Abstract

In the context of the digital economy, the strengthening role of socially-oriented non-profit organizations (NPOs) in addressing issues related to the harmonization of social and economic aspects of social development is impossible without changing the focus on strategic targets. The organization of the budgeting system in socially-oriented NPOs is based on the following features: the problem of allocation of the calculation unit; a high level of uncertainty of the budget revenue; social orientation of non-profit organizations, which determines the increased responsibility for the results of activities and requires clarification of the concept of the activity result. The use of a results-based budgeting model in socially oriented NPOs, in which, on the one hand, the expenditure of targeted funds is carried out in accordance with the principle of centralization, and, on the other hand, the goals are achieved on the basis of the principles of decentralization, ensures the planning, execution and control of budget expenditures in direct connection with the set and achieved results. This model uses mobile annual budgets with a one-month budgeting step. The analysis of budget execution, aimed at assessing the performance quality of socially-oriented NPOs, has a bilateral character: on the one hand, the efforts of the organization itself are evaluated, and on the other - the target group. The effect of the use of target funds arises in the subsequent reporting periods of time and is determined by the attitude to socially-oriented NPOs of the society.

Keywords: Budgeting and budgetscalculation unitefficiency of target financingsocial efficiency socially-oriented non-profit organizations (NPOs)social order and target financing

Introduction

Sustainable development of modern market economy is aimed at simultaneous satisfaction of the needs of business entities and society. Throughout the period of development of society there was a need to establish a balance in solving of social and economic problems. In modern conditions, this role is performed by socially-oriented non-profit organizations. The analysis of their activity allows to speak about problems with attraction of target means and an assessment of efficiency of their use (Arena, Azzone, & Bengo, 2015; Bazarov, Appalonova, Sinetova, & Tishkina, 2016).

Currently, socially-oriented activity in accounting is considered as a set of accomplished facts of economic activity. At the same time, the possibility of integration and integral consideration of economic processes in the conditions of digitalization allows us to consider the strategic direction of these processes, which is especially important, because it allows us to economically justify the efficiency and feasibility of attracting targeted funds, on the one hand, and to organize the control of their use, on the other. An important tool for strategic planning and accounting of socially-oriented activities is its budgeting, the practical implementation of which requires development and clarification.

Problem Statement

The nature of an NGO's activities is determined by its Charter. NPOs may also be in related business activities in addition to non-commercial socially oriented activities. The allocation of resources for these activities is targeted. When funds are received for the statutory purposes of non-commercial activities, they are distributed to projects and programs in a targeted manner by the decision of the Supreme governing body of the non-profit organization. Entrepreneurial activity can be divided into a separate project.

Allocation of socially-oriented non-profit organizations as an object of economic activity has determined the need to address issues on the organization and methodology of budgeting of socially-oriented activities as an important tool for assessing its effectiveness.

To assess the role of socially-oriented non-profit organizations, which are responsible for education, medicine, science, culture, religion, to ensure sustainable economic development, it is necessary to measure social efficiency, involving a comparison of social and economic results and expenses.

Research Questions

The use of budgeting as a tool for planning and managing the activities of a non-profit organization aimed at sustainable development.

Consideration of budgeting as a subsystem of management accounting, ensuring the effectiveness of the socially-oriented organization through the planning, control and analysis of costs and results of the responsibility centers.

Purpose of the Study

Development of the project-target budgeting and management of socially-oriented non-profit organizations which is the most effective in the face of uncertainty and instability of environmental factors, as the project-target method involves the management of the results, its application allows you to quickly adjust the goals and objectives.

Research Methods

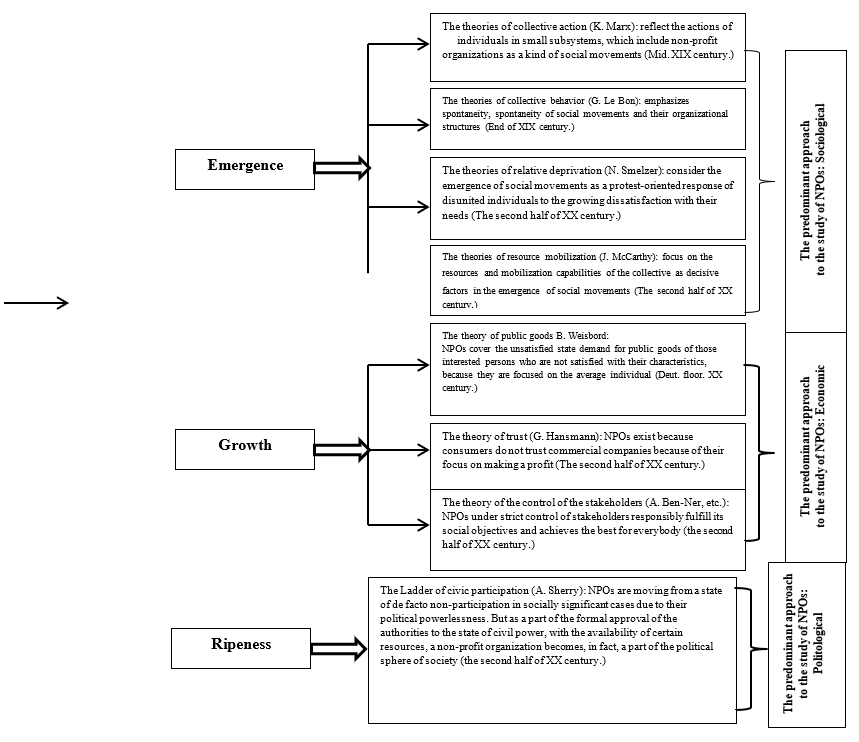

Historical analysis shows that the necessity for the implementation of social functions existed throughout all stages of society development. The evolution of scientific views to the solution of socially-oriented problems is presented in Figure

The figure shows that to solve the problems of harmonization of economic goals of market entities and social goals of society, it needs to create non-profit forms of management, the presence of which ultimately determines the level of the economy development as a system. In countries with developed market economies the share of income of nonprofit organizations is approximately 5% of GDP. Characteristics of such organizations in Russia are presented in Table

Based on the table, it is obvious that the share of income of NPOs in Russia's GDP is less than 1%.

An important tool for attracting targeted funds to the activities of NPOs and monitoring their use is budgeting (Klychova & Hayrullin, 2016).

The principles of budgeting laid down in the office accounting, which was invented in the Western Europe in the middle ages. There was used the concept of estimates, which later became known as the budget.

The classical approach to management uses the program-target concept focused on achievement of the predicted results according to the realized strategy of the corresponding administrative policy (Yegorova & Budasova, 2017).

The program-target approach to budgeting and management involves the creation of a "tree of goals" (Arogyaswamy, 2017), that is, a clear and understandable formulation of the goals and objectives of budgeting, the development of activities aimed at achieving them, determining the size and structure of the necessary resources, as well as the sources of their income. This approach to budgeting implies short-term forecasts. It is impossible to apply it in the conditions of dynamically expanding innovations, it is difficult to correct in cases of changes of external and internal environment factors. The method of program-target budgeting and management is effective only for solving sufficiently studied management problems.

Program-target and project-target approaches have common key elements. They are both results-oriented. However, the project is aimed at achieving a specific single result, and the program combines the results of individual projects to achieve a common goal. Program management projects are coordinated to receive immediate benefits and the degree of control impossible when managing them individually (Shatsky, Volkov, Hramushina, & Folosyan, 2018).

The first practical implementation of program budgeting was undertaken in the mid-twentieth century in the United States in connection with the reform of budget planning called "planning-programming-budgeting". In Russia, interest in the practical application of program budgeting emerged after the publication of the UN recommendations on program budgeting and results-based budgeting.

The results-based budgeting model is based on the method of preparation and execution of the budget, when planning, execution and control of budget expenditures are carried out in direct connection with the specified and achieved results (Villaluenga, 2016; Yendovitskiy, 2007). Analysis of the theory and practice of management shows that in modern conditions, results-based budgeting is one of the infrastructure institutional concepts of management, representing an alternative to the estimated budgeting.

This model was developed for business entities, but it is also applicable for socially-oriented non-profit organizations. It uses, the principle of centralization, according to which earmarked funds are spent, and the principle of decentralization, according to which the objectives are achieved. An important feature of the application of the results-based budgeting model in socially-oriented non-profit organizations is the lack of a marketing component associated with the regulation of the market situation (Kuhnen & Hahn, 2018; Nicholls, 2010).

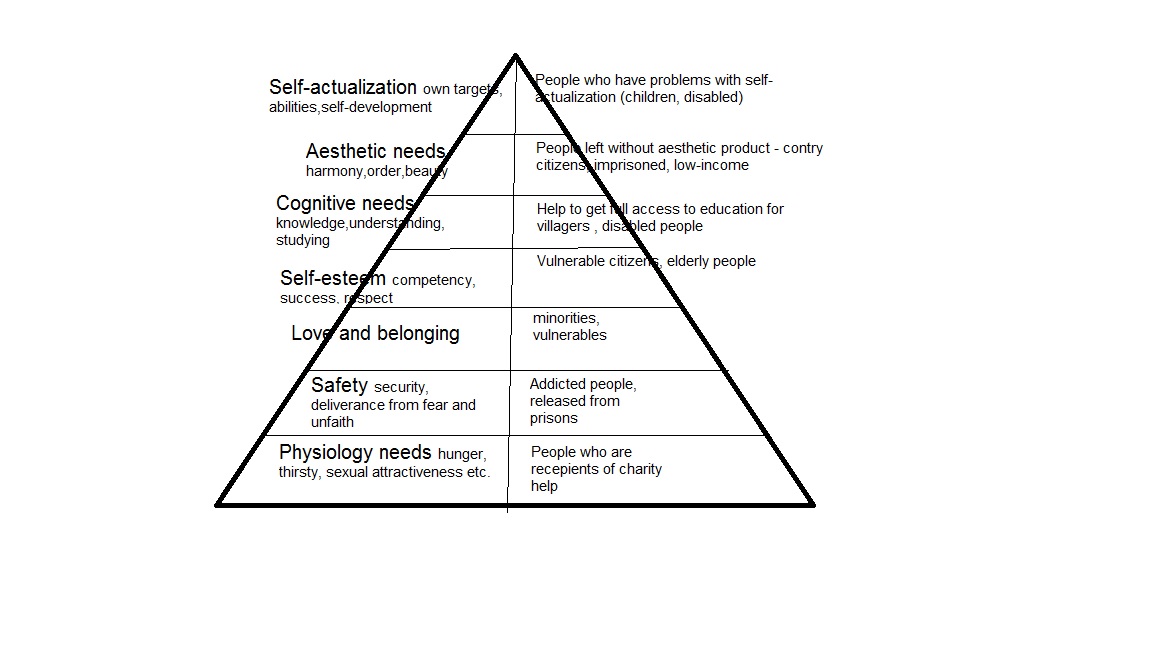

The development of budgeting methods in socially-oriented non-profit organizations has a number of features arising from the specifics of the activities of these organizations, the results of which can be identified using the Maslow pyramid (Figure

Findings

The most significant features of NPO budgeting include the following:

the problem of allocation of the calculation unit. This is due to the fact that the main activity of socially-oriented non-profit organizations is associated with the solution of social problems aimed at the development of society. It is from here that the features of their products (for example, worship for religious organizations);

a high level of uncertainty of the budget revenues, which is formed by revenues from the main and related activities. Income from core activities is determined solely by the amount of earmarked income. Therefore, an important tool for budgeting in socially-oriented NPOs is the development of annual mobile budgets;

the social orientation of non-profit organizations determines the increased responsibility for the results of activities, which is explained by the increased interest and control of the company;

the concept of performance. The activities of a socially-oriented non-profit organization should be evaluated. To evaluate this activity, it is necessary to identify the result by means of special reporting indicators (qualitative and quantitative). The result of the activity of a socially-oriented non-profit organization is determined through the solution of a certain social problem (improvement of the quality of life, growth of health indicators, growth of socio-demographic potential, stimulation of self-realization and self-employment, etc.) and is identified through special reporting indicators (qualitative and quantitative) through behavior, well-being, level of security, life of the target group, etc.

Evaluation of the quality of the results of the activities of socially-oriented non-profit organizations has a two-way character: on the one hand, the efforts of the organization itself, and on the other, it is the target group. In this case, the effect is determined by the amount of target funds in the subsequent reporting periods of time and the attitude to socially-oriented NPOs of the company.

Also, the organization of the budgeting system the same approaches as for commercial enterprises can be used in socially-oriented non-profit organizations:

consistent allocation of responsibility centers;

the development of the system of interlocking budgets;

analysis of deviations to identify the causes of these deviations and personal responsibility of managers for specific targets.

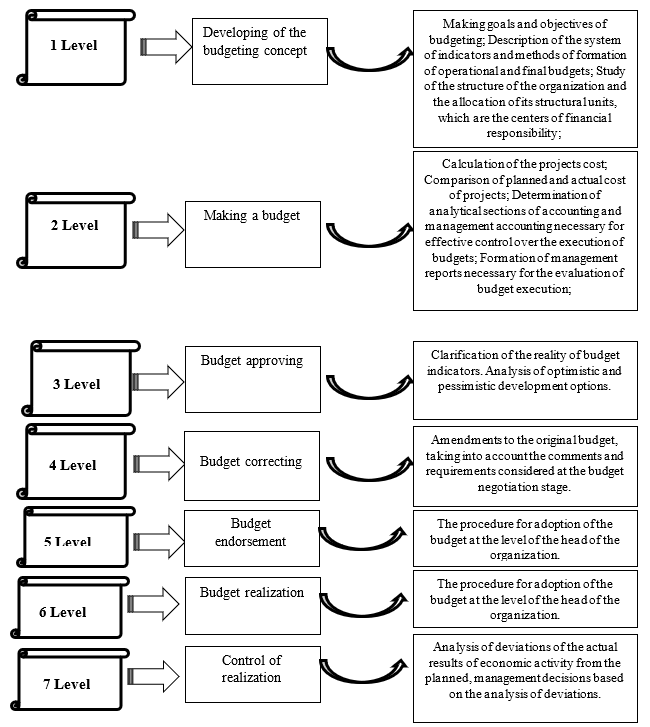

As a rule, the budget of a socially-oriented NPO is developed jointly by the head of the organization and the heads of responsibility centers. The budget process can be divided into the steps shown in Figure

The budget of the project/program is a distribution of funds provided to any Fund by the donor or other organization by object of expenditure related to the implementation of the main objectives of the program/project. Its content is determined by the financing agreement, of which it (the budget) is an integral part. The project/program budget is drawn up for the duration of the funding agreement.

The use of mobile annual budgets is typical for NPOs. The peculiarity of such budgets is that the budgeting step is a month. This means that the budget data apply to the period following the current one, after one month, a new month is added to the budget, and this procedure is carried out throughout the year.

The consolidated budget combines the funds of all projects/programs received in any form that does not contradict the laws of the Russian Federation during the financial year (from January 1 to December 31), and shows their distribution by expenditure items. In accordance with the requirements of the legislation, the annual budget of the organization is approved at the meeting of the governing body of the NPO.

The annual budget can be supplemented by quarterly and semi-annual budgets. If the financial year of the donor does not coincide with the financial year of the NGO, the project/program budget can be reflected in more than one annual period.

Monthly income and expenditure forecasts for the following month are prepared by the accountant on the basis of data on planned expenditures for the coming month in accordance with the proposed activities for various projects, programs and administrative and managerial activities of the organization. The financial procedures should provide for a time frame for staff requests to be made in order for the monthly forecast to be made in a timely manner. It is also necessary to specify the types of budgets that are drawn up in the organization, and the degree of detail of each of them.

The organization can provide for the creation of budgets for different components: the budget of labor costs, the budget of materials, the budget of individual activities, if such detail is necessary for the purposes of financial management. These budgets will be consolidated, and should consolidate similar groups of expenditures on the budgets of individual projects included in the annual budget of the organization. If the number of projects is small, it is possible to limit the direct inclusion of project and program budgets in the annual financial plan.

Conclusion

The expansion of the practice of social order (growth of targeted financing) of socially-oriented NPOs in the digital economy is inextricably linked with the development of their accounting, analytical and control systems and involves the use of such strategic tools as budgeting.

The process of budgeting in socially-oriented NPOs has a number of features, is targeted and is aimed at the allocation of resources necessary for the statutory and related activities.

The analysis of budget execution allows to solve one of the most difficult and important problems of activity, socially-oriented NPOs – the problem of efficiency evaluation, because there is a possibility to estimate the amount of financing and the value of social benefits. At the same time, it should be noted that due to the weak influence of market factors on the activities of socially-oriented NPOs, quantitative indicators of the budget may be little related to the quality of services. Therefore, despite the important role of budgeting in the management of socially-oriented NPOs, it is necessary to develop practical methods, on the one hand, to assess the quality criteria for the effectiveness of non-profit projects, and, on the other hand, to assess the quality criteria for the effectiveness of organizations themselves applying for subsidies and other support for their activities.

References

- Arena, M., Azzone, G., & Bengo, I. (2015). Performance Measurement for Social Enterprises. Voluntas, 26(2), 649-672.

- Arogyaswamy, B. (2017). Social Entrepreneurship Performance Measurement: a Time-Based Organizing Framework. Business Horizons, 60(5), 603-611.

- Bazarov, R. T., Appalonova, N. A., Sinetova, R. G., & Tishkina, T. V. (2016). Financial Support by the State Activity of Non-Profit Organizations on the Example of The Russian Federation. 28th International Business-Information-Management-Association Conference: Vols. I–VII. Vision 2020: Innovation Management, Development Sustainability, and Competitive Economic Growth (pp. 3513-3524). Spain: Seville.

- Klychova, G. S., & Hayrullin, R. R. (2016). Topical issues of management accounting automation. Accounting in Budgetary and Non-Profit Organizations, 9, 2-5. [in Russ.].

- Kuhnen, M., & Hahn, R. (2018). Systemic social performance measurement: Systematic literature review and explanations on the academic status quo from a product life-cycle perspective. Journal of Cleaner Production, 205, 690-705.

- Nicholls, A. (2010). The Functions of Performance Measurementin Social Entrepreneurship: Control, Planning and Accountability. In K. Hockerts, J. Mair, & J. Robinson (Eds), Values and Opportunities in Social Entrepreneurship. London: Palgrave Macmillan.

- Shatsky, A., Volkov, D., Hramushina, H., & Folosyan, M. (2018). Social Entrepreneurship: Problems of Formation and Development. 34th International Scientific Conferenceon Economic and Social Development. Economic and Social Development (Book of Proceedings) (pp. 420-428). Russia: Moscow.

- Villaluenga, S. (2016). Revenues Assigned to The Financing of Expenditures in The Budget and Its Implications for The Administrative Organization and Accounting System in The Religious Institutions and Public Administration Under an Historical Perspective. De Computis-Revista Espanola De Historia De La Contabilidad, 13(24), 57-73.

- Yegorova, S. E., & Budasova, V. A. (2017). Methodological approaches to development of the budgeting system in the face of external volatility. Bulletin of the Pskov State University. Series: Economy. Right. Control, 5, 145-149. [in Russ.].

- Yendovitskiy, D. A. (2007). Budgeting in the system of university financial management. Accounting in Budgetary and Non-Profit Organizations, 8, 97-108. [in Russ.].

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 December 2019

Article Doi

eBook ISBN

978-1-80296-076-1

Publisher

Future Academy

Volume

77

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1056

Subjects

Industry, industrial studies, project management, sustainability, business, innovation

Cite this article as:

Budasova, V. A., Judanova, L. A., Demidova*, S. E., Bogdanovich, I. S., & Egorova, S. E. (2019). Activities Of Non-Profit Organizations As A Factor Of Sustainable Development. In I. O. Petrovna (Ed.), Project Management in the Regions of Russia, vol 77. European Proceedings of Social and Behavioural Sciences (pp. 40-48). Future Academy. https://doi.org/10.15405/epsbs.2019.12.05.6