Abstract

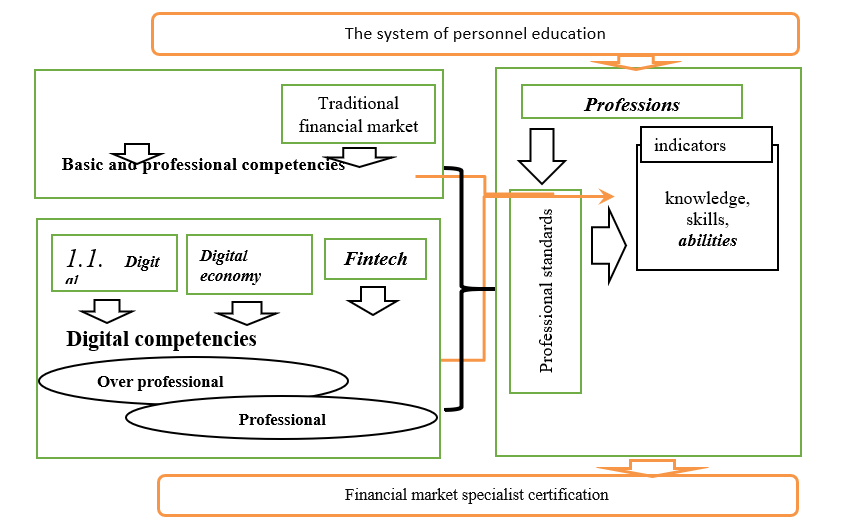

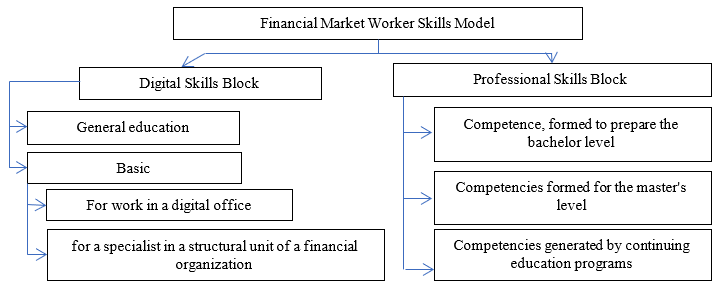

Because of the transition to the digital economy, technologies development and change in economy`s tendencies, employers have started to create new requirements for professionals to enter their companies. These are the reasons to modify the traditional model of skills for financial market specialists. Since the 2000-s new science works and reports have started to appear and become more popular. Despite this, there have been no specific information about exact digital competencies or developed scheme of educating financial market specialists. To solve that problem, the authors of this article have elaborated the scheme of developing competencies that reflect transition from traditional base competencies to digital under the influence of digitalization, fintech. Moreover, the scheme reflects institutional factor of the system, specifically the approach to educate and assess labor force. It includes the model of financial market professional competencies, including the block of digital additional skills, oriented on the functions of financial market specialists. Also, digital competencies sector of financial market competencies is described, specifically common working skills. Implementation of the model would influence the education of financial market professionals, making their knowledge and skills more appropriate of employers. Eventually, companies will be interested in employing the workers which are educated using this model.

Keywords: Skillsfinancial sectorfintechdigital technologiesoverprofessional and digital skills

Introduction

Currently there is the digital economy ecosystem actively being elaborated in Russia. There is no company which can work and prosper without digital technologies. Because of this, digital technologies should be recognized as crucial for modern economy (Program “Digital economy of the Russian Federation”, 2017). According to «The Future of Jobs Report 2018» (World Economic Forum, 2018) labor market will drastically have changed by the 2022: a lot of current professions will change; freelance and other kinds of distant work will become more popular; some jobs, linked with routine operations, will disappear. Some employers state that new tendencies will diminish operational costs and enable to raise capital easier. Financial sector will rapidly adapt the technologies for its purposes. The results of the research are relevant for developed and developing countries, like Russia. According to the article, IT and client-oriented specialists will be highly needed in different countries (The Future of Jobs Report, 2018).

Considering all the information stated above, it is needed to acknowledge that digital economy must be accepted as a lifestyle, ideology and purpose in education (Loginova, Akimova, Shcherbin, & Zaitseva, 2018). The main tendencies of developing professional reserve potential of digital economy include the necessity of educating professionals who have the following qualities: basic, professional and variable; increasing demand in specialists that have versatile, crossproffesional skills and wide social and professional outlook (Zeer, Zinnatova, Tretyakova, Scherbina, & Bukovey, 2018). The requirements of educating spesialists, bachelors and masters are oriented on the most effective development of professional skills. Modern requirements of educating in higher schools are becoming more oriented on an employer and its demands in domestic and international markets (Borisova, Frolova, & Artamonova, 2019). In the process of creating new skills there is an opportunity to gain knowledge and skills within the programs of additional education (Borisova, Frolova, & Merzlikina, 2017), as labor functions of different specialists alter significantly. The most important factor is that there are teachers who have the required knowledge and skills. Therefore, there are programs for teachers which include skills that are relevant in international markets, specifically the competencies which are prior for digital economy (Loginova, Akimova, Shcherbin, & Zaitseva, 2018).

In this case, forming and assessing human capital, taking in account the dynamics of changing skills, becomes essential. Specifically, the assessment of human capital has begun to be accomplished by the replacement of a worker and includes the costs of educating or employing a new worker (Kogut, Janshanlo, & Czerewacz-Filipowicz, 2018).

Some scientists have elaborated different approaches to solve the problem. Specifically, a model of competencies was created which includes digital competencies (data processing, telecom, creation of digital content, cybersecurity, solution of technical issues, data exploration and analysis (Kuzminska, Mazorchuk, Morze, Pavlenko, & Prokhorov, 2018), however authors did not put an accent on the field of application for specialists, which are expected to be the users of the model. Therefore, the authors of this research have elaborated a model which considers the features of financial market.

Problem Statement

The main aspect of forming skills is that they must be based on the specifics of the professional field, which is necessary, but not enough in the conditions of digital economy. Digital technologies and fintech, as necessary attributes of digital economy, require specific knowledge and skills, which can provide financial sector functionality in the conditions of digitalization. It means that the professionals of this sphere must have digital competencies and accomplish new labor functions. For gaining strategic advantage on markets companies seek specialists that have over professional skills. They must be formed in all the participants of economic world who wish to have a stable job. Therefore, with the development of digital technologies new requirements for the sphere of education arise. Digital and over professional competencies must be formed in educational system in addition to basic knowledge and skills. This will require significant modification of educational programs, extra spending on raising teacher`s qualifications, renewing of technical basis of educational process, improvement of processes of developing and usage of the new education technologies.

Research Questions

The results of a large-scale online survey conducted among professionals (N = 1222) working in high-tech creative industries showed that the level of digital skills of the 21st century varies significantly. In addition, each digital skill of the 21st century is explained by a different set of determinants, which requires unique approaches for its development (van Laar, van Deursen, van Dijk, & de Haan, 2019).

Researching this process, the authors faced a number of issues that were not sufficiently disclosed in the works of domestic and foreign scientists, as well as in the practical activities of employers.

- The works lacks a clear definition of digital and over professional skills, a clear scheme of the system of education, training and retraining of personnel, primarily in the financial market, as in the market with the most dynamic development.

- A significant amount of research on digital and professional skills is general in nature and does not take into account the specifics of the financial market.

The digitalization of the economy has sharply raised the question for universities about the need to change the competencies that should be formed by a specialist in the financial market, since there is an urgent need for training personnel who can quickly work in new realities (World Economic Forum, 2017). Therefore, the authors considered it appropriate to correct the existing competency model by including in it digital and super-professional competencies, which should become the basis of modern training.

Purpose of the Study

The purpose of the study: the development of new skills that meet the modern challenges of the digital economy, the construction of a skills formation scheme, the development of a model for the formation of specialists' competencies in the staffing system of the financial market. As part of the achievement of the goal, it is supposed to study the process of forming the necessary skills that take into account the peculiarities of financial markets. As a result, the authors have to make an informed choice and make proposals for the formation and filling of competencies that meet the needs of the digital economy.

Research Methods

The research was based on the study of scientific papers, government programs and practical experience of Russian and foreign companies (European Commission, 2019; Butenko et al., 2017). The analysis of the totality of sources, the digitalization processes of the financial sector of the economy, the increase and complication of the functions of financial market participants, the synthesis of the obtained analytical and methodological information allowed the authors to develop a scheme for the formation of the necessary skills of financial market specialists in the digital economy, presented in Figure

This scheme later allowed the authors, using a number of empirical methods, such as monitoring, the process of customer service in the financial market, comparing methodological studies on digital and professional skills to offer an original model of skills for a financial market specialist (Figure

At the master's level, we consider it necessary to develop skills related to leadership, analytical, managerial, entrepreneurial skills and multi-literacy. This will allow specialists to understand a wide range of issues facing the head of the structural unit and organization. In the framework of continuing education programs, the main emphasis should be placed on skills that allow performing their main work functions at a high level. The proposed model will allow the training of financial market specialists, taking into account the latest requirements of employers.

Findings

The study showed that the development of new financial and digital technologies necessitates the transformation of requirements for financial market specialists, therefore, a block of digital competencies should be integrated into the traditional skills formation scheme. A comparison of the requirements of employers in the financial market made it possible to identify the skills that are mostly demanded today. As a result, an author’s model of digital and super-professional skills of a financial market specialist was presented, which takes into account the current state of the business environment, but at the same time requiring further continuous improvement in connection with the ongoing processes of changing equipment and technology. Accordingly, the authors came to the conclusion that it is necessary to constantly improve the skills model of a financial market specialist, which is the subject of further research by the authors.

Conclusion

The transition to digitalization, the emergence of platforms, the improvement of professional programs and software products, as well as the desire of employers to optimize the costs of the management process, attracting to change the requirements for the skills necessary for successful work in the financial market. In particular, our research has allowed us to study and develop models of digital and super-professional skills. In this development of skills, you must start at school age and continue for the duration of life. This will allow future professionals to work effectively in a digital economy. This allows us to modernize the requirements in terms of the formation of new skills in order to train specialists who will be in demand in the digital economy.

Acknowledgments

The article was prepared based on the results of studies carried out at the expense of budget funds on a state assignment to the Financial University: “Personnel support of the digitalization of the financial market”.

References

- Borisova, O., Frolova, V., & Artamonova, L. (2019). The educational and globalization components of sustainable development, and their factors. In M. Tyulenev, S. Zhironkin, A. Khoreshok, S. Vöth, M. Cehlár, et.al. (Eds.), Proceedings of the IVth International Innovative Mining Symposium. E3S Web of Conferences, 105 (04047). Les Ulis: EDP Science. https://doi.org/10.1051/e3sconf/201910504047

- Borisova, O., Frolova, V., & Merzlikina, E. (2017). Modern trends of additional professional education development for miniral resource extracting. In M. Tyulenev, S. Zhironkin, A. Khoreshok, S. Vöth, M. Cehlár, D. Nuray (Eds.), Proceedings of the IInd International Innovative Mining Symposium. E3S Web of Conferences, 21 (04016). Les Ulis: EDP Science. https://doi.org/10.1051/e3sconf/20172104016

- Butenko, V., Polunin, K., Kotov, I., Sycheva, E., Stepanenko, A., Zanina, E., …, & Topolskaya, E. (October 2017).Russia 2025: From workforce to talents. Retrieved from: http://d-russia.ru/wp-content/uploads/2017/11/Skills_Outline_web_tcm26-175469.pdf Accessed: 01.10.2019. [in Rus.].

- European Commission (2019). The digital competence Framework 2.0. Retrieved from: https://ec.europa.eu/jrc/en/digcomp/digital-competence-framework Accessed: 01.10.2019.

- Kogut, O. Yu., Janshanlo, R. Es., & Czerewacz-Filipowicz, K. (2018). Human capital accounting issues in the digital economy. In S. Ashmarina, A. Mesquita, M. Vochozka (Eds.), Digital Transformation of the Economy: Challenges, Trends and New Opportunities. Advances in Intelligent Systems and Computing, 908 (pp. 296-305). Cham: Springer. https://doi.org/10.1007/978-3-030-11367-4_29

- Kuzminska, О., Mazorchuk, М., Morze, N. Pavlenko, V., & Prokhorov, A. (2018). Digital competency of the students and teachers in Ukraine. In V. Ermolayev, M.C. Suárez-Figueroa, V. Yakovyna, H.C. Mayr, M. Nikitchenko, A. Spivakovsky (Eds.), Information and Communication Technologies in Education, Research, and Industrial Applications. Communications in Computer and Information Science, 1007 (pp. 148-169). Cham: Springer. https://doi.org/10.1007/978-3-030-13929-2_8

- Loginova, S. L., Akimova, O. B., Shcherbin, M. D., & Zaitseva, E. V. (2018). The specifics of the digital economy in higher education. In V. Mantulenko (Ed.), Proceedings of GCPMED 2018 International Scientific Conference Global Challenges and Prospects of the Modern Economic Development. The European Proceedings of Social & Behavioural Sciences, 57 (pp. 1-12). London: Future Academy. https://doi.org/10.15405/epsbs.2019.03.1

- Program “Digital economy of the Russian Federation”. Approved by the Order of the Government of Russian Federation from 28.07.2017. № 1632-р. (2017). Retrieved from: http://static.government.ru/media/files/9gFM4FHj4PsB79I5v7yLVuPgu4bvR7M0.pdf Accessed: 01.10.2019. [in Rus.].

- Van Laar, E., van Deursen, A. J. A. M., van Dijk, J. A. G. M., & de Haan, J. (2019). Determinants of 21st-century digital skills: A large-scale survey among working professionals. Computers in Human Behavior, 100, 93-104. https://doi.org/ 10.1016/j.chb.2019.06.017

- World Economic Forum (2017). Advancing human-centered economic progress in the fourth industrial revolution. Retrieved from: https://www.weforum.org/whitepapers/advancing-human-centred-economic-progress-in-the-fourth-industrial-revolution Accessed: 25.10.2019.

- World Economic Forum (2018). The future of jobs report 2018. Retrieved from: http://www3.weforum.org/docs/WEF_Future_of_Jobs_2018.pdf Accessed: 01.10.2019.

- Zeer, E. F., Zinnatova, M. V., Tretyakova, V. S., Scherbina, E. Yu., & Bukovey, T. D. (2018). In V. Mantulenko (Ed.), Proceedings of GCPMED 2018 International Scientific Conference Global Challenges and Prospects of the Modern Economic Development. The European Proceedings of Social & Behavioural Sciences, 57 (pp. 13-19). London: Future Academy. https://doi.org/ 10.15405/epsbs.2019.03.2

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

09 March 2020

Article Doi

eBook ISBN

978-1-80296-078-5

Publisher

European Publisher

Volume

79

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1576

Subjects

Business, business ethics, social responsibility, innovation, ethical issues, scientific developments, technological developments

Cite this article as:

Frolova*, V. B., & Borisova, O. V. (2020). Building New Skills In The Digital Economy. In S. I. Ashmarina, & V. V. Mantulenko (Eds.), Global Challenges and Prospects of the Modern Economic Development, vol 79. European Proceedings of Social and Behavioural Sciences (pp. 928-934). European Publisher. https://doi.org/10.15405/epsbs.2020.03.134