Abstract

The article is devoted to determining the place and role of one of the Russian Federation major million-plus cities in the country general development. The object of the study is Samara city district of the Samara region. Researchers focus on region’s locomotive industries, which provide competitive advantages both of the city and of the Samara region as a whole. During the Samara social and economic development analysis, a sociological study was carried out, the purpose of which was to objectively assess the conditions of doing business and then diagnose the current entrepreneurial climate problems. Based on the comparison of statistical indicators for a number of Russian million cities transformation key areas of, the leading positions of the object under study were revealed. Additional indicators were used to confirm the relative objectivity of the business environment: assessment of the business development and investment activity economic entities success. The Samara’s entrepreneurial climate state dynamics is also characterized by the enterprises investment activity. It has been revealed that the following factors significantly limit the activities of entrepreneurs: high administrative barriers, lack of effective state support, difficulty with access to credit resources.

Keywords: Urban environmentratinganalysiscompetitive advantagessocioeconomic development

Introduction

The socioeconomic aspect's analysis of modern cities' transformation is an urgent topic of scientific research. High demographic indicators (high employment, higher fertility, etc.), developed socioeconomic environment, infrastructure of modern city entail formation of qualitatively new modern territory, development of which is possible through investments in production, services and infrastructure (Murzin, 2017).

In 2018, Samara accounted for:

36.4 % of the population;

35.9 % of human resources;

35.9 % occupied in economy;

20 % of the shipped products of industrial production;

71.4 % occupied at small enterprises from the general employment in small business;

62.5 % of a turnover of small enterprises;

14.2 % of budget revenues;

less than 8.2 % of own budget revenues.

29.4 % of investments into fixed capital.

The article authors carry out an in-depth analysis of the main competitive advantages of the Samara city district of the Samara region. The formed rating system allows identifying key parameters for creating a favorable investment climate in the city.

Problem Statement

Modern million-plus cities demonstrate high rates of development, developed infrastructure, and social protection of the population. An urgent task for any city (country) is to identify its strengths and competitive advantages (Fattakhov et al., 2019).

According to statistics for 2018, the topics of economic growth in the Samara city district are slowing down, while the overall rating indicates the leading positions in a number of industries. The identification of additional resources in key areas of the Samara region economy is a determining direction in the framework of the investment projects development, improving the business environment.

Research Questions

Samara is the city of significant scientific and production potential, developed infrastructure of innovation activity (Ivanenko & Taseev, 2017), personnel high professional level (Fursov et al., 2018).

In the course of the study, the following tasks were solved. Analysis of socioeconomic indicators of the city. Samara is the key industrial city district in the region (the volume of shipped products, works and services by industrial enterprises of the Samara city district in the total shipment volume of the Samara region excluding small business is 19.3%) (Acri, 2018).

Determination of rating positions of the Samara city among the largest Russian cities' of over one million. Samara in 2016-2018 occupies the first places in the aggregate rating of the Samara region city districts, which is explained by the above-mentioned high base – socioeconomic indicators of this municipality are either at the average level or exceed it (Vladimirova, 2019). The sociological study was carried out to objectively assess the conditions of doing business and then diagnose the current entrepreneurial climate problems (Grebenkin, 2020).

Purpose of the Study

The aim of the study is a comprehensive analysis of the socio-economic aspects affecting the transformation of Samara in modern conditions from the point of view of identifying competitive advantages and a favorable investment climate (Kislitsyna et al., 2017). Comparative analysis is carried out by authors on demographic indicators, social, economic data, as well as the level of development of urban infrastructure.

Research Methods

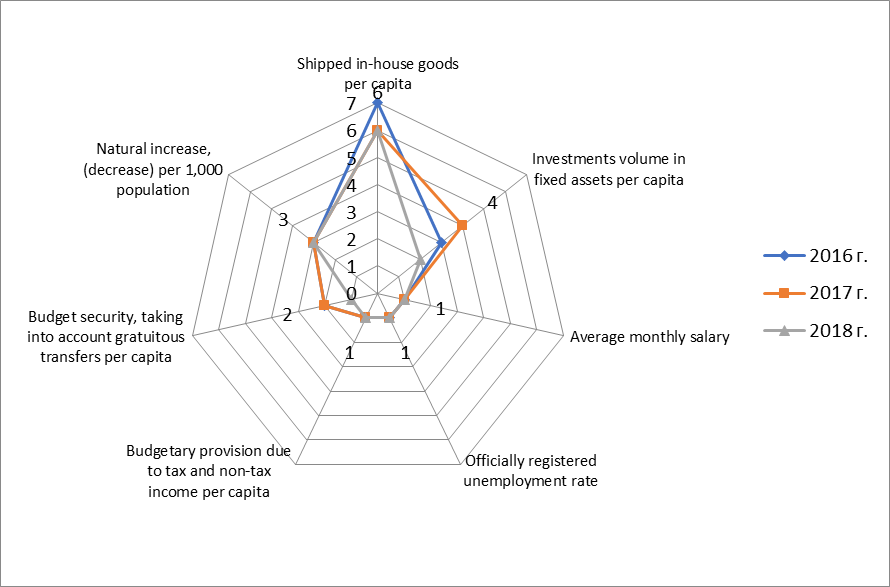

The authors analyze the Samara city socioeconomic development from the point of favorable investment climate view. To identify the Samara competitive advantages, the rating method was used (gradually comparing the similar indicators of the Russian largest cities with a population of more than a million) (figure

Findings

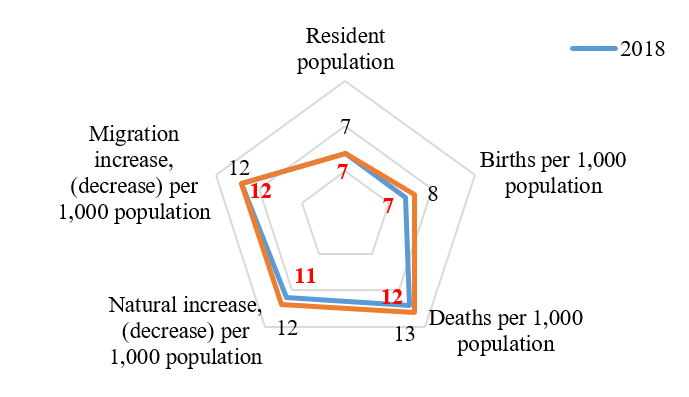

Samara is on the Russian Federation largest cities' list, which has powerful internal resources, developed infrastructure and high socio-economic development key indicators (Kosareva & Polidi, 2017). The main indicators characterizing the demographic situation are presented in figure

In 2017 - 2018, Samara ranked 7 in terms of "Resident population", the second in terms of "Migration increase" among Russian cities' of over one million (3.6 per 1000). The first place in this indicator for the same period of time was held by the Omsk city with a figure of 5 per 100 people. The “natural population movement” was 2.2 per 1000 inhabitants (Volgograd and Nizhny Novgorod are ahead of Samara in this indicator).

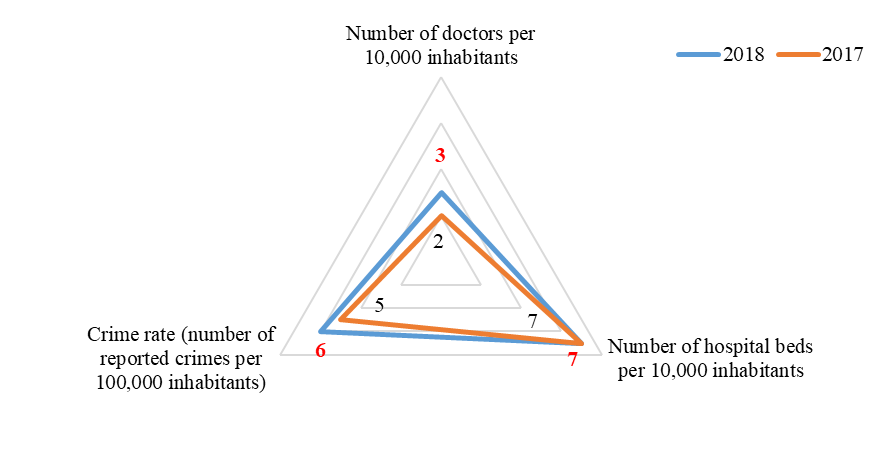

Next, consider Samara 's rating positions on social indicators (figure

In 2018, Samara took third place thanks to the indicator “Number of doctors per 10,000 inhabitants” (80.8 units), which characterizes the high social population protection. The first two places were taken by Voronezh (85.4 units) and Ufa (81.9 units), respectively.

In terms of the number of hospital beds per 10 thousand inhabitants, Samara is in 7th place with a value of 113.5 units (separation from the first place - Yekaterinburg - is 17.9 hospital beds per 10 thousand people).

The indicator “Number of reported crimes” is also high (1,507 units per 100,000 inhabitants); Samara took the 6th place in terms of crime in 2018.

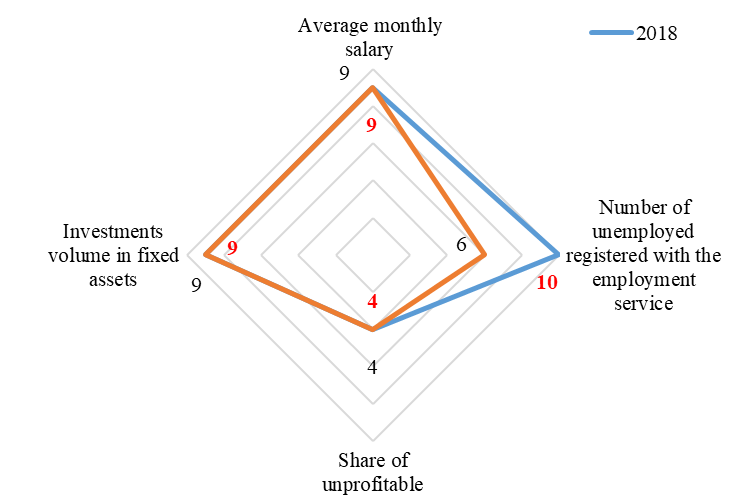

The Samara city ranking positions for key indicators on economic sphere are presented in figure

In the framework of identifying the competitive advantages of the city of Samara, an important indicator is “Investments in fixed assets”. Here, Samara took the 9th place in 2018, and the Kazan city became the leader in this indicator, where indicators are more than 1.5 times higher.

For two years Samara has not changed its position in terms of the “Share of unprofitable organizations” in the overall rating of the largest cities in Russia. Retaining the 4th place with a value of 2.8 %. The first place in this indicator belongs to Yekaterinburg (15.6 %), the last to Volgograd (34.8 %).

In terms of average monthly wages, Samara took 9th place in 2018 among the largest cities in Russia. Krasnoyarsk was the leader in this indicator.

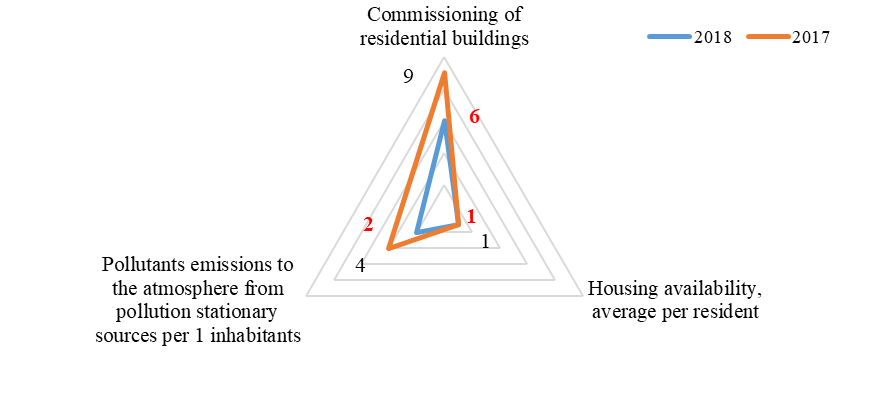

The results of the analysis of the urban level of development of Samara are presented in figure

In 2018, Samara took the 1 place in terms of the indicator "Housing availability on average per resident" (28.9 square meters), followed by the city of Voronezh (27.8 square meters). It is worth noting the positive increase in the indicator "Commissioning of residential buildings", an increase of 10 positions ensured the 6th place in the rating in Russia (744 thousand sq. m.), for example, 1104.8 thousand square meters - 3 place - were put into effect in Voronezh.

During the period under review, an improvement in the environmental situation of the city of Samara is noted, which is evident from the rating (Hkilchenko et al., 2020). The volume of pollutant emissions into the atmosphere from stationary sources of pollution amounted to 20.1 thousand tons, while in Omsk this indicator was fixed at 202.2 thousand tons (lower bound in rating). Summary rating positions in key areas of development are presented in figure

In 2018, Samara took 7th place in terms of industrial production. This was facilitated by high budgetary security and investment attractiveness of the industry.

At the same time, the structure of economic activity is dominated by wholesale and retail trade, repair of motor vehicles (36.1%); construction (12.2%), scientific and technical activities (8.4%).

The analysis confirms the leading position of the Samara city district in key indicators of socio-economic development (Repina et al., 2019): average monthly wage, officially registered unemployment rate, level of budgetary provision due to tax and non-tax income per capita (Repina et al., 2019).

Conclusion

Samara is the administrative center of the Samara region. According to statistics for 2018, the Samara city district makes the greatest contribution to the region-wide indicators of small business turnover and employment (Kuklin & Korobkov, 2018).

During the Samara social and economic development analysis, a sociological study was carried out, the purpose of which was to objectively assess the conditions of doing business and then diagnose the current entrepreneurial climate problems.

The key for this study was a direct question to respondents - "How do you assess the dynamics of the state of the entrepreneurial climate in the city over the last 2-3 years"? The vast majority of respondents surveyed - two thirds - expressed negative estimates about the state of the entrepreneurial climate (66.4 %). A quarter of respondents (25.1 %) said that the city did not experience special changes in the business climate. Only 8.5 % of respondents expressed the opinion that the conditions of doing business in the city have improved.

This trend correlates with the negative all-Russian trend - the share of companies that speak about the deterioration of the business climate and a sharp decrease in the share of companies whose opinion the state of the business environment in the Russian Federation has improved in recent years is growing significantly.

In the case of assessing the state of their business, the survey participants gave more optimistic answers than in the case of assessing the business climate. More than half (63.0 %) of respondents rated the development of their business over the last year as "average." The share of those who noted the negative dynamics of success of business development is significant - almost a third (30.3 %). Entrepreneurs who "successfully" estimate the development of their business over the last 2-3 years, turned out to be slightly less than a percent of respondents (0.8 %), "very successfully" the development of their business was not assessed by anyone. This situation confirms the previously mentioned thesis that there was no real improvement in the business conditions in the city during the period under review, on the contrary, the comfort of the business environment has significantly decreased.

There is a positive significant correlation at a fairly high level between investment estimates in recent years and investment planning in the coming years.

More than two thirds of enterprises (70.3 %) have not invested in recent years, just over half of them and do not plan investment investments in subsequent years (53.4 %). 45 % of enterprises indicated their intentions as "investments are planned, but not in significant volumes".

More than half of the respondents negatively assess the prospects of new "players" wishing to start working in the city. The vast majority of respondents surveyed (68.9 %) indicated significant difficulties in organizing business on the city territory.

This is partly due to lack of own financial resources, excessive taxes, lack of existing infrastructure necessary for business and administrative barriers. The lack of the necessary infrastructure significantly increases the costs to the business, all other things being equal, reduces the profitability of production and, ultimately, reduces the competitiveness of enterprises.

More than half of respondents (53.4 %) noted that the minimum value of start-up capital should be up to 500 thousand rubles to start own business in the city. Just over a quarter (28.8 %) of respondents believe that money in the amount of 501 thousand rubles to 1 million rubles is necessary.

The size of the start-up capital is directly determined by the scale and type of economic activity of the respondents participating in the survey. Given that a large majority of respondents are micro and small enterprises, such results are quite natural. About half of the entrepreneurs surveyed (53.6 %) used borrowed funds when opening a business, and their share in the start-up capital reached 50 %. At the same time, respondents noted an average assessment of the availability of financial resources for starting a business, which presented a number of difficulties. Difficulties in obtaining credit resources were described as the most acute problem for business by more than a third of all participants in the survey conducted by the Support of Russia at the end of 2016. Answers to the question at which credit rate companies can borrow in rubles with collateral (about 15 %) confirm - the availability of loans has decreased. About 60% of small business entities noted that the rate for their companies exceeds 15 %.

During the survey, respondents specified how long it takes to establish a new company in the city from the moment of submission of documents for state registration to the receipt of all documents necessary to start activities. This is one of the key indicators of the state of the entrepreneurial climate. It should be noted that the term of the procedure for creating a new company is determined by the specifics of its economic (production) activity. If the activity of the company involves obtaining a license, issuing permit documents in construction (takes on average 40 days), obtaining municipal premises for rent (takes on average 35 days), the term of creation of the new company is significantly extended. The presence in the structure of respondents of a large proportion of enterprises whose activities are related to obtaining a license and other permit documents has significantly increased the duration of the procedure for creating a new company in the city - up to 40-90 days.

At the same time, the share of companies (32.2 %) that spent up to 19 days on registration is quite large. Within the framework of the National Rating of the State of the Investment Climate in the Constituent Entities of the Russian Federation, a similar value was about just over 12 days.

The key factors in the business opening procedure are the timing and financial costs when connecting to engineering infrastructure systems. The survey found that respondents did not connect to engineering infrastructure on their own, and in those rare cases where this happened, there were no significant difficulties.

Acknowledgments

The authors express gratitude to the Department of Economic Development, Investment and Trade of the Samara city district Administration. The article was prepared within the framework of municipal contract № 913 for the research works "The investment passport creation of the Samara city district's" performance (September 16, 2019).

References

- Acri, E. P. (2018). Analiz sostoyaniya zhilishchnoj politiki v Samarskoj oblasti [Analysis of the status of housing policy in the samara region]. In Innovative strategies for development of management in construction and urban economy (pp. 130-138). Samara: Samara State Technical University. [in Rus].

- Fattakhov, R. V., Nizamutdinov, М. М., & Oreshnikov, V. V. (2019). Ocenka ustojchivosti social'no-ekonomicheskogo razvitiya regionov Rossii [Assessment of the Sustainabilityof the Socioeconomic Developmentof the Regions in Russia]. The world of new economy, 13(2), 97-110. [in Rus]

- Fursov, V., Krivokora, E. & Strielkowski W. (2018). Regional'nye aspekty ocenki trudovogo potenciala v sovremennoj Rossii [Regional aspects of labor potential assessment in modern Russia]. Terra Economicus, 16(4), 95-115. https://doi.org/10.23683/2073-6606-2018-16-4-95-115

- Grebenkin, I. V. (2020). Tendencii izmeneniya promyshlennoj specializacii i dinamika razvitiya rossijskih regionov [Trends in industrial specialization and development dynamics in the russian regions]. Economy of region, 16(1), 69-83. https://doi.org/10.17059/2020-1-6

- Hkilchenko, N. V., Atamanova, E. A., & Slavikovskaya, Yu. О. (2020). Diagnostika ekologo-social'nyh ugroz razvitiya territorii [Diagnostics of environmental and social threats to the territory’s development]. Economy of region, 16(1), 43-58. https://doi.org/10.17059/2020-1-4

- Ivanenko, L. V., & Taseev, V. B. (2017). Upravlenie innovacionnym razvitiem krupnogo goroda [Management of innovative development of the big city]. Bulletin USPTU. Science, education, economy. Series economy, 2(20), 107-113. [in Rus].

- Kislitsyna, V. V., Cheglakova, L. S., Karaulov, V. M., & Chikisheva, A. N. (2017). Formirovanie kompleksnogo podhoda k ocenke social'no-ekonomicheskogo razvitiya regionov [Formation of the Integrated Approach to the Assessment of the Socioeconomic Development of Regions]. Economy of region, 13(2), 369-380. https://doi.org/10.17059/2017-2-4

- Kosareva, N., & Polidi, T. (2017). Assessment of gross urban product in Russian cities and its contribution to Russian GDP in 2000–2015. Russian Journal of Economics, 3(3), 263-279. https://doi.org/10.1016/j.ruje.2017.09.003

- Kuklin, A. A., & Korobkov, I. V. (2018). Vybor effektivnoj traektorii social'no-ekonomicheskogo razvitiya regiona [Selection of an Effective Trajectory of Regional Socioeconomic Development]. Economy of region, 14(4), 1145-1155. https://doi.org/10.17059/2018–4–7

- Kuznecov, S. V., Rastova, Yu. I., & Rastov, M. A. (2017). Rejting kak mera ocenki kachestva zhizni v rossijskih regionah [Rating Evaluation of the Quality of Life in Russian Regions]. Economy of region, 13(1), 137–146. https://doi.org/10.17059/2017–1–13

- Murzin, A. D. (2017). Social'nye faktory razvitiya monogorodov [Social factors of monotown development]. Bulletin of Kemerovo State University. Series: Political, Sociological and Economic sciences, 4, 11-17. https://doi.org/10.21603/2500-3372

- Repina E. G., Guseva, M. S., & Polyanskova N. V. (2019). Integral'naya statisticheskaya ocenka urovnya social'no-ekonomicheskogo razvitiya municipal'nyh rajonov Samarskoj oblasti [Integral statistical assessment of the level of socioeconomic development of municipal districts of the Samara region]. Science of the xxi century: actual directions of development, 1-2, 148-154. [in Rus]

- Repina E. G., Polyanskova N. V., & Belyaeva G. I. (2019). Social and economic development of Russian municipalities study based on statistical estimates of the life quality. In Paper Materials of the 1st China and CIS Countries Scientific Readings “Urbanization Level, Rural Labor Transfer and Economic Growth in the XXI-st Century: Economic Models, New Technologies, Management & Marketing Practices and Mutual Collaboration” Dedicated to the 60th anniversary of professor Galina V. Astratova and the 20th anniversary of her scientific school "Theory, methodology and practice of marketing and marketing research". Lanzhou University of Finance and Economics School of Business Administration; Ekaterinburg Academy of Contemporary Art. https://www.elibrary.ru/item.asp?id=41825651

- Vladimirova, I. S. (2019). Statisticheskaya ocenka investicionnoj privlekatel'nosti regionov privolzhskogo federal'nogo okruga s uchetom faktorov riska i potenciala [Statistical assessment of investment attractiveness of regions of Volga federal district taking into account risk factors and potential]. Sustainability management, 2(21), 13-19. [in Rus].

- Wilson, T. (2016). Visualising the demographic factors which shape population age structure. Demographic Research, 35, 867-890. https://doi.org/10.4054/DemRes.2016.35.29

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

21 October 2020

Article Doi

eBook ISBN

978-1-80296-089-1

Publisher

European Publisher

Volume

90

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1677

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Polyanskova, N. V., & Belyaeva, G. I. (2020). Analysis Of City's Competitive Advantages In Conditions Of Socioeconomic Transformation. In I. V. Kovalev, A. A. Voroshilova, G. Herwig, U. Umbetov, A. S. Budagov, & Y. Y. Bocharova (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST 2020), vol 90. European Proceedings of Social and Behavioural Sciences (pp. 1645-1653). European Publisher. https://doi.org/10.15405/epsbs.2020.10.03.189