Abstract

Microcredit scheme was established to provide small loan to assist poor people to generate income through self-employment activities. This loan enables the poor people to either start a small business venture or to expand their existing small business activities. This business ventures are intended to help them to achieve economic independence. There was clear evidence in the literatures that microcredit delivers positive impact in uplifting the socio-economic status of the micro-entrepreneur. However, there were also some studies that indicated that microcredit worsened the economic well-being of the poor or in some cases microcredit did not reach the intended target that is the poor. This paper is intended to review the effectiveness of the microcredit scheme in Malaysia based on existing literatures on the impact of microcredit on its recipients. In doing so, we identified 21 related studies to be examined. The analysis focuses on the economic and social impact of microcredit. We discovered that the social impact of microcredit is relatively less studied than the economic impact. The economic impact of microcredit was discovered to have a positive relation with income, asset, saving, consumption expenditure, employment and economic vulnerability. On the other hand, our review found that the social impact of microcredit has a direct relationship with quality of life, individual welfare, social welfare, empowerment and religious practices of the beneficiaries. Overall, the evidence showed that microcredit has positive impact on the beneficiaries which, to a large extent, includes the poorest.

Keywords: Microcrediteconomic impactsocial impactAmanah Ikhtiar Malaysiamicroentrepreneurs

Introduction

The concept of microcredit involves the process of making available small loans to the poor to allow them to engage in micro-entrepreneurship. Even though this concept has its roots centuries ago, but only in 1970’s did the term microcredit emerged and is now used extensively. Microcredit programme in Malaysia began as an active study called Ikhtiar Project in an extreme poverty area in Northwest Selangor between January 1986 to June 1988. The result from this project was considered successful with 70% of participants successfully increasing their income. Overall, the average monthly income increment was RM119. Women participants were able to generate greater increment in income of RM136 monthly compared to RM65 monthly by men. In addition, the women’s participants also recorded 90% repayment rate. In view of this success, the Ikhtiar Project was declared as a successful programme in alleviating poverty among the rural poor through micro-entrepreneurship. In 1987, the project was institutionalized as Amanah Ikhtiar Malaysia (AIM). Since then, microcredit has become one of the important national programmes for poverty alleviation, particularly among the poor women. Due to the potential of microcredit in the uplifting socio-economic status of the poor, nowadays, the microcredit scheme is being offered by many agencies in Malaysia, such as The Economic Fund for National Entrepreneurs Group (TEKUN), Yayasan Usaha Maju Sabah (YUM), Malaysia’s development financial institutions and commercial banks (Central Bank of Malaysia, 2019).

Problem Statement

The proponents of microcredit have argued that access to microcredit will help stimulate the economic activity among the borrowers and thereby increase their income. Consequently, this would lead to the poverty reduction. Broadly, studies on the economic impact of microcredit concentrated on the expenditure, consumption and assets. Meanwhile, the social impact of microcredit was measured based on the assess to education, health, nutrition levels, anthropometric and contraceptive use which became popular in the early 1980s while recently it has been extended into the social-political arena by emphasizing on empowerment (Hulme, 2000).

A plethora of studies in the microcredit literatures also yielded mixed results and the impacts varied from one case to another due the differences in economic, culture, environment, and the operation set-up of the microcredit institutions. Given this state of affairs, assessing the impact of the microcredit program is relevant and important. Since there is no microcredit impact studies using a systematic review in Malaysia, this study attempts to figure out the various impacts of microcredit to attain more understanding on the impact of microcredit to the borrowers and whether it delivers positive or negative impact to the borrowers.

Research Questions

What is the impact of microcredit in Malaysia?

Does microcredit deliver positive or negative impact to the borrowers?

Purpose of the Study

This study aims to systematically examine the impact of microcredit in Malaysia and to assess whether microcredit delivers positive or negative impact towards its beneficiaries. In doing so, the study also revealed the various impacts of microcredit and to what extent that the impacts have reached the targeted group.

Research Methods

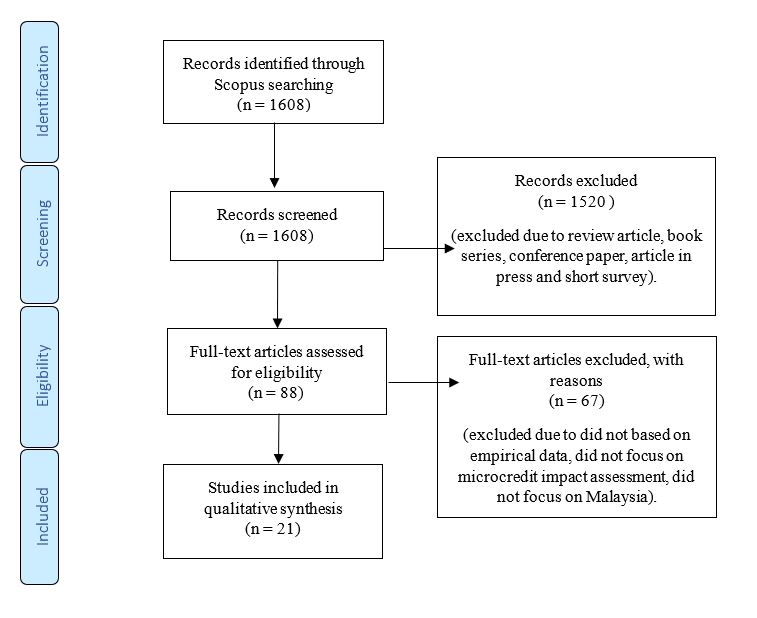

The systematic review was conducted in line with the PRISMA statement (Preferred Reporting Items for Systematic Reviews and Meta-Analyses). It comprises four steps namely identification, screening, eligibility and inclusion (Gillath & Karantzas, 2019) as shown in Figure

This search generated 1608 articles. The next step is screenFing and determining several eligibility and inclusion criterion. The study only included article journals focused on the empirical research which means we excluded review article, book series, conference paper, article in press and short survey. In line with the objective of the study, only articles carried out in Malaysia were selected. The remaining articles were assessed by reading through the abstract and by reading the full articles to identify the impact of microcredit and whether microcredit has positive, negative or no effects on the lives of the poor. We found studies which did not focus on the impact assessment, were not done in Malaysia and did not perform empirical study therefore, all these studies were excluded from our next assessment. In the end, only 21 articles were eligible to be assessed and analysed by performing content analysis to examine themes related to the impacts of microcredit. The process that was used to search and select the papers can be seen in Figure

Findings

The thematic analysis was used in this study to examine the impact of microcredit on both economic and social impacts. In this part, we also presented a cross -comparison in the literatures that have studied the impact of microcredit towards the beneficiaries of microcredits in Malaysia.

The theory of microcredit highlights that the reason why the poor are trapped in the cycle of poverty is because of the lack of access to finance. Thus, it is expected that by assisting the poor people with small loans would allow them to venture into micro-enterprise, which would increase their income and move them out from poverty trap and therefore, uplift their socio-economic status. Based on our review, the available evidence showed that the theory is in line with the case of Malaysia. As shown in Table

Furthermore, an increase in income alone does not necessarily mean the economic well-being of the borrowers has also increased. As argued by Noll and Weick (2015), the standard of living of a person is not just a matter of income, but important also is to examine the quality and level of their consumption in terms of goods and services purchased. Unfortunately, studies related to consumption expenditure among microcredit borrowers are few, and because of this, it is difficult to provide a clear evidence to show that microcredit recipients enjoyed economic well-being in terms of consumption expenditure. This finding is line with Meager (2019) whom stated that consumption variables is likely negligible in literatures related to the microcredit impact assessment. However, we do find that microcredit is effective in increasing asset among the borrowers since many studies were conducted on the impact of microcredit on asset acquisition. We found that the microcredit recipients accumulated more asset either productive or non-productive asset such as transportation, home appliances, jewellery and microenterprise asset (Al-Mamun et al., 2011; Al-Mamun et al., 2013). Extensive review on economic impact of microcredit found five studies dealing with savings made by the borrowers and the result indicated that microcredit had positive outcome on saving. In addition, three studies looked at the impact of microcredit on employment and found positive impact related to employment. Lastly, there was only one study concentrated on the impact of microcredit on economic vulnerability and it was found that the economic vulnerability among the borrowers has decreased after participating in microcredit programme.

Social impact is related to the non-financial assessment which reflect the effect microcredit has on human well-being. Empowerment is an emerging concept in assessing social outcome of microcredit. We identified four studies that were carried out with reference to women empowerment and microcredit as shown in Table

Finally, we found only one study related to the impact of microcredit on religious practices and the result showed that microcredit positively increased the religious practices among the borrowers. We found no study measuring the subjective well-being of participants in relating to life satisfaction in terms of happiness in one’s life. Having this information is important in order to gain deep understanding on the level of satisfaction felt by the microcredit borrowers on their life, after receiving the loans. Bhuiyan and Ivlevs (2019) in their study revealed that microcredit borrowers felt more satisfaction with financial security and achievement of life after participating in the programme however, microcredit borrowing also increased their worry and delivered negative impact on overall life satisfaction. As the social impact intended to bring positive effect on the well-being of individuals and communities, it is important to also emphasize on the subjective well-being related to the happiness in one’s life as an important social outcome of microcredit.

Conclusion

With all 21 studies contained in this review, we found that microcredit scheme in Malaysia generally has a positive impact on the beneficiaries economically and socially. Our findings also revealed that microcredit programme in Malaysia are able to reach positive impact to a large extent towards reaching the hardcore poor (Al-Mamun, Wahab, Hossain, & Malarvizhi, 2010). This result is consistent with a study by Hussain, Mahmood, and Scott (2018) which shown that that microcredit contributes significantly in improving socio-economic status of the poorest.

Our review also found that the old microcredit participant enjoys greater socio-economic improvement than the new participant. This indicates that prolonged involvement in microcredit scheme is likely to benefit them more. Apart from the significant role microfinance institutions play in improving the socio-economic status of the poor, it is also important to realize that microfinance institutions should assist the poor to the extent that they will be able to achieve economic independence. This means that the poor should not rely on the external financial assistance in such long period and being too dependent on government incentives to support their life (Al-Mamun et al., 2011)

Based on the systematic review performed, authors have identified income, asset, saving, consumption expenditure, employment and economic vulnerability as important economic impact of microcredit. We acknowledge that among the economic impact of microcredit, existing literatures have given higher concentration on changes in income and the possession of asset. Meanwhile the social impact of microcredit can be grouped into quality of life, individual welfare, social welfare, empowerment and religious practices. We also acknowledge that empowerment has gained more attention among researchers as an important social outcome of microcredit compared to other social indicators. Our assessment on the overall impact of microcredit attested that small scale loaning has a profound outcome in uplifting socio-economic status of its beneficiaries, which includes the hardcore poor. Hence, we would suggest the microfinance institution to increase more fund and expand the outreach of the programs. However, despite the remarkable success of microcredit in improving social and economic status of the borrowers, more studies are needed to address the consumption expenditure among the borrowers as it is less studied, nonetheless it is important to reflect the economic well-being of the borrowers.

References

- Alam, M. M., Hassan, S., & Said, J. (2015). Performance of Islamic microcredit in perspective of Maqasid Al-Shariah: A case study on Amanah Ikhtiar Malaysia. Humanomics, 31(4), 374–384. https://doi.org/10.1108/H-12-2014-0072

- Al-Mamun, A. (2014). Investigating the development and effects of social capital through participation in group-based microcredit programme in peninsular Malaysia. Journal of Interdisciplinary Economics, 26(1–2), 33–59. https://doi.org/10.1177/0260107914540822

- Al-Mamun, A. (2016). Access to credit, education and entrepreneurial competencies: A study among women micro-entrepreneurs in Malaysia. Vision, 20(3), 159–168. https://doi.org/10.1177/0972262916651510

- Al-Mamun, A., Adaikalam, J., & Mazumder, M. N. H. (2012). Examining the effect of Amanah Ikhtiar Malaysia ’ s microcredit program on microenterprise assets in rural Malaysia. Asian Social Science, 8(4), 272–280. https://doi.org/10.5539/ass.v8n4p272

- Al-Mamun, A., Adaikalam, J., & Mazumder, M. N. H. (2013). Measuring the impact of Amanah Ikhtiar Malaysia ’ s micro finance program on household assets in urban Peninsular Malaysia. International Journal of Economic Perspectives, 7(4), 22–29.

- Al-Mamun, A., Malarvizhi, C. ., Wahab, S. A., & Mazumder, M. N. H. (2011). Investigating the effect of the utilization of microcredit on hardcore poor clients household income and assets. Asian Social Science, 7(7), 141–152. https://doi.org/10.5539/ass.v7n7p141

- Al-Mamun, A., Mazumder, M. N. H., & Malarvizhi, C. A. (2014). Measuring the effect of Amanah Ikhtiar Malaysia’s microcredit programme on economic vulnerability among hardcore poor households. Progress in Development Studies, 14(1), 49–59. https://doi.org/10.1177/1464993413504351

- Al-Mamun, A., Wahab, S. A., & Malarvizhi, C. A. (2010). Impact of Amanah Ikhtiar Malaysia’s microcredit schemes on microenterprise assets in Malaysia. International Research Journal of Finance and Economics, 60, 144–154. https://doi.org/10.2139/ssrn.1946089

- Al-Mamun, A., Wahab, S. A., Hossain, S., & Malarvizhi, C. A. (2010). Impact of Amanah Ikhtiar Malaysia’s microcredit schemes on hardcore poor households quality of life. International Research Journal of Finance and Economics, 60, 155–167. https://doi.org/10.2139/ssrn.1944375

- Al-Shami, S. S. A., Majid, I., Mohamad, M. R., & Rashid, N. (2017). Household welfare and women empowerment through microcredit financing: Evidence from Malaysia microcredit. Journal of Human Behavior in the Social Environment, 27(8), 894–910. https://doi.org/10.1080/10911359.2017.1345341

- Al-Shami, S. S. A., Majid, I., Rizal, S., Mohmed, R., & Rashid, N. (2014). The role of Malaysian microfinance (AIM) on the women households and empowerment. World Applied Sciences Journal, 32(7), 1437–1449. https://doi.org/10.5829/idosi.wasj.2014.32.07.835

- Al-Shami, S. S. A., Razali, M. M., Majid, I., Rozelan, A., & Rashid, N. (2016). The effect of microfinance on women’s empowerment: Evidence from Malaysia. Asian Journal of Women’s Studies, 22(3), 318–337. https://doi.org/10.1080/12259276.2016.1205378

- Al-Shami, S. S. A., Razali, R. M., & Rashid, N. (2018). The effect of microcredit on women empowerment in welfare and decisions making in Malaysia. Social Indicators Research, 137(3), 1073–1090. https://doi.org/10.1007/s11205-017-1632-2

- Bhuiyan, M. F., & Ivlevs, A. (2019). Micro-entrepreneurship and subjective well-being : Evidence from. Journal of Business Venturing, 34, 625–645. https://doi.org/10.1016/j.jbusvent.2018.09.005

- Central Bank of Malaysia (2019). Pembiayaan Mikro. Retreived from http://www.bnm.gov.my/documents/sme/20140320FAQ_on_Pembiayaan_Mikro_English_FINAL.pdf

- Chan, S. H., & Ghani, M. A. (2011). The impact of microloans in vulnerable remote areas: Evidence from Malaysia. Asia Pacific Business Review, 17(1), 45–66.

- Gillath, O., & Karantzas, G. (2019). Attachment security priming: a systematic review. Current Opinion in Psychology, 25, 86–95. https://doi.org/10.1016/j.copsyc.2018.03.001

- Hassan, M. S., & Ibrahim, K. (2015). Sustaining small entrepreneurs through a microcredit program in Penang, Malaysia: A case study. Journal of Human Behavior in the Social Environment, 25, 182–191. https://doi.org/10.1080/10911359.2014.956961

- Hulme, D. (2000). Impact assessment methodologies for microfinance : Theory, experience and better practice. World Development, 28(1), 79–98. https://doi.org/10.1016/S0305-750X(99)00119-9

- Hussain, J., Mahmood, S., & Scott, J. (2018). Gender, microcredit and poverty alleviation in a developing country: The case of women entrepreneurs in Pakistan. Journal of International Development, 31(3), 247–270. https://doi.org/10.1002/jid.3403

- Meager, R. (2019). Understanding the average impact of microcredit expansions: A bayesian hierarchical analysis of seven randomized experiments. American Economic Journal: Applied Economics, 11(1), 57–91. https://doi.org/10.1257/app.20170299

- Noll, H.-H., & Weick, S. (2015). Consumption expenditures and subjective well-being : empirical evidence from Germany. International Review of Economics, 62(2), 101–119.

- Saad, N. M., & Duasa, J. (2011). An economic impact assessment of a microcredit program in Malaysia : The case of Amanah Ikhtiar Malaysia ( AIM ). International Journal of Business and Society, 12(1), 1–14. https://doi.org/10.1111/j.1469-8137.1987.tb00674.x

- Selvaraj, T., Karim, Z. A., Rahman, A. A., & Chamhuri, N. (2018). The effects of microcredit access and macroeconomic conditions on lower income group. International Journal of Economics and Management, 12(1), 285–304

- Zainudin, M. Z., & Kamarudin, M. F. (2015). Impacts on the implementation of social policy: Comparative study in Malaysia and Indonesia. Asian Social Science, 11(17), 48–56. https://doi.org/10.5539/ass.v11n17p48

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 March 2020

Article Doi

eBook ISBN

978-1-80296-080-8

Publisher

European Publisher

Volume

81

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-839

Subjects

Business, innovation, sustainability, development studies

Cite this article as:

Muda, N. S., & Tuan Lonik, K. ‘. (2020). The Impact Of Microcredit In Malaysia – A Systematic Review. In N. Baba Rahim (Ed.), Multidisciplinary Research as Agent of Change for Industrial Revolution 4.0, vol 81. European Proceedings of Social and Behavioural Sciences (pp. 329-338). European Publisher. https://doi.org/10.15405/epsbs.2020.03.03.40