Abstract

In their activities, oil and gas companies are exposed to various risks that can have a negative impact on production and financial results. Companies try to reduce risks which are under their control and take into account possible negative consequences of risks that they are unable to control. The analysis of numerous practices enables to systematize and manage risk processes. At the same time, the increasing turbulence of the economy and the complexity of working conditions in gas companies require constant attention to the account of newly discovered factors in the process of risk management. Despite existing a lot of fundamental and applied research in this area, the specific features of the oil and gas industry quires to conduct assessment procedures for reducing risks and overcoming difficulties in the large-scale projects’ realization since these project are usually influenced by diverse factors reflecting current market conditions. Most gas companies implement a complete technological value chain. This leads to an increase in management costs and a need for a single strategy. It should be noted that when implementing the company strategy, it is necessary to take into account specifics of each link of the business process. However, not all parts of the business process equally lead to an increase in the cash flow of the enterprise and, as a consequence, the growth of the company's value. Companies face a question of competent risk management. Each business process has a specific set of risks.

Keywords: Business processrisk managementgas companiesrisk identificationmethods of risk assessment

Introduction

The creation of a risk management mechanism in the gas industry allows to identify, assess and minimize risks, taking into account the peculiarities of the gas business. In today's reality, the use of a risk management mechanism is one of the necessary conditions for improving the business competitiveness. The existing risk management mechanism has significant shortcomings limiting the activities of managers.

Problem Statement

Companies have been puzzled by the problem of effective risk management for many years. The complex nature of the gas field development process leads to a high degree of risks in the organization of business processes. However, in Russia, the risk management in the development of gas fields is not properly applied. This process is characterized by the following problems:

problems of risk assessment and accounting in business processes;

lack of accounting the specifics of the business processes organization in the gas companies;

the problem of risk management methods.

Research Questions

The aim of this research is to develop a risk management mechanism for business processes of gas companies, taking into account specifics of the gas industry (Konoplyanik & Sergeeva, 2018). This mechanism is necessary for improving the selection and analysis of possible risks and the competent risk management in the context of the effective enterprise management.

Purpose of the Study

The purpose of our research is the development of an effective risk management mechanism for gas companies. The realization of this goal is possible through consistent solving of the following tasks:

create an industry value chain in the context of the vertical integration of the gas business;

determine tools for assessing business processes in relation to the gas industry and methods for determining key business processes in this type of business;

develop a risk management mechanism for business processes of gas companies.

Research Methods

The methodological basis of this research was made up of scientific works of Russian and foreign authors devoted to the issues on nature, methods and tools of risk management, methodologies of business processes construction, business processes assessment, research on questions of strategic development of business processes. The authors used the main principles of the system approach, methods of analysis and synthesis, comparison, grouping and classification, economic and mathematical modeling, forecasting, expert evaluation method, analytical, statistical and graphical methods (Losev & Kozerod, 2012). The application of these methods provided the complexity of the risk research, identification of risks for each business process and effective management of them in the enterprise.

Findings

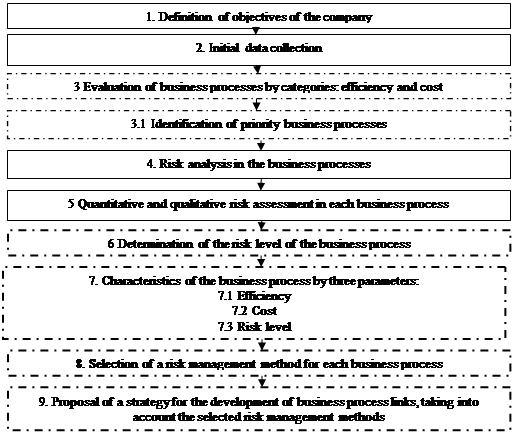

Currently, the gas industry is at the stage of completion of deposits, as a result, there is a large set of risks. Companies need the competent risk management; moreover each business process has a specific set of risks. The authors propose a risk management mechanism (figure

The dissipation method is the most suitable when the company carries large risks, the process is costly and the efficiency of the business process is high or medium. If the business process is highly efficient, other risk management methods are in appropriate. The dissipation method is the most appropriate when the company carries high risks, while the process is costly and the effectiveness of the business process is high or medium. If the business process is highly efficient, other risk management methods are inappropriate.

The developed mechanism of risk management for business processes of gas companies is characterized by a set of elements that are taken into account when choosing risk management methods. To assess risks, the authors propose a matrix, which determines the influence degree and probability of risk emergence (table

The localization method is suitable when the risk and the process efficiency are low, and the cost is medium or high. In this case, the business process is expensive, and since the risk is low its distribution among participants can reduce the risk level (Risk management – Principles and guidelines…, 2009). The evasion method is an acceptable method of the risk management by low risks or low efficiency and low cost of the business process and high risks. If the business process is inefficient and requires small investments, but at the same time it has high risks, the best measure to manage such risks is evasion. This method does not require large costs to manage these types of risks, because the investment in this case will not be justified. The compensation method is used if the risks can be predicted in advance and measures to reduce them can be developed. In this case, it is necessary to analyze the external environment carefully.

Conclusion

The risk management mechanism proposed by the authors allows a more thorough analysis of risks arising in business processes, takes into account the specifics of the gas industry. It also enables to choose the appropriate methods for reducing the risk level in the company. The mechanism contributes to the quality improvement of management decisions in the process of creating added value of the company through a comprehensive assessment of efficiency.

References

- Analytical Center for the Government of the Russian Federation (2016). Russian Energy 2015. Retrieved from: www.ac.gov.ru/files/publication/a/10205.pdf Accessed: 01.10.2019. [in Rus.].

- Chaldaeva, L. A. (2013). Risk assessment of business processes of small and medium-sized enterprises on the basis of the comparative analysis and algorithmic modeling. Economic Issues, 35(173), 40-48. [in Rus.].

- Konoplyanik, A. A., & Sergeeva, A. A. (2018). The emergence of the liquefied natural gas market in the Danube region. Alternative Fuel Vehicles, 2(62), 32-43. [in Rus.].

- Losev, V. S., & Kozerod, L. A. (2012). Assessment of the effectiveness of business process management of an industrial enterprise. Bulletin of TOGU, 1(24), 167-178. [in Rus.].

- Project Management Institute (2008). A guide to the project management body of knowledge. Atlanta: Project Management Institute.

- Risk management – Principles and guidelines. ISO/FDIS 31000: 2009 (2009). Retrieved from: https://www.iso.org/standard/43170.html Accessed: 01.10.2019.

- Shabanova, D. N., Aleksandrova, A. V., & Nelina, V. V. (2017). The question risk analysis of oil and gas projects. Scientific works of the Kuban State Technological University, 1, 394-399. [in Rus.].

- Shayakhmetova, K. O., & Kussen, E. T. (2012). Risks of the oil and gas industry and risk management capabilities. KazNU Bulletin. Economics Series, 3(91), 153-157. [in Rus.].

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Sirgalina*, G. T., Burenina, I. V., & Kotov, D. V. (2020). Key Stages Of Risk Managementin Business Processes Of Gas Companies. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 241-245). European Publisher. https://doi.org/10.15405/epsbs.2020.03.34