Abstract

The article deals with organizational and legal issues of the digital currency usage in settlements and payments, which are recognized as relevant all over the world. The article analyzes the identified gaps in the legislation that create problems for the business community in using of digital currencies. The authors paid special attention to the risks for business communities and identified and analyzed the risks for State as a whole. The analysis of risks, including criminal-legal: charge in money laundering, in illegal banking activity, and, in connection with not fixed system of the taxation at implementation of the specified operations, and in non-payment of taxes is carried out. Goals, objectives and opportunities in solving urgent problems of minimizing and levelling risks in the field of using digital currencies are considered. The solutions of emerging problems by introducing supervisory measures to reduce possible losses of the business community and State are proposed. It is proved that the risks of participants of these systems should be solved at the state level, since only the establishment of supervisory measures can reduce the possibility of losses from illegal actions of digital society participants. The authors note that the elimination of gaps in legislation and the introduction of supervisory measures by the state will create the possibility of legal use of digital currencies, which will certainly increase investment interest to the country. In turn, the organizational and legal improvement of the system of settlements and payments will contribute to the economic growth of our country.

Keywords: Digital currencysupervisory measureslegal risksblock chain

Introduction

There are no direct prohibitions to use of digital currencies in financial transactions in Russia, except the position of the Bank of the Russia, which controls and supervises the functioning of the national payment system, and Federal Financial Monitoring Service, whose powers include Anti-Money Laundering and Counter-Financing of Terrorism (hereinafter AML/CFT). Representatives of these agencies, since 2014, speak sharply negatively about such financial transactions. Financial transactions using digital currencies are made, but remain within the gaps of the legislation, because in the Russian Federation there are no rules governing the turnover of digital currencies.

Problem Statement

For the business community, the absence of legislative prohibitions opens up opportunities in this area, on the other hand, does not cancel the risks, including criminal law: the accusation of money laundering, illegal banking activities, and in connection with the loose tax system in the implementation of these operations, it is also possible in the non-payment of taxes.

When carrying out exchange operations of digital currency to fiat (the national currency of a state) and vice versa, one can be accused in carrying out illegal banking activities or this can be reclassificate into illegal business activities. For example, in 2018, the staff of the criminal investigation Department detained three members of the group who carried out illegal banking activities by using one of the international payment systems and bitcoin exchange platform. A case has been brought against them under part 2 of article 172 Criminal code of the Russian Federation «Illegal banking activities committed by an organized group, with the extraction of income on a large scale».

The money laundering charge is one of the most discussed issues in the world. When forming the legal basis for the use of digital currencies (cryptocurrencies) in most countries, the procedures “know your customer” (hereinafter KYC) and AML/CFT ones are introduced first of all. The practice of prosecution in Russia has not developed, but given the vagueness of the wording in article 174 of the Criminal code of the Russian Federation, according to the authors, the probability of prosecution is very high. The risk of being accused of tax evasion is also quite real, although there are no precedents yet.

There is a wide discussion about the risks of using digital currencies, as well as their advantages. The opinion on this problem has already been expressed by scientists Levis, Muradoǧlu, and Vasileva (2016), Kiselev and Nechaeva (2018), Corbet, McHugh, and Meegan (2017), Cvetkova (2018), Czapliński and Nazmutdinova (2019), Kolomeytseva (2019), McKenzie, Burt, and Dukeov (2018), Shaydullina (2018) and Evanoff (2019).

Research Questions

How to avoid the risks of using digital currencies?

Are there risks only for the business community or for the state too?

Should the state take measures to mitigate risks?

What are the benefits for economic actors and the state in the use of digital currencies?

Purpose of the Study

This study was conducted in order to develop proposals for leveling the risks in the field of settlements and payments for the use of digital currencies for the business community and the state as a whole. To achieve this goal, according to the authors, it is necessary to solve the following tasks: to determine the risks of using digital currencies, both for the business community and for the state. Current practice requires the development of supervisory measures that mitigate these risks.

Research Methods

A wide range of methods was used to solve the tasks in the study: formal-legal, system analysis, generalization and analogy. The formal legal method allowed to solve the tasks related to the formulation of problems of using digital currencies. The method of system analysis provided the reliability of the study, as it analyzed the existing risks of their using for the business community and the state. Methods of analogy and generalization contributed to the formation of proposals for the necessary supervisory measures, leveling these risks. The potential of the used methods allowed to solve the problems posed in the study.

Findings

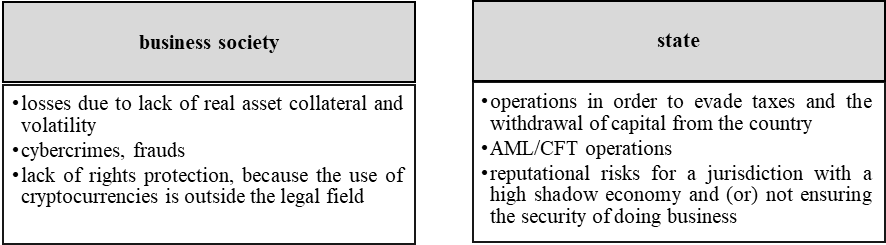

In addition to the risks listed earlier in the Problem Statement section, at the moment the use of digital currency (cryptocurrency) carries other risks, both for the business community and for the state, the main of which are presented by the authors in figure

It is possible to mitigate risks when using digital currencies by creating a legal framework. Legal regulation should be aimed at protecting the rights of participants in distributed registry systems - the business community. The risks of participants in these systems specified in figure

The formation of a legal environment conducive to the development of the system of settlements and payments will ensure the economic growth of the state, and, for example, a ban on exchange operations with digital currencies can only increase reputational risks. According to experts (Kuznetsov, Prokhorov, & Pukhov, 2017), such a ban will provoke the departure to the shadow market of the sphere of circulation of digital currencies, the emergence of "gray network exchangers", state control over the activities of which will be difficult to implement.

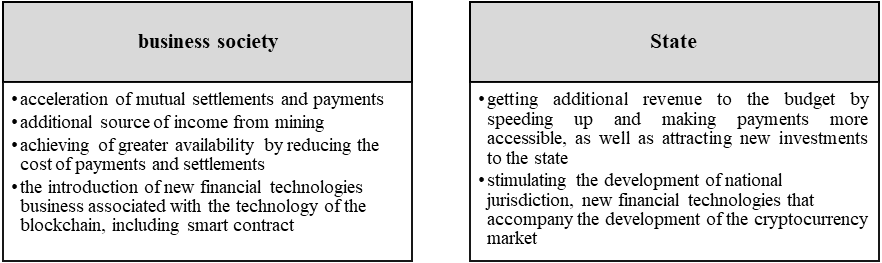

Issues related to the use of cryptocurrency in making payments and settlements are currently causing a wide discussion among scientists and practitioners not only in Russia, but also in the world. In our country, public authorities, paying attention to the advantages of using cryptocurrency, seek to assess the risks. These advantages, as well as risks, can be divided into two categories. The first category is related to citizens and legal entities (business), and the second – to the state as a whole, taking into account the reputational risks of national jurisdiction.

The advantages for the business community associated with the use of cryptocurrency in payments and settlements are determined by the principles of the block chain platform:

the distributed registry is not filled in with data that is restricted in accordance with the legislation of the Russian Federation;

legal significance of digital transactions carried out by maintaining a distributed registry;

no technological need for intermediaries;

using smart contract technology;

scaling, i.e. storing and recording digital transactions for each participant of the blockchain platform;

absence of a single point of failure, guarantees the safety of data about completed digital transactions, i.e. increased security requirements;

distributed accounting of resources needed to support the platform.

The existing advantages of using cryptocurrency for the business community and the state are presented by the author in figure

Acceleration and cost reduction in mutual settlements and payments is achieved through the use of blockchain technology. The blockchain platform is actually a payment system created on the basis of the distributed registry technology and the blockchain data structure. According to forecasts, credit organizations can save about 60-75% on counter – transaction processing, product structuring, account management, audit and financial control after switching to blockchain technology, and about 50% on the whole in terms of operating activities when transferring all processes to the new technology, the savings can be increased to 80%.

Participants of the blockchain platform have equal rights to maintain a distributed registry. Intermediaries for money transfers are not provided by this technology. The absence of intermediaries helps to reduce the material and time costs for conducting a digital transaction.

The blockchain platform provides a reward system for validators (miners) for processing digital transactions calculated in cryptocurrency. When calculating remuneration for miners, the cost of calculations performed within the transaction, as well as the percentage for the amount of data entered in the distributed register, should be taken into account. Abroad (for example, Poland, Czech Republic, Singapore, New Zealand), the activity of miners is considered as a business activity.

The advantages of using cryptocurrencies for the state are completely derived from the opportunities received by the business community, which, having additional sources of income pays more taxes to the budget. Speeding up and achieving greater availability of settlements and payments in the state stimulates economic development, therefore, a successfully growing economy attracts new investments.

Thus, the development of national jurisdiction in General is stimulated by the accompanying areas of improving the cryptocurrency market, and the introduction of new financial technologies should be considered as an impetus for the transition to the digital economy.

Conclusion

Based on the above, the state in the formation of legal regulation should focus on the creation of: a tax system; a system of state supervision that prevents the implementation of AML/CFT operations; a system of requirements for the implementation of internal control of payment systems that use digital currency and / or carry out exchange operations with digital currency, for example, such as logging of settlement transactions, KYC transactions, etc.

These state measures, according to the authors, should neutralize the risks arising from the use of digital currencies, including criminal ones. The possibility of legal use of digital currencies will increase investment interest to the country, as is already happening in Japan, Australia and other countries. Improving the system of settlements and payments will contribute to its economic growth.

References

- Corbet, S., McHugh, G., & Meegan, A. (2017). The influence of central bank monetary policy announcements on cryptocurrency return volatility. Investment Management and Financial Innovations, 14(4), 60-72. https://doi.org/10.21511/imfi.14(4).2017.07

- Cvetkova, I. (2018). Cryptocurrencies legal regulation. Brics Law Journal, 5(2), 128-153. https://doi.org/10.21684/2412-2343-2018-5-2-128-153

- Czapliński, T., & Nazmutdinova, E. (2019). Using FIAT currencies to arbitrage on cryptocurrency exchanges. Journal of International Studies, 12(1), 184-192. https://doi.org/10.14254/2071-8330.2019/12-1/12

- Evanoff, D. D. (2019). Introduction to the special issue: Prudential financial regulation. Global Finance Journal, 39, 1-2. https://doi.org/10.1016/j.gfj.2018.01.007

- Kiselev, V., & Nechaeva, E. (2018). Priorities and possible risks of the BRICS countries` cooperation in science, technology and innovation. Brics Law Journal, 5(4), 33-60. https://doi.org/ 10.21684/2412-2343-2018-5-4-33-60

- Kolomeytseva, A. A. (2019). Global oil market trends. Espacios, 40(3), 02.

- Kuznetsov, V. A., Prokhorov, R. A., & Pukhov, A. V. (2017). On possible scenarios of legislative regulation of digital currencies in Russia. Money and Credit, 7, 52-56. [in Rus.].

- Levis, M., Muradoǧlu, Y. G., & Vasileva, K. (2016). Home bias persistence in foreign direct investments. European Journal of Finance, 22(8-9), 782-802. https://doi.org/10.1080/1351847X.2015.1019640

- McKenzie, B., Burt, S., & Dukeov, I. (2018). Introduction to the special issue: Technology in retailing. Baltic Journal of Management, 13(2), 146-151. https://doi.org/10.1108/BJM-01-2018-0032

- Shaydullina, V. K. (2018). Legal regulation of financial services under the conditions of accession of Russia to the world trade organization. Espacios, 39(39), 5.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Bagreeva*, E. G., & Barakina, E. Y. (2020). Legal Risks Of Using Digital Currency In Settlements And Payments. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 693-698). European Publisher. https://doi.org/10.15405/epsbs.2020.03.99