Abstract

The formation of the Eurasian Economic Union (EAEU) was a significant step in fostering the partnership and future development in the number of post-soviet countries. The EAEU Treaty promotes measures for strengthening the financial integration among the strategic members of the Union. Particularly, one of the Treaty’s objectives supports the creation of the cross-Eurasian financial market. The goal to create such an integrated financial market among the countries of the EAEU is set by 2025. To realize this ambitious task, the members of the EAEU will have to establish common rules for managing different types of financial services, including banking, insurance, exchange, monetary, payment. However, with the global digitalization of the economy and risks associated with it, new challenges will arise to maintain a secure financial environment. On the other hand, the Eurasian integration is developing in the context of political tensions that have a tremendous effect on the success of the EAEU. Hence, members of the Treaty should converge gradually and thoughtfully. The initial measure toward the creation of the cross-Eurasian financial market, which is reasonable and practically feasible, is improving collaborations in the financial transaction sphere. The single payment area of the EAEU can be leveraged to achieve a stable platform for traders and market agents. This area should provide security for the financial and economic transactions. Current work is focused on a discussion of the economic and political challenges associated with the implementation of the EAEU Treaty objectives in the sphere of financial integration.

Keywords: Eurasian Economic Unionsingle financial marketcross-Eurasian financial spacesingle payment areaunified payment systemdigital economy

Introduction

In the context of polycentrism and digital globalization, the international economy is facing new trends toward integration processes. Such an alliance implies the establishment of standardized conditions for the participating economic parties. On the other hand, integration processes generate world fragmentation, forming global, yet also local features. Four freedoms must be ensured across a single economic space for the successful integration of the countries: freedom of capital, mobility of goods, services, and labor. A distinguishing feature of the modern global economy is its financial character, i.e. its financialization due to the growing influence of the financial capital ( Hilferding, 2019). In this regard, issues of integration in the financial sector become paramount and can hinder economic integration. A prominent example of such economic integration is the Eurasian Economic Union (EAEU), historically young, yet not conceptually novel economic entity, determined to create a single financial market in accordance to the Treaty signed among the participating countries (Treaty on the Eurasian Economic Union, 2014) and the current EAEU development strategy.

Problem Statement

The EAEU was officially established by the EAEU Treaty on May 29, 2014. In January of 2015, the Union started to function officially, and today it emerged as a center that draws the attention of economists, politicians, scientists, as well as common people living within the geopolitical borders of the EAEU. One of the main EAEU goals is the formation of a single market for goods, services, capital, and labor ( Eurasian Economic Commission, 2018). Today, the strategic priority is the creation of a single financial market, including the standardization of the payment cooperation terms within the Union. A long term goal is the creation of a single payment area similar to a Single Euro Payment Area (SEPA). Considering governments' statements about increasing self-sufficiency, gaining independence and strengthening foreign economic security ( Sergi, 2018), an important question becomes to evaluate opportunities and risks toward efficient cooperation between the EAEU countries in the payment sector. The members of the Union are challenged to find ways to economic integration in the context of political tensions, fragmentation of the world economic structures and digitalization processes.

Research Questions

This work is focused on evaluating feasible mechanisms for the financial integration in the EAEU, particularly establishing collaborations in the payment sector. The main subject of discussion is the evaluation of the opportunities and risks for creating a single payment area within the EAEU. The creation of such area is reasonable and perhaps even necessary, as the global non-cash transactions is increasing from year to year, while a significant decrease in cash transactions is predicted for the near future. In this regard, to assess the prospects of the EAEU single payment area, it is crucial to review the current situation in the payment sector among the EAEU members. Specifically, it is important to explore the developing trends of cash and non-cash payments within the individual countries of the Union, features of the existing payment systems, possibilities and risks for creating a single payment area at different levels of economic development.

Purpose of the Study

It is essential to assess the prospects for countries’ cooperation in the payment sector, as well as to identify the risks and opportunities for creating a single payment area in the context of current political tensions and financial instability. The benefits of creating such a single area include reduced transaction costs, greater security of payments and transfers, trade transparency for the participating parties, standardization of operations, swiftness of operations, simplicity, etc. At the same time, a single payment area meets the objectives of the EAEU strategy to create a single financial market by 2025 and implement of the common digital agenda.

Research Methods

The authors of this work applied general scientific research methodologies, including analysis, synthesis, induction, deduction, and generalization to identify the current state of the payment sector in the EAEU countries. Statistical methods were utilized to collect and process the data, which was used to examine the indicators of the payment sector. A graphical method was used for the visual representation. To draw conclusions regarding the prospects for the cooperation in the payment sector and the creation of single payment area, the method of expert assessments and findings generalization were used.

Findings

According to the World Payments Report ( Capgemini, 2018), issued by the Capgemini firm in association with BNP Paribas, the global volume of the non-cash transactions expanded by 10.1% in 2016, reaching 482.6 billion U.S. dollars. According to the report, total world-wide annual non-cash transactions are expected to reach a 12.7% increase, while a 21.6% increase is projected in the developing countries between 2016 and 2021. Currently, the developing nations constitute a third of the global cashless market, but they are expected to grow and expand their contribution to a half by 2021. Such projected growth, if realized, will be three times the amount in countries with developed economies.

Based on the data, the attraction of the EAEU states to financial integration and future creation of a single financial market meets the current world trends and the external challenges, faced by the members of the Union ( Mostafa, & Mahmood, 2018). These objectives are reflected in the Decision of the Supreme Eurasian Economic Council of 2015 ( Eurasian Economic Council, 2015), which defines the main directions of the EAEU economic development until 2030, as well as outlines the areas of cooperation, strengthening the competitiveness of the Union states. One of the goals is ensuring the availability of the financial resources within the Union and the formation of an effective financial market, which implies the development of effective mechanisms for the accumulation, distribution, and redistribution of financial resources. Furthermore, the EAEU is planning to form a single financial market for the EAEU by 2025 ( Golodova, Shkvarya, Bondarchuk, & Kolosova, 2017). This digital agenda was brought up on multiple occasions by the Eurasian Economic Commission, intending to realize the plan by the proposed date. The same period is stipulated in the EAEU Treaty in article 103, section

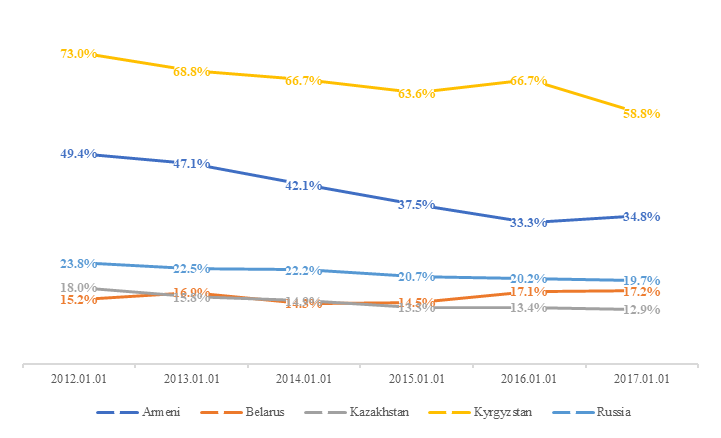

The creation of a single financial market involves making key decisions, particularly integrating all sectors of the EAEU financial markets, specifically the payment segment ( Obaeva & Bal’chinova, 2018). The cooperation in the payment sector will provide a considerable economic effect for all the parties of the Union. The formation of a unified payment infrastructure is possible, provided countries' readiness and the emergence of the right market conditions ( Kondratieva, 2016). According to the Eurasian Economic Commission ( Eurasian Economic Commission, 2019), the largest contribution of cash transactions as of January 1, 2018, is observed in Russia, Kyrgyzstan, and Armenia (Table

Analogous to Europe, one of the main challenges toward the Eurasian integration is appreciative discrepancies in the economic developments among the participating nations of the Union ( Kirkham, 2016). This inequality is further endorsed by the drastic differences in the GDP of the EAEU members. Moreover, there is a significant spread in the monetization indicators of the economies and the swiftness of money circulation for 2018 (Table

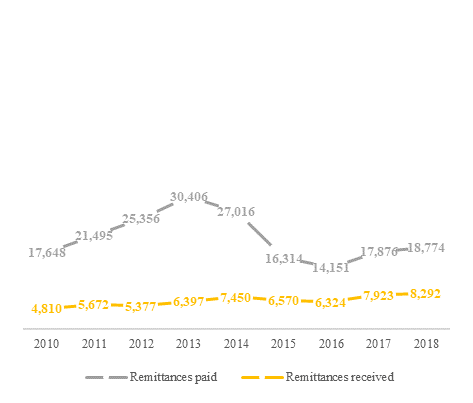

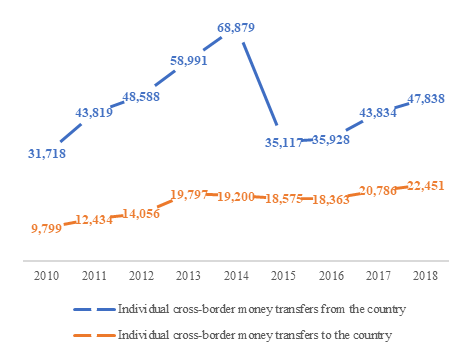

Political tensions are an important factor affecting the rate of the EAEU financial integration ( Khapaeva, 2016). Hence, the sanctions imposed in 2014 against Russia negatively affected the individual cross-border money transfers and remittances paid and received. The growth of these indicators up to 2015 was followed by an abrupt decrease down to the values of the post-crisis period. Since then, a gradual restoration of the positive trends is observed, though the original values are yet to be reached (Fig.

After the anti-Russian sanctions were first introduced in 2014, the Russian government began the development of the National Payment System (NPS). Approved by the Board of Directors of the Bank of Russia, the NPS development strategy discusses the possibility of using NPS as a foundation for the creation of single payment infrastructure for the EAEU.

Positive trends are observed when it comes to the performance of payment systems’ indicators in the nations of the Union ( National Payments Council, 2019). The central banks of the EAEU states introduce initiatives to stimulate a non-cash operations within their countries (Table

A resolution to continue the creation of a single payment area was adopted, along with the arrangements to integrate national payment systems, such as “Elkart”, “Belkart”, and “Uzcard” during 2018-2019. An agreement was reached between the NSPK and the BELKART payment systems, intending to implement the interplay of the Russian and Belarussian payment systems. A similar arrangement was made to sign a road map for the integration with “Elkart”, the payment system of Kyrgyzstan.

Conclusion

Despite the presented improvements toward the creation of a unified financial sphere within the EAEU, it is still a challenge to predict a definite path toward the successful integration into a single payment space of the Union. The EAEU was created as a response to the current trends of global digitalization and financialization, attempting to build an independent, reliable and transparent payment infrastructure for the participating countries. The benefits toward the creation of a unified payment system are apparent: transparency and security of the operations, swiftness, reduced transaction fees, etc. However, the Eurasian integration is strongly affected by the political tensions, so any common strategic goals can be obstructed for the long term by the international disagreements ( Vinokurov, 2016). Furthermore, no great demand for non-cash transactions is observed in the EAEU states, while their decisions are sensitive to the state of the outward-looking economic policy. The formation of a single payment area will also require seamless legislation of the financial sphere within the EAEU and delegating the institution responsible for regulating this sphere. Given the current geopolitical climate, this economic integration and establishment of a single payment area can be projected in the long term, though positive tendencies are apparent even today.

References

- Capgemini (2018). World Payments Report. Retrieved from: https://worldpaymentsreport.com/wp-content/uploads/sites/5/2018/10/World-Payments-Report-WPR18-2018.pdf Accessed: 12.09.19.

- Eurasian Economic Commission (2018). Numbers and facts (Eurasian integration library). Retrieved from: http://www.eurasiancommission.org/ru/Documents/%D0%95%D0%AD%D0%9A%20-%20%D0%91%D1%80%D0%BE%D1%88%D1%8E%D1%80%D0%B0%20(%D0%A6%D0%B8%D1%84%D1%80%D1%8B%20%D0%B8%20%D1%84%D0%B0%D0%BA%D1%82%D1%8B)_%D1%80%D0%B0%D0%B7%D0%B2%D0%BE%D1%80%D0%BE%D1%82.pdf Accessed: 11.09.19. [in Rus.].

- Eurasian Economic Commission (2019). Statistical publications (Financial statistics). Retrieved from: http://www.eurasiancommission.org/ru/act/integr_i_makroec/dep_stat/fin_stat/statistical_publications/Pages/default.aspx Accessed: 12.09.19. [in Rus.].

- Eurasian Economic Council (2015). The Decision of the Supreme Eurasian Economic Council N 28 “The main directions of economic development of the EAEU until 2030”. Retrieved from: http://www.eurasiancommission.org/ru/act/integr_i_makroec/dep_makroec_pol/seminar/Documents/Аналитическое%20издание%20ОНЭР.pdf Accessed: 11.09.2019. [in Rus.].

- Golodova, Z., Shkvarya, L., Bondarchuk, N., & Kolosova, E. (2017). The effectiveness of monetary policy in the Eurasian economic union. Central Asia and the Caucasus, 18(1), 100-108.

- Hilferding, R. (2019). Finance capital. A study of the latest phase of capitalist development. London: Routledge.

- Khapaeva, D. (2016). Triumphant memory of the perpetrators: Putin's politics of re-stalinization. Communist and Post-Communist Studies, 49(1), 61-73. https://doi.org/10.1016/j.postcomstud.2015.12.007

- Kirkham, K. (2016). The formation of the Eurasian economic union: How successful is the Russian regional hegemony? Journal of Eurasian Studies, 7(2), 111-128. https://doi.org/10.1016/j.euras.2015.06.002

- Kondratieva, N. B. (2016). Eurasian economic union: Achievements and perspectives. World Economy and International Relations, 60(6), 15-23 [in Rus.].

- Mostafa, G., & Mahmood, M. (2018). Eurasian economic union: Evolution, challenges and possible future directions. Journal of Eurasian Studies, 9(2), 163-172. https://doi.org/10.1016/j.euras.2018.05.001

- National Payments Council (2019). NPC Participants news (It will be possible to use “Mir” in Armenia). Retrieved from: http://npc.ru/ru/media/mamber_news/?id=2629 Accessed: 12.09.2019. [in Rus.].

- Obaeva, A., & Bal’chinova, V. (2018). Eurasian economic union: Prospects for cooperation in the payment sector. International Banking Operations, 2. Retrieved from: http://www.reglament.net/bank/mbo/2018_2/get_article.htm?id=5683 Accessed: 11.09.2019. [in Rus.].

- Sergi, B. S. (2018). Putin's and Russian-led Eurasian economic union: A hybrid half-economics and half-political “Janus Bifrons”. Journal of Eurasian Studies, 9(1), 52-60. https://doi.org/10.1016/j.euras.2017.12.005

- Treaty on the Eurasian Economic Union. (2014, 29 May). Retrieved from: https://www.un.org/en/ga/sixth/70/docs/treaty_on_eeu.pdf Accessed: 10.09.19.

- Vinokurov, E. (2016). Eurasian economic union: A sober look. Voprosy Ekonomiki, 12, 43-60. [in Rus.].

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Medvedeva, E. A., Shcherbachenko*, P. S., & Krasnikova, A. S. (2020). On The Way To Single Payment Area Of The Eurasian Economic Union. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 1496-1502). European Publisher. https://doi.org/10.15405/epsbs.2020.03.215