Abstract

The article considers the cases of bankruptcy of insurance companies engaged in compulsory insurance of auto-civil liability in Russia. All cases of bankruptcy of these insurance market entities for the period from 2018 to the present date on the basis of analysis of financial indicators have been studied. Among the factors reflecting negative trends in the insurance company, three were chosen, on which a model of control of the probability of bankruptcy of the insurance company was built. The article considers the dynamics of these indicators by the bankrupt companies under research and contains the conclusions about the correlation of these indicators and the probability of bankruptcy of the insurer. A mechanism to prevent bankruptcy of the compulsory auto-civil liability insurers or to minimize the losses of both the insurers and the fund of the Russian Union of Motor Insurers have been proposed. In addition to its main social task, this mechanism can serve as a referral point system for financial departments of insurance companies in business planning and setting a sales system for selling departments. The proposed system of indicators can also be used in the bodies of the Central Bank of the Russian Federation to score the activities of the insurance company in order to regulate the financial stability of the insurance market entities and control the volume of compulsory insurance of auto-civil liability in the portfolio of insurance companies.

Keywords: Insurancebankruptcyriskscoringinsurance market

Introduction

As of March 2020, according to the Central Bank of the Russian Federation, in Russia, 43 companies have fees for compulsory insurance of auto-civil liability (further - OSAGO). In 2018, according to the Central Bank of Russia, there were 56 such companies. Most of them left the insurance market by way of revoking their licenses, subsequent bankruptcy and transferring their obligations under OSAGO policies to Russian Union of Motor Insurers, for other types of insurance insurers will not be able to get insurance reimbursement (in the event of an insurance event). At the moment, the Central Bank of the Russian Federation, as the main regulator of the insurance market, cannot foresee future bankruptcies of an insurance market participant and take preventive measures to reduce the possibility of withdrawal of funds from the insurance company, reduce the volume of OSAGO in the insurer's portfolio or promptly transfer the portfolio to another insurer. There is no mechanism for the rapid diagnosis of auto insurers and, as a rule, the regulator relies only on the results of the periodic inspections of insurers, not taking into account the sustainability of the competitive position of insurance companies at a certain level of competition intensity in the auto insurance industry (Klochkov et al., 2017).

Problem Statement

Currently, in Russia, the supervisory function is implemented, as a rule, either by way of responding to the requests (complaints) of insurers, or through regular checks. A mechanism is needed to respond to changes in the balance of the insurer's portfolio in order to prevent the risk of bankruptcy or solvency reduction. It should be a scoring mechanism containing simple indicators, which at the same time allow to objectively assess the possibility of the insurer leaving the market soon. In order to increase the objectivity of the scoring mechanism and these indicators, it is necessary to take into account the uncertainties, which include macro-environment factors and industry factors that influence changes in performance values. These factors determine the degree of uncertainty associated with the behavior of consumers of auto insurance services in the insurance market, and the actions of the insurer, taking into account the intensity of competition in the insurance industry during the given period of strategic planning. It should be noted that in the case of OSAGO, victims have the opportunity to receive the insurance reimbursement from the fund of the Russian Union of Motor Insurers, voluntary species remain completely unprotected from the point of view of consumers in the event of bankruptcy of the insurer.

Research Questions

The following questions are the subject of the study.

What indicators of the insurance portfolio should be compared when analyzing the effectiveness of the insurer's insurance operations?

What periods should be affected when comparing the dynamics of insurance company fees?

What are the most critical indicators for assessing the balance of the insurance portfolio?

What uncertainties can influence changes in performance values to assess the balance of the insurance portfolio?

Where, in addition to the regulator, can this set of indicators be used?

It should be noted that the answers to the questions set must be agreed upon.

Purpose of the Study

The purpose of this study is as follows.

Forming the list of insurers studied

The allocation of the list of bankrupt insurance companies engaged in compulsory insurance of auto-civil liability, and the main reason for the bankruptcy of which was the imbalance of the insurance portfolio. At the same time, it is necessary to confirm or refute the assumption that the main reason for that was OSAGO insurance.

Selecting key indicators that reflect the non-efficiency of the insurance portfolio

Finding the common indicators (both financial and managerial) between bankrupt companies and identifying their critical values, the achievement of which can lead to financial insolvency of the insurer. Form a minimum list of such indicators or a minimum number from the list.

Identifying and analyzing the uncertainties that affect the deviation of the values of the main indicators

Determining the boundaries of the industry and the OSAGO consumer market. Using STEEP analysis to identify and analyze the impact of macro-environment factors on the insurance industry within a given boundary. Applying the method of industry analysis, using the model of five forces of competition in the industry M.Porter. Finally, the definition of the list of key factors of success (CFCs) in the OSAGO segment within the specified boundaries (Levkina et al., 2019). Only those factors from the list of CFC of the auto insurance industry, the values of which will influence the possible deviations of the values of the main indicators studied, are subject to accounting.

Forecast and identifying companies at risk

Applying the resulting model of indicators to predict further dynamics of the OSAGO market, identifying companies at risk and developing proposals to apply possible measures to limit their access to the market of compulsory insurance auto-civil liability.

Research Methods

Selection of insurance organizations for research

According to the Central Bank of the Russian Federation, in March 2020 in Russia, 43 companies have fees for compulsory insurance of auto-civil liability (further - OSAGO). Actually, there are more insurers who possess licenses, this is due to the fact that some insurers are refusing from their business, so they do not conclude new insurance contracts, and wait for the end of existing OSAGO licenses. The research period is January 2018 - March 2020. During this period, the number of OSAGO insurers decreased by 22% from 55 to 43 companies (Bank of Russia).

Selection of indicators for the study

The following indicators were taken for the study:

The share of OSAGO in the insurer's portfolio.

The dynamics of changes in fees for OSAGO in 2019 compared to 2020.

The presence in the portfolio of large contracts on compulsory types of insurance, affecting the portfolio of the insurer.

The last paragraph was included because (except for the compulsory insurance of the civil liability of the owner of a dangerous object for causing harm as a result of an accident at a dangerous object) the mandatory types of insurance carry significant risks for the insurer, as the combined ratio for them usually fluctuates in the region of 100% (Klochkov et al., 2016, Klochkov et al., 2016).

Identifying the list of factors that change the values of the selected metrics

The point of strategic analysis of the influencing factors of the external environment on the auto insurance industry is to determine deviations in the current setting of the values of the CFC insurance industry in a given period of time.

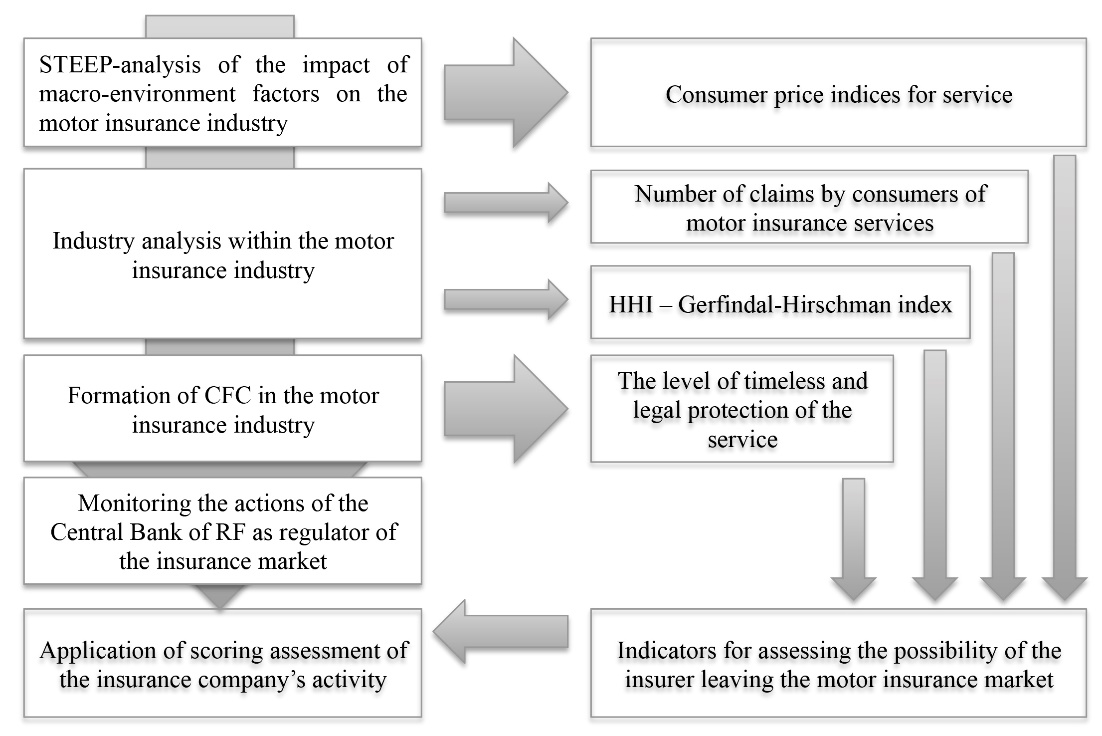

The logic of the possible deviation analysis of the values of indicators to assess the possibility of the insurer leaving the auto insurance market is presented on Figure

As can be seen from the presented scheme, the results of the analysis of the influence of macro-environment factors allow to obtain relevant aggregates for the industry, which in a certain way affect the financial stability of insurance companies (Klochkov et al., 2018).

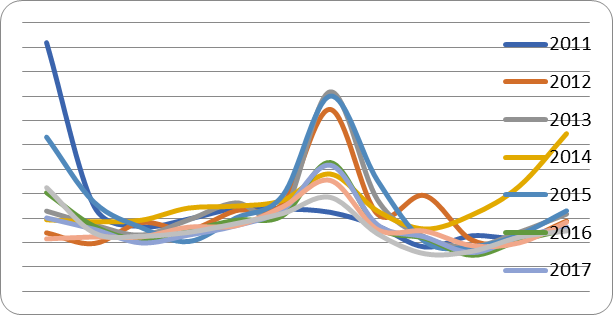

For example, how the decline in the consumer ability of Russians affect the insurance industry. In order to carry out the research and evaluation, it is advisable to use consumer price indices for services in the Russian Federation in 2011-2019, (Consumer price indices for the Russian Federation in 1991, 2019), the values of which are presented below in Figure

Changes in the values of this index, including in the case of insurance industry services, allow to predict the economic behavior of consumers of auto insurance services and take into account the deviations in the assessment of the insurers withdrawal from the market.

We do not consider the situation of influence of unpredictable factors, such as force majeure, at present - sanctions, blocking of travel and communications, the fight against coronavirus, the decline in the solvency of the population, changes in interest rates and exchange rates. Though the proposed strategic analysis tools are most suitable for such situations (Klochkov et al., 2018).

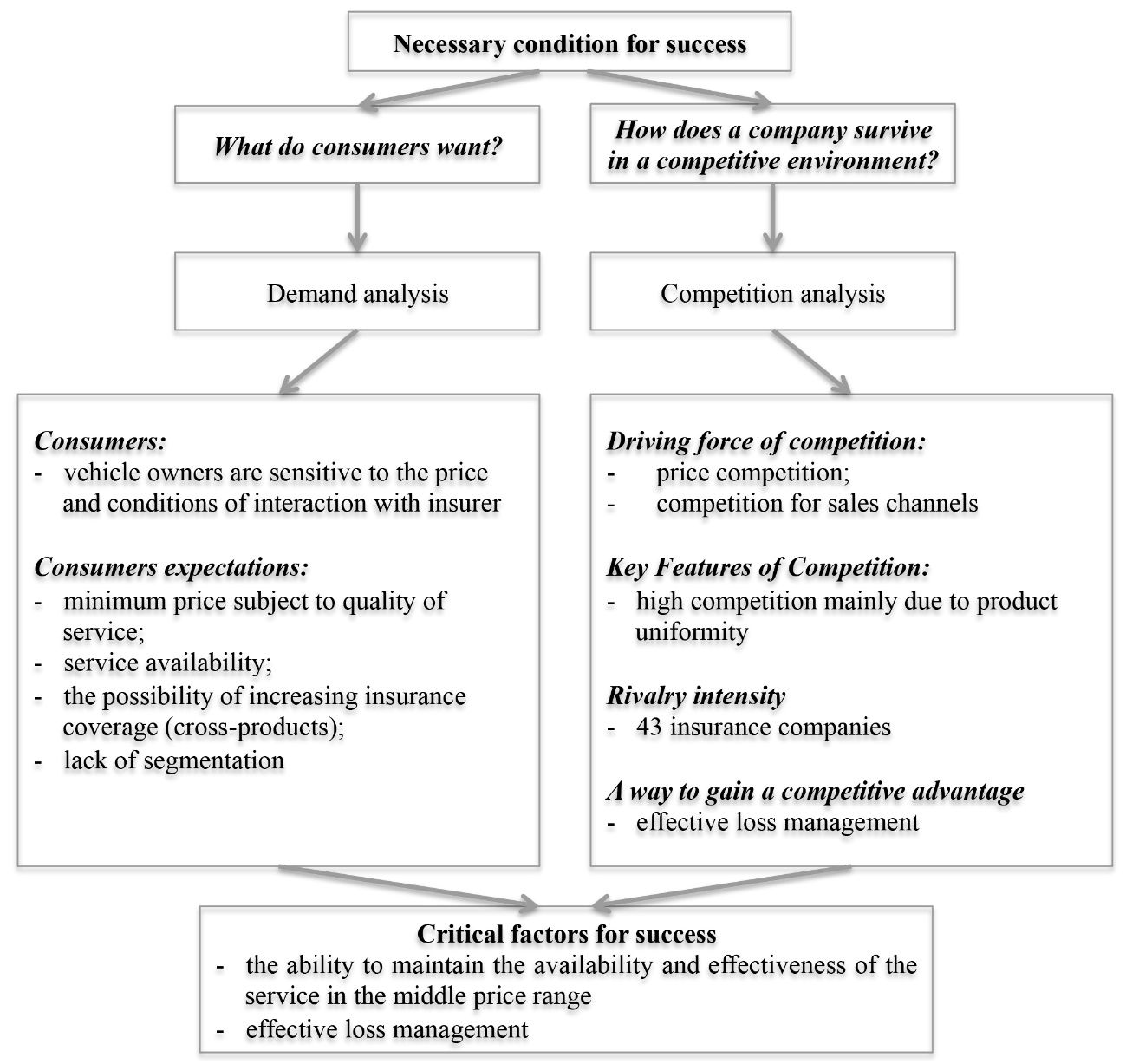

We suggest to discuss the use of the five-force model of competition in the auto insurance industry. The industry is in the maturity of the industry life cycle. The industry is approaching the consolidation phase, when various mergers and acquisitions are possible (Iskoskov et al., 2019). The degree of competition in the industry is above average, the degree of influence of consumers of auto insurance services and the threat of substitute products is increasing, and this fact allows us to speak about the low margins of the auto insurance industry (Baburin, 2011).

In a given period of time, the most "mobile" in terms of variations in influence power estimates are fluctuations in the level of "consumer power" and the level of "threat from substitute products" under the influence of individual macro-environment factors and individual factors of the industry environment changes (Ljovkina et al., 2019). Although in the period under review, the level of competition of insurance companies may be at the same level.

Finally, let's look at the external sources of competitive advantages of the insurance company, the industry KFC. As an example, we cite a fragment of the formation of CFC in the auto insurance industry, which is presented in Figure

The assessment of intra-industry competition of insurance companies may be the calculation of the Gerfindal-Hirschman index. In order to analyze the level of competition of insurance companies in the industry, it is easy to calculate the Gerfindal-Hirschman index, as there are data on the number of competitors in the strategic group, the capacity of the market, the volume of sales of companies and the dynamics of the share of OSAGO (Bozhuk et al., 2019; Ryzhova, 2019). Fluctuations of this index will affect the deviation of selected indicators to assess the possibility of the insurer leaving the auto insurance market.

The results of the setting and assessment of factors allow to determine the correlation factor of deviations from the values of influencing factors and indicators in the indicator model to predict the dynamics of the OSAGO market (Drozdov et al., 2011).

In addition, the logic of the analysis proposed will allow to take into account the possible changes of the key factors of success in the industry, which are initiated by car owners, i.e. the consumers of OSAGO.

Sampling

As a result of sampling of companies that have left the insurance market for the above period, it is possible to form the following table with information about bankrupt insurers. Table

Findings

Summing up the analysis of the sample results we note as follows:

The negative impact of large contracts and tour operator liability insurance

In the two bankrupt companies, large high-risk contracts had the greatest negative impact in addition to sharp changes in OSAGO fees (more than 25% compared to the same period last year). In one case, it was the State contract of compulsory state insurance of life and health of persons of the rank and file of the internal affairs bodies of the Russian Federation No.31/31GC of 10.01.2018, which occupied more than 97% of the company's fees, in the second case the company was the leader of insurance of the liability of tour operators for the failure or improper performance of the contract on the sale of the tour product, which in the conditions of the fall of the tourist flow of the investigation and as a bankruptcy of numerous tour operators led to the failure to comply with the insurance portfolio.

The hyperbolized dynamics of changes in OSAGO fees

In all these companies there is a hyperbolized dynamic of both the fall and the growth of OSAGO fees. In the case of positive dynamics, it can be concluded that a classical financial pyramid is constructed (Klochkov et al., 2016), when the fees for the current period are the source of insurance payments under contracts concluded in the previous period. In this case, the insurance company is not engaged in the formation of insurance reserves to cover losses. This system can be sustainable only if the share of OSAGO in the portfolio is insignificant, as the loss under OSAGO exceeds 100%.

In the case when there is a sharp reduction in fees under OSAGO (25 percent or more) with the share of OSAGO in the portfolio of more than 60%, this situation also in most cases leads to the bankruptcy of the insurance company, because in this case the the insurance company has nothing to cover the cash gap.

Risk-zone companies in Russia as of March 2020

Having applied the results achieved to companies operating in the Russian insurance market now, we can draw the following conclusions about a number of companies according to Table

These companies tend to have a significant share of OSAGO in their portfolio and/or show an abnormal increase in the dynamics of fees for this type. It is also worth paying attention to the three-fold increase in fees under Tinkoff Insurance. With a small percentage of OSAGO, this dynamic leads to the conclusion that in the near future the size of the share of OSAGO will reach a critical size and the regulator will need to take measures.

Conclusion

The analysis allows us to draw the following conclusions. In order to ensure the stability of its OSAGO obligations, the insurer must meet at least two of the three criteria:

the OSAGO share of no more than 60% in the portfolio;

the dynamics of OSAGO fees for the same period of the last year is no more than 25%;

the insurer’s portfolio does not contain non-insurance contracts, which can have a significant impact on changes in fees or payments.

It makes sense to include these criteria in the public procurement system when forming a criterion for the selection of participants. Since, for example, NASCO was the leader in insurance OSAGO in Tatarstan, and as a result of its bankruptcy most of the budget enterprises (insured in NASCO through state purchases), were forced to replay the competitions and look for a new executor. The introduction of mandatory criteria in the part of OSAGO will ensure the guarantee of the performance of government contracts.

References

- Baburin, V. A. (2010). Modernizaciya biznesa i obrazovaniya v usloviyah innovacionnogo reformirovaniya. Kollektivnaya monografiya. [Modernization of business and education in the context of innovative reform. Collective monograph]. Saint-Petersburg state university of service and economy. [In Rus]

- Bozhuk, S., Krasnostavskaia, N., Pletneva, N., & Maslova, T. (2019). The problems of innovative merchandise in the context of digital environment, 12-15.

- Consumer price indices for the Russian Federation in 1991 (2019). https://www.gks.ru/free_doc/new_site/prices/potr/tab-potr1.htm

- Drozdov, G. D., Makarenko, E. A., & Pastuhov, A. L. (2011). Modelirovanie processov strahovaniy [Modeling of the insurance process]. Saint-Petersburg state university of service and economy. [In Rus]

- Iskoskov, M. O., Kargina, E. V., & Klochkov, Y. (2019). Innovative model of the organization of a marketing system at engineering enterprises. In Paper presented at the Proceedings - 2019 Amity International Conference on Artificial Intelligence, AICAI 2019 (pp. 992-997). https://doi.org/10.1109/AICAI.2019.8701397

- Klochkov, Y., Gazizulina, A. & Golovin, N. (2016). Assessment of organization development speed on based on the analysis of standards efficiency. 2nd International Symposium on Stochastic Models in Reliability Engineering, Life Science, and Operations Management, SMRLO 2016 Proceedings, 530-532.

- Klochkov, Y., Gazizulina, A., Ostapenko, M., Eskina, E., & Vlasova, N. (2016) Classifiers of nonconformities in form and requirement. 2016 5th International Conference on Reliability, Infocom Technologies and Optimization, ICRITO 2016: Trends and Future Directions 5, Trends and Future Directions, 96-99.

- Klochkov, Y., Klochkova, E., & Vasilieva, I. (2016) Forecasting of staff resistance level in the process of introduction of new standards. 2nd International Symposium on Stochastic Models in Reliability Engineering, Life Science, and Operations Management, SMRLO 2016 Proceedings, 533-535.

- Klochkov, Y., Klochkova, E., Alasas, B.M., Konakhina, N., & Kuzmina, T. (2017). Development of external customer classification based on the analysis of interested parties. 2017 International Conference on Infocom Technologies and Unmanned Systems: Trends and Future Directions, ICTUS 2017 2018, 729-732.

- Klochkov, Y., Klochkova, E., Antipova, O., Kiyatkina, E., Knyazkina, E., & Vasilieva, I. (2016). Model of database design in the conditions of limited resources. 2016 5th International Conference on Reliability, Infocom Technologies and Optimization, ICRITO 2016: Trends and Future Directions 5, Trends and Future Directions. 2016, 64-66.

- Klochkov, Y., Klochkova, E., Didenko, N., Frolova, E., & Vlasova, N. (2018). Development of methodology for assessing risk of loss of a consumer through the fault of an outsourcer. Paper presented at the 2017 International Conference on Infocom Technologies and Unmanned Systems: Trends and Future Directions, ICTUS 2017, 2018-January (pp. 719-724). https://doi.org/10.1109/ICTUS.2017.8286101

- Klochkov, Y., Klochkova, E., Krasyuk, I., Krymov, S., Gasyuk, D., & Akobiya, N. (2018). An approach to decrease the risk of losing customers. In Paper presented at the 2017 6th International Conference on Reliability, Infocom Technologies and Optimization: Trends and Future Directions, ICRITO 2017, 2018-January (pp. 133-142). https://doi.org/10.1109/ICRITO.2017.8342414

- Klochkov, Yu. S., Klochkova, E.S., Volgina, A., & Dementiev, S. (2016). Human factors in quality function deployment. 2nd International Symposium on Stochastic Models in Reliability Engineering, Life Science, and Operations Management, SMRLO 2016 Proceedings, 466-468.

- Levkina, A. O., Dusseault, D. L., Zaharova, O. V., & Klochkov, Yu. (2019). Managing innovation resources accordance with sustainable development ethic: typological analysis. Resources, 8(2), 82.

- Ljovkina, A. O., Dusseault, D. L., Zaharova, O. V., & Klochkov, Y. (2019). Managing innovation resources in accordance with sustainable development ethics: Typological analysis. Resources, 8(2). https://doi.org/10.3390/resources8020082

- Ryzhova, O. A. (2019). Innovacii v setevoj roznichnoj torgovle v period cifrovizacii ekonomiki [Innovations in network retail trade during the digitalizationof economy] Innovacionnaya deyatel'nost' [Innovation Activity], 4(51), 60-69. [In Rus]

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

21 October 2020

Article Doi

eBook ISBN

978-1-80296-089-1

Publisher

European Publisher

Volume

90

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1677

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Makarenko, E. A., & Pesockij, A. B. (2020). Scoring System As A Mechanism For Preventing Buncruptcy Of Insurance Conpanies. In I. V. Kovalev, A. A. Voroshilova, G. Herwig, U. Umbetov, A. S. Budagov, & Y. Y. Bocharova (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST 2020), vol 90. European Proceedings of Social and Behavioural Sciences (pp. 1446-1455). European Publisher. https://doi.org/10.15405/epsbs.2020.10.03.167