Abstract

The relevance of the study is confirmed by the high share of the consolidated budget expenditures of the Russian Federation and state extra-budgetary funds for pension provision in their total volume. The purpose of this research is to determine the main ways to improve life quality of pensioners in the Russian Federation. The authors gave a detailed description of the pension system at the present stage of its development. It is noted that the population does not have sufficient knowledge about the procedure for the formation of pension rights and calculation of insurance pensions, as well as about accumulative pensions and non-state pension provision, which requires further strengthening of the work to improve the financial (including pension) literacy of citizens. As part of the modernization of the pension provision of Russians, the authors recommend, on the one hand, to strengthen the requirements for the availability of insurance experience and age for the appointment of insurance pensions, and on the other – to increase their size, including additional for citizens with long experience. The practical significance of the study is connected with the possibility of their practical implementation in the Russian Federation within the framework of the changes in the pension provision parameters of citizens. It seems that through the practical implementation of the author's proposals, it is possible to achieve the tasks of stimulating the economic and improving the life quality of Russians as key priorities in the context of the implementation of national projects.

Keywords: Pensionerslife qualityexpenditures of the budgetbudget

Introduction

Recently, attention to pension issues has increased significantly, which deals with the correction of pension legislation. At the same time, according to the authors’ points of view, there is no doubt that the socio-economic development of the state is possible only in the formation of a responsible and effective budget policy, including building a fair pension system. At the same time, it is possible only in conditions of high level of financial (including pension) literacy of citizens ( D'Amico, Lika, & Petroni, 2019).

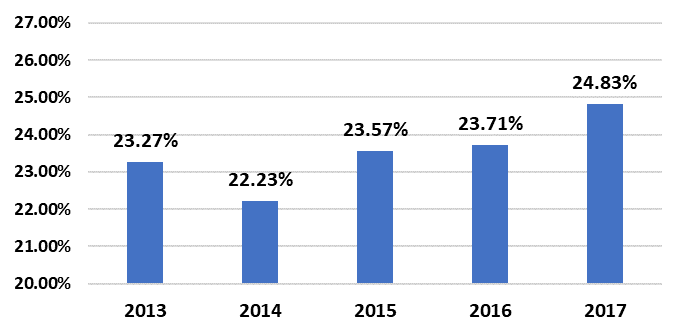

The relevance of the study is confirmed by the high share (almost a quarter) of expenditures of the consolidated budget of the Russian Federation and state extra-budgetary funds for pension provision in their total volume (Fig.

Problem Statement

In the context of the providing correction of the retirement age, as well as the active discussion of other proposals, many people give comments, making inaccuracies ( Hagemann & Scherger, 2016; Hu, 2019; Grodem & Hippe, 2019; Alcacer & Cruz-Machado, 2019; Rossit, Tohme, & Frutos, 2019). In this regard, some positions characterizing the pension system of the Russian Federation should be considered:

Currently, there is no pension tax in Russia. Formation of pension rights of citizens is carried out at the expense of accrued and paid insurance premiums by employers (not employees!) without reducing the salary of the insured person. At the same time, not only the employer, but also the employee takes part in the formation of the future pension abroad (and often the accrual and transfer of the corresponding payments is carried out in equal shares).

The proposal to increase the rate of value added tax (VAT) from 18 to 20% has nothing to do with the size of the insurance pension, as it doesn’t deal with the formation of citizens’ pension rights. Moreover, VAT is not an income of the Pension Fund budget of the Russian Federation, but is fully credited to the Federal budget (2019).

The retirement age for state and municipal employees has previously been raised, and in 2018 is 56 years for women and 61 years for men. Moreover, legislation proposes to accelerate the step of increasing this value and bringing it to a value corresponding to the overall dynamics of the increase in the framework of this correction. At the same time, since 2017, the length of service of the state civil (municipal) service for the appointment of a pension for long service (from 15 to 20 years) is increased annually by 6 months. According to the authors, it seems expedient to provide a gradual increase in this experience for another 5 years in the new pension reform.

The retirement age used in modern Russia was established in 1932 and clearly does not correspond to socio-economic realities (including the increased life expectancy of the population).

It is important to distinguish between the concepts of "life expectancy" and "expected period of payment of pensions", since the value of life expectancy is influenced by mortality at an age that is not the minimum for the appointment of an old-age insurance pension. Therefore, to estimate the expected period of payment of the old-age insurance pension, it is necessary to use the value of life expectancy at the age set as the minimum for retirement. It should be noted that comparable data for different countries by the world health organization are given in the category "at birth" and "at the age of 60 years".

It should be noted that the mortality of citizens at an earlier age is often influenced by the use of tobacco products, alcohol and drugs directly by them or their parents or other persons (for example, passive smoking).

Assessment of changes in the number of Russian pensioners showed an increase of 58.68% in 1981-2017 (32.44% in 1991-2017). At the same time, it is also important to note a serious increase (almost 2.4 times by January 1, 2016 compared to the beginning of 1991) in the number of working pensioners receiving an old-age pension.

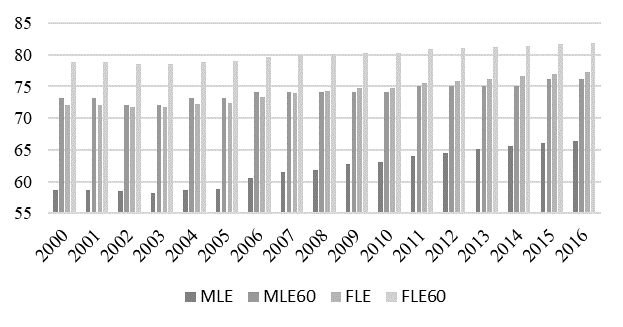

At the same time, only for the period 2000-2016. life expectancy in the Russian Federation (Fig.

02 ) significantly increased ‒ from 65 to 71.9 years (for men-from 58.7 to 66.4 years; for women-from 72 to 77.2 years). It is also important to emphasize that the life expectancy of women who have reached 60 years exceeds 81 years, and men-76 years.

Conventional indicators. LE –Life expectancy (MLE –men life expectancy, FLE –female life expectancy, MLE60 - men when they reach 60 years (considering the period of 60 years), FLE60 - women when they reach 60 years (considering the period of 60 years) - life expectancy60).

9.Some persons who consider themselves experts and analysts in the field of socio-economic transformations point to the discrepancy between the calculated expenditures of the budget of the Pension Fund of the Russian Federation per person and the size of the average pension, without taking into account that the budget expenditures of the extra-budgetary fund also include those related to the functioning and activities of its network throughout the Russian Federation. Moreover, the budget expenditures of the Pension Fund of the Russian Federation also include the financing of transferred powers (for example, in terms of the provision of maternity capital), etc.

10.Refusal from the point order of formation of the pension rights operating since 2015 and the subsequent calculation of the size of the insurance pension on the basis of the formed their total quantity for all period of lawful labor activity and socially significant periods seems to be inexpedient, at least, on the following reasons:

this mechanism of pension calculation is the least labor-intensive (including in comparison with the current one), which in turn, firstly, minimizes the probability of errors and inaccuracies and, secondly, maximizes (of course, the greatest effect is achieved when carrying out relevant activities) its accessibility and comprehensibility by the population;

large-scale educational work has been carried out to bring the content of the new pension formula to the masses of the population (including children) ( Chute & French, 2019; Lim & Kim, 2019; Beetsma, Romp, & Vos, 2012; Grogan & Summerfield, 2019).

Research Questions

According to the authors, it seems that it is indisputable to ensure the growth of pensions in the conditions of increasing the number of their recipients, it is necessary to enlarge the retirement age. At the same time, it should be carried out without increases, be smooth and gradual, implying an annual adjustment of its value for a period of no more than 6-9 months (at the same time the smallest step of 1-2 months is the best option).

Due to a longer period of work, the number of individual pension coefficients collected by the insured person will increase, which certainly lead to an increase in the size of insurance pensions.

Purpose of the Study

The purpose of this research is to define the main ways to improve life quality of pensioners in the Russian Federation. Some positions characterizing the pension system of the Russian Federation should be considered. The idea of creating a single state extra-budgetary fund will be described as well.

Research Methods

To solve the stated problem a set of complementary research methods is used: theoretical: (analysis of philosophical, sociological, social economic literature on the problem under consideration; analysis of documentation on, data from the Federal Treasury (2019); empirical (study of documents, questionnaires, observation, interviews, testing, self-assessment, study of products). Some acmeological methods are proposed to consider the state of problem research rate analysis. All-Russian center for public opinion research data will be taken into consideration.

Findings

Because of income increase and the simultaneous (but, by the way, at a higher rate) reduction in spending and the creation of incentives for citizens not only to labor activity, but also to longevity, it is necessary to consider additional pension provision for older citizens (especially distinguished by long-term labor activity). It should be done in this way: by means of increased insurance pensions to persons over 80 years, providing them not only the preservation of doubling fixed payment (without establishing additional requirements for the number of years of insurance), but also an increase in the number of individual pension coefficients in the presence of the insurance experience of 35 years and above.

These coefficients should increase in this way:

at the age of 80 - 7 %;

when reaching 81-89 years-annually for 3%;

at the age of 90 - 10%

at the age of 91-99 years-annually by 5%.

The idea of creating a single state extra-budgetary fund looks rather controversial. Of course, the key advantage of the practical implementation of this proposal is the possibility of instant redistribution of funds on the financial security payments on different types of social insurance, but this enhanced mobility will not contribute to strengthening the link between the amount of premiums paid and one of insurance coverage for a particular form of social one, as well as will lead to the discouragement of increasing the size of pension coverage at a rate exceeding the rate of inflation in the state, and, ultimately, could be a obstacle to enhance the quality of life of Russians.

The existing limit of three individual pension coefficients in the annual non-explicit correction of the old-age insurance pension is absolutely unfair, since for working citizens, the payment of contributions by employers is made regardless of the availability of the assigned pension.

Currently, a person who does not have insurance experience when reaching the age of 60 / 65 years has the right to receive a social old-age pension, which in the absence of other income (and, as a rule, such citizens do not have other official sources of income) through the Federal (regional) surcharge is brought to the minimum subsistence minimum in the country (or region). The adoption of this decision is not accompanied by an assessment of need (in particular, does not have any impact on the ownership of expensive property or the availability of funds in accounts with credit institutions, etc. According to the authors, this approach is not fair.

The idea of establishing reduced rates of insurance premiums paid by employers for persons of retirement / pre-retirement age clearly looks unfair, as it will contribute to the creation of artificial barriers to attract employers of Russian youth. Ultimately, this can lead to serious socio-economic problems (including the extremely serious shortage of highly qualified personnel) ( Mudzimbabwe, 2019; Hsieh & Tung, 2016; Mavlutova, Titova, & Fomins, 2016).

There is insufficient fairness in the calculation of individual pension coefficients for socially significant periods (for example, when caring for the third and fourth child is charged the same number of points, and, starting from the fifth, - under certain conditions-it is possible to appoint a pension early, but the calculation of pension points is not made).

The pension calculator placed on the website of the Pension Fund of the Russian Federation carries out approximate calculation of future insurance old-age pension, proceeding from cost of one individual pension coefficient and the parameters of the formula which have developed on date of calculation. Thus annually cost of one pension point, as a rule, is indexed not lower than on inflation rate (consumer price index) ( Moriggia, Kopa, & Vitali, 2019).

Currently the population has not sufficient knowledge about the procedure of pension rights formation and the calculation of insurance pensions, as well as about accumulative pensions and non-state pension provision, which requires further strengthening of the ongoing work to improve the financial (including pension) literacy of citizens.

The insufficiency of the work is also confirmed by the statement of the head of All-Russian center for public opinion research, Scientific Director of the Faculty of Sociology and Political Science of the Financial University. Better preparatory work would allow the population to perceive the issue of raising the retirement age as an instrument for ensuring the social and economic development of the Russian Federation, including improving the quality of life, and, accordingly, to achieve greater values of the indicator used by the head of the sociological service in the commentary on changes in the pension legislation.

It seems that in order to increase the pension literacy of the population, it is necessary to develop a road map to increase the pension literacy of the population with participation (in time - up to 30.06.2020):

deputies of the State Duma of the Russian Federation and members of the Federation Council in charge of relevant issues;

professional community (including officials of the Pension Fund of the Russian Federation, the Ministry of labour and social protection);

scientific and pedagogical workers dealing with these issues;

political party;

citizens.

In the conditions of active dissemination of information technologies, attention should be paid to the modernization of the personal account of the insured person by increasing the detail with a detailed calculation of the amount of the assigned pension, including the allocation as separate blocks:

the number of years of pensionable service (there is currently);

total amount of funds of individual pension coefficients and breakdown for the period up to 01.01.2015 and after 01.01.2015 (present now);

the number of individual pension coefficients for socially significant periods (in total and broken down by periods) with a detailed indication of the stages of their calculation);

fixed payment size;

type (Federal/regional) and the amount of social Supplement to the pension (if any);

indexation for each date of its carrying out with the indication of stages of calculation (including reduction of percent of indexation, allocation of the sums before and after that) , etc.

It seems that it is possible to achieve the following objectives by means of the practical implementation of the above author's proposals:

To cope with economic growth.

Increase legal literacy of the population.

Increase financial literacy of the population.

Create preconditions for the emergence of long money.

To ensure the development of the stock market.

To increase the activity of civil society.

To increase the transparency of public finances.

At the same time, within the framework of ensuring effective and responsible management of the pension system of the Russian Federation, it is recommended to introduce a risk-oriented approach with the construction of a risk map in order to determine possible measures to minimize the negative impact of them during implementation.

Conclusion

In conclusion, it should be noted that the relevance of the study is confirmed by the high share of expenditures of the consolidated budget of the Russian Federation and state extra-budgetary funds for pension provision in their total volume. The main ways to improve life quality of pensioners in the Russian Federation were defined. Some positions characterizing the pension system of the Russian Federation were considered. It seems that through the practical implementation of the author's proposals, it is possible to achieve the tasks of stimulating the economic and improving the life quality of Russians as key priorities in the context of the implementation of national projects and the achievement of national goals defined by the decree of the President of the Russian Federation of 07.05.2018 “About national goals and strategic objectives of development of the Russian Federation for the period till 2024” ( 2018).

It is important to note that all of the above mentioned steps will provide key goal of socio-economic development of the state ultimately: improving the quality of life of the population.

References

- Alcacer, V., & Cruz-Machado, V. (2019). Scanning the Industry 4.0: A literature review on technologies for manufacturing systems. Engineering Science and Technology, an International Journal, 22(3), 899-919. https://doi.org/10.1016/j.jestch.2019.01.006

- Beetsma, R. M. W. J., Romp, W. E., & Vos, S. J. (2012). Voluntary participation and intergenerational risk sharing in a funded pension system. European Economic Review, 56(6), 1310-1324. https://doi.org/10.1016/j.euroecorev.2012.06.003

- Budget Code of the Russian Federation dated July 31, 1998 N 145-FZ (as amended on November 4, 2019; as amended on November 12, 2019) (2019). Retrieved from: http://www.consultant.ru/document/cons_doc_LAW_19702/ Accessed: 15.11.2019. [in Rus.].

- Chute, C., & French, T. (2019). Introducing Care 4.0: An integrated care paradigm built on Industry 4.0 Capabilities. International Journal of Environmental Research and Public Health, 16(12), 2247. https://doi.org/10.3390/ijerph16122247

- D'Amico, G., Lika, A., & Petroni, F. (2019). Risk management of pension fund: A model for salary evolution. International Journal of Financial Studies, 7(3), 44. https://doi.org/10.3390/ijfs7030044

- Decree of the President of the Russian Federation from 07.05.2018 “About national goals and strategic objectives of development of the Russian Federation for the period till 2024”. (2018). Retrieved from: http://www.kremlin.ru/acts/bank/43027 Accessed: 15.11.2019. [in Rus.].

- Federal Treasury (2019). Budget execution reporting. Retrieved from: http://roskazna.ru/ispolnenie-byudzhetov/ Accessed: 15.11.2019. [in Rus.].

- Global Age Watch index. (2015). Help age international. Retrieved from: https://www.helpage.org/resources/publications/ Accessed: 15.09.2019.

- Grodem, A. S., & Hippe, J. M. (2019). Networking, lobbying and bargaining for pensions: trade union power in the Norwegian pension reform. Journal of Public Policy, 39(3), 465-481. https://doi.org/10.1017/S0143814X18000144

- Grogan, L., & Summerfield, F. (2019). Government transfers, work, and wellbeing: Evidence from the Russian old-age pension. Journal of Population Economics, 32(4), 1247-1292. https://doi.org/10.1007/s00148-018-0726-8

- Hagemann, S., & Scherger, S. (2016). Increasing pension age – Inevitable or unfeasible? Analysing the ideas underlying experts' arguments in the UK and Germany. Journal of Aging Studies, 39, 54-65. https://doi.org/10.1016/j.jaging.2016.09.004

- Hsieh, K. Y. -Ch., & Tung, A. -Ch. (2016). Taiwan’s national pension program: A remedy for rapid population aging? The Journal of the Economics of Ageing, 8, 52-66. https://doi.org/10.1016/j.jeoa.2016.05.001

- Hu, W. (2019). Policy effects on transitional welfare in an overlapping generations model: A pay-as-you-go pension reconsidered. Economic Modeling, 81, 40-48. https://doi.org/10.1016/j.econmod.2018.12.005

- Lim, S., & Kim, J. (2019). Technology portfolio and role of public research institutions in Industry 4.0: A Case of South. Applied Sciences, 9(13), 2632. https://doi.org/10.3390/app9132632

- Mavlutova, I., Titova, S., & Fomins, A. (2016). Pension system in changing economic environment: Case of Latvia. In A.I. Iacob (Ed.), Proceedings of the 3rd Global Conference on Business, Economics, Management and Tourism. Procedia Economics and Finance, 39 (pp. 219-228). Amsterdam, Netherlands: Elsevier Science BV. https://doi.org/10.1016/S2212-5671(16)30316-1

- Moriggia, V., Kopa, M., & Vitali, S. (2019). Pension fund management with hedging derivatives, stochastic dominance and nodal contamination. Omega, 87, 127-141. https://doi.org/10.1016/j.omega.2018.08.011

- Mudzimbabwe, W. (2019). A simple numerical solution for an optimal investment strategy for a DC pension plan in a jump diffusion model. Journal of Computational and Applied Mathematics, 360, 55-61. https://doi.org/10.1016/j.cam.2019.03.043

- Rossit, D. A., Tohme, F., & Frutos, M. (2019). Industry 4.0: Smart scheduling. International Journal of Production Research, 57(12), 3802-3813. https://doi.org/10.1080/00207543.2018.1504248

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Nizhneva, N. N., Balynin*, I. V., & Nizneva-Ksenofontova, N. L. (2020). Ways To Improve The Life Quality Of Pensioners In The Russian Federation. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 1437-1444). European Publisher. https://doi.org/10.15405/epsbs.2020.03.206