Investigating Relationships among Personality Characteristics and Repayment Behavior: Quantitative Research in Turkey

Abstract

In practice, creditors frequently use socio economic and demographic indicators to assess repayment behaviours of individuals. However, the inefficiency of socio economic and demographic factors to explain the indebtment and repayment behaviours are commonly accepted, and the need to search psychological and personality characteristics affecting indebtment and repayment behaviours are indicated by a large number of researchers. In this respect, this survey aims to search relationship of psychological factors, in terms of personality characteristics, with repayment behaviour quantitatively by utilizing a questionnaire survey. The survey was conducted on 205 respondents locating in Bursa, İstanbul by utilizing convenience sampling method. Data obtained from 205 respondents were analyzed through the SPSS 21.00 statistical packet program. Descriptive analyses have been utilized to reveal the demographics of respondents. Besides, factor analysis and reliability analysis have been conducted to test the reliability of scales, and correlation analysis have been conducted to test proposed relations. Research findings revealed that repayment behavior is negatively correlated with unconscientiousness and external locus of control while positively correlated with intuitive decision-making style, which demonstrate that conscientiousness, locus of control and decision making style are more related personality characteristics to repayment behaviour.

Keywords: Repayment behaviourconscientiousnesspunishment avoidancesense of collectivismlocus of controldecision making style

Introduction

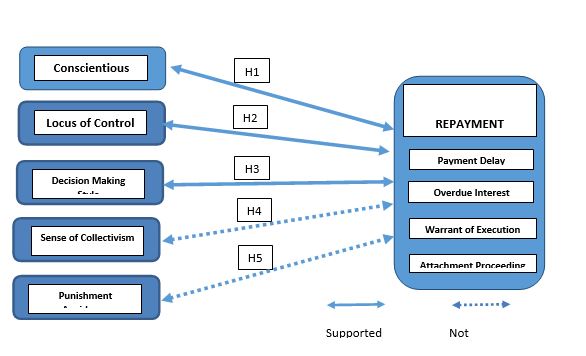

This survey is continuation of a research previously conducted by Özşahin, Yürür and Coşkun (2018), which aimed to explore relevant psychological determinants for debt repayment behavior. They have conducted a qualitative and explorative research to reveal personal characteristics that affect debt repayment behavior in Turkey. That previous research findings revealed that, responsibility, long term orientation, sanction fear, sense of collectivism, rational decision making and risk aversion are main characteristics of regular payers, while external locus of control, irresponsibility, short term orientation, irrational decision making, emotional imbalance are common characteristics of irregular payers. Accordingly, conscientiousness, time orientation, sanction fear (punishment avoidance), sense of collectivism, locus of control and decision making style are come out as primary personal and attitudinal factors explaining the repayment behavior. In the light of findings of previous research, this survey aims to search relationships of those personal and attitudinal factors (conscientiousness, time orientation, sanction fear, sense of collectivism, locus of control and decision making style ) with repayment behavior quantitatively by utilizing a survey on a large number of respondents.

In other words, the question of “Which factor stands out to explain a wide proportion of repayment behavior?” will be addressed in this survey. To the best of our knowledge, except the study of Özşahin et al. (2018), there is no other research specifically addressing the effects of personal and attitudinal factors on repayment behavior in Turkey, although repayment behavior is an outstanding mater that directly or indirectly results in psychological, social, economic and financial outcomes. Thus, inquiring this issue at all points is expected to provide significant contributions to literature at macro and micro level. When creditors insert that information on psychological determinants into their algorithms for their decision support systems, they will prone to make more accurate and appropriate credit decision and prefer the regular payer mostly, which brings about increasing repayment and decreasing credit risks. Moreover, accurate and appropriate credit decision based on a wide range of criteria on personal and attitudinal factors, will proactively respond to prospective social and economic problems, because it moves down the over-indebtedness. It is commonly implied that the over-indebtedness and payment default leads to psychological and physiological disorders in individuals (e.g. Paparella, 2015).

Besides, it has been indicated that stress and mental diseases bring about a significant increase of economic burden in a country (Nguyen, 2016). Thus, inhibiting that kind of disorders stemming from over-indebtedness and payment default will lead to avoiding health care expenses substantially. Moreover, the negative impacts of payment default on social structure are better known. According to TUİK 2016 Family Structure Survey, 42 % of divorce in Turkey results from economic problems (TUİK, 2016).

Thus, explaining repayment behavior of individuals at all points gets great importance when its economic, social and psychological impacts are taken into consideration. In this context, the limited number of research on indebtment and repayment behavior in Turkey and to the best of our knowledge, the absence of research examining the effects of psychological determinants in terms of personal and attitudinal factors on indebtment and repayment behavior (except the study of Özşahin et al., 2018), states the vital importance of this study which examines the relations among personal and attitudinal factors (conscientiousness, time orientation, punishment avoidance, sense of collectivism, locus of control and decision making style ) and repayment behavior quantitatively.

Literature Review and Theoretical Framework

In practice, creditors use socio economic and demographic indicators including income level, spending attitude, occupation, etc. to assess repayment behaviors of individuals. However, those indicators as like current occupation, current revenue or current family status may fail to predict repayment behavior of individuals. Dissimilar indebtment and repayment behaviors of individuals who have similar socio economic and demographic background such as similar revenue, occupation, family status etc., demonstrate the inefficiency of those socio economic and demographic factors to explain and predict the indebtment and repayment behaviors of individuals. Some researchers also accept the inefficiency of socio economic and demographic factors to explain the indebtment and repayment behaviors, and underline the need to search psychological and personality characteristics affecting indebtment and repayment behaviors (Kamleitner et.al., 2012; Wang et al., 2011; Robb and Sharpe, 2009; Zhu and Meeks, 1994; Lea et al., 1993; Livingstone & Lunt, 1992).

According to interactionist perspective in psychology, individuals and their behaviors are significantly complicated phenomena, and in addition to conditional and environmental factors, individual factors such as personal needs and personality traits shape the individuals’ behaviors. Furthermore, personality characteristics such as locus of control, self-efficacy, risk attitude, time horizon, self-esteem, social comparison have been examined by a large number of researchers to explain problematic debts (Vieira, Rovedder de Oliveira and Kunkel, 2016; Harrison, Agnew and Serido, 2015; Achtziger, Hubert, Kenning, Raab and Reisch, 2015; Stumm, O’Creevy and Furnham, 2013; Rogers, Rogers and Securato, 2015; Arya, Eckel and Wichman, 2013; Gathergood,2012; Wang,Lu & Malhotra, 2011; Mewse, Lea and Wrapson, 2010; Lusardi and Tofano, 2009; Stone and Maury, 2006). A large number of those studies examining the relationship between psychological factors in terms of personality characteristics and debt have been conducted after 2000s, which demonstrates that the issue has been examined recently and still need to be searched particularly.

In Turkey, a few researches have been conducted examining individual determinants of indebtment and repayment behaviors (Özşahin et al., 2018; Özkan, 2014; Kaptan, 2011). Furthermore, among those, the studies of Özkan (2014) and Kaptan (2011) focused on the effects of behavioral and demographic factors on credit card use, debt level, debt structure rather than direct relation between personality characteristics and repayment behavior. In other words, when the literature is reviewed in Turkey, except the study of Özşahin et.al (2018) there is no research directly focusing on the relationship between personality characteristics and repayment behavior, to best of our knowledge.

Özşahin et al. (2018) conducted a qualitative research utilizing in depth interview to reveal main personality characteristics of regular and irregular payer. In this respect, three types of sample groups are targeted to interview: (1) “bank staff” who have authority to make credit decisions, along with interacting with individual customers one to one and have at least 5-years of experience in individual customer banking; (2)“regular payers” who have debtor-creditor relationship with a bank and pay his/her debts before or on due date; and (3) “irregular payers” who have debtor-creditor relationship with a bank but have some problems with paying his/her debts (eg. paying interest/fine because of late payment or facing debt litigation or attachment proceedings) (Özşahin et al., 2018:27-28). The research findings revealed responsibility, long term orientation, sanction fear, sense of collectivism and rational decision making as main characteristics of regular payers; whilist external locus of control, irresponsibility, short term orientation, irrational decision making as common characteristics of irregular payers (Özşahin et al., 2018:30-31). Based on the findings of their research, Özşahin and her colleagues proposed the conscientiousness, time orientation, locus of control, decision making style, sense of collectivism and sanction fear (punishment avoidance) as main personality characteristics which determine the repayment behavior, and recommended for further researches to verify the proposed relations through an extensive questionnaire survey. In this regard, this survey aims to examine the relationships of the personality characteristics stated as conscientiousness, locus of control, decision-making style, sense of collectivism and sanction fear (punishment avoidance) with repayment behavior. Although time orientation, “referring to the connection of the past with the current and future actions/challenges” ( Özşahin et al., 2018:31) was observed as an determinant of repayment behavior by the research of Özşahin et al. (2018), it has been excluded from this survey because researchers focus on personality characteristics rather than the behaviors influencing the repayment behavior.

Conscientiousness, characterized by self-discipline, self-efficacy, orderliness, achievement-striving and dutifulness, has been proposed as one of the determinants of debt repayment behavior in previous studies (e.g. Özşahin et al., 2018; Nyhus and Webley, 2001; Livingstone and Lunt, 1992). For example, Nyhus and Webley (2001) argue that conscientious persons would be expected to keep track of their finance, thus more prone to pay their debts. . Similarly, Livingstone and Lunt (1992) indicate that people who repaid regularly are more concerned with personal achievement and self-direction, which demonstrate a positive effect of conscientiousness on regular payment behavior. So, in this study researchers propose the following statement:

H1. There is a significant relationship between conscientiousness and repayment behavior.

Locus of control, referring to person’s belief that s/he has control over the outcome of events in his/her life, is another personality characteristic associated with indebtedness according to relevant literature. For example, Livingstone and Lunt (1992) indicate that people having higher level of external locus of control are more prone to over-indebtedness. External locus of control, the characteristics of people who attribute what happens all in their life to the external factors (Spector, 1982), was also observed as trait of irregular payers and essential determinant of repayment behavior by Özşahin and her colleagues (2018). Those people having external locus of control may avoid psychological pressure of debt by attributing the reasons of non-payment to external factors rather than themselves, so, get rid of the responsibility in short-term (Özşahin et al., 2018). Briefly, as external locus of control is associated with over-indebtedness and irregular payment in literature, locus of control is expected to affect repayment behavior. So:

H2. There is a significant relationship between locus of control and repayment behavior.

Decision making is basically defined as a process consisting of searching information, processing those information, forming alternatives and choosing one of those alternative to solve the problem. On the other hand, decision making style is defined as the learned, habitual response pattern exhibited by an individual when confronted with a decision situation (Scott and Bruce, 1995:820). Although literature is full of different classification of decision making style, Hunt, Krzystofiak, Meindl, and Yousry, (1989) basically identify two style -analytic and intuitive-based on evidence suggesting that the data-gathering and the decision making dimension are not independent (Scott and Bruce, 1995). Analytical or rational decision making style is characterized by a thorough search for and logical evaluation of alternatives; while intuitive decision making style is characterized by a reliance on hunches and feelings (Scott and Bruce, 1995). Even though, there is no study directly focusing on decision-making style and repayment behavior; decision-making style, as a psychological factor, is associated with financial indebtedness and mismanagement in literature (Ong, Theseira, and Ng, 2019; Stone and Maury, 2006; McKenna, Hyllegard and Linder, 2003; Hershey and Schoemaker, 1980). For example, McKenna et al. (2003) examined the relationship between psychological types and financial decision making, and state that intuitive decision makers are more prone to think about the future and mostly like planning to address future needs while analytical decision makers prefer thinking ask about cost benefit trade-offs and creating systematic plans fits their strengths. In this context, it can be concluded that both intuitive and analytical decision makers are expected to pay their debt regularly because they consider cost-benefit trade off and future fines they may confront unless they pay on time. So:

H3. There is a significant relationship between decision making style and repayment behavior.

“Sense of collectivism” and “fear of sanction (punishment avoidance)”, investigated by the research of Özşahin et al., (2018) as trait of regular payers, which have not been identified relevant to repayment behavior previously in international literature. Turkey has been classified as collectivist nation, involving “collectivist culture” by Hofstede (1980). As been indicated by Özşahin et al. (2018), in such a kind of collectivist cultures, individuals commonly feel that they have to obey the rules and values of group or society in which they live and mostly avoid the behaviors which are not accepted by the society and law. So, social pressure aroused from society will be responded severely by those people who have intensive sense of collectivism. Indeed, “debt default” is still considered as a shame in Turkish culture. Therefore, in such a collectivist culture, people with high level of feelings of “sense of collectivism” and “punishment avoidance”, are expected to pay regularly in order to avoid social and legal pressures. Furthermore, people recognizing credit and debt as shameful, to be avoided, a source of problems, are more prone to build up their savings with their resources rather than servicing their debts with (Livingstone and Lunt, 1992), so are not getting problem with paying. In this regard, researchers propose that:

H4. There is a significant relationship between sense of collectivism and repayment behavior.

H5. There is a significant relationship between punishment avoidance and repayment behavior.

Research Method

The purpose of this research is to examine relations between psychological factors in terms of personal characteristics and repayment behaviour quantitatively. In this context, the relationships of conscientiousness, punishment avoidance, sense of collectivism, locus of control and decision making style to repayment behaviour will be inquired quantitatively by utilizing a survey on a large number of respondents.

3.1. Sample and Data Collection

The survey was conducted on 205 respondents locating in Bursa and İstanbul by utilizing convenience-sampling method. Questionnaire forms were filled out by respondents thorough face-to-face survey administration. Data obtained from those 205 questionnaires were analysed through the SPSS statistical packet program. Of the 205 participants, 51,2 % are female, 48,8 % male.. Most of the participants (57,2 %) are university graduate and included in 35-40 years-old interval (55,5 %). Furthermore a considerable number of respondents (137 respondents, 67,6 %) have monthly revenue less than 5000TL (Table

3.2. Measures

Researchers mostly benefited from literature to form the measurement instruments of the questionnaire. In this respect, to measure sense of collectivism and punishment avoidance 17 item-scale adopted from Griffin and Husted (2015) was used. 12 item-scale adopted from Goldberg (1990) and 10 item-scale adopted from Rotter (1966) have been used to measure conscientiousness and locus of control respectively. Decision making style scale including two dimension-rational (4 item) and intuitive (5 item) decision makings style- adopted from Scott and Bruce (1995) was also used. Overall, 48 items measuring sense of collectivism, conscientious, locus of control, decision making style and punishment avoidance were assessed with five-point-Likert Type scale with anchors 1= strongly disagree and 5=strongly agree. Furthermore, to measure repayment behaviour, researchers ask questions to reveal whether respondents have payment default or not. Based on opinion of expert lawyer at law of commerce and obligations, sanctions imposed in case of payment default are enlisted according to their severity level. In this context, respondents were asked the frequency of (1) payment delay, (2) overdue interest, (3) warrant of execution and (4) attachment proceeding they experienced for their payment default, at which

Analyses and Findings

Data obtained from 205 respondents were analyzed through the SPSS 21.00 statistical packet program. Descriptive analyses have been utilized to reveal the demographics of respondents. Besides, factor analysis and reliability analysis have been conducted to test the reliability of scales, and correlation analysis have been conducted to test proposed relations.

Explorative factor analysis results revealed 7 factor with 46 item (Table

4 items of locus of control and 5 items of conscientiousness have loaded on same factor. When those items are checked over, researchers recognized that items representing internal locus of control (e.g. what happens to me is my own doing) and high level of conscientiousness (e.g. I have some targets and work to a schedule to achieve those targets) are included in same latent variable, which was named as responsibility (Internal locus of control and higher in conscientiousness). Remaining 6 items of conscientiousness loaded on one same factor, which is called unconscientiousness. Moreover, remaining 5 items of locus of control come to gather which is indicated as external locus of control. As seen in Table 4, the items of punishment avoidance (8 items) and sense of collectivism (9 items) loaded on their own factor; whilst the items of decision making style loaded on two different factors: rational decision making(5 item) and intuitive decision making (4items) styles. Cronbach’s Alpha values for all construct are above 0,70, which demonstrates the higher reliability of the measures (Table 4).

Correlation analysis results displayed that payment delay is correlated to none of the personality characteristics. However, overdue interest is positively correlated with unconscientiousness (r=,144; p≤ 0.05), while execution is positively correlated with external locus of control (r=,183; p≤ 0.05). Namely, respondents who are unconscientious tend to pay overdue interest, whilst respondents with high levels of external locus of control are more prone to get more severe sanctions as like warrant of execution for their payment default frequently. Furthermore, attachment proceeding, which is the more severe sanction executed if a debtor still does not pay despite of demand of payment letter, is positively correlated with external locus of control ((r=,207; p≤ 0.01) and unconscientious (r=,180; p≤ 0.05) but negatively correlated with intuitive decision making (r=-,216; p≤ 0.01).

According to correlation analysis results depicted in Table

Conclusion and Discussions

According research findings, repayment behavior is negatively correlated with unconscientiousness and external locus of control while positively correlated with intuitive decision-making style, which demonstrate that conscientiousness, locus of control and decision making style are more related personality characteristics to repayment behavior. On the other hand, non-significant relationships of sense of collectivism and punishment avoidance to repayment behaviour in terms of payment delay, overdue interest, warrant of execution and attachment proceeding have been observed by the findings of this survey.

The findings of this survey primarily revealed that none of the personality characteristics are related to the first level of repayment behaviour- payment delay. In other words, individuals experiencing payment delay do not have any distinct personality characteristics. That may result from the fact that people can delay payment upon the conditional factors rather than personality traits. Moreover, absence of severe sanctions at this first level of payment default may result in individuals from different background and having different personality traits to experience

The second level of payment default, overdue interest, is correlated with unconscientiousness according to survey findings. Besides overdue interest, unconscientiousness is also correlated to attachment proceeding. Indeed, unconscientious people indicated that they frequently pay overdue interest and experience attachment proceeding. In this study, reverse questions measuring the conscientiousness dimension of “big five personality” built up a new factor, so conscientiousness dimension is divided into two factor, which are named by researchers as

Another finding of this survey is the significant relationship between external locus of control and repayment behavior. According to correlation analysis results, external locus of control is related to both warrant execution and attachment proceeding significantly. In other words, people having external locus of control engage in more severe aspects of payment default- warrant execution and attachment proceeding-more frequently. This finding is also consistent with the findings of previously conducted survey of Özşahin et al. (2018). External locus of control is the characteristics of people who attribute what happens all in their life to the external factors such as luck, destiny or other people rather than their own doings (Rotter, 1990). Thus, people who have external locus of control are more prone to accuse others for their failures. Because they cannot recognize the relationship between their efforts and the results they got, they are unable to learn from their mistakes (Bernardi, 2001). Furthermore, those people display same attitude in case of debt and accuse others or laws for problems stemming from debt, thus they may experience payment defaults such as warrant execution and attachment proceeding more frequently rather than others.

Analysis results revealed intuitive decision making as another personality characteristic linked to repayment behavior. Findings indicating a negative significant relationship between intuitive decision-making and attachment proceeding demonstrate that the intuitive decision makers are more prone to pay regularly, thus they do not engage in payment default as frequently as others. Attachment proceeding is offered to respondents as the most severe results of the payment default. In decision-making literature, loss aversion is indicated as primary emotional tendency affecting decisions of individuals (Simon et al., 2007). Namely, when individuals have to make a decision between same amount of loss and gain, they mostly tend to make decision to avoid the loss. However, the effect of loss aversion in decision-making varies upon the amount of the losses–small amount of loss means weak effect of loss aversion (Simmons and Novemsky, 2008). In that case, the tendency of intuitive decision makers to avoid from such a severe sanction-attachment proceeding- of payment default is coherent result produced by this survey.

In addition to those indicated results above, findings displayed non-significant relations of

In conclusion, it has been observed by this research that personality characteristics, especially some characteristic as like unconscientiousness, external locus of control, intuitive decision making, are significantly related to repayment behavior. However striking finding of this research is that opposite sides of any construct does not produce opposite results. For example, while unconscientiousness is negatively correlated with repayment behavior,

Acknowledgments

This paper supported by Yalova University Bilimsel Araştırma Projeleri Koordinasyon Birim (BAP)– grant number 2018/AP/0004.

References

- Achtziger, A., Hubert, M., Kenning, P., Raab, G., & Reisch, L. (2015). Debt out of control: The links between self-control, compulsive buying, and real debts. Journal of Economic Psychology, 49, 141–149. DOI:

- Arya, S., Eckel, C., & Wichman, C. (2013). Anatomy of the credit score. Journal of Economic Behavior & Organization, 95, 175– 185. DOI:

- Bernardi, R. A. (2001). A Theoretical Model for the relationship among stress, locus of control and longevity. Business Forum, 26(3-4), 27-33.

- Doğan, T., Kürüm, A., & Kazak, M. (2017). Kişilik özelliklerinin erteleme davranışını yordayıcılığı [Predictability of personality traits on the procrastination behaviour]. Başkent University Journal of Education, 1(1), 1-8.

- Gathergood, J. (2012). Self-control, financial literacy and consumer over-indebtedness. Journal of Economic Psychology, 33 (3), 590–602. DOI:

- Goldberg, L. R. (1990). An alternative "description of personality": The Big-Five factor structure. Journal of Personality and Social Psychology, 59(6), 1216-1229.

- Griffin, D., & Husted, B. W. (2015). Social sanctions or social relations? Microfinance in Mexico. Journal of Business Research, 68(12), 2579-2587.

- Harrison, N., Agnew, S., & Serido, J. (2015). Attitudes to debt among indebted undergraduates: A cross-national exploratory factor analysis. Journal of Economic Psychology, 46 (Feb.2015), 62-73. DOI:

- Hershey, J. C., & Schoemaker, P. J. (1980). Prospect theory's reflection hypothesis: A critical examination. Organizational Behavior and Human performance, 25(3), 395-418.

- Hofstede, G. (1980). Culture and organizations. International Studies of Management & Organization, 10(4), 15-41.

- Hunt, R. G., Krzystofiak, F. J., Meindl, J. R., & Yousry, A. M. (1989). Cognitive style and decision making. Organizational Behavior and Human Decision Processes, 44(3), 436-453.

- Kamleitner, B., Hoelzl, E., & Kirchler, E. (2012). Credit Use: Psychological perspectives on a multifaceted phenomenon. International Journal of Psychology, 47(1), 1-27.

- Kaptan, Ö. B. (2011), Bireysel kredilerin risk ve tüketici davranışı açısından analizi [Analysis of individual credits in context of risk and consumer behavior), Doktora Tezi [Ph.D. Thesis], Ankara: Ankara Üniversitesi / Sosyal Bilimler Enstitüsü / İşletme Anabilim Dalı.

- Lea, E. G. S., Webley, P., & Levine, R. M. (1993). The economic psychology of consumer debt. Journal of Economic Psychology, 14(1), 85–119. DOI:

- Livingstone, M. S., & Lunt, K. P. (1992). Predicting personal debt and debt repayment: Psychological, social and economic determinants. Journal of Economic Psychology, 13(1), 111–134.

- Lusardi, A. & Tufano, P. (2009). Debt literacy, financial experiences, and overindebtedness, CFS Working Paper, No. 2009/08, http://nbn-resolving.de/urn:nbn:de:hebis:30-63796

- McCrae, Robert R., & Costa, P. T. (1989), Rotation to maximize the construct validity of factors in the neo personality inventory, Multivariate Behavioral Research, 24 (1), 107-124.

- McKenna, J., Hyllegard, K., & Linder, R. (2003). Linking psychological type to financial decision-making. Journal of Financial Counseling and Planning, 14(1), 19-29.

- Mewse, A. J., Lea, S. E. G., & Wrapson, W. (2010), First steps out of debt: Attitudes and social identity as predictors of contact by debtors with creditors. Journal of Economic Psychology 31(6), 1021–1034. DOI:

- Nguyen, S. (2016). Cost of Stress on the U.S. Economy is $300 Billion? Says Who?, Workplace Psychology, https://workplacepsychology.net/

- Nyhus, E. K., & Webley, P. (2001). The role of personality in household saving and borrowing behaviour. European journal of personality, 15(1), 85-103.

- Ong, Q., Theseira, W., & Ng, I. Y. (2019). Reducing debt improves psychological functioning and changes decision-making in the poor. Proceedings of the National Academy of Sciences, 201810901.

- Özkan, C. (2014), Türkiye’de Kredi Kartı Kullanıcı Profili Ve Davranışı Analizi [Analysis of credit card users’ characteristics and behaviors in Turkey], Uzmanlık Yeterlilik Tezi, Ankara: Türkiye Cumhuriyet Merkez Bankası Bankacılık ve Finansal Kuruluşlar Genel Müdürlüğü.

- Özşahin, M., Yürür, S., & Coşkun, E. (2018). A Field Research to Identify Psychological Factors Influencing the Debt Repayment Behavior in Turkey. EMAJ: Emerging Markets Journal, 8(2), 26-33.

- Paparella, G. (2015). Debt and Health: A Briefing, Oxford: Picker Institute Europe, UK.

- Ridgway, N. M., Kukar-Kinney, M., & Monroe, K. B. (2008). An Expanded Conceptualization and a New Mesaure of Compulsive Buying. Journal of Consumer Research, 35 (4), 622-639.

- Robb, A. C., & Sharpe, D. L. (2009). Effect of personal financial knowledge on college students’ credit card behavior. Journal of Financial Counseling and Planning, 20(1), 25–34.

- Rogers, P., Rogers, D., & Securato, J. R. (2015). About Psychological Variables In Application Scoring Models. Revista de Administracao de Empresas, 55 (1), 38-49.

- Rotter, J. B. (1966). Generalized expectancies for internal versus external control of reinforcement. Psychological Monographs: General and Applied, 80(1), 1-28.

- Rotter, J. B. (1990). Internal Versus External Control of Reinforcement: A Case History of A Variable. American Psychologist, 45 (4), 489-493.

- Scott, S. G., & Bruce, R. A. (1995). Decision-making style: The development and assessment of a new measure. Educational and Psychological Measurement, 55(5), 818-831.

- Simon, G., Eric, J. J., & Andreas, H. (2007). "Individual-Level Loss Aversion in Riskless and Risky Choices," IZA Discussion Paper 2961, Institute for the Study of Labor (IZA).

- Simmons, J., & Novemsky, N. (2008). "From Loss Aversion To Loss Acceptance: How Gambling Contexts Undermine Loss Aversion" Working Paper.

- Spector, P. E. (1982). Behavior in organizations as a function of employee's locus of control. Psychological Bulletin, 91(3), 482-497. DOI:

- Stone, B., & Maury, R. V. (2006). Indicators of personal financial debt using a multi-disciplinary behavioral model. Journal of Economic Psychology, 27(4), 543-556.

- Stumm, S. O’Creevy, M. F., & Furnham, A. (2013). Financial capability, money attitudes and socioeconomic status: Risks for experiencing adverse financial events. Personality and Individual Differences, 54 (3), 344–349. DOI:

- Ulu, S., Özdevecioglu, M., & Ardiç, K. (2016). Kisilik Özelliklerinin Hasta Iken Ise Gelme (Presenteizm) Davranisi Üzerindeki Etkileri: Imalat Sanayiinde Bir Arastirma [The Effects of Personality Characteristics On Presenteeism: A Study Of Manufacturing Industry]. Erciyes Üniversitesi Iktisadi Ve Idari Bilimler Fakültesi Dergisi, 47, 167-181.

- Vieira, K. M., Rovedder de Oliveira, M. O., & Kunkel, F. I. R. (2016). The Credit Card Use and Debt: Is there a trade-off between compulsive buying and ill-being perception? Journal of Behavioral and Experimental Finance, 10 (June 2016), 75–87. DOI:

- Wang, L., Lu, W., & Malhotra, N. K. (2011), Demographics, attitude, personality and credit card features correlate with credit card debt: A view from China, Journal of Economic Psychology 32 (1), 179–193. DOI:

- Zhu, Y. L., & Meeks, B. C. (1994). Effect of low-income families ability and willingness to use consumer-credit on subsequent outstanding credit balance. Journal of Consumer Affairs, 28(2), 403–422. DOI:

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 October 2019

Article Doi

eBook ISBN

978-1-80296-070-9

Publisher

Future Academy

Volume

71

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-460

Subjects

Business, innovation, Strategic management, Leadership, Technology, Sustainability

Cite this article as:

Özşahin*, M., & Yürür, S. (2019). Investigating Relationships among Personality Characteristics and Repayment Behavior: Quantitative Research in Turkey. In M. Özşahin (Ed.), Strategic Management in an International Environment: The New Challenges for International Business and Logistics in the Age of Industry 4.0, vol 71. European Proceedings of Social and Behavioural Sciences (pp. 429-442). Future Academy. https://doi.org/10.15405/epsbs.2019.10.02.39