Abstract

The article contains results of a preliminary study that verifies the initial hypothesis about the relation between the use of digital financial services and technologies (DFS&T) by the population and its financial literacy. In addition, the authors show the influence of users’ activity (in terms of DFS&T use) on the structure of monetary transactions. For this purpose, the initial data on the comparative structure of household expenditure transactions in 2015 and 2019 are presented; the analysis of questionnaires of 929 respondents was carried out in Yekaterinburg to assess the level of the financial literacy, the activity of the use of DFS&T and the availability of savings. Another premise of the study was the search for an answer to the question on the impact of the digital financial services and technologies use by citizens in their everyday life and the level of their financial literacy on the structure of monetary transactions of households. People who actively use digital financial services technology and/or who are financially more literate tend to be more financially disciplined when making financial decisions. The study is based on subjective assessments (survey results) and objective data of the National Payment Association and the Federal State Statistics Service (FSSS), and the Central Bank of the Russian Federation. The main result was the confirmation of the initial research hypothesis about the relations of the digital financial services and technologies use, the level of the financial literacy of the population and the structure of monetary transactions of households.

Keywords: Financial literacyfinancial transactionsfinancial decisions

Introduction

People use digital financial services (DFS) everyday, even those who believe otherwise. Shopping in supermarkets, travel by the public transport, getting salaries and much more involve the use of the DFS. Integration processes in the financial sphere make it almost impossible to isolate any subjects from the system of financial relations: neither the state, nor corporate structures, nor the population. The development of a range of financial instruments is stimulated by the increasing use of digital services by people in everyday transactions. To a large extent, this is due to the convenience of new banking services, the availability of their usage in terms of the time and place. Simultaneously with the availability of digital financial services, the pool of risks associated with their use increases: cyber-attacks on the servers of financial institutions and various fraudulent schemes, loss of personal data of users and a number of others. These risks affect both ordinary operations with the use of bank cards and complex multi-stage transactions.

In the consumer sector is characterized by the growth of non-cash transactions – purchases of goods and services and money transfers using:

mobile banking applications;

electronic wallets (Qiwi, Yandex-money, Web money and others);

electronic services (PayPal; on-line banking and others);

debit cards (payroll transfer, payment for goods and services, card2card transfers);

credit cards and other services.

The authors analyzed data of the Central Bank of Russia and the Federal State Statistics Service (FSSS) on the growing trend in the use of non-cash services (table

The increase in the number of non-cash transactions indicates the popularity of electronic gadgets and services that make digital financial technologies more accessible. This fact is associated with some increase in the level of the financial literacy of citizens. In this study, the authors proceed from the hypothesis that the development of financial services a relation to the knowledge of the population about opportunities and risks associated with their use. Financially literate people tend to form an independent strategy to optimize the structure of financial resources of their households.

Problem Statement

Taking into account the international importance of projects on the assessment of the financial literacy level and the integration of Russia in these projects, we can see that the Russian Federation is implementing the national strategy for the financial literacy development at the level of the Ministry of Finance of the Russian Federation, carrying out the overall coordination of the work. Functions of the supervisory and coordinating agency are implemented by the Interagency Project Commission (IPC), members of which are the Ministry of Finance, the Central Bank, the Ministry of Education and Science, the Ministry of Economic Development and the Agency for Consumer Rights Protection of the Russian Federation. The responsibility of these structures is to monitor the implementation of the Strategy. The working group of the Ministry of Finance provides administrative support in the process.

Ultimately, the increase in the financial literacy level by the population and the development of digital financial services and technologies can give impetus to the development of the national economy (Rasumovskaya & Lebedev, 2019) and, at the same time, to the greater protection of the domestic financial space of the country from threats posed by international digitalization and integration processes (Ozili, 2018).

The main issues, which the listed state structures deal, are:

financial literacy of the population by main types of financial relationships and products to reduce the risk from decision making on a disposable income;

creation of educational content for all groups and categories of the population in the area of the financial education;

formation of the autonomy by the population in the protection of consumers’ rights while using financial services;

decrease in the socio-economic paternalism in the Russian society.

Research Questions

It is quite difficult to prioritize the relations between the impact of people's active use of digital financial services and technologies in everyday life on the level of their financial literacy and the structure of monetary transactions of households. Does the financial literacy affect the activity of using digital financial services and technologies or vice versa (the activity of using modern gadgets makes people more financially literate)? Does the financial literacy affect the structure of monetary transactions or, on the contrary, do people become more financially literate and actively use digital financial services while facing with the need to use cashless payments in many transactions? These questions have to be investigated much deeper than the identification of some correlation between these behavioral manifestations.

Purpose of the Study

The main objective of this study is to find confirmation or refutation of the hypothesis about the impact of people's active use of digital financial services and technologies in everyday life on the level of their financial literacy and the structure of monetary transactions of households.

Research Methods

Research on the dynamics of the financial behavior of households is based on two main methods: 1) thematic surveys, which allow to collect information on a wide range of issues and are an adaptive way to change the vector of the study, if necessary; 2) collection and processing of statistical information on the research subject, in this case-on the size, structure and dynamics of incomes and expenditures of the population.

However, both methods have some disadvantages (French & Vigne, 2019): so, the determination of the structure of citizens’ non-cash transactions is only possible using the data from commercial banks – card issuers, but such data shall not be disclosed (there is legislation regarding the protection of personal data), and in this case, we can only come from the subjective information obtained from respondents in the survey. Data on expenses in general are contained in forms of the Federal State Statistics Service and demand processing in the necessary format – on separate or enlarged groups.

Methods to obtain reliable and relevant data of value for scientific research are traditionally typed according to certain criteria (Razumovskaia, Isakova, Razumovskyi, Mokeyeva, & Kuklina, 2016):

by the method of the data collection: contact (interviewing) and contactless (questioning);

according to the format: oral (by phone, recording on audio devices) and written (filling in formalized questionnaires);

at the venue: continuous (in crowded places with high traffic – shopping centers, crowded events, transport hubs, etc.) and selective (places of study, work);

by the competence level: mass (continuous) and expert (in a competent environment);

by the interaction with respondents: personal (full-time) and impersonal (correspondence).

Conducting surveys involves compliance with the rules that determine the need to obtain complete, if possible – reliable and objective information. The enlarged rules are the following ones (Burke & Fry, 2019; Cardaci, 2018):

the right choice of the target audience, which contributes to the collection of reliable information, since its equal distortion by a competent audience is hardly possible (the sample of respondents must meet certain criteria: demographic, social, and other relevant ones for the survey subject);

the survey should be thematic, otherwise it will be difficult to obtain objective information: respondents' answers will be incomplete; switching from one topic to another will reduce the reliability, which is already not quite inherent in this method of research;

the form of the questions should be brief, clear, not verbose, assume a clear answer; the number of questions should be so that the time of interviewing or filling out the questionnaire does not exceed a few minutes;

building a logical structure of the questionnaire so that the questions were not only related, but also would retain the interest of the respondent (in the first part of questionnaires it is necessary to place simple questions, then more difficult ones, but not so that to enter respondents into confusion; in the final part the questions should be simple too to leave an impression of potentiality, achievement of results.

The authors assessed the financial literacy level of the population by contactless written continuous mass personal survey of people in the shopping center. Respondents were offered questionnaires in which, in addition to identification questions about age and gender, there were four thematic questions on the assessment of their financial knowledge and a self-positioning question about the category of usage of digital financial services and technologies.

The chosen complex method is characterized by impartiality in the aspect of mixed criteria of respondents and some uniqueness. Its use can be carried out with any regularity – it provides information on the dynamics by which you can track changes in the level of the financial literacy. In this case, the fact that the respondents will not be the same – does not matter, but, such a format is able to cover through the survey a significant mass of people of different categories: age, income, education, marital status, profession and other characteristics. This means that such a different contingent, to a greater extent than the selected audience, will reflect the representativeness of the sample and serve as a basis for approximating results to other ones (Brounen, Koedijk, & Pownall, 2016).

Findings

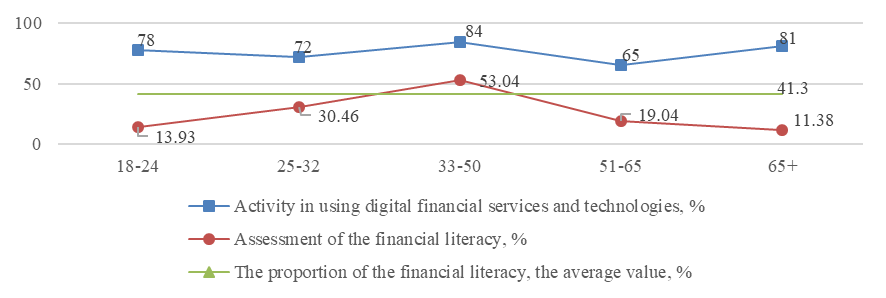

The results of the survey are presented in table

The methodology used in this study requires some clarification: questionnaires were evaluated on the principle of a simple majority of correct answers (for this purpose, there is an odd number of questions in the questionnaire – 5), that is, if three or more correct answers are given – a respondent was formalized as financially literate and vice versa – three or more incorrect answers mean financial illiteracy of a respondent. The calculation of the generalized value (41.3%) was obtained by the weighted average method:

(42×0,23+57×0,34+22×0,58+90×0,26+114×0,44+27×0,66+103×0,17+56×0,51+17×0,65+57×0,14+50×0,41+9×0,63)/929 = 41,3

The questionnaire questions were adapted for Russian conditions, but then authors used as a basis methodological principles and directions of the financial literacy assessment recommended by the Organization for Economic Co-operation and Development (OECD): understanding of risk and profitableness, and the impact of inflation on prices. Other thematic tasks were deliberately not included in the questionnaire in order not to overload it. But, on these topics, the authors compiled more than one question, to eliminate the factor of surprise, confusion, random errors by answering – people did not expect the examination, coming to the shopping center.

The questionnaire does not include questions about education, profession, marital status, because for the purposes of this study, the priority is the financial discipline – the formation of savings, reflecting not only the knowledge that it is necessary to plan the structure of financial resources, but also the behavior that confirms the adherence to this knowledge. In addition, the questionnaire includes the question of whether respondents consider themselves as active users of financial services and technologies – that is also important to verify or refute the working hypothesis of whether such activity affects the financial knowledge. The question about cases of the consumer rights violation by using financial services is not included in the OECD methodology, but it is included in the Russian methodology for assessing the level of the financial literacy of the population.

The assessment of completeness, reasonableness of answers, logical orientation by the perception and the analysis of tasks conditions were not considered; the ability to count without the help of auxiliary means – was welcomed, but did not influence the assessment.

figure

Conclusion

In conclusion, the authors present results of the survey on the range of digital financial services and technologies used by the same sample of respondents (table

table

However, the authors believe it is important to note that the study was conducted not in "pure" conditions, leveling side factors, and, therefore, its results are distorted by a number of determinants:

1. We can’t consider answers of respondents as objective ones except data from the questions assuming ‘right’ or ‘not right’ answers (i.e. as any objective data). Respondents referred themselves to income categories, stated that they have savings and that they actively use digital financial services and technologies, but it is not possible to verify the reliability of these statements. In addition to unreliability, people can subjectively consider themselves a particular income category, so that they are not considered as losers and to overcome internal dissonances. The above is based on personal psychological characteristics, which are not considered appropriate to analyze in detail within the framework of this study.

2. The structure of transactions (table

3. Earlier it was noted that the comparison of indicators of the countries rating and the indicator obtained by the authors based on the results of the survey of Yekaterinburg residents is not quite correct in terms of the assessment periods of the financial literacy.

Overcoming these distortions can provide an objective channel of information on the same positions as the survey:

1. Real data on the volume and structure of transactions with cards available to respondents and other digital channels through which these transactions are carried out.

2. Conducting periodic questionnaires or even questionnaires to assess the level of the financial literacy of the same audience (not a sample) – customers of the shopping center, as a sample that has some signs of categorical generality. It would allow receiving subjective, but more reliable data – all cannot behave equally – it is possible to declare false data, but each time they will be not identical, and by a very considerable number of respondents, the probability of the data reliability will be higher.

3. Expanding questionnaire questions by including data to rank respondents by level of education, profession, availability of assets, liabilities and other parameters, so that the results would allow to draw reasonable and most objective conclusions.

Summarizing the study results, the authors are ready to confirm the hypothesis that there is a connection between the usage of digital financial services and technologies and the financial literacy. The usage of DFS&T enables people to manage their financial resources in a mobile way, plan and monitor the cost structure, to gain knowledge about financial products and their use – this and much more allows households to consciously form a strategy for using financial resources and try to optimize their financial decisions (Rasumovskaya, 2016).

Acknowledgments

This material was prepared in accordance with the Order of the Ministry of Finance of the Sverdlovsk region from 17.05.2019, № 216 "On approval of model forms of agreement on granting from the regional grants budget in the form of subsidies in compliance with section 781 of the Budget code of the Russian Federation" in the framework of the Agreement "About granting the "Ural State Economic University" from the regional grant budget in the form of a grant to exercise functions of the regional centre of the financial literacy".

References

- Analitical Center NAFI (2019). The growth of the number of users of non-cash payments has slowed down. Retrieved from: https://nafi.ru/analytics/rost-chisla-polzovateley-beznalichnykh-platezhey-zamedlilsya/ [in Rus.].

- Brounen, D., Koedijk, K. G., & Pownall, R. A. J. (2016). Household financial planning and savings behavior. Journal of International Money and Finance, 69, 95-107. https://doi.org/10.1016/j.jimonfin.2016.06.011

- Burke, M., & Fry, J. (2019). How easy is it to understand consumer finance? Economics Letters, 177, 1-4. https://doi.org/10.1016/j.econlet.2019.01.004

- Cardaci, A. (2018). Inequality, household debt and financial instability: An agent-based perspective. Journal of Economic Behavior & Organization, 149, 434-458. https://doi.org/10.1016/j.jebo.2018.01.010

- Central Bank of the Russian Federation (2019). Questionnaire “Financial Litarecy”. Retrieved from: https://www.cbr.ru/Ankets/MailForm.aspx?PartID=fingram [in Rus.].

- Federal State Statistics Service (2019). Digital economy of the russian federation: Monitoring the development of the information society in the Russian Federation. Retrieved from: http://www.gks.ru/free_doc/new_site/figure/anketa1-4.html [in Rus.].

- French, D., & Vigne, S. (2019). The causes and consequences of household financial strain: A systematic review. International Review of Financial Analysis, 62, 150-156. https://doi.org/10.1016/j.irfa.2018.09.008

- National Payment Association (2019). Remote services, mobile solutions, cards and payments 2019": the main themes of the anniversary conference were named. Retrieved from: https://www.paymentcouncil.ru/single-post/2019/10/02/20191002001 [in Rus.].

- Ozili, P. K. (2018). Impact of digital finance on financial inclusion and stability. Borsa Istanbul Review, 18(4), 329-340. https://doi.org/10.1016/j.bir.2017.12.003

- Rasumovskaya, E., & Lebedev, A. (2019). Financial regulation in the initial phase of market reforms in Russia and its impact on subsequent economic development. In A. Belousova (Ed.) Proceedings of the 2nd International Conference on Education Science and Social Development (ESSD 2019). Advances in Social Science, Education and Humanities Research, 298 (pp. 559-564). Paris: Atlantis Press.

- Rasumovskaya, E. A. (2016). Personal financial planning: Theory and process modeling. Saarbrucken: Palmarium Academic Publishing. [in Rus.].

- Razumovskaia, E., Isakova, N., Razumovskyi, D., Mokeyeva, N., & Kuklina, E. (2016). Financial decision-making by the population: Process modeling and trends. Indian Journal of Science and Technology, 9(46). https://doi.org/10.17485/ijst/2016/v9i46/107570

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Rasumovskaya*, E. A., Rasumovskyi, D. Y., & Ovsyannikova, E. Y. (2020). Impact Of The Digital Financial Technology To The Financial Literacy Of Population. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 380-388). European Publisher. https://doi.org/10.15405/epsbs.2020.03.55