Abstract

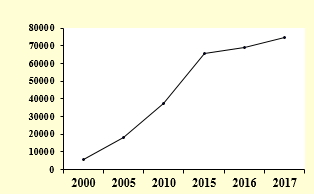

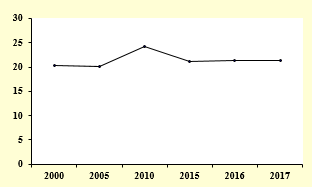

The article presents a retrospective analysis of the structure of the accumulation fund in the USSR during 1980-1990s; it brings to the conclusion that with an increase in the rate of accumulation of fixed assets and the efficiency of accumulation, the growth rate of national income increases. This consistent pattern is true only with a simultaneous increase in both the norm and the efficiency of accumulation. The article characterizes the components and functions of investment management. The following reasons for the decline in investment activity are highlighted: a decrease in gross national savings, inflationary processes, structural deformation of the money supply, a reduction in budget investment expenditures with an uncompensated increase in financing of investments from enterprises, cash outflow from the country, instability of the financial and budgetary system and others. The data on the dynamics of investment expenditures in fixed assets at actual and comparable prices in the Russian Federation in the context of administrative-territorial units in the period of 2000-2018 are presented; the dynamics of the gross regional product for 2000-2017 is analyzed. The authors give the results of calculating the share of investment expenditures as part of the gross regional product and draw the conclusions on the importance of this indicator to ensure proportions of expanded reproduction in modern economic conditions and the need for an active investment policy.

Keywords: Economic growthinvestment dynamicsratio of consumption and accumulationreproductive proportions

Introduction

The analysis of reproductive proportions discussed in a number of research works by Russian and foreign economists acquires special relevance and significance in present-day economic conditions. First of all, it is due to the need for a reasonable distribution of the income received for accumulation and consumption. The solution to this problem is of great theoretical and practical importance. A choice between consumption and accumulation is, indeed, the axis around which the economy revolves. Any economic entity always faces a dilemma: either to direct its income to expand production or to use it for consumption. As known, previously used in the Russian economy ways of solving this problem through centralized regulation of reproductive proportions, mainly through a strictly regulated ratio of productivity and wages, did not give positive results. Nowadays economics involves the use of more flexible methods of regulating the basic proportions of reproduction. The problem is aggravated, in addition, by the instability and uncertainty of the economic situation under inflation.

Problem Statement

Accumulation and consumption belong to the categories of the reproductive process and are associated with the satisfaction of needs. As known, accumulation is the use of part of a product to expand production. Accumulation, therefore, is designed to satisfy the growing needs of the means of production and commodities. Accumulation should provide the bloc “production – consumption”. If accumulation is not connected with consumption, then the “production - production” bloc appears, that is, the economic turnover does not reach consumer demand, production begins for the sake of production and, as a result, the balance between production and demand is disrupted. The optimal proportions between productivity and labor remuneration, between accumulation and consumption allow for expanded reproduction, for production of the required amount of production with minimal labor and means of production, and at the same time, an increase in material interest is ensured (Mavrenkova, 1993).

The relevance of the economic rationale for the rational ratio of productivity and wages, accumulation and consumption increases in conditions of the need for sustainable economic growth.

Research Questions

The optimization of reproductive proportions and the distribution of newly created value for accumulation and consumption have been the focus of economic science since its inception (Faktoren und Kriterien der intensiv erweiterten Reproduktion im Sozialismus, 1972). Nevertheless, at the regional level, this problem has not been studied enough. The issues of the formation of accumulation and consumption funds have not been fully developed; there is ambiguous approach to the patterns of the relationship between productivity and labor and the choice of indicators for assessing it. In the context of the development of project management and the need to ensure sustainable economic growth in the present-day Russian economy, the formation of reproductive proportions is not given due attention, which determines the relevance of their research.

Purpose of the Study

The research purpose is a retrospective study of the proportions of accumulation and consumption, the dynamics of investment expenditures and an assessment of their impact on the efficiency of the economy in the context of the administrative-territorial units of the Russian Federation (federal districts).

Research Methods

In the research process, abstract-logical, economic-statistical, computational-constructive methods were used.

Findings

According to the accepted calculation methodology, the rate of accumulation of national income characterizes the proportion between the values of the accumulation fund and the used national income. The calculated dynamics of the structure of the accumulation fund in the USSR for 1980-1990 based on data on the enlarged composition of consumption and accumulation funds is presented in Table

The minimum share (23.1%) of the growth of fixed assets in the accumulation fund was in 1990. The rate of accumulation of national income in the same year was 20.7%, which is also the lowest indicator for the period under review. The product of these two parameters is the rate of accumulation of fixed assets, which in 1990 amounted to 4.8%. In the structure of the accumulation fund over the past three years under review, there has been a noticeable decrease in the share of growth in fixed assets, and over ten years its specific gravity has decreased from 41.9% to 23.1%.

The efficiency of the accumulation of fixed assets, measured by the increase in the used national income of the same period, increased from 1.10 rubles in 1989 to 1.14 rubles in 1990, however, in the formula, the accumulation efficiency indicator includes the growth of the national income of the t-period, and the accumulation (growth) of fixed assets (t-1) of the period.

As known, such an indicator was first introduced under the name of “accelerator” into the theory of economic growth in the Harrod-Domar model. For the year 1990 г. indicator value (t) equals 0.8949. If the value of the parameter is multiplied by the accumulation rate of fixed assets , equal to 6.44% for 1989, then the growth rate of the used national income in actual prices equal to 5.8% will be obtained. Exactly this value was in 1990 in the economy of the USSR.

Thus, with an increase in the rate of accumulation of fixed assets and its effectiveness, the growth rate of national income increases. However, this happens only with a simultaneous increase in both the norm and the efficiency of accumulation. In a real economy, the growth of one of them can be blocked by the fall of the other. So, despite the increase in the efficiency of accumulation in 1990 compared with 1989 by 4%, the growth rate of national income decreased by 1.8 points due to a decrease in the rate of accumulation of fixed assets.

The share of the accumulation fund in the used national income on average for 1985-1990 amounted to 24.3%, and by years respectively, 26.4%, 25.8%, 24.6%, 24.8%, 24.3%, and 20.7%. The methodology for calculating the rate of accumulation in the USSR was not quite comparable with the Western one, but recalculation, according to generally accepted methods, carried out by the Economic Institute under the USSR State Planning Commission, showed that in 1985 the share of investments in GNP in the USSR was 1.7 times higher than in the USA and 1.5 times more than in Western Europe. However, the efficiency of investments in the USSR was twice lower than, for example, in the USA. The mortification of funds in unfinished construction, the rising costs of repairing and restoring obsolete production assets had to be compensated by a pumping of capital investments (Berezikov, 1989).

In modern conditions, the solution to the problem of optimal proportions of accumulation and consumption acquire a new meaning for all economic entities. If earlier these proportions were strictly regulated, at present the distribution dilemma is becoming relevant.

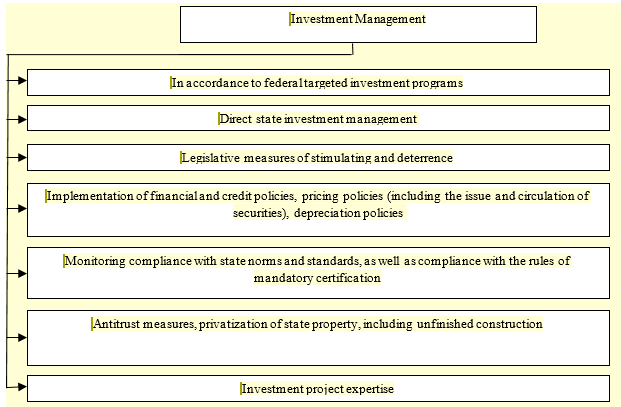

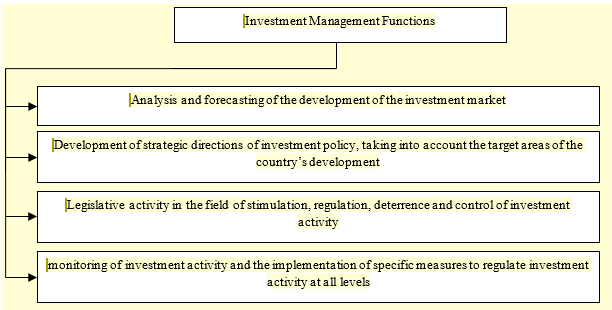

The formation of accumulation funds directly depends on effective investment management. Investment management includes such well-known management functions as analysis and forecasting, planning of all types, monitoring, regulation of activities. The main objectives of investment management at the levels of the state, the constituent entities of the Federation, and regions include the following areas:

creating conditions for ensuring high rates of economic development through the use of factors of effective investment activity;

maximizing national income, which is directly determined by investment activity;

minimizing risks in investment activities.

The state level investment management aimed at the socio-economic, scientific and technical development of the Russian Federation is presented in Figure

Among the factors directly affecting the dynamics of economic development, the decisive role belongs to the investment sphere. Investments affect the deep foundations of economic activity, determining the process of economic development as a whole. Therefore, in the end, any reforms will not have a positive result without intensifying the investment process, the rational organization of which is a prerequisite for economic growth and improving the living standards of the country’s population.

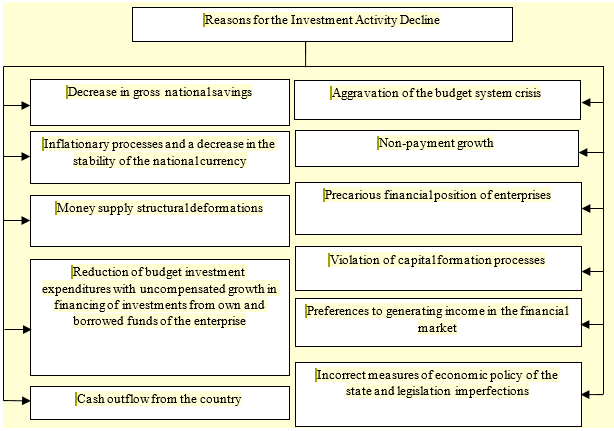

The most important component of the systemic crisis of the Russian economy during the period of market transformations was a deep investment crisis. Its main manifestations were a significant decline in investment, a decrease in total investment potential, negative shifts in the functional, sectoral and regional structure of investments, a decrease in the efficiency of use of emerging financial markets. The investment crisis was due to a whole range of factors. The main reasons for the decline in investment activity in the Russian economy are presented in Figure

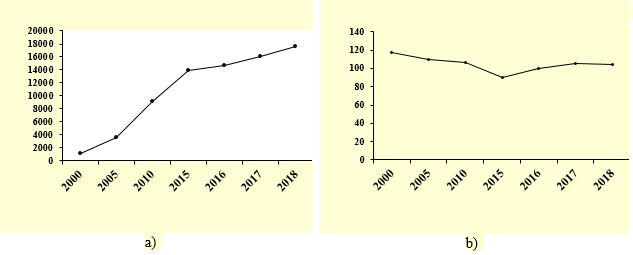

The dynamics of fixed capital investments in the Russian Federation at current prices for 2000-2018, which characterizes the growth trend, is presented in Table

The dynamics of fixed capital investments in the Russian Federation at comparable prices is presented in Table

Table

Table

Russia takes not the last position in investment ratings, however, it should be noted that the Russian Federation concedes to such countries as Pakistan, Vietnam, Zambia, Ghana, Thailand. Obviously, moving forward along with sufficient effect can only be ensured by a sound, rational investment policy.

As noted in publications, the investment policy of the state should be aimed at improving the legal support of investment processes; the formation of organizational and institutional mechanisms for managing investment activity at the international level, at the state and regional levels; increasing the efficiency of economic levers for the development of investment processes, in particular, tax, depreciation and monetary policy (Duffie, 2019; Lu, Pena-Mora, Wang, Liu, & Wu, 2019; Oatley, 2019; Pagoni & Patroklos, 2019). An important task of the investment policy of Russia today is the economically sound choice of priority areas of investment.

Conclusion

The conducted research shows that the rate of reproduction mainly depends on that part of the newly created value that goes to accumulation and consumption, in present-day economic conditions, the indicator characterizing the share of the accumulation fund is the share of investment expenditures in GDP.

With a rational correlation in the income of accumulation and consumption funds, productivity and wages increase, while payment does not increase by increasing its share in income, its absolute size increases due to income growth, which is favorable for expanded reproduction (Mavrenkova, 1993).

There is no doubt that the size of the savings depends on the level of resource supply. As the results of numerous studies on this problem show, in subjects that have reached a higher level of resource potential, the rate of accumulation may be relatively lower.

References

- Berezikov, V. I. (1989). The rates and proportions of the aggregate social product under conditions of socialist expanded reproduction. Preprint Novosibirsk: IE and OPP SB AS USSR. [in Russ.].

- Duffie, D. (2019). Prone to Fail: The Pre-Crisis Financial System. Journal of Economic Perspectives, 33(1), 81-106.

- Faktoren und Kriterien der intensiv erweiterten Reproduktion im Sozialismus. (1972). Berlin: Akademie-Verlag.

- Lebedeva, A. V., & Lebedeva, G. V. (2019). Investment policy at the regional level. Mauritius: LAP LAMBERT. [in Russ.].

- Lu, Z., Pena-Mora, F., Wang, S. Q., Liu, T., & Wu, D. (2019). Assessment Framework for Financing Public-Private Partnership Infrastructure Projects through Asset-Backed Securitization. Journal of management in engineering, 35(6), 16-31.

- Mavrenkova, G. V. (1993). Economic justification of the ratio of accumulation and consumption in agricultural enterprises (on the example of the Leningrad region) (PhD thesis). Retrieved from https://search.rsl.ru/ru/record/01007903666. [in Russ.].

- Oatley, T. (2019). Toward a political economy of complex interdependence. European journal of international relations, 25(4), 957-978.

- Pagoni, E. G., & Patroklos, G. (2019). A system dynamics model for the assessment of national public-private partnership programs’ sustainable performance. Simulation modelling practice and theory, 97, 46-62.

- Statistical Yearbook. (1991). The national economy of the USSR in 1990. Moscow: Finance and statistics. [in Russ.].

- Statistical Digest of Novgorodstat. (2018). Statistical Yearbook of the Novgorod Region. Veliky Novgorod: Novgorodstat. [in Russ.].

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 December 2019

Article Doi

eBook ISBN

978-1-80296-076-1

Publisher

Future Academy

Volume

77

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1056

Subjects

Industry, industrial studies, project management, sustainability, business, innovation

Cite this article as:

Lebedeva, A. V., & Lebedeva*, G. V. (2019). Reproduction Proportions As A Factor Of Sustainable Development. In I. O. Petrovna (Ed.), Project Management in the Regions of Russia, vol 77. European Proceedings of Social and Behavioural Sciences (pp. 669-677). Future Academy. https://doi.org/10.15405/epsbs.2019.12.05.82