Abstract

The paper considers lines of development of unified cross-channel information solutions as they define the necessity to form intelligent information system with flexible orientation towards client's needs. Being thus formed, the product offers may lead to the following changes: merging of a mass of products or services previously unused by the client into a common information massif; using active predictive analytics, merging potentially possible product for the client that they may potentially use on the basis of their transaction and purchase history; formalizing a range of products or services that potentially improve client's quality or life or personal status; offering of alternative or packaged products that take into account future expectations of client and their potential needs. The author believes that a strategically important reference for development of intelligent cross-channel information solutions may lie in creating an adaptive architecture of cross-channel interactions with clients within the framework of existing information system while conforming to the following principles: changes into and coordination of already existing cross-channels within the boundaries of existing development strategy; Forming investments for creation of a new architecture of cross-channels embedded into existing business projects; Lack of cross-channel priority on the basis of its applicability for the client, determining a need for continuous monitoring of client-related information and products and services the client uses. As a tool for this, the paper proposes to develop a complex technique of intelligent verification of client interaction cross-channels.

Keywords: Bankingcreditfinance companiesinformation service

Introduction

Today, creation of a quality client-centered offer is impossible without using big data analytic technologies and artificial intelligence, which determines a necessity of continuous cooperation with trade networks, mobile communication and Internet providers and other financial intermediates. As a result, additional operational expenses arise in a budget of a credit and financial organization. Besides, in the context of Open Banking development that unites different financial services under a common user interface, new possibilities open for selection of products or desired services, impeding competitiveness of credit and finance organizations.

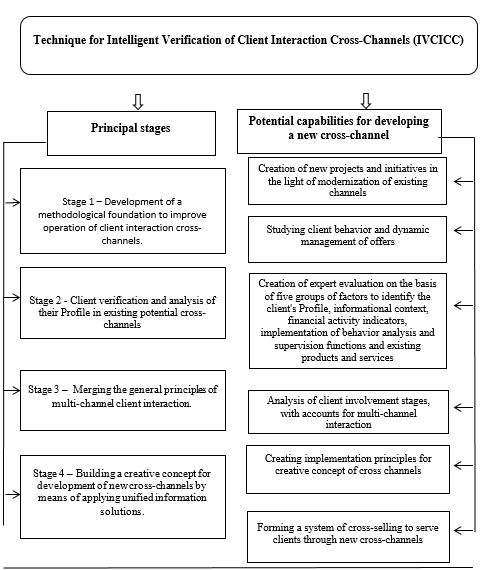

The author believes, that a solution for this situation may be development of a complex technique for Intelligent Verification of Client Interactions Cross-Channels (IVCICC) based on the OpenBanking concept (Osipov, 2013) and implemented as a step-by-step algorithm embedded into information solutions of organizations in credit and finances sector with account for strategic development milestones and search for new growth zones for banking business.

A determinative reference for practical application of IVCICC is a possibility of its subsequent application for development of a unified front-end information platform (hereinafter – UFIP), development of which the author proposes in the third chapter of the research and that includes Internet bank, mobile bank, management of personal finances and many other useful modules providing monetization of infrastructural information products and increased possibilities for digital marketing development.

Practically, within the concept of the technique being developed, UFIP serves as a storage of information data that unites information on client profile (Luger, 2016) formed from statistical information (sex, age, etc.), applied information context (current location, device, browser), client’s financial indicators, financial targets, behavior analysis, etc.

IVCICC algorithm consists of several sequential and mutually related stages:

The first stage involves development of a methodological foundation to improve operation of client interaction cross-channels.

The second stage involves client verification and analysis of their Profile within the boundaries of existing and potential cross-channels.

The third stage unites the general principles of multi-channel client interaction.

The fourth stage is characterized by building a creative concept for development of new cross-channels by means of applying unified information solutions.

Figure

Earlier we have already mentioned that development of intelligent verification of client interaction cross-channels within corporate applications (Whitten, Bentley, & Dittman, 2004) is determined by a need to use modern IT tools, such as resource planning systems (ERP – Enterprise Resource Planning, they are based on retrograde analysis of Plan/Actual), AI-based applications (BI – Business Intelligence), Corporate performance management (CPM), Customer Relationship Management (CRM) systems, machine learning models that apply predictive analytics to improve the efficiency of decision-making within the framework of package offer presentation.

Problem Statement

Practical implementation of IVCICC is possible only on the basis of using intelligent information systems, whose objectives are optimization of probabilistic parameters, forecasting, detailing of analytics and retrograde analysis of past data.

In Table

Development of advanced technologies in the modern context of banking services determines a need to improve the tactics of creating cross-channels, related largely to use of predictive analytics for forecasting of future events related to client behavior and changes in client's needs (Hofstede, Steetkamp, & Gordon, 2002). Earlier, we have already mentioned that constructing a predictive model supposes using various scenarios of client behavior with considerations for different conditions leading to various events, determining a need to create a system of continuous monitoring with accounts for revealing deviations from regular business practice.

From that, there is a need to develop a complex cross-channel information system, including to reveal cases of fraud and falsification in the bank, however, its practical implementation determines change in the architecture of existing information systems in creation of automatic solution for (Magomaeva, 2017):

application and improvement of existing standard control procedures to be used in standard observation of clients and inclusion of retrograde data.

Creation of operational risk data base that records daily realized and non-realized capital losses by the bank with computation of cost for each deviation.

Use of semi-automated control procedures related to analysis of client tickets and complaints for bank services.

Formation of automated control procedures, application of which on a constant basis will allow identifying risky operations of clients in terms of bank products (analysis of schemes of typical and suspicious client operations, including operations subject to mandatory control).

Practical implementation of IVCICC in combination with use of statistical and predictive methods, formalizes creating new-generation intelligent information solutions that combine analysis of structured and unstructured data that defies traditional analytic procedures. Unstructured and weakly structured data predominate in financial analytics and need additional information support and application of predictive methods to their processing with accounts to use of simulations and variable models. Analysis of unstructured data and their transformation into structured information supposes constant and continuous cycle of processing that supposes a need for its preliminary evaluation using:

- retrograde analysis and collection of analytics with accounts for Plan/Actual approach;

- method of rating evaluation with accounts for scenario modeling approach;

- CRISP-DM method to identify business target in case of creating a client's profile or operation;

- predictive analytics method for forecasting

- optimization method with probabilistic parameters of the cross-channel.

Research Questions

Having practical implementation of IVCICC in mind, organizations of credit-and-finance sectors may find it practical to construct rule-based algorithms with flexible conditions and client-dependent values. A key drawback of rule-based information solutions is a necessity of constant actualization and additional adjustment of the system in manual mode. Among other drawbacks of existing information solutions there are: small number of used parameters or values, subjective nature of assessment (different experts may have different scales of risks, which prevents ranking on a common scale with considerations for already known risk factors), use of already known characteristics of client and their operations without account for predictive evaluation, a need for adjustments and changes in functioning of the information systems as the number of operations and client characteristics grow, increase in the amount of transactions for remote service channels, appearance of new payment instruments. One may say that application of IVCICC in comparison with traditional information solutions allows solving tasks that were previously solvable only with the help of foreign-made information systems that combine scenario modeling, planning, predictive analysis, optimization-related and statistical modeling, retrograde analysis and machine learning. Besides, in addition to already used techniques for information systems, practical application of IVCICC allows using elements of integration in hybrid cross-channels that combine external data, ERP systems, CPM systems (Uskenbaeva & Bulegenov, 2016), BI systems and systems of statistical modeling on the basis of retrograde data, machine learning systems, CRM systems.

Purpose of the Study

The purpose of the study is to develop a complex cross-channel information system that may, among other uses, identify cases of fraud and falsification in a bank. It will allow solving tasks that were previously solvable only with the help of foreign-made information systems that combine scenario modeling, planning, predictive analysis, optimization-related and statistical modeling, retrograde analysis and machine learning.

Research Methods

Instrumental and methodological apparatus of the research was comprised by objective evaluations and determination of development vectors of information system as a new functional foundation for improved competitiveness of companies operating in the credit-and-finance sector. The instrumental foundation of the research was implemented with such methods and observation, modeling and method of scientific abstraction.

Findings

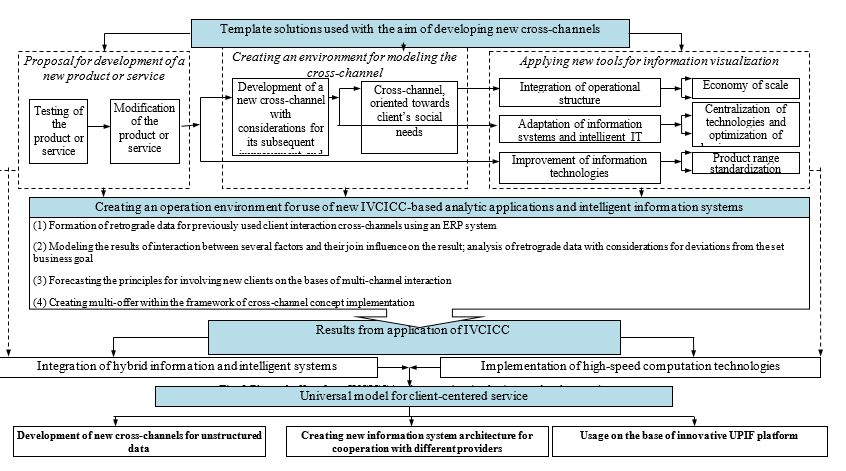

Figure

Among additional practical advantages of IVCICC there are: Ability to conduct timely testing of demand for retail products or services by means of studying targeted offers via different communication channels, studying of client needs to project a portrait of a potential client and implementation of intelligent information systems in the context of complete automation of bank's front-office from the moment of client's request to actual creation of a new cross-channel, which significantly changes business processes and allows optimizing operational expenses arising due to excess personnel and servicing software.

In Russia, this practice has not got wide currency yet, however there are already some preconditions for it. Due to this, the author sees a necessity to form a complex model of client-centered service in addition to implementation of new information solutions in the practice of creation of new cross-channels. In this model, the key role will be played by an innovative information platform that combines prognostic and predictive models of client behavior with new methods of processing unstructured data that defies traditional analytics.

Conclusion

A determining condition for practical implementation of IVCICC is a possibility to create on its foundation new models of client-centered information service in conditions of active development of open informational infrastructure of Open Banking that provides formation of new long-distance channels for clients with the aim of covering their needs, creating modular solutions and, in the end, opening new, more modern cross-channels for the financial market.

At the same time, it should be taken into account that practical development of a new client-centered service using advanced informational solutions assumes formation of a full-scale innovative information platform. A prototype of such a platform may be seen in the UPIF as a storage of information data for accumulation of statistical foundation and determination of the most significant characteristics of client's Profile.

The author sees the most probable prospects and effects of IVCICC implementation in possibility of its integration with hybrid information and intelligent systems with simultaneous implementation of high-speed computation technologies, thus allowing not only expanding ways of interactions with traditional information providers, such as mobile providers, NBCH, non-banking financial companies, microlenders, etc., but also with service companies interested in increasing their customer flow. For example, car hire companies, tourist companies, restaurants and incidental service companies.

Global practice shows that lack of common information platform for creation and marketing of cross-channels for credit-and-finance organization leads to fast replacement of traditional banking services with retailers providing credit-and-finance services in parallel to their main activities (Galazova & Magomaeva, 2018). This practice may be currently seen as exemplified by such trade and information giants as Amazon, Alibaba, Google, Apple, Samsung and others. Defying stereotypes, the non-banking organizations start creating loan and payment services on the basis of interaction with their own information systems.

Informational competition practically transforms into a technological revolution in the context of active charge from FinTech companies to expand the share of goods and services that are in most demand with their clients, where a special place is reserved for players aspiring to create their own payment systems, thus driving the weakest banks from the financial market.

References

- Galazova, S. S., & Magomaeva, L. R. (2018). New challenges and problems of financial market in the context of open bank system. Management, 6(3), 66–71.

- Hofstede, T., Steetkamp, R., & Gordon, P. (2002). International Market Segmentation-Issue & Perspectives. International Journal of Market Research, 19, 185–213.

- Luger, G. O. (2016). Artificial Intelligence: Structures and Strategies for Complex Problem Solving. Moscow: Dialectica.

- Magomaeva, L. R. (2017). Information and communication technologies in financial globalization worldwide. Economic Sciences and Humanities, 10(309), 72–84.

- Osipov, D. S. (2013). Development trends in banking and modernization of loan products. Banking loans, 4, 87–96.

- Uskenbaeva, R. K., & Bulegenov, D. A. (2016). CRM system as a necessary component of successful business. Young Scientist, 10, 101–105. Retrieved from: https://moluch.ru/archive/114/30286/ (Access date: 26.02.2019).

- Whitten, J. L., Bentley, L. D., & Dittman, K. C. (2004). System Analysis and Design Methods, 6 ed. New York: McGraw-Hill.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

28 December 2019

Article Doi

eBook ISBN

978-1-80296-075-4

Publisher

Future Academy

Volume

76

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3763

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, science, technology, society

Cite this article as:

Magomaeva*, L. (2019). Developing A Technique For Intelligent Verification Of Client Interaction Cross-Channels. In D. Karim-Sultanovich Bataev, S. Aidievich Gapurov, A. Dogievich Osmaev, V. Khumaidovich Akaev, L. Musaevna Idigova, M. Rukmanovich Ovhadov, A. Ruslanovich Salgiriev, & M. Muslamovna Betilmerzaeva (Eds.), Social and Cultural Transformations in the Context of Modern Globalism, vol 76. European Proceedings of Social and Behavioural Sciences (pp. 3544-3552). Future Academy. https://doi.org/10.15405/epsbs.2019.12.04.476