Abstract

The authors analyse the difference in interests of Russian machine builders and metallurgists. Machine builders generate demand for relatively small batches of rolled metal of a certain section, which meet rather stringent requirements for surface microgeometry and its quality. On the other hand, it is beneficial for metallurgists to work to foreign market and sell large batches, which ensures the maximum percentage of profit. The authors also analyse the development of the metallurgical industry in Germany, China, Japan and the United States and show that in these countries the state has a strong regulatory impact. Its goal is to moderate the actions of the business to work with an eye to the future and for the benefit of the whole nation, in particular, to effectively use fairly limited resources. The issues under consideration are directly related to the task of increasing GDP, which is constantly voiced by the Russian leadership. This task becomes possible in case of stimulating domestic producer of high value-added products. For this, it is necessary to coordinate the actions of metallurgists with the end consumers of their products, effectively use the potential of industry science and create advantages for the sale of metal products in the domestic Russian market. In addition, the quality and the assortment of metal products should be improved.

Keywords: Machine buildingstate regulationmetal rollingexport of metal productsquality

Introduction

An urgent task for Russian machine builders remains to increase the output of metal-intensive products in the form of machinery and equipment, which is possible, in particular, if relatively inexpensive and high-quality metal products are available. In particular, it is forecasted (Eremin, 2018) that the demand for special engineering in metal products will increase by 43% from 2020 to 2030, and the share of domestic products in the Russian market of special engineering should increase to 72%. The growth in the production of special equipment, for example, high-capacity truck cranes (Zelensky, 2018), increases demand for high-quality high-strength steels. This is happening against the background of stagnation in construction according to the results of 2018 (Sentyurin, 2018).

Problem Statement

It is known that there are certain problems in the interaction of Russian machine builders and metallurgists. The main contradiction is that it is profitable for metallurgists to work for export and sell large batches that give maximum profit. So, in 2018, the first three places in the structure of Russian metal products export are occupied by semi-finished products from iron or non-alloy steel (30.4%), hot-rolled and forged steel from non-alloy steel (23.4%) and cast iron (8.2 %). It is indicated that it is profitable for metallurgists to produce and sell the maximum amount of metal with a minimum number of readjustments (Ocheretov, 2018). The export orientation of Russian metallurgy is emphasized by the fact that steel production in Russia in 2018 amounted to 4% of the global volume, and export - already to 7% (Sentyurin, 2018).

Research Questions

The products of the metallurgical industry of Russia are undoubtedly in demand on the domestic and world markets. This is reflected, in particular, in the fact that the profitability of metallurgy is two times faster than the same indicator of machine building, and three times higher than the level of salaries (Babkin, 2018). At the same time, starting in 2015, the number of measures restricting the steel export of Russia is growing (Sentyurin, 2018). Now there are about fifty of them. It is possible that restrictive measures will lead to a significant reduction in the export of metal products, and domestic consumption will not be able to raise demand to a level that will maintain the previous level of profitability in the industry (Gavrikova, 2016).

Purpose of the Study

It is significant that the prices for rolled metal in Russia are 18…30% higher than the prices for the same products for export due to the payment of indirect taxes. It turns out that the state stimulates the export of metal products, which, of course, is the logic, but at the same time, manufacturers using metal products within Russia find themselves in a less convenient position than their foreign competitors, which hardly meets the goals of stimulating the production of machinery, equipment and development of the domestic market (Tyurin, 2019). Protecting the interests of Russian metallurgists with quotas for the import of metal products often contradicts the needs of Russian machine builders. Thus, the introduction of quotas for the supply of hot-rolled steel leads, ultimately, to an increase in prices and a decrease in the competitiveness of truck cranes (Babkin, 2019).

Large metallurgical companies were one of the main lobbyists for Russia's accession to the WTO, and during the crisis of 2008, many of them received multibillion-dollar assistance in the form of loans from the state. However, these companies often do not consider it necessary to meet the wishes of machine builders.

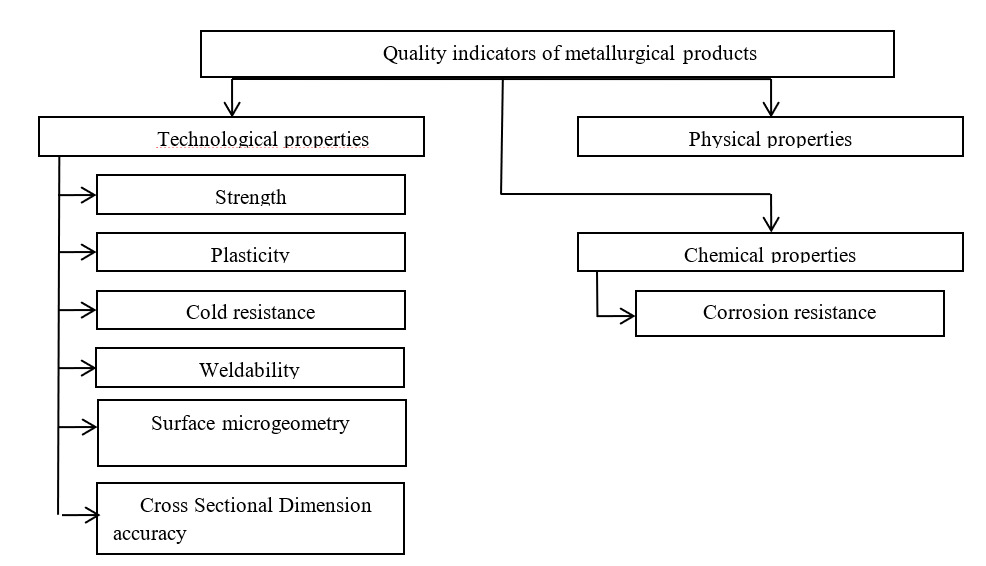

On the other hand, machine-building production workers need small batches of rolled products of the required section, those which the necessary requirements for the geometry of the surface and its quality (Fig. 1). As you know, the quality of work of enterprise units, in this case metallurgical, is assessed by the yield of defective products, nonconforming products and suitable products (Salganik et al., 2013). It can be noted that both the quality of products and the work of enterprises as a whole suit a foreign consumer, but not always a Russian consumer.

So, “RPRZ Ltd”., which produces parts for Rostselmash agricultural machinery, for manufacturers of automotive components and household appliances (Ocheretov, 2018), uses over a thousand types of different rolled products and 99% of the demand is covered by Russian metallurgists.

Research Methods

Machine builders point out certain problems with the products of the Russian metallurgical industry, expressing claims on (Babkin, 2018):

Quality:

non- compliance with consumer requirements and a high proportion of defects. Quite often (Babkin, 2019; Ocheretov, 2018) - non-compliance with geometric dimensions (thickness, diameter), flatness tolerances, poor surface quality of flat products (rolled mill scale, delaminations, films), non-compliance with the level of residual internal stress in the metal, delamination of the zinc coating (Ocheretov, 2018);

obsolescence of the state standards (GOST) (Babkin, 2019), discrepancies in their provisions and requests of machine builders. For example, GOST 19903-74 states that for sheet metal with a side of 4000 mm, deviations in flatness of up to 40 mm are permissible. The same GOST allows surface defects, such as risks, dents with a depth of up to 10% of the thickness of the rental. As a result, the quality that is regulated by GOST 19903-74 does not suit tractor manufacturers at all (Ocheretov, 2018) in the manufacture of load-bearing components - cabs, frames;

Deliveries:

limited assortment and lack of certain types of rental. For example, the company RPRZ LLC (Ocheretov, 2018), due to the lack of corresponding Russian production, buys abroad pipes with a complex contour for agricultural machinery cabins, hot-rolled sheet metal with high surface quality for the manufacture of machine front parts, sheet metal for the production of aluminum-silicon fuel tanks coated and much more;

unfavorable conditions for placing and fulfilling orders (Ocheretov, 2018). Quite often, after placing an order, a significant period of time takes 2.5-3 months to receive the finished product (Ocheretov, 2018);

inconvenient serialization and delivery conditions. Mounting is the minimum batch of rolled metal that metallurgists agree to produce (Ocheretov, 2018) and far from always the size of this batch is convenient for machine builders;

Price:

high price in the domestic market.

Findings

Quite interesting are the counter-arguments of representatives of the metallurgical industry, indicating the reasons for the current state of things (Babkin, 2019):

a small volume of the domestic Russian market both in absolute terms and in relation to the global one;

unprofitable investments in the development of relevant industries and products. At the same time, they are often guided by the EBITDA index (Ocheretov, 2018), which shows how profitable the company's activities are. Thus, taking into account the interests of Russian machine builders can lead to a decrease in this index and a decrease in the investment attractiveness of this company;

difficulties in the development of small and medium-sized businesses. Indeed, it would be logical to assume that the relatively small demands of consumers of metal products could satisfy companies commensurate in scale. However, here the business is faced with problems specific to Russian industrial enterprises: the high price of loans, as well as the lack of qualified labor force that can effectively work on equipment of a new level (Gavrikova, 2016).

Positive dynamics in this direction is possible under the following conditions (Alin, 2018):

improving the business climate;

state support for industrial enterprises;

implementation of new large industrial infrastructure projects;

coordination of metallurgists with Russian suppliers and developers of equipment, with industry science, as well as with end users of their products, including providing friendly terms of delivery;

creation of advantages for the sale of metal products in the domestic market in comparison with exports;

improving the quality and expanding the range of metal products;

the emergence of the opportunity to purchase metal products in batches of convenient size.

It can be noted that in the metallurgical industry as a whole, and in the aspect of taking into account the needs of machine builders, there is a movement in the right direction.

So, in the period after 2000, a fairly large-scale modernization was carried out in the metallurgical industry, while the amount of invested funds reached 1.6 trillion. rub. by 2013 (Novikov, 2013) and 2.4 trillion. rub. by 2018, this allowed to reduce depreciation of fixed assets from 53.5% in 2000 to 42% in 2015 (Sentyurin, 2018). As a result, Russian metallurgists got the opportunity to produce, in particular, pipe products, in quality that meets all international standards. For example, Vyksa Steel Works is launching two new pipe manufacturing workshops (Alin, 2018). In addition, steel consumption per ton of finished steel for the period 2000-2018. decreased by 15.3%, and labor productivity increased 2.9 times (Sentyurin, 2018).

National Technical Committee for Standardization TC 375 "Metal Products from Ferrous Metals and Alloys", with a secretariat operating on the basis of TSSM FSUE TsNIIchermet named after I.P. Bardina” work is underway to update the regulatory framework (Eremin, 2018). For the period 2015-2019 27 standards governing the quality of metal products were revised and, in the fall of 2019, about a dozen standards were in operation.

At the same time, the tasks are set to increase the competitiveness of metal products and the modernization of the metallurgical complex on the basis of evidence-based regulation.

There is another positive example of the joint work of machine builders and metallurgists (specialists, respectively, Rostselmash and Severstal) in the direction of bringing the quality of flat products to the required level (Ocheretov, 2018). To solve this problem, a standard with more stringent requirements for flatness and surface quality of rolled products (metal S355J2) was specially developed, and a special straightening machine was purchased.

When considering aspects of the development of metallurgy in Russia, it is very indicative of the situation with the development of this industry in other developed countries.

The rapid industrial development of Germany in the mid-end of the XIX century is inextricably linked with the production of steel and products from it, primarily weapons, as well as rails and axles for railways, at the enterprises of the Krupp family. At present, the national raw material base is rather depleted and metallurgical plants operate on imported raw materials, which affects the fact that new ferrous and non-ferrous metallurgy enterprises are built on the coast (Metallurgy of Germany, 2016). In Germany, there are many centers of steelmaking metallurgy and rolling plants, the products of which are in demand by the highly developed engineering industry.

In the second half of the 20th century and the beginning of the 21st century, US metallurgy most directly experienced several different trends (Metallurgy USA, 2014):

the growing influence of financially speculative capital - the transfer of a significant part of "dirty industries" to developing countries, as well as a decrease in the material consumption of production;

gradual depletion of American deposits;

focus on the production of high-quality steels and, at the same time, the growth of imports of lower-quality metal from other countries.

The production of ferrous metals and iron ore has been steadily declining since the 1970s, and primary aluminum since the 1980s. The situation with refined copper is less negative, however, one can talk about stagnation there (the peak of production was in 2000).

The metallurgy of Japan is an exemplary example of how to achieve success due to large volumes of investments, continuous introduction of innovations and progressive technological processes (Ferrous metallurgy of Japan, 2014). This is carried out against the background of the practical lack of its own raw material base and is aimed at energy and resource conservation. Steel in Japan is smelted only by oxygen-converter (2/3) and electric steel (1/3 ways). Until the mid-1990s Japan was the largest exporter of steel. The volume of production in this industry has remained at a nearly constant level since 1973. The main international specialization of Japan in the field of metallurgy is the production of rolled steel for the manufacture of ships (The history and modernity of metallurgy in Japan, 2011) and other high-quality steel, for example, stainless steel sheet steels.

Using the example of China's metallurgy, one can show how the regulatory function of the state moderates the actions of business so that it functions with an eye to the future and for the good of the whole nation.

What happened in this industry during the “Great Leap Forward” (1958-1963) is well known, it is only necessary to add that such a policy, among other things, led (Metallurgical industry in China, 2009) to severe wear equipment. Deng Xiaoping's new policy was much more thoughtful and, as a result, by the mid-1990s. China has become a world leader in steel production. From that moment, the government actually began to restrain production growth too fast in order to prevent overproduction and a collapse of the market, as well as an overspending, in general, of rather limited resources. Nevertheless, steel production in China is gradually growing and most of it is in demand within this country, and about 1/10 of it is exported. The state supports the reconstruction of enterprises, the introduction of resource-saving technologies, the concentration of production to increase its efficiency. A policy is being implemented, which includes (Metallurgical industry in China, 2011):

import of inexpensive semi-finished products;

stimulation of the production of high-grade steel to supply domestic production;

containment of the export of cheap steel (billets, slabs);

export of expensive and high-quality steel of high value added with high added value.

Conclusion

Thus, in order for metallurgy to work in the interests of the entire national economy, it is quite often necessary for the state to have regulatory impact on this industrial sector to focus it not on the rapid achievement of maximum profit, but on multi-vector development, including taking into account the interests and demands of the domestic producer. For Japan, the USA, and China, the most appropriate strategy is to save, to one degree or another, limited resources. For Russia, the task of saving resources is less relevant, although, of course, it should be taken into account as one of the principles of the modern economy. A more important task is to increase GDP, which requires promotion of the domestic high value-added products producer. It should be implemented as part of public policy and manifested in:

tax benefits and affordable targeted loans;

construction of the necessary engineering infrastructure and development of territories, if necessary, at the opening of new metallurgical industries, the products of which are in demand by Russian machine builders;

promoting cooperation between machine builders and applied science;

stimulating the export of products of Russian machine-building enterprises.

References

- Alin, A. (2018). The Russian CCI supports a constructive dialogue between metallurgists and machine builders. https://tpprf.ru/en/interaction/committee/kpr/meetings/tpp-rossii-podderzhivaet-konstruktivnyy-dialog-metallurgov-i-mashinostroiteley/

- Babkin, K. A. (2018). Metallurgy and mechanical engineering: how to strengthen cooperation? http://tpprf.ru/download.php?GET=gqKxZ3dCFZVcEByCMmIyUWAHAMdGwM%2FKpP5EMC50ppVhYWFhYWFhYWFhYWFhYWFhCsRWTOxM

- Babkin, K. A. (2019). The cooperation of machine builders and metallurgical enterprises a year later. http://tpprf.ru/download.php?GET=9elPkECUIrET%2FetEjj4cUYtpP6pArBt4LuuD%2FfSwocdhYWFhYWFhYWFhYWFhYWFhC8hVTOhJ

- Eremin, G. N. (2018). Metallurgy of Russia: current problems of production growth and sales. http://tpprf.ru/download.php?GET=%2FxMZ5dE8h4iiaoDHdaaVr70wcQpHVAdPvdcN0t6wToVhYWFhYWFhYWFhYWFhYWFhC8hVTOhK

- Ferrous metallurgy of Japan. (2014). https://compendium.su/geographic/world_1/73.html

- Gavrikova, E. (2016). Experts at the RF CCI discussed the problems of protecting small businesses from monopoly metal producers. https://tpprf.ru/en/news/144258/

- Metallurgical industry in China (2009). Part II Metallurgy of China. https://www.metalika.ua/articles/metallurgicheskoe-proizvodstvo-kitaya-chast-ii-metallurgiya-kitaya.html

- Metallurgical industry in China (2011). Part III. Plans and forecasts. https://www.metalika.ua/articles/metallurgicheskoe-proizvodstvo-kitaya-chast-iii-plany-i-prognozy.html

- Metallurgy of Germany (2016). https://metallplace.ru/about/stati-o-chernoy-metalurgii/metallurgiya-germanii/

- Metallurgy USA. (2014). https://helpiks.org/3-35710.html

- Novikov, S. V. (2013). Ferrous metallurgy of Russia: “white” innovations and quality. Standards and products. International Student Scientific Bulletin, 3-1, 137-137a., Quality, 3, 100-101.

- Ocheretov, A. (2018). Production of parts for agricultural machinery Rostselmash, stamped parts for manufacturers of automotive components using laser cutting. http://tpprf.ru/download.php?GET=laDtVq5xqipZAuCCAn5htMQQG9ru5JO26PGpOFnQw1FhYWFhYWFhYWFhYWFhYWFhC8hVTOhM

- Salganik, V. M., Poletskov, P. P., & Gushchina, M. S. (2013). Development of methodological indicators for an integrated assessment of the overall level of technology performance and product quality of the metallurgical industry. Theory and Technology of Metallurgical Production, 1, 73-75.

- Sentyurin, A. V. (2018). About the current situation and the main trends in the iron and steel industry of Russia. Steel, 4, 61-63.

- The history and modernity of metallurgy in Japan. (2011). https://world-japan.livejournal.com/56925.html

- Tyurin, A. V. (2019). The RF CCI sought a compromise between the interests of metallurgists and machine builders. Retrieved from: https://tpprf.ru/en/interaction/committee/kpr/meetings/v-tpp-rf-iskali-kompromiss-mezhdu-interesami-metallurgov-i-mashinostroiteley-/

- Zelensky, O. K. (2018). Increasing the applicability of high-strength steels in construction and road engineering. http://tpprf.ru/download.php?GET=geSeUDGFg97TwX0g5fnnvpDqjr6VNHYq3-BaitWmvGCJhYWFhYWFhYWFhYWFhYWFhCsRWTOxO

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 October 2020

Article Doi

eBook ISBN

978-1-80296-089-1

Publisher

European Publisher

Volume

90

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1677

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Rudyuk, M. Y., Kulikova, S. G., Gerasimova, A. V., & Antropova, A. V. (2020). Issues Of Providing Russian Machine-Builders With Metal-Rolling. In I. V. Kovalev, A. A. Voroshilova, G. Herwig, U. Umbetov, A. S. Budagov, & Y. Y. Bocharova (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST 2020), vol 90. European Proceedings of Social and Behavioural Sciences (pp. 218-225). European Publisher. https://doi.org/10.15405/epsbs.2020.10.03.26