Abstract

In the course of the study, the authors conducted a survey of respondents-business entities operating in Samara region (Russia). The survey respondents assessed their company's environmental record-keeping in a number of areas. The obtained results indicate an unsatisfactory state of environmental accounting of the Samara region companies. Thus, environmental accounting is carried out by 29.3% of the surveyed companies, while the systematization of information about environmental risks is carried out by 4.9% of the surveyed business entities. Few business entities (7.4%) that manage the costs of environmental activities mainly use the ABC method for this. A small number of companies from the total sample (8.1%) use the sustainable development report in forming non-financial reports. Business entities that responded positively to this question, are distinguished by the presence of foreign shareholders. At the same time, the absolute majority (84.6%) of respondents answered positively to the question of financial accounting of environmental objects, although the fact that financial accounting of environmental objects does not give the company the ability to manage environmental costs. Authors proposed as part of the integrated system of environmental accounting to allocate in addition to financial accounting and management accounting of environmental costs, accounting and aggregation of environmental risks. Systematization of information about environmental activities in the format of an integrated system will open opportunities to improve management procedures, as well as improve the objectivity of the assessment of the organization, which will provide competitive advantages to the organization necessary for its sustainable development.

Keywords: Non-financial reportingenvironmental reportingintegrated reportingstrategic reportingtransparencysustainable development

Introduction

Currently, the activities of companies have an increasing impact on the environment, which is associated with active technological and industrial development. As a result of overexploitation of natural resources and irrational use, protection and improvement of the environment are becoming one of the most important problems of mankind (Denedo, Thomson, & Yonekura, 2019).

The implementation of production activities by business entities, of course, has a negative impact on the environment. Just as every economic entity seeks to improve the quality of a product or service, so certain investments are needed to maintain an ecosystem.

Society is becoming increasingly aware of the fact that the success of the activities carried out by the company, largely depends on the activities aimed at the protection and protection of the environment (Lanka, Khadaroo, & Böhm, 2017). Therefore, each business entity should conduct purposeful work and provide information on programs, objectives for environmental protection implemented at the level of the organization, as well as investments in environmental protection measures and costs incurred to reduce the negative impact on the environment (Ogilvy, 2015).

Environmental accounting is a global concept for the assessment, identification, registration and analysis of the impact of economic activities on the environment in order to use such information in the management decision-making process and in the disclosure of information to stakeholders in non-financial reporting (Mace, 2019).

Problem Statement

Companies are under certain pressure from stakeholders, which is associated with the consideration by interested users of environmental performance indicators as a significant criterion for selecting an investment object. In particular, the EY study "investor Attitudes to non-financial (ESG) reporting and its role in investment decision-making" (Russian Union of Industrialists and Entrepreneurs, 2019) found that risks related to human rights, supply chain and climate change have become key for investors. Thus, about 50% of respondents – potential investors in the survey noted that with significant risks of these types of investment in the company is considered impossible.

Non-financial reporting based on risk aggregation to external stakeholders, including investors, is more informative than the sustainability reports currently published by most large companies (Lai, Melloni, & Stacchezzini, 2018). Risk-based reporting is more objective, while sustainability reports provide companies with an opportunity to present their economic, environmental and social indicators in a comprehensive manner.

The aggregation of environmental risk is the identification, collection and processing of data about risks in accordance with the requirements for reporting on them, allowing companies to measure their performance taking into account risk appetite, i.e. the level and type of risk that company is willing to accept the economic conditions in the conduct of its activities for the purposes of its business and its obligations to participants, debtors and creditors, and other stakeholders. It is important that the company has established a system of risk accounting and assessment (McLeod, & Holden, 2016).

Government organizations contribute to the strengthening of legislation, the creation of new directions, the adoption of new rules that can raise awareness of the majority of the population sensitive to environmental problems (Al-Shaer, 2018). Companies need to be aware of the seriousness of the environmental problem and take environmental concerns into account in their economic activities, which means the need to develop and apply tools that will monitor both environmental performance and the impact of products and services on the environment.

These circumstances require companies to establish and maintain environmental accounting, which is a management tool used in many areas such as cost management and control, improving the efficiency of investments in relation to the environment, increasing productivity in relation to the environment, promoting less polluted products and cleaner production processes and improving the efficiency of investments in less polluting technologies, etc.

Environmental accounting has become a new challenge for the professional accountant to maximize the well-being of mankind, and the need for the use and implementation of environmental accounting by business entities is becoming increasingly apparent (Feger & Mermet, 2017). Thus, the purpose of environmental accounting can be defined as the correct assessment and registration of the impact of the company's activities on the environment (Osipov, 2016).

The implementation of environmental accounting of the consequences of activities and the formation of non-financial information in reporting with a system characteristic of risk shows a serious positive impact in assessing the value of the company, as well as contributes to the increase of investment attractiveness and competitiveness.

However, despite the fact that economic entities form arrays of environmental information, they often face problems in the process of organizing and maintaining environmental accounting, which are associated with the fact that the methodological and theoretical provisions of this type of accounting have not yet been sufficiently developed. First of all, it should be noted that neither in foreign nor in Russian practice there is no consensus on the definition of "environmental accounting", researchers have not formed a clear position on the essential characteristics, objects and place of environmental accounting in the system of types of accounting.

Active attention to the development of the concept of "environmental accounting" was paid by many foreign researchers, including Basel and Dalla Via (2014), Schaltegger (2018). Foreign authors generally interpret environmental accounting as a set of methods used for internal management accounting, financial accounting for external reporting purposes, as well as for cost-benefit analysis of actual productivity.

Among Russian scientists, there is also no consensus on the category under study. At the same time, it can be noted that domestic experts adhere to a common approach, which consists in the fact that the object of environmental accounting-environmental activities (Melguy, Ermakova, Kovaleva, & Kovalev, 2018; Volodin & Gazaryan, 2016).

Research Questions

In accordance with the identified problems in the field of methodology of environmental accounting, the following questions were formulated in the framework of this study: What tools are used in the conduct of environmental accounting in Russian company? What does the rational structure of the company's integrated environmental accounting system look like?

Purpose of the Study

The aim of the study is to analyze the features of environmental accounting by companies based on the assessment of progressive world experience.

Based on this goal, the following tasks were formulated:

evaluate the tools used in environmental accounting by Russian business entities;

develop proposals for the formation of an integrated environmental accounting system of the company.

Research Methods

Formation of research hypothesis

Environmental accounting of the results of activities with high information value for the company itself and further stakeholders in the disclosure of non-financial information makes significant demands on the tools used by the compilers.

H1 Tools of environmental accounting of Russian companies is a pronounced focus of the formation of financial accounting information in terms of investments and costs incurred, while the state of environmental accounting in Russia is significantly behind foreign practice.

H2 Environmental accounting is an integrated information system aimed at solving a wide range of problems. In this regard, in order to rationalize the costs for the formation and systematization of information on environmental activities, business entities purposefully stand its structure to avoid possible duplication of functions of different company departments to collect similar data.

Research methodology

By means of the analysis, system approach to justification of theoretical, organizational and methodical provisions of ecological accounting the content of its tools in practice of application by the foreign and Russian companies is specified. To assess the state of environmental accounting in a particular region of the Russian Federation, the questionnaire method was used.

Data collection procedure for the study

In the process of the study in September 2019, a survey was conducted of 100 respondents-business entities operating in the Samara region (Russia). Respondents in the survey assessed the environmental accounting in their company in this areas presented in table

At the same time, in order to systematize the results, fixed answers to the questions were provided, but in order to assess the tools used for environmental accounting, most of the answers also provided a brief description of the state of this area in the surveyed organization. The survey was conducted in relation to both small and large businesses, regardless of their industry affiliation. The answers of the respondents were analyzed by the authors to form a reasonable opinion on the state of environmental accounting in a particular region of Russia.

Findings

The results of the survey in the respondents response were systematized in a fixed form (table

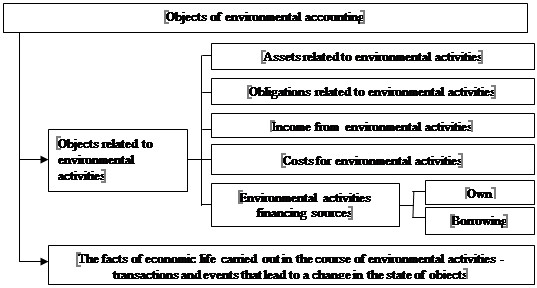

At the same time, the absolute majority (84.6%) of respondents answered positively to the question of financial accounting of environmental objects. Based on the detailed characteristics of the answers to this question of the questionnaire, the authors formed a classification of environmental objects of financial accounting, which is typical for the Russian practice. (Figure

It should be noted that the fact of financial accounting of environmental facilities does not give the company the ability to manage environmental costs, as this type of information is historical and is not relevant. In addition, financial accounting indicators are formed by companies according to Russian or international reporting standards, which reduces the value of such information for management purposes.

The most common classification of environmental costs, which is used by Russian companies for management purposes, is their division into external and internal, structuring in the last two classes, depending on the nature of their reimbursement: costs included in the cost of production, or recoverable from the company's profits. A few business entities (7.4%) that manage the costs of environmental activities, mainly used for this activity-based costing (ABC-method).

The technology of ABC-method goes beyond calculation and accounting technologies. It provides accumulation and systematization of information on various financial indicators involved in the activities of the enterprise, in the context of the main business processes and operations. The ABC -method system was based on the idea of an indirect relationship between financial indicators and objects of accounting through transactions. Operation as the basis of technological, marketing, management or ecological process requires the involvement of resources of all kinds. This allows to link transactions and the assets necessary for their implementation, the costs incurred in their implementation, the obligations to attract assets.

A small number of companies from the total sample (8.1%) most often use the sustainable development report when forming non-financial reports. Business entities that responded positively to this question, as a rule, are distinguished by the presence of foreign shareholders.

Conclusion

The problems identified on the basis of the survey indicate the need for the formation of an integrated system of environmental accounting by Russian companies. In the structure of such a system, according to the authors, the following components can be distinguished:

1. Financial accounting of environmental objects and facts of economic life on the basis of application of the relevant national and international financial reporting standards.

2. Management accounting of environmental costs, the development of which is necessary in Russia. We recommend that business entities use tools such as input-output analysis, cost accounting for material flows, the method of accounting for environmental costs by type of activity, accounting for environmental costs for the life cycle of the product.

3. Accounting and aggregation of environmental risks for the system management of the company and the formation of non-financial reporting. As part of this component of the integrated system, the company should develop a system of registration and principles of risk aggregation, as well as a template for presenting data in risk reporting.

The result of the functioning of the integrated environmental accounting system will be the rationalization of the costs of obtaining information. The systematization of information on environmental activities opens up opportunities for the company to significantly improve management procedures, as well as improve the objectivity of the assessment of the organization's activities, which provides competitive advantages of the organization necessary for its sustainable development.

References

- Al-Shaer, H. (2018). Do environmental-related disclosures help enhance investment recommendations? Journal of Financial Reporting and Accounting, 16(1), 217-244. https://doi.org/10.1108/JFRA-03-2016-0020

- Basel, J. S., & Dalla Via, N. (2014). Behavioral aspects and decision-making research in accounting: History, recent developments, and some future directions. SSRN Electronic Journal. Retrieved from: http://dx.doi.org/10.2139/ssrn.2244363

- Denedo, M., Thomson, I., & Yonekura, A. (2019). Ecological damage, human rights and oil: Local advocacy NGOs dialogic action and alternative accounting practices. Accounting Forum, 43(1), 85-112.

- Feger, C., & Mermet, L. (2017). A blueprint towards accounting for the management of ecosystems. Accounting, Auditing & Accountability Journal, 30(7), 1511-1536. https://doi.org/10.1108/AAAJ-12-2015-2360

- Lai, A., Melloni, G., & Stacchezzini, R. (2018). Integrated reporting and narrative accountability: The role of preparers. Accounting, Auditing & Accountability Journal, 31(5), 1381-1405. https://doi.org/10.1108/AAAJ-08-2016-2674

- Lanka, S., Khadaroo, I., & Böhm, S. (2017). Agroecology accounting: Biodiversity and sustainable livelihoods from the margins. Accounting, Auditing & Accountability Journal, 30(7), 1592-1613. https://doi.org/ 10.1108/AAAJ-12-2015-2363

- Mace, M. G. (2019). The ecology of natural capital accounting. Oxford Review of Economic Policy, 35(1), 54-67. https://doi.org/10.1093/oxrep/gry023

- McLeod, C., & Holden, J. T. (2016). Ecological economics and sport stadium public financing. William & Mary Environmental Law and Policy Review, 41(3). Retrieved from: http://dx.doi.org/10.2139/ssrn.2879524

- Melguy, A. E., Ermakova, L. V., Kovaleva, N. N., & Kovalev, A. F. (2018). Topical issues of environmental cost accounting. Bulletin of the Bryansk state University, 1(35), 235-242. [in Rus.].

- Ogilvy, S. (2015). Developing the ecological balance sheet for agricultural sustainability. Sustainability Accounting, Management and Policy Journal, 6(2), 110-137. https://doi.org/10.1108/SAMPJ-07-2014-0040

- Osipov, P. S. (2016). Accounting for environmental costs in construction: as a necessity at the present stage. New University: Economics and Law, 9(67), 46-49. [in Rus.].

- Russian Union of Industrialists and Entrepreneurs (2019). Non-financial reporting in Russia and the world: sustainable development goals-in focus. Retrieved from: http://media.rspp.ru/document/1/f/6/f6e6f97287df39e326d6b2d236b459b1.pdf

- Schaltegger, S. (2018). Linking environmental management accounting: A reflection on (missing) links to sustainability and planetary boundaries. Social and Environmental Accountability Journal, 38(1), 19-29. https://doi.org/10.1080/0969160X.2017.1395351

- Volodin, O. N., & Gazaryan, N. M. (2016). Environmental accounting as a factor of increasing the competitiveness of the company. Journal of Economy and Entrepreneurship, 10(1-1), 852-860. [in Rus.].

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Potasheva*, O. N., Tatarovskaya, T. E., & Tatarovsky, Y. A. (2020). Integrated Environmental Accounting System Creation. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 345-352). European Publisher. https://doi.org/10.15405/epsbs.2020.03.50