Abstract

Taxation is an important element of the activity of any legal entity or individual. Presenting taxes as exemptions in favor of state bodies, the question of the impact of this aspect on financial and economic activity, that is, the assessment of the tax burden becomes particularly important. It is the tax burden on business that largely determines the entrepreneurial activity of the country's population, its economic and investment climate, the welfare of the population. Thus, the tax burden is the main indicator characterizing the harmonization of the interests of the state, on the one hand, and taxpayers, on the other. We cannot deny the fact that taxation plays a big role for businesses, from the standpoint of evaluating their obligations to the budget and extra budgetary funds, which makes it possible to determine how burdensome the tax system for legal entities and individuals and what portion of the resources of the entity need to be sent as payments to state bodies, that means the determine of the taxpayers tax burden. Therefore, determining the optimal size of the tax burden is the task of finding a compromise, a balance of divergent interests of the state and the taxpayer. In this context, both the current state of the solution of this issue in the Russian Federation and the experience gained by the countries of the European Union are extremely important, since the integration of international and Russian accounting standards cannot but affect the issues of taxation.

Keywords: Economic analysestax burdenstakeholderstaxation analysessmall and medium enterprises

Introduction

With the help of the tax burden indicator, key management decisions are made at the micro level, involving the development of methods of tax optimization, the choice of the tax regime, etc. Thus, the tax burden is an important criteria for attracting foreign investment, which the Russian ad foreign business entities need very much today (Hines, 2018). Despite the importance of the tax burden indicator, there is ambiguity in its interpretation in the scientific and practical environment of domestic and European scientists, as well as by state bodies and supranational entities.

Problem Statement

The search and creation of "growth points" of the domestic economy, the development of small and medium-sized businesses cannot but touch upon issues related to the tax burden on business (Adachi, 2018). On the one hand, the decrease in the amount of funds withdrawn in favor of the state creates prerequisites for the development of entrepreneurship by both residents and non-residents of the country. At the same time, today the state has no right to refuse or freeze the amount of funds allocated for the performance of its duties in order to maintain political stability. That is why the issue of tax burden can be considered as a search for a compromise of key stakeholders: the taxpayer, public authorities and recipients of public services (Sinevičienė, 2016).

Research Questions

The key issue of the study is the experience of applying approaches to the analysis of the tax burden in Russia and the EU (Schratzenstaller & Krenek, 2019), as well as management decisions that can be made on the basis of the data. This question has a fairly broad theoretical development, but it is not only the consensus of scientists, but even the legal aspect leaves unanswered basic questions, which significantly reduces the possibility and practicality of using this indicator in practice. This situation is extremely unfavorable and does not contribute to the increase of investment attractiveness or the development of entrepreneurial activity (Wenjuan, 2018).

Purpose of the Study

The aim of the study is to develop recommendations for improving the methodology for analyzing the tax burden of the enterprise, which is based on domestic and European experience. The study suggests that the use of European experience is necessary in the aspect of Russian and international financial reporting standards harmonization. At the same time, it is necessary to develop such methodological approaches to the analysis of the tax burden, which not only assessed the share of contributions to the state in the total income or expenses of the business, but also were able to reveal directions to improve its financial condition.

Research Methods

Domestic and foreign developments in the field of assessment of the tax burden, including regulatory and applied by international organizations, were considered as a methodological basis. Also were used key methods of cognition:

- theoretical model of relationships between tax burden and financial results;

- analysis of the structure and dynamics of the measure of the tax burden, both in the micro and macro level of economy;

- mathematical models describing the relationship between the studied phenomena

- deduction and induction, were are required for analysis and outcomes.

The recommendations formed as a result of the study were tested at a number of enterprises and proved their practical significance.

Findings

Many foreign countries and organizations are engaged in the calculation and analysis of the tax burden, among which are the methods of calculating the tax burden developed by the International monetary Fund, the Organization for economic cooperation and development and the World Bank (European experience). In each of the proposed methods, there are differences, in particular in the composition of taxes and fees that are accepted for calculation. Despite this, the presented methods are aimed at making macroeconomic decisions and have only advisory value for business, and therefore, of great value for the study are the author's developments of scientists in this field, which have not received as much distribution as described above (Lyal, 2016).

Summarizing the controversial points and differences in the views of economists involved in the development of tax burden analysis methods, two controversial points can be distinguished:

1. Disagreements in the aggregate of taxes, the burden on the activities of the enterprise from which it is planned to assess;

2. Differences in the basis of comparison with the totality of taxes: income, funds remaining at the disposal of the enterprise after payment of all taxes, the corresponding tax base.

However, a significant disadvantage of these approaches, according to experts, is that they do not characterize the tax capacity of the enterprise, which, by analogy with the creditworthiness or solvency, is determined by the ability of the enterprise to meet tax obligations without compromising its financial condition and economic security. This allows to assess the level of tax burden in relation to financial performance and property potential, which is necessary to improve in the aspect of the business efficiency (Mitu & Stanciu, 2018).

Developing this logic, a number of scientists allocated such a characteristic as the tax potential (Stam & Verbeeten, 2017), which even at the micro level is interpreted broadly, ranging from hidden, implicit overpayments of taxes to the budget, which is a reserve of the organization to improve its financial results and ending with the optimal amount of taxes and fees in an ideal for a particular organization of the tax system. According to the approaches of some economists, tax potential is the ratio of the amounts paid to the budget of taxes and fees to profit before tax. The values of this indicator are in the range from zero to plus infinity. The economic meaning of the values of this indicator is presented in table

There are also particular points in the economic interpretation of the tax potential indicator, which should be paid attention to especially in the context of Russian and foreign small and medium-sized businesses (Braunerhjelm, Eklund, & Thulin, 2019). A high value of this indicator, falling in the interval from one to infinity, may indicate the following: 1) low quality of tax management and non-application of tax optimization measures; 2) reduction of economic potential and manifestation of crisis processes at the enterprise which can provoke loss of solvency of the enterprise; 3) unreliability of the data presented in the accounting (financial) statements.

According to this approach, the tax potential indicator should be compared with the tax burden on business, calculated by the method of the Federal Tax Service of Russia. The excess of the tax potential over the tax burden indicates the absence of a negative impact on the results of financial activity on the part of taxation, which indicates an effective system of tax optimization, as well as a comfortable (stimulating) tax regime. Finding the values of these indicators in the range from zero to one and the implementation of the inequality characterizes the situation when the company is able to invest in its activities at the expense of funds received as a result of its operation. This situation is also beneficial to the state, as a sustainable and developing business is a long-term source of income for budgets of different levels (Hou, 2019).

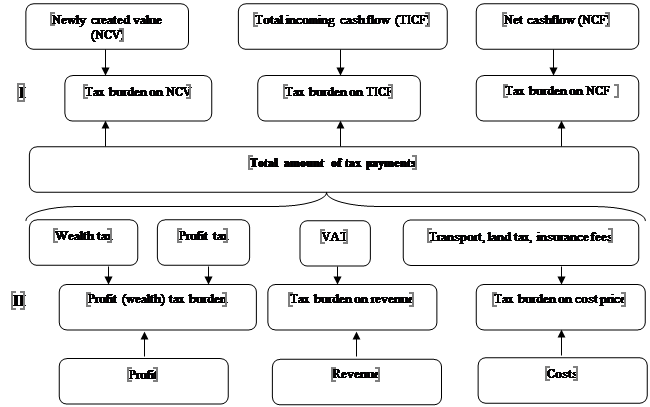

The excess of the tax burden over the tax potential characterizes the destructive role of taxes in the functioning of business. An economic entity in this case is not able to perform its duties as a taxpayer, loses its solvency, thereby increasing the risk of bankruptcy (Kovárník & Jedlička, 2017). In determining the direction of the analysis of the tax burden in the context of the implementation of its incentive functions, general and particular coefficients of the tax burden are used. General indicators of the tax burden are the quotient of the total tax burden divided by indicators that usually characterize the income of the organization, or funds remaining at the disposal of the organization after expenses: revenue, total income, newly created value, total cash inflow, net cash flow, etc. Private indicators of the tax burden are calculated as the ratio of taxes paid to the base of their calculation (Salm, 2017). The relationship of General and particular indicators of the tax burden can be displayed in figure

Source: authors

Block I describes the general indicators of the tax burden, and block II-private indicators of the tax burden.

Thus, the directions of improvement of methods of analysis of the tax burden on the part of the enterprise should obtain the information necessary for the development and adoption of management decisions in the field of improving the efficiency of financial and economic activities. Therefore, the analysis of the tax burden should be carried out in the context of its impact on business activity, which is possible by calculating the presented indicators using the following algorithm:

Calculation of tax potential and tax burden;

Comparison of the indicators calculated in paragraph 1, the formulation of conclusions about the impact of the current amount of taxes on the economic potential of the enterprise;

Calculation of the tax burden on cash flows;

Analysis of the data obtained in paragraph 3, the formation of conclusions about the scale of withdrawal of funds in favor of the state in the context of the total cash flow;

Calculation of private indicators of the tax burden;

Analysis of the results of calculations carried out in paragraph 5, including dynamics;

Consolidation of conclusions obtained as a result of paragraphs 2, 4, 6. Development of measures to optimize the tax burden and improve the efficiency of the business.

Also, within the framework of the study conducted by the authors, a correlation and regression analysis was carried out, characterizing the relationship of key indicators of financial and economic activity of the enterprise with the indicator of the tax burden. Thus, 30 small and medium-sized enterprises of the Samara region were analyzed, the results are presented in table

Despite theoretical assumptions about the impact of the level of tax burden on the financial condition of enterprises, the calculations did not allow to demonstrate a high correlation between financial indicators and the tax burden, which negatively characterizes the stimulating possibilities of the tax burden of the enterprise and actualizes the need to develop other ways to stimulate small and medium-sized businesses in Russia. Besides, it is necessary to take into account the fact of the specifics of the functioning of small and medium-sized businesses in the Russian Federation and the inaccuracy of accounting (financial) statements. The last aspect is the big problem of Russian small and medium-sized enterprises.

Conclusion

The study revealed the importance of the process and the results of the analysis of the tax burden, because due to this indicator it becomes possible to:

Get more detailed and systematic description of the taxation of the enterprise;

Identify possible ways to minimize the tax burden of the organization in question;

Increase the importance of the tax factor in improving the financial condition of a commercial organization.

The existing ambiguity in approaches and interpretations, the ambiguity of key terms, including at the level of legislative acts, significantly reduces the expediency of using existing techniques. Moreover, it was revealed that most modern approaches to the analysis of the tax burden are to find the share of funds withdrawn in favor of the state in a particular base of comparison. However, the development of the domestic economy requires analytical orientation of these approaches and identification of the relationship with the financial results of the enterprise. In this case, the stimulating function of taxes can be fully realized and budget expenditures on the programs of development of entrepreneurship and investment attractiveness will be more effective. Thus, the further development of issues related to the tax burden is relevant both in theoretical and practical terms, while the solution of this issue is neither in domestic nor in European economic practice.

References

- Adachi, Y. (2018). Erratum to: The economics of tax and social security in japan. In: The Economics of Tax and Social Security in Japan. Singapore: Springer.

- Braunerhjelm, P., Eklund, J. E., & Thulin, P. (2019). Taxes, the tax administrative burden and the entrepreneurial life cycle. Small Business Economy, 1-14. https://doi.org/10.1007/s11187-019-00195-0

- Hines, J. R. (2018). Excess burden of taxation. The New Palgrave Dictionary of Economics. London: Palgrave Macmillan. https://doi.org/10.1057/978-1-349-95189-5

- Hou, Y. (2019). Simulation of tax incidence and redistribution effects of the tax proposal. In Development, Governance, and Real Property Tax in China. Politics and Development of Contemporary China (pp. 135-191). Cham: Palgrave Macmillan.

- Kovárník, J., & Jedlička, P. (2017). The analysis of tax burden on labor in the Czech Republic. In Bilgin M.H., Demir E., Can U. (Eds.), Proceedings of the 17th Eurasia Business and Economics Society Conference (pp. 281-292). Country Experiences in Economic Development, Management and Entrepreneurship. Springer, Cham. https://doi.org/ 10.1007/978-3-319-46319-3_17

- Lyal, R. (2016). Tax law. In Baudenbacher C. (Ed.), The Handbook of EEA Law (pp. 721-748). Cham: Springer.

- Mitu, N. E., & Stanciu, C. (2018). Tax principles between theory, practice and social responsibility. In Current Issues in Corporate Social Responsibility. CSR, Sustainability, Ethics & Governance (pp. 11-24). Cham: Springer.

- Salm, M. (2017). Theoretical insight on the property tax. In Property Tax in BRICS Megacities. Contributions to Economics (pp. 13-40). Cham: Springer.

- Schratzenstaller, M., & Krenek, A. (2019). Tax-based own resources to finance the EU budget. Intereconomics, 54(3), 171-177.

- Sinevičienė, L. (2016). Tax burden and economic development: The case of the European Union countries. In Bilgin M., Danis H. (Eds.), Entrepreneurship, Business and Economics, 2, Eurasian Studies in Business and Economics, 3/2. (pp. 283-298). Cham: Springer.

- Stam, E., & Verbeeten, F. (2017). Tax compliance over the firm life course. International Small Business Journal, 35(1), 99-115. https://doi.org/10.1177/0266242615615185

- Wenjuan, S. (2018). Research on tax burden and enterprise R&D efficiency. In T. Haga, J.K. Lee (Eds.), Proceedings of the 5th International Conference on Education, Management, Arts, Economics and Social Science. Advances in Social Science, Education and Humanities Research, 264. (pp. 1113-1117). Netherlands: Atlantis Press.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Tatarovskaya*, T. E., & Tselniker, G. F. (2020). Enterprises Tax Burden Analysis From The Russian And European Experience Perspective. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 193-199). European Publisher. https://doi.org/10.15405/epsbs.2020.03.27