Abstract

The study is focused on growth opportunities for investment activity of subsoil users developing oil-fields with a high level of oil reserve depletion. Moreover, depreciation policy of the oil and gas company is considered as one of the mechanisms for mobilizing the company’s own investment resources. A comparison is made of two depreciation methods - a linear one and an accrual method in proportion to oil production volume recommended by international financial reporting standards. The calculations, performed using the example of the investment project for the additional oil-field development, have led to ambiguous conclusions. On the one hand, the conclusion was drawn about the advantages of the accrual method in proportion to the volume of production, which allows linking cash flows with financing needs for geological and technical measures, which is especially important for fields at a late stage of development. On the other hand, the presented calculations show that depreciation methods affect the size and distribution of cash flows, the economic efficiency of the development project, and the length of the profitable development period. Based on calculations, it was concluded that the applied depreciation policy in the oil company affects cost effectiveness indicators of the oil-field development, the income of project participants and the choice of development option.

Keywords: Depreciation chargesoil fieldlinear methodaccrual method in proportion to oil production volumecash flow

Introduction

Among the main internal problems and limitation of the Russian oil complex development, deterioration of its resource base with exploited fields’ depletion, an increase in the capital intensity of developing remote oil and gas provinces, and a decrease in the size and quality of new geological discoveries are highlighted. Deterioration of the resource base of the oil industry will inevitably lead to a significant increase in the costs of production and processing of hydrocarbons in the future. The presence of existing problems makes it necessary to develop and implement government measures to support and stimulate the activities of subsoil users in the field of the mineral resource base reproduction (Kryukov, Tokarev, & Shmat, 2016).

One of the ways to solve the problem of maintaining oil production levels and achieving the target values of indicators outlined in ES-35 is to increase the oil recovery coefficient in existing fields. In mature fields, in connection with the need to extract significant volumes of residual reserves, the role of new technologies for stimulation and enhanced oil recovery increases. In these conditions, stimulating the investment activity of companies developing oil-fields with a high level of reserve depletion is of particular relevance. One of the mechanisms that can mobilize the company’s own investment resources is an effective depreciation policy (Bobylev, 2016).

Problem Statement

The new economic literature does not adequately cover issues related to peculiarities of depreciation policy in the oil production complex, as well as the assessment of its impact on economic indicators of the oil-field development. The works of Chaya and Pankratova (2010), Medvedeva (2009), Yatsenko (2016), and many others are devoted to various methods of calculating depreciation in the oil and gas complex in accordance with international and Russian practice. Foreign and domestic authors considered the impact of depreciation on investment policy: (De Waegenaere & Wielhouwer, 2002; Glover, 2002; Park, 2016; Craford, 2015; Yatsenko, 2016). There are no works that comprehensively cover the problems of stimulating the investment activity of oil companies developing fields with a high level of reserve depletion providing depreciation in accordance with international standards.

The above problems are to solve two main problems.

First, we need to increase the government attention to factors that motivate subsoil users to long-term development of hydrocarbon fields. It is necessary not only to create conditions for the effective development of oil-fields in promising new regions, but also to stimulate companies to produce “difficult” oil from old facilities through the development and application of innovative technologies for enhancing oil recovery. To do this, it is necessary to use state mechanisms stimulating oil companies to involve all the reserves that can bring income to both the companies and the state. Secondly, the promotion of investment activity by companies developing oil-fields with a high level of reserve depletion is becoming particularly relevant. One of the mechanisms that can mobilize the company’s own investment resources is depreciation policy (De Waegenaere & Wielhouwer, 2002; Glover, 2002; Park, 2016; Craford, 2015).

Research Questions

The reproduction of fixed assets in the oil and gas industry is fundamentally different from operating conditions in manufacturing industries, which necessitates the application of the appropriate depreciation policy. The main asset of oil companies is represented by drilled and developed reserves. The life of this asset is determined by geological and mining factors and the chosen strategy for its operation.

The retirement and subsequent decommissioning of oil wells is carried out not as a result of their wear, but according to the development project at the end of the reservoir exploitation or for extraordinary technical reasons. Thus, part of the well stock can be operated for several decades, i.e., a period significantly exceeding depreciation periods. But many wells can be abandoned long before the end of their operation life. Consequently, in relation to oil and gas wells, it can be noted that their construction, the period of operation and the withdrawal from the production process are primarily determined by the volume of reserves and properties of the hydrocarbon field.

The choice of the depreciation method is important for oil companies for the following reasons:

1) Distribution of depreciation is an important factor determining the dynamics of investment capital and cash flows of the company, which in turn determines its investment opportunities;

2) Method of calculating depreciation affects the period of the profitable oil-field development and the assessment of the fair value of the oil company's production assets, and, consequently, the adoption of investment decisions.

In accordance with IFRS in relation to oil production, there are two main ways of depreciation: the linear method and the accrual method in proportion to oil production volume (tonnage method).

The linear method generally accepted in domestic practice is certainly convenient, but in oil production, as in other mining industries, depreciation based on the useful lives of fixed assets is not taken into account, especially the development of reserves and the dynamics of well productivity.

In accordance with the “Classification of fixed assets included in depreciation groups”, for oil producing wells, depreciation is calculated on a straight-line basis based on the useful life of more than 7 years up to 10 years inclusive (paragraph 3 of article 258 of the Tax Code of the Russian Federation) (Yatsenko, 2016; Medvedeva, 2009).

The linear method of depreciation as the main one for production assets can create a situation where the useful life of the object (for example, a production well) will significantly differ from the period of reserve recovery (field). This leads to a sharp decrease in depreciation at late stages of the oil-field development, when the need for additional sources of financing to maintain production volumes increases sharply. As a result, the logic and economic meaning of depreciation is distorted, and the financial aspect of the company is ignored.

On the other hand, according to IFRS, when choosing depreciation policy, mining companies should be guided by the requirement that the income from mining operations and expenses in the form of depreciation deductions from mining and other fixed assets are directly related to the preparation and development of mineral reserves in the entire field or its parts. In other words, the depreciation method should reflect the schedule of return on the economic value of the asset (International Accounting Standards Committee, IASC, 1983; Chaya & Pankratova, 2010).

The requirement for conformity of income and expenses is most consistent with the accrual method in proportion to oil production volume (a special case of the method “in proportion to output” established by clause 18 of PBU 6/01), when depreciation is charged in proportion to extracted mineral reserves during their extraction. In this case, investments in the oil-field development are depreciated in proportion to developed reserve depletion. This approach is used by foreign oil companies, as well as in Russia, when preparing financial statements in accordance with international standards. It is believed that when using this method of depreciation, there is a match between the rates of physical and functional depreciation of fixed assets, on the one hand, and the recorded rate of their financial depreciation, on the other (Yatsenko, 2016).

Purpose of the Study

The purpose of the study is to compare depreciation methods using the linear method and the accrual method in proportion to oil production volume and to establish how they affect cash flows by years of the oil-field development and project performance indicators. The effect of various depreciation methods was studied for a separate medium-sized oil field, which is at a late stage of development, operated by Bashneft PJSC.

Research Methods

When calculating the amount of depreciation deductions in proportion to the volume of oil production, the company's production assets are grouped on their compliance with one geological object (Yatsenko, 2016; Medvedeva, 2009). As a rule, the basis for calculating depreciation is an oil-field considered as a cash generating unit. Such a grouping of assets allows you to calculate the amount of depreciation charges separately for each oil-field. This is of significant importance in the investment program of the company, since it makes it possible to rank fields according to economic efficiency.

A for fixed assets related to oil production (wells and related equipment, equipment for simultaneous and separate production and injection, etc.), depreciation was carried out according to the formula recommended by Ernst & Young:

where Аmt – depreciation for the period; Zd.r.k.t – estimated proven developed reserves at the end of the period; Qd.r.z.t – production volume for the period calculated on the basis of proved developed reserves; Akt – the value of the asset involved in the oil-field development at the end of the period; Аmsumm.nt – total depreciation and depreciation at the beginning of the period.

IFRS does not indicate which of the categories of reserves complying with the SPE-PRMS classification should be taken as a basis for calculating production volumes for a period: proved developed reserves, proved reserves or proved and probable reserves (Khalikova & Kirichenko, 2017).

For the costs of acquiring a license to develop an oil- field, the following formula was used:

where Zd.k.t – estimated proved reserves at the end of the period; Qd.z.t – production volume for the period calculated on the basis of proved reserves; Alic.k.t – costs of a license to develop an oil-field at the end of the period; Аm.sum.lic.nt – total depreciation and depreciation of the license at the beginning of the period.

When calculating depreciation amounts for fixed assets relating to oil production, the authors took into account the category of proven developed reserves, and for the costs of acquiring a license, the category of proved reserves. For assets not directly related to oil production, depreciation was charged on a straight-line basis.

Findings

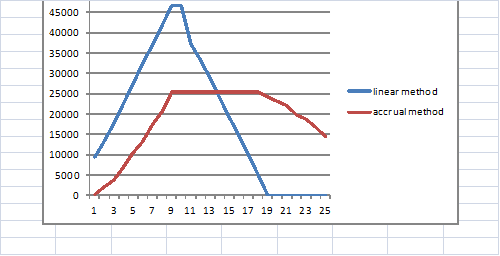

Figure

In the case of the linear method, there is a sharp decrease in annual depreciation at the late stage of the oil-field development due to the fact that the useful life of fixed assets is used as the base for calculating depreciation, which is much shorter than the life of the oil-field.

We can conclude that depreciation in proportion to production volumes (accrual method) seems to be more correct, since it allows linking cash flows with financing needs for geological and technical measures, which is especially important for oil-fields at a late stage of development.

In order to increase the objectivity and completeness of estimates, the decision to choose the depreciation method should be based on the use of investment analysis tools. Obviously, the method chosen by the company for calculating depreciation deductions affects the cash flow from the oil-field development (Misund, 2017; Dvořáková, Kronych, & Malá, 2018; Wielhouwer & Wiersma, 2017).

At the next stage, the authors studied the impact of the depreciation method on the formation of cash flows and on the economic efficiency of the oil-field development (Table

This situation may lead to a decrease in the attractiveness of investments in re-development projects of existing oil-fields, a decrease in incentives for drilling new wells and the use of highly effective, but costly improved oil recovery methods (ORM), premature completion of depleted reserves development, and a decrease in oil recovery index (ORI). In turn, for the state budget this will have a negative impact on its revenue, which will be manifested in a decrease in tax revenues due to non-involvement in the development of new facilities and the refusal to re-develop old ones.

As a result, we strongly need measures of state support for oil companies engaged in the development of highly watered, heavily depleted reserves. The most technologically effective oil recovery methods (ORM), which are more likely to give a greater increase in oil recovery index, are highly costly, and with the existing taxation system, projects for their implementation do not always reach the level of profitability required by investors, and therefore their application is very limited (Solov'eva & Makasheva, 2015).

Conclusion

The study showed that the accrual of depreciation in proportion to production volumes (tonnage method) seems to be more correct than the linear method, as it allows you to link cash flows with financing needs for geological and technical measures, which is especially important for oil-fields at a late stage of development. This conclusion contradicts the assertions of those economists who believe that the company should reimburse its costs associated with fixed assets as soon as possible.

In turn, the reference to the International Accounting Standard 16: Fixed assets, IASC (International Accounting Standards Committee, IASC, 1983), in accordance with which the depreciation method should reflect the schedule of the return on the economic value of the company’s asset, speaks in favor of the current method of depreciation.

The study also showed that the method of calculating depreciation deductions affects the duration of the profitable development period, and therefore the value of the total cash income of the oil-field development project.

The identified problem requires an integrated approach to investment policy of the oil company engaged in the development of depleted reserves, since the applied depreciation policy affects cost effectiveness indicators of the oil-field development, the income of project participants and the choice of development option.

References

- Bobylev, Y. (2016). The development of the Russian oil sector. Problems of Economic Transition, 58(11-12), 965-987. https://doi.org/10.1080/10611991.2016.1316093

- Chaya, V. T., & Pankratova, V. V. (2010). Regulatory control of accounting in Russia. Audit and Financial Analysis, 1, 0-23. Retrieved from: http://auditfin.com/fin/2010/1/02_06.pdf Accessed 28.09.2019. [in Rus.].

- Craford, G. (2015), Network depreciation and energy market disruption: Options to avoiding passing costs down the line. Economic Analysis and Policy, 48, 163-171. https://doi.org/ 10.1016/j.eap.2015.11.004

- De Waegenaere, A., & Wielhouwer, J. L. (2002). Optimal tax depreciation lives and charges under regulatory constraints. Operations Research-Spektrum: Quantitative Approaches in Management, 24(2), 151-177. https://doi.org/10.1007/s00291-002-0096-0

- Dvořáková, L., Kronych, J., & Malá, A. (2018). Cash flow management as a tool for corporate processes optimization. Smart Science, 6(4), 330-336. https://doi.org/10.1080/23080477.2018.1505370

- Glover, J. (2002). Discussion of controlling investment decisions: Depreciation and capital charges. Review of Accounting Studies, 7(2-3), 283-287. https://doi.org/10.1023/A:1020242522608

- International Accounting Standards Committee, IASC (1983). International Accounting Standard 16: Fixed assets, IASC. Retrieved from: https://finotchet.ru/articles/138/ Accessed 28.09.2019 [in Rus.].

- Khalikova, M. A., & Kirichenko, Yu. A. (2017). Assessment the fair value of the development of an oil field. Internet-journal «Naukovedenie», 9(2). Retrieved from: http://naukovedenie.ru/PDF/104EVN217.pdf Accessed 28.09.2019. [in Rus.].

- Kryukov, V. A., Tokarev, A. N., & Shmat, V. V. (2016). How can we preserve our oil and gas “hearth”? Problems of Economic Transition, 58(2), 73-95. https://doi.org/10.1080/10611991.2016.1166899

- Medvedeva, N. V. (2009). Depreciation of oil and gas assets in preparation of financial statements in accordance with IFRS. Corporate financial statements. International standards. Journal and Practical Developments in IFRS and Management Accounting, 3, 89-96. Retrieved from: https://finotchet.ru/articles/500/Accessed 28.09.2019. [in Rus.].

- Misund, В. (2017). Accounting method choice and market valuation in the extractive industries. Cogent Economics & Finance, 5(1), 1408944. https://doi.org/10.1080/23322039.2017.1408944

- Park, J. (2016). The impact of depreciation savings on investment: Evidence from the corporate Alternative Minimum Tax. Journal of Public Economics, 135, 87-104. https://doi.org/10.1016/j.jpubeco.2016.02.001

- Solov'eva, I. A., & Makasheva, A. M. (2015). Improvement of the economic mechanism of state regulation of an oil and gas complex. Internet-journal «Naukovedenie», 7(2). Retrieved from: http://naukovedenie.ru/PDF/53EVN215.pdf Accessed 28.09.2019. [in Rus.].

- Wielhouwer, J. L., & Wiersma, E. (2017). Investment decisions and depreciation choices under a discretionary tax depreciation rule. European Accounting Review, 26(3), 603-627. https://doi.org/10.1080/09638180.2017.1286250

- Yatsenko, V. M. (2016). Problems of effective management of fix assets in the gas industry and mechanisms for their solution (using the example of Gasprom). Moscow, Russia. [in Rus.].

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Solovjeva*, I. A., Khalikova, M. A., & Avdeeva, L. A. (2020). Depreciation Policy Impact On Cost Effectiveness Indicators Of The Oil-Field Development. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 265-272). European Publisher. https://doi.org/10.15405/epsbs.2020.03.38