Abstract

The relevance of this article is due to the fact that small and medium-sized businesses are an important component of the entire complex of Russian enterprises. This article discusses the circumstances affecting the development of small business, external conditions and internal reasons, as the main one is ineffective management. There have been analyzed problematic aspects of using software products and processing economic information based on IT technologies. According to the authors’ opinion, the use of special accounting information systems in the activities of small enterprises can optimize the processing of all business processes. The article provides a comparative analysis of various specialized software products and hardware-software complexes for collecting and registering primary documents, conducting strict registration of business transactions, arranging settlements with counterparties, generating reporting data arrays for expenditure of corporate resources and entrepreneurial opportunities. Particular attention is paid to the use of special tax treatments, simplified tax accounting rules, simplified tax returns for small businesses and the use of a simplified accounting and reporting system for small business entities. It is noted that the use of software products to ensure the company document flow requires special control measures to protect information and restrict access to information media. Targeted processes for creating set of interrelated measures of organizational and legal nature aimed at the efficient use of the company economic resources and development under current IT technologies are provided.

Keywords: Accounting and analytical activitiesinformation securityaccounting information systems

Introduction

Small business is entrepreneurial activity carried out by business entities under conditions that are determined by criteria stipulated by laws. The development of small business determines the development of commodity markets, the formation of independent sources of income for economically active part of the country, and the reduction of social burden on budget expenditures at all levels. State policy in the field of small business is aimed at:

creation of competitive conditions for small firms;

assistance to small and medium-sized businesses in promoting their products, completed work, results of intellectual activity in the Russian and foreign markets;

ensuring the population employment conditions in small businesses;

assistance to increase the size of small business products and services in the total gross domestic product;

increase of taxes transferred by small businesses.

State policy in the field of small business assumes:

separation of powers in the field of assistance to small business entities (SBE) between the subjects of federal authorities and local self-government; (Prokopova, 2018)

increased responsibility on the part of authorities at various levels for creating convenient conditions for the functioning of small businesses;

ensuring the same conditions for SBE access to state support, based on the conditions for its provision, which are stipulated by the RF state programs.

Regulatory legal regulation of the activities of small firms assumes:

maintaining simplified methods of accounting and reporting, simplified procedure for conducting of cash transactions;

development of measures to protect the rights and interests of small businesses during implementation of state control;

creation of conditions for financial support of entrepreneurship in the small business.

Problem Statement

Entrepreneurship in the small business is caused by predictability, functioning of transparent legal framework, and the use of personal computers in the information environment (Badretdinova, 2017). Availability of control functions in arrangement of the company economic stability, closely interacting with production activities, is associated with various types of risks and obstacles to the production process. One of the priority tasks is information security associated with the use of software products.

The use of computer programs, especially in the context of situational approach in the practice of doing business generally and the need for quick change of management in the face of information uncertainty, ensures the company financial security at a particular time (Tretyakova, 2017). Particularly, reporting to tax inspectorates and statistical agencies can be done using the Kontur-Extern software solution. The Kontur system is accredited special operator and one of the leading electronic document management operators in Russia, it uses a reliable encryption system and secure communication channels with contractors.

The certification center SKB Kontur operates in accordance with Law No. 63-FZ as of 06.04.2011 "On electronic digital signature" and is based on the CryptoPro UC Certification Center software package platform certified by the Federal Security Service of the Russian Federation. Reliable functioning of SKB Kontur is confirmed by the certificate of compliance with safety requirements of 5th Class. This certificate is guarantee of the highest degree of SS security in the field of ensuring the security of confidential data and trade secrets. The built-in SKB Kontur verification system monitors possible errors when filling out reports, checks control ratios.

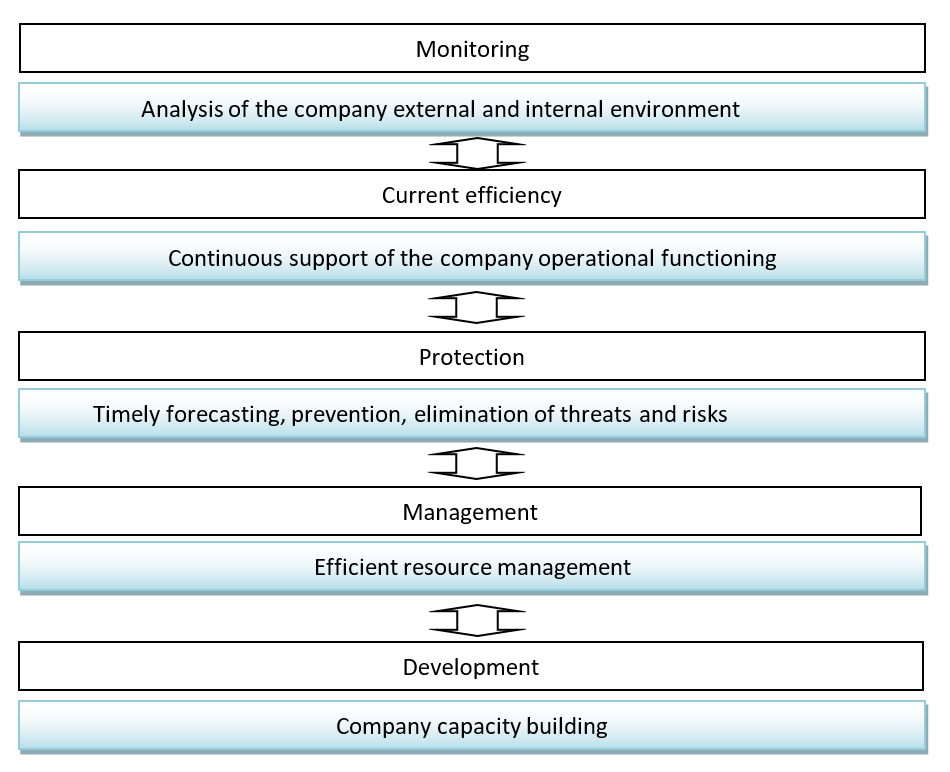

In practice, the electronic reporting and electronic document management system has proven to be very effective. Currently, the advanced reporting tool is Online - reporting via the Internet, which is convenient service for small businesses. The high-quality use of information resources depends on qualifications and mobility of management, coordination between departments, since in conditions of the need for quick decisions, each of them decides the situation at his discretion, which may cause problems in other company departments (Khapilina, 2017). Stable entrepreneurial activity and the formation of company information security include monitoring and identifying bankruptcy threats, taking adequate measures to prevent or neutralize them, continuously supporting the company operational functioning and timely forecasting of financial support (Sheremet & Negashev, 2019). Forecasting and eliminating the threats of bankruptcy of business processes include the following areas (Figure

When using telecommunication tools, there are risks of virus attacks. There is also a fear that information transmitted through Internet resources may be in the hands of attackers and thereby cause significant damage to financial stability and protection of the company's own trade secrets.

The implementation of objectives of the Russian Federation Government Decree No. 131 as of April 15, 2014 "On approval of the state program Information Society (2011-2020)" assumes the development of technical and technological opportunities for development of information society and prevention of economic information threats to the activities of economic entities of small businesses under modern conditions. Moreover, advanced measures of data encryption and coding, protection technologies against server hacking can minimize this probability.

Research Questions

In this paper, the following questions are investigated related to the accounting and analytical activities of small businesses:

What conditions must be met when organizing the financial statements transfer via telecommunication channels to fiscal authorities?

What are the requirements for information security with the use of software products?

How is provided the financial security of the enterprise at a particular time?

Purpose of the Study

The organizing system of accounting and analytical activities is determined by the company production structure and consists of set of various measures (adoption of accounting policy in the field of accounting and taxation, use of technical data processing tools, development of workflow schedule, job descriptions for accountants, whose element is knowledge and ownership of software products). Studying the automation capabilities of this system is this research purpose.

Research Methods

All this set of measures in modern business practice is carried out automatically using modern computer programs (Capetanakis, 1979; Chang, 2015)

Business data processing using modern software products related to the registration, transfer and accumulation of data based on software (Table

Creation of accounting information systems (AIS) in small businesses enable to optimize all data processing at workplace of accountants.

The modern development of IT-technologies and software in order to automate all levels of the company management system creates the conditions for (Bulava & Shamsutdinova, 2017):

collection and registration of primary documents;

conducting strict registration of business transactions;

arrangement of settlements with counterparties;

formation of reporting data arrays for expenditure of corporate resources and entrepreneurial opportunities that guarantee the most dynamic scientific and technological development (Foss, 2016; Jin, 2017).

Small businesses mainly use the specialized software product "1C: 8.3 Enterprise Accounting". The program automatically creates regulated financial reports, which are transmitted via telecommunication channels to fiscal and extra-budgetary authorities.

Automated processing of business operations is carried out in accordance with the provisions of the RF Tax Code, federal laws, government regulations, the RF Ministry of Finance Decrees, RAS and other regulatory documents. Accounting and tax reporting in the program is updated in a timely manner, all significant changes in legislation are promptly reflected.

"1C: Enterprise" is a whole family of programs designed to automate accounting in variety of companies, including small businesses. All 1C programs have common base, foundation, i.e. technological platform wherein applications are launched and run (application solutions, configurations).

For small businesses and individual entrepreneurs (IE), 1-C has developed specialized options, for example, 1C: Simplified 8 for simplified tax system accounting.

The advantages of application programs and programming systems ensure formation of accounting and analytical models of document management and provision of electronic financial statements via telecommunication channels by connecting to the Reporting system.

This is a convenient way to send reports, transfer other electronic documents to fiscal authorities without leaving the program.

When developing such a portal, many years of corporate experience and many user recommendations were taken into account, a convenient mechanism for installing and connecting everything necessary for sending reports directly from the program was used.

Increasing the effectiveness of SBE accounting and information functions is possible under conditions:

use of special tax treatments, simplified tax accounting rules, simplified tax returns for small businesses;

applying of simplified accounting and reporting system for the SBE.

From the point of view of clear document flow management, accounting for movement of goods flows, using barcoding, controlling purchases and settlements with suppliers, and analyzing sales, the FREGAT-RETAIL management and accounting system is interesting.

The hardware-software complex FREGAT-RETAIL includes the functional components:

the Front Office (the cash program and trading equipment) is used to ensure control of cash transactions;

the Back Office controls pricing, reflects inventory results, prints price tags and labels with bar codes, sales volumes and settlements with counterparties;

the Center Office provides centralized analytical information and generates financial reports according to accounting registers, manages goods distribution in the whole enterprise.

Data for processing in the trading system are entered using scanner, downloaded from the data collection terminal or from ready-made tables in EXEL, WORD, HTML, etc.

To improve the accounting and information activities, it is advisable to implement certain measures, for example, use of simplified tax accounting rules, simplified statistical reporting procedure for SBE.

It should be noted that at present the problem of mutual cooperation of company applying the special tax treatment and in the general taxation system has not been resolved (Romanova & Zakharova, 2017).

When using modern versions of software products during processing of accounting and analytical data at the corporate level, it must be taken into account polystructurality, ability to make good use of resources, scientific and technological progress, social sphere and adequate response to changes in internal and external environment by preventing all kinds of economic threats. The company`s adequate reaction means targeted changes of parameters, structure and properties of any company link in response to ongoing changes, both in the facility external environment and within it.

The use of software products to ensure the company document flow, coupled with the notification of reporting information to the IFTS, PFR, SIF, and other instances, require special control measures to protect information and restrict access to information media.

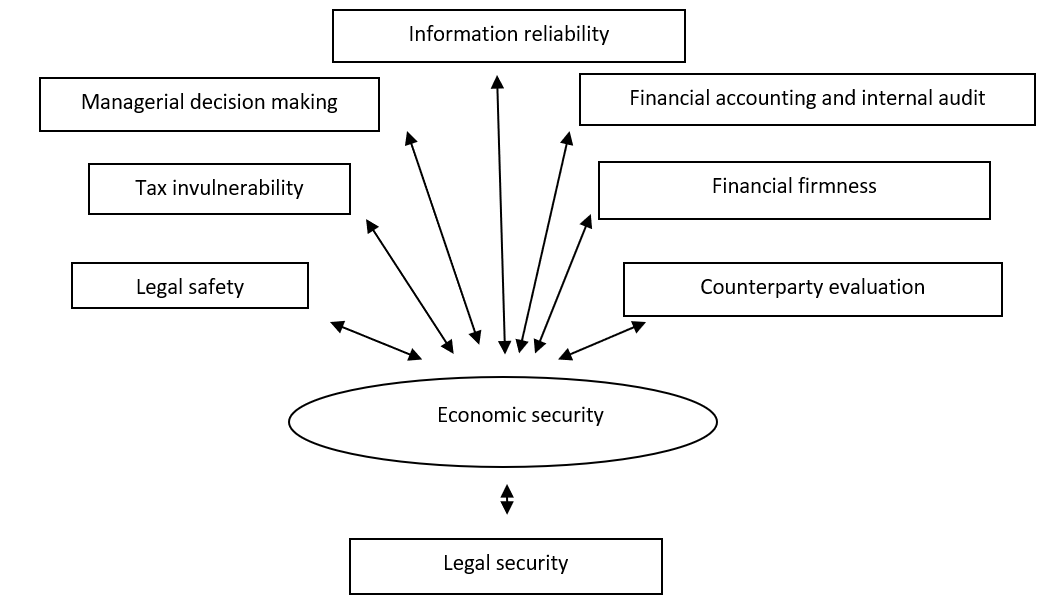

Given the uncertainty of unified structural and functional components of the company economic stability, there are envisaged targeted processes for creating set of interrelated measures of organizational and legal nature aimed at the efficient use of the company economic resources and development under current IT technologies.

Small businesses may use the services presented in the cloud, which reduce the cost of technical support and maintenance of information systems.

These factors make it possible to identify reserves for increasing the company's profitability and protection against economic risks (Figure

Findings

The development of structural component of the work of entrepreneurs in small business is carried out by the conscious actions of businessmen and is carried out in order to achieve the desired results (Brown et al., 1990).

The procedures of stimulating business processes have different purpose, which involves the management of finances, property, risk situations, profitability, costs, price of goods, etc. (Ha & Lan, 2018).

The development of managerial tools for organizing production activities involves the study of economic leverage, administrative and legal measures, the calculation of business performance indicators, and audit procedures.

State structures have productive effect on commercial activity, using direct and indirect methods of regulating entrepreneurial interests, which forces them to create relations with the state.

The tool to improve business performance is the availability of material incentives, and each entrepreneur is aimed at gaining benefits for individuals stimulating business. Example of incentive is various types of remuneration, wages, scarce resources, exemptions, etc. The economic impact, besides available economic incentives, includes various constraints (penalties, tax system, deductions, payments, etc.).

Conclusion

Motivation activities are designed to maximize the needs of company employees for effective implementation of assigned work. The motivation function affects the company staff and encourages them to work effectively through collective and personal incentives.

The use of software products to ensure the company document flow, coupled with the notification of reporting information to the IFTS, PFR, SIF, and other instances, require special control measures to protect information and restrict access to information media.

Information about the company production activities after the reporting period and the effectiveness of their operation are recorded in the financial statements about the company property status. Based on the financial statements data, it is possible to establish indicators of the company economic activity.

More in-depth assessment of financially-effective information, performance of controlling functions is made by the internal audit department, whose purpose is to ensure production processes with consistent information and prevent possible losses. Survey of the production sector by the internal audit service will allow the company to avoid financial losses.

Accounting and analytical services and independent business audit and analysis of the company activities, in its own industrial interest, are obliged to fulfil check functions, for example, taking inventory, as part of their official duties.

The effective mechanism of the company’s management system is caused by the efficient use of economic potential with applying of competent management of economic problems of business entity.

Applying of systematic approach enables to create the company model as complex system for development of entrepreneurial activity in difficult economic conditions, characterized by the risk of reducing economic stability.

The use of IT-technologies in the company activities contributes to the efficiency of transmission and optimization of data processing (Chen et al., 2017; Vaezi et al., 2017).

References

- Badretdinova, A. A. (2017). Information base for risk analysis and assessment. NovaInfo.Ru., 6(58), 235-239.

- Brown, Ch., Hamilton, J., & Medoff, J. (1990). Employers Large and Small. Harvard University Press.

- Bulava, I. V., & Shamsutdinova, E. R. (2017). Classification of modern methods for assessing the financial situation of enterprises. Economics and entrepreneurship, 1, 844-884.

- Capetanakis, J. I. (1979). Tree algorithms for packet broadcast channels. IEEE transactions on information theory, 25, 505–515.

- Chang, C. H. (2015). Design and analysis of multichannel slotted ALOHA for machine-to-machine communication. IEEE Global Communications Conference (GLOBECOM). IEEE, 1–6.

- Chen, X., Zhang, Z., Zhong, C., Jia, R., & Ng, D. W. K. (2017). Fully Non-Orthogonal Communication for Massive Access. IEEE Transactions on Communications, 66(4), 1717–1731.

- Foss, S. G. (2016). Doubly randomized protocols for a random multiple access channel with «success–non-success» feedback. Problems of information transmission, 52(2), 156–165.

- Ha, T., & Lan, A. (2018). Development of tax system for small and medium business in Vietnam. Economics and Management: Problems, solutions, 12, 2(84), 28-32.

- Jin, H. (2017). Recursive pseudo-Bayesian access class barring for M2M communications in LTE systems. IEEE Transactions on Vehicular Technology, 66(9), 8595–8599.

- Khapilina, S. I. (2017). Ways to increase the company solvency based on factor analysis of accounts payable turnover. International Student Scientific Herald, 1, 21-25.

- Malyavina, A. A., & Grebneva M. E. (2017). Improving the financial condition of the enterprise through analysis of financial statements. Modern trends in the development of science and technology, 1-5, 91-93.

- Prokopova, F. T. (2018). Regional Economics and Territorial Development Management: Textbook and Workshop for Undergraduate and Graduate Programs. Yurait Publishing House.

- Romanova, I. V., & Zakharova, R. L. (2017). Legal aspects of accounting and taxation and ensuring the economic security of small businesses. Actual problems of economics and management, 3(15), 7-13.

- Sheremet, A. D., & Negashev, E. V. (2019). Methods of financial analysis of the activities of commercial organizations: Practical Guide 2nd Ed., Revised and amended. INFRA-M.

- Tretyakova, A.S. (2017). Practical approach to compiling an assessment of ensuring economic security at the enterprise. Collection: The scientific community of students of the XXI century. Economic sciences Electronic collection of articles based on papers of the LII Student International Scientific-Practical Conference, 44-49.

- Vaezi, M., Schober, R., Ding, Z., & Poor, H. V. (2017). Non-Orthogonal Multiple Access: Common Myths and Critica Questions. IEEE W.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

21 October 2020

Article Doi

eBook ISBN

978-1-80296-089-1

Publisher

European Publisher

Volume

90

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1677

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Romanova, I. V., & Zakharova, R. L. (2020). Accounting And Analytical Activities Of Small Businesses Using Applied Information Technology. In I. V. Kovalev, A. A. Voroshilova, G. Herwig, U. Umbetov, A. S. Budagov, & Y. Y. Bocharova (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST 2020), vol 90. European Proceedings of Social and Behavioural Sciences (pp. 1437-1445). European Publisher. https://doi.org/10.15405/epsbs.2020.10.03.166