Abstract

Economic theory and practice have accumulated extensive experience and knowledge, which confirm the importance of money inflow as a leading tool for implementing the investment policy of an enterprise. Investments are a complex of financial, material and labor costs of a long-term nature the ultimate goal of which is the increase of assets value and the profits of the enterprise. Investment policy is part of the overall financial strategy of an enterprise, which is aimed at selecting and implementing the most effective forms of real and financial investments in order to ensure high rates of enterprise development and constant increase in its market value. In the process of formation of investment policy it is necessary to consider: the increase in the value of the company; achieving economic, social and budgetary effect; the possibility of obtaining state support (guarantees of the government of the Russian Federation, etc.); strict compliance with regulations of the Russian Federation governing investment activities; minimization of risks associated with the implementation of specific projects. Increasing the economic potential of an enterprise is possible through investment activity, which involves the argumentation of the choice of investment and its subsequent implementation. Systematic and ongoing development of any commercial enterprise is impossible without clever and well-wrought investment policy. For the most complete understanding of the concept under consideration, the current investment policy and investment attractiveness of commercial enterprise are analyzed, and possible measures to increase the effectiveness of the investment policy of commercial enterprises in the chemical industry are suggested;

Keywords: Commercial enterpriseinvestment attractivenessinvestment policyinvestment project

Introduction

Investment policy, being an important element of the financial strategy of an enterprise, determines the degree of efficiency of its investment activity. It is characterized by a permanent nature and involves not only the process of selecting and implementing the most effective ways of investing, but also ensures the reproduction of the investment process itself.

When working out an investment policy, the following principles should be followed:

consistency - implies bringing the investment policy into compliance with strategic goals of the enterprise;

priority - investment policy should give priority only to the areas of greatest significance;

efficiency - involves considering investment projects in terms of their final positive result;

controlling - implies regular assessment of achievements against the goals set, adjustment of the results and control throughout the entire investment process (Obraztsova, Poliakova, & Popovskaya, 2017).

An enterprise engaged in the development of investment policy must comply with the following rules:

working out of an investment policy should be coordinated with the legal acts of the Russian Federation regulating investment activities;

it is necessary to conduct a detailed study of investment projects interrelation, as well as their impact on individual elements of the system;

investment policy should have a number of alternatives when making management decisions;

when choosing an investment project, one should be guided by the maximum efficiency as the main indicator;

regular adjustment of the planned results in the implementation of investment policy should be carried out;

ongoing investments should be liquid;

ongoing investments should minimize investment risks;

it is necessary to make a qualitative forecast of the economic situation in order to make adjustments to the current investment policy.

When implementing investment policy, it is also extremely important to improve the system of control over expenditures aimed at investment activities. This will allow to track in detail the movement of cash flows in investment projects, determine the minimum level of their financing, carry out timely adjustments of planned values in accordance with the actual state of affairs and identify the causes of the deviations that have developed (Butsenko, 2018).

In general, the investment policy of an enterprise implies a combination of methods and actions aimed at gradual improvement of its financial position. The degree of competitiveness of the enterprise, the prospects for its further presence in the market depend on the efficiency and adaptability of this policy (Welter & Smallbone, 2011).

Problem Statement

Modern market system has an extremely dynamic character - constant development and sophistication of economic processes force all participants of market relations to adapt and modernize their approach to doing business. In turn, the existence of a company without a rational and effective investment policy is not possible. It is for this reason that the improvement of investment policy is also a priority for any enterprise (Cao, Myers, Myers, & Omer, 2015).

Compliance with the above-mentioned rules and principles in the formation of investment policy allows you to avoid many problems and risks at the initial stages of its implementation, but this does not obviate the need to change and update it. Timely upgrading of the policy will allow maintaining a high degree of efficiency of the enterprise’s investment activity, thereby opening up access to potential assets and profits (Inzelt & Csonka, 2017).

Research Questions

How is the investment process organized in the enterprise?

What are the factors of formation and content of the investment policy of the enterprise?

How is the investment attractiveness of the enterprise assessed?

What are the ways of improvement of the investment policy of the enterprise?

The object of research is Acron PJSC, one of the largest producers of ammonia, nitrogen and complex mineral fertilizers in Russia, the headquarters is located in Veliky Novgorod. Acron PJSC products are sold in more than 50 countries of the world; however, most of them are in the markets of Russia, China, South America and Asia.

Purpose of the Study

The purpose of the article is to study the investment policy of a modern company on the example of an industrial enterprise of chemical industry.

Research Methods

The study is conducted through the monographic method, methods of comparisons and analogies.

Organization of the investment process on the example of Acron PJSC

Since 2005, the main direction of investment of Acron PJSC has been the development of its own mineral resource base and strengthening of vertical integration through the development of its own production of the three main raw materials - nitrogen, phosphorus, potassium. Based on this direction, the company implemented a large-scale investment program, which was based on three key projects:

Ammonia-4 - creation of a reserve for expanding the production of nitrogen products;

Oleniy Ruchey mine - own phosphate raw materials;

Talitsky MPP - own production of potassium.

Expected results from the investment program:

increase of profitability and competitiveness of complex fertilizers production by replacing mineral raw materials purchased from third parties with their own;

increase the profitability of Acron through the sale of excess phosphate and potash raw materials;

an increase in the production of marketable products from 5 million tons in 2015 to 10 million tons over the next few years.

In July 2016, in the presence of the President of the Russian Federation Vladimir Putin, the Ammonia-4 unit was put into operation. The main characteristics of the project are presented in table

The main characteristics of the project:

design capacity of the new unit “Ammonia-4” is 700 thousand tons per year; after its commissioning, the total capacity of the enterprise for the production of ammonia will increase to 2.6 million tons per year;

The new ammonia unit is 11% more efficient than the existing ones - gas consumption will amount to 938 cubic meters. m / t.

Additional volumes of ammonia will allow to fully meet the growing needs of the enterprise in the nitrogen raw materials, as well as open up broad prospects for further capacity expansion.

In 2015, the first stage of the Oleniy Ruchey mine was commissioned at full capacity. Construction of the second stage of the Oleniy Ruchey mining and processing complex is in the final phase.

The project reached a production volume of 1.1 million tons of apatite concentrate per year, which not only fully covers the needs of Russian chemical plants of the Acron Group reaching the amount of about 750 thousand tons per year, but also allows the Group to be a major supplier of apatite concentrate in the market. The main characteristics of the project are presented in table

As long ago as at the end of 2016, the use of ore from the underground mine began, and at the end of 2017 an enriching plant was expanded. In 2016-2021 production volumes of apatite concentrate will be systematically increased against the background of increased mining at the underground mine. In 2018, construction of the Oleniy Ruchey mine, which is being implemented by North-Western Phosphorous Company, is expected to continue.

The implementation of the potash project Talitsky MPP remains in the sphere of interests of Acron PJSC, but today it is in the process of searching for partners and project financing mechanisms. The main characteristics of the project (table

the project is aimed at satisfying its own needs of 600 thousand tons per year, and at selling potassium to the market;

salts reserves are enough to develop the field for about 40 years;

the deposit is favorable for exploitation due to shallow occurrence, developed infrastructure and high-quality ore.

Acron PJSC maintains a long-term goal of vertical integration into potash raw materials and the realization of this project, however, given the changing global market situation, potash integration is not a top priority for Acron PJSC.

The main results achieved by the investment program implemented in 2005-2017 as part of a vertical integration strategy:

increasing of complex fertilizers production profitability and competitiveness due to replacement of mineral raw materials purchased from third parties with their own (23% of Acron's PJSC EBITDA in 2017 fell on Oleniy Ruchey mine);

increase in the production of commercial product in 2015-2017 by 36% - to 7.3 million tons - and guaranteed further growth in production in the coming years.

Thus, the key objectives of vertical integration strategy were successfully achieved, and the future strategy of Acron PJSC requires transformation Acron PJSC plans to work out an updated strategy of development in 2019. Creation of a new long-term investment program as part of the updated strategy will be based on maximizing the use of existing potential of processing raw materials (ammonia, apatite concentrate) into end products, as well as developing production of types of products and their distribution.

Factors of formation and content of the investment policy of Acron PJSC

Factors shaping the investment policy of Acron PJSC are presented in table

A number of existing risks and their impact on an investment project, including commercial risks (construction, production, etc.) are assessed through a possible decrease in efficiency and expected return. Such risks can be reduced by reserve capital creation, portfolio diversification, etc. It is possible to combat the influence of non-commercial risks (natural disasters, accidents, etc.) with the help of guarantees of the Russian Federation Government and investment insurance. To assess how liquid investments will be, we weigh the probability of important changes in the external environment, market conditions and the enterprise development strategy in the coming year. The impact of such changes can reduce the profitability of individual projects and increase their riskiness, which will give potential investors negative impression of the company. Often, when planning, it is necessary to provide for timely exit from projects and to take appropriate decisions in time and reinvest free capital (Bek & Gadzhaeva, 2018).

The above reasons are quite weighty and indicate that it is necessary to timely assess the level of investment liquidity in each individual project. And so, projects whose liquidity level is higher than the others are accepted for implementation (Table

Table

Findings

Assessment of the investment attractiveness of the company

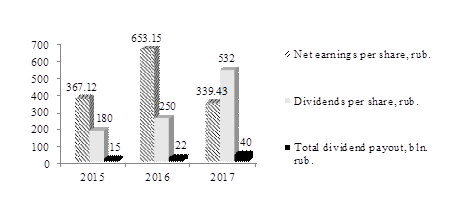

Let us consider in greater detail the indicators that external investors pay their attention to when making decisions about the investment attractiveness of a company (Figure

Thus, Acron PJSC has fairly high indicators of investment attractiveness, the increase in which during the period under review shows that the company is developing quite steadily and increases its production volumes.

The P / E ratio shows how many years the company's profit will cover the cost of buying its shares. The higher this indicator, the less attractive the stock is in terms of its current profitability, and its very low value may indicate hidden (or obvious) threats to the company, ambiguity of its development prospects or some kind of uncertainty. Acron PJSC has good ratings and analysts' forecasts are stable. For comparison, the investment attractiveness of Acron PJSC is comparable to the investment attractiveness of its competitor - Uralkali PJSC (Table

From the data of Table

Thus, investment policy of Acron PJSC is promptly adjusted in accordance with the development strategy and financial capabilities. Given the stable financial situation, sufficient level of profitability and investment potential of the entire industry, the company can well afford the implementation of its investment policy, in particular its bias towards the expansion of production.

But while developing the investment policy, Acron also has a number of problems:

1) high level of borrowed funds which reduces the creditworthiness of the company and may impede the attraction of new sources;

2) sanctions imposed on Russian companies and crisis manifestations in the economy contribute to increasing the influence of risks, requiring a more thorough assessment, as well as reducing the demand for products and the loss of customers;

3) consolidation of interests of strategic investors owning large blocks of shares that can pursue different goals.

Improvement of the chemical industry investment policy

From the above, we can conclude that analysis and control are key concepts in the formation and improvement of investment policy. However, powerful software allows providing swift high-quality analysis and control. Modern automation technologies make it possible to work simultaneously with many investment projects, to monitor the stages of their implementation, to make quick and timely analysis. Among the popular and technologically relevant programs the following ones can be named: PROJECT EXPERT 6 Professional, INVESTOR, Alt-Invest 3.0, COMFAR. Their use in the implementation of investment policy will allow saving money and labor resources of the company, improving the quality and speed of analysts and managers work. Consequently, application of updated software products will be one of the directions for improving the investment policy of the company.

Special attention should be paid to monitoring the effectiveness of the company investment policy implementation. This type of control determines the final results of investment activities and is of a strategic nature. The use of current methods of control will help to avoid adverse effects for the organization, reduce economic risks and adapt their actions in time (Kelchevskaya, Chernenko, & Popova, 2017).

Proposals for improving the investment policy of Acron PJSC and justifying their effectiveness can be formulated as follows:

1) Boost investment in research and development due to high-tech nature of chemical industry and presence of competitors. It is necessary because of the high-tech nature of mineral fertilizer industry and if companies stop paying due attention to this investment issue, they will very quickly begin to lose their leading positions. It is also very important that companies continue to carry out research and invest in research in order to identify ways and methods of improving the environmentally-friendly production (this criterion is one of the main ones in the implementation of the investment policy of chemical enterprises).

2) Pay more attention to attracting private investors, because self-financing is not fully applicable for companies in this industry due to the high cost of technology and equipment, as well as the high level of borrowed funds.

3) Control the expenditure of funds for investment activities, fixation of the required funding limit, timely elimination of deviations and analysis of their causes. This helps to detect all deviations in time, analyze them, identify the causes of these deviations, as well as find ways to correct deviations; It also helps to control the process of investment activity and analyze the nature of the deviations and their consequences for the corporation.

4) From the point of view of restrictions on the cost of financing sources, a thorough and comprehensive analysis of investment projects and their effectiveness in forming the investment policy it will help determine the profitability below which projects cannot be accepted for implementation by the company. It is important because it is necessary to try to take into account all possible risks and positive and negative consequences of the adoption of the investment project. The more implementation options will be modeled before implementation, the fewer unforeseen events during implementation can occur and all future cash flows will be estimated closer to real numbers. It is also important to build a certain reserve capital in case of unforeseen events and minimize their consequences.

5) Investing in environmental programs that will allow the company to increase its competitiveness and strengthen its position in the industry.

6) Attract foreign investment. In view of the introduction of sanctions against Russian companies and general economic recession, there is a problem of a lack of foreign investment in Russian economy. It is very important in the conditions of existing sanctions to continue the search for ways to sell products both in the domestic market and by attracting foreign investment, concluding long-term contracts guaranteeing implementation over the next few years, as there are no prerequisites for the cancellation of sanctions.

Conclusion

Recommendations for improving the investment policy of the company under consideration are developed with due regard to the results of the analysis of external factors, results of the financial condition analysis and analysis of its investment attractiveness.

Measures recommended above will provide an opportunity to improve the efficiency and quality of the implemented investment policy of the company.

The main principles in the improvement of investment policy are relevance and intensity of the methods used. Investment policy is associated with high risks, and at the same time it plays a key role in the development of a company. And it is for this reason, that its continuous modernization gives the company the opportunity to maintain high competitiveness, actively expand its production and increase profits.

References

- Bek, N. N., & Gadzhaeva, L. R. (2018). Open Innovation Business Models and Open Strategies: Features, Challenges, Development Prospects. Bulletin of Moscow University. Ser. 6. Economics, 1, 140-159.

- Butsenko, E. V. (2018). Optimization of investment design management based on a game-theoretic approach. Economy of the region, 14(1), 270-280.

- Cao, Y., Myers, J., Myers, L., & Omer, T. (2015). Company reputation and the cost of equity capital. Review of Accounting Studies, 20(1), 42–81. https://dx.doi.org/10.1007/s11142–014–9292–9.

- Inzelt, A., & Csonka, L. (2017). The Approach of the Business Sector to Responsible Research and Innovation (RRI). Foresight and STI Governance, 11(4), 63–73.

- Kelchevskaya, N. R., Chernenko, I. M., & Popova, E. V. (2017). The impact of corporate social responsibility on the investment attractiveness of Russian companies. Economy of the region, 13(1), 157-169.

- Obraztsova, O., Poliakova, T., & Popovskaya, E. (2017). The Choice of Funding Sources for Start-Ups in a Transitional Economy: The Ability to Predict in a National Context. Foresight and STI Governance, 11(3), 71–81.

- Reverte, C. (2012). The Impact of Better Corporate Social Responsibility Disclosure on the Cost of Equity Capital. Corporate Social Responsibility Environment Managent, 5(19), 253–272.

- Welter, F., & Smallbone, D. (2011). Institutional Perspectives on Entrepreneurial Behavior in Challenging Environments. Journal of Small Business Management, 49(1), 107–125.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

02 April 2019

Article Doi

eBook ISBN

978-1-80296-058-7

Publisher

Future Academy

Volume

59

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1083

Subjects

Business, innovation, science, technology, society, organizational theory,organizational behaviour

Cite this article as:

Kanishcheva, N., Askerova, M., & Zhdanova, N. (2019). Problems Of Commercial Enterprise Investment Policy Implementation At The Present Stage. In V. A. Trifonov (Ed.), Contemporary Issues of Economic Development of Russia: Challenges and Opportunities, vol 59. European Proceedings of Social and Behavioural Sciences (pp. 590-600). Future Academy. https://doi.org/10.15405/epsbs.2019.04.63