Abstract

The article presents an analysis of change trends in the number of self-employed people in the economy of Russia and those countries of the world that are characterized by the increase in its share in the economically active population. The necessity of improving the regulation of self-employed activities, including taxation, is substantiated. The characteristic of the special tax regime introduced in Russia, which regulates the activities of the self-employed population as an experiment in four constituent entities of the Russian Federation, is presented. Based on the reasons stimulating this type of activity, three groups of self-employed are determined: lack of employment; self-reliance and independence in work; creative self-realization. Identified restrictions in the registration of self-employed are associated with the fear of an increase in the tax burden (payments to insurance and pension funds). The growth in the number of self-employed since the beginning of experiment caused by the introduction of “professional income tax” is analyzed. The tax can have the following negative consequences: the transition of individual entrepreneurs to the self-employed group, a reduction in tax revenues, the redistribution of tax revenues from federal to regional budgets, the difficulty of accounting for cash settlements, the likelihood of moving relations with employees to the civil law sphere, the lack of mechanisms for monitoring activities of self-employed. Ways for improving the introduced tax regime for the self-employed groups were identified, including the use of a system of fines and incentives, patent taxation.

Keywords: Income taxself-employedtaxationtax rates

Introduction

One of the features of the current stage of development of the world community is the desire of people for independence in economic activity: an increasing number of them are ready to engage in freelance and be self-employed.

The data of the Organization for Economic Cooperation and Development (OECD) indicate that currently the share of the self-employed population in different countries of the world is from 10.0% to 25.0% of the working population (Niall McCarthy, 2018). The results of numerous studies show that this proportion is increasing (Jansen, 2017; Bradley, 2016).

According to the information and analytical project of Json & Partners Consulting (Json & Partners Consulting, 2016), by 2020, up to 14.0 million Russians, i.e. one fifth of the working-age population will engage in freelance activity periodically or permanently, since the level of development of modern technologies allows a person to be in one part of the planet and do work for companies operating in another part of the planet. This phenomenon has a positive effect on the conditions and results of labor, on the possibilities for self-realization of a person, helps to reduce the enterprises’ expenses; however, it complicates the fulfillment of its functions by the state.

Obviously, in the next 20-30 years, countries will compete not only for attracting large companies to their territory and their investments, but also compete in retaining and attracting the population as a tax payer and consumer (Korobkova, 2014). A study by Data Insight LLC based on the results of 2017 showed that two-third of Russian self-employed already gets jobs from foreign customers; foreign freelance accounts for the largest share of the income of people working both in the domestic and foreign markets (55.0%) (Datainsight, 2017).

These trends indicate the need to improve the regulation of self-employed activities, including the regulation of its taxation.

Problem Statement

Understanding the importance of normative regulation of this type of employment, several attempts have been made in Russia to introduce a new tax system that is consistent with objective realities.

The first attempt was made in 2014 after the initiative of the President of the Russian Federation voiced to the Federal Assembly. The developed bill offered the introduction of a patent system of taxation for individual entrepreneurs operating without involvement of employees. According to the bill, a tax rate of 6.0% of income was established, which subjects of the Russian Federation could reduce to 0.0% for a period of up to two years. The next attempt to regulate the activities of the self-employed was made in the fall of 2015: in accordance with the proposed bill, a fixed amount of tax payment was determined (in the amount of 10.0 thousand rubles) and the registration procedure as a self-employed was simplified. However, these bills were not approved by the Federal Assembly. A variety of similar initiatives were discussed in subsequent years. The problem of determining the legal status of the self-employed was discussed in 2016 at a meeting of the Presidential Council for Strategic Development and Priority Projects.

In 2018, the President of the Russian Federation, understanding the urgency of the problem of regulating the activities of the self-employed, outlined the task of ensuring favorable conditions for the activities of this category of citizens as a priority. The result was the introduction in January 2019 of a special tax regime – “professional income tax” – as an experiment, in four constituent entities of the Russian Federation: Moscow, the Republic of Tatarstan, Moscow Region and Kaluga Region. The experiment established a tax rate of 4.0% and 6.0% of the self-employed income, depending on who the client is - the end user or entity. Registration of the payer of “income tax” is carried out in a simplified manner through the special mobile application “My Tax”. The tax is paid monthly; to do this, the payer should transfer the necessary amount to the account of the tax authority. The use of this tax regime does not imply the submission of a declaration or other accounting; the only way to control the taxpayer’s turnover on the part of the tax authorities is to monitor transactions with the taxpayer’s bank cards. The law stipulates that the tax rate for the payer of the “tax on professional income” cannot change for 10 years.

It should be noted that the term “self-employed” in Russia and in the world means a person who receives income from performing work tasks received directly from the customer. A self-employed can be either an individual entrepreneur or a freelancer. The tax regime introduced in Russia is focused on these individuals; however, individual entrepreneurs hiring workers are excluded from taxable entities, which is consistent with the understanding of the self-employed in the countries of the European Union, where an entrepreneur cannot hire workers.

Research Questions

In this research, the authors intended to answer the following number of questions.

What are the prerequisites for changing the number of self-employed and their features in Russia?

What are the features of taxation of the self-employed in developed and developing countries of the world?

What are the results of the experiment on the introduction of “professional income tax” in the regions of Russia?

What are the restrictions on use of the applicable tax regime?

Purpose of the Study

The article presents an analysis of the prerequisites and consequences of the introduction of a special tax regime for self-employed citizens of Russia – “professional income tax”. The study allowed to identifying problems and determining the prospects for introducing a tax on self-employed throughout the country.

Research Methods

Previous studies have shown dependence between the standard of living of the population and the share of the self-employed population. The analysis showed that as the standard of living of the population increases, the share of the self-employed decreases, due to the higher level of wages of wage workers and the amount of social guarantees provided to them (Gindling, Mossaad, & Newhouse, 2016). In other words, the traditional labor market models of developed countries imply the employee’s desire for maximum income and the free movement of labor from self-employment to large business. In contrast, in developing countries where significant government regulation of the labor market restricts formal employment by setting a minimum wage and taxation system for hired workers, informal employment is developing, which leads to the fact that workers are not officially employed and are forced to work in the informal sector or become self-employed (Lehmann, & Pignatti, 2018).

We believe that there are different prerequisites for the formation of self-employment, which largely determine the features of the development of this type of work in Russia.

We distinguish three groups of the self-employed population. The least successful group in terms of income size and stability of its receipt includes a population for which self-employment is a way out in the absence of another job. In most developing countries, this population group works in agriculture and in areas related to unskilled labor (Tokman, 2007; de Mel, McKenzie, & Woodruff, 2010). The produced agricultural products provide for their primary needs, and surpluses are sold. The second group of self-employed are people who, according to a number of researchers (Maloney & William, 2004), prefer self-employment because of their own independence and the possibility of generating additional income. And the third, most successful group of freelancers includes people engaged in creative and innovative work (Bennett & Estrin, 2007).

In most developing countries the largest part of the self-employed is represented by the first group. Accordingly, with economic development, the share of the self-employed population will decline, being replaced by wage earners. For developed countries, a third group of self-employed is preferable, which includes highly qualified specialists involved in the creation of unique products and developments. With the development of technology and the increasing role of human capital, their share in the economy will grow.

It should be noted that researchers define various prerequisites for the formation of self-employment as a form of economic activity, among them are job satisfaction (Hanglberger & Merz, 2015; Millán, Hessels, Thurik, & Aguado 2013), higher education (Habibov, Afandi, & Cheung, 2017) and others.

In Russia, all the self-employed groups mentioned above are represented. An expert survey was conducted to identify the areas of activity of the self-employed and determine their incentives. The experts were 170 experienced self-employed, working as freelancers for three or more years and having demanded accounts on popular freelance exchanges and service sites.

The survey showed the following results.

The first group, besides the self-employed in agricultural sphere, includes the population engaged in the provision of repair and construction services. Currently, there is a tendency to reduce the share of self-employed in the first group, due to a decrease in the informal sector in the economy.

The second group of self-employed is working in the field of education, the field of editorial services, including translation, in the beauty industry, in the field of real estate and transportation services. Self-employment of this group of people is connected both with the possibilities of independent earnings, and with the possibilities of obtaining more income when working without an intermediary in the form of the owner of the company. Most representatives of this group work with end users represented by individuals (up to 70% of customers).

The third group of the Russian self-employed is represented by workers in the IT industry, design (including graphics, architecture, typesetting, and multimedia developments) and specialists who sell their own photos, music, and illustrations through online stores. The key motivation for self-employment for this group is the possibility of self-realization, the absence of restrictions on creativity and work with those projects that are interesting. The tenants of these services are most often domestic and foreign companies (up to 80% of customers).

The represented self-employed groups in Russia are distinguished by their willingness to work in the new tax regime, as well as the ability to work with mobile applications, the desire to legalize income, the understanding of the need to provide reporting documentation to clients, etc. The distinguished features of the behavior of self-employed groups should be taken into account when regulating taxation.

The introduction of a “professional income tax” in Russia was not due to the need for fiscal regulation of the market, but to the desire of legalizing the shadow economy. In the next 10 years, under the conditions of an unchanged tax rate, which is guaranteed by law, a substantial reduction in self-employed, acting informally, is expected. To a large extent, this is expected due to the establishment of a relatively low tax rate, which is much lower than in most developed countries (Table

At the same time, the results of the survey showed that most self-employed in Russia are afraid of an increase in the tax burden due to the transition to a special tax regime, including the introduction of mandatory payment of social contributions for retirement benefits.

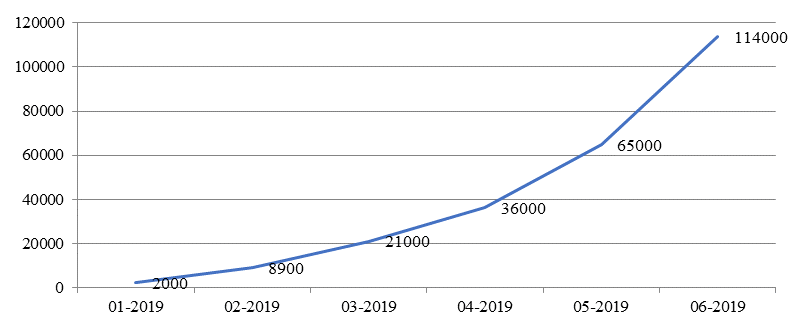

The dynamics of the number of citizens registered as self-employed in four regions of Russia since the start of the experiment to the present has proved its demand – an increase of 57 times (Figure

The results of the survey showed that some of those registered as self-employed do not live in the territory where the experiment is conducted, but they have clients in one of the four constituent entities of the federation, which allows for conclusion that it is advisable to introduce a special tax regime that is positively assessed by the self-employed throughout Russia.

Findings

The advantages of applying the new tax regime are obvious; however, there are certain contradictions that must be eliminated before the introduction of the tax regime throughout Russia in 2020.

Firstly, there are fears that citizens registered as self-employed are those who previously operated as individual entrepreneurs, i.e. the introduction of the tax regime did not contribute, as expected, to the legalization of informal employment, but rather allowed individual entrepreneurs to simplify the accounting process. However, this is not a problem provided that self-employed pay social contributions. According to the data of the year 2019, individual entrepreneurs in Russia are obliged to pay contributions to the Pension Fund in the amount of 29354.0 rubles (+ 1% of income if it exceeds 300.0 thousand rubles) and the Federal Compulsory Medical Insurance Fund in the amount of 6884.0 rubles. Thus, insurance funds may receive less than 4.0 billion rubles a year if the registered self-employed (previously individual entrepreneurs) will not pay social contributions. In this case, the losses of the consolidated federal budget also increase: individual entrepreneurs choosing a simplified tax regime can pay taxes in the amount of 6.0% of income, or 15.0% of profit. Self-employed people who switched to paying “professional income tax” pay 4.0% of the turnover when working with individuals or 6.0% when working with legal entities. A lower tax rate will reduce tax revenue. In addition, the budget for tax revenues will change: a simplified taxation system involves payments to the federal budget, and 63.0% of the “income tax” goes to the regional budget.

Secondly, the liability of the person carrying out activities the income from which is taxed with “professional income tax” is changing. In the Russian Federation, administrative or criminal liability arises if a person carries out entrepreneurial activities without state registration as an individual entrepreneur or legal entity. Registration of citizens as self-employed is voluntary and does not entail liability. This can lead to the abandonment of entrepreneurship and work as an employee in the informal sector. Restrictions on inspections, proposed as a self-employed incentive, can aggravate the situation with shadow employment due to the reorientation of individual entrepreneurs to the new tax regime.

Thirdly, certain difficulties may be caused by the provisions of the law prohibiting the payment of “professional income tax” by persons hiring workers under labor contracts. Obviously, an individual entrepreneur wishing to pay a “professional income tax” will switch to civil law relations with employees. Thus, the labor rights of workers will be violated and, most likely, as a result, the payment of “professional income tax” by such employees will become impossible, since, assuming such an outcome, the drafters of the law provided for a corresponding clause according to which the provision of services on civil law contracts to former employers is prohibited.

Fourth, the law does not exclude the possibility of mutual settlements in cash; however, it is not determined how the tax reporting will be formed in this case. In addition, the possibility of cash payments without using online cash desks will be an outlet for individual entrepreneurs who do not seek to use them.

Fifthly, the tax authorities need to determine how the self-employed will be monitored, namely, whether banks will participate in monitoring the movement of funds on accounts. How the ones that relate to professional activities, and are not friendly transfers, will be singled out from the huge mass of money transfers, remains an open question.

Conclusion

An experiment to establish a special tax regime in a number of Russian regions is aimed at legitimizing the self-employed and should create incentives for working in the formal sector. The main provisions of the tax regime are aimed at this, namely, simplified registration, electronic document flow, low tax rate, etc. At the same time, a number of provisions of the law require refinement and clarification, as it can lead to a negative effect in the form of a decrease in the number of individual entrepreneurs, a decrease in contributions to insurance funds. In addition, although the proposed tax regime is not aimed at increasing revenues to the tax budget, the ambiguity of a number of its provisions may lead to losses in the consolidated budget of the regions and the Russian Federation. We believe that the effectiveness of the tax regime largely depends on the sense of civic responsibility of its potential payers.

It seems that the existing format of the special tax regime for the payment of “professional income tax” is intended mostly for the third group of self-employed. On the one hand, they require official paperwork when making transactions with customers, on the other hand, the sense of justice among the indicated category of citizens is stronger. Representatives of the second group of self-employed will undergo registration procedure, as this will increase their status and will become the evidence of their independence. However, they will not fully legalize their income and, where possible, will make cashless payments. Therefore, for this category of self-employed, it is necessary to provide a system of fines for illegal activities and a system of incentives for the payment of pension contributions. The first group of self-employed is the most difficult from the point of view of regulation due to the lack of special knowledge on keeping records of activities among representatives of this category. We believe that the patent tax system, which involves the payment of a fixed amount of taxes, will be most convenient for them.

Acknowledgments

The reported study was funded by RFBR and Penza region according to the research project №19-41-580008.

References

- Bennett, J., & Estrin, E. (2007). Entrepreneurial Entry in Developing Economies: Modelling Interactions Between the Formal and Informal Sector. Working paper, 44, 1-24. London: School of Economics.

- Bradley, J. (2016). Self-employment in an equilibrium model of the labor market. IZA Journal of Labor Economics, 5(1), 1-30.

- Datainsight (2017). Freelance in Russia. Retrieved from http://www.datainsight.ru/en/paypal-freelance17-ENG

- De Mel, S., McKenzie, D., & Woodruff, C. (2010). Who are the Microenterprise Owners? Evidence from Sri Lanka on Tokman v. de Soto. Policy Research Working Paper 4635, 1-35. Retrieved from http://documents.vsemirnyjbank.org/curated/ru/814061468302955199/pdf/wps4635.pdf

- Gindling, T. H., Mossaad, N., & Newhouse, D. (2016). How Large are Earnings Penalties for Self-Employed and Informal Wage Workers? IZA Journal of Labor & Development, 5(11), 1-3.

- Habibov, N., Afandi, E., & Cheung, A. (2017). What is the effect of university education on chances to be self-employed in transitional countries? Instrumental variable analysis of cross-sectional sample of 29 nations. International Entrepreneurship and Management Journal, 13(2), 487-500.

- Hanglberger, D., & Merz, J. J. (2015). Does self-employment really raise job satisfaction? Adaptation and anticipation effects on self-employment and general job changes. Journal for Labor Market Research, 48(4), 287-303.

- Jansen, G. (2017). Farewell to the rightist self-employed? “New self-employment” and political alignments. Acta Polit, 52(3), 306-338.

- Json&Partners Consulting. (2016). Remote job is the future of Russia. Retrieved from http://json.tv/ict_news_read/udalennaya-rabota-buduschee-rossii-20161205044710. [in Russ.].

- Korobkova, N. A. (2014). Meeting the needs of consumers of the territory as a basis for the development of its potential. In G. A. Reznik (Ed.) Experience and problems of social and economic transformations in the conditions of transformation of society: region, city, enterprise, XII International scientific and practical conference, 29-33. Penza: Penza state agrarian university. [in Russ.].

- Lehmann, H., & Pignatti, N. (2018). Informal employment relationships and the labor market: is there segmentation in Ukraine? Journal of Comparative Economics, 46(3), 838-857.

- Maloney, W. (2004). Informality Revisited. World Development, 32, 1159-1178.

- Millán, J. M., Hessels, S. J., Thurik, R., & Aguado R. (2013). Determinants of job satisfaction: A European comparison of self-employed and paid employees. Small Business Economics, 40(3), 651-670.

- McCarthy, N. (2018). Where Are The World's Self-Employed? Statista. Retrieved from https://www.statista.com/chart/14443/where-are-the-worlds-self-employed/

- Tokman, V. E. (2007). Modernizing the Informal Sector. DESA Working Paper, 42, 1-13. Retrieved from https://www.un.org/esa/desa/papers/2007/wp42_2007.pdf

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 December 2019

Article Doi

eBook ISBN

978-1-80296-076-1

Publisher

Future Academy

Volume

77

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1056

Subjects

Industry, industrial studies, project management, sustainability, business, innovation

Cite this article as:

Patturi, Y. V., & Korobkova*, N. A. (2019). Self-Employed Taxation: Russian Realities And Prospects. In I. O. Petrovna (Ed.), Project Management in the Regions of Russia, vol 77. European Proceedings of Social and Behavioural Sciences (pp. 203-210). Future Academy. https://doi.org/10.15405/epsbs.2019.12.05.24