Abstract

The article, based on Russian and foreign scientific works, considers approaches to digitalization of the state control system elements, assesses availability or possibility of implementing "smart technologies". Within this framework, such elements of the state control system are identified as: departmental electronic document management ; monitoring of information and telecommunication network Internet; the remote data collecting, as well as automated analysis and verification of compliance with mandatory requirements of the collected data on the control objects. The purpose of the study is to present the theoretical foundations and consider the application of the main tools of "smart technologies" in the field of state control of fiscal relations in the Russian Federation. The research object is "smart technologies" in the field of digital state control of fiscal relations in Russia. The choice is determined by the fact that the designated area is considered by government agencies and the business community to be the flagship in terms of implementing "smart technologies" in practical use. "Smart technologies" of state control systems were divided into the following several groups: the identifiers; the non-automated devices; the automatic control devices; the information systems. Examples of specific applications are given for each of the groups, as well as responsible operators and regulatory authorities. In conclusion, the article presents development directions for digitalization of the sphere of state control of fiscal relations in the Russian Federation and provides recommendations for stimulating this process.

Keywords: Smart technologiestaxationcontrolfiscal relationsdigital economydigitalization

Introduction

Modern digitalization processes associated with the implementation of "smart technologies" into practice both at the level of regulatory authorities and at the level of economic entities occur in most sectors of the economy. The importance of developing "smart technologies" from the perspective of various stakeholders is undeniable, since they allow building fundamentally new processes of interaction between the state and economic entities, as well as the latter among themselves.

There is no single approach to the definition of "smart technologies" today, however, the general approach combines several components into this category, namely " smart»:

systems,

appliances,

home,

materials,

other innovative components.

Within the framework of this research, we will focus on "smart technologies" used in the field of digital state control of fiscal relations between various economically active entities in the Russian Federation.

Problem Statement

The use of "smart technologies" in the field of state control of fiscal relations has been considered in the works of Russian scientists. Abzalov et al. (2018) considered the issues of taxes and taxation in the digital economy. Vishnevsky and Chekina (2018) reviewed the issues and solutions of functioning the machine and man in the role of inspector in the tax system in Industry 4.0. Shalneva (2019) considered the application of blockchain technology in the control of transfer pricing. Alekhnovich and Nikitin (2018) revealed the main elements of the "smart" tax system and tax policy of the Russian Federation.

The works of foreign scientists also analyzed various issues of the topic under consideration. Wijaya et al. (2019) studied the use of smart contracts in taxation. Demirhan (2019) considered the issues of efficiency of the taxation system based on Blockchain technology. Kablan (2019) presented the features of accounting and taxation of cryptocurrencies in emerging markets. Garcia (2020) considered the technology of artificial intelligence, the Internet of things, big data and technologies in the digital economy using blockchain to meet the needs of smart humanity in a sustainable way.

Despite a fairly extensive list of works, the issues of using "smart technologies" in the field of state control of fiscal relations in the Russian Federation are, in our opinion, insufficiently systematically disclosed. The author's view allows considering the main elements of smart technologies in the field of fiscal control, implemented in electronic form in the Russian Federation.

Research Questions

This study addresses the following issues.

What is the essence of the "smart technologies" category in the Russian Federation?

What are the main elements of the system of state control, including fiscal control, implemented electronically through "smart technologies"?

What specific tools that allow data collection, automatic analysis, verification of compliance, detection of violations or evidence of potential violations are included in the system of state control through "smart technologies"?

Purpose of the Study

The purpose of the study is to present the theoretical foundations and consider the application of the main tools of "smart technologies" in the field of state control of fiscal relations in the Russian Federation. The object of research is "smart technologies" in the field of digital state control of fiscal relations of the Russian Federation. The choice is determined by the fact that the designated area is considered by government agencies and the business community to be the flagship in terms of implementing "smart technologies" in practical use. This experience is of interest not only within countries but also at the international level, as evidenced by the appointment in 2013 Vice-Chairman of the Bureau Forum on Tax Administration of the Organization for Economic Cooperation and Development head of the Federal Tax Service of Russia.

Research Methods

The process of implementing "smart technologies" in the activities of state authorities in Russia has received a vector of orientation and impact for implementation in the presidential address to the Federal Assembly on February 20, 2019, which set the task of reorienting the state's fiscal policy to the use of modern information and telecommunication technologies. Today, the state is implementing mainly punitive measures, when the priority of sanctions procedures, such as fines, penalties, forfeits and other similar payments, will be replaced by a risk-based approach, in which the priority of control procedures will be given to the task of preventing violations through operational consulting using digital technologies.

Today, there is no single scientifically accepted definition of the category of digital state control, so it is usually understood as any practice of using information and telecommunication technologies in the implementation of regulatory functions of the tax authority. Let's list the main elements of the state control system implemented in electronic form (Skorobogatykh et al., 2019).

1) Departmental document management for planning, conducting and processing the results of control measures. By definition, electronic document management is a set of processes for handling documents presented in electronic form in a software product without the use of paper media. The document management system is organized in one of two ways: either by entering into an electronic document management agreement with the counterparty and then exchanging electronically signed documents via e-mail, or through a special operator (a third-party legal entity). Such a legal entity or vendor is a provider of document management services by installing specialized software from the customer or providing access to cloud services with similar functionality on the company's servers (Valentey et al., 2014).

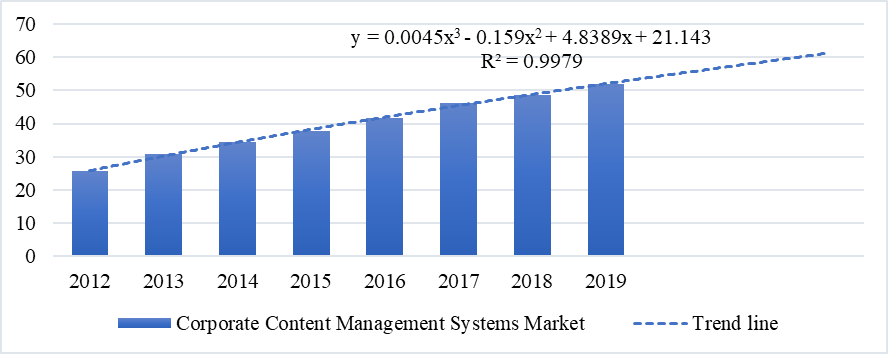

It should be noted that the market of electronic document management systems, which can be an integral part of the corporate content management system (Enterprise Content Management or ECM), has been actively developing in the Russian Federation in recent years, as shown in Figure

Source: compiled by the authors according to data (EDM Russian market, 2020)

According to preliminary estimates of the results of 2019, the growth of this market segment was about 7 %, and its volume did not exceed 52 billion rubles. However, the growth potential in the future is significant, especially taking into account the factor of digitalization of the public sector of the economy, which is confirmed by the trend analysis.

The use of electronic document circulation determines the digitization of information and significantly increases the speed of data exchange, however, the procedure for interaction between the inspector and the person being checked remains generally the same: desk checks relate to electronic documents, and field checks are carried out in the same format for all forms of documents on the territory of the person being checked. This element does not bring any drastic qualitative changes to the control process (Valentey, 2005).

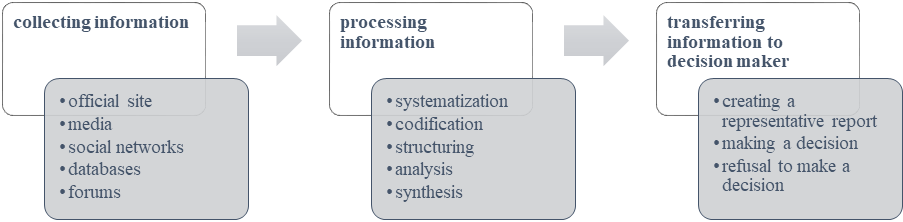

2) Monitoring of the Internet information and telecommunication network in relation to the checked object of control in terms of compliance with mandatory requirements. This direction involves conducting control measures based on open data on the Internet, working with fully digital information. At the same time, this direction is poorly automated due to the inability to structure tasks to algorithmic, which causes the need to work manually. This type of control measures includes, in fact, the search for any information, including information prohibited from dissemination about the activities of the agent being checked (so-called "data leaks"), as well as information, the publication of which is mandatory for organizations in accordance with the legislation of the Russian Federation. Data collection and analysis is carried out by employees of control bodies "manually".

It is worth noting that the tools of the employee-analyst are used not only to go to specific research sites of public and private organizations, but also to use "smart technologies" that aggregate various types of information. Such systems include content aggregators-programs or services that collect data from different news channels, websites, forums, and blogs into a single source. For example, the most accessible news aggregator in Russia is Yandex.News, the accessible news storage is the information and analytical system "Polpred", a tool for assessing the information flow in relation to a specific topic, as well as the emotional color and nature of publication in the media and social networks is the information and analytical system "Medialogiya", many other software and cloud services. The "smart" component of these systems is the ability to automatically monitor content and generate reports on a given topic, however, moderation and analysis of results are left to the user.

In general, this area of control activity is still low-performing, although it is carried out entirely in the digital sphere (Gryzunova et al., 2019).

Nevertheless, based on such needs of the state and the corporate sector, a separate market for monitoring services of open information sources has appeared, the volume of which is estimated at 3.3-4 billion rubles. The national market for monitoring solutions began to form more than 7 years ago and has been actively developing since then. The niche services began to appear, specialized information and analytical support of business. In this case, in addition to media and social networks, in the list of sources includes databases to EGRUL, areas of public procurement and many other sources (Kirsanova, 2019).

In general, the principle of such systems is shown in Figure

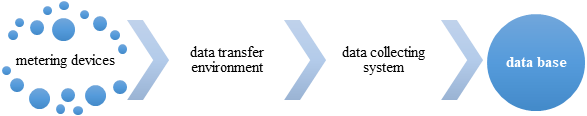

3) The remote data collection on the parameters of the monitoring objects is a data collection system consisting of a recorder and software. The program is installed either on the computer of the operator-controller, or on a dedicated collection server and provides automation of the collection and processing of incoming information. To expand the range of information reception, various data exchange and transfer interfaces can be connected to the collection server. The general principle of operation of such systems is shown in Figure

4) Automated analysis and verification of compliance with mandatory requirements of collected data about control objects. This direction, combined with remote data collection, allows you to increase the number of objects being checked, as well as to increase the level of detail of the verification process while maintaining the number of operators-inspectors.

Source: compiled by the authors

The above-mentioned approaches help to reduce the need for traditional Desk and field inspections, which significantly optimizes the time spent by officials (Romanchenko et al., 2019).

From the point of view of digitalization and the possibility of integration into the system of "smart technologies", the third and fourth directions have a significant potential for qualitative changes in the process of state control. It is expressed in the reduction of labor costs for the verification process, partial automation, which makes it possible to increase the effectiveness of control measures and optimize the costs of their implementation.

Findings

If the national audit is being looked more narrowly, it is limited to specific tools that allow data collection, automatic analysis, verification of compliance, detection of violations or evidence of potential violations. The "smart technologies" of the state control system can be divided into the following several groups.

1) Identifiers are devices that store information in digital format about controlled objects and are read automatically. The most popular are standard barcodes, RFID tags, and QR codes, a comparative analysis of which is presented in table

In practice, RF identifiers are used extensively: with mandatory labelling of alcoholic products, operator is the Federal service for alcohol market regulation and the Supervisory authorities are the Federal Customs Service of Russia, Ministry of Internal Affairs of Russia and corresponding bodies of subjects of the Russian Federation; the issuance of veterinary accompanying documents in electronic form, the operator performs the Rosselkhoznadzor, and regulatory authorities – the bodies of veterinary supervision in the constituent entities of the Russian Federation; when labeling fur products, the operator is the Federal Tax Service of Russia, and control is carried out by the Federal Tax Service of Russia together with Rospotrebnadzor.

2) Non-automated devices are designed to monitor the activity of the object of control without automatically checking for compliance with mandatory requirements. That is why they cannot be called "smart" in full, but they carry a digital component.

As an example, remote sensing by Rosreestr and Rosselkhoznadzor should be cited; photography of the earth's surface by the Main Department of State Construction Supervision for the purpose of examining objects under construction or constructed, their further administration and systematization of land relations in the Russian Federation. Photo materials obtained using aircraft and space vehicles are analyzed by employees of the Unified State register of Real Estate. If necessary, employees conduct additional checks at their discretion. In addition, as an example, it is worth mentioning video monitoring in the field of improvement of Moscow, which is carried out by Mosgortelecom from the position of the operator, and the control is carried out by the Association of Administrative and Technical Inspections (Control and supervisory and licensing activities in the Russian Federation, 2018).

3) Automatic monitoring devices allow recording the parameters of controlled activities and transmit information to the appropriate information systems. Such devices are the components of a "smart control system", which can be divided into personalized automatic control devices (installed on specific objects to be checked) and automatic devices for monitoring an indefinite circle of people (installed on open objects with an indefinite circle of people).

As an example, it is necessary to bring the mandatory use of tachograph (control by Rostekhnadzor and the Ministry of Internal Affairs Russia), the means of registering motion in the carriage of ethanol and alcohol, as well as automatic measuring and accounting of ethyl alcohol, alcoholic and alcohol-containing products (control by Rosalcoholregulirovanie), the on-Board device for calculation of the Platon charging system (control by LLC "RT-Invest Transport System") and others.

4) Information systems are designed to collect and analyze data about control objects received from sensors, or provided by the control objects themselves to identify prerequisites for potential violations, as well as to identify violations themselves or collect data about violations that have already occurred (Zakharova et al., 2018).

As an example, we will describe the automated system used by the Federal Tax Service of the Russian Federation for monitoring the reimbursement of value-added tax. This system automatically compares data from each individual taxpayer's reports with information received from its suppliers and buyers. If there is a discrepancy in the value added tax chain, the system informs the business entity-the taxpayer. The latter, in turn, must explain the reason for the discrepancy in data, and in the absence of such explanations, the situation is analyzed by the tax inspector (Bondarenko et al., 2018). It is within its competence to make a decision on compensation of value-added tax to an economic entity-taxpayer after consideration of a disputed situation. Thanks to the automated value-added tax control system, the Federal Tax Service of the Russian Federation managed to exceed the tax revenue plan by the end of 2019, despite the decline in oil prices and a high comparison base for previous years, providing 76% of the revenue of the country's budget and tax system. In absolute terms, the growth of non-oil and gas revenues amounted to 1.87 trillion. rubles, the growth rate year on year - 12.2%. The use of an automated value-added tax control system, as well as some other hardware and software tools, allows the tax service as a whole to remotely identify risk zones, conduct a detailed pre-verification analysis, and go out with a check only in exceptional cases. It is also worth noting the automation of customs control by the Federal Customs Service of the Russian Federation, which significantly accelerated and simplified the procedure.

Conclusion

Within the framework of our research, such elements of the state control system were identified as: departmental electronic document management; monitoring the information and telecommunication the Internet network; the remote data collection, as well as automated analysis and verification of compliance with mandatory requirements of the collected data on the objects of control.

"Smart technologies" of state control systems were divided into the following several groups: the identifiers; the non-automated devices; the automatic control devices; the information systems. If we try to generalize all the practices of using "smart technologies" in the state control, we can see the following scale: the largest number of them are personalized automatic control devices, followed by a significant margin are automated identification tools, automatic devices for monitoring an indefinite number of people and non-automated remote control devices. This rating is completed by the information systems of automatic analysis, which is quite understandable – these tools, although they provide the most extensive features, are the most complex and expensive in the process of creating and operational developing.

Before the main institution of the state fiscal control (the Federal Tax Service of the Russian Federation) are facing serious challenges, the main of which are: formation of conditions for effective use of cryptographic protection of information; the development of cryptographic, biometric identification; establishment of standards for processing large scale data, and then create them – search measures for improving standards; legislative fixing of new terms, including "electronic document management"; definition of procedures for storage of electronic documents, including their copies and duplicates; giving legal significance to automated self-executing contracts, as well as entering into transactions in electronic form; creating and using a "cloud" electronic signature. The list presented is not closed but requires constant clarification and additions.

Despite the extensive tools of "smart technologies" in state control of fiscal relations in the Russian Federation, the "artificial intelligence " will not be able to replace a person with all the weak optimization and financial potential of the latter. The "smart technologies" are based on "artificial intelligence", but it is important to remember that it itself is a man-made technology, an algorithm for choosing a solution within a specific task. This algorithm is created by a person and adjusted from the outside, the system itself can not reflect by analogy with the mind or intelligence of a person. That is why the most high-tech companies and developed economies in the process of stimulating "smart technologies" and digitalization give priority not to import the technologies themselves, not to purchase and copy software products, but to support and stimulate the development of human potential, which is the main creative actor that creates new programs and technologies.

References

- Abzalov, K. V., Bikbova, А. M., Votinova, Е. I., & Shlyakhtin, А. Е. (2018). Taxes and taxation in the digital economy. Materials of the International student scientific and practical forum on financial literacy Volgograd State University, 48-63.

- Alekhnovich, А. О., & Nikitin, K. М. (2018). "Smart" tax system. Scientific works of the Free Economic Society of Russia, 209(1), 25-44.

- Bondarenko, T. G., Orekhov, S. A., Sokolnikova, I. V., Soltakhanov, A. U., & Khmelev, I. B. (2018). Analysis of the performance efficiency of the largest corporations in Russia. Espacios, 39(36).

- Control and supervisory and licensing activities in the Russian Federation (2018). Analytical report. RSPP and HSE.

- Demirhan, H. (2019). Effective Taxation System by Blockchain Technology. Blockchain Economics and Financial Market Innovation, 347-360.

- Garcia, A. R. (2020). AI, IoT, Big Data, and Technologies in Digital Economy with Blockchain at Sustainable Work Satisfaction to Smart Mankind: Access to 6th Dimension of Human Rights. Smart Governance for Cities: Perspectives and Experiences, 83-131.

- Gryzunova, N. V., Pyatanova, V. I., Manuylenko, V. V., & Ordov, K. V. (2019). Models of credit limit-setting for companies as a means of encouraging competitiveness. Entrepreneurship and Sustainability, 7(1), 615-625.

- Kablan, A. (2019). Accounting and Taxation of Crypto Currencies in Emerging Markets. Blockchain Economics and Financial Market Innovation, 381-405.

- Kirsanova, A. (2019). Market overview of open source monitoring services. Anti-Malware.ru. https://www.anti-malware.ru/analytics/Market_Analysis/media-monitoring-services-in-russia#part3

- Markushina, Yu. A., & Slavkina, Yu. S. (2011). RFID-technologies in trade. Economics and Management: new challenges and prospects, 2, 301-304.

- Romanchenko, O., Shemetkova, O., Piatanova, V., & Kornienko, D. (2019). Approach of estimation of the fair value of assets on a cryptocurrency market. Advances in Intelligent Systems and Computing, 850, 245-253.

- Shalneva, M. S. (2019). Use of blockchain technology in transfer pricing control. Architecture of Finance: new solutions in the digital economy. Proceedings of the IX International Scientific and Practical Conference, 63-66.

- Skorobogatykh, I. I., Shishkin, A. V., Murtuzalieva, T. V., Pogorilyak, B. I., & Gorokhova, A. E. (2019). Marketing tools for development of the tourist and recreational area. Journal of Environmental Management and Tourism, 9(2), 343-354.

- Valentey, S. (2005). Counterinnovative environment of the Russian economy. Voprosy Ekonomiki, 10, 132-143.

- Valentey, S. D., Bakhtizin, A. R., Bukhvald, Y. M., & Kolchugina, A. V. (2014). Development trends of the Russian regions. Economy of Region, 3, 9-22.

- Vishnevsky, V. P., & Chekina, V.D. (2018). Robot vs. tax inspector or how the fourth industrial revolution will change the tax system: a review of problems and solutions. Journal of Tax Reform, 4(1), 6-26.

- Wijaya, D. A., Liu, J. K., Steinfeld, R., Liu, D., Junis, F., & Suwarsono, D. A. (2019). Designing Smart Contract for Electronic Document Taxation. International Conference on Cryptology and Network Security. CANS 2019: Cryptology and Network Security, 199-213.

- Zakharova, D. S., Soltakhanov, A. U., Zhdanova, O. A., & Arabyan, K. K. (2018). Course of the rouble as an indicator of the state of Russia's economy under sanctions. Espacios, 39(18).

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

21 October 2020

Article Doi

eBook ISBN

978-1-80296-089-1

Publisher

European Publisher

Volume

90

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1677

Subjects

Economics, social trends, sustainability, modern society, behavioural sciences, education

Cite this article as:

Shuvalova, E. B., Bolvachev, A. I., & Gordienko, M. S. (2020). Smart Technologies In State Control Of Fiscal Relations Of The Russian Federation. In I. V. Kovalev, A. A. Voroshilova, G. Herwig, U. Umbetov, A. S. Budagov, & Y. Y. Bocharova (Eds.), Economic and Social Trends for Sustainability of Modern Society (ICEST 2020), vol 90. European Proceedings of Social and Behavioural Sciences (pp. 1149-1158). European Publisher. https://doi.org/10.15405/epsbs.2020.10.03.132