Abstract

In modern conditions of an unstable economic situation and the development of globalization, an effective risk management policy takes an integral role in the development process of an organization. One of the most important components of such a policy is effective work with financial risks. Most often, financial risk management is understood as the process of assessing and managing the current and possible financial risks of the company, as well as the process of reducing the company's exposure to various risks. At the same time, financial risk management cannot protect the company from all possible risks, but should help identify risks, as well as evaluate all possible means of protection against them and then take the necessary measures to reduce these risks. The relevance of the study of this issue is due to the fact that in the current economic situation, the rational activity of an economic entity should be based on constant monitoring of internal and external conditions. In the current state, the analysis of financial risk is extremely important for existing enterprises, since most enterprises cannot cope with the “snowball” effect that arises as a result of constantly rising costs amid stagnation or lower profits. The study of this topic is reflected in legislative documents, scientific literature, and the most relevant and controversial issues in the field of financial risks are covered in periodicals. The basis for studying the practical side of this issue was the chemical industry enterprise PJSC “Acron”.

Keywords: Commercial enterprisecredit riskfinancial riskliquidity riskmarket risk

Introduction

Today, PJSC “Acron” is one of the largest chemical industry enterprises in Russia with a large-scale distribution network across the world. These circumstances can have both positive and negative impact on operating and financial performance.

The implementation of the 2005-2016 strategy, which implies creation of a system of vertical integration of production based on the own production of the main raw materials, has significantly reduced the historical risks associated with the purchase of the main types of raw materials. The implementation of the new development strategy until 2025 implies optimization and maximization of the company's production and investment process, which makes market and financial risks the matter of principle in the current conditions.

In the course of its activities, PJSC “Acron” is exposed to various financial risks: market risk (including currency, interest rate and price risks), credit risk and liquidity risk.

PJSC “Acron” has a risk management system that is based on the classification of various methods and approaches to identify the risks that an organization has and also regularly checks the significance of the influence of each factor on the general position of the enterprise (Kanishcheva, 2019).

Problem Statement

The problem of financial risk management is relevant for the practical study of it. In a crisis situation, business entities are forced to resort to various methods of optimizing various types of risks. To develop a full-fledged financial risk management strategy in the current market situation, companies should think about both short-term and long-term forecasting of the situation in the financial market (Ramalingegowda & Wang, 2013; Lucas, 1976).

Research Questions

Specificity and main groups of enterprise financial risks?

What are the ways to improve enterprise financial risk management?

The object of the study is the financial risks of an organization, their legislative regulation, as well as the application of theoretical knowledge on these issues on the example of PJSC “Acron”. The subject of the study is the impact financial risks have on an organization and ways to improve their effective use.

Purpose of the Study

The purpose of the scientific article is to consider the scientific and theoretical basis of the issues of organization's effective financial risk management, and also, using the example of PJSC “Acron”, to understand how the financial risk management process is formed and how it works, what are the ways to improve their effectiveness exist today.

Research Methods

To refine the information on financial risks, the following research methods were used: comparison, grouping, detailing, analysis of factors of the internal and external environment. The totality of the analysis methods used in the process of enterprise research will visually display information on the real impact of the market situation on financial risks both at a particular enterprise and in the industry as a whole (Dyrreng, Hanlon, & Maydew, 2010).

Assessing and controlling market risk is one of the key components of PJSC “Acron” financial management. The development of market risk is associated with a large number of external factors, and therefore all market risks are systematized into three large groups: currency risk, interest rate risk, and liquidity risk (Ross, 1977).

PJSC “Acron” is exposed to a significant foreign exchange risk due to a significant share of revenue and borrowed funds denominated in foreign currencies. Historically, the structure of attracted funds was dominated by the attraction of funds denominated in US dollars and in Russian rubles, as well as a small amount in euros. As at December 31, 2018, the share of loans denominated in US dollars was 54%; the share of loans denominated in Russian rubles amounted to 41%; the share of loans in euros amounted to 5%.

The main source of revenue for PJSC “Acron” is export operations. This is due to the fact that most products are exported outside the Russian Federation, and the share of these products in 2018 amounted to 73% of total production. PJSC “Acron” is exposed to currency risks, primarily due to the instability of the Russian ruble against the US dollar.

Another important component in the structure of market risks of PJSC “Acron” is interest rate risk. Over the past period, PJSC “Acron” managed to optimize interest rate risk. In 2018, a decrease in the cost of lending was influenced by the positive situation in the financial markets and high liquidity in the banking sector. In addition, foreign currency loans were refinanced at the best price conditions. The highest interest rates on ruble loans range from 9.1% to 14% per annum. Rates on loans in foreign currency often depend on the LIBOR rate, ranging from 2.48% to 5.61% per annum.

Changes in interest rates on attracted capital can have a significant impact on the financial result of the company. For PJSC “Acron”, the interest rate risk is quite difficult to interpret due to the variety of the currency structure of the borrowed funds, as well as in connection with a wide range of financing instruments (Kanishcheva, Askerova, & Zhdanova, 2018).

The different structure of the loan portfolio requires PJSC “Acron” to carefully monitor the basic interest rates on borrowed funds in the Russian securities market and through bank financing. An important indicator for assessing and monitoring this risk in the international market is the monitoring of the LIBOR indicator, which is the weighted average interest rate on interbank loans provided by banks. Credit risk arises due to a possible default by counterparties on operations, which may lead to financial losses for the enterprise.

An important condition for the operation of the enterprise is to maintain a high level of liquidity. Conducting continuous investment and production processes involves significant financial costs, which may lead to inability of the company to fulfill its obligations upon maturity.

This factor is associated with a significant dependence of PJSC “Acron” on the behavior of export prices and stakeholders. The risk of seasonality of demand for products due to poor diversification of products and sales markets, the volume of indicators of industry average sales, as well as changes in average indicative prices in the markets for finished products can cause instability of the incoming cash flow over time. The solution to this issue occurs through the use of various cash flow and liquidity management tools (Turygin, 2018).

The liquidity portfolio of PJSC “Acron” includes cash and cash equivalents, the amount of which at the end of 2018 amounted to 4,410 million rubles. in terms of Russian rubles and consisted mainly of funds in US dollars and Russian rubles, and decreased by 2751 million rubles compared to 2017, this dynamics is mainly associated with a significant reduction in cash on term deposits.

It is important to evaluate liquidity assessment both in the short and long term, as well as make comparisons with industry averages. Let us look at PJSC “Acron” liquidity ratios and compare them with the industry averages in Table

From the data in Table

In October 2015, the Moody’s Investors Service rating agency upgraded PJSC “Acron” long-term foreign currency corporate rating from “B1” to “Ba3”. In 2018, the rating was not revised.

Findings

The impact of financial risks on PJSC “Acron” requires regular monitoring of the situation in the financial market and finding effective ways to overcome them. This issue is relevant for PJSC “Acron” primarily because of the large number of external factors and the fact that the business is being done in the markets of different countries.

According to the development strategy adopted by the PJSC “Acron”, as part of improving the current risk management system, it is planned to take measures to: maintain a moderate debt burden, work to improve credit ratings, lower the average interest rate on loans and borrowings, monetize portfolio and non-core assets and ensure an adequate liquidity reserve and diversification of the risks of implementing investment projects through the involvement of strategic partners.

In order to maintain a moderate level of debt load PJSC “Acron”, according to the new development strategy, will reduce the “total debt” indicators and improve the “net debt/EBITDA” ratio in both ruble and dollar terms. As part of implementing this policy for 2018, PJSC “Acron” was able to reduce its “total debt” indicator by 6% compared to 2017.

The change in the “net debt/EBITDA” was achieved due to an increase in EBITDA by 21% in 2018 with an increase in net debt by 16%. Thus, the indicator “net debt/EBITDA” for 2018 showed an increase from 1.9 to 2, and in ruble terms due to the favorable ruble rate from 2 to 1.7.

Also, in order to reduce the financial load indicator, PJSC “Acron” constantly carries out the process of on-lending and diversification of funding sources. So, in 2018, against the backdrop of an improving market for dollar loans, PJSC “Acron” refinanced loans at the best price conditions, including the debt due for payment in the future. Also, as a part of the development of an effective loan portfolio management, PJSC “Acron” implements a process of constant control over the price of short-term borrowed financing.

As a part of the long-term process of reducing financial risks, PJSC “Acron” is developing a long-term strategy to increase credit ratings. Thus, according to estimates by the international rating agency Fitch, PJSC “Acron” has been able to increase its credit rating in foreign and national currencies over the past period. One of the factors that stabilized the credit rating was the completed process of vertical integration of production in various segments. A stable credit forecast is based on the reliable estimates of future profits associated with the upcoming increase in production of major product groups. As part of the assessment, Fitch changed the following credit ratings of PJSC “Acron”:

short-term foreign currency default credit rating increased from “B +” to “BB-“;

national scale long-term credit rating increased from “A” to “A +”;

senior unsecured credit rating in national currency was upgraded from “B +” / ”RR4” to “BB-“ / ”RR4”.

An important development goal of PJSC “Acron” is to control the reduction of interest rates on loans. The main tools to reduce such risks are the active work to minimize short-term credit risks due to the presence of an extensive pool of lenders and a large number of open credit lines, as well as attracting large investments in the form of syndicated loans.

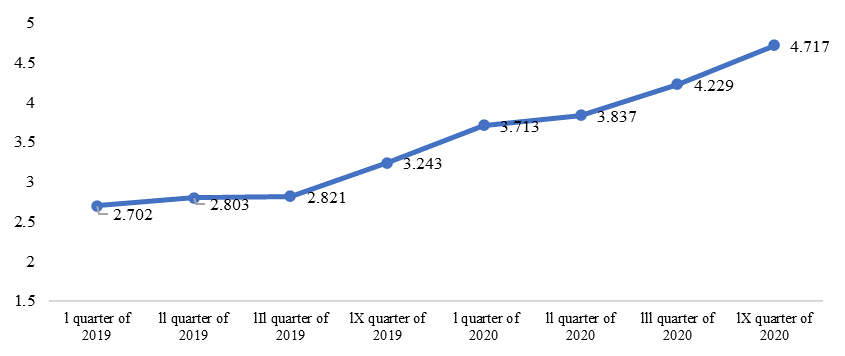

Despite this, the risk remains quite important for the PJSC “Acron” and its development is closely related to various environmental factors. One of the indicators that serves to analyze interest rate risk today is the LIBOR size. The predicted LIBOR values give disappointing forecasts for the future prospects of dollar lending, so according to the Figure

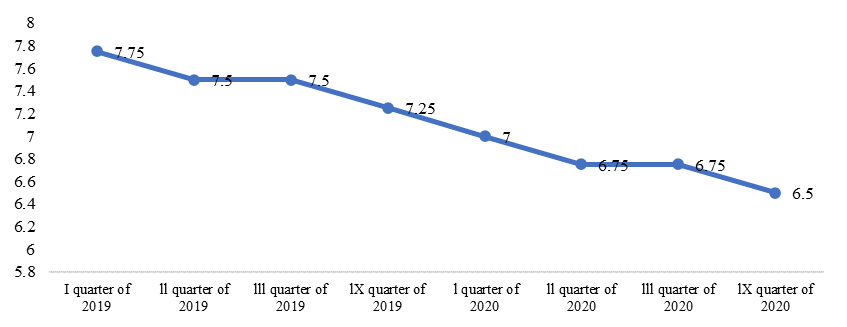

Stabilization of the process of growth in the refinancing rate of the Central Bank of the Russian Federation and a decrease in interest on bank deposits has become one of the reasons for the decrease in interest rates on loans in Russian rubles, but the interest rate on such loans today still remains higher than foreign ones. Figure

Loans in rubles remain extremely important for PJSC “Acron”, since the Russian ruble is the functional currency of the enterprise, and refusal of such loans is impossible. However, PJSC “Acron” must constantly monitor the borrowed funds market and raise funds through various credit lines.

Despite active control over the loan portfolio, PJSC “Acron” spends a lot of money to pay interest on borrowed capital. In order to reduce such costs for bank intermediary operations in the lending process, in modern conditions technologies that are able to remove the bank from the intermediary chain between the client and the credited entity are created.

Today, a new promising technology in the lending process between those wishing to make a contribution and get a loan is the crowdlending technology. Crowdfunding serves as an alternative to banks and allows one to receive loans according to the p2b model without the involvement of the bank as an intermediary in the process of performing the operation (Aristarkhova, Zueva, & Zueva, 2018).

The largest crowdlending company in the Russian market is Penenza, a crowdlending P2B platform. The money on this platform is used for the target use – financing of security through a tender or to execute the tender itself (Bliss, Cheng, & Denis, 2014).

However, the application of this method to finance the activities of such a large method is extremely labour intensive today. The reason for this is that the regulation of the mutual lending market in Russia is in its infancy, another reason is the lack of a large number of users on such platforms and a large amount of financing, since the Russian crowdlending market is estimated at only 25 billion rubles.

Monetization of portfolio and non-core assets is one of the secondary methods of reducing the impact of financial risks. This method is currently underdeveloped in the company, and the only asset to be sold is a 19.8% stake in the Polish company Grupa Azoty, whose market value of the stake for December 31st, 2018 is amounted to 22.6 billion rubles. Revenues from the sale of this shareholding may go towards debt servicing or the payment of dividends.

If this method is used as an effective protection against financial risks, diversification of the objects of portfolio and non-core assets should be made, as the monetization of this asset can be complicated due to weak demand for this shareholding.

One of the important problems of effective financial risk management in PJSC “Acron” is a significant lag in the level of indicators in comparison with industry average values. In the event of solvency problems in the short term, PJSC “Acron” has portfolio investments, as well as funds to quickly repay current liabilities. In addition, PJSC “Acron” has a significant stock of unused credit lines.

The diversification of the risks of implementing investment projects through the involvement of strategic partners is also considered one of the aspects of reducing financial risks. This method of risk diversification is used today in the formation of the PJSC “Acron” further investment program.

So, together with JSC “Dorfos”, it is planned to implement a joint project for the construction of complex fertilizer production, the production volume of which will be 1 million tons of complex fertilizers per year, the forecast investment volume for the project will be $320 million.

Also, together with Russian Railways, a project is underway to build a railway line to organize the shipment of apatite concentrate directly from the mining and processing plant “Oleniy Ruchey” industrial site.

In addition, the implementation of foreign projects of PJSC “Acron” in conjunction with CanPacific Potash Inc. continues. They are developing a project for future development at 13 sites of a potash deposit in the Saskatchewan province of Canada in an area of about 0.6 million acres. The existing resource base can significantly reduce the price risk caused by the monopolization of PJSC “UralKali” on the Russian potash market.

Price risks should be avoided by searching for new markets where the price is above the level of average indicative prices. One of the most promising mineral fertilizer markets, according to RIA Analitika, thanks to strong demand, is Brazil, which increased imports of this fertilizer by 50% in three years, and active purchases in India, where good weather conditions contributed to a high level of fertilizer application.

Conclusion

A practical study of the financial risk management of a commercial enterprise using the example of PJSC “Acron” showed a close relationship between the effectiveness of managing a loan portfolio and working with currency risks, and this dynamics is observed both in the company itself and in the market as a whole.

The company was able to successfully resist the state of the market due to the timely implementation of the program of intensification of expenses, as well as the active diversification of the loan portfolio. Timely management of the loan portfolio and foreign exchange risks allowed to reduce the cost of servicing loans in 2018 compared to 2017 by 10.2%.

The study of a specific enterprise helped to detail the tasks set both in the framework of solving practical and theoretical issues. When considering ways to optimize the financial risks of PJSC “Acron”, it became clear that the use of financial risk optimization programs is individual for each individual enterprise. In order to reduce financial risks, in addition to theoretical calculations, one should study the industry environment and, based on the activities of competitors, develop the most effective strategy for reducing both existing financial risks and clearly identify factors that will become decisive in the future in the process of analyzing financial risks.

Thus, financial risks play an important role, both as a subject of theoretical study and a practical one. Any organization should monitor the structure, size of its currency and credit risks, and the liquidity indicators. The data obtained during the study will allow to carry out effective measures to optimize them in the future. The example of PJSC “Acron” shows how a competently implemented cost-intensification program helps to avoid significant losses with a general drop in prices for the main products. Therefore, the study of cost optimization models is extremely important in conditions of economic instability. Based on theoretical research organizations should choose the appropriate strategy for the development of their business (Ancygina, Zhukov, & Sypchenko, 2017).

References

- Ancygina, A. L., Zhukov, A. N., & Sypchenko, A. E. (2017). Macroeconomic determinants of entrepreneurial activity at various phases of the business cycle: regional level. Ekonomika regiona, 4, 1096-1106. [in Russ.].

- Aristarhova, M. K., Zueva, O. K., & Zueva, M. S. (2018). Enterprise tax stability model. Ekonomika regiona, 14(2), 676-687. [in Russ.].

- Bliss, B. A., Cheng, Y., & Denis, D. J. (2014). Corporate payout, cash retention, and the supply of credit: Evidence from the 2008-2009 credit crisis. Journal of Financial Economics, 115(3), 521-540.

- Dyreng, S. D., Hanlon M., & Maydew E. (2010). The Effects of Executives on Corporate Tax Avoidance. The Accounting Review, 85(4), 1163-1189.

- Kanisheva, N. A. (2019). The investment process and its participants. In V. N. Hodyrevskaya (Ed.) The quality of management personnel and the economic security of the organization: Proceedings of 13th the national sci. pract. conf. Hodyrevskie chteniya (pp. 51-53). Kursk: Kursk State University. [in Russ.].

- Kanishcheva, N. A., Askerova, M. A., & Zhdanova, N. V. (2018). Problems of Commercial Enterprise Investment Policy Implementation at The Present Stage. The European Proceedings of Social & Behavioural Sciences, 59, 590-600.

- Lucas, R. E. (1976). Econometric Policy Evaluation. A Critique Carnegie-Rochester Series on Public Policy, 1, 19-46.

- Ramalingegowda, S., & Wang, Yu. (2013). The Role of Financial Reporting Quality in Mitigating the Constraining Effect of Dividend Policy on Investment Decisions. The Accounting Review, 3(88), 1007-1039.

- Ross, S. (1977). The Determination of Financial Structure: The Incentive-Signalling Approach. The Bell Journal of Economics, 8(1), 23-40.

- Turygin, O. M. (2018). Internal sources of increased financing for investment in fixed assets. Ekonomika regiona, 14(4), 1498-1511. [in Russ.].

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 December 2019

Article Doi

eBook ISBN

978-1-80296-076-1

Publisher

Future Academy

Volume

77

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1056

Subjects

Industry, industrial studies, project management, sustainability, business, innovation

Cite this article as:

Kanishcheva*, N. A. (2019). Commercial Enterprise Financial Risks Management. In I. O. Petrovna (Ed.), Project Management in the Regions of Russia, vol 77. European Proceedings of Social and Behavioural Sciences (pp. 253-261). Future Academy. https://doi.org/10.15405/epsbs.2019.12.05.30