation of bank and banking. Quite evidently, we can assume the ultimate birth of a virtual digital bank which will offer all types of remote operations based on most modern AI technological developments with 1 or 2 offices in cities, virtual bank employees (based on conversational interfaces, AI and machine learning) and widest network of various technological devices for remote operation.

Research Questions

Most scientific developments today result from synergy when several areas merge to bring about qualitatively new results and transform our lives.

How can speech recognition-based technologies be applied in banking

How banks can benefit from speech recognition-based technologies application

How banking can be transformed with digital speech technologies

Purpose of the Study

The study aims at prospecting possible digital transformation of banking with speech technologies and opportunities it can give to banks.

Research Methods

The purpose of ST, also termed speech recognition technologies, is automatic recognition and processing of speech using technologies of signal processing, feature identification, prediction and evaluating the most probable realizations, basically similar to human perception of language, and transformation into spoken or written text, which underlie the development of conversational user interfaces (CUI). CUIs, though being an innovation using sophisticated hidden Markov models, deep neural networks and dynamic time warping, provide the most simple and natural for a human being channel of communication – conversation (Gaikwad et al., 2010). CUIs can be either voice-bots (speech interfaces), or chat-bots (text interfaces transforming the speech input into text and text into speech output) (Spanias & Wu, 2018).

Reliable SR will require recognition of isolated words, connected words, continuous speech and spontaneous speech (Sharma & Kumari, 2019). The easiest to develop and hence the less expensive are the systems which operate with individual words and require thorough articulation of word commands, more sophisticated and more expensive are the systems capable of recognizing spontaneous speech. Speech analysis proceeds from processing sound into spectrum and identification of relevant spectral features for recognition and interpretation of sounds to speech prediction for evaluation of recognition accuracy (Chandra & Sunitha, 2009).

ST-based systems can cause most dramatic transformation of bank-customer interaction to increase customer satisfaction with bank service and new opportunities brought by CUIs. Analysts argue that these systems can gain the competitive edge in both national and international market.

A survey of 2019 with 1100 bank customers in US aimed to reveal the degree of their satisfaction with DTs offered by financial institutions (AI in banking, 2019). Two groups identified by the survey are the settlers who want simple and understandable interface which requires no learning and allows just a few options (8% of polled) and the explorers (86% of polled) who strive for new opportunities and experiences and are ready to switch to the bank offering such (see Figure

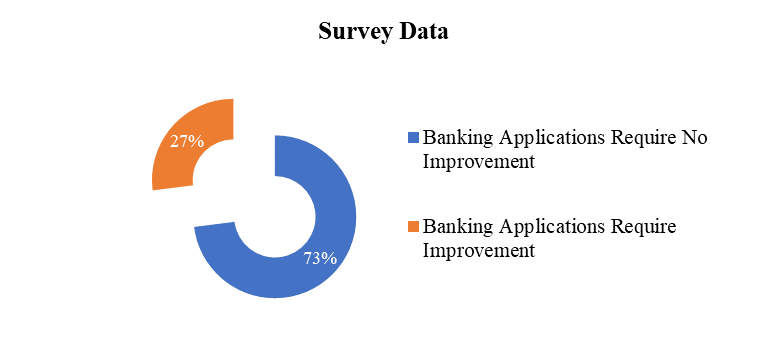

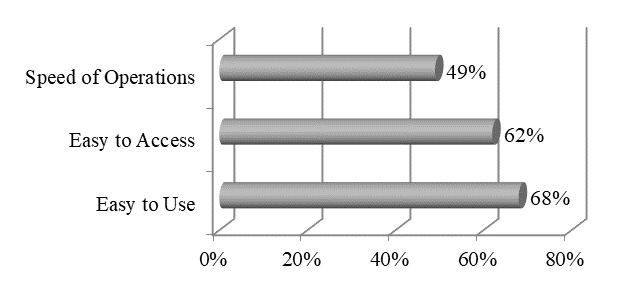

73% of customers polled said existing banking applications require improvement. They also identified the possible lines along which such improvements can be introduced: ease of use (68%); ease of access to the application and functions (62%); high speed of financial operations (49%). 76% of customers polled said they monitor financial institutions to find best experiences and best offers (Figure

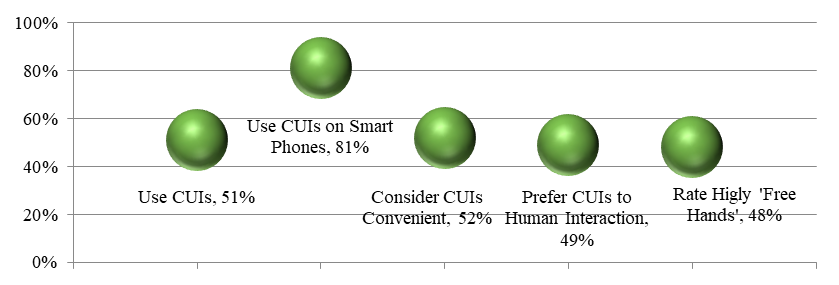

A survey by Capgemini (Figure

The above figures become even more relevant as the number of consumers who have already bought and use smart speakers has grown to 24% with the numbers to increase rapidly (the joint survey by the National Public Radio and Edison Research, USA). At the same time research data show that STs take only 2% of all AI-based technologies in finance (Banking chatbots, n.d.). In fact, of all CUIs the launch of which was announced by banks still in operation is CUI Erica by the Bank of America (Erica by BoA, n.d.).

Findings

SPs in Mobile Banking Applications

A most obvious and promising opportunity for CUIs is banking mobile applications which most leading banks already offer to their customers. Mobile and online applications today allow remote options for various financial operations – the statistics below (Table

Technologies which allow remote financial operation have already transformed banking by replacing the one-channel bank-customer interaction in traditional model – physical contact during the customer visit to the bank – first to multi-channel (telephoning, bank cards, bank terminals) and finally to digital omni-channel model with multiple channels of interaction (physical, telephoning, video-calls, bank terminals, online and mobile applications) which customer can easily switch between (Kearney, 2015). With growth of DTs and spread of smart phones ever increasing number of customers prefer financial operations via online and mobile applications which allow them banking anytime and anywhere.

Development of highly-functional CUIs in online and mobile applications will allow a breakthrough in bank-customer interaction:

Simple and natural communication with application: Using CUIs and voice recognition technologies the customer can initiate the application by voice command, or simple address, and in the course of conversation they will be able to find out account details, make payments and transfers, exchange currency while having no need for other authentication than voice recognition.

Increased functionality: As CUIs can access any information stored in both device and on the bank-developer site they can analyze financial data and analytics on the bank’s site – or wider net – and offer keeping track of where the bankcard details are used and if necessary, update or change them; informing on the changes in the customer credit rating; recommending most beneficial loyalty programs; offering refund programs and informing of refund money receipt, remind of recurring charges; keeping trace of week or month spending – all activated and done with voice while chat-bot communicates with the customer in the form of a chat (Erica by BoA, n.d.).

Data input: CUIs can become a deciding factor when used for chatting with customer on loan options: the customer can inquire of the loans, interest rates, terms and find most suitable loan; then the CUI can offer to fill in the forms online and assist in entering the necessary data by transforming the customer’s speech into written text in the form. Simplifying the procedure of filing forms will make a large number of customers switch to the banks who offer such option (Voice and speech recognition in banking, n.d.).

Personalized interface: CUI can also benefit by personalizing the customer interface in banking application – the one which will show the functions and services used by individual customer; they can also make personalized offers by analyzing the customer transactions and activities; speed up the payment process etc.

Financial consulting: CUIs are claimed to be made extremely useful for customer in optimizing consumer pattern of spending. Financial data analysis already reveals a lack of ability to control spending added by lending in ever increasing amounts and inability of saving money which appears to be typical for milennials who appear to have multiple credits and a credit card, or a few with expenses typically either equal to their income, or exceeding it (AI in banking, n.d.).

Prospects of CUIs and Voice Recognition Applications in Call-Centers and Customer Service

CUIs and voice recognition can be extremely beneficial for customer service and, in a nearer prospect, for operation of call centers:

In call centers CUIs can provide conversation with customers within the scope of FAQ, informing of required services or options, giving required details etc. while human operators can concentrate on dealing with unsatisfied, distressed, or difficult customers. A survey by Salesforce.com (USA) of 2019 gives very interesting results: companies with a CUI-based call center allow for 64% of human operators deal with difficult calls while in companies with no CUI the rate fell to 50%, which obviously affects the customer satisfaction rates (Customer service statistics by Sales Force, n.d.).

Today many banks use robot-based automated systems in call centers which make the customer follow the full of the set algorithm step by step (if you want … press …) with no option of changing the order of steps. Passing through all stages often takes quite a long time which increases load on the bank telephone line and call center operators, often customers get irritated by having to pass through all of the procedure. Besides, customers too often have to wait for an operator to answer them. CUIs will allow to change the scheme times increasing customer satisfaction, while voice recognition technology will make authentication unnecessary – the customer will be authenticated by their voice.

Digital transformation of banking has already made bank-customer interaction impersonal. This inevitably results in lost ‘sense of personal contact’ which brings lower levels of customer loyalty and readiness to switch between banks. Experts believe CUIs can at least partially solve this problem allowing customers to regain ‘personal attitudes’ (Customer service statistics by Sales Force, n.d.).

Using recent developments in NLP CUI-based systems can analyze the customer’s emotional condition – CUIs which can identify speaker’s positive or negative attitudes, even sarcasm, are already in place. CUIs can use emotion recognition in probability prediction, for instance, switch call to human operator if they perceive the customer is distressed and improve their emotional condition by human-to-human conversation.

Russian bank leaders believe that in prospect AI and CUI-based systems can allow banks to totally switch to digital methods of bank-customer interaction regarding them not only as a way to reduce and eventually restructure expenses, but to raise to a qualitatively new level of bank services, and digital transformation will completely change both interaction and attitudes (Danilina, 2019).

Another factor hampering development of CUI-based systems – apart from lack of clarity in recognizing their role in bank strategic development – seems to be high degree of sophistication and expertise required for development. Already existing CUIs are mainly developments of digital giants – Amazon, Google, Apple, Yandex – and many banks cooperate with them for development of banking CUI. Companies who specialize in the field of AI and AI-based applications also offer assistance in development, like Nuance Communications, a developer of CUI for United Services Automobile Association, or Personetics Technologies who assisted in developing a CUI for Ally Bank. Cooperation with digital and AI giants deems inevitable, for such development require expertise and experience which are beyond the scope of banking and can be extremely costly which few banks can afford.

Third party involvement in development can cause a certain degree of concern over safety and security issues related to processing highly sensitive data and over chances for unauthorized access, however, such concerns do not seem irresolvable.

In case of successful development, however, banks will enjoy significantly lower levels of expense on personnel and increase levels of incomes by raising customer satisfaction with banking experiences through simple and reliable interaction methods and by attracting new customers who want easy-to-use functionality and improved digital experiences. The banks who will be first to offer such services will take the lead. Early developers will benefit by having every chance to improve and enhance their CUIs ahead of the competition.

Conclusion

Application of CUI and ST-based systems is to induce full-scale transformation both of bank-customer interaction and the bank structure in general – the ways, means and channels of bank-customer interaction. Wider digitization with AI-based technologies, block chains and big data analysis will eventually turn the bank into a virtual entity integrated into and intrinsic to our living. Realizing that some banks have already started developing CUI-based systems for banking mobile applications and call centers, however, they account for only a tiny percentage of all AI-based developments in banking.

CUI-based ATMs, online and mobile applications will transform the banking itself providing for:

Easy and natural way of communication;

Easy and reliable identification and authentication method;

Increased functionality of applications: consulting and informing using access to financial data, statistics and analytics of individual bank and Internet search; keeping the customer accounts, analyzing incomes and spending, effecting payments and transfers with voice etc.;

Immediate and high-quality interaction with call centers.

Such digital transformation of banking will allow banks

Optimize spending on personnel, operation of call centers, customer servicing in bank offices, providing for lean channel and organization structure and increased incomes;

Improve the levels of customer satisfaction with bank services due to easy-to-use, easy-to-understand natural customer-oriented digital processes and procedures.

In modern banking where the idea of a bank is transforming from seeing a bank as ‘not where you go, but what you do’ (King, 2014), which has already become a standard, to a most recent ‘bank is everywhere but not in bank’ (King, 2018) the changes brought about by AI-based technologies in general and CUI-based technologies in particular will change banking radically and profoundly. And those banks who will fall behind may risk not only losing their customers but go out of business altogether.

References

- AI in banking (2019). In Emerj Artificial Intelligence Research. https://emerj.com/report/ai-in-banking-vendor-scorecard/

- Banking chatbots (n.d.). In Emerj Artificial Intelligence Research. https://emerj.com/ai-sector-overviews/banking-chatbots-customer-experience/

- Chandra, E., & Sunitha, C. (2009). A review on speech and speaker authentication system using voice signal feature selection and extraction. In 2009 IEEE International Advance Computing Conference. https://doi.org//10.1109/IADCC.2009.4809211

- Customer service statistics by Sales Force (n.d.). In Salesforce Resource Center Online. https://www.salesforce.com/resources/research-reports/

- Danilina, M. S. (2019). Tsyfrovaya transformatsya v rossiyskikh bankakh: innovatsyy, motivy, prioritety. [Digital transformation in Russian banks: innovations, motivation, priorities]. bankdelo.ru/expert-opinion/pub/2236 [in Rus]

- Das, P. (2019). Advent of 5g. https://www.finextra.com/blogposting/17885/advent-of-5g--can-banks-do-what-uber-did-in-4g

- Dolgusheva, A. Ya., & Poltoradneva, N. L. (2016). Tsyfrovaya model bankovskogo obsluzhivaniya [Digital model of banking services]. St. Petersburg State Polytechnical University Journal: Economics, 6 (256), 206-212. [in Russ.]

- Erica by BoA. (n.d.). Bank of America Online. https://promo.bankofamerica.com/erica/

- Gaikwad, S. K., Gwali, B. W., & Yannawar, P. (2010). A Review on Speech Recognition Technique. International Journal of Computer Applications, 10(3), 0975–8887.

- Kearney, A. T. (2015). Banking transitioning to a digital world. https://www.consultancy.uk/news/1540/at-kearney-banking-transitioning-to-a-digital-world

- King, B. (2014). Breaking Banks: The Innovators, Rogues, and Strategists Rebooting Banking [Kindle DX version]. https://www.amazon.com

- King, B. (2018). Bank 4.0: Banking everywhere, never at a bank [Kindle DX version]. https://www.amazon.com.

- MIA interface (2020). In Garanti Bank Online. https://www.bbva.com/en/efma-recognizes-garanti-banks-mobile-voice-assistant/

- Sberbank anonsiruet Yelenu [Sberbank launches Yelena]. (2020). In Habr Online. https://habr.com/ru/news/t/460293/ [in Rus]

- Sharma, M. K., & Kumari, O. (2019). Speech Recognition: A Review. Special Conference Issue: National Conference on Cloud Computing & Big Data, 228-235.

- Spanias, A. S., & Wu, F.H. (2018). Speech Coding and Speech Recognition Technologies: A Review. IEEE. International Journal of Trend in Scientific Research and Development, 86-91. https://www.ijtsrd.com/papers/

- Survey of CUIs by Gapgemini (2019). In Gapgemini Online Sources. https://www.capgemini.com/news/

- Voice and speech recognition in banking (n.d.). In Emerj Artificial Intelligence Research. https://emerj.com/ai-sector-overviews/voice-speech-recognition-banking/

- Westpac Live (n.d.). In Westpack Online. https://www.westpac.com.au/personal-banking/online-banking/ways-to-bank/voice/google-assistant/

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

21 October 2020

Article Doi

eBook ISBN

978-1-80296-089-1

Publisher

European Publisher

Volume

90

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1677

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Peshkova, G. Y., & Zlobina, O. V. (2020). Digital Transformation Of Banking With Speech Technologies. In I. V. Kovalev, A. A. Voroshilova, G. Herwig, U. Umbetov, A. S. Budagov, & Y. Y. Bocharova (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST 2020), vol 90. European Proceedings of Social and Behavioural Sciences (pp. 294-303). European Publisher. https://doi.org/10.15405/epsbs.2020.10.03.34