Abstract

In today’s business, customer satisfaction and meet his demands has a critical rule in the organization's objectives and in other words, the key to business growth is to acquire customer satisfaction. So, in large organizations such as banks, the need to create an integrated unit associated with customer affairs is essential. This study examines how Customer Relationship Management is implemented in Agricultural Bank of Iran. In addition, the advantages of employing Customer Relationship Management process, technology as well as structure of sector related to customers in selected banks are investigated. The main objective of this study is to measure the factors influencing adoption of Customer Relationship Management. To achieve this, in a descriptive research of survey type, we test the questionnaires filled by a sample consisted of 381 person of Agricultural bank managers. The findings show that the variables of knowledge, innovation, ease and usefulness have a significant impact on adoption.

Keywords: Customer relationship managementtechnology acceptancee-banking

Introduction

After the industrial revolution, the world was experiencing fundamental change in all aspects. Business and trade were not an exception for this general rule as well and placed in a tangible change cycle. To stay ahead of the competitive market, managers of commercial and manufacturing organizations went on to resort to various strategies and methods to success in the competition. Business and marketing turned to a professional activity, requiring extensive knowledge in various fields of social, political, cultural, economic, and information technology, from the simple and traditional mode. With the advent of the internet and development of electronic commerce, trade and commerce took on a new form. Due to the volume of e-commerce transactions, companies are facing fierce competition. E-commerce wave has affected almost all companies in all economies and these companies are forced to enter the field of e-commerce. Given the importance and impact of customer satisfaction and loyalty in boosting market share, organizations look at the customer relationship management as a means to increase their profitability. The aim of the customer relationship management is to enable organization to provide better services to customers through establishing automated and integrated processes for collecting and processing customer information. In fact, this management relates to each other the three sectors of the customer service, marketing information and sales management. Today, the marketing is not only development, supply and sale, but also the continuous development and after-sales service with a long-term relationship with the customer is considered. Building customer loyalty is a concept that has been more considered in today’s businesses due to the fact that loyal customers have become as the main component of success of companies and organizations. Due to the advancement of technology and increased competition, the most important challenge facing any economic organization is to increase organization profit. In difficult conditions of competition, timely and organized relationship with customers is the most appropriate way to enhance customer satisfaction, increase sales and yet reduce costs (Abbasi & Turkmani, 2006).

The transition from an industrial economy and the elimination of geographical borders of business and consequently exacerbated competition has caused the customer to be raised as an essential pillar and backbone of the organization's activities. Organizations have achieved this important fact that retaining existing customers is cheaper than attracting new customers and the best way to retain customers is acquire their satisfaction. Researches also show that customer satisfaction can lead to an authentic brand and therefore the profitability of institute. Customer relationship management in the 90s along with the development of information and communication technology (ICT) has defined and evolved as an important approach in business with the aim of returning to the individual marketing (Islami & Matinnafas, 2009).

Literature review

Modern banking and CRM position in the banking system

Over the past few decades, changes in delivery channels have changed banking industry. For more than 28 years, banks have used branch-based operation. Since 1980 by entering the relation business and its multiple uses some changes were resulted and the banking industry was affected as well. The advent of delivery channels and payment systems, including devices instead of cashiers, call centers instead of branches, ATM, online banking and credit cards replaced the traditional financial transactions migrated banks to emerging electronic markets. Banks are financial and service institutions that in direct connection with costumers attempt to offer their goods (services). Hence, in today's competitive market, to adopt different strategies from competitors', banks are forced to collect behavioral information of customers, even satisfied and loyal customers. An excellent example of this is banks competition to adjust their interest rates. Change in customer behavior in banks due to the monetary nature of their activities has more sensitivity and requires accurate and timely planning by banking network administrators. Customer relationship management in the banks can achieved by creating and maintaining a personal relationship with profitable customers of bank through customer accounts, with proper use of ICT, customer monitoring process, and management and evaluation of data (Gilbert & Choi, 2003).

For the full implementation of CRM process in banks, four areas are identified:

1. The establishment of appropriate infrastructure to increase customer knowledge and understanding of customer profitability.

2. The allocation of resources integrated with customer-centric strategies to increase customer profitability.

3. Drawing a schematic of the market in order to understand customer value.

4. Integration of strategic planning and customer value management (Ijaz, 2005)

Benefits of CRM

The real value of institute is in attracting new customers and retaining previous customers. It is important for organizations to know that the value is not only in more information and more advanced technologies, but also in having the knowledge of customer relationship management. If businesses turn the costumer information into knowledge and use it to improve relationships with customers, this will create customer loyalty bringing the following benefits:

- Low cost of attracting new customers

- Reduced cost of sales

- High profitability of customer

- The evaluation of profitability

- Creating a fixed value of the business to customers

- Optimize service channels and attract new customers (Injazz, 2003)

Customer relation management

CRM is a concept rooted in sales automation technology and call centers operation and there have been since mid-1990s. At that time CRM was created through integrating customer data via the sale sector or the call center interactions that lead to more informal interactions with the customer.

This concept was released by using organizations and quick integrations and provoked software vendors all of which claimed that have a consistent set of capabilities that were known as CRM. Previously, relationship marketing sought to obtain information about the preferences and interests of customers stored in databases. This appeared in the form of "person to person" marketing which refers to the process and interaction through companies those offered proposals more aligned with customers' demands. Therefore, CRM was developed in order to establish security and management of person to person communication s and creation of a long-term beneficial relationship with customers. In a parallel channel, internet-based tools such as e-commerce, internet marketing and person to person communication came into existence and grew. With this new technology, these products outside the scope of CRM were competed and reached to e-commerce. When CRM and e-marketing concepts merged caused electronic customer relationship management or the same e- CRM become popular in a short time. There are still signs of this transition in industries such as the essential use of e-commerce to add value to vendors referred to as a "partner relationship management" by providing tools for recruiting vendors referred to as "employer relationship management". Similarly, vendors of enterprise resource planning (ERP) recognized that in 360-degree view (the comprehensive view) to the customer are obliged to consider the data transmission. So, they developed a complete software package with CRM capabilities. From a technological perspective, CRM includes a set of applications that tacks into consideration demands and needs of the role facing customer leading to feed a public and common database supported by business analysis tools (Osarenkhoe & Bennani, 2007).

Model and Research

Technology Acceptance Model (TAM)

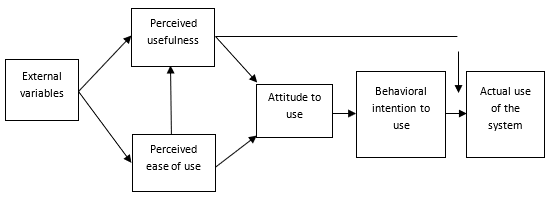

Technology acceptance model was introduced by Davis to predict the acceptance and use of information technologies (software and information systems) within organizations and is one of the most applicable models studied in the adoption of information systems and has recently been used to predict Online Banking. The model explains why users accept or reject certain parts of information technology. Technology acceptance model is shown in Figure

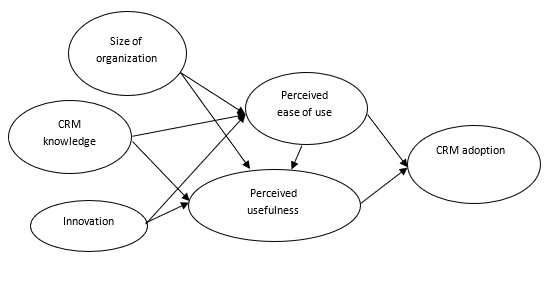

This study aimed at examining adoption of customer relationship based on organizational characteristics banks through establishing the relationship between the research variables include adoption of customer relationship management, perceived ease of use, perceived usefulness, size of organization, innovation, customer relationship management knowledge.

Research background

By reviewing documents of research about customer relationship management (CRM) we can observe the following findings:

In a paper entitled “Critical factors of hospital adoption on CRM system: Organizational and information system perspectives” conducted in Taiwan, Hung, Hung, Tsai and Jiang (2010) found that hospital size, IS capabilities of staff, innovation of senior executives, knowledge management capabilities, and relative advantage have significant influence on the CRMS adoption.

A paper entitled “Factors affecting adoption of CRM in organizational level” was conducted by Zegordi and Fakhredaei (2011) in Iran's shipping industry in 2006. The results of his study indicated that organizational features of attitude to change and CRM knowledge have a positive impact on adoption process of CRM.

In another article entitled “Understanding the antecedents to the adoption of CRM technology by small retailers” conducted on American retail industry, Peltier, Schibrowsky and Zhao (2009) showed that CRM knowledge, enterprise’s change orientation, personal risk taking, level of education and number of employees have a positive impact on CRM process.

In a study entitled “CRM adoption and its impact on organizational performance” conducted on china different service industries, Agnes (2009) found that organizational characteristic and attitude towards change in market orientation and modernity have a positive impact on CRM adoption.

A study entitled “Customer Relationship Management (CRM) Technology Impact on Business-To-Business Customer Relationships: Development of A Conceptual Model” was conducted by Richard in 2008 on various industries in New Zealand. The results of their study indicated that market orientation and technology orientation characteristics of enterprises have a positive impact on CRM adoption process.

In another study entitled “Customer relationship management, technology, market orientation, organizational performance”, Wu (2002) showed that market orientation characteristics of enterprises has a positive impact on CRM adoption process.

The theoretical framework and conceptual model

Every research needs to a theoretical framework. The theoretical framework is a basis all the research relies on. The theoretical framework is a logical, developed, descripted and perfect network between the variables provided through processes such as interviews, observation and review of the literature (Khaki, 2009).

Given that it is difficult to take into account all factors affecting adoption of CRM, using several well-known theories presented in this context and based on studies conducted in the field of CRM and survey of banking professors and experts, model (Figure

-

Size of organization : The size of organization is a variable that includes the total number of employees of an organization (Robbins, 2009) -

Innovation : This variable means provide new products and services resulting from the application of creativity in various work areas of the company. Innovation is also as the successful use of creative ideas in an organization (Rhee, Park, & Lee, 2010) -

CRM knowledge : This variable is associated with staff knowledge about computer information systems and CRM technology (Zegordi & Fakhredaei, 2011) -

Perceived usefulness : The extent to which a person believes that the use of a special tool and procedure will improve his job performance (Avontis et al., 2005) -

Perceived ease of use : The degree to which a person believes that the use of a particular system does not requires a lot of effort in terms of physical or mental effort (Avontis et al., 2005) -

CRM adoption : This variable is associated with the decisions that an organization intends to use CRM (Zegordi & Fakhredaei, 2011).

Research Methodology

In terms of objective, the present study is a developmental research, because the purpose of this research is to develop knowledge in the field of customer relationship management system. In terms of methods, the study is descriptive with emphasis on causal model and finally, in terms of method of collecting data and information is of survey type.

The population of this study is the Agricultural bank branch managers of Semnan province. It should be noted that the total number of the province’s Agricultural bank branches is a total of 44 branches. Given that the statistical population is limited, we use formula (1) to determine the number of samples.

= 95

(0/05)2(119)+(1/96)2

It should be noted that random sampling method is used for sampling.

In the present study, we use questionnaires to take advantage of the views and attitudes of managers of the Agricultural Bank branches of Semnan province and responding scale used is a 5-point Likert scales ranging from strongly agree to strongly disagree. The questionnaire is resulted from a library research and the help and guidance of academic professors and banking experts. In this research, based on the provided model five factors of size of organization, innovation, CRM knowledge, perceived usefulness, and perceived ease of use were specified as organizational characteristics affecting the adoption of customer relationship management system. Then to measure the effectiveness of each feature on the adoption of customer relationship management system questionnaire was used. The questionnaire consists of two main parts. The first part of the questionnaire is made up from 5 factors of innovations, CRM knowledge, size, perceived usefulness, and perceived ease of use and their components

To increase the validity, in this research we used the following tools:

The use of professors’ comments

The use of banking experts

Reading articles, books and magazines that have used this questionnaire or similar questionnaires.

As such, to increase validity of measurement tool of research the initial questionnaire was provided to professionals in this field and using the average of their comments and carrying out reforms, the final questionnaire was designed. In order to determine the reliability of the questionnaire Cronbach's alpha coefficient is used. In practice, to estimate Cronbach Alpha, first a prototype contains 30 questionnaires were distributed among managers of the Agricultural Bank branches of Semnan Province and were pre-tested and then using obtained data Cronbach's alpha coefficient was estimated. Alpha value obtained for the total survey questions is greater than 0.86% which this value is indicative of reliability of the questionnaire. In this research, the SPSS software is used to provide descriptive statistics for data and then to analyze data, testing hypotheses and totally to generalize the results from sample to population the structural equation method is used within Visual pls software.

Data analysis

The analysis of data is of special importance for any kind of research in order to verify hypotheses. The raw data is analyzed using statistical techniques and after processing are provided to users. To analyze the data, the value of the variable was firstly determined based on data and scores obtained from the questionnaires. Then described data was obtained and in the form of descriptive tables and graphs created overview of their distribution. Testing research hypotheses was carried out through modeling structural equation and the entire model was also tested using this method. The results of analytical methods based on causal model are presented in Figure (2):

The coefficient of determination indicates that 33% (relationship intensity of about 0.57) of the change in adoption of customer relationship management system is explained by the model variables. That is, the research model mainly involves the key variables influencing the adoption of customer relationship management system. Table (1) shows direct and indirect effects of model variables on each other. According to this table, perceived ease of use has highest direct effect (0.442) on perceived usefulness and CRM knowledge has highest indirect effect (0.079) on adoption of CRM system through perceived ease of use.

After describing the model fitting and ensuring its goodness, we move on to test research hypotheses. The results of structural equation modeling as well as the results of testing hypotheses on relationships between variables can be seen in Table

Conclusion

Testing the causal model of research suggests that perceived usefulness and perceived ease of use may increase adoption of customer relationship management system by Semnan Agricultural bank branches managers. Also perceived ease of use, has a significant impact on perceived usefulness. The results indicate that Rsq of perceived usefulness is 0.59 percent, perceived ease of use Rsq is 0.49 percent, and Rsq of the adoption of CRM system is 0.33%. Thus, the highest Rsq value is related to perceived usefulness meaning that the variable of perceived usefulness is more affected by independent variables than perceived ease of use and adoption of customer relationship management system. It seems that Agricultural bank branches of Semnan province have a proper position in the field of collection of data and environmental and internal information and its publication within branches. According to the results of model testing, it was observed no relationship between innovation and adoption of customer relationship management system. Several reasons could be causing this phenomenon. Perhaps the most important reason is the lack of innovation in advertising and failure to provide new services in agricultural bank branches of Semnan province. In addition, we found no relationship between the variable of organization size and adoption of CRM system. Perhaps the most important reason for this is the lack of optimal risk management, and the lack of strong infrastructure.

Based on the results of the initial structural model, we can conclude that:

1. The variable of CRM knowledge has a positive and significant effect on perceived ease of use with a coefficient of 0.243; this means that CRM knowledge due to perceived ease of use has a significant positive impact (by about 0.079) on the adoption of customer relationship management system. By comparing the results with similar studies around the world, it is observed that other researchers have reached the same results during their studies. Such as, in a research conducted in Iranian shipping industry, Zegordi and Fakhredaei (2011) found that the CRM knowledge positively affects the adoption of customer relationship management system.

2. The perceived ease of use with value of 0.442 has a positive and significant effect on perceived usefulness. Therefore, this variable may also be considered as an organizational characteristic affecting the adoption of CRM system in Iran.

3. Perceived usefulness has a positive and significant effect (0.302) on the adoption of CRM system. Hence, this variable may also be considered as an organizational characteristic affecting the adoption of CRM system in Iran.

4. Perceived ease of use has a positive and significant effect (0.327) on the adoption of CRM system. By comparing the results with similar studies around the world, it is observed that other researchers have reached the same results during their studies. In a paper entitled “Perceived Usefulness, Ease of Use, and Usage of Information Technology”, Adams, Nelson and Todd (1992) concluded that perceived ease of use has significant impact on intend to use. So, in Iran, we can also consider this variable as an organizational characteristic affecting the adoption of CRM system.

Finally, to increase adoption of customer relationship management system by the branches of Agricultural Bank of Semnan province, the following recommendations are presented:

Holding courses and training seminars for managers to increase managers’ information and knowledge about customer relationship management regarding the positive impact of CRM knowledge on perceived ease of use.

Designing CRM system-based software having the feature of ease of use and more operational power regarding the positive effect of perceived ease of use on usefulness perceived from CRM.

The results indicated that perceived usefulness has a positive effect on the adoption of CRM system. Therefore, by notifying managers about public interest of using customer relationship management system such as maintaining current customers, customer relationship in less time and with greater speed, improve customer service, increase competitive power of organization, identify new business opportunities and so on, we can strengthen the variable of perceived usefulness.

References

- Abbasi, M. R., & Turkmani, M. (2010). Theoretical model of the implementation of customer relationship management. Business Review, 41.

- Adams, D. A., Nelson, R. R., & Todd, P. A. (1992) Perceived Usefulness, Ease of Use, and Usage of Information Technology: A Replication. MIS Quarterly, 16(2), 227-247.

- Agnes, L. K. Y. (2009). CRM Adoption and Its Impact on Organizational Performance. (Unpublished Doctoral dissertation). University of Nottingham.

- Foehn, P. (2004). Client valuation in private banking: Results of a case study in Switzerland. Managing Service Quality, 14, 195-204.

- Gilbert, D. C., & Choi, K. C. (2003). Relationship marketing practice in relation to different bank ownerships: a study of banks in Hong Kong. International journal of bank marketing, 21(3), 137-146.

- Hung, S. Y., Hung, W. H., Tsai, C. A., & Jiang, S. C. (2010). Critical factors of hospital adoption on CRM system: Organizational and information system perspectives. Decision support systems, 48(4), 592-603.

- Ijaz, D. R. (2005). How banks manage CRM Ab2b Perspective? (Master thesis). Lulea University of Technology.

- Injazz, J., & Popovich, K. (2003). Understanding Customer Relationship Management. Process & Purpose & Technology, 21-34.

- Islami, Z., & Matinnafas, F. (2009). Designing a suitable structural model for the establishment of customer relationship management in banks, Monthly Journal of Economic News, 25-30. (in Persian)

- Khaki, G. (2009). Research Methodology in Management, Islamic Azad University of Tehran Press. (in Persian)

- Osarenkhoe, A., & Bennani, A. E. (2007). An Exploratory Study of Implementation of Customer. Business Process Management Journal, 13(1), 139-164.

- Peltier, J. W., Schibrowsky, J. A., & Zhao, Y. (2009). Understanding the antecedents to the adoption of CRM technology by small retailers: Entrepreneurs vs owner-managers. International Small Business Journal, 27(3), 307-336.

- Rhee, J., Park, T., & Lee, D. H. (2010). Drivers of innovativeness and performance for innovative SMEs in South Korea: Mediation of learning orientation. Technovation, 30(1), 65-75.

- Richard, J. E. (2008). The impact of Customer Relationship Management Technology Om Business to Business Customer Relationship. (Doctoral Dissertation). Victoria University of Wellington.

- Robbins, S. (2009). Organization Theory. Marketing, 126(5), 353-370.

- Vainio, H. M. (2006). Factors Influencing Customer Acceptance of Internet Banking: Case of Scandinavian Trade Finance Customers. (Master Thesis). The Swedish School of Economics and Business Administration.

- Wu, W. (2002). Customer Relationship Management, Technology, Market Orientation, Organizational Performance. (Master Thesis). Concordia University of Canada.

- Zegordi, S., & Fakhredaei, N. (2011). The factors affecting adoption of CRM at organisational level in Iran's shipping industry. IJBIS, 8(2), 165-191.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

20 December 2019

Article Doi

eBook ISBN

978-1-80296-074-7

Publisher

Future Academy

Volume

75

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-399

Subjects

Management, leadership, motivation, business, innovation, organizational theory, organizational behaviour

Cite this article as:

Yami, M., Galini, E., & Sabouri, M. S. (2019). Banks’ Organizational Characteristics And Adoption Of Crm In Agricultural Bank’s Branches. In C. Zehir, & E. Erzengin (Eds.), Leadership, Technology, Innovation and Business Management, vol 75. European Proceedings of Social and Behavioural Sciences (pp. 377-387). Future Academy. https://doi.org/10.15405/epsbs.2019.12.03.31