Abstract

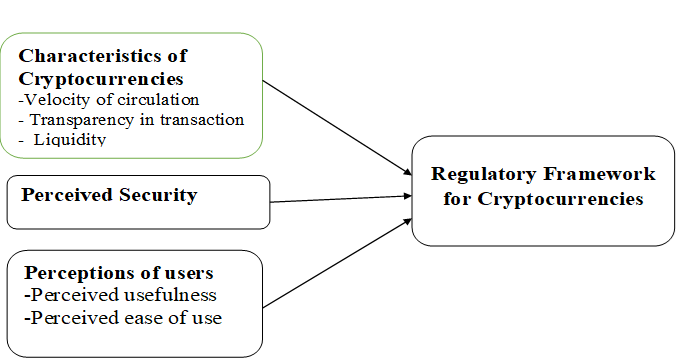

Malaysian regulators have recently published policy regulations for digital currency exchange that operate in the country, which are primarily intended to safeguard against money laundering and the risk of terrorism financing. Notably, previous theoretical and empirical studies have been conducted to explore the government governance on digital currency. However, development of regulatory framework of digital currency in Malaysian context is still lacking in many ways. The current study is based on the former foresight research results and literature review. It highlights the perception of regulators in the world, legal status and taxation policies of digital currency in Malaysia. Thus, the study proposes a conceptual framework that suggests the variables of characteristics of digital currency, perceived security and perceptions of users are important to be considered in developing a conceptual regulatory framework in Malaysian perspectives. The regulator(s) may gain insights of the degree of acceptance of digital currencies and the regulatory frameworks among Malaysians. The development of conceptual regulatory framework will shed insights on designing strategies to achieve an effective and robust Anti-Money Laundering and Counter Financing of Terrorism (AML/CFT) control measures associated with the use of digital currency. Such measures will be critical in safeguarding the safety and integrity of the financial system, and in promoting greater transparency in the conduct of digital currency transactions among current and potential investors.

Keywords: Digital currencyregulatorymeasuresworldMalaysia

Introduction

In the 1980s, cryptographer David Chaum devised an extraordinary secured algorithm that allowed for the kind of encryption required in electronic fund transfer (Stark, 2017). Chaum’s blinding algorithm laid the foundation for the future development of all types of digitalised currency transactions. Many cryptocurrencies exist in the market, such as Bitcoin, Dogecoin, Litecoin, Mastercoin, Namecoin, Ripple, Zerocoin, etc. Among the most popular cryptocurrency technology is Bitcoin which supplies both payment and currency system. The illicit motives are currently driving the cryptocurrency revolution. According to a research carried out in Australia, approximately half of the Bitcoin transactions and one quarter of the users are associated with unlawful activities, which amounted to USD72 billion per annum in value of unlawful trades through cryptocurrency (Foley et al., 2018).

Bank Negara Malaysia (BNM) reported an average of RM75 million in transactions of Bitcoin and other cryptocurrencies each month in Malaysia on four (4) active digital currency namely Luno, Coinhako, XBit Asia and PinkExchange (Zainal, 2017). In 2018, one of the cryptocurrency exchangers hit a trading volume of some RM500 million from Malaysian trades. According to Abdul Rasheed Ghaffour, the Deputy Governor, even though, digital currencies are not legal tender in Malaysia, the BNM is not stopping the trading of Bitcoin because a ban would just curb innovation and creativity (The Star, 2017).

Legal Status of Digital Currencies in Malaysia

The high volatility of the value of digital currency and the lack of support by any authority are exposing the users to potential financial loss. Malaysian regulators are introducing measures to safeguard against the associated financial risks. On 27th February 2018, Bank Negara Malaysia (BNM) issued a policy entitled “Anti-Money Laundering and Counter Financing of Terrorism (AML/CFT) – Digital Currencies (Section

The Perception of Regulators in the World

A cryptocurrency is any kind of peer-to-peer digital money powered by Blockchain technology, which is the first decentralised payment system in the world. Bitcoin is a virtual digital currency introduced by a Japanese Mathematician, Nakamoto (2009). Since its creation, many different types of cryptocurrencies were introduced to the market. Different terms were used by different countries to refer to cryptocurrency. The terms include digital currency (Malaysia, Argentina, Thailand, Australia), cyber-currency (Lebanon, Italy), electronic-currency (Lebanon, Colombia), token (Germany, Switzerland), virtual-commodity (China, Canada, Taiwan) and virtual-asset (Mexico).

There are different perceptions of cryptocurrencies from different stakeholders around the world (Congress, June 2018). The most common reaction by the governors is issuing statement to warn public about the high risk of investing in cryptocurrencies due to its high volatility and the lack of regulatory control. Some governments are attentive to the possibilities that cryptocurrencies facilitate illegal activities specifically funding terrorism activities and money laundering; and thus, some countries have enacted the money laundering and counter terrorism act in their nations. Many countries passed laws on anti- money laundering, counter-terrorist financing and unlawful activities that can be carried out by individuals or institutions through dealing with cryptocurrencies. These countries include Australia, Canada, Estonia, Denmark, Japan, Luxembourg, Singapore, South Korea, Switzerland, Mexico while another group of jurisdiction imposes taxation law.

Some policy makers reacted more intensely and imposed restriction on the activities, both the investments and the use of cryptocurrencies in payment. Voluminous states, for example Macau, Algeria, Bolivia, Egypt, Ecuador, Morocco, Iraq, Namibia, Nepal, Pakistan, South Africa, Turkey, Vietnam and United Arab Emirates impose ban on activities engaging in cryptocurrencies. Bahrain restricts cryptocurrencies activities within the country but the dealings outside the country are not regulated by the law of Bahrain. Other countries like Bangladesh, China, Colombia, Iran, Lesotho Lithuania and Thailand impose the barring of transaction on the financial institutions inside their boundaries. Nonetheless, not all perceive that digital currency is a threat. Some appreciate the contributions of the blockchain technology and apply friendly response toward this new innovation. A few nations, such as Australia, Germany, Japan, Switzerland and the United States, accept the use of digital currencies as legal tender; thus, it can be used as a legal mean of payment and is recognized as an official money. Besides, countries such as Spain, Luxemburg and Uzbekistan, while not recognizing it as a legal currency, develop a friendly regulatory framework to welcome its use in appreciating the incredible blockchain technology behind it (Congress, June 2018).

The regulation on the ICO (initial coin offerings) also varies across different countries. Bolivia, China, Nepal, Bangladesh, Pakistan Algeria, Macau, Morocco and Ecuador impose an absolute ban on ICO whilst countries such as Russia, Singapore, France, Luxembourg, United States and Thailand take their stance to permit ICOs even though it is heavily regulated by laws within the countries. Other than that, most of the countries around the world permit the ICOs (European Union, Germany, Israel, Saudi Arabia, Lebanon, Turkey, Cyprus, Austria, Croatia, Romania, Poland, Finland, Norway, Denmark, Estonia, Ukraine, Italy, Brazil, Greece, Bosnia, Bulgaria, Ireland, Belgium, Portugal, Spain, Iceland, etc). The classification of the ICO, either in the form of equity, debts, investment, security or derivative, has a direct impact on how the ICOs are regulated across the world (Reese, 2018).

Some rulers launched or planned to launch their own national digital currency. Dubai launched the world’s first state-backed cryptocurrency in 2017 known as Emcash. Venezuela is the second country to launch its own national cryptocurrency named Petro in April 2018. It is backed by Venezuelan oil in barrels and the mineral reserve. Estonia proposed to issue the national cryptocurrency referred to as ‘Estcoin’; however, the proposal is still under review. In October 2017, Putin announced his intention to issue Russia’s state-backed cryptocurrency under the name of the Cryptoruble. Sweden planned to launch its national cryptocurrency which known as E-Kroan with the aims to go entirely cashless. In Asia, Japan is expected to issue J-Coin ahead of the Tokyo Olympics in 2020 (Khatwani, 2019). Even the tech giant, Facebook, announced its intention to launch its cryptocurrency, Libra in the first half of year 2020.

The Taxation Policies on Digital Currencies

There are three types of cryptocurrency taxation imposed by countries around the world. The type of tax is closely related to how cryptocurrencies is being classified. The countries that implement income tax on cryptocurrencies revenue earned by individuals and corporations are mostly situated in Europe, America, Argentina, Belgium, Canada, Denmark, Germany, Japan, Malaysia, Norway, Philippines, Poland, Spain, Switzerland, etc. Capital gain tax imposed on crypto-related assets is based on the ground that cryptocurrencies are investment property or commodities acquired for ownership or trading which is similar to equities, bonds and real assets. It is subjected to tax when the sales proceeds exceed the initial purchase value. Countries with capital gain tax on cryptocurrencies revenue are Australia, Brazil, Bulgaria, Croatia, Finland, France, Israel, South Korea, New Zealand and the United States (Noon, 2019) . On the other hand, there are some countries who deem cryptocurrencies as private money do not classify cryptocurrencies as taxable assets; hence, the currencies are exempted from tax. The list of countries that grant full exemption on cryptocurrencies are Denmark, Italy, Portugal, South Korea, and the Netherlands (Oldale, 2018).

Measures of Digital Currency in Malaysia

Bank Negara Malaysia (BNM) reiterated that Bitcoin and all other cryptocurrencies are non-legal payment methods in Malaysia. Hence, the BNM initiated a policy which compels digital currency exchange traders to report their trading activities (Idris, 2017). Other sections such as legal, accounting firms and real estate agents that do not fall under the BNM’s purview are also required to comply with the reporting obligation. The proposed regulations require businesses to verify their customers’ identities, monitor transactions and report any suspicious activities to the Malaysian authorities. Under the transparency obligations, the public will be provided with relevant information to better understand and evaluate risks associated with the usage of digital currencies. If the reporting institutions failed to declare the digital currency trading, such institutions will face potential terminations or denial of financial service usage.

While the Malaysian regulations do not ban the usage of the digital currencies, the nation still does not officially recognise them as legal tender. In December 2017, a new draft of regulations for cryptocurrency exchanges that operate in the country has been published by the BNM. The public is warned to conduct due diligence and to evaluate the risk involved in it carefully before bringing the currency into any business transactions. In addition, the Securities Commission Malaysia (SCM) is currently working on constructing a legal framework for cryptocurrencies in general (The Economist, 2018). SCM provided public consultation on proposed regulatory framework for issuance of digital assets through initial coin offerings (ICOs) which was due on 29th March 2019.

Many governments are seeking regulations on exchanges. During the first week of December 2017, U.K. government intended to expand anti-money-laundering rules that force cryptocurrency exchanges traders to disclose their identities and report suspicious activity to authorities (The Star, 2017). Japanese government requires the exchange to seek explicit approval and license from the Japanese Financial Services Agency, and henceforth, they have licensed fifteen (15) cryptocurrency exchanges. In July 2017, The U.S. Securities and Exchange Commission (SEC) ruled that the coins for sale are in fact securities and subjected to the agency’s regulation. The Hong Kong and Singapore regulators are practising the same approaches as well. Dubai and Russia have revealed that they will open their own fiat currencies in their countries while Japan and Bangladesh have passed law to prevent the official trade of cryptocurrency (McKenna, 2017). China stepped up their measures to ban and block all domestic and offshore platforms related to virtual currency commercial business to prevent financial risk in February 2018. This measure is taken recently after a few months of formal ban on the investment of initial coins offering (ICO) (Wildau, 2017). The summarises of the governments’ attitude toward cryptocurrencies across countries (i.e., developed and developing countries) in the world is shown in Appendix 1 (see Table

Problem Statement

Notably, previous theoretical and empirical studies have been conducted to explore the government governance on digital currency. However, development of regulatory framework of digital currency in Malaysian context is still lacking in many ways. In other words, conceptualization on the explanation of evidence on some of the contextual variables that may be relevant to digital currency are still insufficient. The conceptual study to examine the factors that affect the development of regulatory framework of digital currency is limited and sparse (Schaupp & Festa, 2018; Yussof & Al-Harthy, 2018).

Research Questions

The discussion of the above sections leads to the following research questions.

What is the impact of the potential issues and challenges on the behavioral intention of potential user of digital currencies?

To what extent does the perceived effectiveness of regulatory framework have on the behavioral intention of potential user of digital currencies?

Purpose of the Study

To review the perception of regulators in the world on the use of digital currency as a medium of exchange, and

To examine the potential issues that may arise from digital currencies related transaction in the perspective of the practitioners in the Malaysian context and

To develop a conceptual regulatory framework of digital currency in the Malaysian perspective.

Research Methods

The paper is based on the former foresight research results and literature reviews from Emeralds, Science Direct, Sage databases, local newspaper sand annual reports. The keywords used to facilitate the search activities are digital currency, cryptocurrency, effectiveness, reporting rules, perception of adoption behaviours. A total of 40 to 45 articles was reviewed throughout the research period. It highlights the perception of regulators in the world, legal status and taxation policies of digital currency in Malaysia as well. In addition, the challenges related to characteristics, perceived security and perception of users are reviewed as the construction of possible regulatory framework scenario.

Findings

Key findings

The key findings from the current study are the challenges faced by using digital currencies, particularly the characteristics, perceived security and the perception of users will be discussed in the following sections.

Challenges of digital currencies

Characteristics of digital currencies

Previous literatures explained some issues related to digital currencies (i.e., cryptocurrency) in the scope of money definition and store of value. The theoretical definition of money considers money as "any asset that is generally accepted for payment for goods or services, or for debt settlement" (Revenda et al., 2005, p. 42). In the case of digital currency, there is inconsistency with requirement of general acceptance even though the rate of cryptocurrency usage increases over time. Cryptocurrency is not significantly associated with banking system, there is no such thing as term deposits or securities issued in cryptocurrency. For example, Bitcoin can be used at any time and therefore differentiation according to the levels of liquidity is meaningless. In terms of liquidity Bitcoin can be equated to money on current accounts in banks, more precisely with regards to the speed of the Bitcoins transfers which is also known as "virtual cash". Bitcoin can therefore be clearly included in M1 rank. However, no other Bitcoin monetary aggregates exist (Kubat, 2015). The cryptocurrency trading is free on unregulated open markets, and beyond the control of any government or other institutions.

To determine the circulation of digital currency is problematic. A number of issued digital currency (cryptocurrency) at any given time is known as the total number of cryptocurrencies that will be issued. This does not mean that all existing cryptocurrencies are in circulation. For instance, there is no existence of Bitcoin savings (i.e. the amount of money that is not deliberately used). There is no mechanism control system to monitor how many digital currencies are actually usable in the economy, and the number of usable digital currencies which are going to be decreased after the end of the particular emissions (Kubat, 2015).

Perceived Security

In terms of end users/ investor/ public perspective, Darlington (2014) proposed the three factors that might hinder the adoption of Bitcoin in struggling economies as (i) the lack of infrastructure, (ii) potential problems with the Bitcoin network itself, and (iii) fear of the unknown. Cryptocurrency is not money in a proper sense as there is no issuer behind them. There are commodities to which users attach value with and nothing tangible to support the currencies. Users will be exposed to a host of risks since the creation, trading or usage of virtual currencies is not authorized by most central banks or monetary authorities (not a legal tender) and is without any regulation and insurance scheme.

For instance, the purchased or mined Bitcoins are thereafter stored in a digital wallet on the user’s computer or at an online wallet service. However, there are risks involved in digital storage, as cryptocurrency stored in digital wallets can be lost permanently due to malware or data loss or even destruction of the physical media (Yussof & Al-Harthy, 2018). Gibbs and Yordchim (2014) found that there is a lack of awareness of the digital currency in Thailand and concluded that the digital currency is not used in the daily business transaction in the country as it has no value and existence. Thus, digital currency will not be used as an exchange mean in the country in the immediate future. On the other hand, unlike the decentralised exchanges, centralised exchanges are exposed to hacking risk. There are more than thirty exchanges being hacked over the past decades.

Perception of users

In view of aforementioned issues of digital currency (i.e., cryptocurrency), it is vital to examine the perception of local intermediaries and the public by assessing the perceived usefulness and perceived ease of use of the digital currency. This will shed light in developing an effective regulatory and practices in enhancing the adoption of digital currency. Nevertheless, digital currency is still an emerging area, and industry focus should be on the potential factors to affect the user’s confidence to accept and adopt them.

Generally, the cryptocurrency trading and payment transactions are carried out among pseudonymous parties in order to ensure financial privacy and non-reversible transactions. But most of the cryptocurrency trading is carried out through the centralised exchanges. Centralized exchanges are trading platforms that function like traditional brokerage house; it allows trades from fiat currency to cryptocurrency and vice versa; it also facilitates trades between two different cryptocurrencies. In addition, advisory services, margin trading and the user friendliness promote the use of cryptocurrency trades. The liquidity advantage is another main contributor to the popular usage of the centralized exchanges. With the existence of these benefits, the perceived ease of use is enhanced. In contrast, Bitcoin, the first cryptocurrency, was built on a block-chain technology, using a peer-to-peer network. It is supposed to be decentralised; however, its lack of simple user interface has led to its much lower trading volumes and this implies the preference of the use of the centralised platform overage the decentralised exchanges.

In addition, there are more than 1,500 cryptocurrencies today and there will be more in the future. Instead of economic value, the cryptocurrencies will become a form of personal expression (e.g., celebrities could issue their own cryptocurrencies) with social value and popularity. In this context, focusing on the individual level is important for the usage of financial technology, particularly to describe how some people might start to use a technology at an early stage, while others want to wait until a large group has started to use (Mikołajewicz-Woz´niak & Scheibe, 2015).

Conclusion

To conclude the discussion above regarding the characteristics of cryptocurrency, perceived security and perception of users provide the integrative, dynamic and conceptual regulatory framework of digital currencies (Figure

In summary, this study helps government authority and financial institutions to understand the global perception of regulators on the use of digital currency as a medium of exchange, how public view the effectiveness of digital currency regulatory framework and the acceptance of the digital currency. It also provides insights on the potential issues which may arise from digital currencies in the perspective of the practitioners in Malaysian context. The current study is limited to conceptualize the perception and understanding towards cryptocurrencies. However, future researchers are encouraged to conduct quantitative research in order to provide empirical findings of the perception of adoption behaviour among users and potential users in the Malaysian perspective.

Acknowledgments

This study is funded by the Ministry of Education, Malaysia through Fundamental Research Grant Scheme FRGS/1/2018/SS01/HELP/02/2.

References

- Bank Negara Malaysia (2017). Making digital currencies transparent in Malaysia, Press Releases Ref. No. 12/17/13.

- Congress, T. L. L. O. (2018). Regulation of Cryptocurrency Around the World. https://www.loc.gov/law/help/cryptocurrency/world-survey.php

- CCN. (2015, November 2). Bitcoin Declared Illegal in Taiwan. https://www.ccn.com/bitcoin-declared-illegal-in-taiwan/.

- Darlington, J. K. I. (2014). The Future of Bitcoin: Mapping the Global Adoption of World’s Largest Cryptocurrency Through Benefit Analysis (Honors Thesis). University of Tennessee. https://trace.tennessee.edu/cgi/viewcontent.cgi?article=2741&context=utk_chanhonoproj

- De, N. (2017, December 14). Malaysia’s central bank releases draft rules for Cryptocurrency exchanges. CoinDesk. https://www.coindesk.com

- Foley, S. A. K., Jonathan, R., & Putnins, T. J. (2018). Sex, Drugs, and Bitcoin: How Much Illegal Activity Is Financed Through Cryptocurrencies? Review of Financial Studies, Forthcoming.

- Fong, V. (2019). Meet the 56 Cryptocurrency Exchanges in Malaysia Registered with BNM. https://fintechnews.my/16980/blockchain/cryptocurrency-exchanges-in-malaysia-registered-bnm/

- Idris, I. (2017). Bank Negara wants digital currency exchangers to report their activities. The Star. https://thestar.com.my

- Khatwani, S. (2019, September 6). List of Countries That Have Plans to Roll Out Their Own Cryptocurrencies. Coinsutra. https://coinsutra.com/national-cryptocurrencies/

- Kubat, M. (2015). Virtual currency bitcoin in the scope of money definition and store of value. Procedia Economics and Finance, 30, 409 – 416. https://doi.org/10.1016/S2212-5671(15)01308-8

- McKenna, F. (2017, December 28). Here’s how the U.S. and the world regulate bitcoin and other cryptocurrencies. Marketwatch. https://www.marketwatch.com/story/heres-how-the-us-and-the-world-are-regulating-bitcoin-and-cryptocurrency-2017-12-18

- Mikołajewicz-Woz´niak, A., & Scheibe, A. (2015). Virtual currency schemes – The future of financial services. Foresight, 17(4), 365-377. doi.org/10.1108/FS-04-2014-0021

- Nakamoto, S. (2009). Bitcoin: A Peer-to-Peer Electronic Cash System. https://bitcoin.org/bitcoin.pdf

- Noon, H. (2019, January 31). From 0% to 55%: A Brief Guide to Cryptocurrency Taxation Around the World. Hackernoon. https://hackernoon.com/from-0-to-55-a-brief-guide-to-cryptocurrency-taxation-around-the-world-f3953cd74e58

- Oldale, R. J. (2018, June 11). Tax Regulations On Cryptocurrencies From Around The World. MXC. https://medium.com/mxcoin/tax-regulations-on-cryptocurrencies-from-around-the-world-7e57bb707f22

- Reese, F. (2018, July 27). ICO Regulations by Country. https://www.bitcoinmarketjournal.com/ico-regulations/

- Revenda, Z., Mandel, M., Kodera, J., Musilik, P. K., Divorak K. P., & Brada, J. (2005). Monetary, Economics and Banking 4, Supplemented issue. Praha. Management Press.

- Schaupp, L., & Festa, M. (2018). Cryptocurrency Adoption and the Road to regulation. Proceedings of the 19th Annual International Conference on Digital Government Research: Governance in the Data Age, 1–9. https://doi.org/10.1145/3209281.3209336

- Stark, H. (2017, April 21). From here to where? Bitcoin and the future of cryptocurrency. Forbes. https://www.forbes.com/sites/haroldstark/2017/04/21/from-here-to-where-bitcoin-and-the-future-of-cryptocurrency/#5fdeaf354367

- The Economist Intelligence Unit. (2018, February 5). Malaysia's central bank issues cryptocurrency regulation. The Economist. http://www.eiu.com/industry/article/1426386726/malaysias-central-bank-issues-cryptocurrency-regulation/2018-02-05

- The Star (2017, December 6). Malaysian regulators likely enforce licensing for cryptocurrency exchanges. The Star. https://www.thestar.com.my/business/business-news/2017/12/06/tight-rein-on-icos

- Gibbs, T., & Yordchim, S. (2014). Thai Perception on Bitcoin Value World Academy of Science. Engineering and Technology International Journal of Humanities and Social Science, 8(7), 2334-2336.

- Wildau, G. (2017, September 4). China central bank declares initial coin offerings illegal. Financial Times. https://www.ft.com/content/3fa8f60a-9156-11e7-a9e6-11d2f0ebb7f0

- Yussof, S. A., & Al-Harthy, A. (2018). Cryptocurrency as an Alternative Currency in Malaysia: Issues and Challenges. Islam and Civilisational Renew, 9(1), 48-65.

- Zainal, I. F. (2017, December 15). BNM: RM75 million cryptocurrencies transactions each month. The Star. https://thestar.com.my

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

12 October 2020

Article Doi

eBook ISBN

978-1-80296-088-4

Publisher

European Publisher

Volume

89

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-796

Subjects

Business, innovation, sustainability, environment, green business, environmental issues, urban planning, municipal planning, disasters, social impact of disasters

Cite this article as:

Tenk, M. T. T., Chin, W. S., Heong, A. Y. K., & Saleh, Z. (2020). The Regulatory Framework of Digital Currencies in Malaysia: A Conceptual Paper. In N. Samat, J. Sulong, M. Pourya Asl, P. Keikhosrokiani, Y. Azam, & S. T. K. Leng (Eds.), Innovation and Transformation in Humanities for a Sustainable Tomorrow, vol 89. European Proceedings of Social and Behavioural Sciences (pp. 258-269). European Publisher. https://doi.org/10.15405/epsbs.2020.10.02.24