Abstract

The issue of assessing the cadastral and market value of industrial land sites intended for mining is considered. The purpose of this article is to determine the cadastral value of land sites occupied for mining. This goal is achieved by solving the following tasks: determining sources of information on the assessment of cadastral value, a brief graphoanalytical analysis of the state of the cadastral valuation of land in the mining zone and additional justification of the methodology for assessing the cadastral value of land occupied by mining. Access is given to the most reliable sources of information on the assessment of both the market and cadastral value of real estate represented by the Federal State Registration, Cadastre and Cartography Service (Rosreestr). A brief graph-analytical analysis of the state of the cadastral valuation of land in the mining zone is presented using a Bing-card. An additional substantiation of the methodology for assessing the cadastral value of land sites used for mining is based on the basic principles of real estate valuation. The studies cover the period from 2013 to 2014. The calculation data are taken from reliable sources and previously published materials. Based on the given market parameters, based on recognized fundamental publications in the field of economics, a conclusion is drawn about the lower cost of land under oil and gas facilities in comparison with industrial lands. This allows us to judge about the higher priority of investments in industry in the future than in the oil and gas complex.

Keywords: Cadastral valueinformationindustrial landlandoil and gas facilitiesreal estate valuation

Introduction

The purpose of this article is to determine the cadastral value of land sites used for mining. The following tasks are solved.

1. Determination of sources of information on the assessment of cadastral value.

2. Graphical analysis of the state of cadastral valuation of land in the mining zone.

3. Improving the methodology for assessing the cadastral value of land sites used for mining.

Insufficient attention has been paid to the determination of cadastral value of land sites used for mining. Although there are studies on the economy of minerals (Dunayev, 2006), the determination of market and cadastral values for groups of land sites close to the lands of mining (Svitelskaya, 2016, 2017b, 2019; Leliukhina & Fedorova, 2012), the distribution of industries including oil and gas production at the average rate of return (Sorokin, 2017) and territorial analysis of market phenomena (Yarmolenko, Putintseva, & Pisetskaya, 2019). However, the place of the market and cadastral value of land sites of mining of minerals is not accurately defined in comparison with other lands, for example, industrial lands.

Problem Statement

Since natural resources, including oil and gas are the decisive source of replenishment of the federal budget in the Russian Federation, the fundamental problem is determining the priorities of the country's economic development with a prospect for the next century. In this case, it is necessary to compare the development efficiency of oil and gas sectors with other industrial sectors. The development efficiency of these sectors determines the current market and cadastral value of land under the objects of oil and gas and industrial complexes, respectively. Based on a comparison of the market value of the land sites of these industries, it is necessary to determine the priority investment in the raw material sectors of the economy, or in industry, that is, those that will increase the value of land sites and objects of the corresponding industries in the future.

Research Questions

In connection with the foregoing in the introduction of this article the following questions are posed for solution.

Graphoanalytical analysis of the state of the cadastral valuation of land in the mining zone based on reliable information.

Additional substantiation of the methodology for assessing the cadastral value of land sites used for mining.

Purpose of the Study

The purpose of this article is to determine the cadastral value of land sites used for mining.

Research Methods

The studies were carried out using the methods of geoinformation modeling, theoretical analysis based on reliable statistical data.

Findings

We will consider the solution of the problems in the order of their sequence.

Identification of information sources of cadastral evaluation

The most reasonable source of information on assessing both the market and cadastral value of real estate is the data of the Federal State Registration, Cadastre and Cartography Service (Rosreestr). The State Cadastral Assessment Data Fund can be accessed at https://rosreestr.ru/wps/portal/cc_ib_svedFDGKO. Then it is possible to select the desired report on the assessment of the cadastral value of land sites in a particular region. In this case, the cadastral value of land sites as part of industrial and other special purpose lands of the Khanty-Mansiysk Autonomous Okrug is considered.

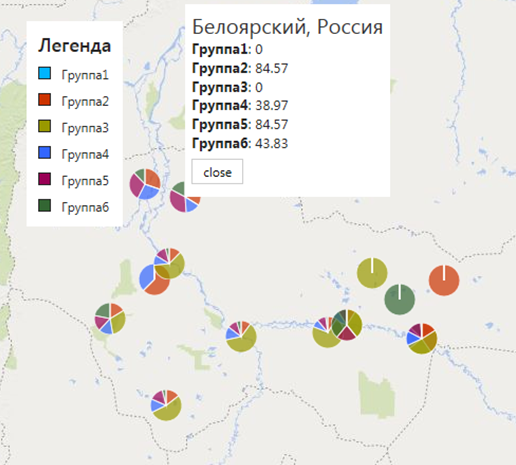

6.2. Graphical-analytic analysis of the state of cadastral evaluation of land in mining zone

According to (Svitelskaya, 2016, 2017a; Postanovleniye Pravitel'stva Khanty-mansiyskogo avtonomnogo okruga – Yugry. 2014) land sites are divided into seven groups, each of which includes land sites for allocation of the following respectively:

the first – ground-based objects of space infrastructure, energy, air transport;

the second - objects of capital construction of industry;

the third – objects of road transport;

the fourth – facilities for the development of minerals, including transport and urban infrastructure;

the fifth – communication facilities, transport – rail and road, pipeline, water – zones with special conditions of use;

sixth – defense facilities.

Table

Figure

The excess of the cadastral value of group 4 over group 2 on average amounts to 122.01 / 110.23 = 1.107 or 10.7 percent in the subject of the Russian Federation. It is associated with risk to take such a ratio as the basis in calculation of the cadastral value relative to industrial land without additional justification because the maximum value of the cadastral value for industrial land is 156.55 (Nizhnevartovsk municipal district) and more than the same value of 143.59 for land sites occupied under mining. Here 156.55/143.59=1.090, which equals 9.0%. Therefore, additional studies are needed to justify the methodology for assessing the cadastral value of land sites used for mining, relative to industrial land.

6.3. Additional substantiation of the methodology for assessing the cadastral value of land sites used for mining

We will take the basic provisions of the income method for assessing the value of real estate as the basis of the research (Gribovskiy, 2001).

The value of the land of the second group – land sites occupied by industrial facilities – can be written as:

, (1)

where V_2 – the value of the land of the second group,

I_2 – profit received from the land site of the second group,

i_2 – rate of return from the land of the second group.

For a site of the fourth group – land sites occupied for mining – we can write:

, (2)

where V_4, I_4, i_4 – the same values assigned to the land site of the fourth group.

Based on expressions (1) and (2) we can find

(3)

Profit values in (3) will be determined on the basis of real data for 2017 taken from (Sorokin, 2017). Tables

In order to compare the data in tables

, where

is given in table

Since net profit is calculated as the difference between profit and its 20 percent value, the replacement of profit ratios by the ratio of net profits is justified here.

We now can calculate the ratio . According to (Sorokin, 2017), the profit margin in the mining sectors, we assume equal to 19.2%, and in the industries – equal to 12.5%.

The we have =0.65 and in accordance with (3):

.

Now we will consider the same situation at the beginning of the crisis period, that is, at the end of 2013. Similar data are given in Tables

The correction factor as the quotient of dividing the average revenue of oil and gas enterprises by the average revenue of industrial enterprises according to Tables

11,402,552 * 19.237 = 219350991.9.

Then we can find the ratio

, where

is given in table

Accepting the rate of return for the period from the end of 2013 to the end of 2017 constant for the above sectors of the economy, we assume that =0.65 and in accordance with (3):

Conclusion

The work on the basis of reliable statistical information proved the low cost of land allocated for the placement of oil and gas industry objects. Moreover, over time, it fell from 0.61 to 0.18 of the value of industrial land. This is primarily due to a decrease in average profits in the oil and gas industry. In our opinion, this should be taken into account when assessing the cadastral value of land allocated for oil and gas industry facilities. This is also confirmed by the fact that the cost of land is negligible in the cost of the right to use deposits, usually obtained at auctions.

Acknowledgments

This article was written on the basis of factual material provided by graduate student of Moscow State University of Geodesy and Cartography Svitelskaya Margarita Aleksandrovna, for which we express our deep gratitude.

References

- Gribovskiy, S. V. (2001). Otsenka dokhodnoy nedvizhimosti [Valuation of profitable real estate]. St. Petersburg, Moscow, Kharkov, Minsk: Peter [in Russ.].

- Dunayev, V. F. (2006). Ekonomika predpriyatiy neftyanoy i gazovoy promyshlennosti [Economics of oil and gas industry]. Moskva: Neft' i gaz. [in Russ.].

- Leliukhina, A., & Fedorova, Y. (2012). Opredelenie stoimosti zemel'nyh uchastkov pod promyshlennymi predpriyatiyami. [Fixing industrial lands’ values]. Izvestia vuzov. Geodesy and aerophotosurveying, 4, 111-116. [in Russ.].

- Postanovleniye Pravitel'stva Khanty-mansiyskogo avtonomnogo okruga – Yugry. (2014). Postanovleniye N 503-p ot 26 dekabrya 2014 g. “O rezul'tatakh gosudarstvennoy kadastrovoy otsenki zemel'nykh uchastkov v sostave zemel' promyshlennosti, energetiki, transporta, svyazi, radioveshchaniya, televideniya, informatiki, zemel' dlya obespecheniya kosmicheskoy deyatel'nosti, zemel' oborony, bezopasnosti i zemel' inogo spetsial'nogo naznacheniya na territorii Khanty-mansiyskogo avtonomnogo okruga – Yugry”. [Resolution of the Government of the Khanty-Mansiysk Autonomous Okrug – Ugra. (2014). Decree No. 503-p dated December 26, 2014 “On the results of the state cadastral valuation of land sites as part of the lands of industry, energy, transport, communications, broadcasting, television, computer science, lands for space activities, lands of defense, security, and other special lands appointments in the Khanty-Mansiysk Autonomous Okrug – Ugra”]. [in Russ.]

- Svitelskaya, М. А. (2016). Problemy ocenki stoimosti i ucheta cenoobrazuyushchih faktorov pri ocenke mestorozhdenij uglevodorodov. [Issues of Valuation and Registration Of Price Forming Factors While Estimating The Areas Of Hydrocarbon Accumulation]. Izvestia vuzov. Geodesy and aerophotosurveying, vol. 60, 6, 50-54. [in Russ.].

- Svitelskaya, М. А. (2017a). Metodika ocenki promyshlennyh zemel'nyh uchastkov, prednaznachennyh dlya dobychi poleznyh iskopaemyh. [Technique Of Evaluation Of Industrial Land Plots Intended For The Extraction Of Minerals]. Izvestia vuzov. Geodesy and aerophotosurveying, vol. 61, 5, 66-68. [in Russ.].

- Svitelskaya, M. (2017b). Tekhnologiya ucheta individual'nyh cenoobrazuyushchih faktorov dlya zemel'nyh uchastkov, prednaznachennyh dlya dobychi poleznyh iskopaemyh. [Technique For Recording The Specific Price Factors Of Land Plots, Which Are Intended For Extraction Of Mineral Resources]. Izvestia vuzov. Geodesy and aerophotosurveying, vol. 61, 6, 48-51. [in Russ.].

- Svitelskaya, М. А. (2019). Razrabotka metodiki ocenki zemel'nyh uchastkov pod ob"ektami promyshlennogo naznacheniya. [Development of a methodology for assessing land under industrial facilities]. The dissertation for the degree of candidate of technical sciences, Moscow. [in Russ.].

- Sorokin, A. V. (2017). Mezhotraslevaya konkurenciya i obrazovanie srednej normy pribyli kak predposylka reindustrializacii [Inter-industry Competition and Formation of Average Profit Rate as a Precondition for Reindustrialization]. Moscow University Economics Bulletin, 1, 22-40. [in Russ.].

- Yarmolenko, A. S., Putintseva, N. Y., & Pisetskaya, O. N. (2019). Modern geoinformation and communication technologies of economic analysis in ms office 365. The European proceedings of social & behavioural sciences, 59, 643-656.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 December 2019

Article Doi

eBook ISBN

978-1-80296-076-1

Publisher

Future Academy

Volume

77

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1056

Subjects

Industry, industrial studies, project management, sustainability, business, innovation

Cite this article as:

Putintseva, N. Y., & Yarmolenko*, A. S. (2019). Assessment Of The Value Of Land Sites Under Oil-And-Gas Production Facilities. In I. O. Petrovna (Ed.), Project Management in the Regions of Russia, vol 77. European Proceedings of Social and Behavioural Sciences (pp. 431-439). Future Academy. https://doi.org/10.15405/epsbs.2019.12.05.52