Abstract

At present, the development of methodological provisions and effective tools in the field of assessing the effectiveness of the use of budget funds by the constituent entities of the Russian Federation in the process of participation in the implementation of investment programs aimed at the socio-economic development of the region is relevant in Russia. As a result, a methodological approach and an optimization algorithm for innovation and investment projects have been formed taking into account the interests of key stakeholders (using the example of the city of Sevastopol), which, given resource constraints, will ensure increased competitiveness of the constituent entity of the Russian Federation, an increase in added value in the mesoeconomic system under consideration, and an improvement in the quality of life of the population. The developed methodological provisions can be used on an ongoing basis to assess the effectiveness of the implementation of investment projects with the involvement of budget funds. The proposed indicators for assessing the effectiveness of innovation and investment activities of Sevastopol in the context of limited financial resources will allow city management to identify “bottlenecks” in a timely manner, where there are significant deviations of the current state of the system from the planned indicators, which indicate areas of increased risk, and purposefully carry out managerial impacts for ensuring the transition of the system to the required state from the perspective of the expectations of the key stakeholder – the population, and also to improve the efficiency of budget spending.

Keywords: Budget investmentseffectivenessinnovationsregional economyresource provisionstrategic development

Introduction

The Strategy of Socio-Economic Development of Sevastopol until 2030 defines a number of key tasks to ensure the creation of a highly efficient economy focused on the production of products and services with high added value, the establishment of the city as a business center, center of tourism, education and culture, the formation of a comfortable urban environment for residents and guests (The Law of Sevastopol, 2017). At the same time, as the risk analysis of the implementation of the strategy of socio-economic development of Sevastopol (Palkina, 2019) showed the lack of financial autonomy is the most significant factor determining the rate of realization of the investment potential of the city and the growth of gross regional product. This leads to the formation of increased requirements for the efficiency and effectiveness of the use of budget funds allocated for the implementation of investment projects in the field of housing and communal services, construction, the resort and recreation complex, transport infrastructure and others, especially those with high capital intensity.

Problem Statement

The issues of economic development of territories on an innovative basis, the creation of a favorable investment climate in the constituent entities of the Russian Federation are given great attention both by state authorities and domestic, foreign scientists and specialists (Sevastopol City Strategy, 2017; Order of the Government of St. Petersburg, 2018; GOST ISO 9000-2011, 2012; Balashova, Krasovskaya, Schislyaeva, & Shamrai, 2019; Dudin, Kutsuri, Fedorova, & Namitulina, 2015; Kazanskaya & Palkina, 2016; Kokh, Prosalova, Smolyaninova, Loksha, & Nikolaeva, 2018; Mochalin & Kasper, 2017; Tayurskaya, Okladnikova, & Solodova, 2018; Ugoani, 2019). At the same time, the authors' attention is paid mainly to the issues of investment efficiency, mainly in the form of private capital, organization of innovative activity, its impact on the economy. In Russia, along with some other countries, the concept of target-oriented financing is used, which involves the distribution of budget funds between approved state programs and national projects. At the same time, despite the enormous resources spent on the implementation of these programs and projects, the degree of achievement of the goals is extremely low according to the data of the portal of the state programs of the Russian Federation (Portal of state programs of the Russian Federation, n. d.), the level of concretization, the reliability of the information used for the operational preparation and adoption of corrective managerial influences is not high. Existing modelling techniques are not universal and require adaptation to the specific conditions of the functioning of the economic system. In addition, existing developments in the field of evaluating the effectiveness of investment decisions made, especially in the field of budget finance, do not provide for the expectations of such a key stakeholder as the population, as a rule, are fragmented and do not take into account the economic specialization of the regions, in other words, the determined “growth points” of the economy specific subject of the Russian Federation. Thus, the problem of increasing the effectiveness of the use of budget funds is not sufficiently developed in the scientific literature and requires additional research, the search for new non-standard approaches to its solution.

Research Questions

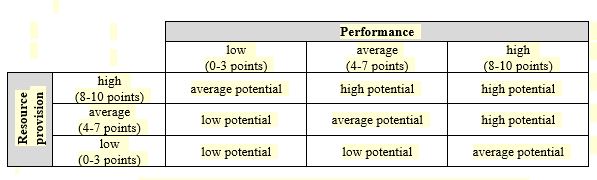

The most important issues in this area that need more detailed study, the development of scientific and practical recommendations, in our opinion, include: determining a methodological approach, an algorithm for optimizing innovation and investment projects taking into account the interests of key stakeholders to ensure increased competitiveness of the subject of the Russian Federation, growth added value in the considered mesoeconomic system and improving the quality of life of the population under resource constraints; building a matrix reflecting the position of the subject of the Russian Federation, its current level and potential for socio-economic development from the standpoint of resource provision and the effectiveness of the implementation of investment projects.

Purpose of the Study

The purpose of this study is to develop guidelines and effective tools for assessing the effectiveness of the use of budget funds by the constituent entities of the Russian Federation with the participation in the implementation of investment programs aimed at the socio-economic development of the region.

Research Methods

To solve the research tasks, we applied a systematic approach, methods of comparative, statistical analysis, expert estimates, matrix construction, mathematical modeling, synthesis, generalization, grouping, a criteria-based approach with integrated assessment of results, and a model of a quality management system based on a process approach (GOST ISO 9000-2011, 2012).

Findings

The basis of the socio-economic development of the subject is its innovation and investment activity. The algorithm for optimizing the portfolio of innovation and investment projects of a constituent entity of the Russian Federation, implemented at the expense of budgetary funds, before making an investment decision, in our opinion, should contain the following key evaluation modules that reflect the interests of the triad of key stakeholders “state - society – business”:

1) checking the degree of innovation of the investment project (to increase the export product potential of the region, it is necessary to ensure an international or national level of competitiveness of goods / services and consider this criterion as a limiting condition for further evaluation);

2) selection of projects contributing to the achievement of the established target values of performance indicators for the implementation of the strategy of socio-economic development of the subject of the Russian Federation;

3) ranking of projects according to performance indicators, investment criteria (payback period, budget efficiency, economic value added (NPV), internal rate of return and others).

Thus, the task of optimizing the portfolio of innovation and investment projects of a constituent entity of the Russian Federation, implemented at the expense of budgetary funds, is reduced to selecting investment projects that meet the requirements of effectiveness and efficiency as much as possible, subject to a limiting condition – the degree of innovation of the project.

It should be noted, in contrast to efficiency, which means the relationship between the achieved result and the resources used, effectiveness is understood as the degree of implementation of the planned activity and achievement of the planned results (GOST ISO 9000-2011, 2012).

For comparative assessment of the values of using the resource and managerial potentials of the socio-economic development of the subject of the Russian Federation and a graphical interpretation of the results, it is proposed to construct a matrix of “resource availability – effectiveness” (Figure

It should be noted that when determining the level of resource provision / effectiveness of budget investments of a constituent entity of the Russian Federation, an integral assessment indicator is used that takes into account the weight (importance) of the corresponding indicators.

First, one needs to define the performance criteria. The key stakeholder in the activities of state authorities, commercial organizations are residents of the city of Sevastopol. Accordingly, based on a process approach to management, the main principle of which is customer focus, it is proposed to evaluate the effectiveness of investments made with the participation of the capital of the subject of the Russian Federation and federal budget funds using a set of relevant indicators that reflect various spheres of life and provide basic human needs, namely:

provision of housing, sq. m/person;

the proportion of the population provided with water that meets safety requirements, %;

the proportion of the population provided with food that meets safety requirements, %;

mortality rate, people;

the number of people born;

workload per doctor, number of visits per 1 doctor;

average hospital bed occupancy, days;

average life expectancy, years;

the proportion of the unemployed among working age people, %;

share of population with higher education, %;

provision with employees of social institutions (hospitals, kindergartens, schools, etc.), %;

the proportion of students in the first shift in schools, %;

the proportion of the population with incomes below the subsistence level, %;

provision of population with leisure facilities (museums, theaters, restaurants), number per 1000 people (both city residents and tourists);

number of hotel rooms, units;

the number of bottlenecks in the areas of transport infrastructure that limit the livelihoods of the population, the development of tourism, industry;

waiting time for the vehicle to be delivered, including at the final points of the route and interchange nodes, min.;

the amount of harmful emissions into the atmosphere, mg/cubic m;

amount of water pollution, mg/l;

share of utilized waste, %.

After this, it is necessary to determine for each indicator the criteria and actual values achieved using the method of expert evaluations and assign a level of importance based on an analysis of deviations and significance level, so that the sum of the importance of all indicators is 100%. The importance (or weight) of the indicator shows how the estimated indicator affects the effectiveness of investment activities carried out at the expense of budget funds.

The second key parameter of the matrix is the resource supply of budget investments (financial, labor, time, material, information, intellectual (know-how) resources). By analogy, it is necessary to determine the importance level for each indicator established by experts, so that the sum of the importance of all indicators is 100%.

Next, each analyzed investment project by experts is assigned a certain score according to the parameters “resource supply” and “performance” on a qualimetric scale from 1 to 10 points, where 1 is the lowest score, meaning that this project has the lowest level of resource supply/performance for the indicator under consideration, and 10 is the maximum score, which means that for this indicator the investment project has the highest positive rating. It should be emphasized that the points are set on the basis of expert evaluation, taking into account the results of the analysis of the obtained quantitative and qualitative data on the implementation of investment projects.

At the next stage, it is necessary to calculate the consolidated score of the investment project, taking into account the importance of each indicator. To do this, one must first multiply the indicator weight by each indicator of the resource/performance assessment by the assigned score of a specific project and then summarize the obtained values.

After the final points for the projects under consideration are obtained by the parameters “resource supply” and “effectiveness”, one should proceed to the construction of the matrix of the same name presented above (Figure

After the final points for the projects under consideration are obtained by the parameters “resource supply” and “effectiveness”, one should proceed to the construction of the matrix of the same name presented above (Figure

Conclusion

As a result of the study, methodological provisions have been developed for a comprehensive assessment of the effectiveness of budget investments in social and economic development projects of a constituent entity of the Russian Federation, taking into account the economic zoning of territories and the interests of the triad of key stakeholders “state – society – business”. The developed methodological provisions can be used on an ongoing basis to assess the effectiveness of the implementation of investment projects with the involvement of budget funds. The proposed indicators for assessing the effectiveness of innovation and investment activities of Sevastopol in the context of limited financial resources will allow city management to identify “bottlenecks” in a timely manner, where there are significant deviations of the current state of the system from the planned indicators, which indicate areas of increased risk, and purposefully carry out managerial impacts for ensuring the transition of the system to the required state from the perspective of the expectations of the key stakeholder – the population, and also to improve the efficiency of budget spending.

Acknowledgments

Authors are grateful for financial support the Russian Foundation for Basic Research and the Government of Sevastopol. The scientific research was supported by the Russian Foundation for Basic Research jointly with the Government of Sevastopol within the framework of the project № 18-410-920016 r_а “Research of socio-economic and ecological processes of Sevastopol with the growth of industrial, traffic, transit and tourist potentials”.

References

- Balashova, E., Krasovskaya, I., Schislyaeva, E., & Shamrai, F. (2019). Calculation and analytical instrumentarium for estimating the economic efficiency of the digital technologies development process. IOP Conference Series: Materials Science and Engineering. DOI:

- Dudin, M., Kutsuri, G., Fedorova, I., & Namitulina, A. (2015). The Innovative Business Model Canvas in the System of Effective Budgeting. Asian Social Science. DOI:

- GOST ISO 9000-2011. (2012). Quality management systems. Basic provisions and vocabulary. Retrieved from http://docs.cntd.ru/document/1200093424

- Kazanskaya, L. F., & Palkina, E. S. (2016). Innovative Imperatives for Competitiveness of National Transport Systems in Conditions of Globalization. Globalization and Its Socio-Economic Consequences:16th International Scientific Conference, WOS:000393253800104.

- Kokh, L. V., Prosalova, V. S., Smolyaninova, E. N., Loksha, A. V., & Nikolaeva, A. A. (2018). Neural Network Theory Evolution as an Innovative Factor of Successful and Dynamic Development of Economic Systems. ESPACIOS, 39(38), 3. Retrieved from https://www.revistaespacios. com/a18v39n21/a18v39n21p39.pdf

- Mochalin, S., & Kasper, M. (2017). The calculated indicators’formation for the public passenger transportation system’s evaluation. Vestnik SibADI, 6, 37-47.

- Order of the Government of St. Petersburg. (2018). On the approval of the Methodological Recommendations for determining the performance indicators for legal entities to use budgetary investments in state property of St. Petersburg and assess their achievement 2018. Adopted on 19.01.2018. Retrieved from https://www.gov.spb.ru/static/writable/ckeditor/uploads/2018/01/23/3-п.pdf

- Palkina, E. S. (2019). Risk analysis for implementation of socio-economic development strategy in Sevastopol. St. Petersburg State Polytechnical University Journal. Economics, 12(3), 88-102.

- Portal of state programs of the Russian Federation. (n.d.) Retrieved from https://programs.gov.ru/Portal/analytics/quarterReportToGovernment

- Tayurskaya, O. V., Okladnikova, D. R., & Solodova, N. G. (2018). Investment In The Regional Economy: Challenges And Prospects. The European Proceedings of Social and Behavioural Sciences, 50, 1161-1168. DOI:

- The Law of Sevastopol. (2017). About the Approval of Sevastopol City Strategy for Social and Economic Development till 2030. Adopted on 21.07.2017 № 357-ZS. Retrieved from https://sev.gov.ru/files/strategy/357-zs.pdf

- Ugoani, J. (2019). Budget Management and Organizational Effectiveness in Nigeria. Business, Management and Economics Research, 5(2), 33-39. DOI: 10.32861/bmer.52.33.39

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 December 2019

Article Doi

eBook ISBN

978-1-80296-076-1

Publisher

Future Academy

Volume

77

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1056

Subjects

Industry, industrial studies, project management, sustainability, business, innovation

Cite this article as:

Kokh, L. V., & Palkina*, E. S. (2019). Improving Efficiency Of Budget Investments In The Russian Federation Subjects. In I. O. Petrovna (Ed.), Project Management in the Regions of Russia, vol 77. European Proceedings of Social and Behavioural Sciences (pp. 974-980). Future Academy. https://doi.org/10.15405/epsbs.2019.12.05.119