Abstract

Waqf estates development refers to a form of development that aims to increase the productivity of waqf estates in order to create more sustainable benefits over a long period of time. The lack of funding in waqf estates development has hindered efforts to develop waqf estates productively. One of the strategies utilized by the Islamic Religious Council (MAIN) to overcome this problem is acquiring cooperation from outsiders. This cooperation is conducted by applying

Keywords: Musyarakah funding methodwaqf estate developmentproductive waqf

Introduction

Waqf is a property of Muslims that bear potential to be a source of funding to the country in providing facilities for Muslim community if it is managed well. This is proven by the success of waqf property development that commenced during the Ottoman Empire period. The implementation of waqf in the Ottoman Empire succeeded in making waqf properties as a source of funding to the government in providing facilities for the community particularly in the education sector such as schools and institutions of higher learning; health sector through hospital construction and free treatment; religion with the establishment of mosques and prayer rooms; as well as infrastructure facilities such as roads, bridges and others.

In Malaysia, the development of waqf property has shown some progress through the implementation of contemporary development methods as utilized by Penang Islamic Religious Council (MAINPP) in Penang. Contemporary waqf property development refers to development implementation that applies contemporary methods that are not merely intended for charity but as well as for any potential fund raising (Omar & Rahman, 2015). Among the contemporary methods that have been implemented in the development of waqf properties especially waqf estates by MAINPP in Penang is to utilize the

Problem Statement

Based on the research on previous studies, waqf property method of development of is divided into two which is the traditional and contemporary methods. Traditional methods are the practices inherited from the early Islamic civilization period by hiring or leasing a waqf property for farming and agriculture, building mosques, cemeteries and so on. Contemporary methods involve activities that can provide economic value such as investment in waqf properties such as building a commercial premises on waqf properties such as supermarkets, housing, hotels, and so on. (Omar & Rahman, 2013). The study of the traditional waqf property development methods has been conducted by Kahf (1998). His research established that the implementation of traditional methods is not appropriate as it could easily lead to bribery and abusive usage of the waqf property as well as making it vulnerable to intrusion. He proposed the implementation of the contemporary methods such as stock waqf, corporate waqf, and using Islamic funding as the capital of contemporary building construction to increase the productivity of waqf properties. Karim (2010) development of waqf property in Singapore involves contemporary methods through funding (

In Malaysia, a study on the application the contemporary method in waqf property development has been studied by Abdullah (2018), Omar and Rahman (2013), Bahari and Rahman (2012) and Omar and Rahman (2015). The research of Bahari and Rahman (2012) examines the form of funding and risk in developing the property of Seetee Aisah waqf property. While the research of Omar and Rahman (2013) studied the management method in developing Seetee Aisah waqf property. Their findings displays that the method of development utilized is a joint venture between MAINPP and Government-linked Company (GLC), UDA Land. The results of this joint venture successfully produced Seete Aisah waqf estate with the construction of a residential park known as

In conclusion, the method of waqf property development consists of traditional and contemporary methods. However, contemporary methods are seen as more appropriate at this time as it does not only provides welfare to society but also contributes to socio-economic development of sustainable Muslims such as the

Research Questions

The questions raised; first, how the development of waqf using

Purpose of the Study

This study is conducted in order to achieve two goals. First, to identify development projects on waqf land that utilize the

Research Methods

This study involves qualitative data derived from primary and secondary sources. The primary data is obtained through an in-depth interview on an informant who is a MAINPP officer that is directly involved in managing administering and developing the property and waqf estates in Penang. In this research, he is encoded as PPW 01 in order to maintain confidentiality of the data and information provided. Secondary sources are also obtained through research on document sources such as books, journals, magazines and others. These data are then analysed by content analysis with the help of ATLAS.ti version 8 (AV8) software.

Findings

The development of waqf estate is said to begin with the establishment of the Quba’ mosque and Nabawi mosque in the city of Madinah by Prophet Muhammad SAW as the centre of administration and facilities for Muslims to perform worship and conduct religious activities (Mohd, 2015). However, according to al-Syarbiniy (1997: 523), the waqf of Umar is the first waqf event in the opinions of the scholars. Although scholars differs in opinions regarding the early history of the occurrence of waqf in Islam, the scholars still conclude that the practice of waqf is required and strongly encouraged for Muslims (Al-Syawkani, 1996). The highlight of the waqf implementation in the history of Islamic civilization is during the Ottoman Empire. The success achieved during the reign of the Ottoman government made the waqf institutions drives the progress of civilization in that era. The waqf institution is a capital contributor to the Ottoman government to provide social facilities to the community such as educational institutions, residences, hospitals and so on is a fairly evident that reflects the importance of waqf properties developed for the continuous benefit of the society (Othman, 2015).

In Malaysia, the Zakat, Waqf and Haji Department (JAWHAR) developed 17 major impact projects in collaboration with MAIN that involves an allocation of RM 290.62 million with an estate area of 23. 771 hectares. A few examples of such projects are the construction of Kelana Beach Resort Hotel Port Dickson, Negeri Sembilan, Gran Puteri Hotel in Kuala Terengganu, Terengganu Dialysis Center in Batu Pahat, Johor and so on. The benefits of this development are for the public convenience. In addition to implementing major impact projects, JAWHAR in collaboration with MAIN and YWM has also launched a small impact project by building several units of the People Bazaar in every state in Malaysia including Sabah and Sarawak (Mohd, 2015).

Penang has also collaborated with JAWHAR, a low-medium cost apartment project in Butterworth, Penang which provides 152 residential units and low-medium cost housing in Sungai Nibong, Penang, providing 77 residential units. However, both projects are still under construction (Hassan, 2018). Based on MAINPP treasury record (2012), Penang has 952 acres of waqf estates (199 acres located on the island and 753 acres located on the mainland). Most of them existed over 100 years ago. Now, the land is located in a strategic place especially in Georgetown. The waqf estates are such as Hj Kassim Waqf, Syeikh Eusoff Waqf, Hashim Yahya Waqf, Khan Mohamad Waqf, Alimsyah Waley Waqf, Copee Amah Waqf, Waqf of Mosque of Lebuh Acheh, Kapitan Keling Waqf and others (Omar & Rahman, 2015).

Construction of buildings that is seen quite dominant by MAINPP mainly involves construction of contemporary buildings such as business premises, housing, office buildings and so on. In Malaysia, Penang is one of the states with a large number of productive waqf land and have the potential to be developed more productively. This condition makes MAINPP as a mutawalli in Penang to be more pro-active in designing all forms of development so that the waqf estate gains more productivity.

The significant of implementation of contemporary buildings including the housing is clearly evident after the successful completion of the construction phase of Seetee Aisah waqf in 2013 has boosted the acquisition of existing waqf properties. This is because the Seetee Aisah waqf project has given a business block worth more than RM 10,883,089.35 to MAINPP and the profit in musyarakah funding for housing lease with UDA Land (North) Sdn. Bhd. (Bahari & Rahman, 2012). This shows that waqf housing can generate sustainable benefits to the community.

In addition, MAINPP also applies istibdal method in developing waqf estate in Penang. Istibdal is implemented in the construction project of Mahaad al-Mashoor al-Islaami that originally located at a waqf estate area of Lot23 and 24 Lebuh Teik Soon which is now an established commercial complex (KOMTAR). The waqf estate is replaced (

In general, there are five sources of financing in developing the waqf estate in Penang practiced by MAINPP namely the allocation of the eight, nine and ten Malaysia Plan (RMK 8,9 and 10); funding from private parties; private waqf finance (existing funds); istibdal method; and joint venture with Government-Link Company (GLC) ) (Omar & Rahman, 2015, p.110). For the purpose of this study, only the funding involving musyarakah collaboration is discussed. This joint venture involves cooperation between MAINPP and GLC.

According to PPW 01, there is two development project on waqf estates in Penang that applies musyarakah method which is Seetee Aisah waqf estate development project, Seberang Jaya, Penang and Khan Mohammed waqf estate in Penang. The development of the Seetee Aisah waqf estate involves the collaboration of MAINPP with UDA Holdings Berhad through their subsidiary, UDA Land (North) Sdn. Bhd., while the Khan Mohammed waqf estate involved the joint venture between MAINPP and JKP. Sdn. Bhd.

Seetee Aisah Waqf Estate Development

The 9.86 acres (39902.04 square feet) estate (Omar & Rahman, 2015, p. 113) is originally a paddy field. Seetee Aisah Waqf Estate, Seberang Jaya, Penang is located near several major supermarkets such as Tesco Extra, Sunway Carnival, Billion and Giant. This situation gives an idea to MAINPP to develop the waqf estate as a housing estate because of the strategic location that is able to meet the needs of the community (Hassan, 2018).

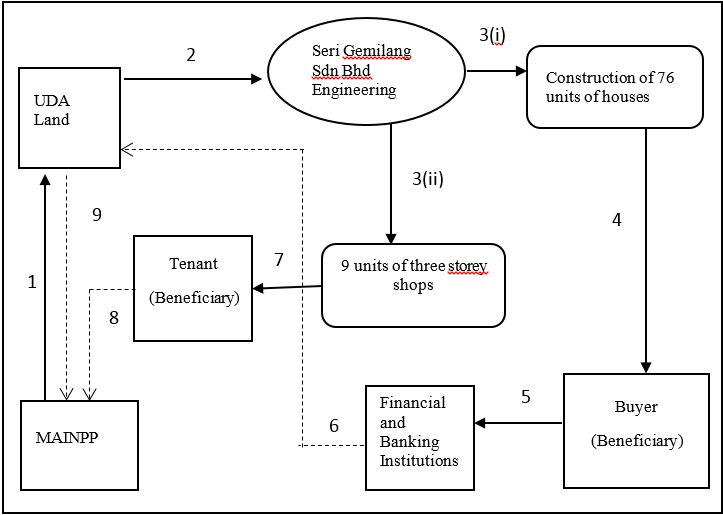

The waqf estate has successfully built a residential building with musyarakah joint venture with the project that started on February 25, 2010 costing RM 15 million. The projects covers the construction of nine units of three storey shops and 76 units of double storey terrace houses fully completed in February 2013. The sale of the house utilize leased hold method for a period of 99 years. The method of implementing the welfare of Setee Aisah housing is shown in Figure

Source: Researcher summary based on the explanation of PPW 01 (2016)

Figure

This development benefits the MAINPP through the rental of nine stores with a total of RM 56,000 per month. MAINPP also receives 30% of musyarakah profits of RM 600,000. This amount has exceeded the amount devoted to be distributed to mauquf ‘alaih as intended by the beneficieries. The surplus is used for fund raising purposes whether they are invested or to buy other waqf buildings. With this successful development, the MAINPP has approved a second phase development project on this waqf estate at a cost of RM 200 million with UDA Land. In addition to continuing the benefit of mauquf ‘alaih and maintaining ‘ayn waqf property, new waqf property can also be added thereby increasing their sustainability. Compared to the situation before the housing development is implemented, Seetee Aisah waqf estate is set up with squatter houses which holds no benefits to MAINPP.

Khan Muhammad Waqf Estate Development

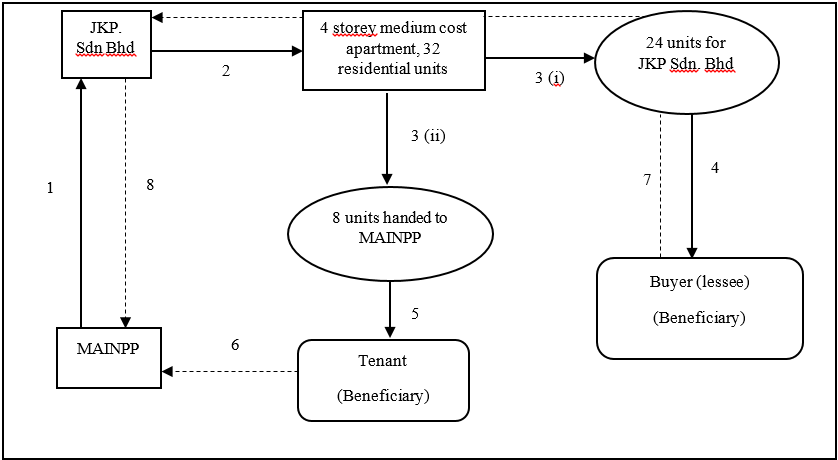

Khan Muhammad waqf apartment, Georgetown, Penang also applies the concept of musyarakah that involves the collaboration of MAINPP with JKP Sdn Bhd (Hassan, 2018). The development of the Khan Muhammad Waqf Apartment is a development of a block of medium cost apartments. The Waqf Apartment has four floors with a total residential area of 32 units and each unit has an area of 73.51 square meters. Until now, MAINPP and JKP have issued three leases for each unit where each lease has a term of 33 years for the units of the Waqf Apartment. The lease price for each residential unit is RM 112700.00++ (Hassan, 2018). The method of implementation is shown in Figure

Figure

Development Source: Mat Hassan, 2018.

Conclusion

In conclusion, waqf estate development is one of the important factors today as it have potential to benefit the well-being of the Muslim community. The construction of apartment units in Seetee Aisah and Khan Muhammad waqf estates displays that waqf property can fulfil the needs of the community to gain shelter even though if it is temporary. The implementation of the Seetee Aisah and Khan Muhammad estate development have managed to maintain

References

- Abdullah, S. R. (2018). Kaedah pembiayaan pembangunan tanah wakaf oleh Majlis Agama Islam Negeri terpilih di Malaysia [Methods of financial development waqf land by selected state Islamic Religious Council at Malaysia] (Doctoral dissertation). Retrieved from http://eprints.usm.my/id/eprint/43742

- Al-Syarbiniy, S. M. A. K. (1997). Mughni al-Muhtaj ila Ma’rifati alfazal-Minhaj [Sufficient for those who wish]. Vol. 2. Beirut: Dar al-Ma‘rifah.

- Al-Syawkani, M. A. (1996). Nayl al-Awtar [Reaching the wisher]. Vol. 3, Damsyiq: Dar al-Khayr.

- Bahari, Z., & Rahman, A. F. (2012). Modes and risk of financing for waqf development: The case of Seetee Aisyah waqf in Penang, Malaysia. ISDEV Paper Series, No. 37. Pulau Pinang: Center for Islamic Development Management Studies (ISDEV), USM.

- Hassan, M. S. H. (2018). Kelestarian pembangunan harta wakaf: Analisis terhadap perumahan wakaf di Pulau Pinang [Sustainable development of waqf property: Towards waqf housing in Pulau Pinang] (Doctoral Dissertation). Retrieved from http://eprints.usm.my/id/eprint/44023

- Kahf. M. (1998). Financing the development of awqaf property. Paperwork presented at Waqf Development Seminar, on 2-4 Mac, in IRTI, Kuala Lumpur.

- Karim, A. S. (2010). Contemporary shari’a compliance structuring for the development and management waqf aset in Singapore. Kyoto Bulletin of Islamic Area Studies, 143-164.

- MAINPP Waqf Fund. (2016). Waqf project. Retrieved from http://www.danawakaf.com/.

- Mohd, A. C. (2015). Pembangunan wakaf menerusi pendanaan kerajaan dan kerjasama institusi kewangan dan korporat: Hala tuju, cabaran dan harapan [Waqf development using goverment fund and joint venture between finance institution and corporat: Directions, challenges and expectation]. Muzakarah Wakaf, 1, 1–42.

- Omar, H., & Rahman, A. A. (2013). Aplikasi sukuk dalam usaha melestarikan aset wakaf: Pengalaman pemegang amanah wakaf terpilih [Application of sukuk to sustain the waqf property: Based on the experience of selection waqf trustee]. Shariah Journal, 21(2), 89-116.

- Omar, H. H., & Rahman, A. A. (2015). Pembiayaan pembangunan harta wakaf menggunakan sukuk [Financing for the development waqf property using sukuk]. Kuala Lumpur: University of Malaya press.

- Othman, R. (2015). Wakaf tunai: Sejarah, amalan dan cabaran masa kini [Cash waqf: History, current practices and challenges]. Kuala Lumpur: Dewan Bahasa dan Pustaka.

- Rachmad, D. (2014). Investment strategy development of waqf property: a conceptual framework. Inovbiz, Vol. 2, No. 1, 69-82.

- Saniff, M. S., & Hasan. W. W. N. (2009). Isu dan cabaran dalam pasca pembangunan tanah wakaf: kajian di Khan Muhammad Waqf Apartment at Jalan Perak, Penang [Issues and challenges in the post-development of waqf land: Case study Khan Muhammad Waqf Apartment at Jalan Perak, Penang]. Paperwork presented in International Workshop II, Universitas Muhammadiyah Sumatera Utara (UMSU), Medan, Indonesia, on 4-10 Mei 2009.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

23 September 2019

Article Doi

eBook ISBN

978-1-80296-067-9

Publisher

Future Academy

Volume

68

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-806

Subjects

Sociolinguistics, linguistics, literary theory, political science, political theory

Cite this article as:

Hassan, S. H. M., & Bahari*, Z. (2019). Application Of Musyarakah Funding For Estates Waqf In Penang. In N. S. Mat Akhir, J. Sulong, M. A. Wan Harun, S. Muhammad, A. L. Wei Lin, N. F. Low Abdullah, & M. Pourya Asl (Eds.), Role(s) and Relevance of Humanities for Sustainable Development, vol 68. European Proceedings of Social and Behavioural Sciences (pp. 192-199). Future Academy. https://doi.org/10.15405/epsbs.2019.09.19