Abstract

The article is devoted to the research of special aspects of Russian corporate M&A transactions. Modern tendencies of corporate finance are defined; the analysis of the effectiveness of M&A transactions over a period of 2000-2018 is carried out. The aim of the following research is to analyze corporate practices on the merger and acquisition market and to form the image of M&A market in Russian economics; to define the effectiveness of M&A transactions. Problems of corporate finance and their further effective usage in managing business during reorganization were considered in the course of the research; the deals relating to full acquisition and the change of the structure of target-companies were analyzed, as well as the influence of acquiring companies on market figures. Based on the results of the research the conclusion was made that corporate finance in M&A market has some special aspects and the processes of merger and acquisition in Russian corporations are not effectively developed at the moment. The deals influence the market price of acquiring companies’ stocks. The results of the research show a weak influence of the market on economy in general, but at the same time, they show a reducing effect for stockholders. A great number of M&A transactions are aimed at enlarging corporate finance, the growth of the company’s capitalization and the maximization of business cost. The obtained results can be used in predicting the further dynamics of company’s cost, that is of key importance for portfolio and institutional investors.

Keywords: Merger and acquisitionM&A market in Russiacorporate financetender dealshostile takeover

Introduction

The role of merger and acquisition in corporate finance is still multiple-valued. On the one hand, M&A transactions are radical but effective method to increase the cost of an acquiring company. This method was widely spread in 1990-s. On the other hand, from ethical point of view, the purchase of another company is unacceptable and in some cases it is considered as unfair competition. There are a lot of negative examples of such deals, for instance, let’s remember the precedent with the companies Vodafone and Mannesmanne, which led to the withdrawal of a big company in pipe-rolling industry. That’s why the importance of M&A transactions has a double value in corporate finance.

Problem Statement

M&A market in Russia is thought to be one of the main and unstudied phenomena. It is very difficult to define its role for the national economy, as the most part of deals are tender ones. Tender deals are viewed as the deals, which are characterized by aggressiveness and clear intension for hostile takeover ( DePamphilis, 2010). It is rather difficult to find researches with statistics data on M&A market in Russia, which proves the significance of the following research and allows studying the following problem deeply.

Nevertheless, M&A market in Russia exists for quite a long time and a lot of both effective and not effective deals were carried out during this time ( Mikhelashvili, 2017). The effective deals are such deals, which showed a positive synergetic effect or increased the cost of a company in the market, increasing the holders’ welfare. There will be some subjectivity in this research, as not all the deals were carried out for the increasing of the cost and profitability of the companies. That’s why the assumption about the main aim of M&A transactions will be used in the course of the following research, and the assumption will be the increasing of the cost of a company for stockholders.

Research Questions

The following questions are considered in this research:

analysis of carried-out deals and the selection of the deals available for studying;

finding the main criteria of the influence of M&A deals on a company;

providing the research results and predicting the market movement.

Purpose of the Study

The purpose of the study is to check the effectiveness of M&A market in Russia in general (it is based on the change of the prices for acquiring companies’ stocks); and to forecast the development of the market in Russia. Moreover, we are supposed to highlight the key characteristics of Russian M&A market in the course of the research. Additionally, this research will lay the basis for evaluation of efficiency of M&A transactions in Russia.

Research Methods

The research method is based on the market approach for the analysis of the efficiency of a deal ( Meshcheryakova, 2016). The research was carried out on 3 main criteria: market price of acquiring company’s stocks, EV (EnterpriseValue) and MV (MarketValue). In the course of the research 3 time spans and the changes of criteria in these time spans for each deal were analyzed. For each deal the time spans were half a year before its carrying out, the deal itself and 6 months after it. The rate of the growth of stock prices and the EnterpriseValue were calculated based on the findings. The average amount in the market was found.

In this research a market approach is applied to evaluate the efficiency of the deals. This approach implies the analysis of quotations for a particular time span before and after the deal and the analysis of the changes of EV (EnterpriseValue) and MV (MarketValue) criteria during and after the deal.

Findings

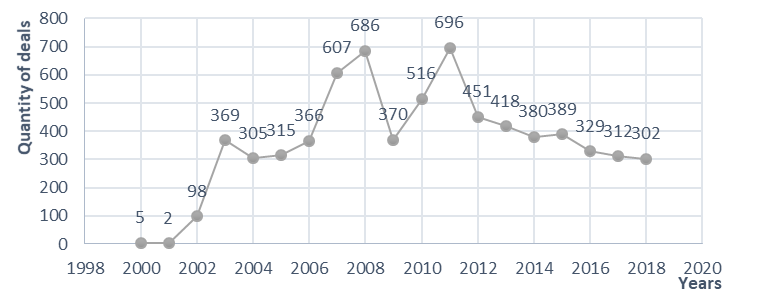

From 2000 to 2018 more than 16 thousand deals with the total sum of 603,66 billion dollars were carried out. We singled out 6916 deals with tender characteristics. Below you can see the dynamics of the deals (Figure

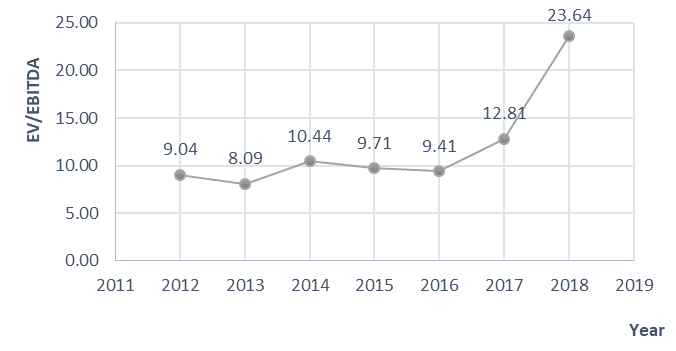

It is worth mentioning that there were 2 waves of merger and acquisition in 2008 and 2011. At the moment the market is in the recession state and the possibility of the growth of the amount of such deals is not high. It is also worth mentioning that the main buy-ins started at the peak of stock market growth, a year before crisis. It is due to the necessity of companies’ development. At the same time, companies often overpaid. Thus in 2011, the cost of the company EBITDA criteria was 51, 26 times, which shows the overvaluation of the market.

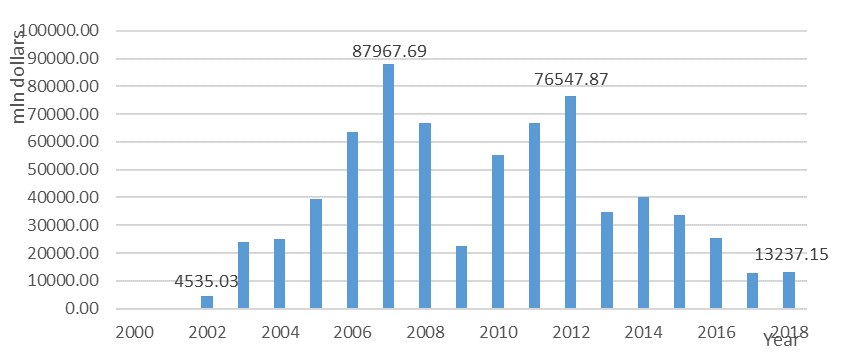

The larger amount of deals not always implies the larger amount of investment in the purchase of companies. Thus, the main investments in M&A market were in 2007 and 2012 (Figure

Analytical and informative agency EMIS also provides the data about the average criteria/ the cost of the company/ sales and Enterprise Value / EBITDA for the last 19 years ( KPMG, 2018). The following criterion reflects the level of overvaluation of the deal on the part of a buyer. On average, the Enterprise Value was valuated as 59 gross incomes of a target-company and 12,57 of EBITDA (Figure

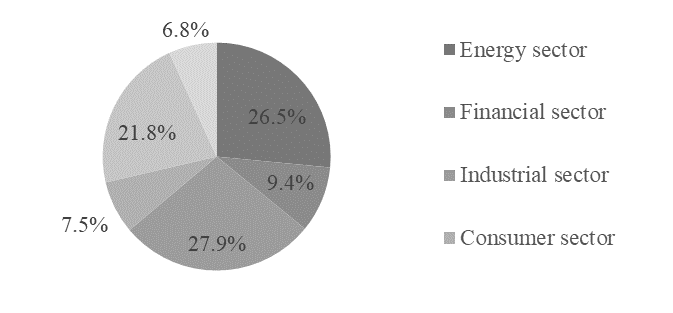

As in any other market, there are high rollers (large companies) in the market under research ( Yang, Guariglia, & Guo, 2019). Based on the obtained selection, 10 largest companies according to the number of deals were singled out. The diversification of buyer companies was carried out based by sectorial criteria (table

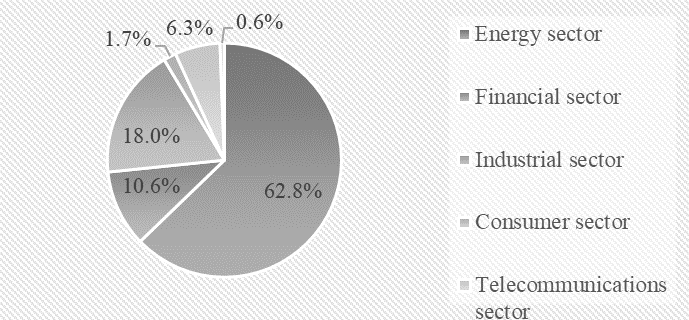

The largest number of deals was carried out by MTC Company, which is a specific case for Russian economy. The largest number of deals was carried out in Industrial sector (Figure

After studying the market in general, the analysis of the dynamics of the deals efficiency was carried out. It is based on the price dynamics and the change of a company cost. The research results you can see in table

The following facts were found out in the course of the research:

on average prices for companies’ stocks decrease by 3,2% 6 month before a deal; companies stocks also decrease by 2, 95 % 6 month after a deal;

58% of deals showed negative dynamics of price changing 6 month before a deal. At the same time, 52% of deals showed positive dynamics;

in general, the cost of a company increases by 5,23% before a deal. After a deal it also increases by 2,27%;

the market cost of stocks increases by 5,19% 6 months before a deal. It also increases by 0,14% 6 months after a deal;

in 55% of cases the cost of a company increases 6 months before a deal and in 52% of cases it increases 6 months after a deal.

Conclusion

Summing up, M&A market in Russia has some similarities with world M&A market, but at the same time, there are some special aspects of national character. Firstly, they are expressed in deceleration in the growth of the market cost of a company after a deal. Also, they are expressed in deceleration in the growth of EM criteria for a company. It can be caused by defective deals or defective targets, which were chosen for takeover.

The growth of a company cost and its high dynamics can be noticed before a deal. It is likely to be connected with mobilization of extra-budgetary recourses for the purchase of another company, as LBO practice is not widely spread in Russia. On the basis of obtained results and other researches ( Pashtova, 2018), we can suppose that the market is not ready yet for the increasing of the amount of deals, due to the actual state of market. Firstly, state transformations in tax section, the change of inflation dynamics and the decrease of FDI in Russian economy reduce the possibility of the growth of the number of deals in 2019. There is even a possibility that the number of deals will fall up to 290-300 ( KPMG, 2018).

Besides, the results of the research make it possible to give a brief characteristic of M&A market in Russia. Above all, the market is characterized by:

a high rate of overpayment for target-companies

the decrease in the number of deals in the last 7 years and the decrease of the total sum, invested in deals;

the growth of companies cost before a deal and at the same time the price decrease for these companies’ stocks;

low efficiency of deals as viewed by stock-holders.

The following research showed additional questions and problems, which can be studied in further researches. We agree that most mergers and acquisition fail because of poor handling of change management. Change is the only thing that will never change so let's learn to adopt by change management ( Kansal & Chandani, 2014). In particular, they are: finding the reasons of the decrease in companies’ growth dynamics after a deal as compared with the growth dynamics before it; the analysis of possibilities for market acceleration and what additional benefits it can bring to the economy; comparison of M&A markets in Russia and The USA, special aspects and main differences.

References

- DePamphilis, D. (2010). Merger, Acquisitions, and Other Restructuuring Activities. 5th edition edition. New York, N.Y.: Academic Press. https://doi.org/10.1016/B978-0-12-374878-2.X0001-3 [in Rus.]

- Kansal, S., & Chandani, A. (2014). Effective management of change during merger and acquisition. Procedia economics and finance, 11, 208-217. https://doi.org/10.1016/S2212-5671(14)00189-0

- KPMG (2018). The market of mergers and acquisitions in Russia in 2017. Retrieved from: https://assets.kpmg/content/dam/kpmg/ru/pdf/2018/03/ru-ru-ma-survey-2017.pdf Accessed: 15.03.2019. [in Rus.].

- KPMG (2019). The market of mergers and acquisitions in Russia in 2018. Retrieved from: https://assets.kpmg/content/dam/kpmg/ru/pdf/2019/02/ru-ru-ma-survey-feb-2018.pdf Accessed: 15.03.2019. [in Rus.].

- Meshcheryakova, A. A. (2016). Approaches to evaluation of the effectiveness of mergers and acquisitions. Economy and entrepreneurship, 2-1(67), 983-985. [in Rus.].

- Mikhelashvili, N. R. (2017). Mergers and acquisitions: Causes and ways to prevent failure. Financial Analytics: Problems and Solutions, 10(2(332)), 215-225. [in Rus.].

- Pashtova, L. (2018). Business reorganization: mergers and acquisitions. Monograph. Moscow: KnoRus Publishing House. [in Rus.].

- Yang, J., Guariglia, A., & Guo, J. (2019). To what extent does corporate liquidity affect M&A decisions, method of payment and performance? Evidence from China. Journal of Corporate Finance, 54, 128-152. https://doi.org/10.1016/j.jcorpfin.2017.09.012

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Pashtova*, L. G., & Maimulov, M. S. (2020). Special Aspects Of Corporate M&A Transactions In Russian Market. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 1489-1495). European Publisher. https://doi.org/10.15405/epsbs.2020.03.214