Abstract

The purpose of the paper is to define approaches to the integrated assessment of investment projects, to substantiate the model of choosing the valuation technique of the investment project and to develop algorithmic models of finding the integral index of evaluating the investment project for different economic entities. The study uses materials of the Financial university research work carried out in the framework of the state assignment for 2019, along with the cost and scenario approaches to the investment project evaluation. The methods used at the evaluation stage of an investment project are profitable, comparative and cost approaches. An integral indicator is built using the expert valuation technique and the Saati method. As proposed, the investment project is considered as an object of integrated assessment, including the assessment of its value, efficiency and compliance with the criteria of economic feasibility. The following types of economic expediency (criteria) are singled out: general; social; budgetary; ecological; regional; branch; economic; commercial; financial; and national economy. The final assessment of the economic feasibility of a project is determined. The model of choosing the calculation method of the investment project value depending on the purpose of the assessment and the stage of the project implementation is proposed. Algorithmic models of investment projects evaluation for different economic entities based on cost and scenario approaches are developed. The models are based on the calculation of the integral evaluation index and determination of its range for making a positive or negative decision on investment.

Keywords: Investment projectevaluationcostefficiencyalgorithmic modelintegral assessment indicator

Introduction

Investment activity is a driver of the development of both a separate economic entity and the country's economy as a whole. Effective investment activity significantly stimulates the introduction of innovations, increases production and productivity in the real sector of the economy, activates the financial market, increases the rating of foreign investors' confidence, promotes the implementation of social and environmental projects, accelerates the processes of economic growth ( Loseva, Fedotova, & Khotinskaya, 2015).

Problems of evaluating investment projects are raised in the works of the following scientists ( Moskaleva & Chelmakina, 2016; Higham, Fortune, & Boothman, 2016; Vickerman, 2017; Particka, Stafne, & Martinson, 2018; Ablaev, 2019). However, the works, as a rule, touch upon either the issues of assessing the economic efficiency of projects, or the issues of ensuring social or environmental efficiency. Our study attempts to integrate the economic and social feasibility of implementing an investment project based on the value-based approach.

Integrated assessment of investment projects (hereinafter referred to as IP) implies an interconnected assessment of cost, efficiency and justification of the economic feasibility of their implementation for different economic entities.

Determination of the investment project value involves the calculation of cost indicators reflecting the value of IP, depending on the purposes of its evaluation for specific economic entities.

Economic feasibility of an investment project is expressed in such categories as ( Ministry of Finance of the Russian Federation, Gosstroy of the Russian Federation, 1999):

efficiency of the project

financial feasibility of the project, i.e. availability of sufficient funds for project implementation

acceptable level of project implementation risk.

The efficiency of an investment project is a category reflecting the compliance of an investment project with the goals and interests of the project participants, which are understood as the subjects of investment activity and society as a whole ( Nikonova & Smirnov, 2016).

Problem Statement

The study sets the following objectives:

to define approaches to the integrated assessment of investment projects, objects and subjects of assessment

to characterize the system of quantitative indicators through which different types of economic feasibility of investment projects implementation are characterized

to justify the model of choice of the method of cost evaluation of the investment project

to develop algorithmic models of finding the integral index of investment project evaluation for different economic entities.

Research Questions

This study is designed to answer the following questions:

What constitutes an integrated assessment of investment projects?

What are the main subjects and objects of investment project assessment?

What criteria of economic feasibility of investment projects can be identified and how to quantify them

How to choose the valuation technique of the investment project?

How is the integral index of investment project evaluation determined and what is the algorithm of its calculation for different economic entities?

Purpose of the Study

The purpose of the research is to develop algorithmic models of finding the integral index of investment project evaluation. Algorithmic models should be using a value-based approach to evaluation of the project. This should take into account the goals of various economic actors.

Research Methods

Cost and scenario approaches to investment project evaluation are applied. When defining the investment project value methods of profitable, comparative and cost approaches are used. The Saati method is used to implement the scenario approach. When building an integral indicator of investment project evaluation the method of expert evaluation is applied. The methods of modeling and evaluating investment project efficiency are also used.

Findings

Approaches to the integrated assessment of investment projects, objects and subjects of assessment

Investment project appraisal models are based on the application of cost and scenario approaches.

The value technique is based on the value-oriented management concept and assumes that the basic, fundamental criteria for the economic feasibility of IP implementation are value indicators, the specific type of which depends on the type of value and the relevant purpose of evaluation.

The scenario approach to the evaluation of individual entrepreneurs is used, first of all, for the analysis of project risks ( Braouezec & Joliet, 2019). Scenario approach when making a final investment decision on the results of integrated assessment of individual entrepreneurs implies the choice of the scheme for calculating the integral assessment indicator (AI), on the basis of which the decision is made on the adoption, further implementation or completion/liquidation of the project, depending on the specific stage and type of individual entrepreneurs, as well as the significance of the criteria of economic feasibility of individual entrepreneurs for a particular economic entity (investor).

We have identified three stages of an individual entrepreneur: the pre-investment stage, the stage of implementing an individual entrepreneur (including the investment and operational stages), and the stage of completing (liquidating) an individual entrepreneur. Each of these stages, as a rule, includes additional stages, for example, the pre-investment stage may include assessment of the demand for the idea of an individual entrepreneur, preparation of design and estimate documentation, development of a business plan for an individual entrepreneur, etc. The stage of implementation of an individual entrepreneur may include preparation and conclusion of a contract, construction and installation works, carrying out of research and development, production and operation of an individual entrepreneur's object; the stage of completion or liquidation - assessment of the efficiency of incurred capital expenditures, budget expenditures or assessment of liquidation.

The following economic entities may act as subjects of investment activity (assessments of individual entrepreneurs):

the state represented by the authorities (federal, regional and municipal levels); state corporations and companies with state participation; companies implementing public-private partnership projects)

the business represented by commercial organizations of the real or financial sectors of the economy

non-profit organizations and households, including individual citizens.

It is also necessary to consider representatives of the professional community of appraisers as the subject of the assessment, who can be involved at various stages of IP by all the economic entities described above since the value-oriented approach is the basis for the integral assessment of IP according to the concept adopted in the work.

The subject of the assessment can be a direct investor, who determines the object of investment with the expectation to assume a part of the management functions in the invested object, or an indirect investor, i.e. it invests in assets without the right to manage them and receives only a share in the investment portfolio. The state can also act as an investment stimulator, i.e. it can carry out budget subsidies from the federal, regional and local budgets in order to develop promising industries, science and enterprises.

The object of assessment may be an investment project carried out only at the expense of own funds, or an investment project carried out with the involvement of other economic entities. It is assumed that the project is technically, technologically and organizationally feasible. Otherwise, further assessment of the economic feasibility of an individual entrepreneur does not make sense, and it is necessary to develop measures, research and development or other investment projects in order to achieve the fundamental feasibility of the project from these positions.

To build a model, the following types of investment projects will be considered:

General-purpose projects – commercially-oriented investment projects, the main purpose of which is to obtain profit

Social projects - investment projects representing investments in social sphere objects with the purpose of receiving income and improving the standard of living and quality of life of people by satisfying their material, spiritual or social needs

Environmental projects - investment projects aimed at solving environmental problems of the region, industry, city, specific enterprise, which result in environmental protection objects or implementation of measures to reduce the harmful impact of human activity on nature

Infrastructure projects - investment projects aimed at creation, modernization and expansion of infrastructure facilities and characterized, as a rule, by high capital intensity, low level of net present value, long periods of payback and achievement of targeted return on investment

Innovative projects - investment projects aimed at creation and introduction to the market of innovative products, the introduction of innovative technologies, services, management methods and characterized by high risks of repayment of investments due to the unpredictable nature of the idea implementation.

Types of economically feasible implementations of investment projects and indicators characterizing their performance

Indicators of IP assessment represent a system of quantitative indicators, by means of which different types of expediency of its implementation are characterized ( Fedotova & Loseva, 2015): general (socio-economic - SE), social (s), budgetary (B), environmental (Eco), regional (R), sectoral (SE), economic (E), commercial (K), financial (F), national (N).

In particular, social efficiency can be characterized by an increase in the number of jobs, the volume of social services (educational, medical, public) as a result of the project, economic - indicators of NPV, PI and EVA (net present value, return on investment, economic value added), etc. The number of indicators should be limited in order to reduce the labor intensity of the assessment, for example, one or three depending on the importance of a particular criterion.

It should be noted that these indicators should be quantitative and may have different dimensions (monetary, structural, temporal), some of them are absolute and the others are relative. It is also necessary to point out their diversity: the increase of some leads to an increase in the efficiency of the investment project (for example, NPV), and the increase of others - to a decrease (in particular, the payback period). In this regard, when determining the generalized impact of these indicators on the integrated assessment of the investment project, the procedure of their normalization is necessary. It should also be emphasized that this system of indicators can be modified or expanded taking into account investors’ interests and peculiarities of individual entrepreneurs.

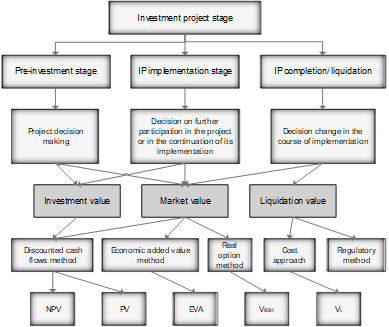

Model for selecting the method of value estimation of an investment project depending on the purpose of the business entity

At the pre-investment stage, the main goal of a business entity is to make a decision on participation in an investment project. At the same time, it is necessary to provide for an algorithm of project(s) selection from a variety of alternatives (if any).

For these purposes, it is necessary to determine the investment value of the project (IP), the main cost indicator of which will be NPV ( Ministry of Economic Development of Russia, 2016b). NPV indicator reflects the potential effect of the project and shows what new value can be created as a result of the project implementation without taking into account the sources of funding and organizational and economic mechanism of its implementation. Accordingly, in calculating NPV, the estimated (forecast) free cash flow (FCF) for the life cycle of the project is used. However, it is recommended to find the economic added value generated by the individual entrepreneurs (EVA>0) for the express evaluation of the project. The method of economic value added refers to the methods of profitable approach and allows to estimate (determine) the value of IP value effect.

At the project implementation stage, the key objective is to make a decision on further participation in the project or its change in the course of implementation under the influence of the emerging market situation. At the same time, the market value of the project (PC) is determined either by the method of discounted cash flows or by the method of options (Black Scholes model), which are based on a profitable approach to assessing the value of the business. If discussing the implementation of the project before reaching production capacity (directly investment stage) then the main value indicator used is also NPV, which should be maximized. If the project provides for an operational stage (and further on), in fact, at this stage the assessment of individual entrepreneurs is similar to the assessment of the existing business and to calculate the value of individual entrepreneurs it is advisable to determine the indicator PV (current value) by DCF (discounted cash flows) method, which will also include the post-projected value. If in the course of the project implementation the investment objectives or the market situation changes in such a way that it is more profitable to suspend the project, the Black Sholes model ( Miller & Waller, 2003) and the SBSI index can be used to calculate the value of an individual entrepreneur. In any case, the scenario of changes is chosen, which gives the highest value of its value when revaluing an individual entrepreneur.

Finally, at the stage of project completion, the key objective is to assess the achieved project objectives, as well as the efficiency of capital investments, other costs incurred, budget spending, etc. Regulatory methods can be used here, for example, the method of assessing the efficiency of capital investments ( Ministry of Economic Development of Russia, 2009). If we are talking about the liquidation of the project, it is necessary to determine the liquidation value (PL) using cost approach methods ( Ministry of Economic Development of Russia N 721, 2016a). Thus, the model of choice of the IP valuation method can be described in the following scheme (Fig.

The process is carried out on the basis of the concept of Agile (flexible project management system), which implies systematic quality control of the final product (financial feasibility and expediency of IP), customer orientation (requirements of the subject of IP evaluation), response to changes in the external environment (adjustment of investment decisions depending on changes in IP parameters under the influence of emerging market conditions) ( Marchioni & Magni, 2018).

This concept means that at each stage of the selected IE there is its evaluation, which integrates three main elements:

Estimation of the value of IP (value parameters) according to the scheme in Fig.

01 Consideration of IP risks in the discount rate.

Assessment of the economic feasibility of individual entrepreneurs on the basis of criteria and relevant indicators by subjects of assessment and types of individual entrepreneurs.

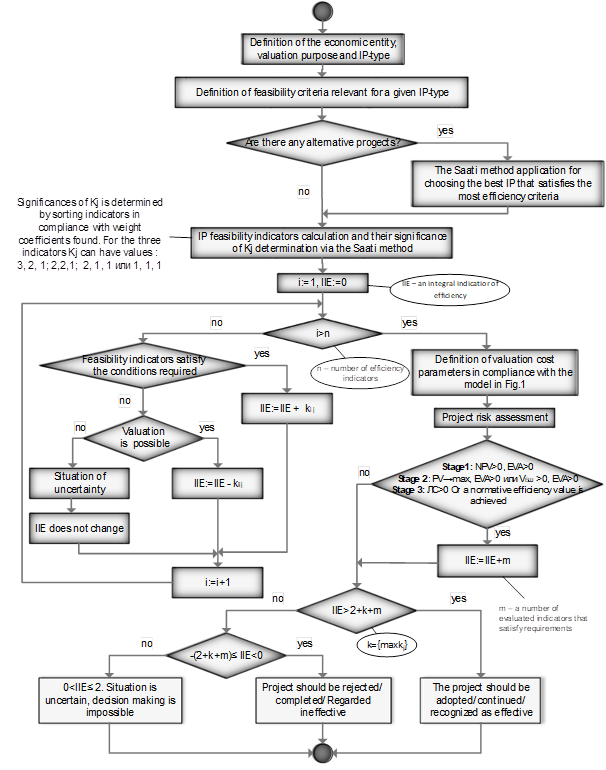

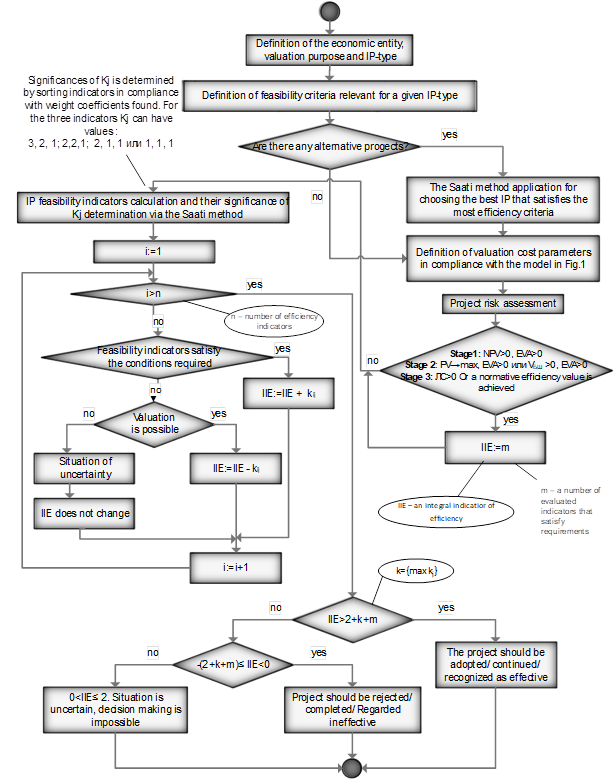

Algorithmic models of finding the integral index of investment project evaluation for different economic entities

Integral assessment of IP can be carried out according to one of the possible schemes depending on the subject of the assessment, taking into account the above three steps. For example, for authorities, PPPs, nonprofit organizations and households the most popular scheme will be: 3→1˄2; for state corporations, companies with state participation and commercial organizations the optimal scheme will be: 1˄2→3.

In other words, the first scheme first checks IP for compliance with the criteria of expediency (whether the indicators meet the specified conditions), and then assesses the value of the project, because the budget investment in IP, as a rule, pursues socially significant goals, and they can be prioritized over commercial (public efficiency is higher than commercial). The second scheme prefers economic benefits and only then evaluates the project's compliance with other objectives. However, the choice of the scheme is not strictly defined. It can also be determined by the type of project. For example, if a social project (involving or training specialists) is vital for a company at this stage, the first scheme may be applied to its assessment.

Let us present the implementation of each scheme (Figures

Based on the fact that the maximum possible number of cost indicators used to assess the project at a particular investment stage and meeting the requirements is equal to 2 (m=2), and the maximum possible importance of the indicator reflecting the feasibility criteria is equal to 3 (kmax=3) and the maximum possible number of indicators when assessing the project is also equal to 3 (n=3), it follows that the maximum value of the integral indicator of evaluation of IIEmax=2+3+3=8. In the worst case, the IIEmin=0-3-3=-6. Thus, we obtain the following boundaries for the IIE: -6 ≤ IIE ≤ 8. Uncertainty situation: 0 ≤ IIE ≤ 2. Then the sphere of making a positive decision depending on the number and significance of the indicators characterizing the efficiency criterion and the number of cost indicators satisfying the requirements: IIE>2+k+m, and negative: -(2+k+m) ≤ IIE < 0, where k= max{kj}, j=1..n.

The proposed models of integrated assessment of investment projects can be used:

Federal executive authorities – when making decisions on state support of investment projects implemented within the framework of PPP

Commercial and non-commercial organizations - when making decisions on participation in investment projects or on the implementation of certain projects.

Conclusion

Thus, the integrated assessment is a metric of investment attractiveness and feasibility of the investment project. Competent investment policy on the basis of making informed investment decisions based on the results of an integrated assessment of the economic feasibility of investment projects based on the cost approach will allow the state to create a favorable investment climate in the country. The proposed solutions will help private investors to increase profits and business value.

References

- Ablaev, I. M. (2019). Approaches to analysis of the innovation activity efficiency. International Journal of Management and Business Research, 9(1), 151-157.

- Braouezec, Y., & Joliet, R. (2019). Valuing an investment project using no-arbitrage and the alpha-maxmin criteria: From Knightian uncertainty to risk. Economics Letters, 178(C), 111-115. https://doi.org/10.1016/j.econlet.2019.03.007

- Fedotova, M. A., & Loseva, O. V. (2015). Assessment of growth factors of investment attractiveness of regions. Property Relations in the Russian Federation, 2(161), 61-105. [in Rus.].

- Higham, A., Fortune, C., & Boothman, J. (2016). Sustainability and investment appraisal for housing regeneration projects. Structural Survey, 34(2), 150-167. https://doi.org/10.1108/SS-09-2015-0044

- Loseva, O. V., Fedotova, M. A., & Khotinskaya, G. I. (2015). Business activity as a leading indicator of economic development: Foreign and Russian experience. Bulletin of the Financial University, 3(87), 26-37 [in Rus.].

- Marchioni, A., & Magni, C. A. (2018). Investment decisions and sensitivity analysis: NPV-consistency of rates of return. European Journal of Operational Research, 268(1), 361-372. https://doi.org/10.1016/j.ejor.2018.01.007

- Miller, K. D., & Waller, H. G. (2003). Scenarios, real options and integrated risk management. Long Range Planning, 36(1), 93-107. https://doi.org/10.1016/S0024-6301(02)00205-4

- Ministry of Economic Development of Russia (2009). Order the N 58 of February 24, 2009 «On approval of the Methodology for assessing the effectiveness of the use of federal budget funds allocated for capital investments» (as amended on February 5, 2018). Retrieved from: http://www.consultant.ru/document/cons_doc_LAW_87435/ Accessed: 06.11.2019. [in Rus.].

- Ministry of Economic Development of Russia (2016a). Order of the N 721 of November 17, 2016 «Determination of liquidation value (FSO N 12)». Retrieved from: http://www.ocenchik.ru/docsf/2727-opredelenie-likvidacionnoy-stoimosti-fso12.html Accessed: 01.06.2019. [in Rus.].

- Ministry of Economic Development of Russia (2016b). Order of the N 722 of November 17, 2016 «On approval of the Federal valuation standards. Determination of investment value (FSO No 13)». Retrieved from: http://www.ocenchik.ru/docsf/2728-ocenka-investicionnoy-stoimosti-fso13.html Accessed: 01.06.2019 [in Rus.].

- Ministry of Finance of the Russian Federation, Gosstroy of the Russian Federation (1999). Guidelines for evaluating the effectiveness of investment projects (approved by the Ministry of Economy of the Russian Federation, 06/21/1999 No VK 477). Retrieved from: http://www.consultant.ru/document/cons_doc_LAW_28224/ Accessed: 06.11.2019. [in Rus.].

- Moskaleva, E. G., & Chelmakina, L. A. (2016). Integral assessment of the effectiveness of investment projects on the basis of econometric methods. European Research Studies Journal, 19(3B), 3-18.

- Nikonova, I. A., & Smirnov, A. L. (2016). Project financing in Russia. Problems and directions of development. Moscow: Publishing house "Consultbankir". [in Rus.].

- Particka, C. A., Stafne, E. T., & Martinson, T. E. (2018). Assessment and valuation of the northern grapes project webinar series. HortTechnology, 28(4), 524-528. https://doi.org/ 10.21273/HORTTECH04088-18

- Vickerman, R. (2017). Beyond cost-benefit analysis: The search for a comprehensive evaluation of transport investment. Research in Transportation Economics, 63, 5-12. https://doi.org/10.1016/j.retrec.2017.04.003

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Klimova*, I. I., Loseva, O. V., & Fedotova, M. A. (2020). Value-Based Approach To Evaluating Investment Projects. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 1056-1065). European Publisher. https://doi.org/10.15405/epsbs.2020.03.152