Abstract

Monitoring regional economic security is required to implement national priorities and counter multiple threats and challenges. This monitoring is complicated by the need to develop an integral index based on multi-scale private indicators. This paper is to assess the economic security of the regions of the Russian Federation using MULTIMOORA method, examine the comparative advantages and disadvantages of the method. Based on data from the Russian Federal State Statistic Service, an analysis of the level of regional economic security has been conducted. Four groups of regions were picked out according to their economic security, factors that influenced the existing level of security were pointed out. The indicators of economic security characterize the demographic and financial situation in the region, the quality of life, investment activity, etc. The results are confirmed by comparison with the calculation of economic security rationing on the magnitude of the difference between the best and the worst values of indicators. On the basis of the correlation analysis, a conclusion about the current absence of the impact of environmental innovations of organizations on economic security was made. The greatest, albeit extremely weak link, is observed between economic security and the reduction of material costs for the production. The advantages and limitations of multipurpose optimization in comparison with the used methods of forming an integral index of economic security were identified. The findings are both theoretical value for further work on assessing the economic security, and practical: the developed method may be useful to federal and regional authorities.

Keywords: Multipurpose optimizationrationingminimax criterionrangingsecurity assessment

Introduction

Granting economic security is the most important condition for the implementation of national priorities and countering both external and internal threats and challenges to the regions’ development. In this regard, to take timely measures to maintain and enhance regional economic security, organization of its monitoring is required (Karginova, 2018).

Note that national and foreign researchers have proposed various methods for assessing economic security. Among them, the most important group is the one that assumes the setting of limit (threshold) values for a selected set of indicators: one (Kalina & Savel'eva, 2014), e.g. or several (Vissarionov & Gumerov, 2017). If there’s a single threshold for each indicator and the territory indexes do not correspond to them, then we can state the existence of negative tendencies, which, without operative intervention, will cause an economic crisis. In the foregoing method, the choice of several limit values allows us to talk about the target, transitive and critical states. At the same time, the threshold values themselves are determined mainly either by basis of expert assessment or historical analogies. Each approach has its own disadvantages: the first one’s are related to the experts’ subjectivity, the second one’s – to the qualitative incompatibility of situation of different territories at different times.

Problem Statement

The main problem that arises during the analysis of a large list of indicators is the need to summarize them (reduce to one). To solve this problem the following methods are used (Kazantsev, 2017):

-Simple rationing by threshold value. This method is quite simple; however, the financial indicator is not very clear and the method is not applicable if the threshold values are zero. Moreover, only one, upper or lower, threshold value can be used. And if the rationed private indicator of the object is equal to zero, then the summarizing indicator will also be zero.

-Complex rationing by threshold value. Its advantages are clarity and wide possibilities of interpretation of the results: areas of catastrophic, critical, significant, moderate risk and stable areas are identified. This method allows to evaluate the contribution of each indicator in the final index. However, just like simple rationing by threshold value, a complex one is not applicable at a threshold value equal to zero or several threshold values. Additionally, in comparison with simple rationing, this method requires complex calculations.

-Rationing on the magnitude of the difference between the best and the worst values of indicators. This method is simple and clear, it allows you to evaluate the contribution of the indicator to a summarized value and identify risk areas (security levels). At the same time, the method doesn’t require knowledge of threshold values of indicators. From the authors’ point of view, its shortcoming is the decrease of the correctness of the assessment carried out in the presence of emissions, as well as for bipolar indicators.

In addition to the foregoing methods, the MULTIMOORA method, presented by Brauers and Zavadskas, (2010) and suggesting the addition of the full multiplicative form to the MOORA method, which the same authors developed earlier (Brauers & Zavadskas, 2006), looks promising in terms of forming a composite indicator of economic security.

Research Questions

The MULTIMOORA method is used for analysis of individual markets (for example, the housing market (Gorzen-Mitka, Skibinski, & Lemanska-Majdzik, 2016) and energy market (Zhang, Chen, Streimikiene, & Balezentis, 2019), the state of regions (Sir & Caliskan, 2019) and countries (Fura, Wojnar, & Kasprzyk, 2017; Siksnelyte, Zavadskas, Bausys, & Streimikiene, 2019). Alongside with the TOPSIS method, the MULTIMOORA method was used in assessing the technological, economic and social status of the countries of the European Union (Li, 2018).

This paper is to conduct an analysis of regional economic security and its connection with the environmental innovations. The MOORA and MULTIMOORA methods were used to study the relationship between economic security and risk indicators in the European Union countries in the Baltic region (Stankevičienė, Sviderskė, & Miečinskienė, 2013). The possibility of using MULTIMOORA method and intuitionistic illegible sets with interval values for risk assessment is pointed out (Zhao, You, & Liu, 2017). However, at the present time the MULTIMOORA method hasn’t yet become widely used in the studies of security issues.

Purpose of the Study

The purpose of this study is to conduct an analysis of regional economic security and its connection with the environmental innovations of organizations using the MULTIMOORA method. On the one hand, the development and introduction of environmental innovations increase the expenses of organizations, but on the other hand, they can lead to a reduction in material and energy costs for the manufacturing a product unit, a reduction in waste disposals costs, increased consumer loyalty, etc. Accordingly, the multidirectionality of the potential effect of innovation in the field of ecology necessitates a quantitative assessment of the connection with economic security. On the basis of the conducted research, both conclusions on the level of economic security of individual regions were made, and the possibilities and limitations of the MULTIMOORA method itself in solving such problems were evaluated.

Research Methods

To assess the economic security of Russian regions and its connection with environmental innovations of regional organizations, data from the Russian Federal State Statistics Service, published in official statistics digests and the organization’s website, were used.

Economic security analysis was conducted on the basis of the following indexes: gross regional product per capita; investment in fixed capital to gross regional product; the ratio of people employed in the economy per one pensioner; percentage of the region’s population with income below the subsistence minimum; percentage of the technological innovation expenses in the total volume of goods shipped, services and work done; percentage of unprofitable organizations. The list didn’t include some commonly used indexes, for instance, the degree of depreciation of fixed funds (it depends on the selected accounting model). The increase in gross regional product can be associated with both the growth of production and the increase in its material consumption and energy intensity, but the value of the gross regional product acts as one of the measures of investment risk.

Initially, within the framework of MOORA method, the formula for rationing the region’s indicators was as follows (see formula 1):

where

The overall assessment for each index is calculated further on. For indicators, the positive direction of which change is their increase, the summarizing is carried out by addition, in relation to indicator that should be minimized – by subtraction. The percentage of the region’s population with income below the subsistence minimum and the percentage of unprofitable organizations are the indexes that should be minimized, all the rest – maximized. Thus, the overall assessment of the region j according to all indexes was calculated as (see formula 2):

where

Based on the obtained assessments, a system of relations was formed: the region with the maximum rating was assigned the first rank, with the minimum – the last.

At the next stage, the reference value of each indicator (

where r

The obtained results are used to re-rank the regions: the lowest value is the best, the greatest – the worst.

Further analysis is conducted using MULTIMOORA method. The total utility of the region j is expressed as a dimensionless number obtained using this formula (see formula 4):

where

The obtained assessments were the basis for the third region ranking. In this case, the greatest value is the best, the lowest – the worst (based on Stankevičienė, Sviderskė, & Miečinskienė, 2013). The final region rank is determined on the basis of the sum of the three rankings produced: the minimum amount is the highest rank, and vice versa, the maximum amount – the lowest rank. According to the final rank, the regions are divided into four almost equal groups.

The degree of connection between the final assessment of the economic security of the regions and the environmental innovations implemented in them was determined on the basis of the Pearson correlation coefficient. As an indicator, characterizing regional environmental innovations, the percentage of organizations that carried them out was chosen: this exact index is regularly calculated and published in open sources by statistical agencies.

Findings

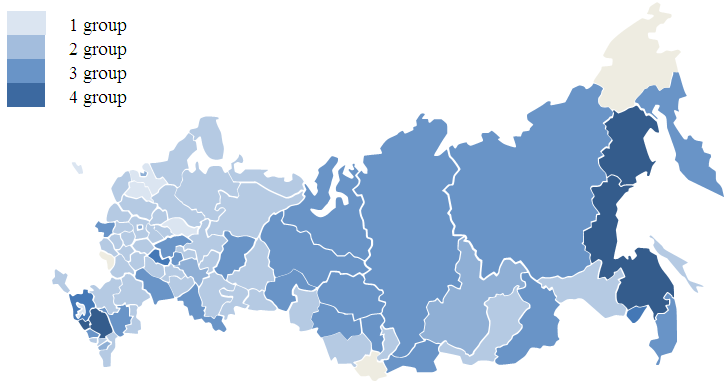

According to the described methodology, the data were processed for the Russian regions for 2017, the gross regional product value was taken as in 2016. Based on the calculated final assessment of regional economic security, all regions were divided into four groups (the first group has the highest rating and, accordingly, the level of security; whereas the fourth – the lowest). Group representatives are marked in Figure

Source: authors.

The first group includes Magadan and Sakhalin regions, the Republic of Sakha (Yakutia) and the Chukotka Autonomous Region. Partly, this is due to increased attention to the economic development of the Far East, the existence of number of preferences. However, the selected indicators of economic security are significantly influenced by the economic specialization of the regions (mainly oil, gas, gold and diamonds) and the sparseness of their population. The city of St. Petersburg, the Tyumen region and the Republic of Tatarstan were assigned to the first group both because of high values of maximizable indexes and because of low reducible indexes.

Similarly, the Republics of Kalmykia and Karelia, the Kurgan and Pskov regions were in fourth group both because of the low values of the maximizable indexes and because of high values of the reducible indexes; The Republics of Adygea and Dagestan – mainly due to the low values of maximizable indexes. The Republics of Ingushetia and Tyva, the Ivanovo region, the Republics of Kalmykia and Karachay-Cherkess have the lowest assessments of economic security in the ascending order.

The first group includes seven regions with the highest value of the gross regional product per capita; six regions with the maximum percentage of investment in fixed capital to the gross regional product; five regions with the maximum ratio of people employed in the economy per one pensioner; ten regions with the minimum percentage of the region’s population with income below the subsistence minimum; only three regions with a maximum percentage of the technological innovation expenses in the total volume of goods shipped; none of five regions with the minimum percentage of unprofitable organizations (the first four were in the fourth, last, group).

In general, it can be noted that there is a low correlation between the positive dynamics of the percentage of unprofitable organizations and other indexes.

The obtained results were verified using the described above rationing for the magnitude of the difference between the best and worst values of the indicators (Kazantsev, 2014). Pearson correlation coefficient between the two ratings was 0.83, which indicates a strong correlation.

To assess the relationship between the level of economic security of the region and the environmental innovations of organizations, the Pearson correlation coefficient between the level of security and the percentage of organizations that carried out environmental innovations in 2017 was calculated. Table

The advantages of the used MULTIMOORA method include its simplicity and clarity, the absence of the need to set threshold values for a selected list of indexes, and high accuracy. As the disadvantages of the method, we can point out the impossibility of including indicators which don’t require to be increased or decreased, but to reach a certain value, for example, unemployment rate (a significant percentage of the unemployed speaks of the non-use of existing labor potential, the growth of expenditure on benefits; the absence or non-achievement of the natural rate of unemployment is accompanied by a rapid increase in wages (inflation of income). Also, the MULTIMOORA method is inapplicable at zero values of minimizable indicators. At the same time, with an appropriate choice of indicators and the absence of zero values, these limitations are not an obstacle to the use of this method.

Conclusion

The analysis of the economic security of Russian regions was conducted as a part of this study. A summary assessment indicator was developed on the basis of which the region rating was compiled, four groups with the similar level of security were identified. It was concluded that at the present time there is no connection between the level of economic security of the region and environmental innovations of organizations.

It can be noted that the MULTIMOORA method had almost all the advantages, that distinguish rationing by the magnitude of the difference between the best and the worst values of the indexes from the simple and complex rationing by the threshold value. In some cases, the MULTIMOORA method is characterized by a higher accuracy of calculations. This is due to the fact that socio-economic parameters often do not correspond to the normal distribution, there is a large number of deviating indicators. Accordingly, within certain tasks, the assessment of economic security using the MULTIMOORA method can be justified.

To continue the study, it’s planned to expand the list of analyzable indicators, examine the change in economic security over time, and also consider its relationship with other factors of environmental security and energy security, another important component of national security. With respect to each group of regions in terms of their economic security, measures and institutions to maintain and enhance security will be proposed.

Acknowledgments

This article was prepared as part of the state assignment by the Karelian Research Centre RAS.

References

- Brauers, W. -K. M., & Zavadskas, E. K. (2006). The MOORA method and its application to privatization in a transition economy. Control and Cybernetics, 35(2), 445-469.

- Brauers, W. K. M., & Zavadskas, E. K. (2010). Project management by MULTIMOORA as an instrument for transition economies. Technological and Economic Development of Economy, 16(1), 5-24. https://doi.org/ 10.3846/tede.2010.01

- Fura, B.,Wojnar, J., & Kasprzyk, B. (2017). Ranking and classification of EU countries regarding their levels of implementation of the Europe 2020 strategy. Journal of Cleaner Production, 165, 968-979. https://doi.org/10.1016/j.jclepro.2017.07.088

- Gorzen-Mitka, I., Skibinski, A., & Lemanska-Majdzik, A. (2016). Rating of European Housing Markets by Multi-Objective Evaluation Method. In E.Kovářová, L. Melecký, M.Staníčková (Eds.), Proceedings of the 3rd International Conference on European Integration 2016 (pp. 263-272). Ostrava, Czech: VŠB - Technical University of Ostrava.

- Kalina, A. V., & Savel'eva, I. P. (2014). Formation of threshold values of the economic security of Russia and its regions. Bulletin of the South Ural State University Series “Economics and Management”, 8(4), 15-24. [in Rus.].

- Karginova, V. V. (2018). The methodological approach to the definition of economic security based on the perception of risk. Voprosy Upravleniya, 1(50), 110-117. [in Rus.].

- Kazantsev, S. V. (2014). Protection of the economy of Russian regions. Novosibirsk: IEOPP SO RAN. [in Rus.].

- Kazantsev, S. V. (2017). Models for the calculation of security indicators of the country and its regions. Region: Ehkonomika i Sociologiya, 2(94), 32-51[in Rus.].

- Li, Ch. (2018). Evaluation of the financial and economic development of the European Union member states on basis of multiple indicators changed to multiple objectives. E&M: Ekonomcs and Management, 21(4), 19-32. https://doi.org/10.15240/tul/001/2018-4-002

- Siksnelyte, I., Zavadskas, E. K., Bausys, R., & Streimikiene, D. (2019). Implementation of EU energy policy priorities in the Baltic Sea Region countries: Sustainability assessment based on neutrosophic MULTIMOORA method. Energy Policy, 125(C), 90-102. https://doi.org/10.1016/j.enpol.2018.10.013

- Sir, G. D. B., & Çalışkan, E. (2019). Assessment of development regions for financial support allocation with fuzzy decision making: A case of Turkey. Socio-Economic Planning Sciences, 66, 161-169. https://doi.org/ 10.1016/j.seps.2019.02.005

- Stankevičienė, J., Sviderskė, T., & Miečinskienė, A. (2013). Relationship between economic security and country risk indicators in EU Baltic sea region countries. Entrepreneurial Business and Economics Review, 1(3), 21-34. https://doi.org/ 10.15678/EBER.2013.010303

- Vissarionov, A. B., & Gumerov, R. R. (2017). Concerning the use of indicators’ marginal (threshold) values of the Russian Federation economic security. Management Science, 7(3), 12-20. https://doi.org/10.26794/2304-022X-2017-7-3-12-20 [in Rus.].

- Zhang, Ch., Chen, Ch., Streimikiene, D., & Balezentis, T. (2019). Intuitionistic fuzzy MULTIMOORA approach for multi-criteria assessment of the energy storage technologies. Applied Soft Computing, 79, 410-423. https://doi.org/10.1016/j.asoc.2019.04.008

- Zhao, H., You, J. X., & Liu, H. C. (2017). Failure mode and effect analysis using MULTIMOORA method with continuous weighted entropy under interval-valued intuitionistic fuzzy environment. Soft Computing, 21(18), 5355-5367. https://doi.org/ 10.1007/s00500-016-2118-x

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Karginova-Gubinova*, V. V., Shcherbak, A. P., & Tishkov, S. V. (2020). Multimoora Analysis Of Regional Economic Security And Its Connection With Environmental Innovations. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 40-47). European Publisher. https://doi.org/10.15405/epsbs.2020.03.6