Abstract

The article analyses the current trend of paid higher education crediting. Despite the key role of human capital and technological progress in determining the standard of living achieved through education, the cost of higher education has increased dramatically in some developed countries in recent years. This trend has led to the development of a mechanism for lending to higher education, which has a mixed impact on the further development of the economy. In recent years, the educational systems of many developed countries have faced the problem of insufficient government financing of higher education, caused by numerous financial crises varying by degree of their intensity. As a result, there is an upward trend in private spending on higher education. This phenomenon is, to some extent, violation of rights to equality in education. The solution to this problem came out of the system of educational credits, well-established in many countries. Even those countries (for example, Germany and Sweden), where higher education is fully financed from the budget, apply this loan system, but in a cut form: borrowed funds are used by students for accommodation and cover other costs related to education. Generally educational lending has both positive and negative effects on the higher education system and the economy.

Keywords: Educational systemstate educational policystudent loanseducational loanspaid education

Introduction

In recent years, the educational systems of many developed countries have faced the problem of insufficient government financing of higher education, caused by numerous financial crises varying by degree of their intensity. As a result, there is an upward trend in private spending on higher education. This phenomenon is, to some extent, violation of rights to equality in education. The solution to this problem came out of the system of educational credits, well-established in many countries. Even those countries (for example, Germany and Sweden), where higher education is fully financed from the budget, apply this loan system, but in a cut form: borrowed funds are used by students for accommodation and cover other costs related to education.

Problem Statement

Generally educational lending has both positive and negative effects on the higher education system and the economy. On the one hand, student loans provide an opportunity for more students to pursue higher education. This factor should be positively perceived by higher education institutions, because it allows to broaden significantly the range of students, thereby extending the profit margins of the institution. At the same time, the positive side of this phenomenon is the factor of educational boundaries expansion, when the student is not bound by the choice of the University, based on its geographical location, because the student loan can be used also for living. The latter factor should contribute to improving the efficiency of universities, improving the quality of education in them. According to researches, in general, people with higher education are more demanded in the market and earn more. Their chance of finding work exceeds the average by 10%, and the level of salaries-by 56%.

Research Questions

Effective education, which produces competent specialists, undoubtedly has a positive effect on economic growth. First of all, this is the case of modern economic model, where the basis of GDP is formed by the services’ income, but not the commodity income. Accordingly, every state is interested in a high educational level of its graduates. It is proved that as the role of services in the economy increases, the level of education of employees also increases ( Wolf, 2016).

Today, educational lending is represented in almost all the countries: the United States, Western Europe, Latin America, etc. Some countries use mixed financing of higher education, and there are those where higher education is fully paid, for example, the United Kingdom, Austria.

Purpose of the Study

There is no worked-out effective mechanism of students’ loan provision in Russia nowadays. In the year 2017, the Ministry of education of the Russian Federation began its work on the creation of a special system of student loans - on preferential terms with a long period of repayment after graduation ( Toutina et al., 2017).

The shift from broad public funding of higher education to private funding education by loans creates greater risk for some students. Contemporarily, the phenomenon has potentially negative social and economic risks of a national scale.

While student loans are devised to increase University access to the wider population, the nature of the risk they entail may have the opposite effect. Applicants from low and middle-income families who are concerned about subsequent student loan repayments will choose not to commit to long-term financial obligations. However, this potential "scare" is a small fraction of the possible financial problems that will entail student loans.

American studies shown that high debt levels not only constrain access to higher education at the beginning, but can also discourage students from successfully graduating. In the United States, for example, a large number of students, taking an educational loan, did not graduate and did not pay off the loan. At the same time, without a diploma they cannot find a profitable job to refund their loan.

The second issue related to the increase in student loan debt is the impact on the economy. High level of private sector credits is hampering economic growth. As a result of the financial crash, households are trying to reduce borrowing, or pay off their debt, so they can have a healthier financial outlook, reduce the amount of their income they use to service their debt, and start investing and consuming again. In the process of reducing the share of borrowed funds, household spending is limited, which is an obstacle for a healthy economy. High level of household debt makes the economy more vulnerable to financial crises ( Kalomiris & Haber, 2017).

The next issue is distribution of debt among the population. Thus, if debt is concentrated among high-income students, economic resistance will be less than if it is concentrated among low or middle-income families. For example, in the United States, about 70% of all University graduates have student loan debt ( Tanzi, 2018). Thus, the volume of student loans continues to accumulate and the burden of interest payments in addition to the payment of principal loan will further constrain the economy. And, since educational lending is not able to stop the problem of rising tuition fees in universities, a vicious circle appears: the lending system allows universities to increase the cost of education, which forces students to borrow large amounts, exposing students to even greater risk and further increasing the need for loans. As a result, student loan balance has soared over the past decade, and this can have a very negative impact on the economy ( Toutina et al., 2017).

Thus, economic growth significantly reduces, because households can not make large and medium-sized purchases due to the encumbrance of credit obligations and economic growth is severely limited or stopped altogether. Entrepreneurial activity decreases, young people are less likely to take risky decisions.

Therefore, it can be tentatively concluded, that educational lending has a negative impact on various economic outcomes, such as educational and career choices, household and private business formation, and retirement savings decisions. Negative trends, by themselves, in these areas can lead to a decrease in the economic development of the country.

Research Methods

In addition, in the labor market the high level of student debt is a serious obstacle to careers in the public or public sectors, where wages are usually lower than in the business sector. Also, this phenomenon will definitely have a negative impact on the geographical choice of the graduate place of work: in Russia, today is characterized by pronounced inequality in wages based on the region. The gap in the level of average wages in the Federal districts can exceed several times, while the most paid becomes the Central Federal District, and the least paid North Caucasus and Siberian Federal districts ( Toutina et al., 2017).

Findings

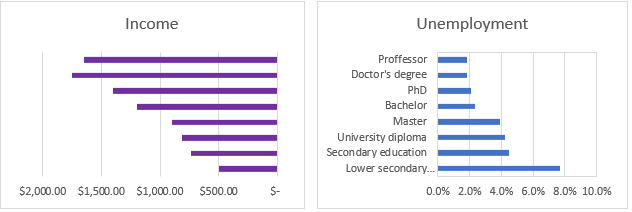

Meanwhile, having a higher-than-average education offers opportunities for better working conditions and higher income prospects. Below you can see a diagram (see Figure

International modern economy is increasingly dependent on knowledge-related economic activities. That is why human resources will play more important role in determining long-term economic growth. Thus, as Nobel laureate, Joseph E. Stiglitz emphasized, the costs of higher education and the level of graduate debt are not only a problem of equality of opportunity, but also a serious threat to the future prosperity of developed countries ( Stiglitz, 2013).

This article proves that in terms of society, a high level of student debt can have serious negative consequences on economic growth. It should be mentioned that our results are based on two main hypotheses. Firstly, the urgent Russian problem of brain drain, one of the factors of its origin is obliged to the described mechanism of higher education financing in the country. Secondly, it seems reasonable to assume that graduates who have received education at the loan expense issued to themselves or their family, will be more likely to seek a higher-paid job that will allow them to repay the educational loan faster than one that would bring pleasure. The latter fact plays a significant role in the further development of talent for a certain type of activity, which as a result, leads to higher labor results.

In conclusion, it should be emphasized that for a country that is focused on advanced development and high economic growth, the cornerstone of educational policy should be the effect of productivity, which implies an effective distribution of human resources. However, the potential dangerous impact of the increasing difference in the average growth rate of real family income and average higher education spending may be even more widespread ( Elovskaya, 2017).

The described inefficiency of educational policy pushes educated professionals to engage in different activity that the applicant dreamed of. In particular, doctors who have completed an average of almost a decade of education have the opportunity to find employment, for example, as a sales Manager in pharmaceutical companies. When choosing a job, the graduate should take into account that the student loan is provided for up to 10 years, and the monthly payment is on average from 10 to 35.000˙₽ ( Toutina et al., 2017), depending on the cost of education and the conditions of the credit institution. A cursory analysis of the medical labor market in the Russian Federation suggests that as of March 28, 2018, the salary of a surgeon in the city clinic of Samara is an average of 35 000 ₽, while a sales Manager in a pharmaceutical company requires a salary of 100 000 ₽ ( Toutina et al., 2017).

As a result, the country has an acute shortage of doctors, a decrease in the quality of medical care for the population ( Toutina et al., 2017), and as one of the consequences of this situation - a low level of life expectancy of the population compared to developed countries, and pharmaceutical companies are foreign and such employment is at least a "brain drain" with obvious consequences.

Conclusion

Taking into account all the above, Ministry of education of the Russian Federation should not force the formation of student educational lending in the framework of the state educational policy of the Russian Federation. The author considers it acceptable to develop a separate direction of lending to students in the framework of higher education, aimed at providing loans for food and accommodation of a non-resident student. This decision is necessary, fair and financially less burdensome for future graduates, with the amount of payment on the loan on preferential terms up to 5 000 rubles per month.

References

- Elovskaya, E. (2017). Unstable by design: political causes of banking crises and credit deficits. Moscow: Publishing house of Gaidar Institute. [in Rus.].

- Kalomiris, C., & Haber, S. (2017) Fragile in construction: The political causes of banking crises and credit deficits. Moscow: Publishing house of Gaidar Institute. [in Rus.].

- Stiglitz, J. E. (2013). Student debt and the crushing of the American dream. The New York Times. Retrieved from: https://opinionator.blogs.nytimes.com/2013/05/12/student-debt-and-the-crushing-of-the-american-dream/ Accessed: 11.05.2019.

- Tanzi, V. (2018). Government versus Markets: The Changing Economic Role of the State. Cambridge: Cambridge University Press.

- Toutina, U., Bondarenko, E., Borta, Yu., Emelyanova, E., Isaev, N., Knutareva, M. … & Chernova, E. (2017). Medicine deficit. Why are Russians deprived of normal medical care? Arguments and Facts, 37. Retrieved from: http://www.aif.ru/society/healthcare/deficit_mediciny_pochemu_rossiyane_lisheny_normalnoy_medicinskoy_pomoshchi Accessed: 11.05.2019. [in Rus.].

- Wolf, M. (2016). The shifts and the shocks: What we’ve learned – and still have to learn – from the financial crisis. Moscow: Publishing house of Gaidar Institute. Retrieved from: http://economytimes.ru/sites/default/files/Wolf.pdf Accessed: 11.05.2019. [in Rus.].

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Ponyavina*, M., Samoilenko, M., & Tishina, Y. (2020). Student Loans As A Negative Phenomenon Of Educational Policy. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 1255-1259). European Publisher. https://doi.org/10.15405/epsbs.2020.03.179