Abstract

Tax revenues are the main source of replenishment of the revenue side of the budget, which allows us to solve problems associated with the sustainable development of individual territories. As one of such factors is the shadow economy, the main effect of which is appearance of the tax losses of the budget. The aim of this study is to quantify the tax losses of the regional budget from the shadow economy and determine their impact on the sustainable development of the territory. Justification of the need for a systematic determination of tax losses from the shadow economy to conduct an effective regional fiscal policy. To assess the impact of the shadow economy on the value of tax revenues of regional budget is used the method of differences based on comparison of data obtained from different sources. Conducted the study assessment of the tax losses of the regional budget have led to the conclusion that the shadow economy has a significant impact on the amount of tax revenues and, accordingly, reduces the possibility of the implementation of socio-economic policy of the subject and does not allow solving problems associated with the sustainable development of individual territories. Therefore, the reduction of tax losses of the budget from the shadow economy is one of the most important conditions for the sustainable development of the region.

Keywords: Budgetmanagementnon-observed (shadow) economyregionsustainable developmenttax losses

Introduction

Stability of the tax system and balanced budget are the most important conditions for the economic growth of the country. However, the current state of the budget and tax systems in Russia is hardly stable.

The relevance of research

Stability of the tax system and balanced budget are the most important conditions for the economic growth of the country. However, the current state of the budget and tax systems in Russia is hardly stable.

According to the data from the Ministry of Finance of the Russian Federation (RF), out of 85 constituent regions of the Russian Federation only 13 do not receive subsidies to equalize the fiscal capacity, which indicates that the regions are experiencing an acute shortage of their own revenues designed to fulfill the obligations imposed on them by existing legislation.

At the same time, the balance of the federal budget is largely determined by the state of the oil and gas sector, which tax revenues consistently provide about a third of the total revenues for the Russian budget system. Therefore, the decline in oil prices, often observed during the periods of economic downturns, and the resulting reduction in tax revenues of the federal budget, create additional threats for constituent regions of the Russian Federation.

Given the continuing risks of deterioration of the general economic situation, escalation of geopolitical tensions and unfavorable events in the world financial markets, authorities should focus their attention on finding ways to increase the revenues of the regional budget system, for example, by reducing the level of the non-observed (shadow) economy.

Definition of an unobservable economy

A substantial number of researchers have been studying various aspects of the non-observed (shadow) economy over a long period of time. These include authors such as: Katsios (2006), Medina and Schneider (2017), Schneider (2012), Schneider and Buehn (2017), Alexandru (2013), Solis-Garcia and Xie (2018), Feige (2008), Mazhar and Meon (2016).

However, despite such a significant amount of work, the interpretation of this definition is still open for debate. There are different meanings of the term with each one reflecting precisely the aims the particular research is directed at. However, these aims are not always recognized as different from each other, which can lead to a misunderstanding of this concept’s essence.

The lack of the generally accepted definition of the non-observed economy predetermines the need to specify the term used for the purpose of this work.

This study understands the non-observed economy as activities “... for which there is no basic data obtained since they belong to one or more problem areas divided into: shadow production, illegal production, production in the informal sector, household production for own end use, activities that were not taken into account due to deficiencies in the program for collecting basic statistical data” (Kolesnikova, 2019, p. 2).

Problem Statement

It should be noted that, in spite of the obvious importance of the issue under consideration, there is no generally accepted scientific methodology to estimate the tax losses to the budget from the non-observed (shadow) economy.

Existing approaches to the assessment of tax budget losses

There are a fairly large number of studies that consider and systematize methods of statistical measurement of their scale, and identify two methods – direct methods (based on surveys, surveys of certain population groups, expert assessments, interviews) and indirect methods (based on summarized economic indicators of statistical and tax services).

Schneider and Enste (2000) identify the methods as separate kinds that include, for example, the unobserved variable method. In accordance with this approach, the non-observed economy is assessed as a function of variables that affect the scale of the non-observed economy and the variables it is reflected on.

The possibility of applying existing methods for assessing tax losses at the regional level

However, not every method for estimating the scale of non-observed economy is applicable to assessing the tax losses of the budget. Most of them only allow us to determine the amount of capital circulating in the informal sector. While to measure the amount of tax revenue that has not been received it is necessary to clearly understand the sources of this capital and which taxes it is subject to. In addition, individual methods cannot be used at the regional level due to lack of necessary information.

Research Questions

The absence of a generally accepted definition of an unobservable economy, as well as a generally accepted methodology for assessing its size, predetermined the need to find answers to the following questions:

What is the economic nature and structure of an unobservable economy?

What is the tax loss of the budget from an unobservable economy?

How tax budget losses from an unobservable economy affect the sustainability of the regional economic system?

Is it possible to achieve the sustainability of the regional economic system if there is a high level of unobserved economy in the region?

Purpose of the Study

The purpose of this study is to determine the impact of tax budget losses from an unobserved economy on the sustainable development of regions. To achieve this goal, the primary task is to develop a method for assessing budget tax losses from an unobserved economy at the regional level. The lack of a generally accepted methodology is an important problem, as it creates difficulties in the inter-regional comparison.

Research Methods

We propose to assess the tax losses to the regional budget from the non-observed (shadow) economy based on individual income tax. This approach is built upon the method of discrepancies, based on the comparison of data obtained from various sources.

We compare the actual amount of individual income tax received by the consolidated budget of the constituent region (according to the data from the Federal Tax Service (FTS)) and the theoretical amount of tax calculated on the basis of information provided by the Federal State Statistics Service (Rosstat). Thus, the amount of shadow economy tax losses to the budget based on individual income tax is determined in accordance with the formula 1.

(1)

where – is the amount of shadow economy tax losses to the budget based on individual income tax, – is the amount of tax that should theoretically go to the budget without the influence of the shadow economy, – is the amount of tax actually received by the budget.

The theoretical amount of individual income tax is defined as the product of the current tax rate times the amount of the tax base (minus social transfers and tax deductions granted).

(2)

where – is the amount of tax that should theoretically be received by the budget without the influence of the shadow economy, – is the 13% individual income tax rate (the flat individual income tax rate since 2001), – is the tax base, – is the amount of social transfers, – is the amount of tax deductions granted.

Findings

According to the presented formulas, we made calculations of tax losses from the non-observed (shadow) economy to the consolidated budget of Amurskaya Oblast.

The choice of this region is justified by the results of earlier studies on the spatial distribution of the non-observed economy in the constituent regions of the Russian Federation, according to which Amurskaya Oblast belongs to regions with high risks of developing shadow economic activities.

Budget Loss Assessment Results

The results of estimating the shadow economy tax losses to the regional budget for the period from 2010 to 2016 are presented in Table

The difference between the actual and theoretical (estimated) amount of tax payments should not be more than 5%, which may for example be due to statistical errors or errors during the registration of transactions.

However, as calculations showed, during the reviewed period the consolidated budget of Amurskaya Oblast lost a significant amount of individual income tax. So, in 2010, 12.6%, and in 2015 - 42.6% of the total amount of taxable income were unaccounted for by the tax authorities. The amount of tax losses for the period from 2010 to 2016 increased by 6,957 mln. rubles.

A sharp increase in non-observed economy tax losses in 2011, on the one hand, may have resulted from the deterioration of the general economic situation and the decline in business activity during the crisis of 2008-2010.

Insufficient number of jobs and lower wages forced people to seek additional income, with its source often in shadow economy.

On the other hand, such a significant increase in tax losses could have been caused by an increase in the insurance premium rates from 26 to 34% in 2011.

Increase in the amount of transfers to extra-budgetary funds has led to the increase in the labor costs in the official sector. It is believed that the greater the difference between the total cost of labor in the formal economy and the amount of labor income after taxes, the stronger the incentive for both employers and employees to avoid paying this difference by participating in shadow economic activities (Schneider & Enste, 2000).

The reduction in the social insurance contributions rate after 2011 did not have a significant impact on the scale of the shadow economy: since 2010 there has been a clear upward trend in tax losses.

A surge in non-observed economy tax losses to the budget was noted in 2015, which is largely due to the crisis events in the country's economy in that period.

However, in 2016 this indicator decreased significantly, which in our opinion on the one hand resulted from the gradual growth of the Russian economy after the crisis, and on the other hand, from the decrease in the number of informally employed people in Amurskaya Oblast: in 2016 the proportion of informally employed in the total number of the employed people decreased by 0.4% (1,6 thousand people), while in Russia as a whole this indicator rose by 0.7%.

The high proportion of informal employment in this area can be largely attributed to the immediate border with China, which provides great opportunities for shuttle trade, which is one of the indicators of non-observed economy (Tsepelev & Bobrova, 2019).

The impact of tax losses from an unobservable economy on the sustainability of a regional economic system

The systematic calculation of tax losses is essential not only to understand how much the budget is losing from the activities of the informal sector, but also to determine the effectiveness of fiscal policy.

Therefore, the tax collection indicator plays an important role in assessing the quality of fiscal management.

However, the “paid / accrued” approach adopted in the professional tax environment does not give a complete assessment of the tax collection rate, since it includes only the “open” part of tax base without the deducted component. In addition, this method does not allow estimating the potential amount of additional revenues to the budget by reducing the scale of the non-observed economy (Gurvich & Suslina, 2015).

The most thorough and comprehensive view of the tax collection rate can be obtained by including shadow economy tax losses in the calculations, which becomes possible when using a macroeconomic approach to calculating the tax collection rate.

The method entails determining the ratio between the amount of actually collected tax payments and their theoretical (estimated) value, that is, the amount that should be received by the budget from the same tax base, but without the influence of the shadow economy.

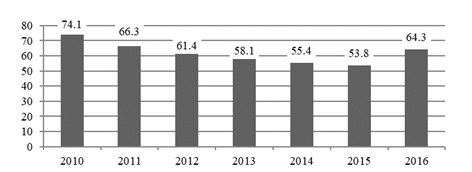

Figure

Conclusion

The study clearly demonstrates the fact that over a long period of time a significant part of the tax potential of Amurskaya Oblast has been concentrated in the non-observed sector of the economy, while the region has been attracting government funding to perform functional tasks all this time, and nowadays it has to spend considerable funds to settle its debt to the federal government.

To summarize, it is impossible to ensure the growth of tax revenues to the regional budget and raise the tax collection rate without a reduction in the level of the non-observed economy, which is the reason why the budget annually loses a significant part of tax revenues. This makes it impossible to solve the problems associated with the sustainable development of the region.

Acknowledgments

This study was supported by a grant from the RFBR № 18-010-00792 “Research the spatial differentiation factors of the non-observed economy, ensuring balanced development of the Russian Far East”.

References

- Alexandru, A. A. (2013). Estimating the size of Romanian shadow economy using Gutmann’s simple currency ratio approach. Theoretical and Applied Economics, 10(587), 33-48.

- Feige, E. (2008). Measuring underground (unobserved, non-observed, unrecorded) economies in transition countries: Can we trust GDP? Journal of Comparative Economics, 36, 287-306. DOI:

- Gurvich, E. T., & Suslina, A. L. (2015). The dynamics of tax collection in Russia: the macroeconomic approach. Financial Journal, 4, 22-33. [in Russ.].

- Katsios, S. (2006). The shadow economy and corruption in Greece. South-Eastern Europe Journal of Economics, 1, 61-80.

- Kolesnikova, O. S. (2019). Determination of Budget Tax Losses from the Non-Observed (Shadow) Economy at the Regional Level. IOP Conf. Series: Earth and Environmental Science, 272, 032141. DOI:

- Mazhar, U., & Meon, P.-G. (2016). Taxing the unobservable: The impact of the shadow economy on inflation and taxation. World Development, 90, 89-103. DOI:

- Medina, L., & Schneider, F. (2017). Shadow Economies Around the World: New Results for 158 Countries Over 1991-2015. CESifo Working Paper Series, 6430.

- Schneider, F. (2012). The Shadow Economy and Work in the Shadow: What Do We (Not) Know? Discussion Paper, 6423, 1-73.

- Schneider, F., & Buehn, A. (2017). Shadow Economy: Estimation Methods, Problems, Results and Open questions. Open Economics, 1(1), 1-29. DOI:

- Schneider, F., & Enste, D. (2000). Shadow Economies: Size, Causes, and Consequences. Journal of Economic Literature, 38, 77-114. DOI:

- Solis-Garcia, M., & Xie, Y. (2018). Measuring the size of the shadow economy using a dynamic general equilibrium model with trends. Journal of Macroeconomics, 56, 258-275. DOI:

- Tsepelev, O. A., & Bobrova, V. V. (2019). Factors of Spatial Differentiation of Non-Observed Economy: Regional Aspect. Advances in Economics, Business and Management Research, 47, 793-795.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 December 2019

Article Doi

eBook ISBN

978-1-80296-076-1

Publisher

Future Academy

Volume

77

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1056

Subjects

Industry, industrial studies, project management, sustainability, business, innovation

Cite this article as:

Kolesnikova*, O. S., & Tsepelev, O. A. (2019). Sustainability Of Regional Economic System. In I. O. Petrovna (Ed.), Project Management in the Regions of Russia, vol 77. European Proceedings of Social and Behavioural Sciences (pp. 756-762). Future Academy. https://doi.org/10.15405/epsbs.2019.12.05.92