Abstract

The main way to assess functioning of the enterprise is a financial diagnostics that adequately evaluates internal and external factors of economic activities, paying capacity, performance, profitability, and prospects of further development. According to the assessment results, it is possible to take reasonable decisions improving the economic performance. Profit serves as a weighty stimulator for any business. This position is connected with the fact that the profit ensures the growth of welfare of businessmen thanks to the income given by the invested capital. So, the problem of managing the profit as the system of principles and methods of developing and implementing management solutions on all main aspects of profit formation, distribution and business application becomes more urgent. The analysis of financial results represents the process of studying conditions and results of forming and using the profit in order to find the reserves to make the profit management still more effective. Relying on the conclusions drawn out in the course of this analysis, managers can develop the solutions enhancing the effectiveness of main activities. The theory of sustainable economic growth put forward by many economists suggests that the chief purpose of any profit management is to ensure the financial balance of the enterprise in the course of its development. The implementation of this purpose ensures the prolonged enterprise development without crises. The article deals with the problem of forming and distributing the profit of an industrial enterprise, JSC “BKO” being taken as an example.

Keywords: Business entityeffective activitiesfinancial performance planningfinancial resultsprofit distributionprofit management

Introduction

Sustainable competitiveness of the enterprise is not the result of accidental circumstances, but the consequence of the purposeful efforts both of managers and ordinary workers, for no company is capable of doing more that its workers can do (Chernikov & Radkov, 2011).

The basis of sustainable functioning of any business entity is its financial stability, effective production, as well as qualified management informed about the financial state of the organization, its economic efficiency, and the prospects of further development. To survive in the market conditions, enterprises must increase the production efficiency. The indicators of financial performance show the absolute production efficiency of all aspects of economic activities: supply, production, sales, finances, investments.

The main way to assess functioning of the enterprise is a financial diagnostic which helps to estimate adequately internal and external factors of economic activities, the paying capacity of the enterprise, its efficiency and profitability, further prospects of development. Taking into account the assessment results, it is possible to make informed decisions aimed at improving the efficiency of activities.

The final financial result of the activity of an economic entity is the algebraic sum of the result (profit or loss) from the sale of marketable products (works, services), the result (profit or loss) from financial, investment activity, and results from other operations, including non-sales.

Profit is the most important indicator of the economic efficiency of an enterprise. Profit-making is the main purpose of any business activities in every field of the national economy (Blank, 2007).

Profit serves as a weighty stimulator of any business. Such a position is connected with the fact that the profit ensures the welfare growth of business owners thanks to their income given by the invested capital (Khaidukova, 2016).

Workers of an enterprise are also persons concerned with the high enterprise profitability. This is explained by the fact that the profit is a significant guarantee of stability and long-term employment of the collaborators. Also, it ensures additional material incentives for labor, the satisfaction of social needs. It is necessary to note that the profit of a business entity through the system of tax payments allows forming a revenue part of state and regional budgets. In its turn, this forms the basis of economic development and prosperity of the whole state. Effective and profitable work can give to any business entity the advantages in obtaining a loan, choosing a partner, attracting highly qualified specialists, and in other fields of activities. In other words, it is possible to say that it is the profit that determines competitiveness and the degree of independence of an enterprise from market unfavourable changes. In connection with this, the problems of economic analysis of the level of profitability in order to find reserves to increase the performance become extremely important.

The analysis of financial results represents the process of studying conditions and results of forming and using the profit in order to find reserves of further growth of efficient profit management at the enterprise. Relying on the conclusions given by the analysis, the managers develop solutions enhancing the increase of the efficiency of main activities (Orekhov & Malyutina, 2015).

All of the above prove relevance of the research topic.

Problem Statement

Profit is the most important economic indicator of the functioning of a business entity. Profit shows the results of economic activities, the production of invested costs in general (Ezhkov & Stepanova, 2015).

On the one hand, we could think that the problem of profit has already been studied sufficiently, but, while studying the economic literature, it becomes clear that there is still a variety of discussion questions on this economic category. The problem statement is the search of directions of improving the profit management of a specific business entity in order to maximize the profit (Karaseva, 2015).

Research Questions

We may name the following main research questions formulated in the work and representing its tasks:

How have the financial results been changing lately?

i.e., what is the dynamics, composition and structure of the profit of the business entity, and how is the profit assessed?

What is the quality of the profit?

What is the prognosis of the profit for the nearest future?

May the enterprise managers expect the cardinal changes of the profit amount obtained?

What factors influence the profit dynamics and structure?

Purpose of the Study

The study purpose is to formulate the key directions of improving the profit management of a specific business entity. Summary of the results obtained will allow replicating and spreading the acquired experience in the whole industrial sector.

Research Methods

Traditional methods of processing the economic information underlie the research: monographic, logical and factorial analyses, comparisons, etc.

Findings

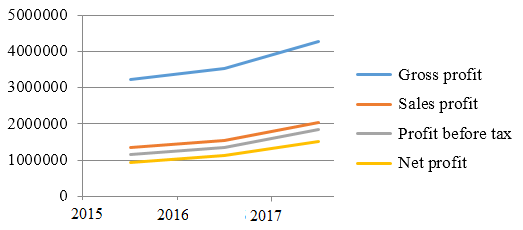

JSC “BKO” is quite a successful, dynamically developing and effective industrial enterprise. For the period concerned, the increase of all indicators forming the sales profit has been observed. The positive fact is that, at the background of the increased rate of the sales profit, the rate of the cost price has been decreased. The main activity of the enterprise has been developing dynamically, and it is rather effective, this being confirmed by the growth of the profit indicators. Thus, we can observe the positive tendency of forming the net profit of JSC “BKO”.

The profit dynamics indicators of JSC “BKO” are presented in Figure

To make decisions related to the sales profit management, it is important to analyze its composition and structure.

The sales profit dynamics by products is presented in Table

The profit growth is observed in all enlarged product groups. The most sustainable change is observed in such product as proppants. These changes are conditioned by the changes of sales structure caused by the market conditions. The sales profit structure is presented in Table

In the structure of the sales profit, the profit from the sales of refractories occupies the largest share.

Due to the permanent growth of net profit, the growth of profit directed to consumption and accumulation is also observed. The order of net profit distribution is especially evident at studying the structure (Table

In the structure of profit distribution, the changes for the period concerned have been observed. Thus, the tendency to reduce the share allocated for dividend payment and that to increase the share allocated for the consumption fund are evident.

One of the stages of profit management is its planning. The aim of profit planning is considered to be the profit growth at the base of the increased turnover and optimized structure of an enterprise.

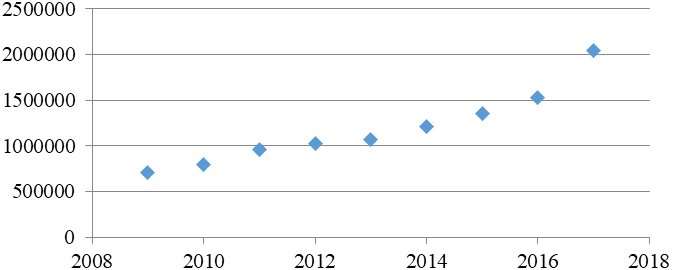

Let us apply Microsoft Excel Programming Features. To do this, we will use the initial data presented above, and construct a dot chart, which takes the form shown in Figure

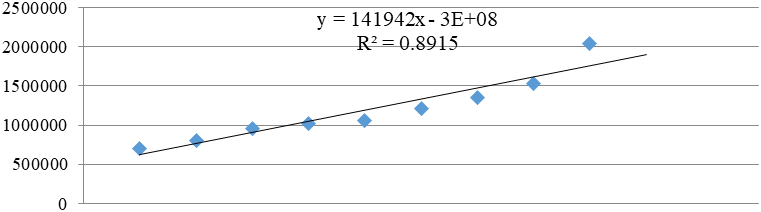

Then, let us reflect the trend line on the chart. The accuracy of approximation is rather high. So, we can say that this function may be used to predict the profit from sales for 2018. The trend line is shown in Figure

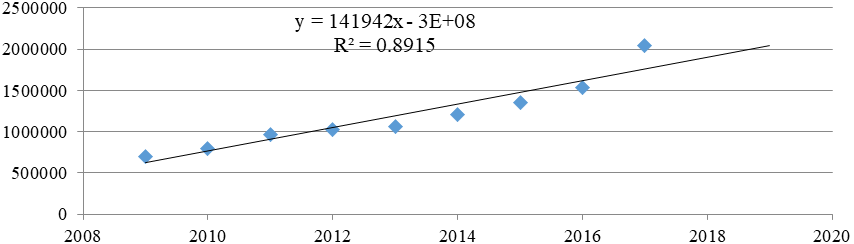

Then, we will continue the trend line for a period (in our case – for a year), thus we will determine the amount of sales profit for 2018 (Figure

The data given by this planning method allow concluding that the amount of the profit from sales of JSC “BKO” will be 1896591.1 thousand rub. in 2018, and 2038533 thousand rub. in 2019. In our opinion, the second method is more realistic.

Conclusion

The analysis performed allows concluding that JSC “BKO” is a fairly successful and effective enterprise with a sustainable tendency of increasing the profit. Nevertheless, they must not stop, but go on working, looking for reserves to increase the profit and performance.

Measures to increase the profit must be determined within the concept of the enterprise development (Fetter, 2014).

As the priority directions of the activity of JSC “BKO”, the managers of the enterprise isolate:

production of proppants;

production of refractories of predominantly complex and especially complex assortments;

further development of import substitution programs;

development of production and expansion of the range, gauges of grog products for gating systems;

increased production of concrete of the Borcast range, thixotropic products and corundum masses;

final development of a full line of production of pipes and products of the ShDT brand for smoke systems;

engineering services, in particular, on the development of lining logics, recommendations on the choice of materials, including new ones, control, and information and technical support;

quality management.

To develop JSC “BKO”, in 2018 the following priority tasks were set:

to increase the production and sales of the enterprise in relation to 2017;

to implement projects on new products;

to reduce defects in manufacturing refractory products;

to extend manufacturing capacities of proppants area and grog burning area;

to confirm conformity of the QMS in relation to the design, production and supply;

to improve the staff policy, including the increase in the proportion of workers with more than one specialty;

to ensure stable supply of raw and other materials necessary for effective economic activity.

The prospects of the society development include the following.

Concentration of marketing efforts of the enterprise in order to promote the most promising and profitable products, improving the production of refractory products, increasing the product performance according to the demands of consumers.

Reduction of unit costs for development, production and promotion.

Implementation of programs on reducing production costs. Emphasis on minimizing operating (technological) costs.

Diversification of markets by regions and industrial fields in order to decrease dependence on the condition of any field, specific consumer, or region.

Active investment policy of renewing production base, creating new technologies, expanding product range.

Development of modern storage facilities.

Improvement of the personnel policy of the enterprise in order to manage the personnel more effectively. Permanent personnel development.

Timely effective environment protection measures.

The necessity for the enterprise to constantly control expenses, and find the reserves for their reduction remains urgent. It may be possible thanks to “Cost Reduction Measure Plan”. This document is a key aspect of “anti-cost” work. Generally, this document may have the following structure shown in Table

In “Measure Plan” the following points must be determined:

what cost article will be reduced after the measure is implemented;

what factors will reduce costs (it may be decreased amount of resources consumed, or reduced value of a separate resource used);

algorithm of actions to make within the planned measures in order to achieve the aim set;

a responsible person (responsibility must not be diffuse, for only an individual responsibility will allow to achieve the result planned);

implementation cost of measures planned;

predicted gross effect, i.e. a specific value: how much the organization will be able to save after implementing the measures planned;

expected net annual effect demonstrating how much the organization will save after implementing the measure, taking into account the expenses for the given measure;

terms of implementing the measure. It is evident that the terms may significantly influence the annual economic effect obtained. It is one thing if we can carry out the measure in this year. Then, the whole next year we will “take off the foam” from the results of the measure. It is quite the other thing if the measure is completed by the end of the summer in the next year. Then, the time to obtain the economic effect will be very limited.

The implementation of measures planned must be under constant internal control, since it is the process of internal control that leads to the achievement of the aims of the enterprise (Berezyuk, 2012).

The presented directions to improve the profit management may be used in the enterprise analyzed, as well as in any industrial enterprise.

References

- Berezyuk, V.I. (2012). Internal control and audit in conditions of world crisis – necessity for company. Moscow University Bulletin, 3, 65-70.

- Blank, I.A. (2007). Profit management (2nd Ed.). K.: Nika-tsentr

- Chernikov, A.V., & Radkov, V.A. (2011). Modern innovative instruments to increase company competitiveness. Moscow University Bulletin, 5, 41-62.

- Ezhkov, I.A., & Stepanova, M.N. (2015). Income and profit management at enterprise. Modern business-space: actual problems and prospects, 1(4), 173-175.

- Fetter, A.A. (2014). Management of financial result from main activity of enterprise. New University, 10(44), 16

- Karaseva, M.Yu. (2015). Enterprise profit management. Economy and entrepreneurship, 3, 56-62.

- Khaidukova, D.A. (2016). Enterprise profit: economic essence, kinds, methods of analysis. Problems of economy and management, 5, 175-179.

- Orekhov, G.S., & Malyutina, E.A. (2015). Profit management methods as chief aim of enterprise financial management. Economy and society, 2-5, 859-862.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

02 April 2019

Article Doi

eBook ISBN

978-1-80296-058-7

Publisher

Future Academy

Volume

59

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1083

Subjects

Business, innovation, science, technology, society, organizational theory,organizational behaviour

Cite this article as:

Askerova, M., & Polyanskaya, O. (2019). Management Improvement Of Forming And Using Industrial Enterprise Profit. In V. A. Trifonov (Ed.), Contemporary Issues of Economic Development of Russia: Challenges and Opportunities, vol 59. European Proceedings of Social and Behavioural Sciences (pp. 620-628). Future Academy. https://doi.org/10.15405/epsbs.2019.04.66