Abstract

The importance of risk management in modern conditions is explained by a number of reasons. First, risk occupies an important place in the enterprise income generation scheme; second, the level of risk depends on the feasibility of a particular financial and economic operation; third, the risk allows to get true assessment of the internal reserves of the enterprise. The above problems are solved only by the development of efficient methods of risk management at enterprises that allow determining the forecast quantitative estimates of indicators of economic activity. Therefore, the purposes of this study are: a) to characterize the main trends in venture capital investment in the oil and gas business; b) to analyze the positive experience of implementing digital technologies in the investment management of foreign oil and gas companies; c) to assess the risk level of investment projects in modern conditions of the digital economy. The results of the study show that the provisions formulated by experts of the All-Russian Scientific and Practical Forum with international participation “Digitalization-2018” are subject to certain criticism, which raises the following questions:1. Human role in the digitization of the economy: how much does the digitalization of the economy depend on the use of human capital? 2. Cybersecurity: what is the capacity of cybersecurity industry to resist digital risks? 3. Prospects of the enterprise transformation: to what extent do barriers of the digital economy constrain efficient development and interaction of science and industry?

Keywords: Economyoil and gas businessventure capital investmentsrisks of digitalization

Introduction

The development of international economic cooperation based on the integration of national economic ties into the global economic space, the openness of the economy, and the free movement of capital between countries increased the importance of venture capital investment management. The strategy for the development of the information society adopted in Russia has designated the goal of digital transformation: to increase the efficiency of various types of production, technologies, equipment, storage, sale, delivery of goods and services ( Decree of President of the Russian Federation №203, 2017). Therefore, it has pointed to the need to attract investment resources in the digital business. According to the European Association of direct investment and venture capital one of the effective, proven forms of financial support for high-tech companies with growth potential are venture capital investments, which should be managed taking into account the criteria of limitation, optimality, flexibility, efficiency ( Fomina & Khodkovskaya, 2018). Venture capital investment is a risky undertaking, but specialists do not have an unambiguous judgment on the risk level of venture capital investment. Thus, Colin ( 2015) and Janeway ( 2012) explain the influx of investments in high-tech and high-tech projects by the fact that the implementation of these business projects is carried out with less risk. A number of scientists, such as Gerard George, Eva Nathusius, Sergio Tieri, Eli Talmor, note that venture investment in European countries and the United States is focused on the introduction of digital technologies and services, artificial intelligence systems ( European Private Equity and Venture Capital Association, 2018). In particular, in the United States, 65% of all venture capital investments in the country were directed to ensuring cybersecurity in 2018, while the total amount of injections increased by 42% compared to 2017. CB Insights experts note that in 2018, the volume of world venture capital investments in new promising developments amounted to $ 52.95 billion, which is 47% higher than in 2017. Internet and digital technologies remain the most attractive projects for venture capital investment. International Data Corporation estimates that information security spending is projected to increase to $ 133.7 billion by 2022, with spending on cybersecurity software and services increasing by an average of 9.9% annually ( Colin, 2015). Thus, the risk of introduction/use of digital technologies becomes really tangible.

Problem Statement

The trend for digitalization and economic transformations in Russia requires a new plan and management of the multifaceted activities of oil and gas companies, attracting recommendations for solving organizational, production, economic and other problems including risk. The need to study the possibilities of risk management of investment projects as the main condition for efficient operation of oil and gas companies in conditions of the digital business transformation is confirmed by the results of the analysis of barriers to digitization of the oil and gas industry of the Russian Federation. It shows that the main obstacles to the digitalization of the oil and gas sector are lack of funding and threats to cybersecurity ( Peskova, Khodkovskaya, & Nazarov, 2019). For Russia and many countries of the world, the assessment of the risks of oil and gas companies' investment projects in conditions of the digital economy is of paramount importance, since there is a huge interest of the state and business in the benefits that digital solutions can bring. These are the implementation of the most promising and potentially highly profitable business projects. According to experts of Accenture Technology Vision, 94% of top managers from 27 countries indicate that their business growth rate has accelerated in the context of digitalization ( Accenture, 2019).

The complexity of business processes and business operations in modern oil and gas business requires constant updating and improvement of not only technological equipment, but also the transformation of the applied software, robotics, implementation of analytical systems allowing to make production as profitable as possible, i.e. deep integration of technologies with business processes. According to a survey conducted by Oil & Gas IQ, when answering the question "How can intelligent corporate systems affect your business?" 65% of the largest international oil and gas companies representatives were in favor of costs reduction, 45% – process optimization, 44% – business modernization, 42% – time saving, 35% – gain in competition ( Manigart et al., 2002). Given that the oil and gas business in Russia has a priority role in the digital economy, the risk assessment of investments in digital technologies is necessary and mandatory; otherwise, it is impossible to carry out efficient business.

In the context of the current level of competition and the pace of economic development in business processes of oil and gas companies, the economic value of investment projects is becoming increasingly important. The economic value of venture projects is the quoted value of expected cash flows. In maximizing it, company managers see financial and commercial appeal for both investors and the company. However, the quoted value of expected cash flows does not often take into account the strategic prospects of the business or project of oil and gas companies: the nature of the long-term consequences and the uncertainty of the multiplier effect of its implementation, growth opportunities, managerial flexibility adjusted for risk. Therefore, in the process of venture capital investment, the manager is able to stop the implementation of the project and leave a hopeless business, minimizing investment risks and financial losses by shortening the implementation period of a loss-making project or cutting volumes of unprofitable production. It is also possible to carry out measures to expand the activity in case of optimistic scenario of the project development; use gained experience at other cities or in other venture projects of the company; suspend the business or postpone the start of the project until more detailed information on its parameters is obtained; switch to a more appropriate option for project implementation. It should be noted that in world practice possible accounting of the opening options for the implementation of investment projects is carried out using the real option valuation (ROV) method. However, the opportunities embodied in the investment project can be realized only under certain conditions, without taking into account the risk adjustment. Thus, the aim of this work is to study the characteristics of venture capital investment in oil and gas companies and assess the risks of investment projects in conditions of the digital economy.

Research Questions

Based on the study of such issues as qualitative benefits, the cost of the investment project, the objectives of the various stages of the project, the timing of their completion, the required number of employees, their skills, control, etc. we determine their impact on the expected result of business processes in oil and gas companies. The shifts or changes in the planned values helped to measure the level of risk in the business. In our opinion, the use of risk analysis methods is impossible without studying the consequences of each risk factor, developing strategies and tactics for managing the risk of investment projects in conditions of the digital economy. It involves the calculation of estimated risk indicators, based on the identification of possible losses that the company may suffer. This means that the basis of the risk analysis is the finding of a relationship between certain amounts of losses in a company's commercial profit and the probability of their occurrence. In connection with the above, the following questions are formulated for conducting this study: 1) What are the main types of risks in the digitized oil and gas business? 2) To what extent do the risks of introducing digital technologies affect the business performance of oil and gas companies? 3) What is the probability of stable business performance of oil and gas companies while implementing risk-adjusted investment projects?

Purpose of the Study

The purpose of this study is to assess the risks of investment projects in the context of the digital transformation of the oil and gas business. The article provides a comparative description of different risk evaluation methods for the companies engaged in oil and gas business. The question examined is whether the existing methods are suitable for modern business models based on the use of digital technologies.

Research Methods

To answer research questions and achieve the research goal, methods of scientific knowledge and mathematical modelling are used as the main research methods. The information base of the study consisted of analytical reviews on the use of digital fields in the oil and gas industry, data from analytical research centers (European Private Equity and Venture Capital Association, International Data Corporation, CB Insights, Accenture Technology Vision), legislative and regulatory acts of the Russian Federation, materials of thematic conferences, monographs, scientific articles by Russian and foreign authors on the problems and prospects of digital transformation of the economy and industry. The study of features of risk manifestation in conditions of the digital economy, its impact on the efficiency of ongoing business processes, risk assessment methods used in domestic and foreign practice, made it possible to determine that in connection with the continuous transformation of technologies and management methods, it is necessary to ensure digital and information security, since digitalization along with marked effects put barriers to achieve business efficiency. This necessitated the assessment and accounting for risk as a mandatory component of investment projects in conditions of the digital economy, which cannot be utterly avoided.

As a result, the most common types of risk in digitized business were identified: cybersecurity risk, Internet fraud, virus penetration, hacker attacks, Internet terrorism and organized crime. Grouping of risks of the digitized oil and gas business according to the possibility of management (managed, unmanaged) and management levels (global, local) made it possible to conclude that the risks of investment projects of oil and gas companies are managed local risks, therefore, it is possible to quantify them. Analyzing the final cost of the projects, Edwin Mansfield concludes that it is characterized by high cost and time delays ( Mansfield & Wagner, 1975). This judgment indicates that scientific and research developments face significant cost overruns and do not meet deadlines. Warren McFarlan shares the position, stating that the 3 important points determine the amount of risk inherent in any project: the size of the project, experiments with technology and the structure of the project ( McFarlan, 2007) Therefore, evaluating the total risk of an investment project, one should take into account the division of the project into the business processes of the oil and gas company.

Findings

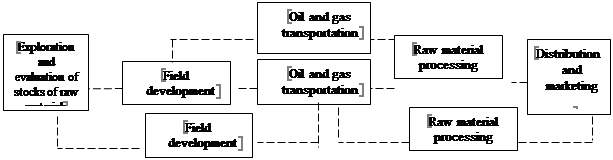

In the international oil and gas business, companies independently determine the types of their activities: upstream (exploration and evaluation of raw materials, field development, oil and gas transportation, processing, distribution and marketing); midstream (oil and gas transportation, processing); downstream (distribution and marketing). However, most of the vertically integrated companies in the domestic oil and gas business carry out a full cycle of business processes - upstream. For this purpose, it is appropriate to create a micro-risk tree that reflects the risk structure for business processes: the micro-risks of each business process are formed in accordance with business operations and represent a deviation from the planned indicators of the investment project: either savings or cost overruns. Savings indicate that the actual costs of production were less than planned. In this case, the company's profit increases by the amount of savings if taxes are stable. Overruns of planned costs reduce the planned profit margin at a stable quality of goods and services. It is quite difficult to obtain savings in the process of production of the final product if, during the implementation of the project, the source of risk is associated with scientific and technical discoveries at the beginning of the life cycle of goods and services. Uncertainties arising from demand and cost are easier to manage than uncertainties associated with attempts to change the level of science and technology involving the laws of nature. Therefore, according to research by Jensen and Meckling ( 1976), the final cost of an investment project increases by 200% - 300% compared to initial estimates, and the time delay is 33% – 50 %. This deviation from the planned cost in the form of cost overruns is explained either by technical difficulties in the process of implementing the investment project or by optimistic assessments at the stage of business project formation. As the practice of the oil and gas business proves, the formation of investment project indicators should be carried out from the standpoint of the presence of risk. In the oil and gas business, all business processes of an investment project can be represented as a chain of sequential or parallel connections. The sequence of business processes in the oil and gas business is dictated by the technological rules for obtaining high-quality commercial products: the beginning of one business process follows the completion of the previous one. Parallel connection of business processes in the oil and gas business involves simultaneous execution of business processes. As a result of empirical calculations, the probability of stable performance of business processes was estimated and the total probability was 0.815 for a sequential connection of business processes, and 0.894 for a parallel connection of business processes. The obtained values of the probability of stable performance of business processes indicate that the value in case of a parallel connection of business processes is 9.7 % higher than in case of a sequential connection. For the most efficient implementation of business processes, the scheme that takes into account internal risk factors is proposed: figure

The probability of stable performance of business processes was 0.899. It was found that the growth rate of the probability of stable performance of business processes amounted to 10.31%. Thus, the above calculations indicate that the likelihood of performing business processes will be higher and, therefore, the risk level will be less significant when implementing business process organization scheme that takes into account the internal risk factors of the oil and gas company.

At the present stage of economic development, risk manifests itself as a regulator of the entire market process, encompassing all the relationships between the sphere of production and the sphere of consumption: formal and informal. Therefore, the basis of risk management at the enterprise is the interests of business entities. To create an integrated risk management mechanism for investment projects from the standpoint of minimizing risk, the oil and gas business has to take into account market factors, as well as the following recommendations:

Constantly changing external economic environment predetermines the continuity of forecasting the value of investment risk at all stages of business processes. Therefore, the input information of the system of forecasting the value of investment risk is the information about the oil and gas company environment, which is characterized by specific parameters at a certain time. At the output the risk prediction system forms scientifically-based information: on the directions of minimizing investment risk during the entire forecast period; on the sequence of implementation of the directions of minimization; on the structure of input information parameters, which will have developed by the end of the forecast period.

The combination of research and regulatory forecasts regarding the external and internal environment of the oil and gas company is connected with the fact that the outcome of the oil and gas company depends on the stable operation of all business processes. Therefore, considering internal relations in the oil and gas business as a branch of the economy, it is necessary to choose a resource allocation mechanism that would ensure maximum return at all levels of the oil and gas business activity.

The complexity of methods for predicting micro-risks. The complexity of methods for predicting investment risk factors is necessary so that different approaches to identifying risk factors would ultimately give either a quantitative or a qualitative assessment of micro-risks, as well as integral investment risk.

Conclusion

The current economic environment in which oil and gas companies operate is characterized by instability and uncertainty. The implementation of investment projects of oil and gas companies is influenced by the deterioration of geological conditions, the quality of reserves and various changes in market conditions. The sustainable development of oil and gas companies in the future depends on the ability to predict and flexibly respond to changing environmental conditions, to retain and acquire new competitive advantages in the struggle for markets. The use of digital solutions in the business environment makes it possible to increase competitiveness and efficiency by effectively responding to the situation, the objective of which is facilitated by monitoring and comprehensive analysis of the array of data coming ( Peskova, Khodkovskaya, Charikov, & Sharafutdinov, 2019). In this regard, the significance of risk assessment of investment projects is growing. Moreover, digital leadership is not always the best strategy for a company, and it can be costly. Therefore, the oil and gas business as a risk-oriented direction of modern economy, seeking to provide competitive advantages in solving tactical and strategic tasks, needs to take into account market factors and risks that determine the efficiency of investment decisions.

References

- Accenture (2019). Accenture technology vision 2019: Full report. Retrieved from: https://www.accenture.com/ru-ru/insights/technology/technology-trends-2019 Accessed: 27.09.2019. [in Rus.].

- Colin, N. (2015). Low risk, high reward: Why venture capital thrives in the digital world. The Family. Retrieved from: https://salon.thefamily.co/low-risk-high-reward-why-venture-capital-thrives-in-the-digital-world-ed56d0b14dc Accessed: 25.09.2019.

- Decree of the President of the Russian Federation N 203, 05.09.2017 (2017). On the Strategy for the Development of the Information Society in the Russian Federation for 2017-2030. Retrieved from: https://base.garant.ru/71670570/ Accessed: 25.09.2019. [in Rus.].

- European Private Equity and Venture Capital Association (2018). EVCA reporting guidelines. Retrieved from: https://www.eesc.europa.eu/en/policies/policy-areas/enterprise/database-self-and-co-regulation-initiatives/75/ Accessed: 30.09.2019.

- Fomina, E. A., & Khodkovskaya, Y. V. (2018). Resource management of business projects in the oil and gas industry of the Russian Federation. Economics and Management: Scientific and Practical Journal, 4(142), 121-126. [in Rus.]

- Janeway, W. H. (2012). Doing capitalism in the innovation economy. Markets, speculation and the state. Cambridge, UK: Cambridge University Press.

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Manigart, S., De Waele, K., Wright, M., Robbie, K., Desbrières, P., Sapienza, H. J., …, & Beekman, A. (2002). Determinants of required return in venture capital investments: A five-country study. Journal of Business Venturing, 17(4), 291-312. https://doi.org/10.1016/S0883-9026(00)00067-7

- Mansfield, E., & Wagner, S. (1975). Organizational and strategic factors associated with probabilities of success in industrial R&D. The Journal of Business, 48(2), 179-198. https://doi.org/10.1086/295734

- McFarlan, F. W. (2007). Governance in global information economy. China Journal of Information Systems, 1(1), 8-15.

- Peskova, D. R., Khodkovskaya, J. V., Charikov, V. S., & Sharafutdinov, R. B. (2019). Development of business environment of oil and gas companies in digital economy. In V. Mantulenko (Ed.), Proceedings of the International Scientific Conference «Global Challenges and Prospects of the Modern Economic Development». The European Proceedings of Social & Behavioural Sciences, 57 (pp. 1205-1212). London: Future Academy. https://doi.org/10.15405/epsbs.2019.03.122

- Peskova, D. R., Khodkovskaya, Yu. V., & Nazarov, M. A. (2019). The driver of development and transformation of global oil and gas business in digital economy’s conditions. In V Mantulenko (Ed.), Proceedings of the 17th International Scientific Conference «Problems of Enterprise Development: Theory and Practice». SHS Web of Conferences, 62 (03005). Les Ulis: EDP Science. https://doi.org/10.1051/shsconf/20196203005

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Peskova*, D. R., Khodkovskaya, J. V., & Charikov, V. (2020). Risk Assessment Of Investment Projects In The Digital Economy. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 1170-1176). European Publisher. https://doi.org/10.15405/epsbs.2020.03.168