Abstract

Logistics centres play an important part in the logistics infrastructure. They have become a noticeable element of the economic landscape characteristic for cities and suburban areas. Apart from typical functions and goals of the logistics centres resulting from their logistics operations, they also have an exogenic function, which means that, as a result of their interactions with the local environment, they spur the development of the local economy. The aim of the present paper is to determine the location factors facilitating the establishment of logistics centres as well as to assess their benefits for the local economy. Theoretical conclusions drawn within the paper are supported by the empirical analysis performed on a seven logistics centres. The survey was based on an questionnaire addressed to companies in Poland. The areas which offer the combination of the above mentioned location factors are sought by the companies as they enable them to reduce the investment costs and daily operation costs, as well as enable the companies to increase profit and decrease the investment risk.

Keywords: Logistics centredevelopment conditionslocalisation factorscities

Introduction

In Poland, logistics centres are a relatively new, but important, part of the economic landscape. They are a visible, or even characteristic, element of the Polish urban and suburban landscape. Their location in the vicinity of big cities is not accidental. It results from their strong connection with the cities which, due to their infrastructure and transportation hubs, facilitate the establishment and development of logistics centres. The article discusses the conditions and factors facilitating the establishment and operation of logistics centres, pointing out to the role played by the local administration. It also discusses the significance of logistics centres for the cities. In the theoretical part, the paper presents some remarks on the significance, function and tasks of the logistics centres understood as the entities providing logistics services. The theoretical part is followed by the empirical analysis of a survey conducted on seven logistics centres selected for the study.

The notion of a logistics centre and its function

The notion of a logistics centre (LC) has been appearing in the scientific literature since the 1980s. One of the first to use the term was R. Tress (1984), who differentiated between logistics centres and other logistics entities. The author claimed that, within a particular logistics centre (in German Güterverkehrszentrum – GVZ), there operate independent TSL entities which may – potentially – co-operate with one another (Milińska & Krośnicka, 2017). However, LCs are still being associated mainly with warehousing, storage keeping and shipping, irrespectively of the actual scope of their activities. Numerous authors have presented their own definitions of LCs over the years.

The existing definitions of logistics centres may be divided into two groups, depending on the adopted criteria (Meidute, 2010). The first group comprises the authors who consider logistics centres part of the transport infrastructure, and who see them as places where goods flow through subsequent levels of the value chain. Thus, a logistics centre ensures the availability of various means of transportation, fulfils many logistics functions, and provides services for a wide variety of users as well as uses advanced IT systems (i.e. electronic data interchange). Fechner (2010) understands the logistics centre in this way, and describes it as a spatially functional object with the infrastructure and organization, which carries out logistics services connected with receiving, storing, dividing and issuing goods; business entities situated in its centre provide accompanying services too, and they do so independently from the sender or recipient of the goods.

The second group comprises the definitions which treat LCs as a trigger for business activity. In this understanding, logistics centres facilitate the development of companies and impact the regional economy (the city or agglomeration). Here one may refer, for example, to Palšaitis and Bazaras’s (2004) definition, which treats the logistics centre as a place where logistics services and other logistics activities concentrate, and through which the companies carry out their customer service tasks.

Common features of the LC regardless of the adopted criteria or definition are (Rimienė & Grundey, 2007):

a company (independent business entity) – usually from the service sector with logistics functions (storage, warehousing, handling, transportation)

a large space facility (from a few to several dozens of hectares)

technical means of transportation and storage (buildings, constructions, sites, plots etc.)

proximity to the transport infrastructure (main roads and rail roads)

A complex nature LC’s activity stems from a diversity of functions and tasks the logistics centres fulfil. LCs provide a variety of services for the companies; among these, one may differentiate four categories: logistics (basic) functions, financial (subsidiary) functions, additional functions, IT and information functions (Płaczek, 2006; Walczak, 2008; Fechner, 2009; Kaźmierski, 2012; Önden, Acar, & Eldemir, 2018).

Basic functions comprise activities connected with transportation, storage, stock management, orders, planning and picking. Financial functions embrace the trade operations, commission sale and accounting as well as insurance services. Additional functions consist of storage inventory, customer service including post-sale operations, control and marking the goods, customs and marketing. IT and information services ensure the flow of data between the elements of the logistics chain and the logistics centre. It is possible due to the electronic data interchange as well as the free access to information on the markets and goods. One may ascribe particular tasks to particular functions, such as the management of the flow of the goods, information and finances (Table

Types of logistics centres

Logistics centres differ in terms of their spatial integration, types of ownership, scopes of handled goods, scope of influence as well as the degree of transport availability (Table

Logistics centres are also divided according to their territorial scope, which marks their operational space. These are: international LCs (scope around 500 km), regional LCs (up to 50-80 km), local LCs (up to 5-8 km). Such differentiations, however, should be treated as tentative or even artificial. The reason for it being the fact that:

economic areas and global supply chains used by global manufacturers and logistics operators are changeable and their transport conditions are being adjusted mainly to the pan-regional units such as the supply and trade market,

local territorial scope cannot be limited to a small regional range (5 km) (Fechner, 2004), as it would be difficult to define a clear-cut border of the economic activity. Regional scope should therefore be linked to the particular functions of the logistics centre within the area.

One may thus agree with Fechner (2004), who argues that the best way to classify LCs is to do so according to their intermodal or non-intermodal (monotransport) character. Intermodal LCs use a single terminal for handling the combined transport system and a single freight unit, which justifies their territorial scope at more than 300 km between the place of shipment and delivery. Non-intermodal LCs should have a smaller territorial scope and more limited functions (Table

Conditions facilitating the establishment and development of the LCs

Localisation of the LCs is vital for their development. Therefore, choosing the place to locate the LC one should take into account the right criteria. These are, on the one hand, some general factors known also as conditions; on the other hand, these are the so called location factors, which are much more specific. Both conditions and location factors have their impact on the operations of the logistics centre. The conditions are divided into external and internal. The external conditions embrace a wide range of categories and they refer to a bigger area (e.g. a country, voivodeship or other basic administrative regions). The external conditions embrace the features important for the location of the logistics centre (a city, a region).

Logistics centres are usually located in the places which have the need for their services and in which the favourable location factors are concentrated. One may differentiate three categories of such places but, interestingly enough, they may overlap; sometimes a particular place may belong to all three categories.

Areas where the logistics centres provide services for a few voivodeships simultaneously as well as for their main urban centres; it is facilitated by the existing transportation links between the main transportation hubs (e.g. marine ports, airports) and freeways,

Areas with high concentration of economic and industrial activities as well as service providers e.g. special economic zones, technical and technological complexes, clusters or industrial districts

Agglomerations and big cities, which justify the economic functioning of the logistics centres. Additionally, such areas characterise themselves with a highly developed transport infrastructure and high capacity roads, which allow for a fast growth of logistics services.

The development of LCs within the urban areas depends mostly on:

geographical location, especially the proximity of big cities (agglomerations), which are the markets for goods and services,

demand generated by big cities (agglomerations) – their inhabitants and companies – for logistics services in particular as well as for transportation services,

well-developed infrastructure, in particular the transportation and IT infrastructure; the city’s location near hubs and transport channels, etc.

well-qualified workforce and a flexible education sector, responding to the needs of business.

The ways for the city to create the favourable conditions for the development of LCs entail:

beneficial investment policies, attractive investment areas at affordable prices,

beneficial fiscal policies – lower local taxes (e.g. tax discounts or subsidies),

helpful local administration (investment support, administrative facilities),

broad availability of the communal services.

-

Empirical study – methodology and study subjects

The assumptions presented above have been empirically tested on a sample of seven logistics centres. The aim of the study was to determine their location factors (conditions). The study was carried out in 2018. The companies selected for analysis were: Beiersdorf Manufacturing Poznań, Distribution Centre Volkswagen Group Poland (VGP), CLIP Logistics, DB Schenker Poland, GEFCO Poland, Hendi Poland and Raben Logistics Poland. These business entities were then characterised based on the data available through the following websites: www.niveapolska.pl, www.vw-group.pl, www.clip-group.com, www.dbschenker.com.pl, www.gefco.net, www.hendi.pl, www.polska.raben-group.com as well as on the information provided through the survey. The survey was sent to:

the process owner for selecting external warehouses for finished goods in Beiersdorf Manufacturing Poznań,

a member of the project team in VGP responsible for determining the location,

a member of the project team in CLIP Logistics LLC taking part in the process of determining the location,

the director of the Poznań branch of DB Schenker Poland,

a member of the project team GEFCO Poland,

the owner of Hendi Poland who designed the process for determining the location,

an employee of Raben Group Poland; the connection of the position with the process of determining the location has not been specified in the survey.

The first of the investigated companies, Beiersdorf, has moved its business activities from Chlebowa street to Gnieźnieńska street in Poznań. The new location is in the suburbs of Poznań near National Road 92, which links Rzepin with Poznań and Warsaw. The company manufactures Eucerin skin care products and some of the Nivea lines: Visage, Body, Baby, Men and Styling.

The decision to create the new centre was taken in 1998, and construction work started two years later. In 2001, one of the most advanced Beiersdorf manufacturing plants was opened. After seven years, the manufacturing plant was developed further. In 2010, the company produced 8.600 tonnes of creams and balms (more than 100 million units) 90% of which was exported to Western and Eastern Europe, Asia, Australia, South America and Africa. The plant’s floor space is 21 000 square metres, with its total area being 7.2 hectares.

The second of the investigated companies, VGP, moved its business activities from Sady and Poznań (Krańcowa street) to Komorniki in 2015. The total area of the centre is 32 000 square meters. VGP imports car parts for Volkswagen, Audi, Škoda, SEAT and Porsche. The company also sells new cars, original components and accessories as well as provides legalization services necessary for their admission for sale. The idea to build the centre appeared in 2012 as a result of some internal planning initiatives aimed at coming up with new development strategies for selling the original parts and accessories for the car brands united within the group.

The third of the investigated companies, CLIP, is located in Swarzędz from the moment of its establishment in 1998. The company is a multi-modal logistics centre comprising six class A warehouses with combined floor space of 150 000 square meters. They are equipped with advanced, high-bay internal transportation system. In the survey, the company declared that it provides services for all the markets suggested in the survey, namely the local market, the regional market (Swarzędz and vicinities), the national market (Poland), the international market, including Central and Eastern Europe, European Economic Area, as well as the global market, including developed and developing countries.

The forth of the investigated companies, DB Schenker Poland, is located in Tarnów Podgórny and is known as the Poznań branch. The company offers complex logistics services including road and air transport, contract logistics and managing the supply chain for motor and technological industries, consumption goods, special transport and special events logistics. DB Schenker in Tarnów Podgórny provides services for the regional market, but it does not mean that its territorial scope overlaps with the administrative division of the country. The company claims that it results from the shape of the transportation network in Poland.

The fifth company, Hendi, conducts wholesale trade of cooking equipment. It was located in 2005 in Gądki. This location benefits from the proximity of S11 express road, linking Koszalin and Piekary Śląskie as well as from the proximity of A2 highway. It is an international company with branches in Holland, Austria and Romania and it has been present on the market for 75 years. The company produces, sells and distributes cooking equipment and accessories. Its warehousing space in Poland is more than 4 000 square meters.

The sixth company, GEFCO, has been present in Poland since 1999, with its main headquarters located in Warsaw. Its other branches are located near Łódź, Poznań, Katowice, Wrocław, Kraków and Rzeszów. The study was conducted in Kąty Wrocławskie, whose total area is 10 000 square meters. The company offers logistics services in the following areas: FVL – warehousing, distribution and preparation of vehicles, Overland – road transport, Overseas – marine, air and combined transport, Warehousing & Reusable Packaging – warehousing and managing recyclable packaging, Customs – customs and taxes. The company declared that it is present on the global market and that it plays a dominant role in the Polish logistics sector.

The seventh of the studied companies, Raben Logistics Polska LLC, is located in Gądki near Poznań. Its other branches are located in 12 countries in Central and Eastern Europe. Raben has been present in Poland since 1991, providing services in the following areas: logistics, warehousing, national and international road transport, intermodal transport, sea and air forwarding as well as fresh logistics. The company has 1 150 000 square meters of warehousing space and a fleet of 8000 vehicles. The company declared in the survey that it plays a dominant role in the Polish logistics sector.

The survey

The research was conducted in form of a structured questionnaire (survey) consisting of three parts: general data collection, main part, and particulars. The main part was divided into two sections: the first one applied to the process of location and the other to the cooperation with the local administration units. The survey encompassed both open and closed questions. The closed questions enabled one to choose a single answer (the so called alternative questions), or to choose more than one answer (the so called conjunctive questions). The questionnaire contained also ranking questions, in which the participants were expected to rank the answers according to the adopted criteria. The structure of the open questions was dictated by the requirements of a narrative analysis, which treats the respondents’ answers as a form of their subjective description of the external reality (Silverman, 2009, p. 197).

The reasons behind the location of the LCs and their impact on the cities – the results of the survey

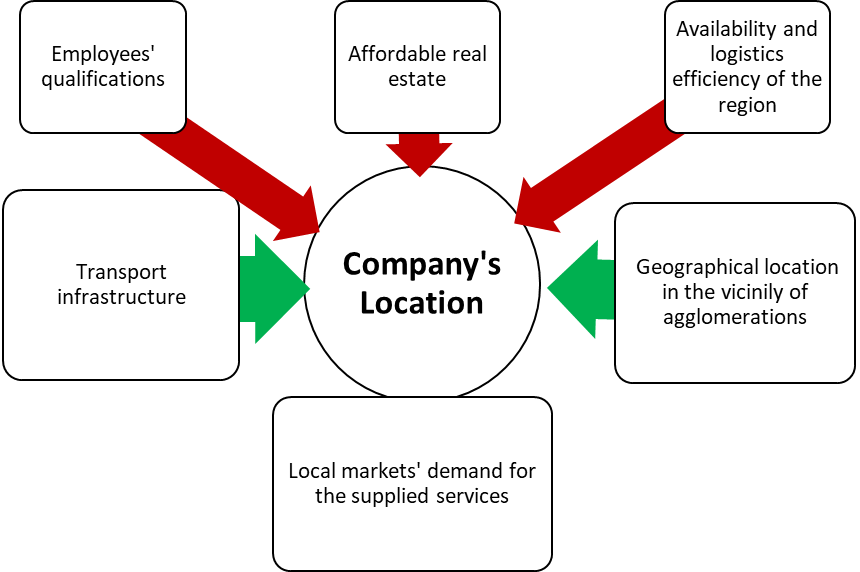

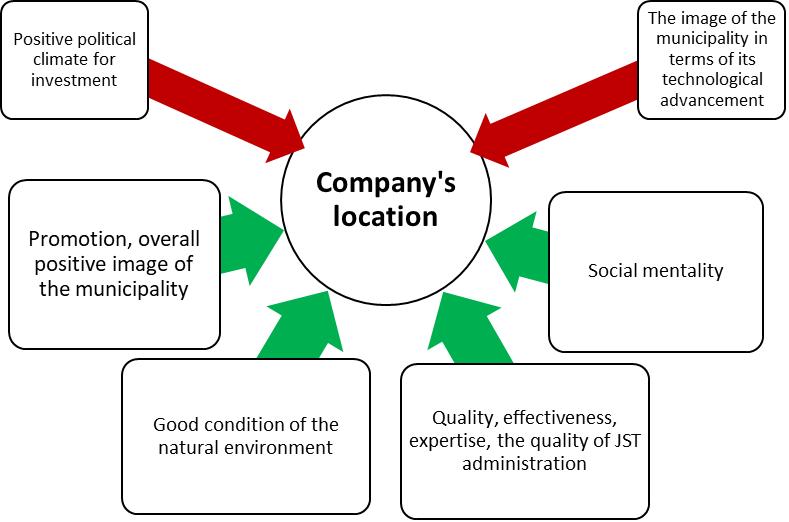

The main aim of the study was to determine what factors influence the decision on the company’s location as well as to assess the quality of cooperation between the companies and the units of the local administration. The participants were to choose from 26 factors (14 hard and 12 soft factors).

According to the surveyed companies, the most important factors are (Draft 1): transport infrastructure, geographical location near urban agglomerations and the local market’s demand for the company’s services – these were ranked as “important” or “very important”. This shows a significant role played by agglomeration and the opportunities it offers. Advanced infrastructure, trade market and offered services attract investors and thus affect the area’s development. The location of a LC is connected with the city’s investment in transport infrastructure (e.g., the development or modernisation of roads, ring roads, express roads, bridges, tunnels, etc.). One may even argue after Kaźmierski (2006 p. 49) that the logistics centres, being a new form of business activity organisation, enforce the development of infrastructure. The creation of a LC as a new form of urban development raises land prices and attracts investors, enhancing the city’s competitiveness on the market and improving its image.

Additionally, one should pay attention to some indirect benefits brought about by the presence of an LC such as the development of advanced manufacturing networks comprising specialised sub-suppliers and co-operators (cooperation within the supply chain) or the development of horizontal relationships between the companies working in different business areas (development of various forms of cooperation). Such benefits mean that LCs improve the economic situation of the agglomeration, making it a centre of economic development for the region.

Therefore, the local administration should more decisively support economic activities and create favourable conditions for the companies. The respondents pointed out the lack of sufficient support from the local administration. Municipalities should be more active in attracting external investment as it boosts employment and increases tax revenues. The single company’s success may attract other investors, improving the local business activity. It is a multiplication effect.

The companies do not regard labour cost incurred by the local workforce as vital. The workforce supply within the agglomeration is not a problem, even if it means additional costs connected with organising the commute for the employees. However, generating additional traffic connected with the commute may cause increasing traffic problems within the whole agglomeration area (traffic congestion). As a result, the costs may rise and it is more difficult to maintain the timeliness of deliveries. Increasing traffic congestion means also the rising levels of pollution and noise, increasing wear of the road surface (especially due to lorries and trucks). In consequence, one should take into account also the negative aspects of locating LCs within the area.

According to the surveyed companies, the most important soft factors (Draft 2) are: promotion, good condition of the natural environment, quality, effectiveness, JST administrative expertise, social mentality (positive attitude towards new investment, openness and readiness to take up challenges). The logistics centres marked soft factors as less important. VW, GEFCO and Hendi claim that they have no significance when it comes to the location of a logistics centre.

The companies ascribed particular importance to the factors related to the investment attractiveness of the area. It is a source of the competitive advantage of the companies located in the area. It also affects the competitiveness of the region. While making location decisions, contemporary companies take into account environmental protection and social interests according to the ideas of CSR – corporate social responsibility.

One may therefore claim that it is crucial to enhance the investment attractiveness of the area; this may be achieved with the aid of some mechanism of shaping the market in favour of the development of LCs on the local and regional level. It applies predominantly to technical infrastructure, real estate, technological innovations as well as effective economic marketing of the region. According to the companies, secondary, though still important, factors are the protection of the spatial order, natural environment and quality of life.

The areas which offer the combination of the above mentioned location factors are sought by the companies as they enable them to reduce the investment costs and daily operation costs, as well as enable the companies to increase profit and decrease the investment risk. As Camagni (2002 p. 2396) argues, every area has a particular specialty which decides of its competitiveness. According to the responders, this specialty should be clearly visible in technological innovation, research, and innovation characteristic for developed and highly developed economies. In this way, the investors’ trust may be enhanced and specialised capital may be drawn to the area.

Conclusion and Discussions

Numerous examples of cites and their functions prove the existence of a relationships between the urban centre and the logistics centre. Transportation hubs contribute to the formation of the cities. They may be enhanced by the location of a logistics centre. A similar rule applies to the industry function, which in the past played a similar, city-forming role. Their importance may be kept by the logistics services offered in the vicinity and realised through the LC. One should also stress the fact that LCs’ connections with the city are stronger and more visible in the case of a mono-transportation centre (of a smaller scope).

Localised logistics centres may draw other manufacturers or sellers to invest in the area, as they require complex logistics services. Investing in logistics projects has a positive impact on construction, transport, roads as well as services. The location of a logistics centre improves city logistics; the concentration of goods in the centre, in turn, facilitates the management of deliveries for the companies and inhabitants of a given agglomeration.

The location of LCs as a large format facility usually embracing from a few dozen up to 200-300 hectares has a significant impact on the surrounding space. In spite of that, such investments allow for a relative concentration of logistics activities. It is important to note that the logistics centre should be located in non-urbanized areas so as not to interfere with the everyday life of the city, but support it economically.

The creation and development of the logistics centre depends on the city (public sphere) which creates the favourable conditions for the creation of LCs, and sometimes takes part in the realisation of the investment as part of the public-private partnership. Mutual relations between the city and LC are strong, but the cities create LCs and it depends on the cities (their authorities) if such investments are successful and if they bring expected long-term benefits.

References

- Camagni, R. (2002). On the Concept of Territorial Competitiveness: Sound or Misleading? Urban Studies, Volume 39(13), 2395–2411.

- Fechner, I. (2004). Uwarunkowania rozwoju centrów logistycznych i aglomeracji miejskich [Conditions for the development of logistics centers and urban agglomerations]. In T. Nowakowski (Ed.), Logistyka a infrastruktura miejska. Wrocław: CL Consulting i Logistyka, Oficyna Wydawnicza „Nasz Dom i Ogród”.

- Fechner, I. (2009). Centra logistyczne i ich rola w sieciach logistycznych [Logistics centers and their role in logistics networks]. In Logistyka, Kisperska-Moroń, & Krzyżaniak S. (Ed.), Poznań: Biblioteka Logistyka.

- Fechner, I. (2010). Centra logistyczne i ich rola w procesach przepływu ładunków w systemie logistycznym Polski [Logistics centers and their role in load flow processes in the Polish logistics system]. Prace Naukowe Politechniki Warszawskiej, Volume 76.

- Kaźmierski, J. (2006). Centra logistyczne jako element infrastruktury i czynnik rozwoju gospodarczego regionu [Logistics centers as an element of infrastructure and economic development factor of the region]. In T. Markowski (Ed.), Rola centrów logistycznych w rozwoju gospodarczym i przestrzennym kraju. Biuletyn KPZK PAN, Volume 225.

- Kaźmierski, J. (2012). Konsekwencje lokalizowania centrów logistycznych w przestrzeni miejskiej [Consequences of locating logistics centers in urban space]. Problemy Rozwoju Miast, no. 1.

- Kisperska-Moroń, D., & Krzyżaniak, S. (2009). Logistyka [Logistics]. Poznań: Instytut Logistyki i Magazynowania.

- Matlewski, A., & Jezierski, A. (2009). Rynkowe uwarunkowania lokalizacji centrum logistycznego w Gdańsku [Market conditions for the location of the logistics center in Gdańsk], In J. Dworak & T. Falencikowski (Eds.), Cele i uwarunkowania funkcjonowania współczesnych przedsiębiorstw, Gdańsk: CeDeWu.

- Meidute, I. (2010). Comparative analysis of the definitions of logistics centres. Transport, Volume 20(3).

- Milińska, J., & Krośnicka, K. (2017). Nowoczesne intermodalne centrum logistyczne [Modern intermodal logistics center]. In Mindur, M. (Ed.) Logistyka. Nauka-Badania-Rozwój. Warszawa-Radom: Instytut Technologii i Eksploatacji – Państwowy Instytut Badawczy.

- Önden, İ., Acar, A. Z., & Eldemir, F. (2018). Evaluation of the logistics center locations using a multi-criteria spatial approach. Transport, 33(2), 322-334.

- Palšaitis, R., & Bazaras, D. (2004). Analysis of the prospectives of intermodal transport and logistics centres in Lithuania. Transport, 19(3), 119-123.

- Płaczek, E. (2006). Logistyka międzynarodowa [International Logistics]. Katowice: Wydawnictwo Akademii Ekonomicznej w Katowicach.

- Rimienė, K., & Grundey, D. (2007). Logistics centre concept through evolution and definition. Engineering Economics, (4), 87-95.

- Silverman, D. (2009). Prowadzenie badań jakościowych [Conducting qualitative research]. Warszawa: Wydawnictwo Naukowe PWN.

- Tress, R. (1984). Das Güterverkehrszentrum als infrastrukturelle Schnittstelle des Güterverkehrs [Logistics centre as infrastructural node of freight traffic]. Düsseldorf: Verkehrs-Verlag J. Fischer.

- Walczak, M. (2008). Centra logistyczne [Logistics centers]. Wyzwania. Przyszłość. Warszawa: Wydawnictwo Wyższej Szkoły Cła i Logistyki w Warszawie.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 October 2019

Article Doi

eBook ISBN

978-1-80296-070-9

Publisher

Future Academy

Volume

71

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-460

Subjects

Business, innovation, Strategic management, Leadership, Technology, Sustainability

Cite this article as:

Budner, W. W., & Pawlicka*, K. (2019). Logistics centre – location and its significance for the city. In M. Özşahin (Ed.), Strategic Management in an International Environment: The New Challenges for International Business and Logistics in the Age of Industry 4.0, vol 71. European Proceedings of Social and Behavioural Sciences (pp. 369-380). Future Academy. https://doi.org/10.15405/epsbs.2019.10.02.34