Abstract

The functioning of the housing-and-municipal complex in the regions is provided by three main sources: budget funds, non-budget funds, and population and organizations’ funds. In general, financial distributions can be carried out on a repayable and non-repayable basis using such forms as budgeted financing, lending, investment, subsidies, and project financing. Despite the variety of financing forms of housing-and-municipal complex, currently, the Russian government assigns a special role to project financing as the most promising. Project financing will solve the problem of defrauded homebuyers and give them safety guarantees of invested funds. The state will achieve the important social goal that is associated with the need to make the housing financing at the population’s expense safe. About 80% of the Russian housing accommodations are financed by the population in the form of investment on a shared basis. The amount of population’s funds, aimed at housing construction financing, is estimated at about 1.5 tn. rubles. Thus, in the Russian Federation, participation of non-dedicated investors who independently make decisions to invest their own money in financing is rather high. The increase of population funds in financing is the current feature of housing-and-municipal complex development and characterizes the process to improve the financial situation in this area. All these issues are revealed in the paper.

Keywords: Financial resourcesforms of financinghousing-and-municipal complexinvestmentlendingproject financing

Introduction

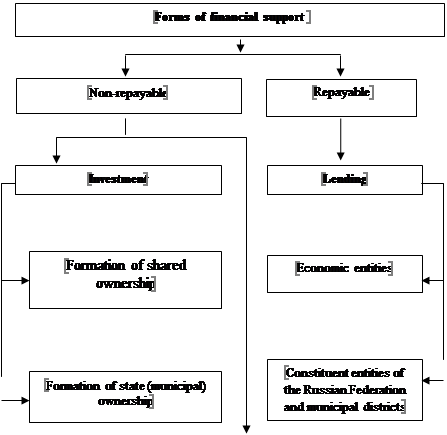

The housing-and-municipal complex is the life-supporting system in the regions and country. This fact determines its key role in the formation of regional policy and economic development. The functioning of the housing-and-municipal complex in the regions is provided by three main sources: budget funds (federal, regional, local), non-budget funds (Housing and Utility Reform Foundation, Support Fund for the Reform of the Housing and Utilities Sector, Investment Fund of the Russian Federation), and population and organizations’ funds. In general, financial distributions can be carried out on a repayable and non-repayable basis using such forms as budgeted financing, lending, investment, subsidies, and project financing (Figure

Source: authors.

Despite the variety of financing forms of housing-and-municipal complex, currently, the Russian government assigns a special role to project financing as the most promising. This is due to the need to make the financing of housing construction at the population’s expense safe.

Problem Statement

The housing-and-municipal complex is one of the problematic. A number of authors deal with the problems of housing and public utilities development. Some of them consider the industry-specific regulation features, meaning ways to assess the effectiveness of housing and public utilities at different levels (Filyushina, Trush, & Yarlakabov, 2019). The works of Khmelnitskaya, (2015) are devoted to reformation of housing-and-municipal complex. Other researchers pay attention to the information systems implementation in the housing sector (Inyushkin et al., 2018; Golubeva, Chernikova, Rusanovsky, Lugovskoy, & Bludova, 2019). Some researchers believe that the possibility and quality of solving existing problems depends on the degree of validity of decisions of public authorities in the field of economic policy of housing and communal services (Timchuk, Grigorova, & Vihoreva, 2018).

Another important problem is the mechanism to finance the housing-and-municipal complex. In Russia, the Federal Law on shared-equity construction No 214-FZ came into force on 1 January 2005 (Federal Law of 30 December 2004 N 214-FZ, 2004). The law has undergone numerous changes and amendments, but is still in force and regulates relations related to the attraction of citizens’ funds and legal entities on the basis of shared-equity construction contracts.

The main disadvantages of financial support of housing construction as equity financing include a large number of unfinished construction projects and, accordingly, defrauded homebuyers. In order to eliminate the social tension, the government of the Russian Federation decided to refuse (within 3 years) equity financing at the population’s expense and head over to project financing.

Research Questions

Project financing is characterized by the following features:

capital nature of the investments to profit,

creation of a specialized legal entity (engineering company),

attraction of funds from various financing sources,

long-term investments,

return of creditors’ funds at the expense of cash flow accumulated during the project result operation.

The main sources of project financing include:

self-financing (own funds of organizations: authorized funds, reserve funds, and profit),

budget financing (subsidies and state contracts funds),

bank lending,

financing through the factoring mechanism,

note-backed lending,

- raising funds through the stock market (bond issue and placement of shares).

Financial funds from the above sources are attracted to the project according to certain ratios, which depend on both sources availability and the project implementation stage. The mechanism to finance projects is determined by two indicators: efficiency and sustainability. Efficiency has to do with how much the distortions involved with the subsidies, the taxes that financed them induce changes in behavior, and which impose losses. Sustainability refers to whether the government can maintain and continue a subsidy program (Buckley, Kallergis, & Wainer, 2016).

Based on the existing practice to implement project financing in the Russian Federation, we can mention the following ratio of own and attracted sources of financial support:

own funds (self-financing) - 40-42%,

bank loans - 8-10%,

borrowed funds of other organizations (factoring, leasing) - 5-7%,

state funding - 5-20%,

higher authorities’ funds – 10-15%,

issues of bonds and shares – 1-3%,

other sources - 5-8%.

Purpose of the Study

The feasibility of funds attraction from a particular source is determined by the project lifecycle phase and stage of its implementation.

The scientific literature distinguishes the following project lifecycle phases:

pre-investment (pre-project),

investment (project implementation),

operational.

At the first stage (pre-investment), own funds of the organization (self-financing) are used to prepare business plan and project documentation, and to register land. At this stage, it is extremely difficult to attract borrowed funds as lenders require investment of project promoters’ own funds (10%) in the way of evidence of seriousness of their intention.

The possibility to borrow funds appears over time after investing in the project the minimum required amount of lenders' own funds (20%). At the second stage of the project lifecycle, a bank loan (50%) may be the source of project financial support. At the stage of project implementation, investment costs are the most significant, that is why in addition to loan assets, it is advisable to use the leasing mechanism to get expensive equipment (10%).

At a certain stage of project readiness, it becomes possible to use commercial lending (factoring). Suppliers and contracting agencies, having established a stable trust relationship with the engineering company, can supply materials and raw materials, as well as perform work with delay in payment (commercial lending) (Rusanov & Bektenova, 2017). By contrast, the factoring mechanism can be already used in the sale of finished goods, when the engineering company accumulates debts receivable due to the sale of a product large volume, and the buyers cannot pay it simultaneously. Using these mechanisms, it is possible to raise up to 10% of funds.

At the investment phase of the project, there is a high probability to attract budget funds in the form of subsidies for the created municipal infrastructure, or in the form of funds to purchase goods for state needs (10%).

Research Methods

The theoretical and methodological basis was laid by the concepts of modern economic theory, by the works of Russian and abroad researchers, and practisers. Methodology applied in this study combined general scientific methods (synthesis, analysis and generalization, analogy, historical and logical methods) and empirical knowledge methods (classification, observation, description and comparison).

Findings

Analyzing international experience of financial support of housing construction, it should be noted that countries' funding models for house finance are heterogenic (Cerutti, Dagher, & Dell’Ariccia, 2017). In Western Europe, project financing is used as the main scheme to attract funds for housing construction. The housing construction is carried out on borrowed funds, and customers’ money goes to special escrow bank accounts, which become available only after putting accommodations into operation. Then the developer makes a profit.

In Germany, there are building-and-loan associations. The future buyer of real estate first invests money in building-and-loan associations, and after a few years it becomes possible to apply for a housing loan to purchase the accommodation. Funds from building-and-loan associations can be used exclusively for housing construction.

In the UK, residential real estate is sold according to the following principle: during the project construction cycle, the developer finances the construction and can afford to take an advance payment of up to 5% for the apartment, and the rest is own and borrowed funds of the developer or investor. They receive full payment after putting accommodations into operation, and in most cases, accommodations are in finished condition. The cost of project financing for developers does not exceed 5-6%, and the cost of mortgage loans is 1.5-3%.

In Israel, the equity financing mechanism is spread over time. The housing equity holder pays 10% of purchase price at the stage of issue of housing construction permits. The next part is paid at the time of accommodation release from the ground, and the rest is paid after completion of work. That is, the payment of the housing equity holder is related to the construction readiness of the object.

In our opinion, the advantages to use project financing include:

developer’s positive business reputation,

experience in construction projects,

availability of authorizations and approvals that have passed the examination and have estimate documentation,

control over the construction schedule and construction financing.

We cannot say that the banks will make any new requirements. At the same time, they will need to significantly complicate the analysis of the financial condition of both the borrower and all participants of credit transactions, to study more thoroughly all financial indicators (actual and forecasting) and the ownership structure of the borrower, and to tighten the approach to market evaluation and collateral guarantee quality. The adoption of project financing will force developers to prepare financial plans and projects more carefully. The construction process will become more transparent and technological.

Conclusion

The positive effects from project financing implementation include:

transparency increase in the construction market,

disappearance of unconscientious developers,

construction deadline management and accommodation quality increase,

risk reduction of uncompleted construction.

Project financing, in one form or another, is already used in financial support of housing construction in the regions of the Russian Federation. On the one hand, the new features are aimed at quality and safety improving of investment in housing construction, and building a more civilized relationship between the investor and the developer, that is, protecting investors. On the other hand, they will inevitably lead to difficulties for developers. Therefore, it is necessary to constantly monitor current problems and resolve them in a timely manner, informing the higher levels of government and offering options to change the situation together with developers in the Russian regions.

Evaluating the new conditions of financial support of housing, there is no doubt about the capabilities of developers. There are more questions to the banking community. Will the banking system cope? With the implementation of new rules for project financing in the scheme "developer – consumer", there will be a mandatory intermediary, a bank, that will manage all financial flows and monitor the developer’s activities (financial and constructional) throughout the project. Thus, the bank assumes credit risk twice, when it lends money to the individual person and grants a loan to the developer.

On the one hand, the state of the banking system at the current stage is characterized by excessive liquidity, in general, but on the other hand, by the instability of particular banks. The construction industry share in the bank loan portfolio is from 8% to 11% over the past three years.

Therefore, the banking system is interested in placing its assets in reliable and cost-effective investment projects that include housing construction projects. These projects should be properly designed and evaluated, and banking specialists should analyze them. But due to the instability of the financial situation in some commercial banks, the Central Bank of the Russian Federation has to strengthen control over the liquidity of the banks that lend to housing construction, as the bank assumes credit risk twice, when it lends money to the individual person and grants a loan to the developer.

The government of the Russian Federation has developed requirements for the banks that work with escrow accounts. The list of banks admitted to work is constantly updated and posted on the website of the Central Bank. At first, 25 banks met these requirements. On 1 September 2019, there were 95 banks in this list.

In our opinion, the banks that apply to work with escrow accounts should have specialists with the professional competence, which is necessary to assess and manage project risks in housing construction. The authors think that nowadays the banking sector needs specialists or credit inspectors who can visit the construction site, easily read and understand construction documents, and monitor compliance with project documentation and technologies in accommodation construction. Thus, project financing is becoming a priority form of housing finance. This will make the housing finance market transparent, professional and efficient.

References

- Buckley, R. M., Kallergis, A., & Wainer, L. (2016). The emergence of large-scale housing programs: Beyond a public finance perspective. Habitat International, 54(3), 199-209. https://doi.org/10.1016/j.habitatint.2015.11.022

- Cerutti, E., Dagher, J., & Dell’Ariccia, G. (2017). Housing finance and real-estate booms: A cross-country perspective. Journal of Housing Economics, 38, 1-13. https://doi.org/10.1016/j.jhe.2017.02.001

- Federal Law of 30 December 2004 N 214-FZ "On participation in shared-equity construction of blocks of flats and other real estate objects and on modification of some legal acts of the Russian Federation" (2004). Retrieved from: http://www.consultant.ru/document/cons_doc_LAW_51038/ [in Rus.].

- Filyushina, K., Trush, E., & Yarlakabov, A. (2019). Analysis of peculiarities of industry-specific regulation of a housing and utility complex on the example of the Russian Federation. In Kaz, M., Ilina, T., Medvedev, G. (Eds.), Global Economics and Management: Transition to Economy 4.0. Springer Proceedings in Business and Economics (pp. 269-278). Cham: Springer. https://doi.org/10.1007/978-3-030-26284-6_25

- Golubeva, T. G., Chernikova, O. A., Rusanovsky, E. V., Lugovskoy, S. I., & Bludova, S. N. (2019). Main directions of information provision of development of regional housing and utility sector. In: Popkova, E., Ostrovskaya, V. (Eds.), Perspectives on the Use of New Information and Communication Technology (ICT) in the Modern Economy. ISC 2017. Advances in Intelligent Systems and Computing, 726 (pp. 783-792). Cham: Springer. https://doi.org/10.1007/978-3-319-90835-9_90

- Inyushkin, A. A., Kryukova, E. S., Povarov, Y. S., Ruzanova, E. V., Ruzanova, V. D., & Frolovskiy, N. G. (2018). The Russian information systems of the housing and utilities sector: Peculiarities of legal regulation and application. In Popkova, E. (Ed.), The Impact of Information on Modern Humans. HOSMC 2017. Advances in Intelligent Systems and Computing, 622 (pp. 227-233). Cham: Springer. https://doi.org/ 10.1007/978-3-319-75383-6_29

- Khmelnitskaya, M. (2015). Reform of Russian housing and utility services. In The Policy-Making Process and Social Learning in Russia. St Antony’s Series, (pp. 128-164). London: Palgrave Macmillan. https://doi.org/10.1057/9781137409744_5

- Rusanov, Yu. Yu., & Bektenova, G. S. (2017). Project financing on housing and municipal utilities: Analyzing the project efficiency after putting it into operation. Bulletin of the Russian University of Economics named after G. V. Plekhanov, 4(94), 48-54. [in Rus.].

- Timchuk, O. G., Grigorova, L. Ye., & Vihoreva, M. V. (2018). Topical usage of contract lifecycle management in housing and Russian utility sector. In Ardashkin I. B., Bunkovsky V. I., Martyushev N. V. (Eds.), Proceedings of RPTSS 2018 International Conference on Research Paradigms Transformation in Social Sciences. The European Proceedings of Social & Behavioural Sciences, L (pp. 1169-1178). London: Future Academy. https://doi.org/10.15405/epsbs.2018.12.143

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Kovaleva*, T. M., Boyko, I. A., & Popova, E. V. (2020). Development Of Financing Mechanism Of Housing And Public Utilities In Russia. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 151-157). European Publisher. https://doi.org/10.15405/epsbs.2020.03.21