Abstract

The article is devoted to the issue of transformation of the economic structure in the era of globalization of all the spheres of social life, increased competition in all developing sectors of the economy. The authors focused on the need to develop tools to assess the effectiveness of the management accounting system, as the basic unit of the management system of a company. The article places special emphasis on benchmarking, as one of the promising areas of analytical research. Benchmarking allows identifying and applying the best management accounting practices in an industry or a segment. In order to achieve benchmarking purposes, a multi-level system of financial and economic indicators of company activities was formed. The authors propose developed reference scale of key financial indicators of benchmarking in public catering enterprises in order to assess the effectiveness of management accounting. The achieved results make it possible to determine the competitive position of a company, to identify weak points in the construction of the accounting system. In addition, they can be used as a basis for making rational and sound management decisions. The proposed reference scale of financial indicators can be recommended to the highest management in the field of public catering. The research was performed on the data of the West Siberian region, the center of which is Omsk. The research results are of a scientific nature and can be used in the course “Management Accounting”. Findings can be useful for scientific articles, textbooks, and for further scientific research.

Keywords: Benchmarkingeffectivenessmanagement accountingfinancial indicators

Introduction

In modern conditions of globalization and digitalization of economy, the question of the need for setting up a management accounting system in an enterprise already disappears. It can be explained by the fact that many progressive managers of the highest management level have adjusted to the trends of a rapidly changing world, and adequately respond to any innovations in this area. Instead, one of the main and objective issues that arise in the arrangement, organization and operation of a management accounting system at an enterprise is the formation of a methodology and a system of indicators to assess its effectiveness. Since the introduction of management accounting in practice, despite all its advantages, does not guarantee that the organization will achieve its purposes. Consequently, the need to assess the effectiveness of the management accounting system is a priority and requires its practical implementation at a particular enterprise, a part of management accounting, in the adopted specific management decision. One of the promising tools for assessing the effectiveness of the management accounting system is benchmarking, the use of which in this context has not yet been considered by the scientific and business community.

Problem Statement

The practicability of analyzing the existing methodologies for assessing the effectiveness of the management accounting system of an enterprise and highlighting the most promising ones among them is related to the need to study the opinion of scientific community on the research issues, identify the most objective assessment tools, and form a scientific basis for future research.

Research Questions

Many scientists made great contributions to the scientific literature on the study of historical aspects and the evolution of benchmarking, creating for it the potential of an advanced management tool (Camp, 1989; Madsen, Slatten, & Johanson, 2017). Methodological aspects of benchmarking, as applied to accounting processes, are discussed in the fundamental work of Beretta, Dossi, and Grove (1998).

Sharif (2002) argues that the underlying benchmarking system of performance management indicators has recently become a widespread and popular management method in advanced countries. Modern technologies allow analyzing corporate information for comparing them with benchmarks and introducing the most promising management accounting systems.

Gothwal and Raj (2018) was engaged in the selection of the most appropriate indicators of effectiveness using benchmarking methods, considering it to be one of the strategic problems that can affect a flexible production system. The used in their scientific works the fuzzy logic of the conversion of qualitative indicators into quantitative ones.

Galindro, Zanghelini, and Soares (2019) consider benchmarking techniques to improve communication in life cycle assessment. As a result of the study, they put forward the following propositions: benchmarking methods were divided into four categories, including two of which focused on the future. These research areas continue in works of Cook, Ramón, Ruiz, Sirvent, and Zhu (2019). These authors conclude that when evaluating performance, it is advisable to expand the use of such benchmarking methods based on achievable goals that represent the best practices in the industry or segment.

Developing benchmarking methods, within the scope of data envelope analysis (DEA), foreign researchers (Adler, Friedman, & Sinuany-Stern, 2002) propose to use a ranking technique for both effective and inefficient departments and develop six types of this methodology depending on the research situation.

Docekalova and Kocmanova (2015) propose an assessment of the efficiency of production companies by financial and non-financial indicators in relation to corporate sustainability. Hřebíček, Soukopová, Štencl, and Trenz (2011), considering the groups of indicators in the integrated assessment of a company, put forward the criteria for economic development. In addition, they justify the use of their quantitative assessment, which gives the most objective result in the research.

The problematic aspects of assessing the effectiveness of the management accounting system in commercial organizations were investigated in the works of many Russian scientists (Maksakova, 2007; Mukhina & Aristova, 2014; Romanov, 2016; Suprunova, 2018; Katkova & Katkov, 2011). According to Maksakova (2007), the methodology for assessing the effectiveness of management accounting system should not be limited only to economic practicability. The assessment of the resource, market and organizational effect during the creation of an effective management accounting system will allow building a rational system. Mukhina and Aristova (2014) perform a comparative analysis of possible techniques used to assess the effectiveness of the management accounting system. Romanov (2016) believes that the effectiveness of the management accounting system should be divided into future and current. In this case, under the future assessment should be understood dynamic performance, and under the current assessment – static one.

The study of global and Russian experience of research in the field of benchmarking and assessing effectiveness formed the authored approach to the investigated problem.

Purpose of the Study

The purpose of the research is to summarize and assess the opinion of the scientific community on benchmarking financial indicators generated in the management accounting system, as well as to develop the authored methodology for using benchmarking tools in assessment procedures for determining the effectiveness of management accounting systems in enterprises and to apply this methodology for ranking public catering enterprises in terms of their effectiveness at the market.

Research Methods

In the course of the study the authors used both theoretical and empirical methods of scientific knowledge. The use of methods of analysis, synthesis and induction made it possible to systematize the existing methods and techniques of benchmarking and select the most appropriate ones for the achievement of the research objectives and form the adequate system of indicators of efficiency and sustainability for public catering market. Empirical methods allowed processing the facts of economic reality, using them in the constructed theoretical models and getting the result of applied significance.

Findings

Nowadays one of the promising methods for assessing the management accounting system of an enterprise is benchmarking, which is a process of comparing the state of one organization with other enterprises in this field. Benchmarking involves the use of data collected as effectiveness indicators and comparing them with other organizations that function in this industry segment, or have similar business processes. Benchmarking in comparison with the other tools allows measuring effectiveness with the help of nonstandard approaches. This also includes the effectiveness of the management accounting system of an enterprise.

Benchmarking improves efficiency by identifying and applying the best demonstrated practice for a management accounting system. Managers compare the effectiveness of their products, processes with competitors and best-in-class organizations and internally with other operations that perform similar activities in their own enterprises. The purpose of benchmarking is to find examples of better performance and to understand the processes and methods that regulate this performance. Then organizations improve their work by adapting and incorporating these best practices into their own operations — not through imitation, but through innovation. In the management accounting system, benchmarking will help identify the most promising management accounting tools needed for managers to make rational management decisions.

Management accounting is usually considered a financial function. Benchmarking in this area is used in two ways: it focuses on planning and budgeting processes, receivable and payable accounts management, developing accounting systems, charging fees, financial analysis and forecasting, internal audit, comparative analysis of the operational level of both production and service organizations.

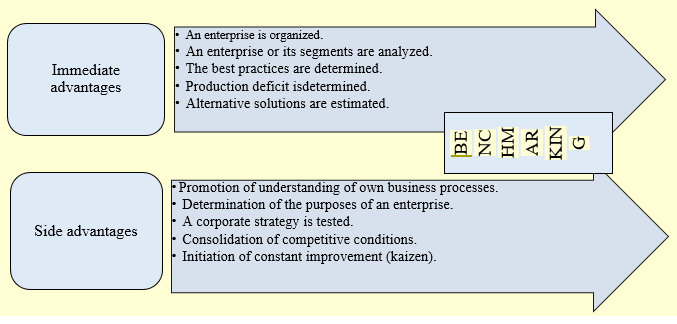

Benchmarking allows organizations learning from the outside, as well as developing appropriate measures and implementing solutions for specific enterprises in the industry, segment or business process. Basically, an organization can receive both direct and indirect advantages for Russian organizations (Fig. 01).

During the course of the research, the authors developed a benchmark scale for benchmarking financial indicators, adapted for public catering enterprises of the Omsk region allowing assessing the effectiveness of management accounting system.

Financial indicators generated in the accounting system and used for benchmarking purposes should be divided into several levels in order to systematize them. The first level includes the indicators reflected in the balance sheet report and the statement of financial results in absolute terms, while it is necessary to focus on their growth rates. The increase in absolute indicators will largely depend on the scale of activity of the economic entity, therefore comparing with the reference enterprise, it is necessary to take into account such aspects as the belonging of investigated enterprise to small, medium or large business, organization turnover, etc.

The second level includes indicators of liquidity and solvency of economic entities. When calculating these indicators and comparing with a reference enterprise, one should also take into account their normative values, as well as average values at the all-Russian and industry levels.

The third level includes indicators of business activity, which is characterized by turnover ratios: turnover ratio of current assets, turnover ratio of receivable accounts, turnover ratio of payable accounts, turnover ratio of inventory and cash ratio. The higher these ratios, the more stable the financial position of a company. It should be noted that the turnover indicators in a small business are always higher in comparison with large business, sometimes even higher than in reference enterprises.

The fourth level is characterized by profitability indicators, which include the return on assets, return on sales, and return on equity.

The objects of research are presented by public catering enterprises of the West Siberian region, which are the suppliers of their products to home and office: “Sushi Market”, “Zebras” and “Terra Café”. The chosen companies operate in the administrative center of the region - Omsk. The choice of objects of research is reasoned by the fact that public catering with food delivery to home is the most dynamically developing branch of the Russian economy, which quickly reacts to all changes of the market. Table

Considering the first level, as reference indicators it is advisable to use the maximum value of the indicators, since the increase in the investigated parameters indicates the effectiveness of a company. At the second level, it is advisable to use industry-wide norms as benchmarks. Based on the analysis of the second level, it is advisable to conclude that only “Sushi Market” fully corresponds to the level of the reference enterprise. The situation is worse for “Terra Café”, which, in addition to the absolute liquidity ratio, also fails to comply with the standard for equity-assets ratio, which further emphasizes the worsening financial position of the company on the public catering market of the Omsk Region.

Investigating the third level, as reference indicators it is advisable to use the turnover ratios with the highest value for the public catering industry of the Omsk region. Therefore, on the third level, it should be noted that the higher the turnover ratio of current assets, the more intensively the assets are used in the company. Therefore, it is advisable to use “Terra Café” as the benchmark for public catering enterprises in the Omsk region where the largest value of the indicator means that assets for the financial period are turned over for 2.83 times. According to the turnover ratios of receivables and payables as the benchmark indicator, it is advisable to use the maximum value, i.e. 16.56 (“Sushi Market”) and 16.75 (“Terra Café”), respectively. The authors took 38.60 as a reference value for the turnover ratio of current assets, although the increase in this indicator does not always have positive signs, as it indicates the scarcity of stocks and possible failures of the production process. The cash turnover ratio reflects the intensity of their use in a company. The reference value of this indicator can be recognized as 214.70 (Zebra LLC), which is several times ahead of the value of competitors.

Considering the fourth level, as reference indicators it is advisable to use the turnover ratios with the highest value for the public catering industry of the Omsk region. Since public catering is a part of trade, it is advisable to use a value of more than 3.30% as a standard value (reference value) of return on assets. The reference value of the profitability of sales should be more than 7.00% for the industry of innovative economy. The indicators of the safe level of profitability were published by the Federal Tax Service of Russia by type of economic activity for the period of 2017. The only enterprise that significantly exceeds the standard value of return on assets and sales is “Sushi Market”. Nevertheless, this state of affairs is essential, since the enterprise is several times higher than its competitors in terms of indicators reflected in the balance sheet report and statement of financial results. As for the return on equity, for the inflationary economy of Russia, it is advisable to use the Bank of Russia discount rate as a reference value of the indicator, which as of 01/01/2019 amounted to 7.75%. In “Zebras” this ratio is 0%, which raises the question of the practicability of running such a business.

Table

Conclusion

Summarizing the above mentioned provisions, it is necessary to briefly enumerate the main results obtained in the course of the study of existing approaches to the solution of the problem:

Firstly, from the standpoint of the authors, benchmarking is the most promising tool that can be used for comparative analysis not only in accounting, but also in management, marketing, budget management, and in many other sectors of innovative economy.

Secondly, a comparative analysis of public catering enterprises of the Omsk region was carried out, which resulted in the ranking of the objects of study on the basis of the proposed financial criteria and identified leaders and outsiders in the investigated sector of the economy of the Omsk region.

Thirdly, a reference scale of benchmarking of financial indicators for public catering enterprises of the Omsk region was proposed, which can serve as a basis for further research.

References

- Adler, N., Friedman, L., & Sinuany-Stern, Z. (2002). Review of ranking methods in the data envelopment analysis context. European Journal of Operational Research, 140, 249–265.

- Beretta, S., Dossi, A., & Grove, H. (1998). Methodological strategies for benchmarking accounting processes. Benchmarking for Quality Management & Technology, 5(3), 165–183.

- Camp, R. C. (1989). Benchmarking: The Search for Industry, Best Practices that Lead to Superior Performance. Milwaukee, WI: ASQC Quality Press.

- Cook, W.D., Ramón, N., Ruiz, J. L., Sirvent, I., & Zhu, J. (2019). DEA-based benchmarking for performance evaluation in pay-for-performance incentive plans. Omega, 84, 45–54. https://doi.org/10.1016/j.omega.2018.04.004

- Docekalova, M. P., & Kocmanova, A. (2015). Evaluation of the Effectiveness of Manufacturing Companies by Financial and Non-financial Indicators. Procedia – Social and Behavioral Sciences, 213, 491–496.

- Galindro, B. M., Zanghelini, G. M., & Soares, S. R. (2019). Use of benchmarking techniques to improve communication in life cycle assessment: A general review. Journal of Cleaner Production, 213, 143–157.

- Gothwal, S., & Raj, T. (2018). Prioritising the performance measures of FMS using multi-criteria decision making approaches. International Journal of Process Management and Benchmarking, 8(1), 59–78. DOI: 10.1504/IJPMB.2018.088657

- Hřebíček, J., Soukopová, J., Štencl, M., & Trenz, O. (2011). Integration of economic, environmental, social and corporate governance performance and reporting in enterprises. Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis, LIX(7), 157–166.

- Katkova, E. A., & Katkov, U. N. (2011). Synergetic effect in a sustainable management accounting system. Vestnik BGU, 3, 273–275.

- Madsen, D. O., Slatten, K., & Johanson, D. (2017). The emergence and evolution of benchmarking: a management fashion perspective. Benchmarking. An International Journal, 24(3), 775–805.

- Maksakova, M. N. (2007). Evaluation of the effectiveness of the management accounting system in commercial organizations. Uchet i statistika, 2(10), 50–54.

- Mukhina, Е. R., & Aristova, J. V. (2014). Comparative characteristics of methods for assessing the effectiveness of management accounting. APRIORI, ser. Gumanitarnye nauki, 4. Retrieved from: http://www.apriori-journal.ru/seria1/4-2014/Muhina-Aristova.pdf.

- Romanov, M. S. (2016). Assessment of economic efficiency of management accounting at the enterprise, Servis v Rossii i za rubezhom, 9(10), 65–76.

- Sharif, A. M. (2002). Benchmarking performance management systems. Benchmarking: An International Journal, 9(1), 62–85. https://doi.org/10.1108/14635770210418588

- Suprunova, Е. А. (2018). Strategic and management accounting: synergy of interaction. EHkonomicheskie i gumanitarnye nauki, 7(318), 17–24.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

28 December 2019

Article Doi

eBook ISBN

978-1-80296-075-4

Publisher

Future Academy

Volume

76

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3763

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, science, technology, society

Cite this article as:

Glushchenko*, M., & Suprunova, E. (2019). Benchmarking As A Tool For Assessing Of Management Accounting (Regional Aspect). In D. Karim-Sultanovich Bataev, S. Aidievich Gapurov, A. Dogievich Osmaev, V. Khumaidovich Akaev, L. Musaevna Idigova, M. Rukmanovich Ovhadov, A. Ruslanovich Salgiriev, & M. Muslamovna Betilmerzaeva (Eds.), Social and Cultural Transformations in the Context of Modern Globalism, vol 76. European Proceedings of Social and Behavioural Sciences (pp. 1080-1087). Future Academy. https://doi.org/10.15405/epsbs.2019.12.04.145