Abstract

In a globalized economy, close attention should be paid to ensuring the economic security of commercial organizations at the strategic level. The main problem of ensuring economic security in the context of business management is the gap between the current results and its ultimate goals. In this regard, the concept of a balanced scorecard seems promising, since it focuses on strategic aspects rather than control, which is more typical for modern enterprises, and which, in our opinion, is the main problem of the low efficiency of measures taken in the field of economic security. The balanced scorecard sets strategic goals for economic security and suggests further development of measures necessary to achieve the goals. An important aspect of the balanced scorecard is also the fact that it is designed to form employees at all levels of the enterprise a common vision of the enterprise and the strategic orientation of its activities. Thus, the management of the organization must clearly understand what should be the final result of actions to improve the level of enterprise economic security, as well as to form a set of actions to achieve the goals and objectives for each employee, thereby forming an agreed tree of goals. A balanced system of economic security indicators makes it possible to form a strategy aimed at countering risks and threats, and not to develop measures to combat the negative moments that have arisen and eliminate their consequences.

Keywords: Balanced scorecardeconomic securityeconomic analysisrisksenterprise strategy

Introduction

The balanced scorecard (BSC) is an important tool for developing and implementing strategic management decisions. Despite its active development and application in foreign enterprises (Hansen & Schaltegger, 2016), in Russia it needs further development due to the need to improve productivity and efficiency on the part of both regulatory authorities and business. Thus, the adaptation of this concept for domestic commercial organizations is of great theoretical and practical importance, both for their activities in general (Hristov, Chirico, & Appolloni, 2019) and to ensure their economic security in particular.

Problem Statement

Today, there is a common approach to ensuring economic security at the enterprise by responding to incoming challenges and risks (Klewitz & Hansen, 2014). This reactive approach is costly, ineffective, and only aimed at countering a specific risk or event (Cooper, Ezzamel, & Qu, 2017). At the same time, ensuring the economic security of the enterprise should be part of the key strategic goals, and measures to ensure economic security should be developed systematically and reflect the specifics of the enterprise and the interaction of internal business processes. According to Malagueño, Lopez-Valeiras, and Gomez-Conde (2018) this is vitally important for small enterprises.

Research Questions

The study raised the following questions:

-What should identify the current problems of building a system of economic security in a commercial enterprise and what indicators can describe it;

-What is the role of the balanced scorecard in the system of economic security (SES) of the enterprise, from which components it is formed;

-What specific indicators should consist a system of the enterprise economic security balanced scorecard.

Purpose of the Study

The aim of the study is to develop a methodological approach to the formation of the enterprise economic security balanced scorecard. To achieve this goal, it is paramount to determine what indicators can be assessed the level of economic security. Also, the next step is to determine the logical or functional relationship between the financial, personnel, customer components and business processes component of the balanced scorecard of economic security of the enterprise.

Research Methods

Achieving the goal and objectives requires a substantial methodological framework. It consists of theoretical developments of domestic and foreign scientists, as well as the experience of implementing a balanced scorecard, published in practice-oriented professional journals. The study used the following methods of cognition: statistical-analytical, tabular, graphic.

Findings

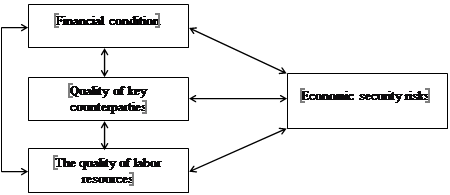

According to the position of the authors of the balanced scorecard concept (Madsen & Slåtten, 2015), it is developed individually for the enterprise taking into account the specifics of its activities, strategic goals, individual features of the business model (Akkermans & van Oorschot, 2018). Accordingly, it is advisable to build strategically related indicators for the formation of enterprise economic security balanced scorecard, as shown in figure

The initial element necessary to create a balanced scorecard is the development of a strategic map that allows to:

Formalize and communicate to each employee the development plan of the enterprise.

Increase employee motivation by accurately understanding the impact of their performance on the performance of the organization as a whole.

Reflect the interdependencies between individual strategic objectives.

Explain the implications of achieving a strategic objective.

The main element in the formation of the enterprise economic security balanced scorecard system is the development of a strategic approach to ensuring and managing economic security, as well as its expression through specific indicators.

The authors of the concept of Balanced scorecard did not offer methodological foundations or recommendations for the formation of balanced scorecard. However, the main point in the implementation of the concept of balanced scorecard, formulated by Gupta and Salter (2018) is its compactness, that means that each group should contain no more than 3-4 indicators. Let us consider in detail each of the components of the economic security balanced scorecard system of the economic entity.

I. Financial component.

The strategic objective of the financial component of the enterprise economic security balanced scorecard of the enterprise is to improve financial stability and financial performance. As a key indicator, it is possible to use the indicator of financial stability, which is defined as the effective formation, distribution, and use of financial resources, ensuring the development of the enterprise on the basis of profit growth, capital and preservation of solvency with balanced borrowing (table

The list of indicators presented in the table consists of the main coefficients that most fully and comprehensively describe the financial aspect of the enterprise economic security ensuring with the available recommended value, which can also take an individual assessment.

II. Component of counterparties.

The component of quality of contractors of the enterprise economic security balanced scorecard, unlike traditionally allocated client component, is wider and includes not only the analysis of the sales channel (Sainaghi, Phillips, & d’Angella, 2019), but also quality of supply. At the same time, the key indicators characterizing the component of counterparties of the enterprise economic security balanced scorecard are aimed at assessing, first of all, the quality of debtors and the state of receivables as parameters that can lead to technical bankruptcy of the enterprise. Thus, the basis of the metrics component of the contractors of the enterprise economic security balanced scorecard is the turnover ratio of receivables and the share of overdue receivables in the total receivables.

Speaking about strategy of economic security in component of counterparties, the key strategic goals are:

- Ensuring economic security in working with contractors.

The company must take due diligence in selecting contractors, providing them with deferred payment, advance works and services.

- Diversification of counterparties.

To ensure the economic security of the enterprise, it is recommended to resort to diversification of contractors. It is aimed at reducing the credit risk arising from commercial lending.

- Ensuring the return of receivables.

It is necessary to provide legal mechanisms that strengthen the creditor's faith and the likelihood of actual debt collection. Such mechanisms may be a penalty, retention, surety, guarantee, pledge, Deposit, security payment.

These strategic goals are interrelated and achieving each previous goal helps to achieve the next.

In modern practice, a lot of methods of qualitative assessment of the reliability of counterparties can be found, which can include the Due Diligence procedure, the recommendations of the Russian Federal tax service on the implementation of the principle of due diligence of the taxpayer, etc.

It is also advisable to assess the property status of the counterparty. One of the most effective from the standpoint of the ratio of information utility and the cost of analytical procedures is to check for compliance with the signs of "good" balance, according to the methodology proposed by Russian economists. This technique assumes 6 points of check characterizing the main changes of parameters of activity of all enterprise. Thus, it is possible to propose the following integral assessment of counterparty quality, based on compliance with the criteria of "good" balance:

High, if all six criteria are met.

Normal, subject to at least two criteria are met.

Low (crisis), if more than three criteria are not met.

Thus, the counterparties component of enterprise economic security balanced scorecard allows not only to increase the intensity of the use of enterprise resources (invested in receivables), to avoid financial losses, but also to counteract tax and business risks.

III. Personnel (staff) component

The component of labor resources use (the personnel component of enterprise economic security balanced scorecard) is based on three key indicators characterizing the final result of use of labor resources (Raval, Kant, & Shankar, 2019), and also indicators of their movement:

Labor force retiring rate;

The rate of labor resources renewal;

Output per worker.

The decrease in the retirement rate indicates that the company retains its human resources potential, and the professional level of its employees increases. At the same time, attraction of additional employees testifies to development of scale of activity of the enterprise that in total with increase in development testifies to positive development of this component of enterprise economic security balanced scorecard. It is also worth noting that the reduction of staff turnover is an important element that ensures the economic security of the enterprise, as:

The cost of training new employees to the level of the retired workforce is reduced, which allows investing in staff development to improve the efficiency of its functioning.

Economic security risks associated with the disclosure of information containing commercial secrets by retired employees are minimized.

High professionalism of employees, allows not only to provide efficiency of the main business processes and high quality of products, but also to reduce operating costs, by means the effect of "experience curve".

The indicator of output per employee characterizes the productivity of labor in the enterprise, which is a key indicator describing the quality of the labor resources use.

IV. Component of internal business processes.

The component of internal processes of enterprise economic security balanced scorecard is directed on counteraction to the main risks inherent in concrete activity and is characterized by effective functioning of system of internal control which can be estimated by means of the following parameters:

Strengthening control over the safety of documents and access to them in the internal regulations of the organization, seals, powers of attorney, careful familiarization of responsible persons signed contracts;

Control over the movement of property, as well as the presence of a written statement of refusal to commit any action with the personal account of the owner without his personal signature;

Protection of internal accounting financial statements;

Monitoring the competitive environment;

Control and analysis of accounts payable in order to protect yourself from the possible purchase of all debts and pressure on the management of the enterprise;

Assess employee reliability and combat corruption in the field;

Availability of internal control system at the enterprise;

Development of measures to control the safety of documents and protect trade secrets;

Monitoring of competing companies;

Development of anti-corruption system in the enterprise.

The effectiveness of the business processes component of the enterprise economic security balanced scorecard largely depends on the systematic nature of its application, as it is designed to identify shortcomings and possible risks, as well as to facilitate their timely elimination. To do this, the company needs to regularly analyze the risk component contained in the internal business processes of the company.

Conclusion

Developed in the framework of the study approach to the formation of the enterprise economic security balanced scorecard is of great importance in practice, as it can be taken as a basis and implemented in any enterprise without significant financial and labor costs, allowing minor adjustments related to the specifics of the activity, individual aspects of the business model or strategic goals of the enterprise. An extremely important point that is put in the center of the concept of balanced scorecard is the relationship of indicators, which is taken into account in the presented methodology for the formation and analysis of the enterprise economic security balanced scorecard. Received under the proposed scorecard information will be relevant to management decisions aimed not only at increasing the level of economic security, but also to enhance the competitiveness of the business and its output to achieve a sustainable pace of development.

References

- Akkermans, H. A., & van Oorschot, K. E. (2018). Relevance assumed: A case study of balanced scorecard development using system dynamics. System Dynamics (pp. 107-132). London: Palgrave Macmillan. https://doi.org/10.1057/978-1-349-95257-1_4

- Cooper, J. D., Ezzamel, M., & Qu, S. Q. (2017). Popularizing a management accounting idea: The case of the balanced scorecard. Contemporary Accounting Research, 34(2), 991-1025.

- Gupta, G., & Salter, S. B. (2018). The balanced scorecard beyond adoption. Journal of International Accounting Research, 17(3), 115-134.

- Hansen, E. G., & Schaltegger, S. (2016). The sustainability balanced scorecard: A systematic review of architectures. Journal of Business Ethics, 133(2), 193-221.

- Hristov, I., Chirico, A., & Appolloni, A. (2019). Sustainability value creation, survival, and growth of the company: A critical perspective in the sustainability balanced scorecard (SBSC). Sustainability, 11(7), 2119.

- Klewitz, J., & Hansen, E.G. (2014). Sustainability-oriented innovation of SMEs: A systematic review. Journal of Cleaner Production, 65, 57-75.

- Madsen, D. Ø., & Slåtten, K. (2015). The balanced scorecard: Fashion or virus? Administrative Sciences, 5(2), 90-124.

- Malagueño, R., Lopez-Valeiras, E., & Gomez-Conde, J. (2018). Balanced scorecard in SMEs: effects on innovation and financial performance. Small Business Economics, 51(1), 221-244.

- Raval, S. J., Kant, R., & Shankar, R. (2019). Benchmarking the lean six sigma performance measures: A balanced score card approach. Benchmarking: An International Journal, 26(6), 1921-1947.

- Sainaghi, R., Phillips, P., & d’Angella, F. (2019). The balanced scorecard of a new destination product: Implications for lodging and skiing firms. International Journal of Hospitality Management, 76(A), 216-230.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Tatarovsky*, Y. A., & Morozova, E. S. (2020). Formation And Analysis Of The Enterprise Economic Security Balanced Scorecard. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 206-212). European Publisher. https://doi.org/10.15405/epsbs.2020.03.29