Abstract

This article is dedicated to the field of contractor checking for reliability, search tools and techniques that are based on innovative solutions for effective evaluation of business partner. This article discusses the concept of unreliable companies, assesses the importance of cooperation risk assessment, available company`s economic security system that identifies signs of cooperation risks, algorithms, methods and tools for contractor checking. This article discusses contractor checking methods proposed by the state in regulatory legal acts and letters of the Federal Tax Service, evaluates their effectiveness in assessing the contractor's reliability. The authors believe that the analysis of potential business partner may be done faster and more efficiently using information systems. As example, this article discusses the use of the Globas Information Analytical System. The system effectiveness is assessed by checking a conditional contractor, evaluating aspects of its activities, identifying alarming factors and then making a decision about cooperation. Also, the system contains unique tools to quickly identify disturbing factors in all aspects of contractor`s activities, which enable to quickly assess the security cooperation and reduce risks when signing contracts with business partners.

Keywords: Risk managementunreliable companiescontractor checkingglobas

Introduction

Development and application of innovative technologies contribute to the effectiveness of the company`s business processes and increases the control effectiveness of economic entities activities.

In modern conditions, one of the most important elements of the company management mechanism is risk management as a system of measures aimed at adoption and implementation of key decisions in order to minimize the risks inherent in some form of economic activity.

Particular attention should be paid to such component of risk management as contract to risk management. The importance of this area is explained by the fact that at the present stage of economic development persist unfairness trends, manifested in the creation of unreliable companies, for example, for realization of fraudulent schemes, etc.

Problem Statement

Significant damage to the business in Russia is caused by activities of unreliable companies. Their significant impact on the business is explained by the following reasons:

lack of clear interpretation of the concept of unreliable companies at the legislative level;

difficulty of identifying unreliable companies.

Lack of clear interpretation of the concept of unreliable companies at the legislative level

The legislation does not disclose the concept of unreliable companies, and often use the term "fly-by-night companies", so the absence of legal definition of this concept leads to complexity of identifying and subsequent evidencing of illegality of their activities. According to the Federal Tax Service of Russia opinion, "fly-by-night companies" refers to organizations that are not created for authorized purposes and they may be identified by features, which are described in the Journal "Accounting, Taxes, Law".

The most obvious features, they can be called classic, include:

the minimum equity;

multiple registration address;

invalid registration address;

multiple founder and general manager;

inaccurate information about the founder and/or general managers;

non-submitted financial statements or representation of "zero" indicators in the reports;

lack of staff (Shevtsova, 2007).

Difficulty of identifying unreliable companies

Difficulty to assign unreliable companies due to the fact that this category should be included not only "fly-by-night", but also "fictitious", "abandoned", "doubtful", "problematic" companies, as well as companies using tax avoidance scheme, and future bankruptcies.

That is the conclusion reached by experts CredInform Information Agency, analysed the long-standing practice of arbitration of disputes between the tax authorities and businesses with regard to obtain unjustified tax benefit, without due diligence and caution (Skobelev, 2017).

Difficulty of identifying "fly-by-night companies" are also related to the fact that the owners have more professional approach to their creation, exclude easily identifiable features, imitate financial and economic activities and transfer their illegal actions against the state to companies and banks (Skobelev, 2019).

Research Questions

To solve these problems, the following issues were raised:

What legal acts regulate the importance of counterparty checking and describe methods for assessing the reliability of business partners?

Is there any efficiency from the methods proposed by the state and the Federal Tax Service for assessing the security of cooperation with the contractor?

Are there information technologies that may conduct contractor checking?

Purpose of the Study

Protection of business from cooperation with unreliable companies is achieved by constructing the company economic safety system that not only supports its internal stability, but also able to withstand external threats. One of the system functions is competent and effective checking of contractors, which is achieved by counteracting the business partnership risks, as shown in Table

To understand how to achieve effectiveness in assessing the security of cooperation with contractor, it is necessary to answer the questions posed in para. 3.

Research Methods

Legal acts regulating the importance of contractor checking

Currently, there is no single well-stipulated approach to evaluating the contractor reliability. At the legislative level, the basis for analysis of contractors is Article 54.1 of the Tax Code of the Russian Federation, according to which companies must confirm the business purpose of transaction with business partner and prove its reality. Moreover, according to the Russian Federation Supreme Arbitration Court Plenum Resolution No. 53 dated October 12, 2006 "On arbitration court assessment of justification for obtaining tax benefits by taxpayer", companies must show "due diligence" to the transaction participant, that is, receipt by the taxpayer of information about the contractor by any available means (RF SAC Bulletin, 2006).

Naturally, any company is interested in assessment of its contractor integrity for commercial benefit, so the main way to test business partner is to ask for sets of registration documents. The Federal Tax Service specialists treat these activities as verification of background information about the contractor, not assessing its integrity, but they advise to assess the contractor reliability level in accordance with criteria stipulated by the Federal Tax Service of Russia Decree N MM-3-06/333 dated 30.05.2007 "On Approval of the concept system planning field tax audits". Among them:

Tax burden level assessment. If the ratio of taxes paid to revenue does not correspond to the industry average value, then the contractor has features of unreliable company.

Net asset value. If net assets for 2 periods excluding force majeure situations (financial crisis) are less than zero, then the company has feature of future bankrupt.

The share of VAT deductions from the total amount of accrued taxes. The contractor is unreliable if the level of this indicator is more than 90% in one year.

The ratio of expense / income growth rate. The excess of expense / income growth rate in the tax and financial reporting indicates contractor unreliability.

The size of average monthly wage. If this indicator is less than the average value for type of activity in particular subject of the Russian Federation, then the contractor has features of unreliable company (Federal Tax Service of Russia Order, 2007).

The presented methodology for the contractor checking covers only some aspects of the contractor’s activities and does not help to reduce each of previously presented risks of business partnership.

Regarding other legislative acts and the Federal Tax Service letters that regulate various aspects of the business entity reliability analysis, then one of them may include:

Federal Law "On Insolvency (Bankruptcy)" No. 127-FZ dated 26.10.2002,

the Russian Federation Government Decree N 367 dated 25.06.2003 "On approval of financial analysis rules by court-appointed manager";

the Federal Tax Service Letter No. AS-4-2/8872 dated May 12, 2017 "On confirmation of due diligence in the selection of contractors".

Efficiency assessment of contractor checking methods proposed by the state and the Federal Tax Service

Among these regulations applicable to the contractor reliability analysis of greatest interest are the Government Decree N 367, and the Federal Tax Service Letter No. AS-4-2/8872 dated May 12, 2017 "On confirmation of due diligence in the selection of contractors". Thus, according to the Decree "On approval of financial analysis rules by court-appointed manager", the company financial analysis is conducted in the following areas:

solvency level analysis;

financial stability analysis;

business activity analysis (RF Government Decree, 2003).

It should be noted that this legislative decree regulates the analysis of status of insolvent companies. However, the applying installed in it method for well-functioning company will not give complete picture of its trustworthiness and solvency will only minimize the risks.

The Federal Tax Service specialists also clarified the methodology for assessing risks when checking the contractor in the Federal Tax Service Letter No. AS-4-2/8872 dated May 12, 2017 "On confirmation of due diligence in the selection of contractors”. In this document, the following features are highlighted for which checking should be carried out:

Availability of information on the state registration of the contractor in the Unified State Register of Legal Entities, which minimizes legal risks.

Availability of the contractor features of fly-by-night companies, which minimizes the risks of cooperation with unreliable companies.

Availability of information about the contractor, valid certificate and license, location of warehouse or retail space, which minimizes compliance risks (The Federal Tax Service Letter, 2017).

However, even in this case, the contractor checking does not cover minimization of all business partnership risks.

Availability of information technologies that may conduct contractor checking

Having studied the legal documents and official documents related to the risk assessment during the contractor checking, we can conclude that this event is extremely difficult and lengthy process. Moreover, it is very common that an entrepreneur does not have enough time for deep and comprehensive checking of future contractor. In this regard, businesses are active users of information systems, which contain the data on legal entities activities. One of such systems, which not only provides relevant data on legal entities, but is also capable of conducting analytical analysis of the contractor’s activities, is Globas Information Analytical System.

Globas is information-analytical system that is capable of performing prompt and high-quality diagnostics of business entities. The system main advantages are submitted information relevance and purity; obtaining online/offline information about foreign companies; availability of analytical tools and functionality. The Globas analytical capabilities enable it to evaluate the company financial capabilities, determine risk levels based on the results of arbitration and enforcement proceedings, and also identify contractors features that are characteristic of unreliable companies (Globas Information Analytical System, 2020).

Findings

So, one of innovative technologies, is able to carry out the company comprehensive checking is the Globas information analytical system. The system has analytical tools able to quickly assess the security cooperation with the company. These include Globas indexes, evaluation and verification of ephemeral regulation criteria. Let`s check their effectiveness on example of LLC "N".

Globas indices for LLC "N"

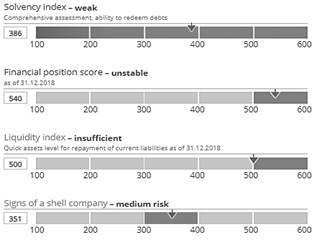

Globas indices are developed taking into account official generally accepted methodologies and international experience and include: solvency index, scoring of financial statements, liquidity index and assessment by criteria of "fly-by-night companies". All indices involved in calculations are evaluated individually for each company in the context of qualitative and quantitative analysis, and characterize various aspects of its activities.

Solvency index is the main indicator and is the result of company comprehensive checking, including analysis of financial indicators, non-financial performance and expert opinion (Solvency index, 2020).

The scoring of financial statements in the Globas system characterizes the financial condition and demonstrates the company's ability to conduct financial and economic activities using its own financial resources.

Liquidity index is indicator that demonstrates the sufficiency of company liquidity assets, characterizes the company solvency in the short term, its ability to withstand transient changes in the market environment and business environment (Liquidity index, 2020).

Index values range from 100 to 600. This range enable to more accurately take into account alarming and negative factors identified by the built-in analytical algorithms in the company`s details and data. The approximation of value to figure 600 indicates increase in such factors, including features inherent in unreliable companies, which will be serious risk for cooperation (Globas Indices, 2020).

The below is given example of Globas indices, applicable to LLC"N" (see Figure

According to indices, we may conclude that the financial activity of LLC "N" is in critical condition, which may characterize it as unreliable company in the rank of future bankrupt (Globas indices for LLC "N", 2020).

From the values of the liquidity index, scoring accounts, the solvency index, we can conclude that the financial situation of "H" is in critical condition and is characteristic of the future bankruptcy.

Further analysis is to assess the risk factors that the system indicates in the Cooperation Safety Assessment. So, for the company LLC "N", the system identifies the following risk factors:

solvency level that does not guarantee repayment of debt obligations;

there is likelihood of financial insolvency in the short and long term;

minimum average staffing number;

loans require guarantees; there is loss in the structure of balance sheet indicators.

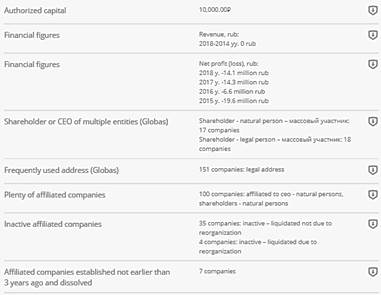

Evaluation by fly-by-night criteria for LLC "N"

The checked company also revealed negative features characteristic for fly-by-night and unreliable companies. These features are disclosed in more detail in the Section "Fly-by-night Criteria Assessment".

When calculating the index takes into account 40 factors recommended by the Internal Revenue Service and are defined on the basis of years of experience of CredInform Information Agency experts. Depending on totality of identified factors, tha risk level is assigned and conclusion is drawn on the likelihood that the analyzed company is classified as unreliable (Fly-by-night Criteria Assessment, 2020).

The risk factors presented in the "Fly-by-night Criteria Assessment' Section are divided into groups: features identified in the registration data, the company's activities and financial statements. For example, for the company LLC "N", the analysis identified the following negative features:

receivables are significantly higher than the amount of revenue that is characteristic for understatement of income tax and VAT (revenue in 2018 = $ RUB, receivables = 66 thsd RUB in 2018);

loans and credits significantly exceed the amount of revenue, which indicates possible tax evasion (revenue in 2018 = 0 RUB, loans and credits = 291 686 thsd RUB);

the cost of fixed assets of the company is negligible (fixed assets = 0 RUB);

taxpayer reflects losses in the financial statements (net loss = 14 109 RUB) (Fly-by-night Criteria Assessment for the company LLC "N", 2020).

On these factors the system also draws attention to the following tools as part of rapid contractor checking method - check regulations.

Check Regulations for company LLC "N"

The Check Regulations are section of the Globas system that evaluates the analyzed company by the positive and negative factors built into the system, of which there are more than 200 in the system. Accordingly, the more negative factors a company has, the more likely it will turn out to be unreliable (User Check Regulations, 2020).

Below is given example of the negative factors identified for the company LLC "N", based on the User Check Regulations (see Figure

Based on the analysis of factors identified by the check regulations and other qualitative indicators within the framework of express method of the contractor checking, it can be concluded that the company LLC "N" is unreliable, with the risk that the company most likely uses tax evasion schemes (User Check Regulations for the company LLC "N", 2020).

Conclusion

Study results of theoretical bases of assessment mechanism and contractor risk management lead to the conclusion that this area of risk management is extremely difficult and multifaceted system requiring from companies significant financial and time resources to attract highly qualified specialists and made comprehensive analysis of the contractor for its reliability. At the same time, the advantages of using information-analytical systems by business entities to obtain relevant and reasonable assessments of the reliability of potential contractor are obvious. So, on example of LLC "N" there were demonstrated possibilities of using the Globas system to obtain reliable picture of the risk level of cooperation with this company.

References

- Federal Tax Service of Russia Order (2007). 30.05.2007 N MM-3-06 / 333 @ "On approval of the system of field tax audits Planning Concept".

- Fly-by-night Criteria Assessment for the company LLC "N". (2020). https://globas.credinform.ru/ru-RU/company/getcompany/2da03aff-8aee-4d96-a5f9-0222354c3ef0

- Fly-by-night Criteria Assessment (2020). The tool was developed by experts of the Credinform Information Agency. https://globas.credinform.ru/ru-RU/home/auth

- Globas indices for LLC "N" (2020). https://globas.credinform.ru/ru-RU/company/getcompany/2da03aff-8aee-4d96-a5f9-0222354c3ef0

- Globas Indices (2020). The tool was developed by experts of the Credinform Information Agency. https://globas.credinform.ru/ru-RU/home/auth

- Globas Information Analytical System (2020). Developed and maintained by the CredInform Information Agency. https://globas.credinform.ru/ru-RU/home/auth

- Liquidity index (2020). The tool was developed by experts of the Credinform Information Agency. https://globas.credinform.ru/ru-RU/home/auth

- RF Government Decree (2003). N 367 dated 25.06.2003 "On approval of financial analysis Rules by court-appointed manager"

- RF SAC Bulletin (2006). The Russian Federation Supreme Arbitration Court Plenum Resolution No. 53 dated October 12, 2006 "On arbitration court assessment of justification for obtaining tax benefits by taxpayer".

- Shevtsova, T. (2007). One hundred and nine unreliability features of the company in the eyes of tax inspector. "Accounting, Taxes, Law", 8. https://www.gazeta-unp.ru/articles/27224--priznakov-neblagonadejnosti-kompanii-v-glazah-na

- Skobelev, V. V. (2017). Due diligence and caution in entrepreneurial activity: modern conceptual approaches and set of measures in the company's economic security system. IX International Scientific and Practical Conference "State and Business. Contemprorary Problems of Economics", 29-31.

- Skobelev, V. V. (2019). Determination of "problematic" contractor using the Globas Information Analytical System. In XIX Scientific-Practical Conference Papers (pp. 228-235). Kostroma State University.

- Solvency index (2020). The tool was developed by experts of the Credinform Information Agency. Retrieved 12 March 2020, from: https://globas.credinform.ru/ru-RU/home/auth

- The Federal Tax Service Letter (2017). No. AS-4-2/8872 dated May 12, 2017 "On confirmation of due diligence in the selection of contractors".

- User Check Regulations for the company LLC "N" (2020). https://globas.credinform.ru/ru-RU/company/getcompany/2da03aff-8aee-4d96-a5f9-0222354c3ef0

- User Check Regulations (2020). The tool was developed by experts of the Credinform Information Agency. https://globas.credinform.ru/ru-RU/home/auth

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

21 October 2020

Article Doi

eBook ISBN

978-1-80296-089-1

Publisher

European Publisher

Volume

90

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1677

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Skobelev, V. V., Rybchinskii, O. M., & Samoylov, A. V. (2020). Innovations Of Contractor Checking Using The Globas Information And Analytical System. In I. V. Kovalev, A. A. Voroshilova, G. Herwig, U. Umbetov, A. S. Budagov, & Y. Y. Bocharova (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST 2020), vol 90. European Proceedings of Social and Behavioural Sciences (pp. 1255-1263). European Publisher. https://doi.org/10.15405/epsbs.2020.10.03.144