Abstract

Current trends in the banking sector development in Russia are undergoing significant changes related to the transformation of the banking system architecture due to changing approach of the Central Bank of the Russian Federation to the regulation of credit organization. Changing equity requirements, increasing regulatory burden on the banking sector is caused by the desire of monetary authorities to financially improve the banking system. However, in practice, such measures lead to the erosion of the category of regional small and medium-sized banks from the banking sector. The basis of financial system of the national economy and the regional national economy is a financial institution. In this regard, this article is devoted to the problem of identification and formalization of regional banks and the regional banking system within Russian banking sector. Approaches to the interpretation of the category of regional banks by scientific community, the legal system and monetary authorities are given. Grouping of credit organizations in Russia according to individual characteristics by the Bank of Russia is noted. Institutional, legal and functional approaches to the identification of a regional bank category are applied. Features and criteria of a regional bank are identified and systematized. Directions of the possible use of a differential methodology for regulating credit organizations in Russia are studied, regarding spatial unevenness of regional social economic state of the meso-level. Main directions of the regional banks interaction with regional authorities and business entities of the relevant region are proposed.

Keywords: Banking systemBankRussiacapitalregional

Introduction

An integral part of the dynamic social economic development of a territorial entity is a stable and efficient financial system. Moreover, if financial system has an appropriate definition in the scientific and educational literature at the national level, then the regional aspect of this category requires clarification and research. So, the concept of regional financial system is a poorly developed area of the financial science (Zotova & Kirichenko, 2015).

The authors also note that the term of regional financial system does not have an established definition in native economic science (Buianova & Diatlov, 2008).

Nikolaev (2010) under the regional financial system means the totality of financial relations arising in the process of formation, distribution and use of cash funds at the regional level.This interpretation is based on the understanding of national financial system of the state as a cash fund, only within the framework of the meso-level.

Kazakov (2013) in his interpretation of the above definition besides the aggregate of cash funds takes into consideration “special financial institutions”, which are designed to manage financial units on the territory of a specific subject of the country. Boldyreva (2009) has a similar point of view, emphasizing the important role of financial institutions in the process of formation and distribution of a monetary fund of the territorial entity. Obviously, under these institutions we should understand credit and financial organizations of the banking and non-banking types, which act as elements of the mechanism that mobilizes, generates and distributes financial resources in the reproduction process.

An exhaustive study of definitional approaches to the interpretation of “regional financial system” category is presented in the paper of Zavialova (2018), pointing out economic agents in her author’s definition. The above agents contribute to the social economic development of the meso-level interacting with each other through financial instruments.

Thus, the basis of regional financial system is the effective interaction of special financial institutions - credit and financial organizations forming the regional banking system. Consequently, the vector of social economic development of a particular region and the national economy as a whole will depend on the structure, balance and sustainability of the regional banking system.

Problem Statement

The issue of such a category as a regional banking system within the confines of Russian practice is associated with the lack of a final interpretation. In this regard, it is necessary to identify the concept of a regional bank for the formalization of this category, and its characteristics. The separation of regional banks into an individual institution of the banking system is under a sufficient justification and relevance in modern conditions of the economy primitivization, the influence of negative factors and the need to increase the pace of economic development of the meso-level. It is also important to note the transformation processes flowing in the banking sector and having a direct impact on the landscape of entire credit system of the country. Under these conditions, it is advisable to reconstruct the banking sector with the allotment of a regional bank institute.

Research Questions

For revealing the subject of research it is important to determine the main objectives:

1. To study the approaches to the interpretation of a regional bank as an economic category;

2. To use institutional, functional and legal approaches to identify a regional bank;

3. To distinguish and systematize the criteria for identifying the regional bank as an institution;

4. To suggest directions of interaction between the regional bank and the corresponding meso-level for ensuring dynamic social economic development.

Purpose of the Study

The purpose of the study is to identify a regional bank as a separate institution of the banking sector for further formalization of this category in order to reconstruct the landscape of Russian banking system.

Research Methods

For almost a 30-year period, Russian banking legislation have not formalized such important concepts for the institutional and functional development of the banking sector as “regional bank” and “regional banking system”. The Federal Law “On Banks and Banking Activities” provides a definition of a bank without categorization. At the same time, the concept of a regional bank is present in statistical and analytical materials, scientific publications and educational literature. Since 2002, the Bank of Russia annually publishes a report on the development of the banking sector and banking supervision, where in the section of banking operations it groups all credit organizations into 7 categories:

1.State-controlled banks.

2.Banks with foreign capital participation.

3.Large private banks.

4.Medium and small banks of Moscow region.

5.Regional medium and small banks.

6.Non-banking credit organizations.

7.Systematically significant credit organizations.

Such a grouping made it possible to assess the structural trends in the banking sector in detail, determining the peculiarities of credit organizations development of various categories and their participation in banking operations. Thus, the Central Bank of the Russian Federation institutionally highlighted regional banks from the general structure of the banking system, which demonstrates their specific status and a separate category of credit organizations.

However, this grouping was used by the Bank of Russia until 2018. In the report on the development of the banking sector and banking supervision in 2017, there were 5 of 7 groups. At the same time, categories were changed, small and medium-sized banks of Moscow region and regional banks were excluded, and private banks with capital above 1 billion rubles and below were also introduced instead of large private banks and non-banking credit organizations. Such changes are associated with two factors. First, since the beginning of 2018, the Bank of Russia began to license banks in two groups: a universal and basic license. Banks with a universal license should increase their capital to 1 billion rubles, and with the basic - not less than 300 million rubles. Second, the transformational trends initiated by the Bank of Russia with the aim of financially improving the banking sector led to a systematic reduction in the categories of regional, as well as small and medium-sized banks, as ineffective. Accordingly, these categories are not a priority group for further development of the banking system, which leads to the absence of the need to monitor their activities.

Due to the lack of legislative interpretation of a regional bank category, a number of definitions are given in scientific research. Various authors, using a multiplicity of approaches, identified the regional bank from different positions.

The foreign author Sinki (1994) emphasizes regional and local banks that are limited by the geographical indication of their activities within a city or a subject of a state.

From the point of view of Edronova and Eliseeva (2007), a regional bank, is established and functions in the region and does not extend its influence to Moscow and Moscow region. Also, the interpretation is limited by territorial location of the bank, without taking into account the quality content.

There are opinions that a regional bank is a regional one, since its founders belong either to regional business or to regional authorities or perhaps to the population of this region through the ownership of bank shares.

If we consider the functional approach to the definition of a regional bank, then Glukhova and Nuzhdin (2014) give the following interpretation - a regional bank should be understood as a credit organization that takes an active part in the development of the economy of a particular region and performs the functions of economic development of the region by banking and financial services. In this case, the role of such a bank as the main financial agent of the region and the “locomotive” in economic development is already traced. Although a branch of any large bank can take on a similar role, namely, Sberbank. Therefore, the above interpretation does not sufficiently reflect the content of a regional bank.

A credit organization can have a regional status if it is tied to a specific region not only by geographical location, but by qualitative filling of the economic development of a given region, integrated into it, reflects its specifics and social economic features, fundamentally created by representatives of regional business or government. Such an organization will have the effective development of the region and its economic entities as a goal of its activity.

A feature of a regional bank as a fundamental element of the banking sector and regional economy is the purpose of its activities. On the one hand, this is primarily a commercial bank, and therefore the purpose of the activity is obtaining and maximizing the profits. On the other hand, an additional goal is fixed in the interpretation of a regional bank, which distinguishes the character and nature of activities of this institution - stimulating the social economic development of the meso-level and ensuring economic security under the influence of negative external and internal factors. The support of regional banks and their allocation as a sub-level of the banking system with the appropriate regulatory tools will allow increasing the level of provision of business entities, population and national economy with banking services.

In Russian practice, prerequisites for the separation of a regional bank have objectively been formed, which confirms the accumulated experience of their activity in the economy. Most regional banks have been operating for more than 20 years, developing and absorbing regional specifics, forming information and customer base, showing a more stable position than large banks. Therefore, a regional bank is more interested in developing its own or contiguous region, since its efficiency, productivity and sustainability will depend on it. Most regions of Russia are experiencing “monetary starvation” and stabilization of the economic space of the meso-level. And the entire national economy cannot be achieved without the mechanisms and available instruments of financial and credit encouragement (Tokaev, 2017).

Also, legal side of the issue is significant. Restricting banking operations by a specific region is contrary to the Constitution of the Russian Federation (RF Government, 1993), namely Section 8, which guarantees the free movement of financial resources. Also, the Civil Code in Section

It is believed that the larger the bank, the higher its stability. These aspects are not interrelated. If we consider the standards of H1 in the activities of regional banks and large credit organizations, then the stability of the latter is much lower for this indicator. A frontal increase in the authorized capital means the liquidation of “niche” and local banks (transformation of banking institutions into non-banking financial institutions) (Vedev, Drobyshevskii, Sinelnikov-Murylev, & Khromov, 2014).

At present, regional small and medium-sized banks account for more than 60% of all credit organizations. In recent years, there has been a significant reduction in these banks under the pressure of excessive regulativism on the part of the Bank of Russia and the monopolization of the banking services market by large credit organizations. The result is an acute reduction in the availability of banking services, their quality, range and degree of security, especially in the periphery (Tavbulatova & Tashtamirov, 2017a). Large banks do not seek to expand their branch network, mostly in the regions of the economically underdeveloped. In such conditions, there is a reduction in regional banking institutions. Further tightening of capital requirements for banks can simply eradicate small and medium-sized banks from the economy. The result will be a federally-branch model of the banking sector with several major credit organizations; and oppression of the development of the national economy, small and medium business, accessibility and security of business entities with banking services and products (Tavbulatova & Tashtamirov, 2017b).

In order to avoid such a negative scenario, it is advisable with distinguishing the institution of a regional bank to reduce its own capital requirements, the size of which for a heterogeneous banking system is unacceptable by the existing spatial differentiation of the meso-level and economic asymmetry by the degree of development. This opinion is shared by the Association of Russian Banks. Based on an analysis of the competitive situation in the banking sector of Russia, the Association of Russian Banks is in favor of creating an institution of regional banks with more liberal requirements for minimum capital and simultaneously limiting banking activities on a territorial basis. The practice of creating an institution of regional banks is fully consistent with international best practice.

The practical significance of the proposed approaches, methods and recommendations based on the requirements of Basel Accord III is that they are able to form the basis of a mechanism for developing and making decisions aimed at integrating a capital management system in regional banks, and also be useful in optimizing risk management technologies (Kunitsyna & Serebriakova, 2015).

Therefore, the question of the amount of equity should be differentiated, depending on features of the meso-level and set by the Bank of Russia in proportion to the level of the social economic and financial development of a region. From the point of view of ensuring the sustainability of a regional bank, it is important to fulfill the requirement of capital adequacy, and not quantitative size.

Findings

Thus, we can offer the following definition of a regional bank - it is a credit and financial organization geographically located and registered in a particular region or macro level, in the capital of which local business entities or authorities take part, aiming to encourage the development of a region, by providing a full range of banking services and meeting regional needs, considering a particular social economic state of the meso-level. Such an interpretation can be considered comprehensive for defining a regional bank as a separate institution of the banking system and regional economy.

On this basis, in order to develop a methodology for regulating regional banks, it is necessary to define a number of features that characterize the status of a regional bank and consolidate it as an institution of the banking system.

The presented features and criteria for the identification of a regional bank in Table

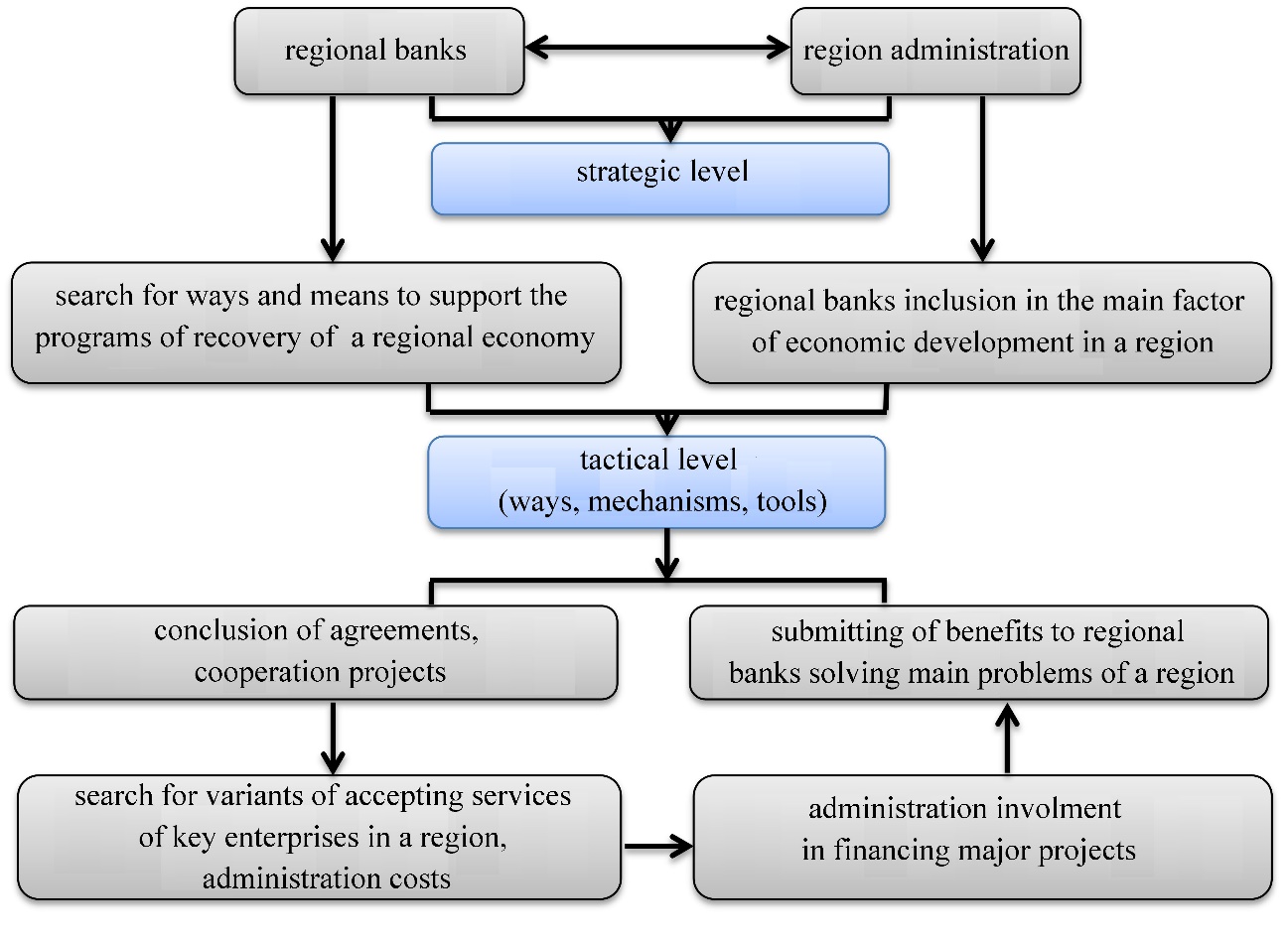

If the executive bodies of the subject of Federation take part in a regional bank, this facilitates the solution of many problems of a social economic nature: crediting of region-forming enterprises, encouraging the building of a housing complex, and participating in financing development programs. The role of banks is growing in crisis conditions; the executive authority of the subject of Federation participates in the bank capital. In the period of 2008–2009, such banks stabilized the regional economy, because they were used in the implementation of anti-crisis programs of regional markets. One of the options for interaction between the regional bank and the executive authorities of the region may be as follows (Figure

The obtained results can be used by monetary authorities to formalize the category of a regional bank and ensure the effective development of regional banking systems to provide dynamic socio-economic development of the subjects of Federation.

Conclusion

The main result of the study is a recommendation on the methodology of applying a differentiated approach to the minimum capital for established regional banks in the subjects of Federation, considering, first of all, their social economic status and the development of financial infrastructure, as well as the differentiation degree of this subject relative to adjacent regions. Such an approach contributes to an adequate response of credit organizations to the specifics of the region, which will ensure a balanced spatial provision with banking services. In turn, a stable banking sector as a set of regional banking systems that implements their functions as a financial intermediary and agent can serve as a basis for its sustainability.

Acknowledgments

The research was carried out in the framework of RFBR grant № 18-410-200002/18.

References

- Boldyreva, L. V. (2009). Implementation of the principles of a systematic approach in justification of the structure and functions of regional finance. Finance and credit, 28, 79–83.

- Buianova, M. E., & Diatlov, D.A. (2008). Risks of regional financial system: identification and assessment. Finance and credit, 37, 36–42.

- CC RF (1994). The Civil Code of the Russian Federation from November, 30. N 51-FL. Part 1. LRS ConsultantPlus.

- Edronova, V. N., & Eliseeva, N. P. (2007). Features of Russian regional banks. Finance and credit, 24, 71.

- Glukhova, S. M., & Nuzhdin, E. G. (2014). Regional banks in modern economy. Economics of education, 1.

- Kazakov, V. V. (2013). Modern issues of development and direction of reforming of regional finance systems. Bulletin of Tomsk State University, 373, 141–146.

- Kunitsyna, N. N., & Serebriakova, E. A. (2015). Distribution mechanism of capital of a regional bank with the requirements of Basel Accord III. National interests: priority and safety, 19, 2–18.

- Nikolaev, A. A. (2010). Features of financial system of the Russian Federation. Audit and financial analysis, 1, 7–9.

- RF Government (1993). The Constitution of the Russian Federation (adopted by nationwide vote on 12.12.1993) (as amended by laws of the Russian Federation on amendments to the Constitution of the Russian Federation from 30.12.2008 N 6-FCL, from 30.12.2008 N 7-FCL, from 05.02.2014 N 2-FCL, from 21.07.2014 N 11-FCL). LRS ConsultantPlus.

- Sinki, J. Jr. (1994). Financial management in commercial banks. Moscow: Catallaxy.

- Tavbulatova, Z. K., & Tashtamirov, M. R. (2017a). Institutional features of structure and problems of stability of the banking system of Russia at the present stage. Russian economic online magazine, 1, 36.

- Tavbulatova, Z. K., & Tashtamirov, M. R. (2017b). Value of regional banks. Scientific notes of Crimean Engineering and Pedagogical University, 3(57), 65–69.

- Tokaev, N. Kh. (2017). About strategic goals, objectives, directions and possibilities of social economic development of regions. Bulletin of North-Ossetia State University named after K.L. Khetagurov Social Sciences, 1, 152–156.

- Vedev, A., Drobyshevskii, S., Sinelnikov-Murylev, S., & Khromov, M. (2014). Current problems of banking system development in the Russian Federation. Economic politics, 2, 7–24.

- Zavialova, D. A. (2018). Modern approaches to defining the category “regional financial system”. Finances and credit, 24(43), 2568–2577.

- Zotova, A. I., & Kirichenko, M. V. (2015). Financial system of a region: structural functional aspect. Modern science: current issues of theory and practice, 11–12, 82–86.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

28 December 2019

Article Doi

eBook ISBN

978-1-80296-075-4

Publisher

Future Academy

Volume

76

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3763

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, science, technology, society

Cite this article as:

Tashtamirov*, M., Tagaev, S., Kudusov, L., Abdurakhmanova, M., & Muskhanova, H. (2019). To Identification Issue Of The Regional Banks Category: Methodical Approaches. In D. Karim-Sultanovich Bataev, S. Aidievich Gapurov, A. Dogievich Osmaev, V. Khumaidovich Akaev, L. Musaevna Idigova, M. Rukmanovich Ovhadov, A. Ruslanovich Salgiriev, & M. Muslamovna Betilmerzaeva (Eds.), Social and Cultural Transformations in the Context of Modern Globalism, vol 76. European Proceedings of Social and Behavioural Sciences (pp. 3066-3073). Future Academy. https://doi.org/10.15405/epsbs.2019.12.04.413