Abstract

The increasing complexity of the market economy in the digital era, the desire of economic agents to create new, efficient business models with the participation of state and private capital is accompanied by the activation of transformational processes of property relations. The most important problem is the question of who, how (through what economic relations) and what appropriates, from whom and how it alienates, in whose hands and what social wealth is concentrated and to whom, ultimately, belongs. By revealing the laws of development and transformation of property relations, one can get the opportunity not only to adequately assess certain socio-economic changes, but also to understand the mechanisms for their implementation. In the context of the emerging corporate sector, the fundamental issues of changing the nature of the appropriation of the created product, forms of ownership and types of association of capital become fundamental. We are talking about transformations of private property itself, caused by the need to strengthen the unification processes. Ways to implement the economic interests of participants in corporate relations are characterized by inconsistent functioning, a high level of unevenness and conflict. The readiness of the Russian economy for further transformations, the flexibility of the highly concentrated capital systems being created, and the rate of formation of large corporate structures will determine not only Russia's positioning in the modern economic space, but also its preservation as an independent state in conditions of exclusion from the distribution of world income.

Keywords: Propertyproperty institutionscorporate relationscorporate propertyeconomic powercorporation

Introduction

Property, being an element of the social system, is of paramount importance for it, since it organizes society, acting as its institutional factor. The connection of property with the needs of society gives the property unique properties - unlike other economic categories, property is based not only on the needs of a person, but also on the needs of the whole society. Such complexity determines the purpose of this concept, its main meaning is to embody economic power. When we talk about the need to create a conceptual framework for the interaction of property theory and corporate relations, it is important to understand that the attention of economic science in this case moves to a completely different plane - an emerging corporate sector, the basis of which is a specific corporate form of ownership. Corporate property, on the one hand, is the result of the socialization of production and its growth, and on the other hand, corporate property becomes the dominant form, especially in cases of capital growth.

Problem Statement

The theory of ownership contains the most important and practically significant economic interests of individuals, companies and society as a whole. Property problems are very acute, because economic science has not developed a unified interpretation of this category. The question of property and the relations it defines will always remain one of the fundamental in economic theory (Karamova, 2009; Tullock, 2011; Filatova, 2013). Questions on the effectiveness and recognition of the advantages of private property over state, the most promising ways of privatization, and the fair distribution of the created goods do not leave the agenda. In the ontological and worldview plan, an extensive range of problems is studied:

property relations as defining economic interests and incentives of economic actors) and forming effective patterns of behavior;

study and measurement of social, collective and personal needs and interests in the aspect of conflicts and contradictions;

the choice of economic policy of the state, the establishment of the prevailing forms of ownership - private, collective or state ownership;

the quality of property institutions, which allows to reduce transaction costs and solve social problems.

Any form of ownership has its own economic content, and this content is defined as a historically concrete, objective production relationship or production relations. In different economic systems, formally similar property relations can have fundamentally different socio-economic content (Buzgalin, 2019).

There is a point of view that corporate property cannot be considered a form of ownership, that it is a form of organization of ownership, that is, to some extent, a form of management (Filatova, 2013). The fact of ownership of many individuals and legal entities in a single appropriation process with unevenly distributed rights makes joint ownership not reducible to either private ownership or any form of collective ownership (Makarova, 2017). Such a complex appropriation structure gives rise to special specifics and can only be represented by a special form of ownership - joint-stock. Of course, this form of ownership has many problems in its implementation - this is a violation of the interests of minority shareholders, and opportunistic behavior of managers, and "hostile" seizures, and blackmail by speculative investors. But it is also unconditional that this form of ownership is functioning successfully and forms the basis of modern economic systems.

Today the corporation is the dominant form of business. And we are talking about large-scale capital systems, large integrated structures that have long gone beyond the organization of their economic activities beyond national borders. «Among the 100 largest economies of the world, 51 are corporations and only 49 states (Belyaeva & Pukhova, 2016). The global economy is characterized by changes in competition, the emergence of large corporate structures as the result of high concentration of capital and changes in property relations. The study of the essence of corporate property requires clarification of the goals of forming a corporation, the essence of corporate relations and their relationship with changes in the nature of ownership.

Research Questions

It is proposed to consider the achievement of the historically specific goal of reproduction as a criterion for the sale of property (Bodrunov, 2018). The economic content of property is a system of historically specific socio-economic relations, through which an economic actor (individual, company, group of citizens, the state, etc.) or a certain combination of these uses the benefits for production, consumption or other economic actions (McAdams, 2015; Nureev & Latov, 2016; Shastitko, 2010). The purely legal approach to determining the essence of ownership forms, with all its simplicity and convenience, in many cases does not allow us to understand what real socially significant content is hidden behind this or that form (Holcombe, 2014; Heinsohn & Steiger, 2013). Each particular ownership relationship (for example, private ownership of capital or state ownership of natural resources) creates a complex system of property rights (Alpatov, 2016). Undoubtedly, the basic relations of appropriation, possession, use and disposal, known even from the works of ancient Roman authors, remain basic. The need to create Russian economic institutions that meet international standards for the forms and sizes of functioning capital was investigated in the works of famous Russian scientists (Belyaeva & Pukhova, 2016; Danilova & Belayeva, 2019; Makarova, 2017; Vinslav, 2019) modern system of property rights is much more complicated. The traditional conflict between the owner and the non-owner was supplemented by the conflict between the multidirectional interests within the associated owner. This conflict is the subject of modern disputes over property issues (Shastitko, 2010). The solution of these problems occurs in two ways - by building an internal corporate culture and using the regulatory impact of the state. An important problem is the appearance of impersonal - financial - property, which activates the overdevelopment of such a property property as profitability. This property of ownership becomes self-sufficient and frees the property from materiality (material content that slows down the rate of turnover), responsibility (burden of the personified owner to society), and direct utilitarianism (since the result of the circulation of securities does not create any consumer utility).

Purpose of the Study

The main goal of the study is to develop the conceptual foundations of the interconnected development of the theory of property and corporate relations, to determine the complex and ambiguous relationships between the nature of property and the development of the corporate sector. The study of the nature and content of property relations, their implementation and the specifics of the redistribution of property rights are key to identifying the objective laws of transformational state of ownership.

Research Methods

The evolution of property theory leads to corresponding changes in the theory of corporate relations. Corporate ownership arises in the context of the expansion of industrial production, the need to support its scale, attract additional financial resources through the corporatization of capital. An individual or legal entity has the opportunity, by contributing its share of capital, to receive income without incurring risks for the entire existing structure. The sustainable mechanism underlying the corporate ownership model is aimed at the continuous growth of economic performance and the provision of expanded reproduction of socio-economic relations. This gives an impetus to large-scale investment and a change in the nature of private property. Attraction of additional capital is carried out through the use of a specific financial instrument - the issue of shares that determine the ownership of capital and the income corresponding to invested capital. In this case, it is important to identify the main participants in corporate relations - these are shareholders and management, but their circle can be expanded at the expense of employees and other interested parties, as the public nature of the corporation's activity is growing. It is no accident that in modern economic theory a corporation is considered not as a bunch of private contracts (an economic institute), but as a social institution. It is not only about expanding the activities of the corporation, but also expanding the circle of participants in corporate relations.

The joint-stock form of organization of production with a combination of diverse economic interests, defined as the basis for the formation of a corporation, is full of contradictions. There is a point of view that joint ownership cannot be considered a form of ownership, since it represents only a form of organization of ownership and to some extent represents a form of management. Undoubtedly, the ownership of many individuals and legal entities in a single appropriation process with unevenly distributed rights does not allow reducing joint stock ownership to either private ownership or any form of collective ownership. The complex structure of appropriation gives rise to special specifics and can only be represented by a special form of ownership - joint-stock. On the one hand, this form of ownership has many problems in its implementation - the infringement of the interests of minority shareholders, the opportunistic behavior of managers, "hostile" seizures, and blackmail by speculative investors. On the other hand, this form of ownership is functioning successfully and forms the basis of modern economic systems.

The corporation is essentially a joint stock company, which is based on corporate property and a combination of conflicting interests of shareholders and management (Oleschuk & Promislov, 2016). New types of organizational structures appear and develop, however, in the short term, no alternative to the corporation is seen as the dominant form of business organization. Corporation:

is an independent subject of civil law, leading an independent existence;

bears responsibility for its obligations within the limits of its property;

forms capital through corporatization;

ceases to exist only in court;

determine the creation procedure and basic principles of operation in accordance with applicable law;

carries out both entrepreneurial and issuing activities.

Mass privatization in Russia led to the emergence of the corporate sector and large corporate structures, which required a rethinking of the concepts and types of property, the expansion of the studied economic interests from the standpoint of the nature and state of emerging corporate property. Many experts note the dominance of a management corporation in the Russian corporate sector, but this is where the similarities with other economies end. In developed economies, the state provides a fairly serious influence and control over the corporation (tax system) and at the same time, the effectively functioning mechanism of the financial market exerts a disciplining effect on the management of a management corporation. The Organization for Economic Cooperation and Development (OECD -99) approved the principles of corporatism in the system of corporate interaction (table

The emergence of corporate structures in the Russian economy has changed all ideas about private property, the ratio of property and power. The distribution of rights and property relations takes place under conditions of corporatization of state property, which leaves a certain imprint on participants in corporate relations, the system of organization of interaction between the shareholder and management (Oleschuk & Promislov, 2016). As a result of large-scale transformations, groups of large shareholders and small shareholders have formed. The latter are satisfied with insignificant incomes and have practically no influence on the adoption of managerial relations. The Russian economy is characterized by a continuous redistribution of property rights and property under the determining influence of local corporate and shadow government regulation, as well as non-economic factors. As a result of this, legally fixed forms of ownership in Russia are not adequate to their actual economic content (Borzakov, 2016).

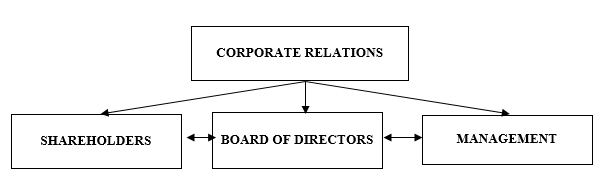

Understanding the specific interests of shareholders and management allows analysis of the separation of property rights and control in the system of corporate relations. The main participants in corporate relations are known (Figure

Along with the expansion of opportunities for attracting financial resources, corporate relations lead to problems caused by the separation of ownership and control (the problem is principal - agent). The company is owned by one group of shareholders, and the company is directly managed by another group - the directorate and management, to which the shareholders delegate management, providing equity for the development of the company. When managing a company, managers actually control all the company's resources - equity and borrowed capital, human capital, intangible resources (brand, know-how, reputation, etc.). Shareholders have a direct interest in motivating and controlling the activities of management (Smertina & Podtserob, 2018). A key role in optimizing agent relations is played by the problems of organizing control over management activities and their motivation. Forms of management based on mixed control over the production process of various owners are a source of discussion about the distribution of this control. The classic interpretation of the interaction of shareholders and management in the Russian corporate sector does not work. Shareholders cannot use standard methods of influence on management. The constant conflicts in the internal organization of entrepreneurial forms of corporations suggest the search for more effective forms of relations between management and shareholders, however, which do not always comply with international standards.

Findings

Russian corporate property represents the concentrated ownership of insiders - large external shareholders. In the role of outsiders are various groups of minority shareholders. As a result, the Russian model of corporate property is characterized by a high level of unevenness, conflict, and inconsistency of functioning, due to the import processes of the institution of corporate property and ways to realize the economic interests of participants in corporate relations. The specifics of regulation of corporate relations forms the institutional space of Russian corporate property and supports the existence of ineffective corporate strategies. Corporate control of dominant owners blocks positive economic changes not only in individual companies, but throughout the economy as a whole (Smertina & Podtserob, 2018).

Unlike Western corporations, where there are limits to protecting the interests of shareholders, in the system of corporate relations of Russian companies:

there is no effective control over management by shareholders and the state;

in developed economies, the nature of their interaction between management and owners consists in organizing effective control over the potential concealment of discretionary income from shareholders. Under Russian conditions, shareholders are limited in their impact on company management. Management, receiving discretionary income hides them, first of all, from state bodies;

as a result of the specifics of privatization, the main owners in the Russian Federation are the managers themselves, who have turned into an oligarchic stratum of temporary workers who think about their own benefits;

there are close relationships between management and the bureaucracy, which leads to a strong corruption component that clearly complicates the control by shareholders.

These circumstances seriously hamper the effective management of corporate property, putting obstacles to the technological development of companies. It should be added that in a digital society the correlation of elements of the corporate structure is changing, where one of the most important resources is the economic information that underlies the development and adoption of management decisions in the company. At the forefront are the relationships of subjects of corporate relations regarding the accumulation and analysis of the use of economic information.

Conclusion

The joint-stock form of organization of production with a combination of diverse economic interests that underlies the formation of a corporation is full of contradictions. In the short term, there is no alternative to the corporation as the dominant form of business organization, and although new types of organizational structures arise and develop, the corporation remains essentially a joint-stock company based on corporate property and the totality of the conflicting interests of shareholders and management.

The corporate sector in Russia urgently needs to expand investment opportunities. The Russian economy is facing new challenges determined by the development of a digital society:

the need for large-scale investment, which is carried out in conditions of limited direct investment and high competition for their distribution;

in solving the problems of free movement of capital not only from one industry to another, but also intercountry movement;

in the development of new aspects of the functional purpose of property - intellectual property, and as a result of changes in the composition of capital in favor of intangible assets.

Strengthening the role of corporations in the development of the digital economy requires combining the interests of subjects of corporate relations, solving the problem of the multidirectional nature of their positions and interests. The tendency for the dominant owner to dominate in high-tech corporations can have a significant impact on the separation of ownership and management functions, changes in the nature of the distribution of forms and types of income, the disappearance of personified carriers of long-term strategic interests.

Strengthening the role of the corporate sector in the development of the digital economy requires combining the interests of subjects of corporate relations, solving the problem of the multidirectional nature of their positions and interests. Trends in the dominance of the dominant owner in high-tech corporations can have a significant impact on the separation of ownership and management functions, changes in the nature of the distribution of forms and types of income, the disappearance of personified carriers of long-term strategic interests.

References

- Alpatov, A. A. (2016). Effective (anti-crisis) corporate ownership structure. Moscow, Russia: Yurlitinform. [in Rus.].

- Belyaeva, I. Yu., & Pukhova, M. M. (2016). Corporate social responsibility and corporate governance: Factors of integration. In M. A. Eskindarov, O. V. Danilova, B. S. Bataeva (Eds.), Modern Corporate Strategies and Technologies in Russia. Collection of scientific articles 2016 Conference (pp. 52-63). Moscow, Russia: Financial University under the Government of the Russian Federation. [in Rus.].

- Bodrunov, S. D. (2018). The future. New industrial society: Reboot. 2rd edn. Moscow, Russia: Cultural revolution. [in Rus.].

- Borzakov, D. V. (2016), Substantive aspects of corporate control social responsibility: A systematic approach. Modern Economics: Problems and Solutions, 7, 50-58. [in Rus.].

- Buzgalin, A. V. (2019). Political and economic theory and practices of economic life: Problems of ownership. The Economic Revival of Russia, 3(61), 15-21. [in Rus.].

- Danilova, O., & Belayeva, I. (2019) Economic efficiency of using the electric grid complex: problems of reserves of network power and development of intelligent technologies. In Popkova E. (Ed.), The Future of the Global Financial System: Downfall or Harmony. Lecture Notes in Networks and Systems, 57. (pp. 241-250). Cham: Springer. https://doi.org/1007/978-3-030-00102-5_26

- Filatova, U. B. (2013). The concept of development of the institution of common property in Russia and abroad. Moscow, Russia: Yurlitinform. [in Rus.].

- Heinsohn, G., & Steiger, O. (2013). Ownership economics: On the foundations of interest, money, markets, business cycles and economic development. UK, London: Routledge. https://doi.org/10.4324/9780203077467

- Holcombe, R. G. (2014). The economic theory of rights. Journal of Institutional Economics, 10(03), 471-491.

- Karamova, O. V. (2009). Features of the methodology of Russian economic and theoretical science. Bulletin of the Finance Academy, 4(52), 37-42. [in Rus.].

- Makarova, O. A. (2017). Joint-stock companies with state participation. Corporate governance issues. Moscow: Yurait Publishing House. [in Rus.].

- McAdams, R. H. (2015). The expressive forces of law: Theories and limits. Cambridge, MA: Harvard University Press.

- Milovidov, V. D. (2017). Corporate governance 2.0: The evolution of the corporate relations system in the information society. Issues of National Strategy, 4, 171-179. [in Rus.].

- Nureev, R. M., & Latov, Yu. V. (2016). The economic history of Russia (institutional analysis experience). Moscow: KNORUS. [in Rus.].

- Oleschuk, N. I., & Promislov, B. D. (2016). Mechanisms of optimization of management of corporate structures (by the example of JSC Gazprom). Moscow: Oil and Gas. [in Rus.].

- Shastitko, A. E. (2010). New institutional economic theory. 4d edn. Moscow: TEIS. [in Rus.].

- Smertina, P., & Podtserob, M. (2018). Why Russian directors do not need breakthrough technologies. Vedomosti, Retrieved from: https://www.vedomosti.ru/management/articles/2018/09/12/780615-ne-nuzhni-prorivnie Accessed: 09/12/2019. [in Rus.].

- Tullock, G. (2011). Public goods, redistribution and rent seeking. Moscow, Russia: Publishing House of Gaidar Institute. [in Rus.].

- Vinslav, Yu. B. (2019). 2019. On neutralization of the remaining threats to economic development on the basis of improvement of a number of instruments of state regulation of the economy. Russian Economic Journal, 1, 3-30. [in Rus.].

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Danilova*, O. V., Belayeva, I. Y., & Markina, E. V. (2020). The Interconnectedness Of Property Transformation And Development Of Corporate Relations. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 401-409). European Publisher. https://doi.org/10.15405/epsbs.2020.03.58